Professional Documents

Culture Documents

Banking Fraud Presentation

Uploaded by

PRANAY DUBEY0 ratings0% found this document useful (0 votes)

50 views14 pagesOriginal Title

BANKING FRAUD PRESENTATION

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

50 views14 pagesBanking Fraud Presentation

Uploaded by

PRANAY DUBEYCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 14

BANKING FRAUD

PRESENTATION

SUMITTED BY: ASHWIN UDAYAKUMAR

COURSE: M.Sc. / M.Com FORENSIC ACCOUNTING &

FINANCIAL INVESTIGATION.

SUBMITTED TO: ANSHU SINGH

INTRODUCTION:

Modern advancements in the banking sector

have resulted in a rapid increase in volume,

as well as the ease with which financial

transactions are being carried out.

Today almost all financial transactions

are being done via digital banking banking.

However these developments comes

with its own set of limitations i.e.

increase in the number and types of internet

banking frauds taking place.

REASON BEHIND INCREASE IN DIGITAL

FRAUD:

Change in e-commerce landscape: Purchasing of goods and services

moving over to online platforms or marketplaces.

Increase in the use of online payments services: The increasing use

of P2P and e-wallet apps has increased the chances of frauds taking

place.

Increase in digital banking services: The demand of consumers for

more online and mobile services from financial institutions resulting in

banks going digital.

More sophisticated fraud tactics: Due to an increasing number of

data breaches over recent years, fraudsters can more easily access PII

(personally identifiable information) and use it against consumers

Unclear legal jurisdiction of cross-border fraud: Most large sum

transactions encompass multiple countries. Hence it is difficult for

individual jurisdictions to properly monitor for fraud risk.

Technological advancements resulting in new sophisticated frauds:

The technologies that companies and banks to innovate, introduce new

products and services are also being adopted by fraudsters.

TYPES OF FRAUDS:

WHATSAPP BANKING FRAUD:

• WhatsApp banking services, are used by

banks provide alert notifications from your

bank through WhatsApp instead of getting

them as SMS.

• The familiarity and simplicity of the

WhatsApp messaging makes it easy for

customers to interact with the bank and get

answers to queries in a seamless manner.

• However Whatsapp is being exploited by

scammers on the platform. Fraudsters send

text messages to Whatsapp users in order to

extract sensitive information such as bank

account details.

CONTD.

• WhatsApp scam makes use of working external links on the

platform. The scam, named "Rediroff.ru" is being circulated by

WhatsApp users themselves. The fraud involves the circulation of

the above mentioned WhatsApp link . As soon as a user opens the

link, they are redirected a web page which tempts them by

promising an assured gift or informing them about the prize of a

giveaway.

• The user opens the web page and fills a survey sheet, the page

collects vital information concerning the user including their IP

address, name of the device and other personal details such as name,

age, address, bank account details which can be then used to scam

the user.

SIM SWAPPING:

• SIM swapping is a form of digital

identity theft which works on social

engineering. It is often the second phase

of a fraud attack, SIM swapping happens

when fraudsters take control of a victim’s

mobile number and from there obtain

verification codes like OTPs and URNs

that give them unrestricted access to

protected accounts.

• Fraudsters take get access to replacement

SIM that is replaced through methods

such as reporting a handset lost or stolen,

placing requests for SIM replacement, or

producing fake documents to get a

duplicate SIM.

COTD

• In April 2018, Gregg Bennett, an entrepreneur in Bellevue,

Washington, noticed something odd happening across his email

account, after which his phone connectivity immediately zeroed out.

Fearing a hacking attempt, Bennett, unfortunately, could do little as

the fraudsters took control of his phone number via his SIM, therein

gaining access to Bennett’s Amazon, Evernote, Starbucks, and even

his Bitcoin account, whereby he lost 100 Bitcoin.

PROCESSES OF SIM SWAPPING:

WHALING:

• A whaling scam or attack is a method

used by cyber fraudsters to masquerade

as a senior player at an organization and

directly target senior officials of an

organization, with the aim of stealing

money or sensitive information or

gaining access to their computer systems

to carryout further criminal activities.

• These are mainly targeted towards

higher officials hence it is also known as

CEO fraud, whaling is similar to

phishing in that it uses methods such as

email and website spoofing to trick a

target into performing specific actions,

such as revealing sensitive data or

transferring money.

COTD.

• The major point of difference between whaling and spear-phishing

is that fraudulent communications is seem like it has come from a

senior officials. These attacks can be made all the more believable

when cybercriminals use significant research that utilizes openly

available resources such as social media to come up with a tailor

made approach for those target individuals.

