Professional Documents

Culture Documents

CHAPTER 1: Finance

Uploaded by

Mohamed Abdi0 ratings0% found this document useful (0 votes)

10 views20 pagesFinance

Original Title

CHAPTER 1: finance

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinance

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views20 pagesCHAPTER 1: Finance

Uploaded by

Mohamed AbdiFinance

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 20

PART ONE

INTRODUCTION

Copyright © 2012 Pearson Education.

All rights reserved.

CHAPTER 1

Why Study

Financial Markets

and Institutions?

Copyright © 2012 Pearson Education.

All rights reserved.

Chapter Preview

The evening news features a segment

about interest rates, the Fed Chairman

Ben Bernanke, and liquidity in credit

markets.

What does all this mean? Do I care about

interest rates? What is “the Fed?” Will this

impact my firm’s ability to get a bank loan?

© 2012 Pearson Education. All rights reserved. 1-3

Chapter Preview

These are good questions. Of course, the

answer to these questions can be found in

this book. In fact, this books touches on a

variety of topics, including the Fed, stocks

markets, bond markets, and banks. We will

begin to appreciate many exciting issues

related to these topics during the course of

this term.

© 2012 Pearson Education. All rights reserved. 1-4

Chapter Preview

To start, we preview subjects of interest to anyone who is

a part of a productive society. We motivate how financial

markets and institutions have significant impact on

important questions about our financial well-being.

Topics include:

Why Study Financial Markets?

Why Study Financial Institutions?

Applied Managerial Perspective

How Will We Study Financial Markets and Institutions

© 2012 Pearson Education. All rights reserved. 1-5

Why Study Financial Markets?

Financial markets, such as bond and stock

markets, are crucial in our economy.

1.These markets channel funds from savers to

investors, thereby promoting economic

efficiency.

2.Market activity affects personal wealth, the

behavior of business firms, and economy as a

whole

© 2012 Pearson Education. All rights reserved. 1-6

Why Study Financial Markets?

Well functioning financial markets, such

as the bond market, stock market, and

foreign exchange market, are key factors

in producing high economic growth.

We will briefly examine each of these

markets, key statistics, and how we will

examine them throughout this course.

© 2012 Pearson Education. All rights reserved. 1-7

Why Study Financial Markets?

Debt Markets & Interest Rates

Debt markets, or bond markets, allow

governments, corporations, and

individuals to borrow to finance activities.

In this market, borrowers issue a

security, called a bond, that promises the

timely payment of interest and principal

over some specific time horizon.

The interest rate is the cost of borrowing.

© 2012 Pearson Education. All rights reserved. 1-8

Why Study Financial Markets?

Debt Markets & Interest Rates

There are many different types of market

interest rates, including mortgage rates,

car loan rates, credit card rates, etc.

The level of these rates are important.

For example, mortgage rates in the early

part of 1983 exceeded 13%. Financing a

house was quite expensive at this time.

© 2012 Pearson Education. All rights reserved. 1-9

Why Study Financial Markets?

Debt Markets & Interest Rates

Because interest rates are important to individuals

and business, understanding the history of interest

rates is beneficial.

We will study these further in several chapters,

examining the types and characteristics of bonds,

as well as theories on how rates are determined.

© 2012 Pearson Education. All rights reserved. 1-10

Why Study Financial Markets?

The Stock Market

The stock market is the market where common

stock (or just stock), representing ownership in

a company, are traded.

Companies initially sell stock (in the primary

market) to raise money. But after that, the stock

is traded among investors (secondary market).

Of all the active markets, the stock market

receives the most attention from the media,

probably because it is the place where people

get rich (and poor) quickly.

© 2012 Pearson Education. All rights reserved. 1-11

Why Study Financial Markets?

The Stock Market

Companies, not just individuals, also watch

the market. Although corporations don’t

typically “invest” in the market, they often

seek additional funding in equity markets

after going public.

© 2012 Pearson Education. All rights reserved. 1-12

Why Study Financial Markets?

The Foreign Exchange Market

The foreign exchange market is where

international currencies trade and

exchange rates are set.

Although most people know little about

this market, it has a daily volume around

$1 trillion!

© 2012 Pearson Education. All rights reserved. 1-13

Why Study Financial Markets?

The Stock Market

These fluctuations matter!

─ In recent years, consumers have found that

vacationing in Europe is expensive, due to a

weakening dollar relative to the Euro.

─ When the dollar strengthens, foreign purchase of

domestic goods falls, and US manufacturers

experience a decreased demand for their goods.

