Professional Documents

Culture Documents

Lecture#3 Continue

Uploaded by

Beluga GamerTM0 ratings0% found this document useful (0 votes)

12 views45 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views45 pagesLecture#3 Continue

Uploaded by

Beluga GamerTMCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 45

Chapter: 03

The Accounting Cycle

Capturing Economic Events

The Ledger

• An accounting system includes a separate

record for each item that appears in the

financial statements.

• For example, a separate record is kept for

the asset cash, showing all increases

and decreases in cash resulting from the

many transactions in which cash is

received or paid.

The Use of Accounts

• Its called a T- account because of its

resemblance to the letter “ T.”

• Its simplest form, an account has only three

elements: (1) a title; (2) a left side, which is

called the debit side; and (3) a right side, which

is called the credit side.

Debits & Credits

• Debits are the left of the T account.

• Debits do not mean increase.

• Debits are not “good” or “bad”.

• Credits are the right of the T account.

• Credits do not mean decrease.

• Credits are not “good” or “bad”.

Debit and Credit Entries

• In simple terms, debits refer to the left side of an

account, and credits refer to the right side of an

account. To illustrate the recording of debits and

credits in an account, let us go back to the eight

cash transactions of Overnight Auto Service,

described in Chapter 2.

When these cash transactions

are recorded in the Cash account, the receipts are

listed on the debit side, and the payments

are listed on the credit side. The dates of the

transactions may also be listed, as shown

in the following illustration:

Determining the Balance of a T Account

• The balance of an account is the difference

between the debit and credit entries in the

account.

• If the debit total exceeds the credit total, the

account has a debit balance;

• if the credit total exceeds the debit total, the

account has a credit balance.

In our illustrated Cash account, a line has been drawn across

the account following the last cash transaction recorded in

January. The total cash receipts (debits) recorded in January

amount to $82,800, and the total cash payments (credits)

amount to $66,200. By subtracting the credit total from the

debit total ($82,800 -$66,200), we determine that the Cash

account has a debit balance of $16,600 on January 31.

Debit Balances in Asset

Accounts

In the preceding illustration of a Cash account,

increases were recorded on the left, or debit, side of the

account and decreases were recorded on the right, or

credit, side. The increases were greater than the

decreases and the result was a debit balance in the

account.

All asset accounts normally have debit balances

Debits & Credits

Assets, Exp Liabilities, Equity

& Dividends & Revenues

DR CR DR CR

Incr. Decr. Decr. Incr.

+ - - +

If you remember this

one, the “other one” is

the reverse.

Concise Statement of the Debit and

Credit Rules

DOUBLE-ENTRY ACCOUNTING—THE

EQUALITY

OF DEBITS AND CREDITS

• The rules for debits and credits are designed so

that every transaction is recorded by equal

dollar amounts of debits and credits.

• If this equation is to remain in balance, any

change in the left side of the equation (assets)

must be accompanied by an equal change in

the right side (either liabilities or owners’

equity).

• According to the debit and credit rules that we

have just described, increases in the left side of

the equation (assets) are recorded by debits,

while increases in the right side (liabilities and

owners’ equity) are recorded by credits, as

illustrated below:

This system is often called double-entry accounting.

The phrase double-entry refers to the need for both debit

entries and credit entries, equal in dollar amount, to

record every Transaction.

Later in this chapter, we will see that the double-entry

system allows us to measure net income at the same

time we record the effects of transactions on the balance

sheet accounts.

The Journal

The journal

• The journal is a chronological (day-by-day)

record of business transactions. At convenient

intervals, the debit and credit amounts

recorded in the journal are transferred (posted)

to the accounts in the ledger. The updated

ledger accounts, in turn, serve as the basis for

preparing the company’s financial statements.

• To illustrate the most basic type of journal, called a

general journal, let us examine the very first business

transaction of Overnight Auto Service. Recall that on

January 20, 2011, the McBryan family invested

$80,000 in exchange for capital stock. Thus, the asset

Cash increased by $80,000, and the owners’ equity

account Capital Stock increased by the same amount.

