0% found this document useful (0 votes)

54 views15 pagesUnderstanding Marginal Costing Principles

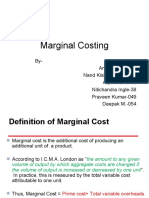

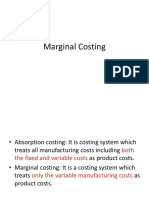

Marginal costing is a technique that classifies costs into fixed and variable costs. It considers only variable costs in calculating the cost per unit of a product. This allows companies to determine the contribution of each unit sold. Contribution is the excess of sales over variable costs and represents the funds available to cover fixed costs and provide a profit. Marginal costing helps companies with decision making, cost control, pricing, and break-even analysis. Some limitations include the difficulty separating fixed and variable costs accurately and that it does not account for fixed costs in inventory valuation.

Uploaded by

Shri VidhyaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPT, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

54 views15 pagesUnderstanding Marginal Costing Principles

Marginal costing is a technique that classifies costs into fixed and variable costs. It considers only variable costs in calculating the cost per unit of a product. This allows companies to determine the contribution of each unit sold. Contribution is the excess of sales over variable costs and represents the funds available to cover fixed costs and provide a profit. Marginal costing helps companies with decision making, cost control, pricing, and break-even analysis. Some limitations include the difficulty separating fixed and variable costs accurately and that it does not account for fixed costs in inventory valuation.

Uploaded by

Shri VidhyaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPT, PDF, TXT or read online on Scribd