Professional Documents

Culture Documents

Children Saving Accounts1

Uploaded by

Kavya Badiger0 ratings0% found this document useful (0 votes)

9 views12 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views12 pagesChildren Saving Accounts1

Uploaded by

Kavya BadigerCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 12

Want to get your children started on

the road to Financial Freedom?

Yes? Then, a Children’s Saving

Account is what your need.

But you have a range of minor

savings account options to choose

from.

Choose the right one to ensure

your child GROWS up financially

AWARE.

ICICI Bank offers two

dedicated Children’s

Account

• Young Star Saving Account

• Smart Star Saving Account

Young Star Saving Account

PURPOSE

To help parents plan and

balance their children’s

needs with ease.

Young Star Saving Account

ELIGIBILITY CRITERIA

Can be opened by a parent

or guardian for the Child

who is between ages of 1

day old and 18 years.

Young Star Saving Account

• Card has zero liability feature

• Minimum monthly blance-

FEATURES AND BENIFITS

INR 2500

• Free passbook facility

• Opened and operated by parent or

• Free e-mail statements

guardian

• Account management

• Standing features to transfer cash

through internet banking,

• Money Multiplier facility

imobile app, etc.

• Daily spend limit ranges- INR 1000- INR

• No transaction limit under

5000

guardianship

• Interest rate- 4% annually

• Debit card facility

Young Star Saving Account

DOCUMENTS

Id and Photograph Birth proof Decleration

address of guardian of minor from

proof guardian

Smart Star Saving Account

PURPOSE

To inculcate the habit of

savings and a responsibility

to spend wisely.

Smart Star Saving Account

ELIGIBILITY CRITERIA

Can be opened in the name

of child having age between

10 years and 18 years.

Smart Star Saving Account

The Two Variants:

• Smart star saving account with guardian consent:

Debit transaction limit of INR 2 lakh in a financial

year

• Smart star saving account without guardian

consent: Debit transaction limit of INR 50,000 in a

financial year

Smart Star Saving Account

• Free first 4 transaction in a

month

FEATURES AND BENIFITS

• Minimum monthly blance- INR

2500

• Money Transfer Facility

• Free passbook facility

• Standing features to transfer cash

• Free e-mail statements

• ATM withdrawl facility

• Account management through

• Daily spend limit ranges- INR 1000- INR

internet banking, imobile app,

5000

etc.

• Interest rate- 4% annually > regular

• Pre-paid mobile recharge

saving account

facility

• Personalized Pocket Debit Card

Smart Star Saving Account

DOCUMENTS

Id and Relationship

Latest Birth proof Document

address

photograph of minor and self

proof of

of applicant cheque (if

guardan

not visiting)

You might also like

- Part 2 Basic Accounting Journalizing LectureDocument11 pagesPart 2 Basic Accounting Journalizing LectureKong Aodian100% (2)

- UPI For Businesses BrochureDocument8 pagesUPI For Businesses BrochuretyagigaNo ratings yet

- Marketing Plan Group 5Document29 pagesMarketing Plan Group 5Neri La Luna100% (1)

- 5WLA Based On Business Process ModelDocument50 pages5WLA Based On Business Process Modeldyah ika100% (3)

- Export MarketingDocument74 pagesExport MarketingkaurpreetgillNo ratings yet

- Unified Payment Interfaces (Upi)Document37 pagesUnified Payment Interfaces (Upi)V.F.MUHAMMED ISMAIL THOUHEEDNo ratings yet

- MGT604 Assessment 2.aDocument9 pagesMGT604 Assessment 2.aGoyal PrachiNo ratings yet

- This Study Resource Was: Agenda Item 11 Half Year 4Document2 pagesThis Study Resource Was: Agenda Item 11 Half Year 4akiyama madokaNo ratings yet

- Axis ASAP FlowDocument13 pagesAxis ASAP FlowArbaz KhanNo ratings yet

- Current Account NotesDocument7 pagesCurrent Account Notes2607982No ratings yet

- CUBDocument22 pagesCUBsathishNo ratings yet

- Idbi Bank: Casa Study Presented byDocument21 pagesIdbi Bank: Casa Study Presented byIndal KhannaNo ratings yet

- Kumari BankDocument26 pagesKumari BankSheetal KarmacharyaNo ratings yet

- PBP BrochureDocument7 pagesPBP BrochureMdShehabazNo ratings yet

- Akshay Jain HDFC DigitalizationDocument32 pagesAkshay Jain HDFC DigitalizationAkshay JainNo ratings yet

- Comparing SBI Pehla Kadam & Pehli Udaan, HDFC Kids Advantage Account & Junior Savings Account On 7PDocument3 pagesComparing SBI Pehla Kadam & Pehli Udaan, HDFC Kids Advantage Account & Junior Savings Account On 7PManjishtaKainthNo ratings yet

