Professional Documents

Culture Documents

4 (Australian Taxes)

Uploaded by

chamalix0 ratings0% found this document useful (0 votes)

9 views25 pagesThe document discusses the foundations of taxation law in Australia. It outlines that there are over 125 different taxes levied in Australia by the Commonwealth, states, territories and local governments. The top 10 taxes account for over 90% of government revenue. Some key Commonwealth taxes discussed include income tax, the Medicare levy, fringe benefits tax, goods and services tax, and wine equalisation tax and luxury car tax. The document provides details on the tax base, period, rates and legislation for some of these major taxes.

Original Description:

tax

Original Title

4+(Australian+Taxes)(1)

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the foundations of taxation law in Australia. It outlines that there are over 125 different taxes levied in Australia by the Commonwealth, states, territories and local governments. The top 10 taxes account for over 90% of government revenue. Some key Commonwealth taxes discussed include income tax, the Medicare levy, fringe benefits tax, goods and services tax, and wine equalisation tax and luxury car tax. The document provides details on the tax base, period, rates and legislation for some of these major taxes.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views25 pages4 (Australian Taxes)

Uploaded by

chamalixThe document discusses the foundations of taxation law in Australia. It outlines that there are over 125 different taxes levied in Australia by the Commonwealth, states, territories and local governments. The top 10 taxes account for over 90% of government revenue. Some key Commonwealth taxes discussed include income tax, the Medicare levy, fringe benefits tax, goods and services tax, and wine equalisation tax and luxury car tax. The document provides details on the tax base, period, rates and legislation for some of these major taxes.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 25

AUSTRALIAN TAXES

Chapter 4

Foundations of Taxation Law

Introduction

• The Commonwealth imposes taxes, as do the six States

and two mainland Territories

• Australia also has over 500 local government authorities,

which levy their own council rates

• At least 125 different taxes levied in Australia, with the 10

largest taxes accounting for more than 90% of all

government revenue

• The majority of these taxes are levied by the

Commonwealth

• Commonwealth also raises the majority of tax revenue

and provides funding to States and Territories

[¶4.1] Foundations of Taxation Law

History of taxation in Australia

• Colonial taxes

• Customs and excise duties

• Licence fees for gold miners

• Estate duties

• Land tax

• Income tax

• Federation in 1901

• Commonwealth has power to levy taxes

• States lost power to levy customs and excise duties

[¶4.2](a) Foundations of Taxation Law

Some key years

• 1902 – Customs and excise duties

• 1915 – Income tax

• 1930 – Sales tax

• 1936 – ITAA36

• 1942 – Uniform tax scheme

• 1983 – Medicare levy

• 1985 – Capital gains tax

• 1986 – Fringe benefits tax

• 1997 – ITAA97

• 2000 – Goods and services tax

• 2000 – WET and LCT

[¶4.2](b) Foundations of Taxation Law

Main Commonwealth taxes

• Income tax

• Temporary budget repair levy (TBRL)

• Medicare levy (ML)

• Medicare levy surcharge (MLS)

• Fringe benefits tax (FBT)

• Superannuation guarantee charge (SGC)

• Excess concessional contributions charge (ECCC)

• Excess non-concessional contributions tax (ENCCT)

• Division 293 tax

• Goods and services tax (GST)

[¶4.3](a) Foundations of Taxation Law

Main Commonwealth taxes (cont)

• Wine equalisation tax (WET)

• Luxury car tax LCT)

• Customs duty

• Excise duty

[¶4.3](b) Foundations of Taxation Law

Income tax

• Income tax is payable by taxpayers on their 'taxable

income' for an income year (1 July to 30 June)

• Income tax is payable at different rates depending on the

nature of the taxpayer

• Individuals pay tax at rates that increase progressively

(from 0% to 45%)

• Companies generally pay tax at a flat rate of 30% (or

28.5% if they are SBEs)

• Complying superannuation funds generally pay tax at a

flat rate of 15%

[¶4.3](c) Foundations of Taxation Law

Income tax (cont)

