Professional Documents

Culture Documents

Audit and corporate governance policies at Adani Ports

Uploaded by

Ritvik Sharma0 ratings0% found this document useful (0 votes)

5 views17 pagesOriginal Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views17 pagesAudit and corporate governance policies at Adani Ports

Uploaded by

Ritvik SharmaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 17

Audit and corporate governance

Assignment

Submitted To: Alka Ma’am

Presented By: Ritvik Sharma & Rudraksh Anand

Roll Number: 20/22141 & 20/22159

Course: B.Com (Hons.)

Semester: VI

•ADANI PORTS CORPORATE GOVERNANCE POLICY

CONTENTS

• Overview

• Ports and terminals

• Board of Directors

• Financial Position

• Types of Committees

• Dividend Decisions

• Code of Conduct

OVERVIEW

• Adani Ports and Special Economic Zone Limited (APSEZ) is an Indian port operator

and logistics company, founded by Gautam Adani on 26 May, 1998. APSEZ is

India's largest private port operator with a network of 12 ports and terminals,

including India's first port-based SEZ at Mundra.

• Adani Logistics Limited (ALL) is the most diversified end-to-end logistics service

provider in the country with presence across all major markets with expertise in

handling varied customer across segments like Retail, Industrial, Container, Bulk,

Break-Bulk, Liquids, Auto and Grain Handling.

• ALL has developed and operates inland container depots at Patli and Kilaraipur

and multi-modal logistics parks (MMLP) at Kishangarh, Malur and Kanech.

• Adani Ports and Special Economic Zone Ltd (APSEZL) provides Dredging and

Reclamation solutions primarily for port and harbor construction. The Adani

Group started investing in developing a dredging fleet in 2005 to achieve planned

high paced growth in the port sector. It has been a major success story since then

and APSEZL today operates a large fleet of 23 dredgers and of the largest capital

dredging capacity in India.

• APSEZ, besides owning dredgers, has a large fleet of support vessels and

equipment such as Multi Utility Crafts, Survey vessels, Floating cranes, Jack up

barges, etc.

PORTS AND TERMINAL

• Mundra Port-Since 2013, Mundra Port is India's largest private commercial port and hosts the world's largest coal

import terminal.

• As of August 2016, approximately 20,000 ships had docked at Mundra without a single accident representing the

high safety standards implemented by the port authorities.

• Krishnapatnam Port-Krishnapatnam Port Company Limited (KPCL) is a multi-cargo facility port located near

Nellore, Andhra Pradesh. KPCL was acquired by Adani Ports in October 2020 for INR 13,000 cr. from the CVR

Group.

• Hazira Port-The Hazira Port is a deep-water port located in the Gulf of Khambat, Surat, Gujarat. The port has been

operational since 2005 and is a strategic port for Shell Energy India.

• Dhamra Port-Dhamra Port, Bhadrak, Odisha is a deep-water, all-weather, multi-user, a multi-cargo port located

between Haldia and Paradeep ports.

• It can handle dry bulk, breakbulk, project cargo, and containers.[34] It has an annual capacity of 40 MMT cargo

which can go up to 100 MMT in the future.

• Dahej Port-The Dahej Port is a deep-water, multi-cargo port in the Gulf of Khambat, Bharuch, Gujarat. It houses

two dry and breaks bulk berths and dedicated facilities for handling project cargo. It has a capacity to handle 2

crore (20 million) tonnes per year. It handles all kinds of dry bulk and breakbulk cargo.

• Vizag Terminal-APSEZ formerly owned a coal terminal in the Visakhapatnam Port. In 2022, only a few years into a

30-year contract they returned it to the Visakhapatnam Port Authority.

