Professional Documents

Culture Documents

Madelyn Rialubin Travel Agency Adjusting Entry

Uploaded by

Claud Nine0 ratings0% found this document useful (0 votes)

30 views4 pagesOriginal Title

Madelyn Rialubin Travel Agency Adjusting entry

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views4 pagesMadelyn Rialubin Travel Agency Adjusting Entry

Uploaded by

Claud NineCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

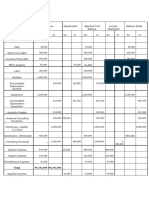

Adjusting entries

Date Particulars Dr Cr Dec. 31

a. Rent expense 120,000 k

Prepaid rent 120,000 k

To record rent expense for Non.-Dec. 2012 120 Ac

Dec. 31

b. Office Supplies expense 36,000

Office supplies 36,000 k 130

To record supplies expense for Dec. 2012 Dec.31

c. Depreciation expense 75,000 End. Bal

Accumulated Depreciation 75,000 k

To record depreciation for the year 2012 140

Dec. 31

d. Salaries expense 105,000 k

Salaries payable 105,000 k End. Bal

To record accrual of salaries

e. Interest expense 54,000 Dec. 31

Interest payable 54,000 k

To record accrual of interest on notes payable

110 Cash 155 Accumulated Depreciation 320 Rialubin, withdrawals

126,000 Dec. 31 435,000 Dec. 31 ###

k 75,000

510 Salaries expense

120 Accounts Receivable end. Bal 510,000 adj. d ###

645,000 105,000

210 Notes payable Bal. ###

130 Prepaid Rent Dec. 31 900,000 520 Rent expense

360,000 a. 120,000 adj. a 120,000

220 Accounts payable

240,000 Dec. 31 285,000 530 Office Supplies expense

adj. b 36,000

140 Office Supplies 230 Salaries payable

63,000 b 36,000 adj. d 105,000 540 Depreciation expense

adj. c 75,000

27,000 240 Interest payable

adj. e 54,000 550 Interest expense

Furniture adj. e 54,000

2,175,000 310 Rialubin, Capital

Dec. 31 1,680,000 560 Miscellaneous expense

Dec. 31 93,000

410 Travel Revenues

Dec. 31 5,133,000

Madelyn Rialubin Travel Agency

Adjusted Trial Balance

December 31, 2012

Account Titles Debit Credit

110 Cash 126,000

120 Accounts Receivable 645,000

130 Prepaid Rent 240,000

140 office Supplies 27,000

150 Furniture 2,175,000

155 Accumulated Depreciation 510,000

210 Notes Payable 900,000

220 Accounts Payable 285,000

230 Salaries payable 105,000

240 Interest payable 54,000

310 Rialubin, capital 1,680,000

320 Rialubin, withdrawal 1,200,000

410 Travel revenues 5,133,000

510 Salaries expense 3,876,000

520 Rent expense 120,000

530 Office supplies expense 36,000

540 Depreciation expense 75,000

550 interest expense 54,000

560 Miscellaneous expense 93,000

total 8,667,000 8,667,000

You might also like

- Jimbo P. Manalastas BSA 1-1Document4 pagesJimbo P. Manalastas BSA 1-1Jimbo ManalastasNo ratings yet

- 1Document2 pages1Jimbo ManalastasNo ratings yet

- Madelyn Rialubin Travel Agency Adjusting Entries AdjustedDocument5 pagesMadelyn Rialubin Travel Agency Adjusting Entries AdjustedJustine Almodiel100% (1)

- Adjusting EntryDocument3 pagesAdjusting EntryNo NotreallyNo ratings yet

- 4.3.2.7 Evaluate 4.2 Rosario Travel Agency - GUILARAN - BSMA 1A WorksheetDocument1 page4.3.2.7 Evaluate 4.2 Rosario Travel Agency - GUILARAN - BSMA 1A WorksheetTrisha Mae BrazaNo ratings yet

- Problem 7 ACCA101Document26 pagesProblem 7 ACCA101Nicole Fidelson100% (1)

- AJE: Chapter 4 Pp. 7-14Document31 pagesAJE: Chapter 4 Pp. 7-14nkrndamascoNo ratings yet

- Homework Chapter 2: ExerciseDocument6 pagesHomework Chapter 2: ExerciseDiệu QuỳnhNo ratings yet