Tax Tax base Tax period Tax rates Taxpayer Legislation

Income Taxable Financial Progressive Income earners ITAA36

tax income year rates (from 0% (eg individuals, ITAA97

to 45% for companies,

individuals) and superannuation ITTPA

flat rates funds) ITA

(generally 30%

ITRA

or 28.5% for

companies and

15% for

complying

superannuation

funds)

[¶4.3](d) Foundations of Taxation Law

Temporary budget repair levy

• Temporary levy

• Imposes additional income tax on individuals for the

2014/15 to 2016/17 income years

• Charged at a flat rate of 2% on so much of a person’s

taxable income that exceeds $180,000

[¶4.3](e) Foundations of Taxation Law

Medicare levy and surcharge

• Medicare levy – Payable by individuals on their 'taxable

income' at rate of 2%, subject to thresholds and shading-in

rules

• Medicare levy surcharge – Payable by individuals who do

not have private health insurance and who have 'income

for surcharge purposes' above specified thresholds on

their 'taxable income' and 'reportable fringe benefits total'

at rates of 1%, 1.25% or 1.5%

[¶4.3](f) Foundations of Taxation Law

Medicare levy and surcharge (cont)

Tax Tax base Tax Tax rates Taxpayer Legislation

period

Medicare Taxable Financial Flat rate of 2% Resident MLA

levy income year (subject to Individuals ITAA36

thresholds and (and certain

shading in trustees)

rules)

Medicare Taxable Financial Flat rate of 1%, Resident MLA

levy income year 1.25% or 1.5% individuals MLSFBA

surcharge and (depending on with high

reportable income for income for

fringe surcharge surcharge

benefits purposes) purposes

total

[¶4.3](g) Foundations of Taxation Law

Fringe benefits tax

• FBT is payable by employers on their 'fringe benefits

taxable amount' for a 'year of tax' (ie 1 April to 31 March)

• FBT rate of tax is 49% (from 1 April 2015)

• Most kinds of benefits (other than salary and

superannuation) provided in respect of employment are

fringe benefits

[¶4.3](h) Foundations of Taxation Law

Fringe benefits tax (cont)

Tax Tax base Tax Tax rates Taxpayer Legislation

period

FBT Fringe FBT year Flat rate of Employers FBTAA

benefits (1 April to 49% FBTA

taxable 31

amount March) FBTACA

[¶4.3](i) Foundations of Taxation Law

Superannuation taxes

• Superannuation guarantee charge (SGC) – imposed on

employers that fail to provide minimum levels of

superannuation support for their employees, based on the

amount of any shortfall

• Excess concessional contributions charge (ECCC) –

imposed on members of superannuation funds that have

'excess concessional contributions'

• Excess non-concessional contributions tax (ENCCT) –

imposed on members of superannuation funds that have

'excess non-concessional contributions' during an income

year

[¶4.3](j) Foundations of Taxation Law

Superannuation taxes (cont)

• Division 293 tax – imposed on members of

superannuation funds that are high income earners and

have 'taxable contributions' during an income year

[¶4.3](k) Foundations of Taxation Law

Superannuation taxes (cont)

Tax Tax base Tax Tax rates Taxpayer Legislation

period

SGC Superannuation Quarterly Total individual Employers SGAA

guarantee superannuation

shortfall guarantee SGCA

shortfalls plus

interest and

administration

components

ENCCT Excess non- Financial Flat rate of 49% Superannuation SENCCTA

concessional year fund members

contributions ITAA97

ECCC Excess income tax Financial Fluctuating rate Superannuation ITAA97

arising from year fund members

excess SECCCA

concessional

contributions

Division Taxable Financial Flat rate of 15% Superannuation ITAA97

293 tax contributions year fund members

SSSCCIA

[¶4.3](l) Foundations of Taxation Law

Goods and services tax

• GST is payable by entities that make 'taxable supplies' and

'taxable importations'

• GST is charged at the rate of 10% of the value of a taxable

supply or a taxable importation

• Registered entities are entitled to 'input tax credits' for the

GST charged on their 'creditable acquisitions' and

'creditable importations'