BOARD

COMPOSITIO

N

• Executive Directors : 2

• Non-Executive

Independent Directors: 5

• Other Non-Executive

Directors: 3

Board of Directors

CHAIRMAN AND MANAGING DIRECTOR WHOLE TIME DIRECTOR

FINANCIAL

POSITIONS

AUDIT COMMITTEE

NOMINATION AND REMUNERATION COMMITTEE

TYPES OF

COMMITEE STAKEHOLDER'S RELATIONSHIP COMMITTEE

S

CORPORATE SOCIAL RESPONSIBILITY COMMITTEE

RISK MANAGEMENT COMMITTEE

AUDIT COMMITTEE

• Every Related Party Transaction and subsequent Material Modifications shall be subject to the prior

approval of the Audit Committee.

• Members of the audit committee, who are independent directors, shall only approve related party

transactions.

• The Audit Committee may grant omnibus approval for Related Party Transactions proposed to be

entered into by the Company which are repetitive in nature subject to compliance of the conditions

contained in the Companies Act, 2013 and SEBI LODR as amended from time to time.

• The audit committee shall also review the status of long-term (more than one year) or recurring RPTs

on an annual basis.

• The Audit Committee shall also review the statement of significant related party transactions

submitted by management as per its terms of reference.

• The Audit Committee shall recommend the Related Party Transactions for approval of Board of

Directors / Shareholders as per terms of this policy.

• The Company has constituted a Nomination and

NOMINATION Remuneration Committee of the Board of Directors

(Board).

AND • At present there are total 8 (eight) directors on the

Board of which 4 (four) are Non-Executive and

REMUNERATI Independent, 1 (One) Non-Executive Director is

ON related to an Executive Director, 1 (One) Non-

Executive Director is GMB Nominee and the

COMMITTEE remaining 2 (two) are Executive Directors. Mr.

Gautam S. Adani, Chairman & Managing Director

and Dr. Malay Mahadevia, Whole-Time Director

draws remuneration from the Company.

• Key Managerial Personnel (KMP) consists of

Executive Chairman and Managing Director, Whole-

Time Directors, Chief Executive Officer, Chief

Financial Officer and Company Secretary who are

employees.

• The Stakeholders’ Relationship Committee is constituted

pursuant to and in accordance with the applicable

provisions of Companies Act 2013 and the Securities and

STAKEHOLDE Exchange Board of India (Listing Obligations and

Disclosure Requirements) Regulation, 2015, as amended

R'S from time to time.

• The Committee reports to and is accountable to, the

RELATIONSHIP Board of Directors of Adani Enterprises Limited.

COMMITTEE • The objective of the Committee is to assist the Board

with oversight of, inter-alia, the effective and efficient

servicing and protecting the stakeholders’ interest

including but not limited to shareholders, debenture

holders, other security holders and rating agencies,

regulators, customers.

• Functions:

• a)To formulate and recommend to the Board, a Corporate Social Responsibility

Policy which shall indicate the activities to be undertaken by the Company in

areas or subject, specified in Schedule VII of the Companies Act, 2013 and rules

made thereunder;

CORPORATE • b) To review from time to time Corporate Social Responsibility (CS) policy in the

light of emergent situation and statutory frame work;

SOCIAL • c) To recommend the amount of investment to be made on CSR activities;

RESPONSIBI • d) To monitor the implementation of CSR policy and review overall performance

in CSR Programmes;

LITY • e) To review from time to time Sustainability policy in the glabal context and

evolving statutory frame work such as BRR;

COMMITTEE • f) To review overall Sustainability performance and Sustainability Reporting of the

Company;

• g) To review from time to time different aspect of Sustainability Performance

• such as ethical governance, environmental stewardship, safety performance at

sites, water and energy use etc.; and

• h) The authority to decide on Disclosure on Management Approach in

Sustainability Reporting and to steer Sustainability Performance is hereby

delegated to CEO of the Company.

RISK MANAGEMENT COMMITTEE

• Procedure for Risk Assessment

• Importance : Integrated assessment to identify the environmental and

• social impacts, risks, and opportunities of projects,

• Framework for Environment and Social Impact Assessment (ESIA)

• Objective:

• To assess the proposed project to determine whether or not the proposed project and associated

activities will have any adverse impacts on theenvironment, taking into account environmental, social,

cultural, economic, and

• legal considerations;

• To evaluate alternatives; and

• To design appropriate mitigation, management, and monitoring measures.