- KhemDocument2 pagesKhemMelonie GalarpeNo ratings yet

- Preparing Adjusting EntriesDocument6 pagesPreparing Adjusting EntriesRey ArellanoNo ratings yet

- RequiredDocument15 pagesRequiredCheska Anne Mikka RoxasNo ratings yet

- ACCTG Act 3-1Document2 pagesACCTG Act 3-1Angel ReblezaNo ratings yet

- Date Account Title and Explanation Debit Credit: Ref. NoDocument7 pagesDate Account Title and Explanation Debit Credit: Ref. NoBlesh MacusiNo ratings yet

- Book 1Document6 pagesBook 1xbautista124No ratings yet

- Worksheet Quiz ExampleDocument5 pagesWorksheet Quiz ExampleFrenzearl ArmadaNo ratings yet

- Travel Agency RubisomethingDocument12 pagesTravel Agency RubisomethingItsRenz YTNo ratings yet

- Lesson34 2Document10 pagesLesson34 2Sami UllahNo ratings yet

- ExamDocument5 pagesExamRudsan TurquezaNo ratings yet

- Buenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaDocument21 pagesBuenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaAnonnNo ratings yet

- Perpetual - Adjusted Trial BalanceDocument1 pagePerpetual - Adjusted Trial BalanceJeon Cyrone CuachonNo ratings yet

- IT ActivityDocument5 pagesIT ActivityTine RobisoNo ratings yet

- Adjusting Entries FR UTB Fill in The Blanks N Effects of OmissionsDocument31 pagesAdjusting Entries FR UTB Fill in The Blanks N Effects of Omissionsjadetablan30No ratings yet

- Principles of Accounting Problem 5Document7 pagesPrinciples of Accounting Problem 5Carlo AbrinaNo ratings yet

- Debit Credit: EGG SHERAN Corp. (Home Office) Unadjusted Trial Balance December 31,20x1Document6 pagesDebit Credit: EGG SHERAN Corp. (Home Office) Unadjusted Trial Balance December 31,20x1Riza Mae AlceNo ratings yet

- Date Adjusting Entries Dec.31Document18 pagesDate Adjusting Entries Dec.31Cheska Anne Mikka RoxasNo ratings yet

- Activity Worksheet PreparationDocument16 pagesActivity Worksheet PreparationLowelle Cielo PacotNo ratings yet

- Jim Boy TradingDocument22 pagesJim Boy TradingRae GallawanNo ratings yet

- Begino, Vanessa Jamila D. Class No. 4Document3 pagesBegino, Vanessa Jamila D. Class No. 4Vanessa JamilaNo ratings yet

- Financial Accounting - Assignment #1#Document5 pagesFinancial Accounting - Assignment #1#Hasan NajiNo ratings yet

- 3rd Long QuizDocument1 page3rd Long QuizRonah SabanalNo ratings yet

- COMEROS - Accounting Services2.2.2Document43 pagesCOMEROS - Accounting Services2.2.2Joshua ComerosNo ratings yet

- Practice For FinalsDocument3 pagesPractice For FinalsStefanie EstilloreNo ratings yet

- Exercise 6 22 Acctba1Document11 pagesExercise 6 22 Acctba1Sophia Santos50% (2)

- Accounting FinalsDocument10 pagesAccounting FinalsrixaNo ratings yet

- Worksheet: Comprehensive ProblemDocument9 pagesWorksheet: Comprehensive ProblemArvic John BresenioNo ratings yet

- Exercises I - Answer KeyDocument5 pagesExercises I - Answer KeyJowjie TVNo ratings yet

- Book 1Document1 pageBook 1iya RasonableNo ratings yet

- Saet Work AnsDocument5 pagesSaet Work AnsSeanLejeeBajan89% (27)

- Abm2 Week-5Document12 pagesAbm2 Week-5amorashella5No ratings yet

- Chapter 8 ActivityDocument1 pageChapter 8 ActivityChristany SheneNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Ledger Account Represented by T-AccountDocument1 pageLedger Account Represented by T-AccountJimbo ManalastasNo ratings yet

- 07 - Activity - 1 PMI CHARTDocument2 pages07 - Activity - 1 PMI CHARTLorielyn Arnaiz CaringalNo ratings yet

- 01 Laboratory Exercise 1Document40 pages01 Laboratory Exercise 1mabelle100% (1)

