Professional Documents

Culture Documents

CH 02 Hull OFOD9 TH Edition

Uploaded by

Pedestal ConciergeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 02 Hull OFOD9 TH Edition

Uploaded by

Pedestal ConciergeCopyright:

Available Formats

Chapter 2

Mechanics of Futures

Markets

Options, Futures, and Other Derivatives, 9th Edition, Copyright ©

John C. Hull 2014 1

Futures Contracts

• Available on a wide range of assets

• Exchange traded

• Specifications need to be defined:

• What can be delivered,

• Where it can be delivered, &

• When it can be delivered

• Settled daily (marked to market)

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 2

Convergence of Futures to Spot (Figure

2.1, page 29)

Futures

Price Spot Price

Spot Price Futures

Price

Tim Tim

e e

(a (b

) )

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 3

Convergence of Futures to Spot

• The difference between the spot and future

prices is called the basis and is given by

Basis=Spot price – Future price

🡺 As the maturity date approaches, the basis

converges to zero. At expiration the spot price

must be equal to the future price🡺 because

the future price has become the price today

for delivery today, which is the same as the

spot🡺 thus, arbitragers will force the prices to

be the same at expiration 4

Margins

• A margin is cash or marketable securities

deposited by an investor with his or her

broker

• The balance in the margin account is

adjusted to reflect daily settlement

• Margins minimize the possibility of a loss

through a default on a contract

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 5

Margin Cash Flows

• A trader has to bring the balance in the margin

account up to the initial margin when it falls below the

maintenance margin level

• A member of the exchange clearing house only has

an initial margin and is required to bring the balance

in its account up to that level every day.

• These daily margin cash flows are referred to as

variation margin

• A member is also required to contribute to a default

fund

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 6

Example of a Futures Trade (page

27-29)

• An investor takes a long position in 2

December gold futures contracts on June

5

• contract size is 100 oz.

• futures price is US$1,450

• initial margin requirement is

US$6,000/contract (US$12,000 in total)

• maintenance margin is US$4,500/contract

(US$9,000 in total)

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 7

A Possible Outcome (Table 2.1, page 30)

Day Trade Settle Daily Cumul. Margin Margin

Price ($) Price ($) Gain ($) Gain ($) Balance ($) Call ($)

1 1,450.00 12,000

1 1,441.00 −1,800 − 1,800 10,200

2 1,438.30 −540 −2,340 9,660

….. ….. ….. ….. ……

6 1,436.20 −780 −2,760 9,240

7 1,429.90 −1,260 −4,020 7,980 4,020

8 1,430.80 180 −3,840 12,180

….. ….. ….. ….. ……

16 1,426.90 780 −4,620 15,180

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 8

Margin Cash Flows When Futures

Price Increases

Clearing House

Clearing House Clearing House

Member Member

Broker Broker

Long Trader Short Trader

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 9

Margin Cash Flows When Futures Price

Decreases

Clearing House

Clearing House Clearing House

Member Member

Broker Broker

Long Trader Short Trader

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 10

Some Terminology

• Open interest: the total number of contracts

outstanding

• equal to number of long positions or number of short

positions

• Settlement price: the price just before the final

bell each day

• used for the daily settlement process

• Volume of trading: the number of trades in one

day

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 11

Key Points About Futures

• They are settled daily

• Closing out a futures position involves

entering into an offsetting trade

• Most contracts are closed out before

maturity

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 12

Crude Oil Trading on May 14,

2013 (Table 2.2, page 36)

Open High Low Prior Last Change Volume

Settle Trade

Jun 2013 94.93 95.66 94.50 95.17 94.72 −0.45 162,901

Aug 2013 95.24 95.92 94.81 95.43 95.01 −0.42 37,830

Dec 2013 93.77 94.37 93.39 93.89 93.60 −0.29 27,179

Dec 2014 89.98 90.09 89.40 89.71 89.62 −0.09 9,606

Dec 2015 86.99 87.33 86.94 86.99 86.94 −0.05 2,181

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 13

Collateralization in OTC Markets

• It is becoming increasingly common for transactions

to be collateralized in OTC markets

• Consider transactions between companies A and B

• These might be governed by an ISDA Master

agreement with a credit support annex (CSA)

• The CSA might require A to post collateral with B

equal to the value to B of its outstanding transactions

with B when this value is positive.