• The difference between the GST charged by an entity and

its entitlement to input tax credits for a tax period is

basically its 'net amount' for the period

[¶4.3](m) Foundations of Taxation Law

Goods and services tax (cont)

Tax Tax base Tax Tax rates Taxpayer Legislation

period

GST Taxable Monthly Flat rate of 10% Suppliers GSTA

supplies and or and GSTTA

taxable quarterly importers

importations GSTIGA

GSTICA

GSTIEA

[¶4.3](n) Foundations of Taxation Law

Wine equalisation tax and luxury car

tax

• Wine equalisation tax (WET) – imposed on assessable

dealings in wine, applied at the last point of wholesale

sale of wine

• Luxury car tax (LCT) – imposed on supply or

importation of luxury cars that have a GST-inclusive

value above the 'LCT threshold‘

[¶4.3](o) Foundations of Taxation Law

Wine equalisation tax and luxury car

tax (cont)

Tax Tax base Tax Tax rates Taxpayer Legislation

period

WET Assessable Monthly Flat rate of 29% Dealers in WETA

dealings in or of taxable value wine (eg WETIGA

wine quarterly wholesalers)

WETICA

WETIEA

LCT Taxable Monthly Flat rate of 33% Suppliers and LCTA

supplies and or of 10/11th of the importers of LCTIGA

taxable quarterly amount by luxury cars

importations which the car’s LCTICA

of luxury cars LCT value LCTIEA

exceeds the LCT

threshold

[¶4.3](p) Foundations of Taxation Law

Customs and excise duties

• Customs duty – tax on the importation of goods into

Australia, payable by the importer

• Excise duty – tax on the manufacture of certain products

in Australia, eg:

• Petroleum products

• Crude oil

• Tobacco

• Beer, spirits, alcoholic beverages other than wine

[¶4.3](q) Foundations of Taxation Law

Customs and excise duties (cont)

Tax Tax base Tax Tax rates Taxpayer Legislation

period

Customs Importation Special Different rates Importers of CA

duty of dutiable rules depending on dutiable goods CTA

goods nature of goods

Excise Production or Special Different rates Producers and EA

duty manufacture rules depending on manufacturers ETA

of excisable nature of goods of excisable

goods goods

[¶4.3](r) Foundations of Taxation Law

State and Territory taxes

• Payroll tax – imposed on wages (including bonuses,

allowances, superannuation contributions and certain

fringe benefits) provided by employers to their employees

• Land tax – imposed on the taxable value of land owned in

a State, with some exemptions

• Stamp duty – imposed on dutiable transactions, eg:

• Transfers of land

• Transfers of shares in 'land rich' companies

• Insurance policies

• Motor vehicle registrations and transfers

[¶4.4](a) Foundations of Taxation Law

GST revenue-sharing arrangements

• Commonwealth shares tax revenue with States

• GST revenue allocated to States under various

intergovernmental agreements

• States and Territories agreed that in exchange for

receiving the GST revenue, they would abolish various

'inefficient' taxes

[¶4.4](b) Foundations of Taxation Law

Local government taxes

• Local governments impose municipal rates

• Municipal rates used to pay for services to local residents

(eg rubbish collection, health services, public libraries and

sports and recreation facilities)

• Municipal rates typically levied on value of land in the city

or shire

[¶4.5] Foundations of Taxation Law

You might also like

- Taxation-Reforms PRESENTATIONDocument17 pagesTaxation-Reforms PRESENTATIONRaman KumarNo ratings yet

- The Tax Formula-1Document24 pagesThe Tax Formula-1Viola Ari PutriNo ratings yet

- Chapter 1 1 CotxaDocument27 pagesChapter 1 1 Cotxafs5kxrcn2gNo ratings yet

- Introduction and Basic Concepts TaxDocument132 pagesIntroduction and Basic Concepts TaxNaman GoyalNo ratings yet

