Professional Documents

Culture Documents

ePGP - Sec A - Group-02 - Case Study Mid Term Assignment - Marketing Management

Uploaded by

Madhav JhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ePGP - Sec A - Group-02 - Case Study Mid Term Assignment - Marketing Management

Uploaded by

Madhav JhaCopyright:

Available Formats

MARKETING MANAGEMENT CASE STUDY MID TERM ASSIGNMENT

Group 02 – “ePGP Sec A”

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 1

Case Study about the Reliance Industries Limited

“Success story of becoming India's Biggest Company”

Group-02 Participants

Students Roll No

Ajay Bhagia 21ePGP010

Alok soni 21ePGP016

Anandi Vijay 21ePGP020

Basav Jyoti Nath 21ePGP040

Debasmita Behara 21ePGP048

Lavanya Ahuja 21ePGP076

Madhav Jha 21ePGP077

Mithun John Varghese 21ePGP086

Nischay C 21ePGP094

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 2

Reliance Industries Limited (RIL) is an Indian organization

headquartered in Mumbai, India. Reliance has its entities across

domains like vitality, petrochemicals, materials, common assets,

retail, and broadcast communications. Reliance is one of the most

prominent businesses in India, the biggest "traded on an open

market" organization in India by showcase capitalization, and the

biggest organization in India as estimated by income after it

outperformed Indian Oil Corporation sometime back. On 18

October 2007, Reliance Industries became the first Indian

company to cross $100 billion market capitalization.

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 3

The organization is positioned 106th on the Fortune Global 500 rundown of the world's greatest

enterprises as of 2019. It was positioned eighth among the Top 250 Global Energy Companies by Platts in

2016. Reliance continues to be India's biggest exporter, representing 8% of India's all-out exports with an

estimation of Rs 147,755 crore and access to business sectors in 108 countries. Reliance is answerable for

nearly 5% of the legislature of India's complete income from traditions and extracts obligation. In 2019,

Reliance Industries Limited became the first Indian business to cross Rs 9 lakh crore valuation mark.

History And Origin Of Reliance Industries Limited

In 1966, Reliance Textiles Engineers Pvt. Ltd. was consolidated in Maharashtra. It built a manufactured

textures plant around the same time at Naroda in Gujarat. On 8 May 1973, it moved towards becoming

Reliance Textiles Industries Limited. In 1975, the organization extended its business into materials with

"Vimal" forming its image in the later years.

The organization held its initial open offering (IPO) in 1977. Sidhpur Mills, a materials organization, was

amalgamated with Reliance Textiles in 1979. In 1980, the organization extended its polyester yarn

business by setting up a Polyester Filament Yarn Plant in Patalganga (Maharashtra) with monetary and

specialized coordinated efforts from E. I. duPont de Nemours and Co., U.S.

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 4

In 1985, the name of the organization was changed from Reliance Textiles Industries Ltd. to

Reliance Industries Limited. Between 1985 to 1992, the organization extended its introduced limit with

regards to delivering polyester yarn by more than 145,000 tons per year.

In 1993, Reliance went to the capital markets abroad for assets through a worldwide depository issue of

Reliance Petroleum. In 1996, it turned into the first private division organization in quite a while to be

appraised by worldwide FICO assessment offices. In 1995/96, the organization entered the telecom

business through a joint endeavor between NYNEX, USA, and advanced Reliance Telecom Private

Limited in India.

In 2001, Reliance Industries Limited and Reliance Petroleum Ltd. turned into India's two biggest

organizations as far as all major monetary parameters were considered. In 2001–02, Reliance

Petroleum converged with Reliance Industries. In 2002, Reliance reported India's greatest gas

revelation (at the Krishna Godavari bowl) in almost three decades. The setup volume of gaseous petrol was

more than 7 trillion cubic feet, proportionate to about 1.2 billion barrels of unrefined petroleum.

