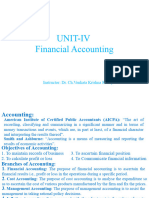

Professional Documents

Culture Documents

Journal

Uploaded by

Chandrika Prasad Dash0 ratings0% found this document useful (0 votes)

8 views20 pagesThe document describes different types of accounts used in accounting - personal accounts for individuals and organizations, real accounts for assets, and nominal accounts for income, expenses, losses and gains. It also provides examples of journal entries for various business transactions like purchases, sales, payments, and adjusting entries.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document describes different types of accounts used in accounting - personal accounts for individuals and organizations, real accounts for assets, and nominal accounts for income, expenses, losses and gains. It also provides examples of journal entries for various business transactions like purchases, sales, payments, and adjusting entries.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views20 pagesJournal

Uploaded by

Chandrika Prasad DashThe document describes different types of accounts used in accounting - personal accounts for individuals and organizations, real accounts for assets, and nominal accounts for income, expenses, losses and gains. It also provides examples of journal entries for various business transactions like purchases, sales, payments, and adjusting entries.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 20

Personal Account

The account which deals with all types of natural persons,

artificial persons and representative persons such as Ram, Rohan,

Akash, Company , School , Bank, Capital , drawings etc known

as Personal Account. Personal Account are following three types:

1.Natural person’s personal account : The account which records

all the transaction relating to human being called as natural

person’s personal account. (Ex-Rohan Account)

2. Artificial person’s personal account : The account which

records all the transactions relating to artificial person created by

law or otherwise called as artificial person’s personal account

(Ex- SBI, BIITM, DAV School)

3. Representative person’s personal account: An account

indirectly representing a person or persons is known as

representative person’s personal account. (Capital , Drawings)

Real Account

The account which deals with all types of assets

(Properties ) such as Land, Building, Machinery,

Patent, Copyright , Cash and Stock etc called Real

Account. Real Account can be of following types

1. Tangible Real account: Assets which can be seen or

touch are known as tangible real account. (Ex-

Machinery, Furniture , Cash)

2. Intangible Real Account: Assets which can’t be

touched physically but can be measured are known

as Intangible Real Account.(Goodwill, Patent, Trade

Mark, Copyright)

Nominal Account

The account which deal with all types

incomes, expenses, losses and gain such

as Sale, Purchase, Salary, Rent, Fire loss,

profit etc known as Nominal Account

Rules of Debit & Credit

Journal

The word Journal is derived from Latin word

‘Jour’ which means a day

Journal means a day book or daily record of

business transaction.

Journal is chronological records of business

transaction showing the accounts to be debited

and credited and amounts to be debited and

credited

Cont…d

The process of recording a transaction in

Journal is called Journalizing

Entries made in the Journal book are called

Journal entries

Journal is otherwise known as book of

original entry

Journalize following transactions

2020

Jan1 .Business started with cash Rs.10,00,000

Jan 2. Goods purchased for cash Rs.3,00,000

Jan 3. Furniture purchased for cash Rs. 30,000

Jan 5. Goods sold for cash Rs. 1,50,000

Jan 6. Goods purchased from Rakesh on Credit Rs. 2,00,000

Jan 7. Salary paid Rs. 50,000

Jan 8. Rs. 20,000 taken by owner for his personal use

Jan 9. Goods sold to Rohan on credit Rs. 100,000

Jan 10. Cash deposited in bank Rs. 2,00,000

Jan 11. Payment made to Rakesh Rs. 2,00,000

Journal Entries

Date Particulars L.F Debit Amount Credit Amount

(Rs) (Rs.)

2020 Cash A/c ………………..Dr 10,00,000

Jan 1 To Capital A/c 10,00,000

( Being business started with

cash)

Jan 2 Purchase A/c ………… Dr 3,00,000

To Cash A/c 3,00,000

(Being goods purchase for

cash)

Jan 3 Furniture A/c ………… Dr 30,000

To Cash A/c 30,000

(Being furniture purchased for

cash)

Jan 5 Cash A/c……………….Dr 1,50,000

To Sales A/c 1,50,000

(Being goods sold for cash)

Journal Entries

Date Particulars L.F Debit Amount Credit Amount

(Rs) (Rs.)

Jan 6 Purchase A/c……………..Dr 2,00,000

To Rakesh A/c 2,00,000

( Being goods purchased from

Rakesh on credit)

Jan 7 Salary A/c ………… Dr 50,000

To Cash A/c 50,000

(Being salary paid )

Jan 8 Drawings A/c ………… Dr 20,000

To Cash A/c 20,000

(Being cash taken by owner

for personal use)

Jan 9 Rohan A/c……………….Dr 1,00,000

To Sale A/c 1,00,000

(Being goods sold to Rohan

on credit )

Journal Entries

Date Particulars L.F Debit Amount Credit Amount

(Rs) (Rs.)

