Professional Documents

Culture Documents

Summary For The Preparation of Bank Reconciliation Statement

Uploaded by

Ghalib HussainOriginal Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSummary For The Preparation of Bank Reconciliation Statement

Uploaded by

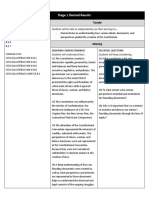

Ghalib HussainTransactions Cash Bank

Book Statement

Interest Credited by Bank Add (+) / Dr -

Direct Direct Deposited to Bank Add (+) / Dr -

Issued Cheque Dishonoured (Issued by the company) Add (+) / Dr -

Debit Side of the Cash Book undercasted or understated Add (+) / Dr -

Not Sufficient Fund (NSF) (in company account) Add (+) / Dr -

Bill Receivable Collected by Bank Add (+) / Dr -

Bank Charges Less (-) / Cr -

Direct Payment by Bank Less (-) / Cr -

Credit Side of the Bank Column in the Cash Book Understated or casted Less (-) / Cr -

short

Cheque Received Entered Twice in the Cash Book Less (-) / Cr -

Deposited Cheque Dishonoured Less (-) / Cr -

Interest Deducted by Bank on Loan or O/D Less (-) / Cr -

Bank Charged Commission on the Collection of Outstanding cheques. Less (-) / Cr -

Payment Made by Cheque but not Entered in Cash Book. Less (-) / Cr -

Uncredited /Uncollected / Uncleared Cheques. - Add (+) / Cr

Outstation Cheque - Add (+) / Cr

Deposit in Transit - Add (+) / Cr

Cheque Deposited into Bank but not Cleared. - Add (+) / Cr

Outstanding/Unpresented / Unpaid / Uncashed Cheques - Less (-) / Dr

Summary for Preparing Bank Reconciliation Statement

Problem 1: (Overdraft)

From the following particulars prepare a Bank Reconciliation Statement to find out the causes of

difference in two balances as on August 31st, 2016 for Four Star (Pvt.) Ltd.

(i) Bank Overdraft as per Bank Statement ……………………………………….………. 17,000

(ii) Check issued but not encashed during the August ………………………………….. 2,200

(iii) Dividends on shares collected by banker …………………………….…………….… 2,300

(iv) Interest charged by the bank recorded twice in the Cash Book ……………..……. 500

(v) Check deposited as per Bank Statement not entered in Cash Book ……….…..… 3,400

(vi) Credit side of the Bank column in Cash Book cast short ……………….…………… 1,000

(vii) Clubs dues paid by bank as per standing instruction not recorded in Cash Book … 1,200

(viii) Uncredited check due to outstation …………………………………………………. 3,900

Problem 2:

From the following particulars, you are required to find out the errors in cash book and bank

statement by using missing method and prepare Bank Reconciliation Statement as on 31-12-

2016, for Chand Bibi Ltd:

(i) Bank balance overdraft as per cash book ………………………………… 80,000

(ii) Check recorded for collection but not sent to the bank ………………… 10,000

(iii) Credit side of the cash book cast short …………………………………1,000

(iv) Premium on proprietor’s Life Insurance Policy (LIP) paid on standing order …5,000

(v) Bank Charges recorded twice in the cash book ……………………………100

(vi) Customer’s check returned by the bank as dishonored …………………4,000

(vii) Bill Receivable collected by the bank directly on the behalf of company …… 20,000

(viii) Check received entered twice in the cash book …………………………… 6,000

(ix) Check issued but dishonored on technical grounds ………………………… 3,000

(x) A checks deposited into the bank of worth Rs. 45,000 but Rs. 8,000 check was not collected

by bank.

Problem 3:

Prepare Bank Reconciliation Statement for the month of December, 2007 by missing method

using T accounts (for cash book and for bank statement) and Reconciliation Statement:

The cash book of M/S Universal Trading Company shows a cash book balance of Rs. 102,568 in

Soneri bank Ltd. as of 31-12-2007. In January, 2008 the firm received a bank statement for the

month of December, 2007 showing a credit balance of Rs. 118,068. Comparison of bank

statement with the cash revealed the following anomalies

i. Check issued totaling Rs. 115,250 recorded in cash book but not appeared in the bank

statement.

ii. Check received from customers amounting to Rs. 75,850 deposited and properly accounted for

in the cash book was not credited by bank.

iii. Check received from the following customers were returned unpaid by the bank.

iv. Check from Ghazi Autos received on 5-12-2007 for Rs. 1,200.

v. Check from Rahil Bros. received on 20-12-2007 for Rs. 18,500.

vi. Check form Akmal Sons was received on 27-12-2007 for Rs. 2,000.

vii. Excise duty debited by bank Rs. 200.

viii. Bank charges debited by bank Rs. 1,200.

ix. Charged commission on collection of outstation check by bank of worth Rs. 800.