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 5

This was the first, historically speaking, disclosure by an Indian private company. In 2002–03, RIL bought a

larger stake in Indian Petrochemicals Corporation Ltd. (IPCL), India's second-biggest petrochemicals

organization, from the administration of India. IPCL later converged with RIL in 2008.

In 2005 and 2006, the organization revamped its business by de-merging its interests in control age and

appropriation, money related administrations and media transmission administrations into four separate

entities. In 2006, Reliance entered the retail showcase in India with the dispatch of its retail

location position under the brand name 'Reliance Fresh'. By the end of 2008, Reliance retail had near

600 stores crosswise over 57 urban communities in India.

In November 2009, Reliance Industries gave 1:1 extra offers to its investors. In 2010, Reliance entered the

broadband administrations showcase with the securing of Infotel Broadband Services Limited; the latter

was the main effective bidder for the skillet India fourth-age (4G) range sale held by the legislature of

India.

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 6

Around the same time, Reliance and Bharat Petroleum declared an association in the oil and gas business.

BP took a 30% stake in 23 oil and gas creation sharing agreements that Reliance works in India, including the

KG-D6 hinder for $7.2 billion. Reliance likewise shaped a 50:50 joint endeavor with BP for sourcing and

showcasing of gas in India. In 2017, RIL set up a joint endeavor with Russian Company Sibur for setting up a

Butyl elastic plant in Jamnagar (Gujarat) that became operational by 2018.

Marketing Strategy Of Reliance Industries Limited

The organization was established by Dhirubhai Ambani and Champaklal Damani in the 1960s as Reliance

Commercial. The marketing mix of Reliance covers 4Ps (product, price, place, and promotion) and explains

Reliance Industries' marketing strategy is as follows:

Products

Reliance Industries Limited is perhaps the greatest aggregate in India. Its business is available in different

segments which are concentrated to comprehend Reliance's item system in its showcasing blend. The retail

segment incorporates Reliance Fresh, Big Bazaar, Reliance Mart, Reliance Market, Reliance Home

Kitchen, Reliance iStore, Reliance Solar, and more.

Reliance Life Sciences is associated with medicines, plants, and biotechnology as it has some

expertise in marking, assembling, and promoting Reliance enterprises items in bio-pharmaceuticals.

Reliance's coordination comprises transportation, dissemination, coordination, inventory network-

related exercises, and telemetry arrangements. Reliance Jio Infocomm Ltd. is a broadband specialist

co-op which gives 4G administrations. Relicord is claimed by Reliance Life Sciences and gives blood

banking administrations. Reliance Industrial Infrastructure Limited deals with the development and

activity of pipelines for moving oil-based

09/26/2022 commodities. Subsequently,

INDIAN INSTITUTE of MANAGEMENT RAIPUR this gives an outline of the 7

Price

Reliance Industries Limited pursues a distinctive valuing methodology for various segments. Thus, the

advertising blend and evaluation technique of Reliance Industries is unique in light of rivalry and market

administration in certain parts. It pursues entrance valuing for retail, media transmission, and well-being. At

the point when the organization propelled Reliance Jio, it offered free Jio administrations to its clients

during the dispatch time frame to build a piece of the pie. Be that as it may, the retail and media

transmission parts are at misfortune; however, the organization is giving ideas to clients to build its client

base.

The evaluating choices on its oil business rely upon the full-scale condition components and

worldwide market situation to a great extent. Reliance Fresh outlets, for example, secure their items

directly from the source, eliminating the middlemen in this way. This is advantageous to the shopper as the

markdown price and value decrease. Reliance Industries performs exhaustive evaluation before valuing its

choices,

Place and this evaluation is a persuasive factor for its ascent in the aggressive market.

Reliance Industries has a solid nearness all over India. Reliance Retail is the biggest retailer that has

more than 1500 stores crosswise over India. Different brands like Reliance Fresh, Reliance Footprint,

Reliance Digital, and Reliance Trends have arrived at Tier 1 and Tier 2 urban areas. Reliance Jio sim

administrations are accessible crosswise over significant areas and its network has improved

significantly over the last years.