• The scope and depth of the ESIA shall be decided based on the nature, complexity, and significance of

the identified issues, as established into ‘Framework for Site Screening and Categorization'. Framework

also provides: Site Screening Checklist for Greenfield Project and Site Screening Checklist for Brownfield

Project.

DIVIDEND

DECISION

CODE OF

CONDUCTS

• ) Equal opportunities employer and

prevention of discrimination.

• 2) Prevention of Harassment.

• 3) Confidentiality of information.

• 4) Resolving conflict of interests.

• 5) Condemns antitrust / anti-competitive

practices.

• 6) Anti-money laundering and prohibition of

insider trading.

• 7) Anti-corruption laws, thereby no frauds.

• 8) Environment, health and safety.

THANK YOU!

You might also like

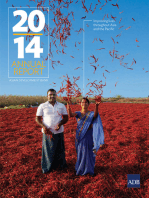

- Strengthening Partnerships: Accountability Mechanism Annual Report 2014From EverandStrengthening Partnerships: Accountability Mechanism Annual Report 2014No ratings yet

- HeromotocorpDocument19 pagesHeromotocorpRajaNo ratings yet

- Evolution of CGDocument50 pagesEvolution of CGUTTAM KOIRALANo ratings yet

- 38-char summary of various committees on corporate governanceDocument33 pages38-char summary of various committees on corporate governanceAarti Chavan100% (4)

- Format (Sample)Document37 pagesFormat (Sample)Harry SingNo ratings yet

- Hindustan Zinc LimitedDocument14 pagesHindustan Zinc Limitedvrushal kambleNo ratings yet

- Cadbury ReportDocument16 pagesCadbury ReportToral Shah100% (1)

- MCSDocument26 pagesMCSRohan KarbelkarNo ratings yet

- Coporate Governance & Ethics at HDFC BankDocument10 pagesCoporate Governance & Ethics at HDFC BankShobhit BhatnagarNo ratings yet

- UK Corporate GovernanceDocument52 pagesUK Corporate Governancexijaban127No ratings yet

- Idfc - Infrastructure Development Finance CompanyDocument45 pagesIdfc - Infrastructure Development Finance Companyruchi070186No ratings yet

- Challenges and Issues in Corporate GovernanceDocument19 pagesChallenges and Issues in Corporate GovernanceShivjeet SinghNo ratings yet

- SM (CSR)Document30 pagesSM (CSR)Hitesh MoreNo ratings yet

- Corporate Governance: Presented by Sadaf Jaffery To Sir Khurram KhanDocument13 pagesCorporate Governance: Presented by Sadaf Jaffery To Sir Khurram KhansadafjafriNo ratings yet

- SBL l4 Governance (IV) BD Com N RemuDocument53 pagesSBL l4 Governance (IV) BD Com N RemuHERLINAH NATASHA BINTI SUYANTONo ratings yet

- Corporate Governance: R.G Nawin KrishnaDocument19 pagesCorporate Governance: R.G Nawin KrishnaRG Nawin KrishnaNo ratings yet

- KUMAR MANGALAM BIRLA COMMITTEE REPORT ON CORPORATE GOVERNANCEDocument16 pagesKUMAR MANGALAM BIRLA COMMITTEE REPORT ON CORPORATE GOVERNANCESiddharth SinghNo ratings yet

- LCA of Top Cement Companies in IndiaDocument31 pagesLCA of Top Cement Companies in IndiaVikas SharmaNo ratings yet

- Corp Gov - TybmsDocument46 pagesCorp Gov - TybmsNurdayantiNo ratings yet

- Cadbury Report, 1992: Submitted By: Sourabh Kumar (4121029)Document20 pagesCadbury Report, 1992: Submitted By: Sourabh Kumar (4121029)Homi NathNo ratings yet