© 2012 Pearson Education. All rights reserved. 1-14

Why Study Financial

Institutions?

We will also spend considerable time discussing financial

institutions—the corporations, organizations, and networks

that operate the so-called “marketplaces.” These institutions

play a crucial role in improving the efficiency of the economy.

We will look at:

1.Structure of the Financial System

─ Helps get funds from savers to investors

2.Financial Crises

─ The financial crises of 2007–2009 was the worst

financial crisis since the Great Depression. Why did it

happen?

© 2012 Pearson Education. All rights reserved. 1-15

Why Study Financial

Institutions?

3. Central Banks and the Channel of Monetary

Policy

─ The role of the Fed, and foreign counterparts, in

the management of interest rates and the money

supply

4. The International Financial System

─ Capital flows between countries impacts domestic

economies

─ Need to understand exchange rates, capital

controls, and the role of agencies such as the IMF

© 2012 Pearson Education. All rights reserved. 1-16

Why Study Financial

Institutions?

5. Banks and Other Financial Institutions

─ Includes the role of insurance companies, mutual

funds, pension funds, etc.

6. Financial Innovation

─ Focusing on the improvements in technology and

its impact on how financial products are delivered

7. Managing Risk in Financial Institutions

─ Focusing on risk management in the

financial institution.

© 2012 Pearson Education. All rights reserved. 1-17

Applied Managerial Perspective

Financial institutions are among the

largest employers in the U.S. and often

pay high salaries.

Knowing how financial institutions are

managed may help you better deal

with them.

© 2012 Pearson Education. All rights reserved. 1-18

Chapter Summary

Why Study Financial Markets?: the three

primary markets (bond, stock, and

foreign exchange) were briefly

introduced.

Why Study Financial Institutions?: the

market, institutions, and key changes

affecting these were outlined.

© 2012 Pearson Education. All rights reserved. 1-19

Chapter Summary (cont.)

Applied Managerial Perspective: the

book will often present material to better

understand how actual managers use the

information in daily operations.

How We Will Study Financial Markets

and Institutions: we outlines the three key

components: analytical framework,

features, and web exercises.

© 2012 Pearson Education. All rights reserved. 1-20

You might also like

- CH 1 ModefiedDocument18 pagesCH 1 ModefiednikowawaNo ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- Why Study Financial Markets and Institutions?: All Rights ReservedDocument23 pagesWhy Study Financial Markets and Institutions?: All Rights ReservedДарьяNo ratings yet

- Corporate Governance Failures: The Role of Institutional Investors in the Global Financial CrisisFrom EverandCorporate Governance Failures: The Role of Institutional Investors in the Global Financial CrisisRating: 1 out of 5 stars1/5 (1)

- C01 (Compatibility Mode)Document8 pagesC01 (Compatibility Mode)Javaria munirNo ratings yet

- Lessons from Private Equity Any Company Can UseFrom EverandLessons from Private Equity Any Company Can UseRating: 4.5 out of 5 stars4.5/5 (12)

- Why Study Financial Markets and Institutions?: All Rights ReservedDocument18 pagesWhy Study Financial Markets and Institutions?: All Rights ReservedAfaq AhmedNo ratings yet

- Financial Literacy: Finding Your Way in the Financial Market (Transcript)From EverandFinancial Literacy: Finding Your Way in the Financial Market (Transcript)Rating: 4 out of 5 stars4/5 (1)

- Why Study Financial MarketsDocument34 pagesWhy Study Financial MarketsDiane RamirezNo ratings yet

- C01Document23 pagesC01Silvery DoeNo ratings yet

- Ch01 ME For BlackboardDocument17 pagesCh01 ME For BlackboardIlqar SəlimovNo ratings yet

- Why Study Financial Market: Course: FINC6019 Introduction To Money and Capital Market Effective Period: September 2019Document33 pagesWhy Study Financial Market: Course: FINC6019 Introduction To Money and Capital Market Effective Period: September 2019Ikhsan Uiandra Putra SitorusNo ratings yet

- The Role of Money and Financial System: Assoc. Phd. Hoai BuiDocument38 pagesThe Role of Money and Financial System: Assoc. Phd. Hoai BuiNguyễn Thảo VyNo ratings yet

- Lecture No. 1: Introduction: Fna 8111: Financial Institutions and MarketsDocument33 pagesLecture No. 1: Introduction: Fna 8111: Financial Institutions and MarketsNimco CumarNo ratings yet