Reliance Industries' dispersion system is so well-arranged that it has a strong grip across the country.

Reliance gets crude materials directly from the source; consequently, it has pulled in an enormous number

of clients because of the advertisements. Reliance clients can speak with the agents by calling

administrations or online channels.

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 8

Promotion

Reliance Industries is vigorously working on publicizing and brand advancement. The special procedure in

the advertising blend of Reliance Industries is engaged towards 360 degree marketing and forceful brand

advancement. Reliance uses the slogan "Development is Life" and has typified its slants of taking

individuals together. RIL proprietor Mr. Mukesh Ambani has now owned the Mumbai Indians franchise

for a long time, and the purchase of a cricket team has been instrumental in bringing the Reliance brand

under the spotlight.

Reliance Industries has roped in Bollywood entertainer Hrithik Roshan for underwriting Reliance Telecom.

It declares limits and leads for different special exercises at various Reliance outlets. Because of its solid

image mindfulness, Reliance Industries has pulled in clients at its stores. Customer happiness has lead to

its expanded client base. Consequently, this covers the promoting blend of Reliance Industries.

Growth And Future Of Reliance Industries Limited

The Indian economy remained the quickest developing significant economy on the planet in 2018. In FY

2018-19, the evaluated Gross Domestic Product development rate was 6.8%, driven by solid private

utilization development at 8.1%. The economy kept on seeing an expansion in speculations with gross

fixed capital formation development at a six-year high of 10%.

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 9

For FY 2018-19, India's oil request developed at about 3% y-o-y with utilization-driven request development

in gas (+8.1%), Gasoil (+3.0%), and stream fuel (+9.1%). The interest was driven by powerful development in

business vehicle deals and solid air traffic development during the year. On the provincial side, though

tractor deals and three-wheeler deals declined from the highs of FY 2017-18, they kept on developing in

twofold digits.

Household request development for petrochemical items was solid with both polymer and polyester

requests developing at 7.0% y-o-y. Reliance Jio has impelled India to turn into the biggest versatile

information devouring economy on the planet. With omnipresent and dependable information

administrations, information systems are progressively being utilized for media and stimulation, instruction,

showcase data, and exchanges.

The appropriation of advanced exchanges saw exponential development. UPI installments developed from

0.7% of GDP in FY 2017-18 to 4.7% in FY 2018-19 while charge card development found the middle value of a

solid 32% y-o-y in FY 2018-19. Individual utilization patterns stayed solid with individual credit at a sound

18% y-o-y. Reliance Retail keeps on profiting by solid interest development crosswise over purchaser

staples, optional merchandise, and its capacity to convey an unrivaled client experience and offer

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 10

Refining And Marketing - Weak Light Distillate Cracks Lead Down Margins

During the year, benchmark Brent oil costs were up 22% due to geopolitical pressures, supply

interruptions from Venezuela, Iran, and Libya just as OPEC+ creation cuts. Request development was

affected by the high siphon level costs in the US and different economies coupled with the slow

development in the Chinese economy.

RIL's gross refining edges declined to US$9.2/bbl due to feeble light distillate breaks; this was somewhat

counter-balanced by flexible center distillate splits. Operational greatness and adaptability helped

Reliance keep up a noteworthy US$4.3/bbl premium over the territorial benchmark-Singapore Refining

Margins. The strong presentation by Reliance's refining business was bolstered by proactive unrefined

sourcing, enhancing of item yields, and vigorous hazard in a difficult domain.

Petrochemicals - Resilient Business Model Shining Through

Petrochemicals business conveyed its best execution with EBITDA commitment of 37,645 crores, up by

45.6% y-o-y. Petrochemical generation was additionally at a record high of 37.7 MMT, up 16% y-o-y.