- GOOD Darwin ReportDocument187 pagesGOOD Darwin ReportdarrelsilvaNo ratings yet

- Maple Leaf Cement Factory Limited Annual Report 2015 HighlightsDocument180 pagesMaple Leaf Cement Factory Limited Annual Report 2015 HighlightsM Umar Farooq0% (1)

- IBC Code 2016 SummaryDocument12 pagesIBC Code 2016 SummaryAmanNo ratings yet

- L4-Organizational Structure of BanksDocument26 pagesL4-Organizational Structure of BanksShameel IrshadNo ratings yet

- Evaluation of The Cash Management & Banking System With A Financial Analysis of Indian Oil Corporation LTDDocument78 pagesEvaluation of The Cash Management & Banking System With A Financial Analysis of Indian Oil Corporation LTDgain.moumitaNo ratings yet

- Corporate Governance 13Document29 pagesCorporate Governance 13dont_forgetme2004No ratings yet

- MGT109DrBusrPr - 3CG - Dr. PLPDocument15 pagesMGT109DrBusrPr - 3CG - Dr. PLPNainish MishraNo ratings yet

- McKinsey Survey, Committees On Corporate GovernanceDocument104 pagesMcKinsey Survey, Committees On Corporate Governanceajmal0% (1)

- Tybfm: Business & Corporate Governance - Unit 2Document39 pagesTybfm: Business & Corporate Governance - Unit 2Babita MishraNo ratings yet

- Code On Corporate GovernanceDocument63 pagesCode On Corporate GovernanceVishwas JorwalNo ratings yet

- Sir Adrian Cadbury Committee, SOX Act, Kumar Mangalam Birla CommitteeDocument27 pagesSir Adrian Cadbury Committee, SOX Act, Kumar Mangalam Birla CommitteeVenkata Sai Varun KanuparthiNo ratings yet

- MBA 8 Business Ethics & Corporate Governance GuideDocument43 pagesMBA 8 Business Ethics & Corporate Governance GuidePragyan NayakNo ratings yet

- Audit Report of ADN - 2020Document12 pagesAudit Report of ADN - 2020Mehedi Hasan HridoyNo ratings yet

- Ar 2018 PDFDocument112 pagesAr 2018 PDFmanjula withanageNo ratings yet

- What is corporate governance? Key principles and guidelines in IndiaDocument29 pagesWhat is corporate governance? Key principles and guidelines in IndiaPoonam SharmaNo ratings yet

- Final PPT Corporate GovernanceDocument31 pagesFinal PPT Corporate GovernanceManpreet KaurNo ratings yet

- Cadbury Report Ethics & Corporate GovernanceDocument13 pagesCadbury Report Ethics & Corporate Governancecohen.herreraNo ratings yet

- JJC LTD - Inception Report - Feasibility StudyDocument9 pagesJJC LTD - Inception Report - Feasibility StudyAustin Sams UdehNo ratings yet

- PPL Annual Report 2011,2010Document166 pagesPPL Annual Report 2011,2010Kehkashan FatimaNo ratings yet

- Board of Directors Duties and Liabilities ExplainedDocument18 pagesBoard of Directors Duties and Liabilities ExplainedGapo Tanim PunoNo ratings yet

- Analysis of Financial Statement of HecDocument28 pagesAnalysis of Financial Statement of Hecsatyadarshi ravi singhNo ratings yet

- Working Capital Maangement at Acc Cements (2) Latest YearDocument98 pagesWorking Capital Maangement at Acc Cements (2) Latest YearRajesh InsbNo ratings yet

- Business - Ethics, Governance & RiskDocument6 pagesBusiness - Ethics, Governance & RiskShaunak ShindeNo ratings yet

- Presented By:-Aditi Chopra, Arpit JainDocument19 pagesPresented By:-Aditi Chopra, Arpit JainRajan SharmaNo ratings yet

- Corporate Governance: Unit Iv Entrepreneurship and Good GovernanceDocument20 pagesCorporate Governance: Unit Iv Entrepreneurship and Good GovernanceShailajareddy ChintapalliNo ratings yet

- Fianl - Cadbury PPT111Document47 pagesFianl - Cadbury PPT111abrolpriyankaNo ratings yet