Bank A/c ……………..Dr 2,00,000

Jan 10 To Cash A/c 2,00,000

( Being cash deposited in

bank)

Jan 11 Rakesh A/c ………… Dr 2,00,000

To Cash A/c 2,00,000

(Being payment made to

Rakesh)

Journalize following transactions

2019

April 1. Business commenced with cash Rs. 18,00,000 and goods

worth Rs. 2,00,000 by owner

April 2. Goods purchased for cash Rs.5,00,000

April 3. A computer purchased for cash Rs. 30,000

April 4. Goods sold for cash Rs. 3,00,000

April 5. Goods purchased from Swadesh on Credit Rs. 4,00,000

April 6. Rent paid Rs. 20,000

April 7. Goods sold to Ramesh Rs. 3,00,000

April 10. Goods worth Rs.5,000 is distributed as free sample

April 11. Rs. 10,000 given as donation

April. 12. Cash paid to Swadesh Rs. 3,90,000 and discount Rs.10,000

allowed by him

Journalize following transactions

April 13. Cash received from Ramesh Rs. 2,98,000 in full

settlement of his account.

April 14. Goods sold to Aryan on credit Rs. 1,40,000

April 15. Goods purchased from Ronak on credit Rs. 1,50,000

April 16. Goods worth Rs. 20,000 returned by Aryan due to

defective

April 17. Goods worth Rs. 15,000 return to Ronak as found damage

after opening the packet.

April 18. Cash paid to Ronak Rs. 1,33,000 in full settlement of his

account

April 19. Aryan declared insolvent and no amount received from

him

April 20. Cash sale Rs.50,000

Journal Entries

Date Particulars L.F Debit Amount Credit Amount

(Rs) (Rs.)

2019 Cash A/c …………………..Dr 18,00,000

April1 Purchase A/c …………… ..Dr 2,00,000

To Capital A/c 20,00,000

( Being business started by

owner by introducing cash

and goods )

April 2 Purchase A/c ………… Dr 5,00,000

To Cash A/c 5,00,000

(Being goods purchase for

cash)

April 3 Computer A/c ………… Dr 30,000

To Cash A/c 30,000

(Being computer purchased

for cash)

April 4 Cash A/c……………….Dr 3,00,000

To Sale A/c 3,00,000

(Being goods sold for cash)

Journal Entries

Date Particulars L.F Debit Amount Credit Amount

(Rs) (Rs.)

April 5 Purchase A/c ……………..Dr 4,00,000

To Swadesh A/c 4,00,000

( Being goods purchased from

Swadesh on credit)

April 6 Rent A/c ……………….. Dr 20,000

To Cash A/c 20,000

(Being rent paid)

April 7 Ramesh A/c ………… Dr 3,00,000

To Sale A/c 3,00,000

(Being goods sold to Ramesh

on credit )

April 10 Advertisement A/c.……….Dr 5000

To Purchase A/c 5000

(Being goods distributed as fee

sample )

Journal Entries

Date Particulars L.F Debit Amount Credit Amount

(Rs) (Rs.)

April 11 Donation A/c ……………..Dr 5,000

To Cash A/c 5, 000

( Being cash given as

Donation)

April 12 Swadesh A/c ………… Dr 4,00,000

To Cash ………….A/c 3,90,000

To Discount Received 10,000

A/c

(Being cash paid to Swadesh

and discount allowed by him)

April 13 Cash A/c …………….... Dr 2,98,000

Discount Allowed A/c Dr 2,000

To Ramesh A/c 3,00,000

(Being cash received from

Ramesh and discount allowed

to him)

Journal Entries

Date Particulars L.F Debit Amount Credit Amount

(Rs) (Rs.)

April 14 Aryan A/c ………………Dr 1,40,000

To Sales A/c 1,40,000

( Being goods sold to Aryan

on credit)

April 15 Purchase A/c ……………..Dr 1,50,000

To Ronak A/c 1,50,000

(Being goods purchase from

Ronak on credit )

April 16 Sales Return A/c ………. Dr 20,000

To Aryan A/c 20,000

(Being goods return by Aryan

due to defective )

April 17 Ronak A/c……………….Dr 15,000

To Purchase Return A/c 15,000

(Being goods returned to

Ronak due to damage)

Journal Entries

Date Particulars L.F Debit Amount Credit Amount

(Rs) (Rs.)