The solid outcomes were accomplished in a situation of declining usage rates in key item chains with a

new supply increase. This exhibits the strength of Reliance's action plan which is dependent on linkages

between refining and petrochemical chains, feed stock adaptability, and wide item portfolio. While

polymer chain edges were affected by new supplies out of the US Ethane-based wafers, polyester bind

gains kept on increasing, driven by a solid PTA and PX edges. With the initiation of ethane splitting at

Nagothane, the key parts of Reliance's petrochemical speculation cycle are adding to its income.

Oil And Gas Exploration And Production

Reliance has attempted the improvement of High-Pressure High Temperature (HPHT) R-Cluster, Satellite-

Cluster, and D55 (MJ) fields. First gas from R-Cluster is normal by mid-2020 followed by Satellite Cluster

and MJ fields. The new improvement will use Reliance's collaboration with BP, the existing framework in

the Krishna-Godavari

09/26/2022 Basin, and the downturn in the ofcapital

INDIAN INSTITUTE hardware

MANAGEMENT RAIPUR and specialist organization 11

advertise.

Reliance Retail - Growth Across All Key Consumption Basket

Reliance Retail accomplished record turnover of र 1,30,566 crore, up 88.7% y-o-y. Turnover development

was driven by quick store extension and strong development in same-store-deals. Reliance Retail

accomplished its most elevated EBITDA of र 6,201 crores, up 145% y-o-y. The solid working presentation

was driven by 100 bps improvement in EBITDA to 4.7%. Proceeding with solid development force,

Reliance Retail has accomplished an income CAGR of 55% and EBITDA CAGR of 76% in the last 5 years.

Reliance Retail had 10,415 retail locations in more than 6,600 towns and urban areas covering a zone of

22.0 million sq. ft. as of March 2019. A record footfall of more than 500 million was witnessed during the

year, a development of 44% y-o-y. Reliance Retail is working on plans to dispatch a separate new

commerce stage which will empower little shippers across India to contend in a computerized age.

Digital Services - Strong Traction In Subscriber Addition And User Engagement

Reliance Jio has over 400 million users to date and is currently India's biggest portable telecom

administrator positioned by Adjusted Gross Revenue (AGR). Jio comes out on top if Average Revenue

Per User (ARPU) (126.2/month) is considered along with sound normal voice utilization (823 minutes

for every client every month) and normal information utilization (10.9 GB per client every month).

Jio is intending to give a worldwide standard wireline framework and administration in India through

FTTH and Enterprise contributions. To quicken this rollout, RIL has made vital investments in Hathway

Cable, Datacom Limited, and DEN Networks Limited. Jio likewise keeps on executing its arrangements

of building an advanced biological system spreading crosswise over media, excitement, trade, training,

human services, and horticulture.

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 12

Media - Strengthening Offering Ahead Of Evolving Market Trends

Reliance is focused on offering media content for the Indian market as a feature of its computerized

administration's bunch. As a component of this dedication, Reliance is putting resources into the

production of unique substance significant for the developing patterns in media utilization. Through

possessed substance motors and cooperative organizations, Reliance is building a broad media content

library which will take into account all portions of the crowd and dovetail with its wide conveyance stages.

Reliance's media organization Network18 proceeded on its development direction and put

resources into key regions to fill blank spaces and sustain its position as a leader.

Advanced Platforms

During the year, Reliance started stage-driven association procedures to tap the noteworthy potential for

its organizations to improve proficiency and encourage educated and basic leadership procedures.

Land Developments

RIL went into a Memorandum of Understanding (MoU) with the Government of Maharashtra to build a

Global Economic Digital and Services Hub with worldwide associations. RIL through its completely claimed

backup has gone into an MoU with NMSEZ to a sub-rent place that is known for around 4,000 sections of

land alongside related improvement rights. The project will usher in industry revolution 4.0 in Maharashtra

and prompt critical industrial development by offering world-class infrastructure and collaboration with the

best of worldwide innovation organizations in the areas of Innovation and Learning, Research and

Development, Technological Advancement, and Manufacturing and Service capacities

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 13

Indian Film Combine

RIL through its completely claimed backup has procured a dominant stake in Indian Film

Combine, and it is building a Drive-in Theater, Hotel, Retail Mall, and Clubhouse at Bandra Kurla

Complex (BKC) in Mumbai.

