Professional Documents

Culture Documents

Slideshow

Uploaded by

Bhavesh Agrawal0 ratings0% found this document useful (0 votes)

5 views37 pagesCopyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views37 pagesSlideshow

Uploaded by

Bhavesh AgrawalCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 37

VAT Basics

Ian M Harris BA(Hons) FIIT CTA MAAT

Leicester City Council

VAT & Taxation Advice Office

VAT & Taxation Advice Office

Who are we?

– Ian Harris BA(Hons) FIIT CTA MAAT

– Taxation Officer

– Part of Financial Services Division

Where are we?

– Room B2.09(B), New Walk Centre (at the moment!)

– Extension: (37)4060 (0116-454-4060)

– Fax: 0116-255-2443

– Mobile/Text: 07980-339581

– E-mail: vattax@leicester.gov.uk

The Introduction of VAT

Started on 1 April 1973

Not intended to impact on local authorities’

statutory activities

Refund system in place for such ‘non-

business’ activities

But when acting in a business capacity

‘normal’ VAT rules apply to local authorities

EU law lays down a requirement to avoid

distortion of competition

VAT - The European Tax

EC Principal VAT Directive lays

down the basis

Applies to all EU Member States

Details the scope of VAT, meaning of

taxable person, time and place of

supply, exemptions from VAT, etc

VAT in the UK

UK implements the Directive by

way of the VAT Act 1994

Secondary legislation: VAT

Regulations 1995 and numerous

other SIs

UK has certain derogations, eg

the retention of zero-rating

The Role of Customs

Administration of VAT in the UK

Network of local VAT offices

Ensure VAT is correctly accounted for

By assessing for underdeclared VAT, plus

interest and penalties!

If disagree have right of appeal

All communication with Customs must go

through the VAT & Taxation Advice Office

VAT - How Does It Work?

Taxable person - someone who is (or

who ought to be) registered for VAT

Taxable supply - a supply of goods or

services which is liable to VAT

A taxable person charges VAT on

his/her taxable supplies and reclaims

VAT incurred in connection with

making those supplies

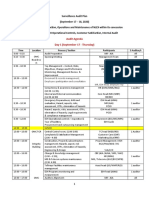

How it Works: An Example

VAT VAT net

incurred charged VAT

forester nil £2.00 £2.00

timber mill £2.00 £20.00 £18.00

manufacturer £20.00 £80.00 £60.00

retailer £80.00 £166.50 £86.50

£166.50

Which equals the amount paid by the

customer

The success of VAT

Intrinsically simple

A self-assessed tax

A self-policed tax

Extremely efficient cost of

collection

The success of VAT

VAT raises over £90billion pa

VAT accounts for over 15% of Government

revenue

– at a cost of less than 1p per Pound

Income Tax raises somewhat more

– but at a cost of over 5p per Pound

Corporation Tax raises only about half as

much

Rates of VAT

Standard-rate

20%

Lower-rate

5%

and

Zero-rate

0%

Note that zero-rate is different to

exemption from VAT

Output Tax and Input Tax

VAT charged by a taxable

person is his/her output tax

VAT incurred by a taxable

person is his/her input tax

Output tax less input tax =

amount payable to Customs

The VAT Return

Total output tax for the period (A)

Total input tax for the period (B)

A - B = amount due TO Customs

Or, if A - B is negative (input tax is

higher than output tax), then A - B

= amount due FROM Customs

Input Tax - General Rules

To reclaim input tax you must:

hold a VAT invoice

– though there are certain cases, eg payphones

and purchases from coin-operated vending

machines, where you simply must demonstrate

that VAT has been incurred on the expenditure

receive the supply

use the goods or services supplied for official

purposes

VAT Invoices - Full Invoices

Used by most businesses such as

wholesalers and manufacturers

Require certain specified information

For businesses - must be issued

within 14 days of the supply

For local authorities - must be issued

within 2 months of the supply

VAT Invoices - Full Invoices

To be valid a full VAT invoice must contain:

- a sequential identifying number

- the date of the supply (the tax point)

- the name, address and VAT-registration number of the supplier

- the name and address of the customer

- a description of the goods or services supplied

- the quantity of the goods, extent of the services, unit price, rate

of VAT applicable and net amount payable

- the total amount payable excluding VAT

- any discount offered

- the total amount of VAT payable in UK Pounds

VAT Invoices - Less Detailed

Issued by retailers and other VAT-

registered persons selling to the public

Often referred to as a ‘VAT receipt’

