Professional Documents

Culture Documents

Currency Management & Accounts: Learning Outcomes

Uploaded by

hiraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Currency Management & Accounts: Learning Outcomes

Uploaded by

hiraCopyright:

Available Formats

FUNDAMENTALS OF CURRENCY MANAGEMENT

05

Currency Management &

Accounts

Learning Outcomes:

• How is distribution of currency carried out and managed in Pakistan?

• What is the role of the Currency Management and Accounts ( CMA) Division?

• What systems of currency accounting are in place?

• How is the Currency in Circulation (CIC) calculated on daily basis?

Overview ISSUE DEPARTMENT

Issue & Treasury

CMA Division

(Cash) Division

Issue Section Verification

Exchange Section Claims

Banking Section Resource

Vaults NBP Chests/Accounts

Examination Halls

Geographical Limit Circle of Issue

Sindh Province Karachi

Punjab Province, AJK, Gilgit Baltistan Lahore

KPK Province Peshawar

Balochistan Province Quetta

FUNDAMENTALS OF CURRENCY MANAGEMENT | Currency Management & Accounts PG 1

How is distribution of currency

carried out in Pakistan?

Karachi Circle Lahore Circle Peshawar Circle Quetta Circle

SBP BSC Karachi SBP BSC Lahore SBP BSC Peshawar SBP BSC Quetta

03 SBP BSC 08 SBP BSC 01 SBP BSC

Offices Offices Office

33 Chest

Branches

49 Chest

18 Chest 26 Chest

Branches

Branches Branches

including GB

53 Sub Chest 51 Sub Chest

Branches Branches

How is movement of currency managed in

Pakistan?

FUNDAMENTALS OF CURRENCY MANAGEMENT | Currency Management & Accounts PG 2

What is the role of Currency Management and

Accounts ( CMA) Division?

The Currency Management & Accounts Division o Resource Unit:

consists of the following units:

The Resource Unit attends to the supply of notes

o Cancelled Notes Verification Unit and coins at different centers (Chests) and keeps

proper accounts thereof.

o Claims Notes Unit

ASSETS AND LIABILITIES OF ISSUE

o Currency Accounts Unit DEPARTMENT

o Resource Unit o The liabilities of the Issue Department comprise

of notes held in the Banking Department and

WORKING OF CMA notes in circulation.

o Cancelled Notes Verification Unit: o The assets of the Issue Department are held in

the form of gold coin and bullion, silver bullion,

The Cancelled Notes Verification (CNV) Unit takes Rupee coin, approved securities and approved

over paid and cancelled notes, foreign exchange including SDR.

subjects the same to both quantity and quality

checks and issues warrants of destruction. • SDRs are defined in terms of a basket of

Thereafter, the notes are destroyed by shredding or major currencies used in international

by burning in the incinerator. trade and finance. At present, the

currencies in the basket are the euro, the

o Claims Notes Unit: pound sterling, the Japanese yen and the

US dollar.

The Claim Notes Unit deals with all the

applications for payment of exchange value of • For the period 2015-present the

mutilated and other claimed notes and maintains composition is:

their account. It also deals with imperfect and

forged notes received in the office. USD 41.73%

o Currency Accounts Unit: Euro 30.93%

The Currency Accounts Units maintains proforma CNY 10.92%

accounts of the balances and transactions of notes

and the assets of the Issue Department, transactions JPY 8.33%

between the Banking Department and Issue

Department, and also the accounts of the Small GBP 8.09%

Coin Depot and the government stock of surplus

Rupee coin maintained in the office.

FUNDAMENTALS OF CURRENCY MANAGEMENT | Currency Management & Accounts PG 3

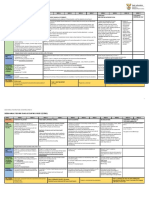

What systems of currency accounting are in place?