April 18 Ronak A/c …………….. Dr 1,35,000

To Cash A/c 1,33,000

To Discount Received 2,000

A/c

( Being cash paid to Ronak

and discount received from

him)

April 19 Baddebt A/c ………… Dr 1,20,000

To Aryan A/c 1,20,000

(Being Aryan declared bad

debt and no amount received

from him )

April 20 Cash A/c ………… Dr 50,000

To Sales A/c 50,000

(Being goods sold for cash)

Pass necessary journal entries in books of

Ganesh Enterprise

2018

Jan 1 Business started with cash Rs.30,00,000

Jan 2 Bought goods for Rs. 15,00,000

Jan 3 Cash deposited in bank Rs. 5,00,000

Jan 4 Goods sold to Ritesh Rs. 2,00,000

Jan 5 Goods sold for cash Rs. 3,00,000

Jan 7 Goods purchased from Surendra Rs.4,00,000

Jan 8 Furniture purchased for Rs. 50,000

Jan 9 Rent paid Rs. 20,000

Pass necessary journal entries in books of Ganesh Enterprise

Jan 10 Income tax paid Rs. 40,000

Jan 11 Goods worth Rs.2,00,000 purchased and trade discount

of 10 % allowed by seller

Jan 12 Commission received Rs.15,000

Jan 13 Goods worth Rs .5000 given as free sample

Jan 14 Ritesh declared insolvent ,being 40 paisa of a rupee

received from him

Jan 15 Stationary purchased for Rs. 10,000

Jan 20 Payment made to Surendra Rs.4,00,000 by Cheque

Jan 21 Computer purchased for Rs. 20,000

Jan 23 Salary paid Rs.50,000

You might also like

- Statement Bank March Delavid Distributor LLC A2cb2f38f9Document10 pagesStatement Bank March Delavid Distributor LLC A2cb2f38f9Madelyn Vasquez100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- 28/11/2022 - 28/02/2023 Statement: 24hr Customer Service: 0207 930 4450Document5 pages28/11/2022 - 28/02/2023 Statement: 24hr Customer Service: 0207 930 4450mark100% (1)

- Accounts SolutionDocument13 pagesAccounts Solutionvishal jaiswalNo ratings yet

- Basic Account 1Document10 pagesBasic Account 1COMPUTER WORLDNo ratings yet

- TS Grewal Few Question SolutionsDocument40 pagesTS Grewal Few Question Solutionsmamta.bdvrrmaNo ratings yet

- Chapter 9 QR Code SolutionsDocument8 pagesChapter 9 QR Code SolutionsSRIRAMAN R X ANo ratings yet

- Q1. Journalize The Following Transactions in The Books of BaluDocument12 pagesQ1. Journalize The Following Transactions in The Books of Balumreenal kalitaNo ratings yet

- Lesson-5 LedgerDocument16 pagesLesson-5 LedgernishaashaxxNo ratings yet

- 1Document5 pages1Steve JacobNo ratings yet

- Journal Ledger and Trial BalanceDocument13 pagesJournal Ledger and Trial Balanceamitabh kumarNo ratings yet

- Abdullah JuttDocument31 pagesAbdullah Juttabdullah0336.juttNo ratings yet

- Ledger Accounts: Ledger Is Bound Book With Pages Consecutively Numbered. It May Also Be A Bundle of SheetsDocument27 pagesLedger Accounts: Ledger Is Bound Book With Pages Consecutively Numbered. It May Also Be A Bundle of SheetsSaranyaNo ratings yet

- Assignment 2Document4 pagesAssignment 2Ritika ChoudharyNo ratings yet

- DK Goel Solutions Class 11 Accountancy Chapter 9 - Books of Original Entry - JournalDocument69 pagesDK Goel Solutions Class 11 Accountancy Chapter 9 - Books of Original Entry - JournalVanyaNo ratings yet

- Shaheed Rajpal DAV Public School: Accountancy Project 2021-22Document11 pagesShaheed Rajpal DAV Public School: Accountancy Project 2021-22Samriddhi SharmaNo ratings yet

- Name Batch SubjectDocument15 pagesName Batch SubjectSayan BhattacharyaNo ratings yet

- Accounting Assignment PDFDocument58 pagesAccounting Assignment PDFIsha_12No ratings yet

- Types of Accounts & DiscountDocument10 pagesTypes of Accounts & Discountsarvesh kumarNo ratings yet

- Journal Entries: Personal AccountDocument6 pagesJournal Entries: Personal Accountb. animeshNo ratings yet