- A Study On Receivable Management & Its ImpactDocument70 pagesA Study On Receivable Management & Its Impactlmbhagya100% (2)

- IDLC History and Organizational StructureDocument10 pagesIDLC History and Organizational StructureSraboni MostafaNo ratings yet

- Hindustan PetroleumDocument22 pagesHindustan PetroleumDeepak sharmaNo ratings yet

- Chapter 2 - Conceptual Framework and Standard Setting Process (Part 2)Document13 pagesChapter 2 - Conceptual Framework and Standard Setting Process (Part 2)Nurul Artikah SariNo ratings yet

- Corporate Governance: Group MembersDocument31 pagesCorporate Governance: Group Membersav2811No ratings yet

- Report of The Committee Appointed by TheDocument33 pagesReport of The Committee Appointed by TheVinod GuptaNo ratings yet

- Management Structure of Cooperative: M. Guna SekaranDocument23 pagesManagement Structure of Cooperative: M. Guna SekaranVela KanniNo ratings yet

- Corporate Governance GuidelinesDocument7 pagesCorporate Governance GuidelinesElaNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteFrom EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteNo ratings yet

- Corporate Governance: A practical guide for accountantsFrom EverandCorporate Governance: A practical guide for accountantsRating: 5 out of 5 stars5/5 (1)

- ADB Annual Report 2014: Improving Lives Throughout Asia and the PacificFrom EverandADB Annual Report 2014: Improving Lives Throughout Asia and the PacificNo ratings yet

- Corporate Governance - Effective Performance Evaluation of the BoardFrom EverandCorporate Governance - Effective Performance Evaluation of the BoardNo ratings yet

- Google Image ResultDocument1 pageGoogle Image ResultRitvik SharmaNo ratings yet

- Adani-Hindenburg ClashDocument2 pagesAdani-Hindenburg ClashRitvik SharmaNo ratings yet

- Marketing Management: Mahtab Alam Assistant Professor Management & Commerce DepartmentDocument74 pagesMarketing Management: Mahtab Alam Assistant Professor Management & Commerce DepartmentRitvik SharmaNo ratings yet

- Topic 10 EthicsDocument9 pagesTopic 10 EthicsRitvik SharmaNo ratings yet

- What is an Advertising AgencyDocument14 pagesWhat is an Advertising AgencyRitvik SharmaNo ratings yet

- Measuring Advertising Effectiveness MethodsDocument8 pagesMeasuring Advertising Effectiveness MethodsRitvik SharmaNo ratings yet

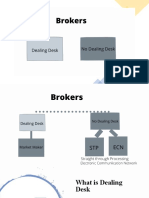

- Lession-5 Brokers TypesDocument5 pagesLession-5 Brokers TypesRitvik SharmaNo ratings yet

- Lesson-4 World Trading HoursDocument14 pagesLesson-4 World Trading HoursKARTHIK P JAYSWAL 2123321No ratings yet

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ritvik SharmaNo ratings yet

- eLeZHcwX7CqLhhps7 - Goldman Sachs - zL2qQYBkYqbp9xpwn - 1649334540616 - Completion - CertificateDocument1 pageeLeZHcwX7CqLhhps7 - Goldman Sachs - zL2qQYBkYqbp9xpwn - 1649334540616 - Completion - CertificateRitvik SharmaNo ratings yet

- Service marketing mix: 7Ps frameworkDocument18 pagesService marketing mix: 7Ps frameworkRitvik SharmaNo ratings yet

- Ritvik MopDocument18 pagesRitvik MopRitvik SharmaNo ratings yet

- Adani's Marketing Mix and AchievementsDocument18 pagesAdani's Marketing Mix and AchievementsBHAVESH KERAI100% (1)

- Adani Ports Iotl AcquisitionDocument22 pagesAdani Ports Iotl AcquisitionParth KariaNo ratings yet