- Pasahol-Far - Adusting Entries - Assignment 2Document5 pagesPasahol-Far - Adusting Entries - Assignment 2Angel PasaholNo ratings yet

- Recording Accounting InformationDocument38 pagesRecording Accounting InformationJanelle Dela cruz100% (1)

- Perpetual Inventory Answer KeyDocument3 pagesPerpetual Inventory Answer KeyShane QuintoNo ratings yet

- Complete Cycle Servicing Graded ActivityDocument13 pagesComplete Cycle Servicing Graded ActivityZPadsNo ratings yet

- AnswersDocument24 pagesAnswersDeul ErNo ratings yet

- Jawaban KuisDocument3 pagesJawaban KuisWidad NadiaNo ratings yet

- Laboratoy Exercise Chapter 9Document3 pagesLaboratoy Exercise Chapter 9Ruthchell CiriacoNo ratings yet

- SEATWORK6Document6 pagesSEATWORK6dumpanonymouslyNo ratings yet

- 77 FDocument3 pages77 FJohn CalvinNo ratings yet

- Case CorporateDocument20 pagesCase CorporatewillyNo ratings yet

- Acc HWDocument5 pagesAcc HWHasan NajiNo ratings yet

- Initial Investment: General Journal Ref Debit Credit Date Account Titles & ExplanationDocument5 pagesInitial Investment: General Journal Ref Debit Credit Date Account Titles & ExplanationG02 BANDELARIA ChristellNo ratings yet

- Journal EntryDocument13 pagesJournal EntryMecah Lou Odchigue LanzaderasNo ratings yet

- Patrocinio TransactionsDocument4 pagesPatrocinio TransactionsancooooNo ratings yet

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- According To Merriam Webster Dictionary-1Document2 pagesAccording To Merriam Webster Dictionary-1Claud NineNo ratings yet

- Jose Rizal Heavy BombersDocument10 pagesJose Rizal Heavy BombersClaud NineNo ratings yet

- A Survey On Perception of E-Wallets Ussage - Reconcillo, Claudine A.Document21 pagesA Survey On Perception of E-Wallets Ussage - Reconcillo, Claudine A.Claud Nine100% (1)

- Both Berle and Dodd Agreed That The Corporation Should Pursue The Public Interest, But Were Initially at Odds in How This Was AchievedDocument3 pagesBoth Berle and Dodd Agreed That The Corporation Should Pursue The Public Interest, But Were Initially at Odds in How This Was AchievedClaud NineNo ratings yet

- ABM Lesson PlanDocument3 pagesABM Lesson PlanCharapril Jen LabadanNo ratings yet

- The Philippine Financial SystemDocument10 pagesThe Philippine Financial Systemgester kentNo ratings yet

- UntitledDocument1 pageUntitledClaud NineNo ratings yet

- First Summative Test-Business FinanceDocument3 pagesFirst Summative Test-Business FinanceRaul Cabanting100% (6)

- UntitledDocument1 pageUntitledClaud NineNo ratings yet

- Statistics & Probability Summative TestDocument1 pageStatistics & Probability Summative TestDindin Oromedlav Lorica60% (5)

- Motivational Quote Desert Mountains Poster (8.27 × 11.69 In)Document1 pageMotivational Quote Desert Mountains Poster (8.27 × 11.69 In)Claud NineNo ratings yet

- Annex A - Informed ConsentNov2020Document3 pagesAnnex A - Informed ConsentNov2020echo alisboNo ratings yet

- Annex B - Health Declaration FormNov2020Document4 pagesAnnex B - Health Declaration FormNov2020jhade_cabatoNo ratings yet

- Annex A - Informed ConsentNov2020Document3 pagesAnnex A - Informed ConsentNov2020echo alisboNo ratings yet

- Annex C - Post Examination Health Surveillance FormNov2020Document1 pageAnnex C - Post Examination Health Surveillance FormNov2020Rei Misaki95% (20)

- Annex C - Post Examination Health Surveillance FormNov2020Document1 pageAnnex C - Post Examination Health Surveillance FormNov2020Rei Misaki95% (20)

- Annex B - Health Declaration FormNov2020Document4 pagesAnnex B - Health Declaration FormNov2020jhade_cabatoNo ratings yet

- Atc Battery Catalogue VerDocument8 pagesAtc Battery Catalogue Verrohan2212No ratings yet

