Professional Documents

Culture Documents

Why Study Financial Markets and Institutions?: All Rights Reserved

Uploaded by

Afaq Ahmed0 ratings0% found this document useful (0 votes)

12 views18 pagesOriginal Title

Chapter 1- Textbook

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views18 pagesWhy Study Financial Markets and Institutions?: All Rights Reserved

Uploaded by

Afaq AhmedCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 18

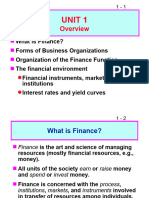

CHAPTER 1

Why Study

Financial Markets

and Institutions?

Copyright © 2012 Pearson Prentice Hall.

All rights reserved.

Chapter Preview

Do I care about interest rates?

What is “the interest rate?

Will this impact my firm’s ability to get a

bank loan?

© 2012 Pearson Prentice Hall. All rights reserved. 1-2

Chapter Preview

This course will help you answer these

questions by addressing a variety of topics

ranging from the functioning of the bond

and sock markets to the behavior of the

interest and banks.

© 2012 Pearson Prentice Hall. All rights reserved. 1-3

Why Study Financial Markets?

Financial markets, such as bond and stock

markets, are crucial in our economy.

1.These markets channel funds from savers to

investors, thereby promoting economic

efficiency.

2.Market activity affects personal wealth, the

behavior of business firms, and economy as a

whole

© 2012 Pearson Prentice Hall. All rights reserved. 1-4

Why Study Financial Markets?

Well functioning financial markets, such

as the bond market, stock market, and

foreign exchange market, are key factors

in producing high economic growth.

© 2012 Pearson Prentice Hall. All rights reserved. 1-5

Why Study Financial Markets?

Debt Markets & Interest Rates

Debt markets, or bond markets, allow

governments, corporations, and

individuals to borrow to finance activities.

In this market, borrowers issue a

security, called a bond, that promises the

timely payment of interest and principal

over some specific time horizon.

The interest rate is the cost of borrowing.

© 2012 Pearson Prentice Hall. All rights reserved. 1-6

Why Study Financial Markets?

Debt Markets & Interest Rates

There are many different types of market

interest rates, including mortgage rates,

car loan rates, credit card rates, etc.

.

© 2012 Pearson Prentice Hall. All rights reserved. 1-7

Bond Market and Interest Rates

© 2012 Pearson Prentice Hall. All rights reserved. 1-8

Why Study Financial Markets?

The Stock Market

The stock market is the market where common

stock (or just stock), representing ownership in

a company, are traded.

Companies initially sell stock (in the primary

market) to raise money. But after that, the

stock is traded among investors (secondary

market).

Of all the active markets, the stock market

receives the most attention from the media.

Why?

© 2012 Pearson Prentice Hall. All rights reserved. 1-9

Stock

Market

© 2012 Pearson Prentice Hall. All rights reserved. 1-10

Why Study Financial Markets?

The Foreign Exchange Market

The foreign exchange market is where

international currencies trade and

exchange rates are set.

Although most people know little about

this market, it has a daily volume around

$1 trillion!

© 2012 Pearson Prentice Hall. All rights reserved. 1-11

Foreign Exchange Market

© 2012 Pearson Prentice Hall. All rights reserved. 1-12

Why Study Financial

Institutions?

The financial institutions—the corporations,

organizations, and networks that operate the so-called

“marketplaces.”

1. Structure of the Financial System

─ Helps get funds from savers to investors

2. Financial Crises

─ The financial crises of 2007–2009 was the worst

financial crisis since the Great Depression. Why

did it happen?

© 2012 Pearson Prentice Hall. All rights reserved. 1-13

Why Study Financial

Institutions?

3. Banks and Other Financial Institutions

─ Includes the role of insurance companies, mutual

funds, pension funds, etc.

4. Financial Innovation

─ Focusing on the improvements in technology and

its impact on how financial products are delivered

5. Managing Risk in Financial Institutions

─ Focusing on risk management in the

financial institution.