You might also like

- Petitioner MemorialDocument36 pagesPetitioner MemorialAshish singh86% (7)

- Foodpanda OrderDocument2 pagesFoodpanda OrderMohd Azfarin100% (1)

- Financial Markets and Institutions: Abridged 10 EditionDocument24 pagesFinancial Markets and Institutions: Abridged 10 EditionNajmul Joy100% (1)

- Urethane Thinner A: Product DescriptionDocument1 pageUrethane Thinner A: Product DescriptionValeriyNo ratings yet

- Bank Reconciliation StatementDocument7 pagesBank Reconciliation Statementkshitijraja18No ratings yet

- Fundamentals of Accountancy, Business, and Management 2Document11 pagesFundamentals of Accountancy, Business, and Management 2Honey ShenNo ratings yet

- C2 Bank ReconciliationDocument22 pagesC2 Bank ReconciliationKenzel lawasNo ratings yet

- FABM2 - q2 - Clas2 Preparation of Bank Reconciliation Statement - v3Document14 pagesFABM2 - q2 - Clas2 Preparation of Bank Reconciliation Statement - v3Joey AgnasNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- BANK RECONCILIATION STATEMENT EXPLAINEDDocument0 pagesBANK RECONCILIATION STATEMENT EXPLAINEDHaseeb Ullah KhanNo ratings yet

- Credit Evaluation Process AnalysisDocument73 pagesCredit Evaluation Process AnalysisNeeRaz Kunwar100% (2)

- Account Closure Form - v2Document1 pageAccount Closure Form - v2OTHER Work100% (1)

- Infosys Balance SheetDocument37 pagesInfosys Balance SheetSakshi BathlaNo ratings yet

- Reconcile Bank Balance Cash Book StatementDocument1 pageReconcile Bank Balance Cash Book StatementJosh BissoonNo ratings yet

- Bank Reconciliation StatementDocument20 pagesBank Reconciliation Statement1t4No ratings yet

- Petty Cash Fund EssentialsDocument9 pagesPetty Cash Fund Essentialsramsha_tajammalNo ratings yet

- Financial StatementsDocument18 pagesFinancial Statementswajeeha.arfat008No ratings yet

- CMA Assignment-1 - Group5Document9 pagesCMA Assignment-1 - Group5Swostik RoutNo ratings yet

- Work Order Financing OptionsDocument2 pagesWork Order Financing Optionsvivekananda Roy100% (1)

- Module 2 ProblemsDocument15 pagesModule 2 ProblemsCristina TayagNo ratings yet

- Bank - Reconciliatio Statement PowerpointDocument61 pagesBank - Reconciliatio Statement PowerpointLoida Yare LauritoNo ratings yet

- Accounting Records Source DocumentsDocument3 pagesAccounting Records Source Documentsziad12321No ratings yet

- 4 Exam Part 2Document4 pages4 Exam Part 2RJ DAVE DURUHANo ratings yet

- Bank Reconciliation and Petty Cash NotesDocument3 pagesBank Reconciliation and Petty Cash NotesCyrus MulopeNo ratings yet

- Autonomous Branches.Document7 pagesAutonomous Branches.Axam Ndawula100% (1)

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- Recruitment and Selection at ICICI BankDocument8 pagesRecruitment and Selection at ICICI Banknitika_gupta219481No ratings yet

- A) Chart of Accounts: 1. On March 1, 2020, Tahir Muktar, A Famous Businessman in Addis, Opened A BusinessDocument12 pagesA) Chart of Accounts: 1. On March 1, 2020, Tahir Muktar, A Famous Businessman in Addis, Opened A Businessrediet solomonNo ratings yet

- The Bank AccountDocument15 pagesThe Bank AccountJerima PilleNo ratings yet

- Complete Mba Project 1Document47 pagesComplete Mba Project 1sachingaubaNo ratings yet

- Reconcile Bank Statement with RecordsDocument70 pagesReconcile Bank Statement with RecordsGSOCION LOUSELLE LALAINE D.No ratings yet

- Suggested Answer Paper CAP III Dec 2019Document142 pagesSuggested Answer Paper CAP III Dec 2019Roshan PanditNo ratings yet

