Professional Documents

Culture Documents

Accounting Report

Uploaded by

nadzraida.binnajar0 ratings0% found this document useful (0 votes)

4 views9 pagesThe document shows cost allocation calculations for departments A, B, C, X, and Y across various cost categories like rent, machine insurance, labor hours, etc. It then calculates total costs for each department and reapportions some costs between departments. The totals show the final cost allocation across all departments.

Original Description:

cost accounting

Original Title

ACCOUNTING REPORT

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows cost allocation calculations for departments A, B, C, X, and Y across various cost categories like rent, machine insurance, labor hours, etc. It then calculates total costs for each department and reapportions some costs between departments. The totals show the final cost allocation across all departments.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views9 pagesAccounting Report

Uploaded by

nadzraida.binnajarThe document shows cost allocation calculations for departments A, B, C, X, and Y across various cost categories like rent, machine insurance, labor hours, etc. It then calculates total costs for each department and reapportions some costs between departments. The totals show the final cost allocation across all departments.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

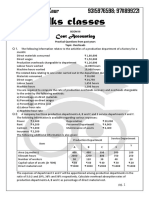

basis Department A B C X Y

Floor area Rent and rates 6 000 3 600 1 200 1 200 800

Machine value Machine insurance 3 000 1 250 1 000 500 250

Labour hours Telephone charges 1 500 900 300 300 200

Machine value depreciation 9 000 3 750 3 000 1 500 750

Labour rates per hour Preoduction salaries 12 800 7 200 4 000

Floor are Heating and lighting 3 000 1 800 600 600 400

Allocated overheads 2 800 1 700 1 200 800 600

total 38 100 20 200 11 300 4 900 3 000

Reapportionment X 2 450 1 225 1 225

50:25:25

TOTAL 40 550 21 425 12 525

Reapportionment Y 600 900 1 500

20:30:50

TOTAL 41 150 22 325 14 025

(b) Two pieces of furniture are to be manufactured for

customers. Direct

costs are as follows:

job 123 job 124

Direct Material £154 £108

Direct Labour 20 hours Dept A 16 hours Dept

A

12 hours Dept B 10 hours Dept

B

10 hours Dept C 14 hours Dept

Job 123 Job 124

£ £

Direct material 154. 00 108.00

Direct labour: [hours x labour rates per hour]

Department A 76.00 60.80

Department B 42.00 35.00

Department C 34.00 47.60

Total direct cost 306.00 251.40

Overhead:

Department A 257.20 205.76

Department B 148.80 124.00

Department C 140.20 196.28

Total cost 852.20 777.44

Profit 284.07 259.15

Overhead = Absorption Rate x Labour Hours

• 12.86 x 20 = 257.20

• 12.14 x 12 = 148.80

• 14.02 x 10 = 140.20

(c) If the firm quote prices to customers that reflect a required

profit of 25%

on selling price, calculate the quoted selling price for each

job.

Cost + Profit = Selling Price

Cost + (0.25)SP = SP

Cost = 0.75SP

Cost/0.75 = SP

Job 123 = £1136.27

Job 124 = £1036.59

b. To effectively control costs, a just-in-time (JIT)

inventory control system might be used. In JIT,

materials are ordered and received just in time for

production. This minimizes holding costs and reduces

the risk of obsolete inventory. The focus is on reducing

waste, improving efficiency, and maintaining a lean

inventory. This approach requires close coordination

with suppliers and efficient production processes to

ensure materials are available precisely when needed.

Total ordering cost = (Annual demand / EOQ) *

Ordering cost per order

Total holding cost = (EOQ / 2) * Holding cost per

unit

Total ordering and holding costs per annum = Total

ordering cost + Total holding cost

Let's calculate it:

Total ordering cost = (26,000 / 2600) * 160

Total ordering cost ≈ 1600

Total holding cost = (26,00)*(16)/2

Total holding cost ≈ 1820

Total ordering and holding costs per annum ≈ 1600

+ 1820

Total ordering and holding costs per annum ≈ 3420

So, the answer to question b is D. $3420.