© 2012 Pearson Prentice Hall. All rights reserved. 1-14

Applied Managerial Perspective

Financial institutions are among the

largest employers and often pay high

salaries.

Knowing how financial institutions are

managed may help better deal

with them.

© 2012 Pearson Prentice Hall. All rights reserved. 1-15

How We Study Financial

Markets and Institutions

Basic Analytic Framework

1.Simplified approach to demand for

assets.

2. Basic supply & demand approach to

understanding behavior in financial

markets.

© 2012 Pearson Prentice Hall. All rights reserved. 1-16

How We Study Financial

Markets and Institutions

Basic Analytic Framework

3. Equilibrium forces & profit seeking

behavior

4.Transactions cost & asymmetric

information approach to financial structure

© 2012 Pearson Prentice Hall. All rights reserved. 1-17

Learning Objectives

─ the basic theory of asset demand and

determination of asset prices,

─ the role of arbitrage and profit motive in

financial markets,

─ the role of information in financial markets,

─ and the causes and consequences of

financial crises.

1-18

You might also like

- Why Study Financial Markets and Institutions?: All Rights ReservedDocument23 pagesWhy Study Financial Markets and Institutions?: All Rights ReservedДарьяNo ratings yet

- Lessons from Private Equity Any Company Can UseFrom EverandLessons from Private Equity Any Company Can UseRating: 4.5 out of 5 stars4.5/5 (12)

- C01 (Compatibility Mode)Document8 pagesC01 (Compatibility Mode)Javaria munirNo ratings yet

- CHAPTER 1: FinanceDocument20 pagesCHAPTER 1: FinanceMohamed AbdiNo ratings yet

- The ImpactAssets Handbook for Investors: Generating Social and Environmental Value through Capital InvestingFrom EverandThe ImpactAssets Handbook for Investors: Generating Social and Environmental Value through Capital InvestingNo ratings yet

- CH 1 ModefiedDocument18 pagesCH 1 ModefiednikowawaNo ratings yet

- Financial Literacy: Finding Your Way in the Financial Market (Transcript)From EverandFinancial Literacy: Finding Your Way in the Financial Market (Transcript)Rating: 4 out of 5 stars4/5 (1)

- C01Document23 pagesC01Silvery DoeNo ratings yet

- Why Study Financial MarketsDocument34 pagesWhy Study Financial MarketsDiane RamirezNo ratings yet

- The Role of Money and Financial System: Assoc. Phd. Hoai BuiDocument38 pagesThe Role of Money and Financial System: Assoc. Phd. Hoai BuiNguyễn Thảo VyNo ratings yet

- Ch01 ME For BlackboardDocument17 pagesCh01 ME For BlackboardIlqar SəlimovNo ratings yet

- M02 Titman 2544318 11 FinMgt C02Document55 pagesM02 Titman 2544318 11 FinMgt C02Abed AttariNo ratings yet

- Financial Institutions: Week 1 Introduction: Financial System and Financial IntermediationDocument15 pagesFinancial Institutions: Week 1 Introduction: Financial System and Financial Intermediationwarrior princeNo ratings yet

- Lecture 2 BA 105Document27 pagesLecture 2 BA 105Boon Han TanNo ratings yet

- Overview of The Financial System: All Rights ReservedDocument65 pagesOverview of The Financial System: All Rights ReservedHoly BunkersNo ratings yet

- Lecture No. 1: Introduction: Fna 8111: Financial Institutions and MarketsDocument33 pagesLecture No. 1: Introduction: Fna 8111: Financial Institutions and MarketsNimco CumarNo ratings yet

- CH - 02 Overview of The Financial SystemDocument35 pagesCH - 02 Overview of The Financial SystemmahadiparvezNo ratings yet

- Financial Management:: Firms and The Financial MarketDocument54 pagesFinancial Management:: Firms and The Financial Marketsiti aubreyNo ratings yet

- Why Do Financial Institutions ExistDocument44 pagesWhy Do Financial Institutions Existwaqar hattarNo ratings yet