JIO World Center

Reliance is also building a best in class, world-class convention center, performing arts theater, retail mall,

office space, and clubhouse at Bandra Kurla Complex (BKC), Mumbai. These undertakings are planned for

making BKC the most alluring retail, entertainment, and cultural area of Mumbai city backed by a world-

class convention center.

The last two years were portrayed by unstable, large-scale financial condition. Adding to vulnerability

were higher oil costs in the principal half of the year and expanding geopolitical pressures as the year

progressed. Reliance accomplished its best execution in this condition with record commitment from its

petrochemicals, retail, and advanced administrations units. "Strong working execution for the year

underscored the quality of the petrochemicals business that we have fortified throughout the last

speculation cycle. Moreover, our purchaser organizations keep on scaling new statures with industry

driving measurements. The adaptability of retail and computerized administration business stages has

made an exceptional incentive for all partners," a Reliance representative added.

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 14

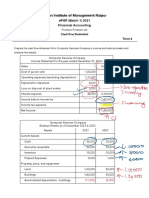

Revenue And Profit Of Reliance Industries Limited

Reliance accomplished solidified income of र 6,22,809 crores (US$90.1 billion), an expansion of 44.6% when

contrasted with र 4,30,731 crores in the earlier year. The increment in income was fundamentally because

of volume expansion with the adjustment of petrochemicals undertakings and oil cost related increment

of refining and petrochemical items. The higher volumes in petrochemicals business are by virtue of first

entire year of tasks of new petrochemical offices. Reliance's solidified income was bolstered by powerful

development in retail and computerized administrations business which recorded an expansion of 88.7%

and 94.5% in income individually when contrasted with the earlier year.

09/26/2022 INDIAN INSTITUTE of MANAGEMENT RAIPUR 15

You might also like

- Demonstrating Responsible Business: CSR and Sustainability Practices of Leading Companies in IndiaFrom EverandDemonstrating Responsible Business: CSR and Sustainability Practices of Leading Companies in IndiaNo ratings yet

- UntitledDocument68 pagesUntitled084 UjwalaNo ratings yet

- Reliance ReportDocument38 pagesReliance ReportoctysystemserviceNo ratings yet

- UntitledDocument11 pagesUntitled084 UjwalaNo ratings yet

- Reliance Industries Limited: Mba ProgrammeDocument5 pagesReliance Industries Limited: Mba Programmerekha BaijuNo ratings yet

- Business & Society Project - CA2Document10 pagesBusiness & Society Project - CA2Bhushan ToraskarNo ratings yet

- Reliance Industry LimitedDocument21 pagesReliance Industry LimitedMehak guptaNo ratings yet

- Financial Analysis of Reliance IndustriesDocument32 pagesFinancial Analysis of Reliance IndustriesManik SinghNo ratings yet

- Indian Institute of Plantation Management: in Reliance Fresh BangaloreDocument26 pagesIndian Institute of Plantation Management: in Reliance Fresh BangaloreTejaswini GHNo ratings yet

- Reliance IndustriesDocument32 pagesReliance IndustriesSiddhi JainNo ratings yet

- History: Reliance Industries Limited (RIL) Is An IndianDocument5 pagesHistory: Reliance Industries Limited (RIL) Is An IndianParthNo ratings yet

- Non Tariff Barriers in IndiaDocument25 pagesNon Tariff Barriers in Indiameera bhanushaliNo ratings yet

- 6th Sem Project FinalDocument60 pages6th Sem Project FinalSaroj KhadangaNo ratings yet

- Reliance Industries LTDDocument4 pagesReliance Industries LTDAnonymous HAkNRaNo ratings yet

- Project ReportDocument25 pagesProject Report21ACO56 RAM PRANAV T PNo ratings yet