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 14

Collateralization in OTC

Markets continued

• If A defaults, B is entitled to take possession

of the collateral

• The transactions are not settled daily and

interest is paid on cash collateral

• See Business Snapshot 2.2 for how

collateralization affected Long Term Capital

Management when there was a “flight to

quality” in 1998.

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 15

Clearing Houses and OTC

Markets

• Traditionally most transactions have been cleared

bilaterally in OTC markets

• Following the 2007-2009 crisis, the has been a

requirement for most standardized OTC derivatives

transactions between dealers to be cleared through

central counterparties (CCPs)

• CCPs require initial margin, variation margin, and

default fund contributions from members similarly to

exchange clearing houses

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 16

Bilateral Clearing vs Central

Clearing House

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 17

New Regulations

• New regulations for trades between dealers

that are not cleared centrally require dealers

to post both initial margin and daily variation

margin

• The initial margin is posted with a third party

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 18

Delivery

• If a futures contract is not closed out before

maturity, it is usually settled by delivering the

assets underlying the contract. When there are

alternatives about what is delivered, where it is

delivered, and when it is delivered, the party

with the short position chooses.

• A few contracts (for example, those on stock

indices and Eurodollars) are settled in cash

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 19

Questions

• When a new trade is completed what are the

possible effects on the open interest?

🡺in two ways:

1) Increase open interest

2) Decrease open interest

• Can the volume of trading in a day be greater

than the open interest?

🡺Yes, it indicates that many traders who entered

into a positions during the day closed them out

before the end of the day (day traders)

20

Types of Orders

• Limit • Discretionary

• Stop-loss • Time of day

• Stop-limit • Open

• Market-if touched • Fill or kill

Options, Futures, and Other Derivatives, 9th Edition, Copyright ©

John C. Hull 2014 21

Regulation of Futures

• In the US, the regulation of futures

markets is primarily the responsibility of

the Commodity Futures and Trading

Commission (CFTC)

• Regulators try to protect the public

interest and prevent questionable

trading practices

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 22

Accounting & Tax

• Ideally hedging profits (losses) should be

recognized at the same time as the losses

(profits) on the item being hedged

• Ideally profits and losses from speculation

should be recognized on a mark-to-market

basis

• Roughly speaking, this is what the accounting

and tax treatment of futures in the U.S. and

many other countries attempt to achieve

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 23

Forward Contracts vs Futures Contracts (Table

2.3, page 43)

FORWARD FUTURE

S S

Private contract between 2 parties Exchange traded

Non-standard contract Standard contract

Usually 1 specified delivery date Range of delivery dates

Settled at end of contract Settled daily

Delivery or final cash Contract usually closed out

settlement usually occurs prior to

maturity

Some credit risk Virtually no credit risk

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 24

Foreign Exchange Quotes

• Futures exchange rates are quoted as the

number of USD per unit of the foreign currency

• Forward exchange rates are quoted in the same

way as spot exchange rates. This means that

GBP, EUR, AUD, and NZD are quoted as USD

per unit of foreign currency. Other currencies

(e.g., CAD and JPY) are quoted as units of the

foreign currency per USD.

Options, Futures, and Other Derivatives, 9th Edition,

Copyright © John C. Hull 2014 25

You might also like

- Citigroup LBODocument32 pagesCitigroup LBOLindsey Santos88% (8)

- Cisi ExamsDocument2 pagesCisi ExamsNitin Collapen100% (1)

- Week 2 Mechanics of Futures MarketsDocument16 pagesWeek 2 Mechanics of Futures Markets胡丹阳No ratings yet

- Ch02HullOFOD9thEdition - EditedDocument31 pagesCh02HullOFOD9thEdition - EditedHarshvardhan MohataNo ratings yet

- Futures and ForwardsDocument52 pagesFutures and ForwardsThiên HànNo ratings yet

- CH 02 Hull OFOD9 TH EditionDocument24 pagesCH 02 Hull OFOD9 TH EditionPhonglinh WindNo ratings yet

- CH 02 Hull OFOD9 TH EditionDocument24 pagesCH 02 Hull OFOD9 TH Editionseanwu95No ratings yet

- Lectures Slides 2b AEV8Document53 pagesLectures Slides 2b AEV8Amal MobarakiNo ratings yet