- Journal, Ledger and Trial BalanceDocument12 pagesJournal, Ledger and Trial Balanceari purnomoNo ratings yet

- 201 Financial Statement Analysis ProjectDocument11 pages201 Financial Statement Analysis ProjectRol4ndLiNo ratings yet

- Bank Reconciliation Format GuideDocument1 pageBank Reconciliation Format GuideMzee KodiaNo ratings yet

- 15BCC0097 Departmental AccountsDocument9 pages15BCC0097 Departmental AccountsArun KCNo ratings yet

- Corporate Governance and Ethiopian Bank PerformanceDocument99 pagesCorporate Governance and Ethiopian Bank PerformanceNaod MekonnenNo ratings yet

- Dec-13 Leasing Vs Borrowing SolutionDocument1 pageDec-13 Leasing Vs Borrowing Solutiondon_mahinNo ratings yet

- Accounting ProblemsDocument4 pagesAccounting ProblemsChe RoodraNo ratings yet

- Branch AccountingDocument7 pagesBranch AccountingAmit KumarNo ratings yet

- Realtime Transfer Reference No Transaction Date StatusDocument1 pageRealtime Transfer Reference No Transaction Date StatusYoelly DarsoenNo ratings yet

- Ledger account and trial balance of business concernDocument10 pagesLedger account and trial balance of business concernhit2011No ratings yet

- Question Answer Chapter 2 FInancial ReportingDocument4 pagesQuestion Answer Chapter 2 FInancial ReportingnasirNo ratings yet

- Mohammed AbbaTemamDocument92 pagesMohammed AbbaTemamBirhanu Meshesha100% (1)

- Chapter 2 Review Sheet AnswersDocument7 pagesChapter 2 Review Sheet AnswersKenneth DayohNo ratings yet

- Opportunities and Challenges Agent Banking in EthiopiaDocument62 pagesOpportunities and Challenges Agent Banking in Ethiopiahaymanot kaba100% (1)

- Excel Skills - Basic Accounting Template: InstructionsDocument39 pagesExcel Skills - Basic Accounting Template: InstructionsStorage BankNo ratings yet

- Forensic Accounting and Integrated Financial Reporting of Banks Using HausmanDocument11 pagesForensic Accounting and Integrated Financial Reporting of Banks Using HausmanMonika GuptaNo ratings yet

- Polaris Banking NotesDocument51 pagesPolaris Banking NotesPolaris EdutechNo ratings yet

- KVIC PMEGP ManualDocument13 pagesKVIC PMEGP ManualD SRI KRISHNANo ratings yet

- BBAs Semester III Taxation Multiple Choice QuestionsDocument36 pagesBBAs Semester III Taxation Multiple Choice QuestionsSom DasNo ratings yet

- Tally Example SumDocument2 pagesTally Example SumGovindaraj Subramani0% (1)

- Madhu Balance Certificate PDFDocument1 pageMadhu Balance Certificate PDFpavan kumar teppalaNo ratings yet

- Update Acknowledgement - Address Change ConfirmationDocument1 pageUpdate Acknowledgement - Address Change ConfirmationSatya Sharma100% (1)

- Frezer Ayele Final ThesisDocument97 pagesFrezer Ayele Final Thesisyusuf abdella100% (1)

- ICAI Admit Card TitleDocument15 pagesICAI Admit Card TitleSrikanthNo ratings yet

- One-Time Settlement (Ots) Scheme of Npas For Micro, Small & Medium Enterprises (Msme) SectorDocument7 pagesOne-Time Settlement (Ots) Scheme of Npas For Micro, Small & Medium Enterprises (Msme) SectorMadhav KotechaNo ratings yet

- Classification of AccountingDocument11 pagesClassification of AccountingManish DebNo ratings yet

- AccountsDocument24 pagesAccountsManavNo ratings yet

- Write A Latter To The Bank Requesting For Overdraft FacilitiesDocument1 pageWrite A Latter To The Bank Requesting For Overdraft FacilitiesBiswajit BeheraNo ratings yet

- Direct Tax Summary NotesDocument19 pagesDirect Tax Summary NotesSabitriDeviChakraborty50% (2)

- Internship Report On Citizens Bank International Ltd. Maitidevi BranchDocument33 pagesInternship Report On Citizens Bank International Ltd. Maitidevi BranchSajan65No ratings yet

- The Path to Billionaire Status: Mastering Wealth Creation and Success StrategiesFrom EverandThe Path to Billionaire Status: Mastering Wealth Creation and Success StrategiesNo ratings yet