- Why Study Financial Market: Course: FINC6019 Introduction To Money and Capital Market Effective Period: September 2019Document33 pagesWhy Study Financial Market: Course: FINC6019 Introduction To Money and Capital Market Effective Period: September 2019Ikhsan Uiandra Putra SitorusNo ratings yet

- 8513 PresentationDocument14 pages8513 PresentationNoaman AkbarNo ratings yet

- An Introduction To The Foundations of Financial Management: All Rights ReservedDocument30 pagesAn Introduction To The Foundations of Financial Management: All Rights ReservedChristian LunaNo ratings yet

- Lecture 1Document16 pagesLecture 1Aliya YerkinNo ratings yet

- Foundations of FinanceDocument22 pagesFoundations of FinanceNur Akmal100% (1)

- Overview of The Financial System: All Rights ReservedDocument44 pagesOverview of The Financial System: All Rights ReservedAfaq AhmedNo ratings yet

- Financial Markets and Institutions: Ninth EditionDocument35 pagesFinancial Markets and Institutions: Ninth EditionمريمالرئيسيNo ratings yet

- Discussion Questions: Foundations of Fin. Mgt. 6/E Cdn. - Block, Hirt, ShortDocument2 pagesDiscussion Questions: Foundations of Fin. Mgt. 6/E Cdn. - Block, Hirt, ShortCyn SyjucoNo ratings yet

- Firms and The Financial MarketDocument57 pagesFirms and The Financial MarketSakinahNo ratings yet

- Answers Text Discussion QuestionsDocument2 pagesAnswers Text Discussion QuestionsbeyonceNo ratings yet

- The Role of Managerial Finance: All Rights ReservedDocument58 pagesThe Role of Managerial Finance: All Rights ReservedTextro VertNo ratings yet

- Why Study Money, Banking, and Financial Markets?Document17 pagesWhy Study Money, Banking, and Financial Markets?Trang VũNo ratings yet

- Slides1 - FIMDocument62 pagesSlides1 - FIMHuzaifa TariqueNo ratings yet

- Chapter 2Document48 pagesChapter 2Mohd AsyrafNo ratings yet

- Ho Mb1e Ch01Document44 pagesHo Mb1e Ch01noormahjufriNo ratings yet

- The Financial Market Environment: All Rights ReservedDocument31 pagesThe Financial Market Environment: All Rights ReservedMahiNo ratings yet

- Slides FimDocument203 pagesSlides FimHuzaifa TariqueNo ratings yet

- CH 1 Role of Managerial FinanceDocument38 pagesCH 1 Role of Managerial FinanceAkash KarNo ratings yet

- Chapter 1 - Introduction - Why Study Financial Markets and InstitutionsDocument23 pagesChapter 1 - Introduction - Why Study Financial Markets and InstitutionsmichellebaileylindsaNo ratings yet

- Chapter 1 - Introduction - Why Study Financial Markets and InstitutionsDocument23 pagesChapter 1 - Introduction - Why Study Financial Markets and Institutionsmichellebaileylindsa100% (4)

- Unit 1: Overview of Financial Management & Financial EnvironmentDocument60 pagesUnit 1: Overview of Financial Management & Financial EnvironmentbadaberaNo ratings yet

- Chap 001Document4 pagesChap 001bullinerfamily7498No ratings yet

- Principles of Managerial Finance: Fifteenth EditionDocument62 pagesPrinciples of Managerial Finance: Fifteenth EditionTanya PribylevaNo ratings yet

- CH 2 Financial Market EnvironmentDocument17 pagesCH 2 Financial Market EnvironmentAkash KarNo ratings yet

- Solution Manual For Principles of Finance 6th Edition by BesleyDocument5 pagesSolution Manual For Principles of Finance 6th Edition by Besleya8707008010% (1)

- The Goals and Functions of Financial Management: Discussion QuestionsDocument8 pagesThe Goals and Functions of Financial Management: Discussion QuestionsAffan AhmedNo ratings yet