- Introduction To DerivativesDocument49 pagesIntroduction To DerivativesPhương TrinhNo ratings yet

- Finance 101 Insead Lec 2Document18 pagesFinance 101 Insead Lec 2Dwijesh RajwadeNo ratings yet

- CH 03 Hull OFOD9 TH EditionDocument29 pagesCH 03 Hull OFOD9 TH EditionPedestal ConciergeNo ratings yet

- Ch01HullOFOD9thEdition - EditedDocument36 pagesCh01HullOFOD9thEdition - EditedHarshvardhan MohataNo ratings yet

- Financial Derivatives: Session 1Document97 pagesFinancial Derivatives: Session 1Vivek KhandelwalNo ratings yet

- FIN4003 - Lecture02 - Mechanisms - of - Futures 16 Mar 2018Document27 pagesFIN4003 - Lecture02 - Mechanisms - of - Futures 16 Mar 2018Who Am iNo ratings yet

- Forward Contracts and Futures MarketsDocument28 pagesForward Contracts and Futures MarketskevinNo ratings yet

- Mechanics of Futures Markets ExplainedDocument23 pagesMechanics of Futures Markets ExplainedaliNo ratings yet

- Hedging StrategiesDocument19 pagesHedging StrategiesFirly IrhamniNo ratings yet

- Futures Markets and Central Counterparties: John C. Hull 2017 1Document10 pagesFutures Markets and Central Counterparties: John C. Hull 2017 1sohanNo ratings yet

- Futures Markets and Central CounterpartiesDocument34 pagesFutures Markets and Central CounterpartiesAradhita BaruahNo ratings yet

- Eun7e CH 007Document43 pagesEun7e CH 007Shruti AshokNo ratings yet

- Futures - Key HandoutDocument9 pagesFutures - Key Handoutvjean_jacquesNo ratings yet

- FMI Lecture 8Document41 pagesFMI Lecture 8Hứa Nguyệt VânNo ratings yet

- Types of Forex Exposure and Transaction Risk ManagementDocument13 pagesTypes of Forex Exposure and Transaction Risk ManagementNeneng WulandariNo ratings yet

- Ch01金融衍生工具8thEditionDocument38 pagesCh01金融衍生工具8thEdition佳文No ratings yet

- Currency Derivatives: For Use With International Financial Management, 3e Jeff Madura and RolandDocument37 pagesCurrency Derivatives: For Use With International Financial Management, 3e Jeff Madura and Rolandياسين البيرنسNo ratings yet

- Hedging Strategies Using Futures: Options, Futures, and Other Derivatives, 9th EditionDocument19 pagesHedging Strategies Using Futures: Options, Futures, and Other Derivatives, 9th EditionAvNo ratings yet

- LNIntlFin 4Document14 pagesLNIntlFin 4Wina WinaNo ratings yet

- International Financial Management PgapteDocument25 pagesInternational Financial Management PgapterameshmbaNo ratings yet

- Ch02HullOFOD7thEd UpdatedDocument37 pagesCh02HullOFOD7thEd Updateddelight photostateNo ratings yet

- BUSI3502: Investments: Trading in Securities MarketsDocument34 pagesBUSI3502: Investments: Trading in Securities MarketsChendurNo ratings yet

- RM 1Document28 pagesRM 1berry liuNo ratings yet

- Currency Futures Introduction and ExampleDocument19 pagesCurrency Futures Introduction and ExampleShumaila KhanNo ratings yet

- Ppt. 1Document28 pagesPpt. 1sadNo ratings yet

- (CFA) (2015) (L2) 03 V5 - 2015 - CFA二级强化班PPT - 经济学 - 何旋1Document98 pages(CFA) (2015) (L2) 03 V5 - 2015 - CFA二级强化班PPT - 经济学 - 何旋1Phyllis YenNo ratings yet

- Chapter 6: Derivative Markets: Lecturer: Truong Thi Thuy Trang Email: Truongthithuytrang - Cs2@ftu - Edu.vnDocument79 pagesChapter 6: Derivative Markets: Lecturer: Truong Thi Thuy Trang Email: Truongthithuytrang - Cs2@ftu - Edu.vnHiếu Nhi TrịnhNo ratings yet

- Economics Investment Chapter 9Document25 pagesEconomics Investment Chapter 9sahil229No ratings yet