- Reverse Logistics: Multimodal Hubs Air Cargo PolicyDocument48 pagesReverse Logistics: Multimodal Hubs Air Cargo PolicyShreedhar KulalNo ratings yet

- Improving cargo handling accuracy at JNPT portDocument60 pagesImproving cargo handling accuracy at JNPT portChavan VivekNo ratings yet

- Ap Current Affairs - 2022Document39 pagesAp Current Affairs - 2022Manu GNo ratings yet

- Gujarat's Ports To Become Major Drivers of EconomyDocument27 pagesGujarat's Ports To Become Major Drivers of Economydeba01234No ratings yet

- CONCOR's Nationwide NetworkDocument54 pagesCONCOR's Nationwide NetworkSiddhesh BridNo ratings yet

- Group 3Document13 pagesGroup 3Suman JajooNo ratings yet

- BPTS Hazira Issue-02 Rev-02 Jan-2021Document49 pagesBPTS Hazira Issue-02 Rev-02 Jan-2021jaya thawaniNo ratings yet

- FY22Document659 pagesFY22BHAVESH KERAINo ratings yet

- Adani Logistics ParkDocument26 pagesAdani Logistics ParkSushma SelaNo ratings yet

- Current Affairs Weekly PDF - April 2021 1st Week (1-7) by AffairsCloud 1Document20 pagesCurrent Affairs Weekly PDF - April 2021 1st Week (1-7) by AffairsCloud 1most funny videoNo ratings yet

- G2 - Snowman Logistics LimitedDocument9 pagesG2 - Snowman Logistics LimitedAaryan GuptaNo ratings yet

- Apsez Ct2 t2 Tariff Booklet Wef 01012022Document15 pagesApsez Ct2 t2 Tariff Booklet Wef 01012022Arora AlfazNo ratings yet

- Adani Ports' Plan to Become World's Largest Private Port Operator by 2030Document563 pagesAdani Ports' Plan to Become World's Largest Private Port Operator by 2030aathi sakthiNo ratings yet

- Maritime India 17 OctDocument24 pagesMaritime India 17 OctSumiran BansalNo ratings yet

- Gujarat-Ports Sector ReportDocument17 pagesGujarat-Ports Sector ReportK. Ashok Vardhan ShettyNo ratings yet

- South African Thermal Coal Prices ImproveDocument2 pagesSouth African Thermal Coal Prices ImproveSANDESH GHANDATNo ratings yet

- Pan-India: Location AnalysisDocument7 pagesPan-India: Location AnalysisupasanaNo ratings yet

- Wealth-Insight - May 2021Document66 pagesWealth-Insight - May 2021vnmasterNo ratings yet

- APSEZ Ports and Logistics Gateway for the NationDocument23 pagesAPSEZ Ports and Logistics Gateway for the NationAlton LeeNo ratings yet

- SPM Arrival Set - FinDocument13 pagesSPM Arrival Set - FinDHSanjNo ratings yet

- Vizhinjam International Seaport Emgerging Transshipment Hub PortDocument75 pagesVizhinjam International Seaport Emgerging Transshipment Hub Portj4jitsNo ratings yet

- PMC Projects (India) Pvt. LTD.: Adani Mormugao Port Terminal (P) LTDDocument31 pagesPMC Projects (India) Pvt. LTD.: Adani Mormugao Port Terminal (P) LTDrenger20150303No ratings yet

- Ports Full ReportDocument188 pagesPorts Full ReportSubhasish GiriNo ratings yet

- Adani PortsDocument11 pagesAdani Portssaurav gotamNo ratings yet

- Adani Visit Report - DSUDocument8 pagesAdani Visit Report - DSUPritesh PandyaNo ratings yet

- Adani Port AnalysisDocument2 pagesAdani Port Analysisabhinavb76No ratings yet

- A.P. Moller - Maersk Accelerates Transformation To Integrated ServiceDocument5 pagesA.P. Moller - Maersk Accelerates Transformation To Integrated ServiceShantanuNo ratings yet

- ONEYDELD08652900Document2 pagesONEYDELD08652900Nawal sharmaNo ratings yet