- Icici Bank Tcs One Pager - Pan IndiaDocument4 pagesIcici Bank Tcs One Pager - Pan IndiaNikhil SahuNo ratings yet

- DAO GuideDocument123 pagesDAO Guideghufranwazir97No ratings yet

- HDFC Bank One Pager English BSBDADocument1 pageHDFC Bank One Pager English BSBDAAnirbanNo ratings yet

- Financial Literacy ProjectDocument8 pagesFinancial Literacy ProjectOsho AryanNo ratings yet

- Icici BankDocument6 pagesIcici BankDell HpNo ratings yet

- Product Orientatin SessionDocument38 pagesProduct Orientatin SessionManjil ShresthaNo ratings yet

- ICICI BANK - Marketing Strategies of Financial ProductsDocument15 pagesICICI BANK - Marketing Strategies of Financial ProductsAkshaya N0% (1)

- MBFS PPT 2Document12 pagesMBFS PPT 2Shreya ShrivastavaNo ratings yet

- FUBAC Presentation On YONODocument19 pagesFUBAC Presentation On YONORajNo ratings yet

- Retail Banking SlidesDocument22 pagesRetail Banking SlidesArafatAdilNo ratings yet

- Transaction Banking Slides-FinalDocument25 pagesTransaction Banking Slides-FinalManjil ShresthaNo ratings yet

- APB Current Account - v2Document20 pagesAPB Current Account - v2Badsha SeikhNo ratings yet

- Financial Institutions and Markets: Case Study: Banking ProductsDocument10 pagesFinancial Institutions and Markets: Case Study: Banking ProductsSai Dinesh BilleNo ratings yet

- Saving OutletsDocument2 pagesSaving OutletsG TechNo ratings yet

- عسکری بینکDocument39 pagesعسکری بینکNain TechnicalNo ratings yet

- Team Singapore HDFC BankDocument14 pagesTeam Singapore HDFC BankRajeev KumarNo ratings yet

- One Saving Account PPT Group-3Document8 pagesOne Saving Account PPT Group-3Shanu SinghNo ratings yet

- Immersion: Presented byDocument20 pagesImmersion: Presented bySathish DNo ratings yet

- Focused On What Matters NBT BankDocument1 pageFocused On What Matters NBT BankElizabeth LewisNo ratings yet

- ICICI Bank Insta Salary PPT - Latest UpdatedDocument2 pagesICICI Bank Insta Salary PPT - Latest UpdatedManish singh sisodiyaNo ratings yet

- Lecture 1 - Digital BankingDocument28 pagesLecture 1 - Digital BankingTrinh Phan Thị NgọcNo ratings yet

- Financial Literacy - Module - 3 BanksDocument25 pagesFinancial Literacy - Module - 3 Banksatharva.surya.guptaNo ratings yet

- HDFCDocument4 pagesHDFCanon-605853100% (1)

- Internship ReportDocument14 pagesInternship ReportVanitha100% (1)

- PIONEER Brochure PDFDocument44 pagesPIONEER Brochure PDFsunilkattaNo ratings yet

- HDFC Bank One Pager English Regular SavingsDocument1 pageHDFC Bank One Pager English Regular SavingsParas JatanaNo ratings yet

- HDFC ProjectDocument13 pagesHDFC ProjectHemanth KumarNo ratings yet

- For Employer PresentationDocument35 pagesFor Employer PresentationAlmario Javate SagunNo ratings yet

- Ecosystem ProjectDocument4 pagesEcosystem ProjectChinmoy HazarikaNo ratings yet

- Personal Finance For Mentors: 17 November 2015Document43 pagesPersonal Finance For Mentors: 17 November 2015MaryroseNo ratings yet

- PMJDYDocument5 pagesPMJDYPEDDER ROADNo ratings yet

- Digital Nov 2021Document64 pagesDigital Nov 2021jagadish madiwalarNo ratings yet

- SB - Kishore and Tarun PDFDocument1 pageSB - Kishore and Tarun PDFsheetalNo ratings yet

- Aman Singh Mofs 2019 0806 0001 0004Document88 pagesAman Singh Mofs 2019 0806 0001 0004AMAN SINGHNo ratings yet

- ELITE Terms and ConditionsDocument56 pagesELITE Terms and ConditionsP. AbhiramNo ratings yet

- New Youth Banking v2Document14 pagesNew Youth Banking v2Abdulai Salawu-deenNo ratings yet

- CitibankDocument9 pagesCitibankSiva BalajiNo ratings yet

- PIH - Arab Bank Digital Flyer - V 05Document5 pagesPIH - Arab Bank Digital Flyer - V 05Edil Derrick CastilloNo ratings yet

- Work PresentationDocument18 pagesWork Presentationasim ali pashaNo ratings yet

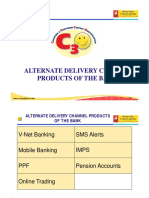

- ADC Products of The BankDocument12 pagesADC Products of The BankthinkingvishalNo ratings yet