Recording a Transaction in the

GENERAL JOURNAL

POSTING JOURNAL ENTRIES TO THE LEDGER

ACCOUNTS

(AND HOW TO “READ” A JOURNAL ENTRY)

Recording Balance Sheet Transactions:

An Illustration

1. Jan. 20 Michael McBryan and family

invested $80,000 cash in exchange for capital

stock.

• Jan. 21 On January 21, overnight Auto

Service purchased the land from the city

for $52,000 cash.

• Jan. 22 Overnight completed the acquisition of its business

location by purchasing the abandoned building from the MTA.

The purchase price was $36,000; Overnight made a $6,000

cash down payment and issued a 90-day, non-interest-bearing

note payable for the remaining $30,000.

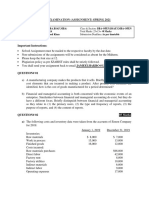

Example

• On April 01, 2016 Anees started business with

Rs. 100,000 and other transactions for the month are:

• 2. Purchase Furniture for Cash Rs. 7,000.

• 8. Purchase Goods for Cash Rs. 2,000 and for Credit

Rs. 1,000 from Khalid Retail Store.

• 14. Sold Goods to Khan Brothers Rs. 12,000 and Cash

Sales Rs. 5,000.

• 18. Owner withdrew of worth Rs. 2,000 for personal use.

• 22. Paid Khalid Retail Store Rs. 500.

• 26. Received Rs. 10,000 from Khan Brothers.

• 30. Paid Salaries Expense Rs. 2,000

Solution

Dual Skill

To do a journal entry, you need to know

1. What accounts are moving/impacted

2. How to classify those accounts

• Asset?

• Liability?

• Equity/Revenue/Expense/Dividend?

3. Where the accounts are going up or down

4. NOW you are ready to declare debit or

credit!

Impact on accounts

Impact on accounts

• How do you show new credit • Debit AR

sales [accounts receivable go • Credit Sales Rev.

up]?

• Debit Insurance Exp

• How do you reflect prepaid

insurance getting used up [go • Credit Prepaid

down]?

• Debit Cash

• How do you take land you sold

off the books [no gain or loss]? • Credit Land

• How do you show an increase to • Debit Cash

cash from a customer paying

their bill? • Credit AR

Liability Accounts

Liability Accounts

• Debit Inventory

• How do you show buying

inventory on credit [accounts • Credit Accts Payable

payable goes up]?

• Debit Tax Payable

• How do you reflect taxes

payable getting paid [go • Credit Cash

down]?

• Debit Old Loan

• How do you show paying off an

old loan with a new loan? • Credit New Loan

• How do you show the • Debit Salaries Expense

obligation to pay workers • Credit Salaries Payable

after their work is complete but

not yet paid?

What do you need – debit or credit?

• Make patents go up?

• Make AP go down?

• Make Revenue go up?

• Make Expenses go up?

• Make Mortgage Loan go up?

• Make Salaries payable go down?

• Make Cash go down?

What do you need – debit or credit?

• Make patents go up? • Debit

• Make AP go down? • Debit

• Make Revenue go up? • Credit

• Make Expenses go up? • Debit

• Make Mortgage Loan go up? • Credit

• Make Salaries payable go down? • Debit

• Make Cash go down? • Credit

Cont:

Dividends

• A dividend is a distribution of assets (usually cash) by

a corporation to its stockholders. In some respects,

dividends are similar to expenses—they reduce both

the assets and the owners’ equity in the business.

However, dividends are not an expense, and they are

not deducted from revenue in the income statement.

The reason why dividends are not viewed as an

expense is that these payments do not serve to

generate revenue. Rather, they are a distribution of

profits to the owners of the business.

• Since the declaration of a dividend reduces

stockholders’ equity, the dividend could be

recorded by debiting the Retained Earnings

account. The debit–credit rules for revenue,

expenses, and dividends are summarized below:

Classification of Accounts

Personal Accounts

• (i) Natural Personal Accounts: Accounts of

individuals relating to natural persons such as Akhil’s

A/c, Rajesh’s A/c, Sohan’s A/c are natural personal

accounts.