You might also like

- Lean Six Sigma GuidebookDocument200 pagesLean Six Sigma Guidebookafonsopilar100% (11)

- (Mas) Week1 Solutions ManualDocument17 pages(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- Lean Assessment Overview BriefDocument23 pagesLean Assessment Overview Briefleansensei50% (2)

- Six SigmaDocument57 pagesSix SigmaYogesh Jadhav50% (2)

- Operations MGMT - AIMADocument549 pagesOperations MGMT - AIMATata SatishkumarNo ratings yet

- Acc123 Reviewer With AnswerDocument11 pagesAcc123 Reviewer With AnswerLianaNo ratings yet

- Assignment SolutionDocument11 pagesAssignment SolutionOsama Pervez100% (1)

- CH 4 Organizational and Managerial Issues in Logistics PDFDocument44 pagesCH 4 Organizational and Managerial Issues in Logistics PDFvamshiNo ratings yet

- Manufacturing Overhead - DepartmentalizationDocument6 pagesManufacturing Overhead - DepartmentalizationJosephine Yen100% (1)

- Basics of Supply Chain Management: Lean and Quality SystemsDocument54 pagesBasics of Supply Chain Management: Lean and Quality SystemsS.DNo ratings yet

- SINGH007 Ans Homework Lec 14 To 21Document47 pagesSINGH007 Ans Homework Lec 14 To 21Lau Chun GuiNo ratings yet

- F5 Section CDocument72 pagesF5 Section CRassie AshNo ratings yet

- F5 Solution 1 & 2Document2 pagesF5 Solution 1 & 2dy sovathNo ratings yet

- Cpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsDocument12 pagesCpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsSophia PerezNo ratings yet

- Maria2 103130Document4 pagesMaria2 103130Clay MaaliwNo ratings yet

- Using The Equation Method:: Distribution Summary Particulars Ratios Production Dept. Service DeptDocument3 pagesUsing The Equation Method:: Distribution Summary Particulars Ratios Production Dept. Service DeptRomjan HusainNo ratings yet

- Chapters 1 3Document112 pagesChapters 1 3julygg0710No ratings yet

- Solutions To ProblemsDocument42 pagesSolutions To ProblemsJane TuazonNo ratings yet

- Job Costing ADMDocument18 pagesJob Costing ADMSiddhanta MishraNo ratings yet

- Absorption (Total) Costing AnswersDocument7 pagesAbsorption (Total) Costing AnswersNalan TafanaNo ratings yet

- P54 QabDocument7 pagesP54 QabAbbas ZainyNo ratings yet

- HW 6 KeyDocument5 pagesHW 6 KeyRosinda ArendainNo ratings yet

- New Practical ExercisesDocument2 pagesNew Practical ExercisesKhanh VoNo ratings yet

- Cost Sheet TemplatesDocument26 pagesCost Sheet TemplatessukeshNo ratings yet

- 21st - OCTOBER - 2022-TODAY CLASS - DotDocument23 pages21st - OCTOBER - 2022-TODAY CLASS - DotPalesaNo ratings yet

- This Examples Are Adapted FROM Cost and Management Accounting (1996) Prentice Hall ISBN 0-13-205923-1Document10 pagesThis Examples Are Adapted FROM Cost and Management Accounting (1996) Prentice Hall ISBN 0-13-205923-1pandy1604No ratings yet

- MA PracticesDocument3 pagesMA PracticesDương Xuân ĐạtNo ratings yet

- Cost Accounting Quiz 2Document13 pagesCost Accounting Quiz 2Camille G.No ratings yet

- Total Annual Overhead CostsDocument3 pagesTotal Annual Overhead CostsJEYASHREE ESTEBANNo ratings yet

- MAE - Pratice - Cost Sheet - SolutionDocument12 pagesMAE - Pratice - Cost Sheet - SolutionDhairya MudgalNo ratings yet

- MA1 - De thi giua ky - HK2 - 21-22 - send-đã chuyển đổiDocument4 pagesMA1 - De thi giua ky - HK2 - 21-22 - send-đã chuyển đổiThu ThanhNo ratings yet

- Chapter 6 OverheadsDocument3 pagesChapter 6 OverheadsDevender SinghNo ratings yet

- Chapter 30 Costing Principles and Systems - Total (Or Absorption) Costing Q1 (A)Document2 pagesChapter 30 Costing Principles and Systems - Total (Or Absorption) Costing Q1 (A)Fegason FegyNo ratings yet