- Channel Access Request FormDocument3 pagesChannel Access Request FormRavi RamrakhaniNo ratings yet

- Salary Account Presentation - GICDocument6 pagesSalary Account Presentation - GICSandeep kumar TanwarNo ratings yet

- Comparative Study On E-Banking of Yes Bank & UBIDocument22 pagesComparative Study On E-Banking of Yes Bank & UBIdhirajmitraNo ratings yet

- InstaBIZ 1Document14 pagesInstaBIZ 1Sacjin mandalNo ratings yet

- Icici Tips On Home BuyingDocument5 pagesIcici Tips On Home Buyingpraveenk81No ratings yet

- Retail Banking: Presented by Group-1Document20 pagesRetail Banking: Presented by Group-1Purti TiwariNo ratings yet

- Commercial Banking System: Services & InnovationsDocument19 pagesCommercial Banking System: Services & InnovationsbharatNo ratings yet

- UntitledDocument6 pagesUntitledAakritiNo ratings yet

- Switch Your Salary Account To HDFC BankDocument2 pagesSwitch Your Salary Account To HDFC BankYashNo ratings yet

- ACC 558 Lecture 5 IPSAS 23 ASSETSDocument89 pagesACC 558 Lecture 5 IPSAS 23 ASSETSEzekiel Korankye OtooNo ratings yet

- Excel Modeling in Investments 4th Edition Holden Solutions ManualDocument87 pagesExcel Modeling in Investments 4th Edition Holden Solutions Manualvictoriawaterswkdxafcioq100% (16)

- Unit 15 Store Audit: StructureDocument24 pagesUnit 15 Store Audit: StructureCherry BlondNo ratings yet

- Bio DataDocument7 pagesBio DataPrakash KcNo ratings yet

- Ch17 WagePayDocument14 pagesCh17 WagePaydaNo ratings yet

- Shell Digital Marketing StrategiesDocument69 pagesShell Digital Marketing StrategiesFiorella AvalosNo ratings yet

- SWOT Pengembangan Udang WinduDocument9 pagesSWOT Pengembangan Udang WinduSiska AmeliaNo ratings yet

- Wael Ali: IT Project Manager Senior Business Analyst Product OwnerDocument3 pagesWael Ali: IT Project Manager Senior Business Analyst Product OwnerWael NabhaniNo ratings yet

- Worksheet#1 MCQDocument3 pagesWorksheet#1 MCQAhmad MedlejNo ratings yet

- BPME3073 Group Assignment RP (A131) GuidelinesDocument10 pagesBPME3073 Group Assignment RP (A131) GuidelinesTeguh HardiNo ratings yet

- Chapter 10 MGT657Document27 pagesChapter 10 MGT657MUHAMMAD AFNAN MOHAMAD SABORNo ratings yet

- 1 - MB Group Assignment I 21727Document2 pages1 - MB Group Assignment I 21727RoNo ratings yet

- Turning Performance Objectives Into Operations PrioritiesDocument14 pagesTurning Performance Objectives Into Operations PrioritiesMriganka Chakraborty67% (3)

- MEDCLAIM - Docx 80 DDocument1 pageMEDCLAIM - Docx 80 DNani krishnaNo ratings yet

- Customer Buying Behavior: Retailing Management 8E © The Mcgraw-Hill Companies, All Rights ReservedDocument30 pagesCustomer Buying Behavior: Retailing Management 8E © The Mcgraw-Hill Companies, All Rights ReservedDavid Lumaban GatdulaNo ratings yet

- 1995 NAFTA and Mexico's Maize ProducersDocument14 pages1995 NAFTA and Mexico's Maize ProducersJose Manuel FloresNo ratings yet

- Hindustan Petroleum Corporation - FullDocument64 pagesHindustan Petroleum Corporation - FullSathyaPriya RamasamyNo ratings yet

- Strategy, Organization Design and EffectivenessDocument16 pagesStrategy, Organization Design and EffectivenessJaJ08No ratings yet

- (PDF) The Impact of Financial Education in High School and College On Financial Literacy and Subsequent Financial Decision MakingDocument71 pages(PDF) The Impact of Financial Education in High School and College On Financial Literacy and Subsequent Financial Decision MakingJerry LacsamanaNo ratings yet

- Homework Solution 7Document64 pagesHomework Solution 7Shalini VeluNo ratings yet

- Chap 003Document37 pagesChap 003fadikaradshehNo ratings yet

- E-Portfolio Econ 1740Document3 pagesE-Portfolio Econ 1740api-240741436No ratings yet

- 18bba63c U4Document11 pages18bba63c U4Thangamani.R ManiNo ratings yet

- BM2.MOD2 in Class Problems 12152010Document2 pagesBM2.MOD2 in Class Problems 12152010Pollie Jayne ChuaNo ratings yet