• (ii) Artificial Personal Accounts: Accounts of

companies, institutions such as Reliance Industries

Ltd; Lions Club, M/s Sham & Sons, National College

account are artificial personal accounts. These exist

only in the eyes of law.

• (iii) Representative Personal Accounts: The

accounts which represent some person such as

wage outstanding account, prepaid insurance

account, accrued interest account are

considered as representative personal

accounts.

2. Real Accounts

• Real accounts are the accounts related to

assets/properties. These may be classified into

tangible real account and intangible real account.

• The accounts relating to tangible assets such as

building, plant, machinery, cash, furniture etc. are

classified as tangible real accounts.

• Intangible real accounts are the accounts related to

intangible assets such as goodwill, trademarks,

copyrights, franchisees, Patents etc.

3. Nominal Accounts

• The accounts relating to income, expenses,

losses and gains are classified as nominal

accounts. For example Wages Account, Rent

Account, Interest Account, Salary Account,

Bad Debts Accounts

RULES FOR DEBIT AND CREDIT

Type of Rules for Debit Rules for Credit

Accounts

a Personal Debit the receiver Credit the giver

Account

b Real Debit what comes Credit what goes out

Account in

c Nominal Debit all expenses Credit all incomes and gains

Account and losses

Illustration: How will you classify the following into

personal, real

and nominal accounts?

• (i) Investments

• (ii) Freehold Premises

• (iii) Accrued Interest

• (iv) Punjab Agro Industries Corporation

• (v) Janata Allied Mechanical Works

• (vi) Salary Accounts

• (vii) Loose Tools Accounts

• (viii) Purchases Account

Illustration: How will you classify the following into

personal, real

and nominal accounts?

• (i) Investments • (ix) Indian Bank Ltd.

• (ii) Freehold Premises • (x) Capital Account

• (iii) Accrued Interest • (xi) Brokerage Account

• (iv) Punjab Agro • (xii) Toll Tax Account

Industries Corporation

• (xiii) Dividend

• (v) Janata Allied

Received Account

Mechanical Works

• (xiv) Royalty Account

• (vi) Salary Accounts

• (xv) Sales Account

• (vii) Loose Tools

Accounts

• (viii) Purchases Account

Solution

• Real Account: (i), (ii), (vii), (viii), (xv).

• Nominal Account: (vi), (ix), (xi), (xii), (xiii),

(xiv)

• Personal Account: (iii), (iv), (v), (x)

Practice: Prepare Journal in the books of K.K. Co.from

the following transactions:

1999 Rs. 1999 Rs.

Dec. 1 Started business with a capital of 50,000 Dec. 15 Purchased goods fromRam 4,000

Dec. 6 Paid into bank 20,000 Dec. 18 Paid wages to workers 300

Dec. 8 Purchased goods for cash 4,000 Dec. 20 Recd. from Pankaj 1,000

Allowed himdiscount Rs. 50

Dec. 9 Paid to Ram 1,980 Dec. 22 Withdrawn from bank 3,000

Dec. 9 Discount allowed by him 20 Dec. 25 Paid Ramby cheque 500

Dec. 10 Cash sales 3,000 Dec. 31 Withdrawn for personal use 200

Dec. 12 Sold to Hari for cash 2,000

You might also like

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Debit and CreditDocument33 pagesDebit and CreditBasma ShaalanNo ratings yet

- Debit and CreditDocument32 pagesDebit and CreditBasma ShaalanNo ratings yet

- Principles of Double EntryDocument26 pagesPrinciples of Double EntryAlex CampbellNo ratings yet

- Debits and Credits: (Cheat Sheet)Document9 pagesDebits and Credits: (Cheat Sheet)Sasha JaffeNo ratings yet

- Accounting TransactionsDocument28 pagesAccounting TransactionsPaolo100% (1)

- Lecture 4Document33 pagesLecture 4Dalia SamirNo ratings yet

- Basis of Debit and CreditDocument17 pagesBasis of Debit and CreditBanaras KhanNo ratings yet