- Reliance Industries Limited: Founder Key People Headquarters Revenue Subsidiaries Roles OfferedDocument5 pagesReliance Industries Limited: Founder Key People Headquarters Revenue Subsidiaries Roles OfferedSeshagiri VempatiNo ratings yet

- A study on impact of training and development on employee engagement in reliance industries limitedDocument54 pagesA study on impact of training and development on employee engagement in reliance industries limitedalifahadmz04No ratings yet

- Business Environment Course Code: MGN 303Document10 pagesBusiness Environment Course Code: MGN 303Sahil PrasharNo ratings yet

- 3361IIMK CS 123 QM&OM 202101 Final UploadDocument26 pages3361IIMK CS 123 QM&OM 202101 Final UploadArka DasNo ratings yet

- A Consolidated Balance Sheet On RelianceDocument10 pagesA Consolidated Balance Sheet On RelianceDhruvraj SolankiNo ratings yet

- Vasu PRJCTDocument35 pagesVasu PRJCTRockyLagishettyNo ratings yet

- Reliance Industries LimitedDocument7 pagesReliance Industries Limitedshobhit chaturvediNo ratings yet

- Reliance ProjectDocument29 pagesReliance ProjectpranavNo ratings yet

- S9 Retail Consumer BehaviourDocument11 pagesS9 Retail Consumer Behaviourmohammed shabeerNo ratings yet

- Reliance Industries' Pricing Strategies & Competition AnalysisDocument12 pagesReliance Industries' Pricing Strategies & Competition Analysissehar Ishrat SiddiquiNo ratings yet

- Introduction to Reliance Group & Reliance Retail's Format StoresDocument58 pagesIntroduction to Reliance Group & Reliance Retail's Format StoresMinecraft ServerNo ratings yet

- Reliance IndustryDocument13 pagesReliance Industryasrai87No ratings yet

- Reliance Industries LimitedDocument28 pagesReliance Industries Limitedveerabhadraveerabhadra150No ratings yet

- Ril Competitive AdvantageDocument7 pagesRil Competitive AdvantageMohitNo ratings yet

- Group - 8 - SecC - Reliance Industries LimitedDocument19 pagesGroup - 8 - SecC - Reliance Industries LimitedShrinivas PuliNo ratings yet

- Reliance Commercial Corporation: Reliance Group Reliance IndustriesDocument8 pagesReliance Commercial Corporation: Reliance Group Reliance IndustriesAbhishek MishraNo ratings yet

- Declaration: Retail Industry AnalysisDocument19 pagesDeclaration: Retail Industry AnalysisLagnajit Ayaskant SahooNo ratings yet

- Reliance Industries Management Control and Financial Analysis/TITLEDocument72 pagesReliance Industries Management Control and Financial Analysis/TITLEmanojrengar52% (33)

- Reliance India LimitedDocument27 pagesReliance India Limitedkunal_vk100% (3)

- Dirubai AmbaniDocument73 pagesDirubai AmbaniRahulNo ratings yet

- Finance Project Prof: Amogh Gothoskar By: Anurita Majumdar Class: PGDPRCCDocument23 pagesFinance Project Prof: Amogh Gothoskar By: Anurita Majumdar Class: PGDPRCCPankaj MadaanNo ratings yet

- Reliance Industries Limited (RIL) Is An: Fortune Global 500Document3 pagesReliance Industries Limited (RIL) Is An: Fortune Global 500surajitbijoyNo ratings yet

- New ProjectDocument195 pagesNew ProjectVarun NeelagarNo ratings yet

- Statistics ProjectDocument33 pagesStatistics Projectsaraansh aryaNo ratings yet

- Lovely Professional University: Mittal School of Business Academic Task - 3Document16 pagesLovely Professional University: Mittal School of Business Academic Task - 3Shashank Rana100% (1)

- Reliance IndustriesDocument52 pagesReliance IndustriesAnsariFaiyazNo ratings yet

- RIL's Strategies and Positioning in BCG MatrixDocument21 pagesRIL's Strategies and Positioning in BCG Matrixnutan korhaleNo ratings yet