- Traditional Approaches To Full Costing Answers To End of Chapter ExercisesDocument4 pagesTraditional Approaches To Full Costing Answers To End of Chapter ExercisesJay BrockNo ratings yet

- F2 Past Paper - Ans12-2001Document9 pagesF2 Past Paper - Ans12-2001ArsalanACCANo ratings yet

- Homework For ABCDocument6 pagesHomework For ABCLikey CruzNo ratings yet

- Arcadia and Enterprise Co. Worked ExamplesDocument22 pagesArcadia and Enterprise Co. Worked ExamplesIvy TulesiNo ratings yet

- Mba MGT ACCT (ILLUSTRATION QUESTIONS)Document13 pagesMba MGT ACCT (ILLUSTRATION QUESTIONS)biggykhairNo ratings yet

- Unit and Batch Homework SolutionsDocument2 pagesUnit and Batch Homework Solutionsnikhilcoke7No ratings yet

- f5 Worksheet BPPDocument19 pagesf5 Worksheet BPPYashna SohawonNo ratings yet

- Unit 2 - Question BankDocument34 pagesUnit 2 - Question BankTamaraNo ratings yet

- Emmppe Associates. Monthly Efficiency of PRODUCTION APRIL 2019-2020Document10 pagesEmmppe Associates. Monthly Efficiency of PRODUCTION APRIL 2019-2020dsivakumarNo ratings yet

- Accounting For FOH Part 11Document16 pagesAccounting For FOH Part 11Shania LiwanagNo ratings yet

- Maria 081947Document4 pagesMaria 081947Clay MaaliwNo ratings yet

- Activity Based Cost: Number of Set-Ups 120 200 200 Customer Orders 8000 8000 16000Document23 pagesActivity Based Cost: Number of Set-Ups 120 200 200 Customer Orders 8000 8000 16000Bennie KingNo ratings yet

- Chater 5Document9 pagesChater 5Shania LiwanagNo ratings yet

- PM KaplanDocument14 pagesPM Kaplanoffong morningNo ratings yet

- Accounting - Activity 2Document10 pagesAccounting - Activity 2PATRICIA CHUANo ratings yet

- AE 22 - MOH - DepartmentalizationDocument4 pagesAE 22 - MOH - DepartmentalizationJake BorinagaNo ratings yet

- Cost & Management AccountingDocument3 pagesCost & Management AccountingAnurag AwasthiNo ratings yet

- Reviewer in Departmentalization of Factory OverheadDocument6 pagesReviewer in Departmentalization of Factory OverheadMirasolNo ratings yet

- Acc 4Document3 pagesAcc 4Izzah NawawiNo ratings yet

- These Overhead Are To Be Allocated and Apportioned To The Four Departements Using The Information BelowDocument13 pagesThese Overhead Are To Be Allocated and Apportioned To The Four Departements Using The Information BelowKos PaviliunNo ratings yet

- Day 2 - COST - TEMPLATEDocument27 pagesDay 2 - COST - TEMPLATEum23328No ratings yet

- Book 1Document12 pagesBook 1Vincent Luigil AlceraNo ratings yet

- Solution JUN 2018Document7 pagesSolution JUN 2018anis izzatiNo ratings yet

- Activity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachDocument4 pagesActivity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachJay BrockNo ratings yet

- SodapdfDocument9 pagesSodapdfSARANYANo ratings yet

- ACMA Unit 6 Problems - Overheads PDFDocument4 pagesACMA Unit 6 Problems - Overheads PDFPrabhat SinghNo ratings yet

- Answers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyDocument10 pagesAnswers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyAnonymous vA2xNfNo ratings yet

- Chapter 6: Job Order Costing Exercise 6-1Document25 pagesChapter 6: Job Order Costing Exercise 6-1Iyah AmranNo ratings yet

- 03 Overhead CostingDocument9 pages03 Overhead CostingPappu LalNo ratings yet

- Problem 1 A Cost of Machinery 285,000.00Document10 pagesProblem 1 A Cost of Machinery 285,000.00Leilalyn NicolasNo ratings yet