- Slide 03Document28 pagesSlide 03Shashika Anuradha KoswaththaNo ratings yet

- Currency Derivatives: Forward, Futures, and Options MarketsDocument25 pagesCurrency Derivatives: Forward, Futures, and Options MarketsRahul BambhaNo ratings yet

- Lecture No. 7 International FinanceDocument31 pagesLecture No. 7 International FinanceNadia MurtazaNo ratings yet

- Presentation 2: Options Futures and Other Derivatives Hull Pretince HallDocument13 pagesPresentation 2: Options Futures and Other Derivatives Hull Pretince HallYolibi KhunNo ratings yet

- Week 6 - Lecture NotesDocument25 pagesWeek 6 - Lecture Notesbao.pham04No ratings yet

- CHAPTER 6 Chapter 5 - Currency Futures and ForwardsDocument30 pagesCHAPTER 6 Chapter 5 - Currency Futures and Forwardsupf123No ratings yet

- BFN 427 Business Scenarios Using Swaps, Options and FuturesDocument68 pagesBFN 427 Business Scenarios Using Swaps, Options and FuturesgeorgeNo ratings yet

- WB 2007 CME Energy FuturesDocument39 pagesWB 2007 CME Energy FuturesNicolas EnriqueNo ratings yet

- Forwards and FuturesDocument38 pagesForwards and FuturesSwar DeshNo ratings yet

- Forex DerivativesDocument54 pagesForex DerivativesSammy MosesNo ratings yet

- Currency Futures Trading GuideDocument18 pagesCurrency Futures Trading GuiderudraNo ratings yet

- Mechanics of Futures MarketsDocument21 pagesMechanics of Futures MarketsJoeyyy121No ratings yet

- FX Markets Chapter OverviewDocument25 pagesFX Markets Chapter OverviewRahul KumarNo ratings yet

- 1 P.G Apte International Financial ManagementDocument42 pages1 P.G Apte International Financial ManagementrameshmbaNo ratings yet

- Currency Derivatives By: Hesniati, SE., MMDocument43 pagesCurrency Derivatives By: Hesniati, SE., MMNouman AhmadNo ratings yet

- Chapter 1Document28 pagesChapter 1ashutoshusa20No ratings yet

- Foreign Exchange: Presented To Coronation Merchant Bank - Training SchoolDocument24 pagesForeign Exchange: Presented To Coronation Merchant Bank - Training SchoolBlake SheltonNo ratings yet

- Mechanics of Futures and The Hedging Strategies Chapter 2&3: Geng NiuDocument71 pagesMechanics of Futures and The Hedging Strategies Chapter 2&3: Geng NiuegaNo ratings yet

- Futures and Options On Foreign Exchange: International Financial ManagementDocument50 pagesFutures and Options On Foreign Exchange: International Financial ManagementvijiNo ratings yet

- Exchange Rates and The Foreign Exchange Market: An Asset ApproachDocument49 pagesExchange Rates and The Foreign Exchange Market: An Asset ApproachTariqul IslamNo ratings yet

- Futures and Options On Foreign Exchange: All Rights ReservedDocument47 pagesFutures and Options On Foreign Exchange: All Rights ReservedArinYuniastikaEkaPutriNo ratings yet

- Forex by NageshDocument44 pagesForex by NageshNagesh KumarNo ratings yet

- CH 09 Hull OFOD9 TH EditionDocument18 pagesCH 09 Hull OFOD9 TH EditionPhonglinh WindNo ratings yet

- Forex Exposure and Exposure Transaction Management: Nageeta Tata Rosa, MBADocument11 pagesForex Exposure and Exposure Transaction Management: Nageeta Tata Rosa, MBAIndri setia PutriNo ratings yet

- BB 2 Futures & Options Hull Chap 1 & 2Document32 pagesBB 2 Futures & Options Hull Chap 1 & 2winfldNo ratings yet

- CH 01 Hull OFOD10 TH EditionDocument62 pagesCH 01 Hull OFOD10 TH EditionPedestal ConciergeNo ratings yet

- CH 03 Hull OFOD9 TH EditionDocument29 pagesCH 03 Hull OFOD9 TH EditionPedestal ConciergeNo ratings yet

- Kavouri SlideshowDocument48 pagesKavouri SlideshowPedestal ConciergeNo ratings yet