- Financial Markets and Institutions: Ninth EditionDocument35 pagesFinancial Markets and Institutions: Ninth EditionمريمالرئيسيNo ratings yet

- Financial Institutions: Week 1 Introduction: Financial System and Financial IntermediationDocument15 pagesFinancial Institutions: Week 1 Introduction: Financial System and Financial Intermediationwarrior princeNo ratings yet

- Lecture 2 BA 105Document27 pagesLecture 2 BA 105Boon Han TanNo ratings yet

- Overview of The Financial System: All Rights ReservedDocument65 pagesOverview of The Financial System: All Rights ReservedHoly BunkersNo ratings yet

- Fim SummaryDocument92 pagesFim Summaryemre kutayNo ratings yet

- CH 01 PPTaccessibleDocument35 pagesCH 01 PPTaccessibleDaner DlawarNo ratings yet

- Ho Mb1e Ch01Document44 pagesHo Mb1e Ch01noormahjufriNo ratings yet

- Week 2 - Monetary Policy and Central BankingDocument7 pagesWeek 2 - Monetary Policy and Central BankingRestyM PurcaNo ratings yet

- Ch02 Financial Mkts and Institutions - MishkinEakins 2018-ENGDocument58 pagesCh02 Financial Mkts and Institutions - MishkinEakins 2018-ENGHoàng Đỗ VănNo ratings yet

- M02 Titman 2544318 11 FinMgt C02Document55 pagesM02 Titman 2544318 11 FinMgt C02Abed AttariNo ratings yet

- Chapter 1 - Introduction - Why Study Financial Markets and InstitutionsDocument23 pagesChapter 1 - Introduction - Why Study Financial Markets and InstitutionsmichellebaileylindsaNo ratings yet

- Chapter 1 - Introduction - Why Study Financial Markets and InstitutionsDocument23 pagesChapter 1 - Introduction - Why Study Financial Markets and Institutionsmichellebaileylindsa100% (4)

- Chap 001Document4 pagesChap 001bullinerfamily7498No ratings yet

- Full Download Solution Manual For Introduction To Finance Markets Investments and Financial Management 16th Edition PDF Full ChapterDocument19 pagesFull Download Solution Manual For Introduction To Finance Markets Investments and Financial Management 16th Edition PDF Full Chapterhematinchirper.ov9x100% (15)

- Solution Manual For Introduction To Finance Markets Investments and Financial Management 16th EditionDocument36 pagesSolution Manual For Introduction To Finance Markets Investments and Financial Management 16th Editionrabate.toiler.vv5s0100% (41)

- Full Solution Manual For Introduction To Finance Markets Investments and Financial Management 16Th Edition PDF Docx Full Chapter ChapterDocument36 pagesFull Solution Manual For Introduction To Finance Markets Investments and Financial Management 16Th Edition PDF Docx Full Chapter Chapterhanukka.fleabite620r0o100% (10)

- Discussion Questions: Foundations of Fin. Mgt. 6/E Cdn. - Block, Hirt, ShortDocument2 pagesDiscussion Questions: Foundations of Fin. Mgt. 6/E Cdn. - Block, Hirt, ShortCyn SyjucoNo ratings yet

- Why Study Money, Banking, and Financial Markets?Document17 pagesWhy Study Money, Banking, and Financial Markets?Trang VũNo ratings yet

- Answers Text Discussion QuestionsDocument2 pagesAnswers Text Discussion QuestionsbeyonceNo ratings yet

- Financial Management:: Firms and The Financial MarketDocument54 pagesFinancial Management:: Firms and The Financial Marketsiti aubreyNo ratings yet

- Dwnload Full Introduction To Finance Markets Investments and Financial Management 16th Edition Melicher Solutions Manual PDFDocument36 pagesDwnload Full Introduction To Finance Markets Investments and Financial Management 16th Edition Melicher Solutions Manual PDFgilmadelaurentis100% (14)

- Solution Manual For Introduction To Finance Markets Investments and Financial Management 16th EditionDocument18 pagesSolution Manual For Introduction To Finance Markets Investments and Financial Management 16th EditionDawn Steward100% (39)

- Why Do Financial Institutions ExistDocument44 pagesWhy Do Financial Institutions Existwaqar hattarNo ratings yet

- 8513 PresentationDocument14 pages8513 PresentationNoaman AkbarNo ratings yet

- The Goals and Functions of Financial Management: Discussion QuestionsDocument8 pagesThe Goals and Functions of Financial Management: Discussion QuestionsAffan AhmedNo ratings yet

