Professional Documents

Culture Documents

Computerizedapplicationsinaccounting 150725070105 Lva1 App6891

Uploaded by

Aabid Naik0 ratings0% found this document useful (0 votes)

2 views15 pagesOriginal Title

computerizedapplicationsinaccounting-150725070105-lva1-app6891 (1)

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views15 pagesComputerizedapplicationsinaccounting 150725070105 Lva1 App6891

Uploaded by

Aabid NaikCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 15

Computers In Accountancy

• Computers , today , are being extensively used for

office administration and accounting to supply

reliable and accurate information [relating to the

company’s financial performance] to various

users.

• This is made possible through sophisticated

computerized accounting systems .

• They handle large volumes of data , process

information and data, present them graphically

and constantly Update the data .

• Finally , this data is presented to the decision

makers.

• Spreadsheets

Electronic Spreadsheets allow you to

do anything that you would normally

do with a calculator, pencil and

columnar scratch pad. A typical

integrated double entry accounting

spreadsheet system will contain some

of the following components: general

ledger, inventory levels, order entry,

payroll, time, and billing .

• Payroll records

The calculation of wages and salaries involves a number of variables which

relate to personal details of the employees ,such as gross pay, individual

deductions, tax liabilities of the employee and so on. These facts can be

retained in the computers and processed every month to produce pay slips

Stock Control Inventory Control

Electronic Inventory Control module has multiple functions,

which includes tracking inventory for both costing and tax

purposes, aid managers in controlling purchasing (and the

overall level of expenditure) and minimizing the investment in

inventory (and subsequent loss of cash flow).

It updates sales and purchases records , determines optimum

re-order levels for different items and prints out the stock lists .

The system can be designed that it triggers orders when

required ; tests those items which are slow moving or give lists

for over-stock items

Sale accounts records

Programming can be done for any sales accounting system . The

computer will pin-point defaulting debtors, determine right limit of

credit towards each debtor .

Costing, Budget control and planning

Costing and budgetary control can de done through computer systems .

The computer will point out variations from the planned performance.

Production Control

The computer helps greatly in production planning and control . It is

possible that scheduling of work may become necessary due to

breakdowns and such unforeseen events. A new critical path may have to

be worked out . A critical path is the shortest path to be followed in

production to achieve production objectives . The computer helps

management lay down this new critical path.

Accounts Receivable And Accounts Payable

Accounts Payable : are amounts a company owes because it purchased

goods or services on credit from a supplier or vender.

Accounts Receivable: are amounts a company has a right to collect

because it sold goods or services on credit to a customer.

Adjusting Entries

The computers can be programmed to accommodate adjustments

[Depreciation , Prepaid expenses ,Outstanding items]in the

financial statements and Final Accounts.

Financial Accounting is the system of Recording,

Classifying, summarizing, Interpretation and

Communicating accounting information to different users.

Uses of computers in Financial accounting

Recording Transactions: The computer can be

programmed to record and update both accounts affected in

a transaction.

Classifying : Excel Spreadsheets act as an aid to

prepare ledgers for various accounts of a business

enterprise. Balancing of accounts can be done accurately

and in a shorter period of time.

Preparing Trial Balance: The computer will prepare

the trial balance and total it immediately [when needed].

Thereby, the arithmetical accuracy of the books can be

ascertained.

Final Accounts: The computer can be programmed to

transfer the information contained in the Trial Balance relating to

various accounts into the TRADING a/c, PROFIT AND LOSS

a/c and finally the BALANCE SHEET

Bank Reconciliation Statement: The computer can

quickly locate errors on comparison between the Cash Book And

the Bank Book and aid in correcting them .

Interpretation And Presentation of data : The

computer can analyze and draw several inferences to ascertain

the performance levels . Comparisons can also be made .

Furthermore, the computer can present the data graphically for

enhanced understanding .

Management Accounting Is the application of

appropriate techniques and concepts in

processing historical and projected data of an

organization to assist the management in

establishing plans for reasonable economic

objectives and taking rational decisions with a

view of achieving them.