- Kivotos HGroup Presentation 2016 FinalDocument93 pagesKivotos HGroup Presentation 2016 FinalPedestal ConciergeNo ratings yet

- FinancialTheoryandPractice PDFDocument96 pagesFinancialTheoryandPractice PDFbaha146No ratings yet

- 03 Corp HY FactsheetDocument6 pages03 Corp HY FactsheetRoberto PerezNo ratings yet

- CAFIB (RWA) PD 02032017 - NDocument528 pagesCAFIB (RWA) PD 02032017 - NHamdan Hassin100% (1)

- SBI History and OperationsDocument54 pagesSBI History and OperationsaanchaliyaNo ratings yet

- Sr. Business Analyst | Scrum Master Rashmi LDocument5 pagesSr. Business Analyst | Scrum Master Rashmi LVinay ShrivasNo ratings yet

- Ind AS: An Overview (Simplified)Document28 pagesInd AS: An Overview (Simplified)Mehran AvNo ratings yet

- Enron Failure Shows Market Forces at WorkDocument24 pagesEnron Failure Shows Market Forces at Workthcm2011No ratings yet

- IBT FinalsDocument5 pagesIBT FinalsRyan CartaNo ratings yet

- Financial Markets & Institutions: Maria Jorgeth O. CarbonDocument65 pagesFinancial Markets & Institutions: Maria Jorgeth O. CarbonFelsie Jane Penaso100% (1)

- FTFM PDFDocument544 pagesFTFM PDFmanojbhatia1220No ratings yet

- CCAP BrochureDocument12 pagesCCAP BrochureRohit KhatriNo ratings yet

- PWC Financing Guide 122022Document382 pagesPWC Financing Guide 122022M Tariqul Islam Mishu100% (1)

- Fundamental AnalysisDocument48 pagesFundamental AnalysisBisma MasoodNo ratings yet

- 2013 Reference Form - Version 10Document141 pages2013 Reference Form - Version 10BVMF_RINo ratings yet

- Strategic Management, Ethics and TQMDocument45 pagesStrategic Management, Ethics and TQMMartin J. CarvalhoNo ratings yet

- Edelweiss Model Portfolio 12 StocksDocument18 pagesEdelweiss Model Portfolio 12 StocksSakthi SaravananNo ratings yet

- Bonds and DerivativesDocument149 pagesBonds and DerivativesLinh LinhNo ratings yet

- Guest Lecture Session By-Bhabani Sankar Rout: Financial DerivativeDocument8 pagesGuest Lecture Session By-Bhabani Sankar Rout: Financial DerivativeAP ABHILASHNo ratings yet

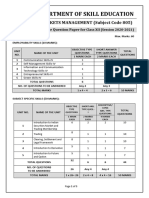

- 805 Financial Market Management SQPDocument5 pages805 Financial Market Management SQPajaydohre893No ratings yet

- 1504 05309 PDFDocument103 pages1504 05309 PDFDiegoFernandoGonzálezLarroteNo ratings yet

- Investment BankingDocument15 pagesInvestment BankingRahul singhNo ratings yet

- Capital Requirements On Market Risk - d457 PDFDocument136 pagesCapital Requirements On Market Risk - d457 PDFGiovanni BossiNo ratings yet

- MDM Maturity ModelDocument209 pagesMDM Maturity Modelanon_245271376No ratings yet

- Introduction to Derivatives Pricing and ApplicationsDocument6 pagesIntroduction to Derivatives Pricing and Applicationslevan1225No ratings yet

- Nism 8 - Equity Derivatives - Test-1 - Last Day RevisionDocument54 pagesNism 8 - Equity Derivatives - Test-1 - Last Day RevisionAbhijeet Kumar100% (1)

- 609331ffb3664e00204f9070 1620259409 SIM ACC 124 - Week 13 14 - ULOaDocument15 pages609331ffb3664e00204f9070 1620259409 SIM ACC 124 - Week 13 14 - ULOaRejen CabasagNo ratings yet

- ACCA P2Int Mock1 Answers June2018 PDFDocument24 pagesACCA P2Int Mock1 Answers June2018 PDFsabrina006No ratings yet

- Credit Default SwapDocument12 pagesCredit Default SwapHomero García AlonsoNo ratings yet