- Types of Accounting AccountsDocument44 pagesTypes of Accounting AccountsAzhar Hussain100% (2)

- PPT 2 - Business TransactionDocument29 pagesPPT 2 - Business Transactionthinkaboutbe14No ratings yet

- 02-General Ledger AccountingDocument96 pages02-General Ledger AccountingRirinNo ratings yet

- Chapter 7Document39 pagesChapter 7juls100% (1)

- JournalizingDocument22 pagesJournalizingJustine MaravillaNo ratings yet

- Basic AccountingDocument48 pagesBasic Accounting3122No ratings yet

- Asset LiabilityDocument8 pagesAsset LiabilityRohit More100% (1)

- Rules of Determining Debit & Credit PDFDocument26 pagesRules of Determining Debit & Credit PDFasadurrahman40100% (1)

- Accounting Financial: General LedgerDocument8 pagesAccounting Financial: General LedgerSumeet KaurNo ratings yet

- 02-General Ledger AccountingDocument96 pages02-General Ledger AccountingFenniLim100% (2)

- BASIC ACCOUNTING PROCEDURESDocument35 pagesBASIC ACCOUNTING PROCEDURESjune100% (1)

- Recording Business Transactions in Primary BooksDocument45 pagesRecording Business Transactions in Primary BooksarifehsanNo ratings yet

- Guide To Bookkeeping ConceptsDocument18 pagesGuide To Bookkeeping ConceptsJudiana TreviñoNo ratings yet

- Practical AccountingDocument45 pagesPractical AccountingShania PersaudNo ratings yet

- Introduction To Financial Accounting (FFA/FAB) : DR Ahmad AlshehabiDocument55 pagesIntroduction To Financial Accounting (FFA/FAB) : DR Ahmad AlshehabiKye SimpsonNo ratings yet

- Accounting For Managers - Unit 2Document161 pagesAccounting For Managers - Unit 2Chirag JainNo ratings yet

- 2211Posting-061cab6e3d56f89-03363994Document12 pages2211Posting-061cab6e3d56f89-03363994Saleh RaoufNo ratings yet

- Accounting Principle - Ujian NasionalDocument115 pagesAccounting Principle - Ujian Nasionalosusant0100% (1)

- Accounting Equation Lec 3rdDocument16 pagesAccounting Equation Lec 3rdWaqas KhanNo ratings yet

- Chapter 5 AccountingDocument23 pagesChapter 5 AccountingShania PersaudNo ratings yet

- DOC 1 Debit and Credit in AccountingDocument3 pagesDOC 1 Debit and Credit in AccountingmamakamilaikasiNo ratings yet

- CHP 1 and 2 BbaDocument73 pagesCHP 1 and 2 BbaBarkkha MakhijaNo ratings yet

- Journal Entries ExplainedDocument10 pagesJournal Entries ExplainedMuhammad MansoorNo ratings yet

- The Recording Process: Weygandt - Kieso - KimmelDocument68 pagesThe Recording Process: Weygandt - Kieso - Kimmelatia fariaNo ratings yet

- Welcomeback: Workshop SixDocument55 pagesWelcomeback: Workshop SixLeah StonesNo ratings yet

- Debits and CreditsDocument4 pagesDebits and CreditsNebojša SavanovićNo ratings yet

- Analyzing financial transactionsDocument29 pagesAnalyzing financial transactionsVall Halla100% (1)

- Chapter 3 The Double-Entry System: Discussion QuestionsDocument16 pagesChapter 3 The Double-Entry System: Discussion QuestionskietNo ratings yet

- Accounting Recording ProcessDocument56 pagesAccounting Recording ProcessSara Abdelrahim MakkawiNo ratings yet

- Chapter-2 Accounting CycleDocument18 pagesChapter-2 Accounting CycleTsegaye BelayNo ratings yet

- Chapter 4 The Bookkeeping Process and Transaction AnalysisDocument17 pagesChapter 4 The Bookkeeping Process and Transaction AnalysisMarwa ElnasharNo ratings yet

- Accounting Equation (Abm)Document43 pagesAccounting Equation (Abm)EasyGaming100% (1)