HOME NOTE ACCOUNT Different heads under Home Note Account:

Home Note Account provides information o Currency

regarding

o Stock

o Total value of notes in stock.

o Exchange Note Account

o Value of notes in circulation.

o Circulation Account

o Daily transactions of notes.

o Invoiced Notes

o Notes defaced and destroyed

o Cancelled Notes

o Stock positions at Chests and Sub Chests.

o Currency Chest Notes

Home Note Account

Debit Credit Description

Currency All notes printed by PSPC less all notes destroyed

Account

Stock Account Fresh notes in stock at Issue Offices – Main Vault

Exchange Notes Fresh/Re-issue notes at BSC Issue Offices – Exchange Vault

Account & Guarantee Vault

Circulation Account All notes held by Public & Commercial Banks

Invoiced Notes Chest Notes pending verification at BSC Offices

Account

Currency Chest Notes held at Chests

Notes Account

Cancelled Notes Cancelled notes awaiting destruction

Account

Net Debit = Net Credit

FUNDAMENTALS OF CURRENCY MANAGEMENT | Currency Management & Accounts PG 4

VALUE ACCOUNT

o Value Account refers to the value or reserves

o Net at debit of the remaining heads of Value

held by SBP against the notes in circulation. Account.

o Reserves include gold coin, gold bullion silver o The agreement of these balances will indicate that

bullion, SDR, approved foreign exchange and the transactions affecting the various heads in the

rupee coins and approved securities. two sets of accounts have been correctly booked.

o The sum total of the assets of entire Issue o If there is in the Home Note Account an entry under

Department should agree with the total value of “Circulation”, there should ordinarily be in the Value

notes in circulation. Account an opposite entry of the same value under

“Currency Officer of Issue” and vice versa.

AGREEMENT OF BALANCES

o Sometimes instead of one gross entry, the net result

o At debit of “Circulation” in the Home Note of two or more entries corresponds with the opposite

Account. entry.

o At credit “Currency Officer of Issue” in the

Value Account.

Value Account

Debit Credit Description

Currency Officer of Value equal to CIC

Issue

Reserve Account Reserve Coin, Gold & Silver

Exchange Coin Account Coins in the Exchange Branch

Currency Chest Coin, Gold & Silver held by Chests

SDRs Special Drawing Rights

Foreign Currency Reserves Foreign Currency Reserves

GOP Securities GOP Securities

Foreign Circle Adjustment of transactions between circles

Foreign Circle Adjusting Adjustments at end of Fiscal Years

Account

SBP Adjusting Account As per instructions from SBP

Net Debit = Net

Credit

FUNDAMENTALS OF CURRENCY MANAGEMENT | Currency Management & Accounts PG 5

CIRCULATION ACCOUNT

Circulation Account

Debit Credit

Notes Issued to the public in exchange of notes Notes Received from the public in exchange of

or coins or both over the counters of the BSC notes or coins or both over the counters of the

Office BSC Office

Notes Issued at Chests maintained at Notes Received at Chests maintained at

Government Treasuries and Sub-treasuries or Government Treasuries and Sub-treasuries or

branches of the National Bank of Pakistan branches of the National Bank of Pakistan

Notes issued to the Banking Department Notes received from the Banking Department

The Net Debit Balance under this head represents the total value along with denomination and design wise

details held with general public and commercial banks (i.e., CIC).

FUNDAMENTALS OF CURRENCY MANAGEMENT | Currency Management & Accounts PG 6

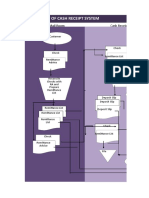

How is the Currency in Circulation (CIC)

calculated on daily basis?

NBP Chests -

BSC Sialkot Lahore BSC Faisalabad

BSC Gujranwala BSC Islamabad

BSC Multan BSC Lahore BSC Rawalpindi

BSC Bahawalpur BSC Muzzafarabad

NBP Chests - NBP Chests -

Peshawar Quetta

BSC Karachi

BSC Peshawar BSC Quetta

Office

NBP Chests -

BSC D.I. Khan Karachi

Finance

Department

SBP

FUNDAMENTALS OF CURRENCY MANAGEMENT | Currency Management and Accounts PG 7

You might also like

- MT and MX Equivalence TableDocument20 pagesMT and MX Equivalence TablejcskNo ratings yet

- Certificate in Securities Ed15Document340 pagesCertificate in Securities Ed15Westa Geafrica100% (4)

- March PitNews Schaap PDFDocument7 pagesMarch PitNews Schaap PDFRajasekaran MNo ratings yet

- Answer: D. P16, 000Document13 pagesAnswer: D. P16, 000JESSA ANN A. TALABOC100% (2)