Computerization of Financial Accounting is a

must for computerized Management Accounting.

Financial Statement Analysis

Financial statement is essentially historical document which provides

organized data according to logical and consistent accounting procedure

and conveys an understanding of some financial aspects of a business firm.

Careful analysis of financial statements can help decision makers to evaluate

an organization’s past performance and predict its future financial health.

The computers can be programmed to draw conclusions and preset the

data graphically.

Cash Flow Analysis

A statement of cash flows reports the cash receipts and cash payments of

an organization during a particular period. It is widely used as a tool for

assessing the financial health of an organization. Other important

purposes of maintaining this statement are to predict future cash flows, to

evaluate management’s generation and use of cash and to determine a

company’s ability to pay interest, dividends, and to pay debts when they

are due.

Inter-firm Comparison

IFC is another technique of Management Accounting which is made by some

inter-firm comparison ratios based on the financial and other records of the

business. Top management can make decision by applying this technique

and comparing the performance of two or more similar types of industry.

Differential Costing

Differential cost (revenue) is the difference in total cost (revenue) between

two alternatives . Making or buying decision, accepting or rejecting certain

orders, deciding whether to discontinue an existing product or launce new

one, expanding the existing business are the decisions required to be taken

by the management.

Budgetary Control

Budgetary control is the system of management control in which all the

operations, as sales, purchase, production etc. are forecasted in advance

and the results, when known, are compared with the planned targets. The

difference between the planned targets and actual results are analyzed and

corrective steps are taken according to the original causes

Share Accounting is concerned with maintaining

the updated list of shareholder. For each

shareholder, the information held by the company

is name , number of shares held, address, details

of bank account.

Applications of computers in Share

Accounting

1.Share Transfer And

Transmission

The computer keeps track of the movement of

shares between individuals. This it

easier to know the current makes as past

shareholders. well as

2.Splitting of share certificates

A person might want to transfer a portion of the total number of

shares held by him . The computer will accurately maintain

records of the newly added shareholders also updating certain

information relating to the other shareholder.

3.Consolidation of shares

The process by which a company changes the structure of its

share capital by reducing the number of shares it has in issue

and increasing the par value of each. For instance, a company

with 100,000,000 shares in issue having a nominal value of

Rs.10 , can undertake to reduce the number of shares to

10,000,000 and changing the nominal value to 100. A

computer can provide reliable, accurate information regarding

this in a very short period.

4. Providing and mailing list of shareholders and

annual reports periodically to each shareholder.

You might also like

- Integrated Accounting SystemDocument12 pagesIntegrated Accounting SystemManmeet RajputNo ratings yet

- Accounting Software IntroductionDocument3 pagesAccounting Software IntroductionMakinwa RehobothNo ratings yet

- Accounting SystemDocument22 pagesAccounting SystemAnkit NagdeoNo ratings yet

- Expanding Horizon of Entrepreneurship Through Computerized Accounting FullDocument10 pagesExpanding Horizon of Entrepreneurship Through Computerized Accounting FullVasim AhmadNo ratings yet

- ERP ModulesDocument88 pagesERP Modulesvijitha_v16100% (1)

- The Basic Activities in Glars:: U Ëc Invlvc Pingc C C Jrnalc Nric RMC A C IcDocument6 pagesThe Basic Activities in Glars:: U Ëc Invlvc Pingc C C Jrnalc Nric RMC A C IcgatchanessNo ratings yet

- Chapter Four Accounting SystemsDocument7 pagesChapter Four Accounting SystemsMathewos Woldemariam Birru100% (3)

- Accounts Assignment: Name:M.Lavanya Class: 1 Yr Mba-A Register No.:19Epmb054Document6 pagesAccounts Assignment: Name:M.Lavanya Class: 1 Yr Mba-A Register No.:19Epmb054BAVYA RNo ratings yet