Minimal information required

Must be able to demonstrate that a

VATable supply has been received

from a VAT-registered supplier

The VAT Fraction

To calculate the VAT amount

from a VAT-inclusive amount

20% VAT so:

20/120ths = VAT amount

simplifies to 1/6th

Imports from Within the EU

Effectively importer charges self VAT

by accounting for UK VAT as

acquisition tax (equivalent to output

tax)

Declare on VAT Return and recover as

input tax

Copy all such invoices to the VAT and

Taxation Advice Office

Imports from Outside the EU

UK VAT payable at point of importation

Shipping agent usually pays UK VAT on

importation then claims reimbursement

but

– shipping agent’s invoice is not a VAT Invoice

Can only reclaim VAT on imports on

basis of C79 Certificate from Customs

‘Imported Services’

Cross-border B2B services normally VATable where

customer located

Customer effectively charges self VAT by accounting for UK

VAT as output tax, declaring on VAT Return and

recovering as input tax

There are some exceptions though:

– notably services supplied where performed or consumed, eg land related

services, hotel accommodation and restaurant and catering services

Copy all invoices for services procured from non-UK

suppliers to VAT and Taxation Advice Office

Cross-border B2C services normally VATable where

supplier is located

There are similar exceptions though

Irrecoverable Input Tax

You cannot recover VAT incurred on:

certain second-hand goods (including goods

bought at auction)

supplies made under the Tour Operators

Margin Scheme (TOMS)

purchases of motor cars (or 50% of VAT on

leased cars)

purchases in respect of business

entertainment

Irrecoverable Input Tax

Also you cannot recover VAT

incurred on:

purchases from suppliers who are

not registered for VAT

supplies purchased on behalf of

someone else

Credit Notes

Credit notes must be issued to correct any

overcharge of VAT

The customer must then repay the VAT

shown on the credit note to Customs

A credit note should be treated as a

‘negative invoice’

Credit notes cannot be used to write off bad

debts

Outputs and Output Tax

An output is a supply of goods or services

Goods - supply made when title passes

Services - to do something (or refrain from

doing something) for payment

Remember payment does not have to be in

money - there could be a barter or part-barter

The supply will bear VAT at standard, lower or

zero-rate or be exempt from VAT or be outside

the scope of VAT (eg a non-business activity)

Tax Points - The Time of Supply

The tax point is the time at which you must account for

VAT and is determined by when the supply is made

A supply is made when:

in the case of goods, they are delivered to or removed by

the customer

in the case of services, the service is complete or, for

ongoing services, a payment is received

But where an invoice is issued the date of the invoice

usually becomes the tax point

Unless payment is received first which triggers a tax

point

Non-Business Activities

Supplies made for no consideration or, in

the case of land, where the consideration is

no more than a ‘peppercorn’

Supplies made by a public body under a

statutory regime

Certain ‘traditional’ local authority

activities which do not ‘compete’ with the

private sector

Non-Business Activities

For a local authority activity to be non-

business it must be -

- free at the point of delivery

or

- subject to a special legal regime

and

- not likely to cause any significant distortion of

competition

Business Supplies

Supplies which are not non-business must be

business supplies and may be:

– standard-rated

– lower-rated

– zero-rated

– exempt from VAT

Business supplies do not have to be made for

a profit

Exemption from VAT

Determined by Schedule 9 of the VAT Act

land (including lettings, leases, etc)

insurance

postal services (by the Post Office)

betting, gaming and lotteries

finance

education (other than statutory education)

health and welfare (other than statutory social care)

Exemption from VAT

burial and cremation

subscriptions to trade unions, professional and

other public interest bodies

sports, sports competitions and physical education

works of art, etc

charity fund raising events

cultural services

goods on which input VAT was irrecoverable

investment gold

services by a cost sharing group to its members

Zero-Rating

Determined by Schedule 8 of the VAT Act

food

sewerage and water

books and printed matter

talking books for the blind and handicapped and

wireless sets for the blind

construction of certain new buildings

certain protected buildings

international services

Zero-Rating

transport (notably public transport fares)

residential caravans and houseboats

gold

bank notes

drugs, medicines and aids for the handicapped

imports and exports

charities

young children’s clothing and footwear and certain

protective clothing and footwear

Lower-Rating

Determined by Schedule 7A of the VAT Act

domestic fuel or power

installation of energy saving materials

grant-funded installation of heating equipment or

security equipment

women’s sanitary protection products

children’s car seats

residential conversions

Lower-Rating

renovations and alterations of dwellings

contraceptive products

advice or information to promote welfare of elderly,

disabled or children

installation of mobility aids for the elderly

smoking cessation products

caravans over 7m long not suitable as a permanent

residence

cable-suspended passenger transport systems

Your Responsibilities

Follow the VAT rules

Remember VAT affects both income

and expenditure

Consider the VAT implications of

decisions made

Refer to the VAT Manual

If unsure, seek advice don’t guess

The VAT & Taxation Advice Office

If in doubt contact:

– THE VAT & TAXATION ADVICE OFFICE

– Room B2.09(B), New Walk Centre

– Extension: (37)4060

– Direct dialling: 0116-454-4060

– Fax: 0116-255-2443

– Mobile/Text: 07980-339581

– E-Mail: vattax@leicester.gov.uk

You might also like

- Botswana Tax Lecture Slides, SydneyDocument84 pagesBotswana Tax Lecture Slides, Sydneysmedupe100% (1)

- Wendell Davis Letter Re: Heidi Carter 021120Document7 pagesWendell Davis Letter Re: Heidi Carter 021120Jeffrey BillmanNo ratings yet

- Test Bank For Advertising and Promotion: An Integrated Marketing Communications Perspective, 12th Edition, George Belch Michael BelchDocument28 pagesTest Bank For Advertising and Promotion: An Integrated Marketing Communications Perspective, 12th Edition, George Belch Michael BelchPauline Chavez100% (12)

- Vat Training ModuleDocument59 pagesVat Training Modulebandajobanda100% (3)

- Pakistan International School, Riyadh.: Admission Test Guideline For Play Group Nursery KindergartenDocument2 pagesPakistan International School, Riyadh.: Admission Test Guideline For Play Group Nursery KindergartenSikandar KhanNo ratings yet

- Our ChallengeDocument198 pagesOur ChallengeZachary KleimanNo ratings yet

- JUDICIAL REVIEW AssignmentDocument12 pagesJUDICIAL REVIEW AssignmentShubham PathakNo ratings yet

- Value Added TaxDocument9 pagesValue Added TaxĴõ ĔĺNo ratings yet

- Unit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Document23 pagesUnit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Bizu AtnafuNo ratings yet

- VAT Questions For Professional Stage Knowledge LevelDocument14 pagesVAT Questions For Professional Stage Knowledge LevelFahimaAkterNo ratings yet

- 8VATDocument70 pages8VATNoelNo ratings yet

- Value Added Tax in Romania VAT TVADocument6 pagesValue Added Tax in Romania VAT TVAmondlyNo ratings yet

- TAXATION - Value-Added TaxDocument10 pagesTAXATION - Value-Added TaxJohn Mahatma Agripa100% (2)

- Value Added Tax-White Paper DocumentDocument117 pagesValue Added Tax-White Paper DocumentVikas MarwahaNo ratings yet

- Accounting For Indirect TaxesDocument40 pagesAccounting For Indirect TaxesSabaa if100% (1)

- VAT Presentation To The General PublicDocument27 pagesVAT Presentation To The General PublicJoette PennNo ratings yet

- Value Added Tax (VAT) : A Presentation by Sanjay JagarwalDocument39 pagesValue Added Tax (VAT) : A Presentation by Sanjay JagarwalJishu Twaddler D'CruxNo ratings yet

- 30_Dinh Phuc UyenDocument6 pages30_Dinh Phuc UyenĐinh Phúc UyênNo ratings yet

- 1 Understanding VAT For BusinessesDocument6 pages1 Understanding VAT For BusinessesBensonNo ratings yet

- ACFI6017, Week 8, VAT 2022-23, TutorDocument28 pagesACFI6017, Week 8, VAT 2022-23, Tutorarpita aroraNo ratings yet

- VAT AnnotatedDocument46 pagesVAT AnnotatedDr SafaNo ratings yet

- VAT GuideZRADocument56 pagesVAT GuideZRADaniel Glen-WilliamsonNo ratings yet

- Lecture VAT With ExercisesDocument82 pagesLecture VAT With ExercisesAko C JamzNo ratings yet

- Value Added TaxDocument8 pagesValue Added TaxDaniel MweuNo ratings yet

- Accounting For VAT in The Philippines - Tax and Accounting Center, IncDocument8 pagesAccounting For VAT in The Philippines - Tax and Accounting Center, IncJames SusukiNo ratings yet

- SlidesCh07show PpsDocument12 pagesSlidesCh07show PpsKhaja ZakiuddinNo ratings yet