- Chapter 1 - Introduction To Finance: FIN2102 - Financial ManagementDocument21 pagesChapter 1 - Introduction To Finance: FIN2102 - Financial ManagementsatingNo ratings yet

- M02 Titman 2544318 11 FinMgt C02Document57 pagesM02 Titman 2544318 11 FinMgt C02kennethfarnumNo ratings yet

- Solution Manual For Introduction To Finance Markets Investments and Financial Management 16th EditionDocument36 pagesSolution Manual For Introduction To Finance Markets Investments and Financial Management 16th Editionrabate.toiler.vv5s0100% (41)

- Full Solution Manual For Introduction To Finance Markets Investments and Financial Management 16Th Edition PDF Docx Full Chapter ChapterDocument36 pagesFull Solution Manual For Introduction To Finance Markets Investments and Financial Management 16Th Edition PDF Docx Full Chapter Chapterhanukka.fleabite620r0o100% (10)

- Full Download Solution Manual For Introduction To Finance Markets Investments and Financial Management 16th Edition PDF Full ChapterDocument19 pagesFull Download Solution Manual For Introduction To Finance Markets Investments and Financial Management 16th Edition PDF Full Chapterhematinchirper.ov9x100% (15)

- Lecture 1Document54 pagesLecture 1M Haris SiddiquiNo ratings yet

- 279 - Fin Management 1 Essential and Fin MarketsDocument17 pages279 - Fin Management 1 Essential and Fin MarketsJohhny BonesNo ratings yet

- The Financial Markets and Interest RatesDocument24 pagesThe Financial Markets and Interest RatesAhmed El KhateebNo ratings yet

- CH 01 PPTaccessibleDocument35 pagesCH 01 PPTaccessibleDaner DlawarNo ratings yet

- LN02 Keown33019306 08 LN02 GEDocument52 pagesLN02 Keown33019306 08 LN02 GEEnny HaryantiNo ratings yet

- Capital MarketDocument43 pagesCapital MarketAnna Mae NebresNo ratings yet

- Understanding Capital MarketsDocument25 pagesUnderstanding Capital MarketsAnna Mae NebresNo ratings yet

- Introduction to Operations Research and Linear ProgrammingDocument18 pagesIntroduction to Operations Research and Linear ProgrammingAfaq AhmedNo ratings yet

- Overview of The Financial System: All Rights ReservedDocument44 pagesOverview of The Financial System: All Rights ReservedAfaq AhmedNo ratings yet

- Chapter 04 - The Simplex Method Tableau FormDocument13 pagesChapter 04 - The Simplex Method Tableau FormAfaq AhmedNo ratings yet

- What Do Interest Rates Mean and What Is Their Role in Valuation?Document28 pagesWhat Do Interest Rates Mean and What Is Their Role in Valuation?Afaq AhmedNo ratings yet

- Operations Research P Rama Murthy PDFDocument716 pagesOperations Research P Rama Murthy PDFPaban Raj LohaniNo ratings yet

- BBM - 978 1 349 19852 8/1Document35 pagesBBM - 978 1 349 19852 8/1Basanta K SahuNo ratings yet

- Chapter 02 - Simplex Method IntroductionDocument14 pagesChapter 02 - Simplex Method IntroductionAfaq AhmedNo ratings yet

- Chapter 03 - The Simplex Method PrinciplesDocument18 pagesChapter 03 - The Simplex Method PrinciplesAfaq AhmedNo ratings yet

- HBL Challan for University of Sindh Exam FeeDocument1 pageHBL Challan for University of Sindh Exam FeeAfaq AhmedNo ratings yet

- MR Afaq Assignment HalfDocument19 pagesMR Afaq Assignment HalfAfaq AhmedNo ratings yet

- Intensive Growth StrategiesDocument2 pagesIntensive Growth StrategiesBindu MadhaviNo ratings yet

- Information Technology Services Centre - ITSC University of Sindh, Jamshoro Examination ProformaDocument1 pageInformation Technology Services Centre - ITSC University of Sindh, Jamshoro Examination ProformaAfaq AhmedNo ratings yet

