Professional Documents

Culture Documents

Unit 7 C9 Presentation Printable Lecture Notes

Unit 7 C9 Presentation Printable Lecture Notes

Uploaded by

fukwhatteythinkCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 7 C9 Presentation Printable Lecture Notes

Unit 7 C9 Presentation Printable Lecture Notes

Uploaded by

fukwhatteythinkCopyright:

Available Formats

Accounting for Depreciation

Copyright Post University 2022, All Rights Reserved

Accounting for a Truck Purchase

Journal

Debit Credit

Purchase a truck for $26,000 cash

Vehicle 26,000

Cash 26,000

Ledger

Cash Vehicle

26,000 26,000

Copyright Post University 2022, All Rights Reserved

Accounting for Depreciation

Straight Line Depreciation

$26,000 cost - $2,000 residual value = $24,000

$24,000 divided by 4 years = $6,000 depreciation

expense per year

Copyright Post University 2022, All Rights Reserved

Accounting for Depreciation

Record depreciation for a Truck Journal

Debit Credit

Costing $32,000

Depreciation Expense 6,000

Estimated life 5 years 6,000

Accumulated Depreciation

Residual value $2,000

Ledger

Depreciation Expense Accumulated Depreciation Contra Asset

6,000 6,000

Copyright Post University 2022, All Rights Reserved

Book Value

After One Year

$26,000 cost minus $6,000 accumulated depreciation = $20,000 book value

After Two Years

$26,000 cost minus $12,000 accumulated depreciation = $14,000 book value

After Three Years

$26,000 cost minus $18,000 accumulated depreciation = $8,000 book value

After Four Years

$26,000 cost minus $24,000 accumulated depreciation = $2,000 book value

Copyright Post University 2022, All Rights Reserved

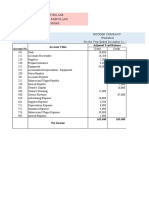

Accounting for Depreciation

How to Show the Vehicle, Accumulated Depreciation

and Depreciation Expense Income Statement

For the Year Ending Dec 31, 200X

in the Financial Statements: Sales $22,700

Expenses:

Depreciation Expense 6,000

Supply Expense 200

Rent Expense 6,600

Wage Expense 3,100

Interest Expense 1,200

Utility Expense 600

Bad Debt Expense 800

Tax Expense 1,500

Total Expense 20,000

Net Income $2,700

Copyright Post University 2022, All Rights Reserved

Accounting for Gain/Loss on the Sale of a Long Term Asset

Journal

Debit Credit

Cash 22,000

Accumulated Depreciation 6,000

Vehicle 26,000

Gain on Sale of Vehicle 2,000

Ledger

Vehicle Accumulated Depreciation

26,000 26,000 6,000 6,000

0 Revenue Account

0

Cash Gain on Sale of Vehicle

22,000 2,000

Copyright Post University 2022, All Rights Reserved

Accounting for Amortization

Journal

Debit Credit

Patent 32,000

Cash 32,000

Amortization Expense 4,000

Accumulated Depreciation 4,000

Ledger

Patent Accumulated Amortization

32,000 4,000

Cash Amortization Expense

32,000 4,000

Copyright Post University 2022, All Rights Reserved

You might also like

- Professional Salesmanship Midterm ExamDocument12 pagesProfessional Salesmanship Midterm ExamChoe Yoek SoekNo ratings yet

- International Marketing Plan of Fresh Cement in BahrainDocument26 pagesInternational Marketing Plan of Fresh Cement in BahrainAl-Rafi Ahmed100% (4)

- M4 - Problem Exercises - Statement of Financial Position PDFDocument7 pagesM4 - Problem Exercises - Statement of Financial Position PDFCamille CastroNo ratings yet

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- Bookstore Marketing PlanDocument4 pagesBookstore Marketing PlanShahab Nasir0% (1)

- SCM Flipkart by Aditya GangradeDocument22 pagesSCM Flipkart by Aditya GangradeAditya GangradeNo ratings yet

- Final Exam 4Document4 pagesFinal Exam 4HealthyYOU100% (1)

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Chapter 8-Absorption and Variable Costing, and Inventory ManagementDocument20 pagesChapter 8-Absorption and Variable Costing, and Inventory ManagementRodNo ratings yet

- Sallys Struthers - Answer KeyDocument7 pagesSallys Struthers - Answer KeyLlyod Francis LaylayNo ratings yet

- Solution Aassignments CH 5Document5 pagesSolution Aassignments CH 5RuturajPatilNo ratings yet

- Sap S4 Hana MMDocument12 pagesSap S4 Hana MMJosé RoblesNo ratings yet

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNo ratings yet

- 3 1Document1 page3 1riza147No ratings yet

- Ru Advanced Accounting ExerciseDocument1 pageRu Advanced Accounting Exerciseprince matamboNo ratings yet

- Paper 32 - InsertDocument8 pagesPaper 32 - InserthtyhongNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- FA1 Financial StatementsDocument5 pagesFA1 Financial StatementsamirNo ratings yet