- Introduction to VAT Terminology and E-Commerce IssuesDocument11 pagesIntroduction to VAT Terminology and E-Commerce IssuesSaurav KumarNo ratings yet

- Business Taxation Types of Taxes: Lecture No.3 Avtar BachaniDocument17 pagesBusiness Taxation Types of Taxes: Lecture No.3 Avtar BachaniLuqman KhanNo ratings yet

- 1 Basics of Value Added TaxDocument58 pages1 Basics of Value Added TaxHazel Andrea Garduque LopezNo ratings yet

- Draft VAT FAQDocument17 pagesDraft VAT FAQreazvat786No ratings yet

- Value Added Tax - VatDocument37 pagesValue Added Tax - VatTimoth MbwiloNo ratings yet

- VatDocument5 pagesVatninaryzaNo ratings yet

- A. VatDocument5 pagesA. VatKaye L. Dela CruzNo ratings yet

- Value Added Tax (Vat)Document40 pagesValue Added Tax (Vat)Phuong TrangNo ratings yet

- VAT Input and Output Tax GuideDocument19 pagesVAT Input and Output Tax GuidePCNo ratings yet

- Value-Added Tax: DescriptionDocument26 pagesValue-Added Tax: DescriptionGIGI BODONo ratings yet

- How To Compute For VATDocument29 pagesHow To Compute For VATNardsdel RiveraNo ratings yet

- ALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXDocument37 pagesALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXjohn apostolNo ratings yet

- Goods & Service Tax CompleteDocument76 pagesGoods & Service Tax CompleteAyesha khanNo ratings yet

- VAT FEATURESDocument3 pagesVAT FEATURESSiva Subramanian100% (2)

- Accounting For VAT in Th... Accounting Center, Inc.Document4 pagesAccounting For VAT in Th... Accounting Center, Inc.Martin EspinosaNo ratings yet

- Vat 2023Document310 pagesVat 2023Thapelo LekgethoNo ratings yet

- VatDocument50 pagesVatnikolaevnavalentinaNo ratings yet

- Comprehensive VAT TAXATION (3!31!14)Document166 pagesComprehensive VAT TAXATION (3!31!14)dereckriveraNo ratings yet

- VAT, WHT and CIT SummaryDocument8 pagesVAT, WHT and CIT Summarymariko1234No ratings yet

- HANDOUT FOR VAT-NewDocument25 pagesHANDOUT FOR VAT-NewCristian RenatusNo ratings yet

- Ad Valorem TaxDocument4 pagesAd Valorem TaxManoj KNo ratings yet

- VAT ArticleDocument4 pagesVAT ArticleSachi SrivastavaNo ratings yet

- LU1 - Value-Added TaxDocument24 pagesLU1 - Value-Added Taxmandisanomzamo72No ratings yet

- VAT - PurchasingDocument2 pagesVAT - PurchasingTzar YS MuskovyNo ratings yet

- Value Added TaxationDocument76 pagesValue Added Taxationxz wyNo ratings yet

- Vat+ +New+Requirements+for+Tax+InvoicesDocument3 pagesVat+ +New+Requirements+for+Tax+InvoicesCj Brits Finansiële DiensteNo ratings yet

- (Return To Index) : DescriptionDocument13 pages(Return To Index) : DescriptionTara ManteNo ratings yet

- Document1BackgroundDocument3 pagesDocument1BackgroundCj Brits Finansiële DiensteNo ratings yet

- Comprehensive VAT TaxationDocument172 pagesComprehensive VAT TaxationIan JameroNo ratings yet

- Tax Base For VAT: Import StageDocument2 pagesTax Base For VAT: Import StageS. M. Saz Lul HoqueNo ratings yet

- Vat Vs GST FinalDocument35 pagesVat Vs GST FinalJatin GoyalNo ratings yet

- Taxation Report2Document22 pagesTaxation Report2Ritchelyn ArbonNo ratings yet

- IAS 12 TaxationDocument30 pagesIAS 12 Taxationwakemeup143No ratings yet

- Value Added Tax (VAT)Document33 pagesValue Added Tax (VAT)chirag_nrmba15No ratings yet

- Value-Added Tax PDFDocument118 pagesValue-Added Tax PDFRazel MhinNo ratings yet

- VAT 2024Document311 pagesVAT 2024thaboNo ratings yet

- VAT Compliance in Slovak RepublicDocument4 pagesVAT Compliance in Slovak RepublicAccaceNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Value Added TaxDocument23 pagesValue Added TaxAmit GuravNo ratings yet