- CH 7 SolutionsDocument12 pagesCH 7 SolutionsGabriel PanoNo ratings yet

- Overheads - IBADocument6 pagesOverheads - IBAZehra HussainNo ratings yet

- Ke Toan Quan Tri FinalDocument13 pagesKe Toan Quan Tri Finalkhanhlinh.vuha02No ratings yet

- Mod Management Theory and Practice 8Document11 pagesMod Management Theory and Practice 8aman ranaNo ratings yet

- 3291-Manuscript (Without Author Details and Acknowledgements) - PDF-8863-1!10!20181228Document17 pages3291-Manuscript (Without Author Details and Acknowledgements) - PDF-8863-1!10!20181228utubenayeemNo ratings yet

- Materials Management I. Chapter SummaryDocument2 pagesMaterials Management I. Chapter SummaryLucille TevesNo ratings yet

- Operational Efficiency & Process Improvement in It Industry: Business Research ProjectDocument3 pagesOperational Efficiency & Process Improvement in It Industry: Business Research Projectjith4uNo ratings yet

- 1.the Promise of Lean in Healthcare Article PDFDocument9 pages1.the Promise of Lean in Healthcare Article PDFP S Lakshmi KanthanNo ratings yet

- Cost Accounting Final ProjectDocument30 pagesCost Accounting Final ProjectFatima SafdarNo ratings yet

- Bussiness Process Management Chapter 1 ResumeDocument8 pagesBussiness Process Management Chapter 1 ResumexcavoxNo ratings yet

- 2024 01 17 Fuyao Glass America Case PresentationDocument15 pages2024 01 17 Fuyao Glass America Case PresentationSeyed mohammad HosseiniNo ratings yet

- Process Improvement by Using Value Stream Mapping A Case Study in Small Scale Industry IJERTV1IS5333Document10 pagesProcess Improvement by Using Value Stream Mapping A Case Study in Small Scale Industry IJERTV1IS5333Praveen KumarNo ratings yet

- Lean ManufacturingDocument66 pagesLean Manufacturingmanpreetsodhi08No ratings yet

- Sundaram Clayton Case StudyDocument25 pagesSundaram Clayton Case StudySathyanarayana A Engineering MechanicalNo ratings yet

- A Well Managed Company V/s A Poorly Managed CompanyDocument36 pagesA Well Managed Company V/s A Poorly Managed CompanyShobhit BhatnagarNo ratings yet

- 1 s2.0 S0272696306000313 Main PDFDocument18 pages1 s2.0 S0272696306000313 Main PDFalilounahdisteNo ratings yet

- Value Stream MappingDocument21 pagesValue Stream MappingmpvoNo ratings yet

- Application of WCM Methodologies For First Time Quality ImprovementDocument110 pagesApplication of WCM Methodologies For First Time Quality ImprovementSalih ErdemNo ratings yet

- Integrating The Automotive Supply Chain: Where Are We Now?: D.R. Towill, P. Childerhouse and S.M. DisneyDocument17 pagesIntegrating The Automotive Supply Chain: Where Are We Now?: D.R. Towill, P. Childerhouse and S.M. DisneyPropgp PgpNo ratings yet

- A Review of Assembly Line Changes For Lean Manufacturing: Awasare Anant Dattatray, M.V.KavadeDocument5 pagesA Review of Assembly Line Changes For Lean Manufacturing: Awasare Anant Dattatray, M.V.KavadeAeyrul KhairulNo ratings yet

- VSM Current and FutureDocument12 pagesVSM Current and FutureLINH TRẦN NGÔ KHÁNHNo ratings yet

- IPMX14-OM1 Quiz July 2021Document7 pagesIPMX14-OM1 Quiz July 2021Arjun SharmaNo ratings yet

- King NARZARY BBA PROJECT 6Document80 pagesKing NARZARY BBA PROJECT 6Sunny SinghNo ratings yet

- Ch01 Opr Supply ChainDocument44 pagesCh01 Opr Supply ChainAyudya Rizky Budi UtamiNo ratings yet

- Implementing Milkrun in Lean Production - HBRP PublicationDocument17 pagesImplementing Milkrun in Lean Production - HBRP Publicationசிறகுகள்No ratings yet

- Recent Trends in OperationsDocument7 pagesRecent Trends in Operationsgag90No ratings yet