- Slides1 - FIMDocument62 pagesSlides1 - FIMHuzaifa TariqueNo ratings yet

- CH - 02 Overview of The Financial SystemDocument35 pagesCH - 02 Overview of The Financial SystemmahadiparvezNo ratings yet

- Understanding Capital MarketsDocument25 pagesUnderstanding Capital MarketsAnna Mae NebresNo ratings yet

- Capital MarketDocument43 pagesCapital MarketAnna Mae NebresNo ratings yet

- CH 1 Why Study Money, BankingDocument15 pagesCH 1 Why Study Money, BankingLoving GamesNo ratings yet

- Principles of Managerial Finance: Fifteenth EditionDocument62 pagesPrinciples of Managerial Finance: Fifteenth EditionTanya PribylevaNo ratings yet

- Chapter 1 NotesDocument28 pagesChapter 1 NotesMaathir Al ShukailiNo ratings yet

- Slides FimDocument203 pagesSlides FimHuzaifa TariqueNo ratings yet

- Sole Proprietorships and Business Organization FormsDocument3 pagesSole Proprietorships and Business Organization FormsparavpNo ratings yet

- Unit 1: Introduction To FinanceDocument18 pagesUnit 1: Introduction To FinancehabtamuNo ratings yet

- The Financial Market Environment: All Rights ReservedDocument31 pagesThe Financial Market Environment: All Rights ReservedMahiNo ratings yet

- Unit 1: Overview of Financial Management & Financial EnvironmentDocument60 pagesUnit 1: Overview of Financial Management & Financial EnvironmentbadaberaNo ratings yet

- Session 1 - IntroductoryDocument6 pagesSession 1 - IntroductoryMd AzizNo ratings yet

- Introduction to Corporate Finance FundamentalsDocument142 pagesIntroduction to Corporate Finance FundamentalsesubalewkumsaNo ratings yet

- ESOM - Chapter 1 Course OverviewDocument24 pagesESOM - Chapter 1 Course OverviewLy KhanhNo ratings yet

- Why Study Money, Banking, and Financial Markets?Document29 pagesWhy Study Money, Banking, and Financial Markets?Lazaros KarapouNo ratings yet

- The Financial Market EnvironmentDocument47 pagesThe Financial Market EnvironmentasimNo ratings yet

- Why Study Money, Banking, and Financial Markets?Document25 pagesWhy Study Money, Banking, and Financial Markets?Ali El MallahNo ratings yet

- Nltcnh - Chapter 1 - Tiếng AnhDocument25 pagesNltcnh - Chapter 1 - Tiếng Anhphamthikieuanh1111No ratings yet

- 1 - Why Study Money, Banking, and Financial Markets?Document25 pages1 - Why Study Money, Banking, and Financial Markets?cihtanbioNo ratings yet

- Chapter 3 PPTX Mudarabah-1Document9 pagesChapter 3 PPTX Mudarabah-1Mohamed AbdiNo ratings yet

- Chapter 3-Bugetary PlanningDocument59 pagesChapter 3-Bugetary PlanningMohamed AbdiNo ratings yet

- Air Cargo GuideDocument211 pagesAir Cargo Guideulya100% (1)

- 42 Air Cargo Operations ManagementDocument2 pages42 Air Cargo Operations ManagementMohamed AbdiNo ratings yet

- Airline and Cargo ManagementDocument107 pagesAirline and Cargo ManagementMohamed Abdi100% (1)

- History of International AccountingDocument39 pagesHistory of International AccountingMohamed AbdiNo ratings yet

- Introduction IADocument26 pagesIntroduction IAMohamed AbdiNo ratings yet

- SOCIAL ACCOUNTING AND REPORTINGDocument10 pagesSOCIAL ACCOUNTING AND REPORTINGMohamed AbdiNo ratings yet

- The Role of The International Civil Aviation Organization On DereDocument57 pagesThe Role of The International Civil Aviation Organization On DereMohamed AbdiNo ratings yet

- National Income AccountingDocument46 pagesNational Income AccountingMohamed AbdiNo ratings yet

- The Impact of Planning On Project Success-A Literature ReviewDocument25 pagesThe Impact of Planning On Project Success-A Literature ReviewanepameerNo ratings yet

- Nonprofit Basics: Entrepreneurship & Intellectual Property ClinicDocument12 pagesNonprofit Basics: Entrepreneurship & Intellectual Property ClinicMohamed AbdiNo ratings yet