- Kokkonda AravindDocument12 pagesKokkonda AravindVB INTERNET AND GROCERY STORENo ratings yet

- Finance Equity ShareholdersDocument19 pagesFinance Equity ShareholdersTabrej AlamNo ratings yet

- Reliance IndustriesDocument11 pagesReliance IndustriesJerryNo ratings yet

- Inventory Management at Reliance IndustriesDocument76 pagesInventory Management at Reliance IndustriesPurvi SehgalNo ratings yet

- Reliance Industries - Wikipedia, The Free EncyclopediaDocument9 pagesReliance Industries - Wikipedia, The Free Encyclopediapaulrulez31570% (2)

- Company Overview 3 1Document78 pagesCompany Overview 3 1Vivek Vikram SinghNo ratings yet

- History: Reliance Industries Limited Is An IndianDocument4 pagesHistory: Reliance Industries Limited Is An IndianDeependra SinghNo ratings yet

- Quality Management of Reliance India LimitedDocument17 pagesQuality Management of Reliance India Limitedsurvish50% (2)

- Reliance Industries: From Wikipedia, The Free Encyclopedia Not To Be Confused With - Reliance Industries LimitedDocument4 pagesReliance Industries: From Wikipedia, The Free Encyclopedia Not To Be Confused With - Reliance Industries LimitedflowermatrixNo ratings yet

- Project ReportDocument7 pagesProject ReportMEHTANo ratings yet

- 242 Saloni SoniDocument43 pages242 Saloni SoniShreyashNo ratings yet

- A Study On Financial Analysis of Indian Oil Corporation LimitedDocument29 pagesA Study On Financial Analysis of Indian Oil Corporation LimitedMayank KumarNo ratings yet

- Marketing Strategiesof Reliance Industries LimitedDocument14 pagesMarketing Strategiesof Reliance Industries Limitedantoprincia1723No ratings yet

- Moh. HushenDocument19 pagesMoh. HushenhaiderhusainNo ratings yet

- Reliance IndustryDocument23 pagesReliance IndustryRajuNo ratings yet

- Reliance Training and DevelopmentDocument58 pagesReliance Training and DevelopmentMeghaDivakar100% (1)

- Reliance MartDocument45 pagesReliance MartSreelakshmiNo ratings yet

- Vertex SolutionDocument2 pagesVertex SolutionMadhav JhaNo ratings yet

- CCRS - Project Management InstituteDocument2 pagesCCRS - Project Management InstituteMadhav JhaNo ratings yet

- 2 Contract LawDocument31 pages2 Contract LawMadhav JhaNo ratings yet

- 1-2 Constitution and Business InterationsDocument23 pages1-2 Constitution and Business InterationsMadhav JhaNo ratings yet

- Practice Problem-CFSDocument6 pagesPractice Problem-CFSMadhav JhaNo ratings yet

- Priyadarshi Melamine Company CaseDocument18 pagesPriyadarshi Melamine Company CaseMadhav JhaNo ratings yet

- Physice 2013 Unsolved Paper Outside Delhi PDFDocument7 pagesPhysice 2013 Unsolved Paper Outside Delhi PDFAbhilashaNo ratings yet

- IEC Developer version 6.n compiler error F1002Document6 pagesIEC Developer version 6.n compiler error F1002AnddyNo ratings yet

- The Power ParadoxDocument27 pagesThe Power ParadoxKieran De PaulNo ratings yet

- Net CallDocument2 pagesNet CallFerdinand Monte Jr.100% (2)

- Phy 111 - Eos Exam 2015Document7 pagesPhy 111 - Eos Exam 2015caphus mazengeraNo ratings yet

- Module 5 Greek ArchDocument22 pagesModule 5 Greek ArchKyla A. EstoestaNo ratings yet