- Plagiarism - ReportDocument5 pagesPlagiarism - ReportAhsan AliNo ratings yet

- The Advantages of Manual VsDocument12 pagesThe Advantages of Manual Vsxxx101xxxNo ratings yet

- Accounting PackageDocument21 pagesAccounting PackageSha dowNo ratings yet

- SAP Exec SummaryDocument3 pagesSAP Exec SummaryAmanda Aurora SimanjuntakNo ratings yet

- Accountant in ComputerDocument8 pagesAccountant in ComputerFilbert SimonNo ratings yet

- CH 4Document4 pagesCH 4Asnaku YenenehNo ratings yet

- Chapter 4Document5 pagesChapter 4Solomon TemesgenNo ratings yet

- Analyzing Accounting Software SystemsDocument4 pagesAnalyzing Accounting Software SystemsDah NEPALNo ratings yet

- R2R Unit 1Document16 pagesR2R Unit 1Bhavika ChughNo ratings yet

- Lesson 6 - Accounting in ERP SystemsDocument2 pagesLesson 6 - Accounting in ERP SystemsMike AntolinoNo ratings yet

- Thakraj 4th Sem.Document29 pagesThakraj 4th Sem.Thakraj Rathore100% (1)

- 1 Introduction To Computerized AccountingDocument17 pages1 Introduction To Computerized Accounting2205611No ratings yet

- Working of Computer AcccountingDocument13 pagesWorking of Computer AcccountingAbhishekNo ratings yet

- Blog AccountingDocument10 pagesBlog AccountingMai TiếnNo ratings yet

- IT in Accounting and FinanceDocument6 pagesIT in Accounting and FinanceHarshk JainNo ratings yet

- Cost Accounting Information SystemDocument9 pagesCost Accounting Information SystemFaiz KhanNo ratings yet

- Management AccountingDocument19 pagesManagement Accountingfahmeetha100% (1)

- Computerized Accounting Systems Revolutionize Business OperationsDocument8 pagesComputerized Accounting Systems Revolutionize Business OperationsNickos Andrew Magno Asanza Jr.No ratings yet

- Microsoft Dynamics 365 Business Central Capability GuideDocument28 pagesMicrosoft Dynamics 365 Business Central Capability GuideMatarNo ratings yet

- Computerized Accounting: What Is Group?Document31 pagesComputerized Accounting: What Is Group?GUNASEELAN SNo ratings yet

- Introduction to the Internship Experience and Computerized Accounting SystemsDocument19 pagesIntroduction to the Internship Experience and Computerized Accounting SystemsVivek ChauhanNo ratings yet

- ERP Business ModulesDocument14 pagesERP Business ModuleshrishikingNo ratings yet

- GL, AP, AR, Cash Journal and R3Document10 pagesGL, AP, AR, Cash Journal and R3sanjaypoptani.mclindiaNo ratings yet

- Set Up and Operate A Computerized Accounting SystemDocument10 pagesSet Up and Operate A Computerized Accounting Systemabebe kumelaNo ratings yet

- Computerized Accounting SystemDocument2 pagesComputerized Accounting SystemCikgu AdawiyahNo ratings yet

- Overview of AISDocument8 pagesOverview of AISBulelwa HarrisNo ratings yet

- Computerized Accounting-An IntroductionDocument15 pagesComputerized Accounting-An IntroductionpalpitopitooNo ratings yet

- Financial Accounting and Cost AccountingDocument34 pagesFinancial Accounting and Cost AccountinggeraldNo ratings yet

- ADVANCE AUDIT Assignment 3Document6 pagesADVANCE AUDIT Assignment 3zainab malikNo ratings yet

- Dynamics 365 Business Central Capability Guide - En-En - Final - v2Document30 pagesDynamics 365 Business Central Capability Guide - En-En - Final - v2Jesus CastroNo ratings yet