- PSO Company ProfileDocument19 pagesPSO Company ProfileAfaq Ahmed0% (1)

- Information Technology Services Centre - ITSC University of Sindh, Jamshoro Examination ProformaDocument1 pageInformation Technology Services Centre - ITSC University of Sindh, Jamshoro Examination ProformaAfaq AhmedNo ratings yet

- Name:-Afaque Ahmed Roll No: - 2k19/BBAE/12 Department: - BBA (HONS) Part 3 Assignment Submitted To DR FarhanDocument6 pagesName:-Afaque Ahmed Roll No: - 2k19/BBAE/12 Department: - BBA (HONS) Part 3 Assignment Submitted To DR FarhanAfaq AhmedNo ratings yet

- Information Technology Services Centre - ITSC University of Sindh, Jamshoro Examination ProformaDocument1 pageInformation Technology Services Centre - ITSC University of Sindh, Jamshoro Examination ProformaAfaq AhmedNo ratings yet

- Assignment On: Managerial Economics Mid Term and AssignmentDocument14 pagesAssignment On: Managerial Economics Mid Term and AssignmentFaraz Khoso BalochNo ratings yet

- MBA Managerial Economics EssentialsDocument193 pagesMBA Managerial Economics EssentialsRambabu UndabatlaNo ratings yet

- Research Methodology MSC Notes of Dr. Judu Illavarasu (Svyasa Univ)Document44 pagesResearch Methodology MSC Notes of Dr. Judu Illavarasu (Svyasa Univ)Syed Abdul Qadus ShahNo ratings yet

- Assignment On: Managerial Economics Mid Term and AssignmentDocument14 pagesAssignment On: Managerial Economics Mid Term and AssignmentFaraz Khoso BalochNo ratings yet

- Research Methodology MSC Notes of Dr. Judu Illavarasu (Svyasa Univ)Document44 pagesResearch Methodology MSC Notes of Dr. Judu Illavarasu (Svyasa Univ)Syed Abdul Qadus ShahNo ratings yet

- LN Research Method FinalDocument138 pagesLN Research Method FinalBalaraman Gnanam.s100% (1)

- Coaching Within TA - Prezentacja (Hay J.)Document23 pagesCoaching Within TA - Prezentacja (Hay J.)nomiczekNo ratings yet

- ST Petersburg TA Association Silver Jubilee 2018: Julie Hay TSTA (OPE)Document10 pagesST Petersburg TA Association Silver Jubilee 2018: Julie Hay TSTA (OPE)patrickNo ratings yet

- Principles of Managerial EconomicsDocument110 pagesPrinciples of Managerial EconomicsSean Lester S. NombradoNo ratings yet

- Leadership in Classroom - Prezentacja (Hay J.) PDFDocument35 pagesLeadership in Classroom - Prezentacja (Hay J.) PDFnomiczekNo ratings yet

- Statbook PDFDocument433 pagesStatbook PDFcokkyNo ratings yet

- Name List: - Afaque Ahmed Khoso Mashooque Ali Akhter Ali Baber Ali Roll Num: - 2K19/BBAE/12/79/18/38Document13 pagesName List: - Afaque Ahmed Khoso Mashooque Ali Akhter Ali Baber Ali Roll Num: - 2K19/BBAE/12/79/18/38Afaq AhmedNo ratings yet

- BBM - 978 1 349 19852 8/1Document35 pagesBBM - 978 1 349 19852 8/1Basanta K SahuNo ratings yet

- Business CombinationDocument24 pagesBusiness CombinationArifinNo ratings yet

- Present Value and Future Value CalculationsDocument3 pagesPresent Value and Future Value CalculationsXyriene RocoNo ratings yet

- A Plain English Guide To Financial TermsDocument42 pagesA Plain English Guide To Financial TermssyedmanNo ratings yet

- 43 of The Most Motivational Quotes - Chirag Patel - LinkedinDocument43 pages43 of The Most Motivational Quotes - Chirag Patel - Linkedinusman379No ratings yet