• This could include an email that seems to be from a senior manager

and could include a reference to something that an attacker may

have got from online sources.

• The sender's email address typically looks like it's from a believable

source and may contain corporate logos or links to a fraudulent

website that has also been designed to look legitimate. Because a

whale or senior officials level of trust and access within an

organization tends to be high. Hence the attacker tends to put more

effort into the finer details in order to pull of a near perfect scam.

DIFFERENCE BETWEEN WHALING AND SPEAR PISHING:

COTD

• In 2016, the payroll department at Snapchat received a whaling

email seemingly sent from the CEO asking for employee payroll

information. Last year, toy giant Mattel fell victim to a whaling

attack after a top finance executive received an email requesting a

money transfer from a fraudster impersonating the new CEO. The

company almost lost $3 million as a result.

CONCLUSION:

Online payments have made it easy to make financial transaction

anytime from anywhere in just a click. However it comes with its own

set of problems and risks. Whether you are regular with online banking

or feel skeptical about it, some safety measures while making a digital

transaction essential. Basic awareness about online scams can help one

avert a financial tragedy.

THANK YOU.

You might also like

- Cyber CrimeDocument17 pagesCyber CrimeVaishnavi khotNo ratings yet

- Online FraudDocument14 pagesOnline FraudSiddu HalashettiNo ratings yet

- Corporate Fraud and Employee Theft: Impacts and Costs On BusinessDocument15 pagesCorporate Fraud and Employee Theft: Impacts and Costs On BusinessAkuw AjahNo ratings yet

- Citi Commercial Card Fraud FAQDocument3 pagesCiti Commercial Card Fraud FAQSajan JoseNo ratings yet

- Romance FraudDocument20 pagesRomance FraudAlmaNo ratings yet

- High Cost of Theft and Fraud: Student's Name Institution Course Name Instructor's Name DateDocument4 pagesHigh Cost of Theft and Fraud: Student's Name Institution Course Name Instructor's Name Datetopnerd writerNo ratings yet

- National Fraud Strategy outlines new approachDocument39 pagesNational Fraud Strategy outlines new approachTanzum MozammleNo ratings yet

- Fraud in Electronic Payment TransactionsDocument10 pagesFraud in Electronic Payment TransactionsDaud SuleimanNo ratings yet

- Demat Account Fraud - How To Safeguard Against Demat Account FraudDocument2 pagesDemat Account Fraud - How To Safeguard Against Demat Account FraudJayaprakash Muthuvat100% (1)

- Fraud Suspicion Procedure: If The Information Does MatchDocument2 pagesFraud Suspicion Procedure: If The Information Does MatchAbner James Yngente LagerfeldNo ratings yet

- Common Scams On Mobile DevicesDocument4 pagesCommon Scams On Mobile Devicessam shaikhNo ratings yet

- Telecommunication Fraud and Detection Techniques: A ReviewDocument3 pagesTelecommunication Fraud and Detection Techniques: A ReviewEditor IJRITCCNo ratings yet

- Pub Other Check Fraud PDFDocument23 pagesPub Other Check Fraud PDFPatrick PerezNo ratings yet

- Identifying Potential Fraud in Insurance ClaimsDocument20 pagesIdentifying Potential Fraud in Insurance Claimssatishreddy71No ratings yet

- Manuscript Online Scams Information and PreventionDocument5 pagesManuscript Online Scams Information and PreventionNORMAN LOUIS CADALIGNo ratings yet

- Date Recorded Attorney Executing AOM Monroe County Book/Page Corporate Identity (Assignor)Document2 pagesDate Recorded Attorney Executing AOM Monroe County Book/Page Corporate Identity (Assignor)Foreclosure FraudNo ratings yet

- Running Head: Resume Fraud in OrganizationsDocument6 pagesRunning Head: Resume Fraud in OrganizationsGeorge MainaNo ratings yet

- Presented By:: Rupali Nayak and Swetalina Mohanty Under Guidance: K.K. AcharyaDocument18 pagesPresented By:: Rupali Nayak and Swetalina Mohanty Under Guidance: K.K. Acharyanur atyraNo ratings yet

- Credit Card Fraud Modus OperandiDocument32 pagesCredit Card Fraud Modus OperandiRESHMI J URK19ISD011No ratings yet

- Identity Fraud Consumer ReportDocument32 pagesIdentity Fraud Consumer ReporteZinexNo ratings yet

- Wire FraudDocument49 pagesWire Fraudayleen arazaNo ratings yet

- Credit Card Fraud Detection Using Hidden Markov ModelDocument23 pagesCredit Card Fraud Detection Using Hidden Markov Modelabcd_010% (1)