- Assignment 1Document9 pagesAssignment 1Yashveer SinghNo ratings yet

- Accounting Information System For Mia: Employee Multipurpose Cooperative (Mempc)Document24 pagesAccounting Information System For Mia: Employee Multipurpose Cooperative (Mempc)Julius Michael BalingitNo ratings yet

- Chapter 1 A Model For Processing AIS (New)Document6 pagesChapter 1 A Model For Processing AIS (New)Muhammad IrshadNo ratings yet

- SK Tally ProjectDocument35 pagesSK Tally ProjectSonu KumarNo ratings yet

- Financial, Management & Cost Accounting ExplainedDocument20 pagesFinancial, Management & Cost Accounting ExplainedTimothyNo ratings yet

- Managerial accounting guide for internal decision-makingDocument5 pagesManagerial accounting guide for internal decision-makingBestboyshoyoNo ratings yet

- Management AccountingDocument15 pagesManagement AccountingRajiv RankawatNo ratings yet

- Computerised AccountingDocument54 pagesComputerised AccountingsuezanwarNo ratings yet

- Principles of Accounting SystemsDocument2 pagesPrinciples of Accounting SystemsHafidzi Derahman0% (1)

- Cost Accounting ExerciseDocument4 pagesCost Accounting ExerciseAnanda RiskiNo ratings yet

- Management AccountingDocument6 pagesManagement AccountingRahul PuriNo ratings yet

- Accounting Information Systems OverviewDocument20 pagesAccounting Information Systems OverviewSabiha MirNo ratings yet

- Introduction To Sap FicoDocument13 pagesIntroduction To Sap FicosangNo ratings yet

- Basics of Managerial AccountingDocument6 pagesBasics of Managerial AccountingUwuNo ratings yet

- Managerial Accounting - Class 1Document19 pagesManagerial Accounting - Class 1AshiqNo ratings yet

- Expenditure Process, Conversion Processes, and Administrative Processes. These Broader Processes Contain Sub-Processes. For Example, TheDocument46 pagesExpenditure Process, Conversion Processes, and Administrative Processes. These Broader Processes Contain Sub-Processes. For Example, TherikanshaNo ratings yet

- Chart of Accounts: BackgroundDocument10 pagesChart of Accounts: Backgroundjohn irsyamNo ratings yet

- What Is Managerial Accounting?Document4 pagesWhat Is Managerial Accounting?Brent ManansalaNo ratings yet

- Meaning and Definitions of Management AccountingDocument9 pagesMeaning and Definitions of Management AccountingHafizullah Ansari100% (1)

- 6 Module VI Recent TrendsDocument14 pages6 Module VI Recent TrendsIsha kaleNo ratings yet

- What Is Cost Accounting and DiferencesDocument6 pagesWhat Is Cost Accounting and Diferenceskasuntop99838No ratings yet

- Spreadsheet L1-1Document8 pagesSpreadsheet L1-1Aabid NaikNo ratings yet

- Computerised Accounting SystemDocument14 pagesComputerised Accounting SystemAabid NaikNo ratings yet

- CommerceDocument22 pagesCommerceWajeeh RehmanNo ratings yet

- Human Resource ManagementDocument7 pagesHuman Resource ManagementAabid NaikNo ratings yet

- Directors, Qualification, Duties and RemovalDocument8 pagesDirectors, Qualification, Duties and RemovalAabid NaikNo ratings yet

- Public Finance, HRM, DIRECTORS QualificationsDocument11 pagesPublic Finance, HRM, DIRECTORS QualificationsAabid NaikNo ratings yet

- Accounting For Manager Complete NotesDocument105 pagesAccounting For Manager Complete NotesAARTI100% (2)

- Statement of Cash Flows ExplainedDocument61 pagesStatement of Cash Flows ExplainedMuhammad RezaNo ratings yet

- Lecture 1 - Concepts and EthicsDocument10 pagesLecture 1 - Concepts and EthicsNikki MathysNo ratings yet

- Forensic Audit and Environmental AuditDocument19 pagesForensic Audit and Environmental AuditAbrha636No ratings yet