- Ledger AccountsDocument58 pagesLedger Accountsshrestha.aryxnNo ratings yet

- Accounts 1.5Document2 pagesAccounts 1.5Prashant ShokeenNo ratings yet

- Journal and LedgerDocument3 pagesJournal and LedgerSushank Kumar 7278No ratings yet

- Case Based BST Class 11 Poonam GandhiDocument11 pagesCase Based BST Class 11 Poonam Gandhimariassketches12No ratings yet

- Accounts ProjectDocument12 pagesAccounts ProjectrupeshNo ratings yet

- Chapter 7 LedgerDocument18 pagesChapter 7 LedgerJumayma Maryam100% (1)

- Journal 2Document2 pagesJournal 2Mehedi HasanNo ratings yet

- Answer Keys of Saturday Weekly TestDocument4 pagesAnswer Keys of Saturday Weekly TestManshika LakhmaniNo ratings yet

- Case BasedDocument8 pagesCase BasedRn GuptaNo ratings yet

- Journal WorksheetDocument16 pagesJournal WorksheetMayank VermaNo ratings yet

- FA Problems SolutionsDocument246 pagesFA Problems SolutionsK. Pavithraa SreeNo ratings yet

- MarketingDocument12 pagesMarketingRahul agarwalNo ratings yet

- LCC JournalDocument49 pagesLCC JournalAman Meher X ANo ratings yet

- Ledger Posting and Trial Balance: Date Particulars JF Amount Date Particulars JF AmountDocument4 pagesLedger Posting and Trial Balance: Date Particulars JF Amount Date Particulars JF AmountChristina FingtonNo ratings yet

- Journal EntriesDocument7 pagesJournal Entriesb20cs099No ratings yet

- 59journal Solved Assignment 13-14Document12 pages59journal Solved Assignment 13-14anon_350417051No ratings yet

- 59journal Solved Assignment 13-14Document12 pages59journal Solved Assignment 13-14anon_350417051No ratings yet

- FMA Financial Accounting Assignments SolutionsDocument58 pagesFMA Financial Accounting Assignments SolutionskrishanptfmsNo ratings yet

- Accountancy Project On Trial BalanceDocument13 pagesAccountancy Project On Trial BalanceBiplab Swain67% (3)

- MEFA UNIT-IV 2024 Introdution of Financial AccountingDocument38 pagesMEFA UNIT-IV 2024 Introdution of Financial Accountingganeshkumar4424kNo ratings yet

- Spring 2017 - MGT101 - 1Document11 pagesSpring 2017 - MGT101 - 1jaydee1000No ratings yet

- Accountancy ProjectDocument16 pagesAccountancy ProjectAaryan KarthikeyNo ratings yet

- Account FINAL Project With FRNT PageDocument25 pagesAccount FINAL Project With FRNT PageMovies downloadNo ratings yet

- 59journal Solved Assignment 13 14Document7 pages59journal Solved Assignment 13 14Monica SainiNo ratings yet

- JournalDocument4 pagesJournalHARIKIRAN PRNo ratings yet

- Chapter 5 - JournalDocument32 pagesChapter 5 - JournalSimmi Khurana100% (1)

- Additional Illustration 17Document2 pagesAdditional Illustration 17ROHIT PAREEKNo ratings yet

- Journal, Ledger and Trial Balance: Dr. Sharon Sophia, Vellore Institute of TechnologyDocument11 pagesJournal, Ledger and Trial Balance: Dr. Sharon Sophia, Vellore Institute of Technologyermias100% (1)

- The Following Are The Transactions of M/s Rajesh Traders. Date ParticularsDocument4 pagesThe Following Are The Transactions of M/s Rajesh Traders. Date Particularsmanit kakkarNo ratings yet

- 6e20585a-a9f2-46a3-8062-778e561a5c94Document17 pages6e20585a-a9f2-46a3-8062-778e561a5c94Sambhav KaushikNo ratings yet

- Accountancy NotesDocument23 pagesAccountancy NotesAlbana QemaliNo ratings yet

- 1 Simple Problem-Financial AccountingDocument32 pages1 Simple Problem-Financial Accountinggaurav650100% (2)

- 5 0Document14 pages5 0Shashwat sai VyasNo ratings yet

- Accounting Equation & Journal Numericals To Be Solved in Class 2023 Dr. Gayatri PaiDocument8 pagesAccounting Equation & Journal Numericals To Be Solved in Class 2023 Dr. Gayatri PaiDishuNo ratings yet

- Journal, Ledger TB - Problems SolutionsDocument14 pagesJournal, Ledger TB - Problems Solutionssri lekhaNo ratings yet