- Treasury Operations - Front Office, Back OfficeDocument28 pagesTreasury Operations - Front Office, Back Officeshrikant shinde80% (20)

- Tail Risk Management - PIMCO Paper 2008Document9 pagesTail Risk Management - PIMCO Paper 2008Geouz100% (1)

- Ebook College Accounting A Career Approach 13Th Edition Scott Solutions Manual Full Chapter PDFDocument52 pagesEbook College Accounting A Career Approach 13Th Edition Scott Solutions Manual Full Chapter PDFkhucly5cst100% (9)

- Cash and Cash Equivalent AuditingDocument8 pagesCash and Cash Equivalent Auditing수지No ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Capital BudgetingDocument65 pagesCapital Budgetingarjunmba119624No ratings yet

- Book 3 - Financial Markets & Products PDFDocument383 pagesBook 3 - Financial Markets & Products PDFSandesh SinghNo ratings yet

- WWW - Edutap.co - In: Forex Markets - Video 1Document51 pagesWWW - Edutap.co - In: Forex Markets - Video 1SaumyaNo ratings yet

- Principles of Accounts: The Cash Book The Petty Cash BookDocument24 pagesPrinciples of Accounts: The Cash Book The Petty Cash BookAts Sheikh100% (1)

- Ranganatham - Security Analysis and Portfolio Management, 2e (2011)Document3,577 pagesRanganatham - Security Analysis and Portfolio Management, 2e (2011)Yash Raj SinghNo ratings yet

- Bill Williams New Trading DimensionsDocument24 pagesBill Williams New Trading DimensionsAmine Elghazi50% (2)

- Forex Samurai Robot: User's Guide ForDocument7 pagesForex Samurai Robot: User's Guide ForHaslucky Tinashe Makuwaza100% (1)

- Chapter 2 Cashiering and Banking May 2010Document32 pagesChapter 2 Cashiering and Banking May 2010Berbagi UsahaNo ratings yet

- World Map: Middle East Europe Africa Asia North America Central, South America South West PacificDocument32 pagesWorld Map: Middle East Europe Africa Asia North America Central, South America South West Pacificvenkat100% (1)

- Treasury Management OverviewDocument47 pagesTreasury Management Overviewlakshika madushaniNo ratings yet

- 13463course Curriculum Forex PDFDocument13 pages13463course Curriculum Forex PDFshubh.icai0090No ratings yet

- KH Audit Foreign Currency TransactionsDocument6 pagesKH Audit Foreign Currency TransactionsФенимор КупърNo ratings yet

- Lfar by PG 25.03.2021Document47 pagesLfar by PG 25.03.2021Ganesh PhadatareNo ratings yet

- AP - Cash in BankDocument4 pagesAP - Cash in BankNorie Jane CaninoNo ratings yet

- Cash Management Business Process Workshop (BPW) : July 2016 Departmental ReleaseDocument48 pagesCash Management Business Process Workshop (BPW) : July 2016 Departmental ReleaseKavitaNo ratings yet

- What Is SOCA?: Demand Accounts Are Accounts Held at Depository InstitutionsDocument5 pagesWhat Is SOCA?: Demand Accounts Are Accounts Held at Depository InstitutionsRahul YadavNo ratings yet

- Accounting Records (Compatibility Mode)Document9 pagesAccounting Records (Compatibility Mode)MahediNo ratings yet

- Bank and Cash 2023 MS SUNLEARNDocument34 pagesBank and Cash 2023 MS SUNLEARNJustyneNo ratings yet

- Afm - PPT M1Document15 pagesAfm - PPT M1Abhishek JainNo ratings yet

- Cash and Securities DepartmentDocument38 pagesCash and Securities DepartmentHAMMADHRNo ratings yet

- FABM 2 - BankDocument58 pagesFABM 2 - Bankmary rose aragonNo ratings yet

- Bank Branch LFAR CA Ketan SaiyaDocument32 pagesBank Branch LFAR CA Ketan SaiyaJovamar MendozaNo ratings yet

- 5708512020book Keeping and Accounting Module - 1Document62 pages5708512020book Keeping and Accounting Module - 1groot marvelNo ratings yet