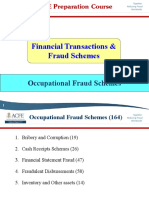

- 02 - Occupational Fraud Schemes 2019Document114 pages02 - Occupational Fraud Schemes 2019abdul syukur100% (1)

- 191 Cases: Fraud in NonprofitsDocument2 pages191 Cases: Fraud in NonprofitsYus CeballosNo ratings yet

- External Bank Fraud-090510 From Henry Hardoon of Hhassociates - Co.ukDocument43 pagesExternal Bank Fraud-090510 From Henry Hardoon of Hhassociates - Co.ukHenry HardoonNo ratings yet

- Cases of Computer FraudDocument3 pagesCases of Computer FraudAnthony FloresNo ratings yet

- Digital FraudsDocument10 pagesDigital FraudsDivyanshi AgarwalNo ratings yet

- Cred Card Fraud ChhapaDocument5 pagesCred Card Fraud ChhapaSomeoneNo ratings yet

- DLT Unemployment Fraud Fact SheetDocument2 pagesDLT Unemployment Fraud Fact SheetNBC 10 WJARNo ratings yet

- FRBCheckFraud PDFDocument10 pagesFRBCheckFraud PDFTess AwasNo ratings yet

- HDFC Bank Request For Credit Card UpgrdeDocument2 pagesHDFC Bank Request For Credit Card UpgrdeDhavalNo ratings yet

- Bouncing CheckDocument3 pagesBouncing CheckginalynNo ratings yet

- Red Flags FraudDocument15 pagesRed Flags FraudMervyn TeoNo ratings yet

- Identity Fraud PresentationDocument6 pagesIdentity Fraud Presentationputi rizna nabilaNo ratings yet

- Online Shopping PDFDocument19 pagesOnline Shopping PDFPrince Nornor-QuadziNo ratings yet

- Frauds in Banks- An OverviewDocument7 pagesFrauds in Banks- An OverviewtareqNo ratings yet

- Controlling Credit Card FraudDocument4 pagesControlling Credit Card Fraudbalaji bysaniNo ratings yet

- Insurance FraudDocument14 pagesInsurance FraudBhagirath AshiyaNo ratings yet

- Debit Card Fraud Detection Using HMMDocument3 pagesDebit Card Fraud Detection Using HMMAmir AmirthalingamNo ratings yet

- An analysis of identity theft: Motives, related frauds, techniques and preventionDocument7 pagesAn analysis of identity theft: Motives, related frauds, techniques and preventionAli RazaNo ratings yet

- Essentials of FraudDocument6 pagesEssentials of FraudShivangi BajpaiNo ratings yet

- Fraud: by Oana VitanDocument13 pagesFraud: by Oana VitanOana_Vitan_6955No ratings yet

- Credit Card FraudDocument13 pagesCredit Card FraudNinad SamelNo ratings yet

- FRAUD 101: Email Scam (Phishing)Document1 pageFRAUD 101: Email Scam (Phishing)BULA PRASHANT KUMAR VU21MGMT0100208No ratings yet

- Uk Fake IdDocument3 pagesUk Fake IdLeo J. Sluss0% (1)

- "SIM Cloning": Submitted To: - Mr. Gurbakash PhonsaDocument6 pages"SIM Cloning": Submitted To: - Mr. Gurbakash PhonsagauravsanadhyaNo ratings yet

- Fake Credit Card StatementDocument17 pagesFake Credit Card Statementvishal sharmaNo ratings yet

- Intro To Fraud ExaminationDocument13 pagesIntro To Fraud ExaminationGladys CanterosNo ratings yet

- Alpha Hustlers Free EbookDocument10 pagesAlpha Hustlers Free Ebookmjraikwar26No ratings yet

- Student's Guide To Fraud ScamsDocument19 pagesStudent's Guide To Fraud ScamsShadrack HernandezNo ratings yet

- MM11 - Bank Fraud - WikipediaDocument8 pagesMM11 - Bank Fraud - WikipediaAtul Sharma50% (2)

- Banking FraudsDocument38 pagesBanking Fraudssamfisher0528100% (1)

- Banking Ombudsman - Quick Guides 2Document5 pagesBanking Ombudsman - Quick Guides 2atty_denise_uyNo ratings yet

- Identity Theft Identity FraudDocument7 pagesIdentity Theft Identity Fraudroshan ranaNo ratings yet

- The Basics of Preventing Check and ETF FraudDocument11 pagesThe Basics of Preventing Check and ETF FraudShahid MumtazNo ratings yet