- Journal EntriesDocument10 pagesJournal EntriesMujaffar Mujawar100% (1)

- Unit 3 - LedgerDocument18 pagesUnit 3 - LedgerKanak RathoreNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- ABC Vacuum Tube Catalog CombinedDocument15 pagesABC Vacuum Tube Catalog CombinedVincent J. CataldiNo ratings yet

- Screenshot 2022-08-04 at 12.53.07 PDFDocument1 pageScreenshot 2022-08-04 at 12.53.07 PDFSimi NaomiNo ratings yet

- Minimum Corporate Income TAXDocument12 pagesMinimum Corporate Income TAXAra Bianca InofreNo ratings yet

- Your Airbnb ReceiptDocument1 pageYour Airbnb ReceiptGabriella SantosNo ratings yet

- Employees Payroll 5Document28 pagesEmployees Payroll 5ArthurLeonard MalijanNo ratings yet

- Cir vs. CA, Cta & Anscor, G.R. No. 108576, January 30, 1999Document4 pagesCir vs. CA, Cta & Anscor, G.R. No. 108576, January 30, 1999Gabriel HernandezNo ratings yet

- 25.no Dues 162Document2 pages25.no Dues 162komalnkishNo ratings yet

- HAWAIIDocument4 pagesHAWAIIallan jay usmanNo ratings yet

- Or Click Here To Create Your Certified Wage Hour Payroll Form in SmartsheetDocument2 pagesOr Click Here To Create Your Certified Wage Hour Payroll Form in SmartsheetArief AradhiyaNo ratings yet

- Offer Letter: InformationDocument1 pageOffer Letter: InformationRobert MilisicNo ratings yet

- IRC Section 863Document3 pagesIRC Section 863EDC AdminNo ratings yet

- 06 Gross IncomeDocument23 pages06 Gross IncomeEloisa MonatoNo ratings yet

- Chapter 3: The Electronic Wallet 3.1. Introduction To E-WalletDocument7 pagesChapter 3: The Electronic Wallet 3.1. Introduction To E-WalletHoàng MiiNo ratings yet

- Bagong Buhay 7 3 2023 SuppliesDocument16 pagesBagong Buhay 7 3 2023 SuppliesJoji Matadling TecsonNo ratings yet

- My - Invoice - 6 Dec 2021, 192249 - 300879422780Document5 pagesMy - Invoice - 6 Dec 2021, 192249 - 3008794227809076 sikandar ShaikhNo ratings yet

- Compa-Ratio CalculationDocument2 pagesCompa-Ratio CalculationgopuvkmNo ratings yet

- Accounting Cycle & Business Transaction: Fabm 2Document11 pagesAccounting Cycle & Business Transaction: Fabm 2Earl Hyannis ElauriaNo ratings yet

- CA Inter Short Notes 2019 20 PDFDocument89 pagesCA Inter Short Notes 2019 20 PDFPrashant KumarNo ratings yet

- Account Statements-MarDocument2 pagesAccount Statements-MarCAT ClusterNo ratings yet

- ReportDocument1 pageReportPriyanka DodkeNo ratings yet

- Digital Currency NoteDocument7 pagesDigital Currency NoteSQIR DGTCPNo ratings yet

- Delhi Airport To HomeDocument3 pagesDelhi Airport To Homeamit_1979kNo ratings yet

- Consignment Sales: Problem 9-1: True or FalseDocument4 pagesConsignment Sales: Problem 9-1: True or FalseVenz LacreNo ratings yet

- Church of Scientology: 1993 Form 1023 Submission To The IRS. Application For 501 (C) 3 Tax ExemptionDocument69 pagesChurch of Scientology: 1993 Form 1023 Submission To The IRS. Application For 501 (C) 3 Tax ExemptionThe Department of Official InformationNo ratings yet

- Mts InfoDocument2 pagesMts InfoscrbddNo ratings yet

- BIR Form 1601-EDocument2 pagesBIR Form 1601-ELovella Phi Go100% (1)

- A To Z of Payroll Guide 2021Document43 pagesA To Z of Payroll Guide 2021melanieNo ratings yet

- C U S T O M S: 3X20GP 60 Sa - Sack TEMU2893464, SITU2858871, SITU2847671 - Waste and Scrap of Cast Iron Mixed Metal ScrapDocument2 pagesC U S T O M S: 3X20GP 60 Sa - Sack TEMU2893464, SITU2858871, SITU2847671 - Waste and Scrap of Cast Iron Mixed Metal ScrapmnmusorNo ratings yet