- Manufacturing Operations - Theory ReviewerDocument4 pagesManufacturing Operations - Theory Reviewerquinn ezekielNo ratings yet

- C5 (MC) - Cost Accounting by Carter (Part2)Document6 pagesC5 (MC) - Cost Accounting by Carter (Part2)AkiNo ratings yet

- 07 Activity 1-BARIACTODocument2 pages07 Activity 1-BARIACTOdanibariactoNo ratings yet

- Chapter 1 PPT CondensedDocument5 pagesChapter 1 PPT CondensedRaymond GuillartesNo ratings yet

- Financial Accounting I 1005Document28 pagesFinancial Accounting I 1005meetwithsanjayNo ratings yet

- Essential Accounting Concepts ExplainedDocument6 pagesEssential Accounting Concepts ExplainedShane CayyongNo ratings yet

- Quizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Document3 pagesQuizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Ferb Cruzada80% (5)

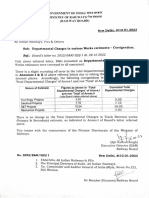

- Corrigendum of Departmental ChargesDocument1 pageCorrigendum of Departmental ChargesADEE G GRCNo ratings yet

- CH1 - Introduction To Financial AnalysisDocument37 pagesCH1 - Introduction To Financial AnalysisStudent Sokha Chanchesda100% (1)

- FABM 2 Module 6 Cash Bank ReconDocument6 pagesFABM 2 Module 6 Cash Bank ReconJOHN PAUL LAGAO40% (5)

- Impact of Adjusted Entries by Group 1: Fernando Casco-Downing, Katie Fleming, Michael Kubik, Emily Stone, Fei WangDocument24 pagesImpact of Adjusted Entries by Group 1: Fernando Casco-Downing, Katie Fleming, Michael Kubik, Emily Stone, Fei WangjjprianNo ratings yet

- Intercompany Transactions ConsolidationDocument1 pageIntercompany Transactions ConsolidationErjohn Papa0% (1)

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument24 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The Questionawesome bloggersNo ratings yet

- BKAN1013 Chapter 2Document70 pagesBKAN1013 Chapter 2Halinnie SueNo ratings yet

- Chap. 9 - Discussion AssignmentsDocument3 pagesChap. 9 - Discussion AssignmentsEdi HermawanNo ratings yet

- Accounting For Sales PDFDocument20 pagesAccounting For Sales PDFJasmine Acta100% (1)

- CPA Seeks Staff Accountant Position for ExperienceDocument1 pageCPA Seeks Staff Accountant Position for ExperienceOrlando ManuelNo ratings yet

- AccountsDocument183 pagesAccountsHeena Shaikh100% (1)

- ISRS 4410 (Revised) Basis For Conclusions-Final - 0Document14 pagesISRS 4410 (Revised) Basis For Conclusions-Final - 0henryparedesNo ratings yet

- Madelyn Rialubin Travel Agency Adjusting EntryDocument4 pagesMadelyn Rialubin Travel Agency Adjusting EntryClaud NineNo ratings yet

- Jon Johnson An Accountant With A Local Cpa Firm HasDocument1 pageJon Johnson An Accountant With A Local Cpa Firm HasMuhammad ShahidNo ratings yet

- Final SLP Accounting For ReceivablesDocument26 pagesFinal SLP Accounting For ReceivablesLovely Joy SantiagoNo ratings yet

- Plant and Intangible Assets: Mcgraw-Hill/IrwinDocument17 pagesPlant and Intangible Assets: Mcgraw-Hill/IrwinAyaz Ul HaqNo ratings yet

- Glxls v1.2.c Contoh DataDocument178 pagesGlxls v1.2.c Contoh DataukyNo ratings yet

- AdjustingDocument7 pagesAdjustingKrisha JohnsonNo ratings yet

- Accounting Tutorial 1Document5 pagesAccounting Tutorial 1Sim Pei YingNo ratings yet