- Principle of Double Entry & Trial Balance: Prepared By: Nurul Hassanah HamzahDocument35 pagesPrinciple of Double Entry & Trial Balance: Prepared By: Nurul Hassanah HamzahNur Amira NadiaNo ratings yet

- Chapter 7: Receivables: Principles of AccountingDocument50 pagesChapter 7: Receivables: Principles of AccountingRohail Javed100% (1)

- 2 Debits and CreditsDocument16 pages2 Debits and Creditswannisa maheswari100% (1)

- Week 4: Ledgers and Trial BalanceDocument23 pagesWeek 4: Ledgers and Trial BalanceIris NguNo ratings yet

- Presentation On Accounting BasicDocument20 pagesPresentation On Accounting BasicKrishna Kumar SinghNo ratings yet

- Finance Management: Hospital: - WHO DefinitionDocument77 pagesFinance Management: Hospital: - WHO DefinitionMitisha Hirlekar100% (1)

- Topic 3 - Recording Transactions (STU)Document60 pagesTopic 3 - Recording Transactions (STU)thiennnannn45No ratings yet

- Accounting MechanicsDocument21 pagesAccounting MechanicsPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (1)

- One Full Accounting Cycle Process ExplainedDocument11 pagesOne Full Accounting Cycle Process ExplainedRiaz Ahmed100% (1)

- Accounting Lec#2Document20 pagesAccounting Lec#2Ovais ZiaNo ratings yet

- Accounting - Basics - Deloitte. 1Document56 pagesAccounting - Basics - Deloitte. 1Shubh100% (1)

- Chapter 4 AccountingDocument22 pagesChapter 4 AccountingChan Man SeongNo ratings yet

- Chapter 3-The Recording Process and Accounting CycleDocument7 pagesChapter 3-The Recording Process and Accounting CycleParvez TuhenNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2: ExpectationDocument131 pagesFundamentals of Accountancy, Business, and Management 2: ExpectationAngela Garcia100% (1)

- Journal EntriesDocument7 pagesJournal Entriesmanthansaini8923No ratings yet

- Accounting Principles 1Document27 pagesAccounting Principles 1shaza jocarlos100% (1)

- Chapter 3-Cash&ReceivablesDocument22 pagesChapter 3-Cash&ReceivablesDr. Mohammad Noor Alam100% (1)

- O Levels Accounting NotesDocument10 pagesO Levels Accounting Notesoalevels90% (20)

- Debit and CreditDocument3 pagesDebit and CreditGretchel Jane MagduraNo ratings yet

- Lab Manual Oop C 2022fDocument52 pagesLab Manual Oop C 2022fBeluga GamerTMNo ratings yet

- Single Multiple, Multilevel Hybrid, Hirarchical Inheritance ProgramsDocument25 pagesSingle Multiple, Multilevel Hybrid, Hirarchical Inheritance ProgramsBeluga GamerTMNo ratings yet

- 1 Dec C&PSDocument21 pages1 Dec C&PSBeluga GamerTMNo ratings yet

- Introduction To Sunnah LECDocument5 pagesIntroduction To Sunnah LECBeluga GamerTMNo ratings yet

- Pro - DR Mufti Munib Ur Rehman Converted CompressedDocument274 pagesPro - DR Mufti Munib Ur Rehman Converted CompressedBeluga GamerTMNo ratings yet

- Seerat (S.A.W)Document20 pagesSeerat (S.A.W)Beluga GamerTMNo ratings yet

- Steps For Cash Flow StatementDocument2 pagesSteps For Cash Flow StatementBeluga GamerTMNo ratings yet

- Exploring key ayat from the QuranDocument2 pagesExploring key ayat from the QuranBeluga GamerTMNo ratings yet

- Lecture#4Document10 pagesLecture#4Beluga GamerTMNo ratings yet

- Equation Lecture#2Document17 pagesEquation Lecture#2Beluga GamerTMNo ratings yet

- Electrical Engineering Company ProfileDocument16 pagesElectrical Engineering Company ProfileBash GroupNo ratings yet