- Clock 38 InstructionsDocument20 pagesClock 38 InstructionsCanNo ratings yet

- Investigação de Um Novo Circuito de Balanceamento de Tensão para Turbinas Eólicas Baseadas em PMSG Offshore Conectadas em ParaleloDocument7 pagesInvestigação de Um Novo Circuito de Balanceamento de Tensão para Turbinas Eólicas Baseadas em PMSG Offshore Conectadas em ParaleloDaniel reisNo ratings yet

- Otimizar Windows 8Document2 pagesOtimizar Windows 8ClaudioManfioNo ratings yet

- Lesson Plan Nº1Document7 pagesLesson Plan Nº1Veronica OrpiNo ratings yet

- Teach Empathy With LiteratureDocument3 pagesTeach Empathy With LiteratureSantiago Cardenas DiazNo ratings yet

- Cause and Effect Diagram for Iron in ProductDocument2 pagesCause and Effect Diagram for Iron in ProductHungNo ratings yet

- Autonomy Necessity and Love by Harry FrankfurtDocument14 pagesAutonomy Necessity and Love by Harry FrankfurtjamesdigNo ratings yet

- FOXPAK Control Valve System SpecificationsDocument0 pagesFOXPAK Control Valve System Specificationscico_ctNo ratings yet

- The Tower Undergraduate Research Journal Volume VI, Issue IDocument92 pagesThe Tower Undergraduate Research Journal Volume VI, Issue IThe Tower Undergraduate Research JournalNo ratings yet

- The PersonalityDocument7 pagesThe PersonalityMeris dawatiNo ratings yet

- Occupational Health and Safety ProceduresDocument20 pagesOccupational Health and Safety ProceduresPRINCESS VILLANo ratings yet

- Awareness On Biomedical Waste Management Among Dental Students - A Cross Sectional Questionnaire SurveyDocument8 pagesAwareness On Biomedical Waste Management Among Dental Students - A Cross Sectional Questionnaire SurveyIJAR JOURNALNo ratings yet

- Review of Train Wheel Fatigue LifeDocument15 pagesReview of Train Wheel Fatigue Lifeabdurhman suleimanNo ratings yet

- Railway Reservation System - ConciseDocument38 pagesRailway Reservation System - ConciseTECH CodeNo ratings yet

- Official Statement On Public RelationsDocument1 pageOfficial Statement On Public RelationsAlexandra ZachiNo ratings yet

- Equipment & Piping Layout T.N. GopinathDocument88 pagesEquipment & Piping Layout T.N. Gopinathhirenkumar patelNo ratings yet

- Einstein and Oppenheimer's Real Relationship Was Cordial and Complicated Vanity FairDocument1 pageEinstein and Oppenheimer's Real Relationship Was Cordial and Complicated Vanity FairrkwpytdntjNo ratings yet

- 1 Shane Fitzsimons - TATA SonsDocument8 pages1 Shane Fitzsimons - TATA Sonsvikashs srivastavaNo ratings yet

- Guidelines For Synopsis & Dissertation-DefenseDocument10 pagesGuidelines For Synopsis & Dissertation-DefenseRajni KumariNo ratings yet

- Short Time Fourier TransformDocument37 pagesShort Time Fourier TransformGopikaPrasadNo ratings yet

- Simha Lagna: First House Ruled by The Planet Sun (LEO) : The 1st House Known As The Ascendant orDocument3 pagesSimha Lagna: First House Ruled by The Planet Sun (LEO) : The 1st House Known As The Ascendant orRahulshah1984No ratings yet

- Pragmatics: The Study of Its Historical Overview, Meanings, Scope and The Context in Language UseDocument7 pagesPragmatics: The Study of Its Historical Overview, Meanings, Scope and The Context in Language UseIHINOSEN IYOHANo ratings yet

- SCI 7 Q1 WK5 Solutions A LEA TOMASDocument5 pagesSCI 7 Q1 WK5 Solutions A LEA TOMASJoyce CarilloNo ratings yet

- Four Golden RuleDocument6 pagesFour Golden RulerundyudaNo ratings yet