- Karimadom Colony - A Case Study of Urban Shelter: JaisonDocument16 pagesKarimadom Colony - A Case Study of Urban Shelter: JaisonumaymahNo ratings yet

- MACROECONOMICS II - BOPDocument51 pagesMACROECONOMICS II - BOPAmanda Ruth100% (3)

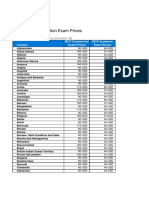

- Microsoft Certification Exam Prices by CountryDocument12 pagesMicrosoft Certification Exam Prices by CountryJackie ZhanNo ratings yet

- Internal Auditors Are Business PartnerDocument2 pagesInternal Auditors Are Business PartnerValuers NagpurNo ratings yet

- Calculating National IncomeDocument7 pagesCalculating National IncomeJoe JosephNo ratings yet

- M.Tech. Admission 2021 Indian Institute of Technology (Indian School of Mines) DhanbadDocument1 pageM.Tech. Admission 2021 Indian Institute of Technology (Indian School of Mines) Dhanbadashish singhNo ratings yet

- Government Procurement Portal FABRIC TENDERDocument2 pagesGovernment Procurement Portal FABRIC TENDERAnees AhmedNo ratings yet

- My Romance Full-PianoDocument4 pagesMy Romance Full-PianoDavi Miranda MirandaNo ratings yet

- Church Financial Report-2Document8 pagesChurch Financial Report-2Grace ChandaNo ratings yet

- Types of Export Finance ExplainedDocument14 pagesTypes of Export Finance Explainedsamy7541No ratings yet

- Nautical Tourism in EuropeDocument6 pagesNautical Tourism in EuropeEdward ShaneNo ratings yet

- Cloze TestDocument9 pagesCloze TestGia Quỳnh Tô NgọcNo ratings yet

- CIS309 MidtermDocument15 pagesCIS309 MidtermGabriel Garza100% (6)

- Determinants of Foreign Direct Investments in Emerging Markets: A Case Study of NigeriaDocument174 pagesDeterminants of Foreign Direct Investments in Emerging Markets: A Case Study of NigeriaLauren LivingstonNo ratings yet

- 3.1 Money and Finance: Igcse /O Level EconomicsDocument17 pages3.1 Money and Finance: Igcse /O Level EconomicszainNo ratings yet

- HDFC Bank Balance Sheet, HDFC Bank Financial Statement & Accounts PDFDocument4 pagesHDFC Bank Balance Sheet, HDFC Bank Financial Statement & Accounts PDFAashish GamdyanNo ratings yet

- Working Capital Management at NALCO: Analysis and RecommendationsDocument11 pagesWorking Capital Management at NALCO: Analysis and RecommendationsAniket JaggiNo ratings yet

- PRODUCTIVITY3Document2 pagesPRODUCTIVITY3Aira Cane EvangelistaNo ratings yet

- Garden State Case#9Document28 pagesGarden State Case#9Aarti J0% (1)

- Demonetisation in India Objectives, Achievements and LessonsDocument7 pagesDemonetisation in India Objectives, Achievements and LessonsarcherselevatorsNo ratings yet

- CommunismDocument4 pagesCommunismVeda meghanaNo ratings yet

- Evaluasi Pelaksanaan Program Amnesti Pajak Tahun 2016 Di IndonesiaDocument17 pagesEvaluasi Pelaksanaan Program Amnesti Pajak Tahun 2016 Di IndonesiaAnjas HeoNo ratings yet

- DocumentDocument24 pagesDocumentCeline YoonNo ratings yet

- Gamuda BerhadDocument2 pagesGamuda BerhadHui EnNo ratings yet

- Your Electricity Bill For: Details OverleafDocument2 pagesYour Electricity Bill For: Details Overleafamalendu sundar mandalNo ratings yet

- Cmt3 QuestionsDocument41 pagesCmt3 QuestionsUpdatest news0% (2)

- ZG120 MN 13Document2 pagesZG120 MN 13Agam SanjayaNo ratings yet

- BBA F 0A Theory of Constraints QuestionsDocument2 pagesBBA F 0A Theory of Constraints QuestionsDIMPI 2122069No ratings yet

- HK GRCC Platinum - Transfer-In App FormDocument1 pageHK GRCC Platinum - Transfer-In App FormpercysmithNo ratings yet

- Tata Nano Case (Questions Answers)Document4 pagesTata Nano Case (Questions Answers)erfan441790100% (4)