- Revision Question Computer ScienceDocument1 pageRevision Question Computer ScienceIGO SAUCENo ratings yet

- Accounting ExamDocument14 pagesAccounting ExamSally SalehNo ratings yet

- Advanced Accounting 2CDocument5 pagesAdvanced Accounting 2CHarusiNo ratings yet

- 514 50456 Fall061aanswersDocument4 pages514 50456 Fall061aanswersVki BffNo ratings yet

- Accounting 02182021Document4 pagesAccounting 02182021badNo ratings yet

- Fabm2 QuizDocument2 pagesFabm2 QuizXin LouNo ratings yet

- Q.1) The Following Trial Balance Has Been Extracted From The Books of Rajesh On 31st December, 2016Document11 pagesQ.1) The Following Trial Balance Has Been Extracted From The Books of Rajesh On 31st December, 2016Aarya Khedekar100% (2)

- AKM (Pert.10)Document6 pagesAKM (Pert.10)akunkampusdinaNo ratings yet

- Worksheet: Zainy-Arif Endaila BSA-1Document4 pagesWorksheet: Zainy-Arif Endaila BSA-1Zainy EndailaNo ratings yet

- Mendez Bags Trial Balance For The Year Ended December 31, 2019 Account Title Debit CreditDocument9 pagesMendez Bags Trial Balance For The Year Ended December 31, 2019 Account Title Debit CreditMecah Lou Odchigue LanzaderasNo ratings yet

- DBM 232-1Document2 pagesDBM 232-1Newton otirnNo ratings yet

- Activity 3Document1 pageActivity 3John Michael Gaoiran GajotanNo ratings yet

- 2022 Sem 1 ACC10007 Lecture IllustrationsDocument8 pages2022 Sem 1 ACC10007 Lecture IllustrationsJordanNo ratings yet

- CH 3 SolutionsDocument37 pagesCH 3 SolutionsRavneet BalNo ratings yet

- Activity 2Document1 pageActivity 2John Michael Gaoiran GajotanNo ratings yet

- Get JC Plan Ch32 001Document7 pagesGet JC Plan Ch32 001Marlene BandaNo ratings yet

- AE 22 Activity 8Document2 pagesAE 22 Activity 8Venus PalmencoNo ratings yet

- Quiz # 2 NewsDocument20 pagesQuiz # 2 NewsSaram NadeemNo ratings yet

- Cash and Cash EquivalentsDocument2 pagesCash and Cash EquivalentsJennifer EcleNo ratings yet

- Solution - Problem 13-18Document45 pagesSolution - Problem 13-18Angelika Delosreyes VergaraNo ratings yet

- Acctg 153aDocument6 pagesAcctg 153aCHESTER JAN BOSONGNo ratings yet

- Problem 2 - AccountingcyleDocument13 pagesProblem 2 - AccountingcyleGio BurburanNo ratings yet

- Fin Acc 2 Assigns 2023Document6 pagesFin Acc 2 Assigns 2023Vinancio ZungundeNo ratings yet

- Accountancy & Auditing-IDocument4 pagesAccountancy & Auditing-Izaman virkNo ratings yet

- Financial Accounting Major Assignment1Document7 pagesFinancial Accounting Major Assignment1Elham JabarkhailNo ratings yet

- Model Solution Solution To The Question No. 1Document5 pagesModel Solution Solution To The Question No. 1HossainNo ratings yet

- Homework P4 4ADocument8 pagesHomework P4 4AFrizky Triputra CahyahanaNo ratings yet

- Erwan Sutikno 5122221028 Akuntansi Untuk ManajerDocument4 pagesErwan Sutikno 5122221028 Akuntansi Untuk Manajerchendy wuwunganNo ratings yet

- Assignment Financial 2024 18TH MarchDocument6 pagesAssignment Financial 2024 18TH MarchBen Noah EuroNo ratings yet

- The Parable of The Talents - 20190714Document6 pagesThe Parable of The Talents - 20190714LynnHanNo ratings yet

- Chapter 2 - Partnership Operations PROBLEM 6 and 8 With Worksheet 6.)Document12 pagesChapter 2 - Partnership Operations PROBLEM 6 and 8 With Worksheet 6.)sanjoeNo ratings yet

- Chapter 1Document12 pagesChapter 1Kyllar HizonNo ratings yet

- Mahmudin Saepullah - Assignment 5BDocument10 pagesMahmudin Saepullah - Assignment 5BRomi Prabowo De jongNo ratings yet

- Problem 1: True or False: Selected ExplanationDocument5 pagesProblem 1: True or False: Selected ExplanationJannelle SalacNo ratings yet

- Ayesha MidsDocument5 pagesAyesha MidsPrince HuzaifaNo ratings yet

- Socw - 1263543589Document7 pagesSocw - 1263543589dolevov652No ratings yet

- Hilary Aguilar - Quizzes 1-3 - Sheet1Document1 pageHilary Aguilar - Quizzes 1-3 - Sheet1ag clothingNo ratings yet