- Mat and AmtDocument18 pagesMat and AmtParth UpadhyayNo ratings yet

- Taxable Income RahulDocument18 pagesTaxable Income RahulRahul ParitNo ratings yet

- Withholding TaxDocument21 pagesWithholding TaxTres SanicamNo ratings yet

- Taxation Law Assignment by Sushali Shruti 18FLICDDN01144Document10 pagesTaxation Law Assignment by Sushali Shruti 18FLICDDN01144Shreya VermaNo ratings yet

- Week 1: Definition of TaxDocument114 pagesWeek 1: Definition of TaxWA TomNo ratings yet

- Spring2015YaleCorporate TaxDocument87 pagesSpring2015YaleCorporate Taxa thaynNo ratings yet

- ATXB 213: NoteDocument2 pagesATXB 213: NoteJustin DavenportNo ratings yet

- Act 311 Term PaperDocument7 pagesAct 311 Term PaperKazi Shariat UllahNo ratings yet

- AMT - Know About Alternative Minimum Tax Applicability, Exemptions, Credits & MoreDocument8 pagesAMT - Know About Alternative Minimum Tax Applicability, Exemptions, Credits & MoreRudrin DasNo ratings yet

- Income Tax Act As Amended by The Finance Act, 2008: SupplementDocument13 pagesIncome Tax Act As Amended by The Finance Act, 2008: SupplementbhavaniNo ratings yet

- Returns PDFDocument109 pagesReturns PDFKrishna VamsiNo ratings yet

- 49 Tax Rates For A y 2011 12Document8 pages49 Tax Rates For A y 2011 12shitalNo ratings yet

- Columbia WHTDocument7 pagesColumbia WHTAnilNo ratings yet

- Minimum Alternative Tax: by V Surya Narayana Raju, Assistant Professor of LawDocument12 pagesMinimum Alternative Tax: by V Surya Narayana Raju, Assistant Professor of LawAnonymous 8CigDwNo ratings yet

- Understanding Goods and Services TaxDocument23 pagesUnderstanding Goods and Services TaxPragya TyagiNo ratings yet

- Assignment: Taxation System in India'Document14 pagesAssignment: Taxation System in India'Devendra OjhaNo ratings yet

- CDA Updates On Rules RegulationsDocument69 pagesCDA Updates On Rules RegulationsChristian Jade HensonNo ratings yet

- 6 Activities For Business Structure & TaxationDocument16 pages6 Activities For Business Structure & TaxationDawit TilahunNo ratings yet

- 6 Activities For Business Structure & TaxationDocument16 pages6 Activities For Business Structure & Taxationyabmitiku123No ratings yet

- 4 Chapter04Document40 pages4 Chapter04Kalkidan ZerihunNo ratings yet

- 2015 PRACTICE NOTES 2 Withholding Tax17022015095605 PDFDocument18 pages2015 PRACTICE NOTES 2 Withholding Tax17022015095605 PDFtendaicrosby100% (1)

- Trabaho BillDocument14 pagesTrabaho BillAvia ColorNo ratings yet

- SMNV Group CDocument20 pagesSMNV Group CHeena DuaNo ratings yet

- India Tax System PDFDocument22 pagesIndia Tax System PDFIlma FatimaNo ratings yet

- Training - India PayrollDocument18 pagesTraining - India Payrollyenumula_inNo ratings yet

- E Filing Income Tax Return OnlineDocument45 pagesE Filing Income Tax Return OnlineAyush MishraNo ratings yet

- BIR WEBSITE - Withholding TaxDocument21 pagesBIR WEBSITE - Withholding TaxAna Carmela Nitro ColoNo ratings yet

- Ca Inter Full Book 2Document32 pagesCa Inter Full Book 2Amar SharmaNo ratings yet

- Unit 4 Return FillingDocument71 pagesUnit 4 Return FillingAnshu kumarNo ratings yet

- Withholding Tax - Bureau of Internal Revenue161116Document20 pagesWithholding Tax - Bureau of Internal Revenue161116SandyNo ratings yet