- Unit 8 Bank Reconciliation StatementDocument7 pagesUnit 8 Bank Reconciliation StatementUrja JoshiNo ratings yet

- Principles of Accounting: Section - B By: Ghalib Hussain Class - XIDocument7 pagesPrinciples of Accounting: Section - B By: Ghalib Hussain Class - XIGhalib HussainNo ratings yet

- Boosting cottage industries and SMEs in PakistanDocument2 pagesBoosting cottage industries and SMEs in PakistanGhalib HussainNo ratings yet

- Audit vs Investigation - Key DifferencesDocument2 pagesAudit vs Investigation - Key DifferencesGhalib HussainNo ratings yet

- Agricultural Credit Sources & Green Revolution ExplainedDocument4 pagesAgricultural Credit Sources & Green Revolution ExplainedGhalib HussainNo ratings yet

- Chapter - 3 Agricultural Development: Measures To Remove These ProblemsDocument1 pageChapter - 3 Agricultural Development: Measures To Remove These ProblemsGhalib HussainNo ratings yet

- Cost & MGT AccountingDocument3 pagesCost & MGT AccountingGhalib HussainNo ratings yet

- Income Tax Law DefinitionsDocument17 pagesIncome Tax Law DefinitionsGhalib HussainNo ratings yet

- Features & Advantages of Joint Stock CompaniesDocument2 pagesFeatures & Advantages of Joint Stock CompaniesGhalib HussainNo ratings yet

- Chapter - 3 Agricultural Development By: Ghaib Hussain (GH)Document2 pagesChapter - 3 Agricultural Development By: Ghaib Hussain (GH)Ghalib HussainNo ratings yet

- A Typical Business Organisation May Consist of The Following Main Departments or FunctionsDocument5 pagesA Typical Business Organisation May Consist of The Following Main Departments or FunctionsGhalib HussainNo ratings yet

- Introduction To Economics: The Economic Problem Opportunity Cost Production Possibility FrontiersDocument8 pagesIntroduction To Economics: The Economic Problem Opportunity Cost Production Possibility FrontiersSaad AhmedNo ratings yet

- Chapter - 4 Audit Programme By: Ghalib Hussain: 2. ObjectivesDocument3 pagesChapter - 4 Audit Programme By: Ghalib Hussain: 2. ObjectivesGhalib Hussain100% (1)

- Differenfce Between Various Types of AuditDocument3 pagesDifferenfce Between Various Types of AuditGhalib HussainNo ratings yet

- (Alan Crawford, Samuel R. Mathews, Jim MakinsterDocument252 pages(Alan Crawford, Samuel R. Mathews, Jim Makinstermohammed.habib6259No ratings yet

- ElasticityDocument36 pagesElasticityMiCan CHaiNo ratings yet

- Appointment of AuditorDocument16 pagesAppointment of Auditorshahnawaz243No ratings yet

- 85MoreProbabilityQuestions SolutionsDocument16 pages85MoreProbabilityQuestions SolutionsRam YadavNo ratings yet

- EconomicImpact of COVID19 On PakistantDocument32 pagesEconomicImpact of COVID19 On PakistantGhalib HussainNo ratings yet

- India's Iron & Steel Industry: A Brief HistoryDocument17 pagesIndia's Iron & Steel Industry: A Brief HistoryEMJAY100% (1)

- Preparation of Financial Statements Under The COVID 19 Circumstances PDFDocument67 pagesPreparation of Financial Statements Under The COVID 19 Circumstances PDFFraz AyoubNo ratings yet

- Financial AccountingDocument217 pagesFinancial AccountingGhalib HussainNo ratings yet

- Accounting Equation SummaryDocument4 pagesAccounting Equation SummaryGhalib HussainNo ratings yet

- Practice QuestionDocument1 pagePractice QuestionGhalib HussainNo ratings yet

- Discus The Procedure To Investigate in Case of Suspected FraudDocument1 pageDiscus The Procedure To Investigate in Case of Suspected FraudGhalib HussainNo ratings yet

- Investigation of Embezzlement ProcedureDocument1 pageInvestigation of Embezzlement ProcedureGhalib HussainNo ratings yet

- Breakdown of The Public Sector Development ProgrammeDocument2 pagesBreakdown of The Public Sector Development ProgrammeGhalib HussainNo ratings yet

- Chapter - 4 Industrial Development: Merits of PrivatizationDocument2 pagesChapter - 4 Industrial Development: Merits of PrivatizationGhalib HussainNo ratings yet