- Lecture 5 - Books of Accounts and Double Entry SystemDocument7 pagesLecture 5 - Books of Accounts and Double Entry SystemmallarilecarNo ratings yet

- Mgt101-7 - Bank Reconciliation StatementDocument36 pagesMgt101-7 - Bank Reconciliation StatementUmer MateenNo ratings yet

- Compendium of Cash Operations in Currency Chest and Branches 04.07.2020Document242 pagesCompendium of Cash Operations in Currency Chest and Branches 04.07.2020Goutam MalakarNo ratings yet

- Chapter - 5: Deposit ManagementDocument12 pagesChapter - 5: Deposit ManagementEEL KfWBMZ2.1No ratings yet

- BANK Audit Material 15th March 2013Document23 pagesBANK Audit Material 15th March 2013padmanabha14No ratings yet

- Introduction To Introduction To Introduction To Introduction To Monetary Accounts Monetary Accounts YyDocument30 pagesIntroduction To Introduction To Introduction To Introduction To Monetary Accounts Monetary Accounts YyHaris HandyNo ratings yet

- Summary of Measurement, Presentation and DisclosureDocument17 pagesSummary of Measurement, Presentation and DisclosureMelrose Eugenio ErasgaNo ratings yet

- Functions of RBI: Prof. Divya GuptaDocument22 pagesFunctions of RBI: Prof. Divya GuptaNeha SharmaNo ratings yet

- The JournalDocument24 pagesThe JournalKim DianaNo ratings yet

- 1.150 ATP 2023-24 GR 12 Acc FinalDocument4 pages1.150 ATP 2023-24 GR 12 Acc FinalsiyabongaNo ratings yet

- September Montly Rep 2020Document22 pagesSeptember Montly Rep 2020meskerem hailuNo ratings yet

- 11CBSE Chapter 1 Meaning and Objective of AccountingDocument8 pages11CBSE Chapter 1 Meaning and Objective of AccountingSanyam YadavNo ratings yet

- Session 1 Basic Cash ManagementDocument10 pagesSession 1 Basic Cash ManagementManik MehtaNo ratings yet

- Mcs 35 SyllabusDocument3 pagesMcs 35 SyllabusSebastianNo ratings yet

- Class 10-11Document38 pagesClass 10-11Asif HussainNo ratings yet

- Mgt101-11 - Control AccountsDocument52 pagesMgt101-11 - Control AccountsKamran ArshafNo ratings yet

- Monetary PolicyDocument30 pagesMonetary PolicyJoab Dan Valdivia CoriaNo ratings yet

- Manual of Regulations On Foreign Exchange TransactionsDocument95 pagesManual of Regulations On Foreign Exchange TransactionsShane EstNo ratings yet

- Trial Balance and Rectification of Errors: Accountancy 180Document46 pagesTrial Balance and Rectification of Errors: Accountancy 180kofirNo ratings yet

- Trial Balance and Rectification of Errors: Accountancy 180Document46 pagesTrial Balance and Rectification of Errors: Accountancy 180Abhijeet NarangNo ratings yet

- Class 11 Accountancy NCERT Textbook Chapter 6 Trial Balance and Rectification of ErroesDocument51 pagesClass 11 Accountancy NCERT Textbook Chapter 6 Trial Balance and Rectification of ErroesPathan KausarNo ratings yet

- Branch Accounting PDFDocument18 pagesBranch Accounting PDFSivasruthi DhandapaniNo ratings yet

- Branch AccountingDocument39 pagesBranch Accountingbilalyasir100% (5)

- GR 10 Accounting P2 EngDocument26 pagesGR 10 Accounting P2 Engtapiwamakamure2No ratings yet

- Reference:STFM Chapter 1 ETM Chapter 1Document45 pagesReference:STFM Chapter 1 ETM Chapter 1ismayilovrNo ratings yet

- Handout. WCM - Cash ManagementDocument26 pagesHandout. WCM - Cash ManagementNaia SNo ratings yet

- Act1 Cash ReceiptsDocument17 pagesAct1 Cash ReceiptsStephanie Diane SabadoNo ratings yet

- Flowchart of Cash Receipt System: Mail Room Cash ReceiptsDocument17 pagesFlowchart of Cash Receipt System: Mail Room Cash ReceiptsStephanie Diane SabadoNo ratings yet