- PHD Research Bureau PHD Chamber of Commerce and IndustryDocument33 pagesPHD Research Bureau PHD Chamber of Commerce and IndustrySUNIL PUJARINo ratings yet

- Business TaxationDocument319 pagesBusiness TaxationsiddheshNo ratings yet

- Bangladesh Tax Handbook 2008-2009 PDFDocument53 pagesBangladesh Tax Handbook 2008-2009 PDFNur Md Al HossainNo ratings yet

- Direct & Indirect TaxesDocument33 pagesDirect & Indirect Taxesdinanikarim50% (2)

- 5.0 Intro To Income TaxDocument31 pages5.0 Intro To Income TaxAllan BacudioNo ratings yet

- Tax Structure and Basic ConceptsDocument64 pagesTax Structure and Basic Conceptstushar_shetti100% (1)

- Types of Supply GSTDocument46 pagesTypes of Supply GSTRajatKumarNo ratings yet

- Bac Iv Law Course Taxation IiDocument168 pagesBac Iv Law Course Taxation IiGilbert SanoNo ratings yet

- GST Notes Semester 6Document39 pagesGST Notes Semester 6Bhanu DangNo ratings yet

- Tax Changes in India and Morocco Taxation CiaDocument20 pagesTax Changes in India and Morocco Taxation CiaMEERA JOSHY 1927436No ratings yet

- Taxation Flow PresentationDocument73 pagesTaxation Flow PresentationMohan ChoudharyNo ratings yet

- Chapter 3 PA IIDocument8 pagesChapter 3 PA IIMule AbuyeNo ratings yet

- Adobe Scan Oct 11, 2023Document9 pagesAdobe Scan Oct 11, 2023Amir HamzaNo ratings yet

- Intro Week 1Document13 pagesIntro Week 1AAANo ratings yet

- Module 1Document17 pagesModule 1Suryansh Kumar AroraNo ratings yet

- PWC DTC 2010 SnapshotDocument7 pagesPWC DTC 2010 SnapshotGs ShikshaNo ratings yet

- Anubhav Sood Helga Cardoza Ragini Rastogi Sumit Kothari Vani SubramanianDocument18 pagesAnubhav Sood Helga Cardoza Ragini Rastogi Sumit Kothari Vani SubramanianSakshi TewariNo ratings yet

- DraftDocument36 pagesDraftAbhinand SadhanandanNo ratings yet

- Withholding Tax SystemDocument73 pagesWithholding Tax SystemrickmortyNo ratings yet

- Direct Taxes Code BookletDocument50 pagesDirect Taxes Code BookletprasadmandreNo ratings yet

- Introduction To Taxation: Hamza Hashmi Advocate Hight Court Partner at Hashmi AssociatesDocument31 pagesIntroduction To Taxation: Hamza Hashmi Advocate Hight Court Partner at Hashmi AssociatesArham SheikhNo ratings yet

- Tax Law & Practice: Arun C. BharatDocument41 pagesTax Law & Practice: Arun C. BharatSöuñdāryà MùnîyásàmỳNo ratings yet

- Eturns: This Chapter Will Equip You ToDocument52 pagesEturns: This Chapter Will Equip You ToShowkat MalikNo ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- 2 (Tax Law Research and Interpretation)Document21 pages2 (Tax Law Research and Interpretation)chamalixNo ratings yet

- CVP Analysis DetailedDocument5 pagesCVP Analysis DetailedchamalixNo ratings yet

- Audit PlanningDocument29 pagesAudit PlanningchamalixNo ratings yet

- AccountDocument67 pagesAccountchamalix100% (1)

- F6 InterimDocument7 pagesF6 InterimSad AnwarNo ratings yet

- Petitioner Respondent: Commissioner of Internal Revenue, Lee Kiwi Holdings, LLCDocument9 pagesPetitioner Respondent: Commissioner of Internal Revenue, Lee Kiwi Holdings, LLCGilbert John LacorteNo ratings yet

- Cir Vs Mirant Pagbilao CorporationDocument2 pagesCir Vs Mirant Pagbilao CorporationPeanutButter 'n Jelly100% (1)