- Techniques For Bioavailability Enhancement of BCS Class II Drugs: A ReviewDocument11 pagesTechniques For Bioavailability Enhancement of BCS Class II Drugs: A ReviewAfridhausmanNo ratings yet

- Techniques For Bioavailability Enhancement of BCS Class II Drugs: A ReviewDocument11 pagesTechniques For Bioavailability Enhancement of BCS Class II Drugs: A ReviewAfridhausmanNo ratings yet

- European Journal of Pharmaceutics and Biopharmaceutics: Volume 65, Issue 1Document5 pagesEuropean Journal of Pharmaceutics and Biopharmaceutics: Volume 65, Issue 1Bhavesh AgrawalNo ratings yet

- European Journal of Pharmaceutics and Biopharmaceutics: Volume 65, Issue 1Document5 pagesEuropean Journal of Pharmaceutics and Biopharmaceutics: Volume 65, Issue 1Bhavesh AgrawalNo ratings yet

- PNP SOP on Investigating Heinous CrimesDocument12 pagesPNP SOP on Investigating Heinous CrimesMark ViernesNo ratings yet

- Agrarian ReformDocument43 pagesAgrarian ReformRalph MarronNo ratings yet

- Chapter 4. Basel's Principle For Effective Risk Data Aggregation and Risk ReportingDocument30 pagesChapter 4. Basel's Principle For Effective Risk Data Aggregation and Risk ReportingBelle AnnaNo ratings yet

- GlobalizationDocument5 pagesGlobalizationVince Bryan San PabloNo ratings yet

- Fraction 1Document5 pagesFraction 1Anjal NasheetNo ratings yet

- Careplus Group BHD: Case StudyDocument6 pagesCareplus Group BHD: Case StudyKhaw Seek ChuanNo ratings yet

- 499e5859-2007-4568-9d6f-e630d740241eDocument29 pages499e5859-2007-4568-9d6f-e630d740241eAntonio Miguel ManaloNo ratings yet

- Additional ClausesDocument13 pagesAdditional ClausesPankaj GuptaNo ratings yet

- Development Communication (Dev Comm) : Unit 2Document3 pagesDevelopment Communication (Dev Comm) : Unit 2Ajith D MawutNo ratings yet

- SBU - Syllabus in Criminal Law I (Updated For AY 2023-2024) CLEANDocument29 pagesSBU - Syllabus in Criminal Law I (Updated For AY 2023-2024) CLEANCarmela Luchavez AndesNo ratings yet

- Credit Suisse Risked So Much On Archegos For So Little - BloombergDocument12 pagesCredit Suisse Risked So Much On Archegos For So Little - BloombergKelvin LamNo ratings yet

- Auditing Theory RA 9298 Auditing Theory RA 9298Document10 pagesAuditing Theory RA 9298 Auditing Theory RA 9298sninaricaNo ratings yet

- Introduction The First World War and Its AftermathDocument8 pagesIntroduction The First World War and Its AftermathYASMIN SAADNo ratings yet

- Regulations: The TheDocument5 pagesRegulations: The Thekaris delcastilloNo ratings yet

- DENTAL JURIS - Growth of Dental Legislation PDFDocument3 pagesDENTAL JURIS - Growth of Dental Legislation PDFIsabelle TanNo ratings yet

- Predrag Palavestra Young Bosnia Political Activism in LiteratureDocument30 pagesPredrag Palavestra Young Bosnia Political Activism in LiteratureCitalacIstoRiJeNo ratings yet

- Iajuddin AhmedDocument6 pagesIajuddin AhmedMichael FelicianoNo ratings yet

- Session Breakout StrategyDocument2 pagesSession Breakout Strategyvamsi kumarNo ratings yet

- Representations of TeenagersDocument3 pagesRepresentations of TeenagersSaaemaxoNo ratings yet

- Surveillance Audit PlanDocument3 pagesSurveillance Audit PlanJessa VillanuevaNo ratings yet

- Financial Model - Real Estate DevelopmentDocument7 pagesFinancial Model - Real Estate DevelopmentAdnan Ali100% (1)

- Quiz BeeDocument19 pagesQuiz BeeJanara WamarNo ratings yet

- Leave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateDocument5 pagesLeave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateVishal V (Vee)No ratings yet

- Government of Tamilnadu Department of Employment and TrainingDocument11 pagesGovernment of Tamilnadu Department of Employment and Trainingjohn chellamuthuNo ratings yet

- Acquiring Competent PersonnelDocument8 pagesAcquiring Competent PersonnelSam MoldesNo ratings yet