- Seferiadis 2018 PDFDocument88 pagesSeferiadis 2018 PDFOleksandrNo ratings yet

- Excel Problem Set 2 FIN 5203 SP21 PDFDocument3 pagesExcel Problem Set 2 FIN 5203 SP21 PDFAhmed MahmoudNo ratings yet

- Turning Great Strategy Into Great PerformanceDocument22 pagesTurning Great Strategy Into Great PerformanceCathy Jeny Jeny Catherine100% (2)

- HDFC Bank LTD Repayment Schedule: Date: 04/02/2016Document2 pagesHDFC Bank LTD Repayment Schedule: Date: 04/02/2016Amish JhaNo ratings yet

- Memorandum of Understanding-SubvendorsDocument3 pagesMemorandum of Understanding-SubvendorsfazilskNo ratings yet

- Prebisch Singer Hypothesis PDFDocument5 pagesPrebisch Singer Hypothesis PDFsandyharwellevansville100% (2)

- Utex Plunger PackingDocument7 pagesUtex Plunger Packinganandkumar.mauryaNo ratings yet

- Summary For The Preparation of Bank Reconciliation StatementDocument5 pagesSummary For The Preparation of Bank Reconciliation StatementGhalib HussainNo ratings yet

- 2 Cost Behavior 2 (20 Pages)Document21 pages2 Cost Behavior 2 (20 Pages)Raju RiadNo ratings yet

- Payable Confirmation LetterDocument2 pagesPayable Confirmation LetterGeralyn BulanNo ratings yet

- Quiz2 3Document5 pagesQuiz2 3Kervin Rey JacksonNo ratings yet

- What Is InflationDocument222 pagesWhat Is InflationAhim Raj JoshiNo ratings yet

- Chapter 10, Question 1. ADocument25 pagesChapter 10, Question 1. AAnh ThưNo ratings yet

- Design and Analysis of Pre Stressed I Girders by Midas Civil SoftwareDocument7 pagesDesign and Analysis of Pre Stressed I Girders by Midas Civil SoftwareEditor IJTSRDNo ratings yet

- 2 TsgraphicsDocument107 pages2 TsgraphicsjuanivazquezNo ratings yet

- 1.2.data - Word Document-Elements, Variables, and ObservationsDocument2 pages1.2.data - Word Document-Elements, Variables, and ObservationsdaotamNo ratings yet

- Omaha HustlerDocument14 pagesOmaha HustlerVladimir Babic50% (2)

- Provisional Merit List of Candidates - Written Test + AssessmentDocument31 pagesProvisional Merit List of Candidates - Written Test + Assessmentrangu prashanthhNo ratings yet

- Mid1s s08Document9 pagesMid1s s08lawrence990No ratings yet

- Appsc Group 1 em Prelims Test Series Schedule-Aks IasDocument147 pagesAppsc Group 1 em Prelims Test Series Schedule-Aks IasBNREDDY PSNo ratings yet

- The Latte FactorDocument10 pagesThe Latte FactorКыр Сосичка100% (1)

- Computation of EWTDocument9 pagesComputation of EWTJaeNo ratings yet

- Course I - Section I - DR - Kanyarat NimtrakoolDocument58 pagesCourse I - Section I - DR - Kanyarat NimtrakoolJO JENG CHINNo ratings yet

- Department of Education: Republic of The PhilippinesDocument5 pagesDepartment of Education: Republic of The PhilippinesJoelmarMondonedo100% (7)

- Katalog MetalindoDocument20 pagesKatalog MetalindoGusti EgorNo ratings yet

- Transport For London: MR Abdihakim Yusuf Flat 14 Mar House, Springfield Grove London Se7 7Tj United KingdomDocument2 pagesTransport For London: MR Abdihakim Yusuf Flat 14 Mar House, Springfield Grove London Se7 7Tj United Kingdomyabdihakim75No ratings yet

- 1-Z-Test For Mean PDFDocument20 pages1-Z-Test For Mean PDFKhanal Nilambar0% (1)

- List of HRERA Agents 692017Document10 pagesList of HRERA Agents 692017sharad159No ratings yet

- Muwin Estate Wines LTD - Speaking NotesDocument10 pagesMuwin Estate Wines LTD - Speaking Notesapi-302371996No ratings yet