- LawFinder 541751Document4 pagesLawFinder 541751sandeepkambozNo ratings yet

- Chapter 1: Purchasing and Supply Chain ManagementDocument23 pagesChapter 1: Purchasing and Supply Chain ManagementUyên DươngNo ratings yet

- International Business and Trade GuideDocument9 pagesInternational Business and Trade GuideGilbert Ocampo100% (2)

- Working at Height PermitDocument1 pageWorking at Height PermitharikrishnaNo ratings yet

- Artificial Intelligence Chatbot Adoption FrameworkDocument18 pagesArtificial Intelligence Chatbot Adoption FrameworksaraNo ratings yet

- PDF Dove Brand Audit Report DLDocument10 pagesPDF Dove Brand Audit Report DLDuyen P TranNo ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- Chapter 3Document10 pagesChapter 3Julia CanoNo ratings yet

- Is the US Stock Market in a Bubble? Signs to Watch ForDocument2 pagesIs the US Stock Market in a Bubble? Signs to Watch ForLeslie LammersNo ratings yet

- Maintenance StrategiesDocument2 pagesMaintenance StrategiesBassemNo ratings yet

- GTP&DWG of - Earthing Pipe& Earth RodDocument6 pagesGTP&DWG of - Earthing Pipe& Earth RodabhishekNo ratings yet

- Editing ServicesDocument3 pagesEditing ServicesBhairavi SagarNo ratings yet

- AfyaDocument1 pageAfyaVitória FernandesNo ratings yet

- Siebel Course ContentsDocument2 pagesSiebel Course ContentsChiranjeeviChNo ratings yet

- Ebook-ENG-The Ultimate Guide For Visas in Australia-Go Study Australia-1Document41 pagesEbook-ENG-The Ultimate Guide For Visas in Australia-Go Study Australia-1Mico de LeonNo ratings yet

- A Complete Guide To Credit Risk Modelling PDFDocument30 pagesA Complete Guide To Credit Risk Modelling PDFAvanish KumarNo ratings yet

- Reading 23 Residual Income ValuationDocument36 pagesReading 23 Residual Income Valuationtristan.riolsNo ratings yet

- Demand Letter - Meropolitan Cannon Insurance Company - Appointment of Advocate To Defend Suit On Behalf of AVIC Nyah 298of2021 - 20.7.2022-2Document3 pagesDemand Letter - Meropolitan Cannon Insurance Company - Appointment of Advocate To Defend Suit On Behalf of AVIC Nyah 298of2021 - 20.7.2022-2Muchangi KamitaNo ratings yet

- The Gold Mine - Field Book For Lean TrainersDocument12 pagesThe Gold Mine - Field Book For Lean TrainersC P ChandrasekaranNo ratings yet

- Audit IT Governance Controls & Structure (39Document132 pagesAudit IT Governance Controls & Structure (39Quendrick Surban100% (1)

- Argus 20230518fmbsulDocument15 pagesArgus 20230518fmbsulngi-moscowNo ratings yet

- Business Ethics - An Oxymoron or NotDocument4 pagesBusiness Ethics - An Oxymoron or NotDong West100% (1)

- Cost APProachDocument40 pagesCost APProachMANNAVAN.T.N100% (1)

- Pola Kerja SLI HO 1 Juni SD 30 JuniDocument6 pagesPola Kerja SLI HO 1 Juni SD 30 Juniandreas siburianNo ratings yet

- Preventing Scope Creep To Avoid Project Delay NICEDocument15 pagesPreventing Scope Creep To Avoid Project Delay NICEzeekel1612No ratings yet

- Design and Fabrication of Compound DieDocument7 pagesDesign and Fabrication of Compound DieRaj PremrajNo ratings yet

- Podcasts For Real Estate Professionals Check Out Advantages and ExamplesDocument3 pagesPodcasts For Real Estate Professionals Check Out Advantages and Exampleskomal khanNo ratings yet

- Kwon & LennonDocument8 pagesKwon & LennonKardus KardusNo ratings yet

- Product Manual ClientDocument79 pagesProduct Manual ClientKajal SarkarNo ratings yet