- Affirmative: Tax Reform For Acceleration and Inclusion (Train) Law in The PhilippinesDocument10 pagesAffirmative: Tax Reform For Acceleration and Inclusion (Train) Law in The PhilippinesTherese Janine HetutuaNo ratings yet

- Corporate Owned Life InsuranceDocument12 pagesCorporate Owned Life InsuranceMartin McTaggartNo ratings yet

- Intermediate Accounting III: Pre-Test - Errors and ChangesDocument2 pagesIntermediate Accounting III: Pre-Test - Errors and ChangesMay RamosNo ratings yet

- GSTs Network EffectDocument3 pagesGSTs Network EffectvinayagarbossNo ratings yet

- EC201 Tutorial Exercise 3 SolutionDocument6 pagesEC201 Tutorial Exercise 3 SolutionPriyaDarshani100% (1)

- Use of MRP Indicator For Capturing Excise Duties From DealerDocument7 pagesUse of MRP Indicator For Capturing Excise Duties From DealerSubhojit BanerjeeNo ratings yet

- ScheduleDocument80 pagesScheduleGanapsthi KNo ratings yet

- Income Tax Payment Challan: PSID #: 146916470Document1 pageIncome Tax Payment Challan: PSID #: 146916470Madiah abcNo ratings yet

- Digitalized Economy Taxation Developments SummaryDocument148 pagesDigitalized Economy Taxation Developments SummaryRating AaNo ratings yet

- Importance of Giving: 5 Reasons To Give To CharityDocument3 pagesImportance of Giving: 5 Reasons To Give To CharityAyibongwinkosi DubeNo ratings yet

- Salary Slip (30745197 January, 2019)Document1 pageSalary Slip (30745197 January, 2019)Sajjad AhmedNo ratings yet

- 8 PF Membership ApplicationDocument1 page8 PF Membership ApplicationKanwal RashidNo ratings yet

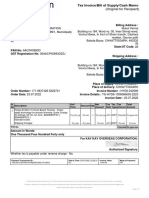

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)DRAGO GAMINGNo ratings yet

- NSL 1287Document2 pagesNSL 1287gutalavenkat8No ratings yet

- CIR v. Isabela Cultural CorporationDocument14 pagesCIR v. Isabela Cultural CorporationkimNo ratings yet

- Implementasi Tax Planning Pajak Penghasilan Badan Pt. Indojaya MandiriDocument19 pagesImplementasi Tax Planning Pajak Penghasilan Badan Pt. Indojaya MandirichristianoNo ratings yet

- AARPW1885E - Show Cause Notice For Proceedings Us 148A - 1041373372 (1) - 23032022Document2 pagesAARPW1885E - Show Cause Notice For Proceedings Us 148A - 1041373372 (1) - 23032022Sukalp WarhekarNo ratings yet

- OCP CAlculations 60-40Document7 pagesOCP CAlculations 60-40kanshika yadavNo ratings yet

- Computation of Gross IncomeDocument10 pagesComputation of Gross IncomemysterymieNo ratings yet

- Fee Waiver Request FormDocument2 pagesFee Waiver Request FormRajesh MukkavilliNo ratings yet

- PaySlip - December 2022Document1 pagePaySlip - December 2022Nisha KumariNo ratings yet

- 44 Depreciation ScheduleDocument6 pages44 Depreciation SchedulezydusNo ratings yet

- GST ChallanDocument1 pageGST Challanshaan creationNo ratings yet

- Main Invoice 2Document2 pagesMain Invoice 2Prasad KumarNo ratings yet

- Wells Fargo Banks V CollectorDocument3 pagesWells Fargo Banks V Collectorarielramada100% (2)

- Gmail - USJ-R E-Study LoadDocument1 pageGmail - USJ-R E-Study Loadfrancis albaracinNo ratings yet

- Exercise 3: Bank of The Philippine IslandDocument4 pagesExercise 3: Bank of The Philippine IslandKim FloresNo ratings yet