- Chapter 9 Accounting For Branches Including Foreign Branches PDFDocument61 pagesChapter 9 Accounting For Branches Including Foreign Branches PDFAkshansh MahajanNo ratings yet

- ACCT1111 Chapter 5 NewDocument47 pagesACCT1111 Chapter 5 NewWky JimNo ratings yet

- De Leon - Interm1 - Module 3 Online Discussion Prompt - Bfac02Document2 pagesDe Leon - Interm1 - Module 3 Online Discussion Prompt - Bfac02Earl De LeonNo ratings yet

- MORFXTDocument95 pagesMORFXTReniel Roquero DiceNo ratings yet

- Long Form Audit Report: Ca Nilesh JoshiDocument33 pagesLong Form Audit Report: Ca Nilesh JoshiCA Faisal VaduvanchalNo ratings yet

- Notes Chapter 6Document2 pagesNotes Chapter 6syafaNo ratings yet

- Internship Report: Company: National Bank of Pakistan Presenter: Rana Muzaffar Iqbal (M-8823)Document34 pagesInternship Report: Company: National Bank of Pakistan Presenter: Rana Muzaffar Iqbal (M-8823)Muzaffar IqbalNo ratings yet

- Treasury Operations in BanksDocument47 pagesTreasury Operations in BanksDuma DumaiNo ratings yet

- Accounts 2 Control Acts PDFDocument14 pagesAccounts 2 Control Acts PDFBaryaNo ratings yet

- Lecture 1 - Concepts and Introduction 4Document63 pagesLecture 1 - Concepts and Introduction 4FarahNo ratings yet

- International Business 15Th Edition Daniels Solutions Manual Full Chapter PDFDocument34 pagesInternational Business 15Th Edition Daniels Solutions Manual Full Chapter PDFthuydieuazfidd100% (9)

- Error Log Inter NoDocument60 pagesError Log Inter NosollyusNo ratings yet

- Bob SsaDocument1 pageBob Ssaranbir9drNo ratings yet

- Poly List April 2020Document17 pagesPoly List April 2020Heber AlvarezNo ratings yet

- Bài tập Unit 3Document9 pagesBài tập Unit 3Thu HàNo ratings yet

- Друштво за маркетинг, трговија и услуги ТАЛЕНТА ДООЕЛ Тетово - OF0032 - 19Document1 pageДруштво за маркетинг, трговија и услуги ТАЛЕНТА ДООЕЛ Тетово - OF0032 - 19Xhevat ZiberiNo ratings yet

- Helios Press Release CAB Payments Lists On The London Stock Exchange - 1Document3 pagesHelios Press Release CAB Payments Lists On The London Stock Exchange - 1b.aggorNo ratings yet

- FECHA: 10/ 06/ 2022: Actívate 1: Write The Following NumbersDocument5 pagesFECHA: 10/ 06/ 2022: Actívate 1: Write The Following Numbersdanna alvarezNo ratings yet

- Forward Rates - June 30 2022Document2 pagesForward Rates - June 30 2022Tiso Blackstar GroupNo ratings yet

- What Is PeercoinDocument2 pagesWhat Is PeercoinlauraNo ratings yet

- Innovative Financial ServicesDocument9 pagesInnovative Financial ServicesShubham GuptaNo ratings yet

- AqEx PitchDeck 20ainDocument25 pagesAqEx PitchDeck 20ainomidreza tabrizianNo ratings yet

- Ultimate List of Important AbbreviationsDocument26 pagesUltimate List of Important Abbreviationsjust cleanNo ratings yet

- Assignment - Exchange Rates 2Document4 pagesAssignment - Exchange Rates 2Praveen Jude CoorayNo ratings yet

- Forex Tester 4 QuickStartGuideDocument151 pagesForex Tester 4 QuickStartGuideempelNo ratings yet

- 1 Case Studies. 2nd SemDocument20 pages1 Case Studies. 2nd SemNeha SinglaNo ratings yet

- The Financial Sector Reforms in IndiaDocument6 pagesThe Financial Sector Reforms in IndiahamidfarahiNo ratings yet

- Pup 20131117 26810Document0 pagesPup 20131117 26810Clark Fabionar SaquingNo ratings yet