- Financial Due Diligence Art NirmanDocument41 pagesFinancial Due Diligence Art NirmanPravesh Pangeni0% (1)

- Recruiters Sites TetenDocument83 pagesRecruiters Sites TetenArvinthNo ratings yet

- SECP (Presentation 01)Document27 pagesSECP (Presentation 01)Asghar IqbalNo ratings yet

- FM Cases For Group PresentationDocument19 pagesFM Cases For Group PresentationSwati AmritNo ratings yet

- F1-04 The Macro-Economic EnvironmentDocument26 pagesF1-04 The Macro-Economic EnvironmentAsghar AliNo ratings yet

- ACC501 - Final Term Papers 02Document17 pagesACC501 - Final Term Papers 02RanoRoseNo ratings yet

- AMC - Taranis - CH0575781247 - PO - Terms - Final - NEWDocument19 pagesAMC - Taranis - CH0575781247 - PO - Terms - Final - NEWBuchotNo ratings yet

- Chapter 2 - Financial Reporting - Its Conceptual FrameworkDocument34 pagesChapter 2 - Financial Reporting - Its Conceptual FrameworkPhuongNo ratings yet

- Gamma Scalping Using Neural Network WithDocument5 pagesGamma Scalping Using Neural Network Withvicky.sajnaniNo ratings yet

- Finan MGT DoneDocument22 pagesFinan MGT DonesnehitachatterjeeNo ratings yet

- TFI InternationalDocument43 pagesTFI InternationalJenny QuachNo ratings yet

- A Study On Mutual Funds As Investment Options: Chapter - 1 Introduction To Indian Financial SystemDocument47 pagesA Study On Mutual Funds As Investment Options: Chapter - 1 Introduction To Indian Financial SystemDeepti ShroffNo ratings yet

- Corporate Finance ProjectDocument45 pagesCorporate Finance ProjectSaiprasad Nitin Lolekar100% (1)

- How Corporations Raise Venture Capital and Issue SecuritiesDocument24 pagesHow Corporations Raise Venture Capital and Issue SecuritiessumanNo ratings yet

- SC's NRA Judgement On Sec.68: Threadbare Analysis of Subsequent DecisionsDocument5 pagesSC's NRA Judgement On Sec.68: Threadbare Analysis of Subsequent DecisionsArchit ShethNo ratings yet

- NASDAQ Market OverviewDocument4 pagesNASDAQ Market OverviewsserifundNo ratings yet

- Statement of Cash Flows: 1. True 6. True 2. False 7. False 3. False 8. True 4. True 9. True 5. True 10. FALSEDocument12 pagesStatement of Cash Flows: 1. True 6. True 2. False 7. False 3. False 8. True 4. True 9. True 5. True 10. FALSEJamie Rose AragonesNo ratings yet

- Moody's Rating SystemDocument2 pagesMoody's Rating Systemnikhil0000No ratings yet

- Chapter 6Document18 pagesChapter 6Selena JungNo ratings yet

- Decision to Lease or Buy Equipment at Warf ComputersDocument7 pagesDecision to Lease or Buy Equipment at Warf ComputersUyên PhạmNo ratings yet

- Nature of Financial ManagementDocument30 pagesNature of Financial ManagementVaishnav KumarNo ratings yet

- Bank reconciliation and journal entriesDocument6 pagesBank reconciliation and journal entriesmeifangNo ratings yet

- Ch19 - Guan CM - AISEDocument38 pagesCh19 - Guan CM - AISELydia WulandariNo ratings yet

- Adventures in Debentures GibbonsDocument144 pagesAdventures in Debentures GibbonsRimpy SondhNo ratings yet

- LTCM Crisis and Systemic RiskDocument5 pagesLTCM Crisis and Systemic RiskMilan MartinovicNo ratings yet

- International Business: by Charles W.L. HillDocument29 pagesInternational Business: by Charles W.L. Hillitalo_ramirez_5No ratings yet