- Alkaline Comp. Multi Step QuestionDocument2 pagesAlkaline Comp. Multi Step QuestionhotfujNo ratings yet

- Question 1: Debit BalancesDocument9 pagesQuestion 1: Debit BalancesAsdfghjkl LkjhgfdsaNo ratings yet

- Ewan Ko NaDocument11 pagesEwan Ko Nastonefiona6No ratings yet

- Tutorial 1Document13 pagesTutorial 1vinaykrishnas97No ratings yet

- RequiredDocument1 pageRequiredMingxNo ratings yet

- Answers Practical Assignments Week 46 2022/2023 Name ... Student Number .... . Assignment 1 FastprintDocument5 pagesAnswers Practical Assignments Week 46 2022/2023 Name ... Student Number .... . Assignment 1 FastprintT.F. EvansNo ratings yet

- Mekidelawit Tamrat MBAO9550.14B 2Document23 pagesMekidelawit Tamrat MBAO9550.14B 2mkdiNo ratings yet

- ISCool MerchandisingDocument6 pagesISCool MerchandisingJulian Adam PagalNo ratings yet

- PPE Exercises and Problems Solutions UpdatedDocument19 pagesPPE Exercises and Problems Solutions Updatedprlu1No ratings yet

- Sample Problems - Estimated LiabilitiesDocument3 pagesSample Problems - Estimated LiabilitiesZaira PerezNo ratings yet

- Bafacr4X Non-Financial Liabilities: Problem 4.1Document7 pagesBafacr4X Non-Financial Liabilities: Problem 4.1Aga Mathew MayugaNo ratings yet

- Elena Pavel - CV Eng-6 PDFDocument2 pagesElena Pavel - CV Eng-6 PDFelena dragutzaNo ratings yet

- Airbnb Business Model CanvasDocument1 pageAirbnb Business Model CanvasAlin MoldoveanuNo ratings yet

- CH 7 PowerpointDocument18 pagesCH 7 Powerpointjaysuhn94No ratings yet

- Senior High School Department: Quarter 3 - Module 11: Preparing Trial BalanceDocument8 pagesSenior High School Department: Quarter 3 - Module 11: Preparing Trial BalanceJaye RuantoNo ratings yet

- CV OF Chaitanya MDocument6 pagesCV OF Chaitanya Mnidhi.ratnaNo ratings yet

- 611B - ImcDocument20 pages611B - ImcRushi100% (1)

- DHDBSJSJDocument23 pagesDHDBSJSJAbdullah Ali AlGhamdiNo ratings yet

- Running Head: A Study On Sastodeal 1Document16 pagesRunning Head: A Study On Sastodeal 1sangita sahNo ratings yet

- Dividend and Retention Policy: By: Pooja Narwani Pratik Lalani Razaali Vakil Richa Shah Riddhi SalotDocument45 pagesDividend and Retention Policy: By: Pooja Narwani Pratik Lalani Razaali Vakil Richa Shah Riddhi SalotGirimallika BoraNo ratings yet

- Unit Costing and Job CostingDocument3 pagesUnit Costing and Job CostingMaria Anndrea MendozaNo ratings yet

- Financial Accounting Course OutlineDocument4 pagesFinancial Accounting Course OutlineASMARA HABIBNo ratings yet

- Chapter 14 - Aggregate PlanningDocument46 pagesChapter 14 - Aggregate Planningali slaimanNo ratings yet

- Cost AccountingDocument59 pagesCost AccountingMuhammad UsmanNo ratings yet

- Literature ReviewDocument10 pagesLiterature ReviewAman SukhijaNo ratings yet

- Markans PharmaDocument19 pagesMarkans PharmaViju K GNo ratings yet

- Human Capital ManagementDocument7 pagesHuman Capital Managementaiswaryasajeevan014No ratings yet

- Chapter 7: The Business's Finance Function .: Internal Reporting To Operational ManagersDocument53 pagesChapter 7: The Business's Finance Function .: Internal Reporting To Operational ManagersJenny WeyNo ratings yet

- 4.4store Atmospherics and Visual MerchandisingDocument23 pages4.4store Atmospherics and Visual MerchandisingaleneNo ratings yet

- Market-Led Strategic ManagementDocument6 pagesMarket-Led Strategic ManagementDietmar Lengauer0% (2)

- Syllabus: BBA (Logistics and Supply Chain Management)Document17 pagesSyllabus: BBA (Logistics and Supply Chain Management)siddharthadhav420No ratings yet

- 4 Organizations and Information SystemsDocument7 pages4 Organizations and Information SystemsSarasi YashodhaNo ratings yet

- Name: Resham Anand PRN: 1800102010 School: BBA Logistics & SCM Subject: Entrepreneurship Development Assignment - 1Document3 pagesName: Resham Anand PRN: 1800102010 School: BBA Logistics & SCM Subject: Entrepreneurship Development Assignment - 1Nishchal AnandNo ratings yet