- A Brief On The Companies Act, 2017Document78 pagesA Brief On The Companies Act, 2017Adeel KhanNo ratings yet

- Chapter - 5 Audit Working Papers By: Ghalib HussainDocument3 pagesChapter - 5 Audit Working Papers By: Ghalib HussainGhalib HussainNo ratings yet

- FAA Issues AD for Certain Airbus Aircraft to Address Fire Extinguishing System IssueDocument6 pagesFAA Issues AD for Certain Airbus Aircraft to Address Fire Extinguishing System IssueJacob MillerNo ratings yet

- API 660 InterpretationsDocument3 pagesAPI 660 InterpretationsMuhammadShabbir0% (1)

- Ubd Unit PlanDocument4 pagesUbd Unit Planapi-351329785No ratings yet

- Event Policies Interim GuidelinesDocument3 pagesEvent Policies Interim Guidelinesniel doriftoNo ratings yet

- Review of Related Literature and StudiesDocument11 pagesReview of Related Literature and StudiesDevilo AtutuboNo ratings yet

- Philippine EgovernanceDocument25 pagesPhilippine EgovernanceMiriam Hannah BordalloNo ratings yet

- RDO No. 33 - Intramuros-Ermita-MalateDocument1 pageRDO No. 33 - Intramuros-Ermita-MalateMNo ratings yet

- Oh DarlingDocument4 pagesOh DarlingLaurent BotzNo ratings yet

- LIM v. SABAN G.R. No. 163720. December 16, 2004Document3 pagesLIM v. SABAN G.R. No. 163720. December 16, 2004SSNo ratings yet

- Capf Paper 2 e - Book TotalDocument347 pagesCapf Paper 2 e - Book TotalUsman Ahmad KhanNo ratings yet

- All About Indian Administrative System - GK Notes For Bank & SSC Exams! - Testbook Blog PDFDocument7 pagesAll About Indian Administrative System - GK Notes For Bank & SSC Exams! - Testbook Blog PDFArathi NittadukkamNo ratings yet

- Isnad and MatanDocument2 pagesIsnad and MatanAiman Imran0% (1)

- Application Form Draft Print For AllDocument2 pagesApplication Form Draft Print For AllAkNo ratings yet

- The First Epistle of Paul To The CorinthiansDocument14 pagesThe First Epistle of Paul To The Corinthiansmaxi_mikeNo ratings yet

- Disability Rights Mississippi Sues MDOC For Inhumane Prison ConditionsDocument39 pagesDisability Rights Mississippi Sues MDOC For Inhumane Prison ConditionsWLBT NewsNo ratings yet

- Statement of Account: Product: Ca-Gen-Pub-Metro/Urban-Inr Currency: INRDocument1 pageStatement of Account: Product: Ca-Gen-Pub-Metro/Urban-Inr Currency: INRAottry MukherjeeNo ratings yet

- PR HawcoplastDocument2 pagesPR HawcoplastRohan JoshiNo ratings yet

- SN54273, SN54LS273, SN74273, SN74LS273 Octal D-Type Flip-Flop With ClearDocument8 pagesSN54273, SN54LS273, SN74273, SN74LS273 Octal D-Type Flip-Flop With Clearsas999333No ratings yet

- Stan Stuart v. Linda Mendenhall, 11th Cir. (2014)Document12 pagesStan Stuart v. Linda Mendenhall, 11th Cir. (2014)Scribd Government DocsNo ratings yet

- Te Ture Whenua Maori Act 1993Document294 pagesTe Ture Whenua Maori Act 1993:eric:1313No ratings yet

- Rizal's Short BiographyDocument2 pagesRizal's Short BiographyAliah CyrilNo ratings yet

- Shayan Zafar - Fourth Year (R) - Roll 58 - IPR Assignment - Concept of Design in IPRDocument16 pagesShayan Zafar - Fourth Year (R) - Roll 58 - IPR Assignment - Concept of Design in IPRShayan ZafarNo ratings yet

- Assignment On Speluncean ExplorersDocument4 pagesAssignment On Speluncean Explorersnnabuifedumebi8No ratings yet

- Final Result CDS II 14 OTA EnglDocument7 pagesFinal Result CDS II 14 OTA EnglSamarth MehrotraNo ratings yet

- Banking Sector NPA AnalysisDocument53 pagesBanking Sector NPA AnalysischaruNo ratings yet

- Loose Constructionism vs. Strict ConstructionismDocument4 pagesLoose Constructionism vs. Strict ConstructionismClaudia SilvaNo ratings yet