- Gamitin Ang Pink Na Catleya Sa Pagsulat NG Mga Sagot SubukinDocument4 pagesGamitin Ang Pink Na Catleya Sa Pagsulat NG Mga Sagot SubukinPatrick Anday100% (1)

- 1009W - Assessing Writing Resume (B117)Document2 pages1009W - Assessing Writing Resume (B117)Victor Manuel Beas Jr.No ratings yet

- Vlsi MPMC POM WC WN Vlsi MPMC TLRF Vlsi WN TLRF Vlsi MPMC Vlsi WC WN TLRF POM Vlsi WC WC WN WN MPMCDocument3 pagesVlsi MPMC POM WC WN Vlsi MPMC TLRF Vlsi WN TLRF Vlsi MPMC Vlsi WC WN TLRF POM Vlsi WC WC WN WN MPMCVIJAYNo ratings yet

- Seiberlich VDocument2 pagesSeiberlich Vapi-631590064No ratings yet

- Second Language AcquisitionDocument38 pagesSecond Language AcquisitionMary Joy Daprosa JoseNo ratings yet

- Lesson PlanrhymingDocument1 pageLesson Planrhymingapi-247963077No ratings yet

- VAK QuestionnaireDocument2 pagesVAK QuestionnaireManuela Dobre0% (1)

- Dissemination of Information AssignmentDocument7 pagesDissemination of Information AssignmentJosephNo ratings yet

- Online Mid MGT 207Document2 pagesOnline Mid MGT 207Muhammad JawadNo ratings yet

- Slide Presentation For Chapter 8Document34 pagesSlide Presentation For Chapter 8RomeoNo ratings yet

- MK110 Portfolio Part 2Document3 pagesMK110 Portfolio Part 2harryNo ratings yet

- Swahili: Paper 3162/01 Paper 1Document3 pagesSwahili: Paper 3162/01 Paper 1mstudy123456No ratings yet

- Disstres Signal BaruDocument14 pagesDisstres Signal BaruYunus Kautsart BahariNo ratings yet

- Week 6 DLLDocument2 pagesWeek 6 DLLAnonymous yElhvOhPn100% (1)

- Peter Bahgat Gerges: Career ObjectiveDocument3 pagesPeter Bahgat Gerges: Career ObjectiveHolli RichardsNo ratings yet

- Language, Music and Computing - Mitrenina, Eds - 2019 PDFDocument239 pagesLanguage, Music and Computing - Mitrenina, Eds - 2019 PDFAngelRibeiro10No ratings yet

- Glossika. Swedish Fluency 2 (PDFDrive)Document368 pagesGlossika. Swedish Fluency 2 (PDFDrive)Anonymous IC3j0ZS100% (1)

- CONVENTIONS of Text TypesDocument12 pagesCONVENTIONS of Text TypesJaime Magnet VegaNo ratings yet

- Observation Notes. CommentsDocument4 pagesObservation Notes. CommentsEduardoAlejoZamoraJr.No ratings yet

- SS5 OverviewDocument1 pageSS5 OverviewJason WestNo ratings yet

- Telenor Marketing StrategiesDocument6 pagesTelenor Marketing StrategiesAmmar Zaman0% (1)

- Xpon Ont Flash 2k15x Dual Band US - Spec SheetDocument4 pagesXpon Ont Flash 2k15x Dual Band US - Spec SheetHello WorldNo ratings yet

- Understanding SemanticsDocument11 pagesUnderstanding SemanticsSyafiq KhairiNo ratings yet

- Gender Representation in MediaDocument10 pagesGender Representation in MediaWalter Daniel delos ReyesNo ratings yet

- Pedagogical Approaches and StrategiesDocument52 pagesPedagogical Approaches and StrategiesDeseree LingayoNo ratings yet

- HS DLL GR7Document35 pagesHS DLL GR7jane trubanos0% (1)

- Cabizares, P.F ELEC 1-7Document29 pagesCabizares, P.F ELEC 1-7Fritzel Ann Rizo TayagNo ratings yet

- The Revelance of Addition, Omission and Deletion in TranslationDocument13 pagesThe Revelance of Addition, Omission and Deletion in Translationdyna bookNo ratings yet

- Excellent Tips To Overcome Oracle Policy Automation Cloud 2019 Implementation Essentials Challenges and Pass With 1z0-1035 Test PracticesDocument9 pagesExcellent Tips To Overcome Oracle Policy Automation Cloud 2019 Implementation Essentials Challenges and Pass With 1z0-1035 Test PracticesbarryAlanNo ratings yet

- (Stephen Krashenstephen KrashenDocument5 pages(Stephen Krashenstephen KrashenIchigo90100% (1)