Professional Documents

Culture Documents

Chapter 6 Edited-New

Uploaded by

SUZILAWATI UYOBOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 6 Edited-New

Uploaded by

SUZILAWATI UYOBCopyright:

Available Formats

66

AUDIT EVIDENCE AND

AUDITING PROCEDURE

Learning Outcomes

After studying this chapter, you should be able to:

Describe the types of audit evidence

Explain the quality and adequacy of audit evidence

Discuss the types of audit procedures

Explain the types of audit tests

Discuss the relationship between financial

statement assertions, procedures and audit evidence

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 3

Audit Evidence

Evidence is important for an auditor to draw

conclusion as to whether the financial statements,

as a whole, are free from material misstatement.

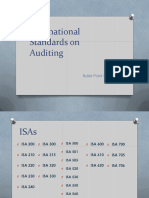

ISA 500 – Audit Evidence

– Enable the auditor to obtain sufficient appropriate

audit evidence to be able to draw reasonable

conclusions on which to base the auditor’s

opinion.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 4

Audit Evidence (cont.)

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 5

Audit Evidence (cont.)

Audit evidence

• cumulative in nature

• obtained from audit procedures performed during

the course of an audit.

Audit evidence: all information used by an auditor

in arriving at the conclusions on which the

auditor’s opinion is based. (ISA 500)

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 6

Audit Evidence (cont.)

Accounting records are also an important source of

audit evidence.

Accounting records (ISA500):

– accounting entries, general and subsidiary

ledgers, journal entries and other adjustments

– supporting records,

– other records

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 7

Sufficient and Appropriate Audit

Evidence

Sufficiency

– the measure of the quantity of audit evidence.

Appropriateness

– The measure of the quality of audit evidence.

– The quality of all audit evidence is affected by the

relevance and reliability of the information it is

based on.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 8

Sufficient and Appropriate Audit

Evidence (cont.)

Factors affecting the quantity of audit evidence

needed :

• The risks of misstatement assessed

• The materiality of accounts

• The quality of the evidence

• The size of a population

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 9

Sufficient and Appropriate Audit

Evidence (cont.)

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 10

Sufficient and Appropriate Audit

Evidence (cont.)

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 11

Sufficient and Appropriate Audit

Evidence (cont.)

Relevance

Relevance means that evidence must be

pertinent to the audit objective being tested.

The auditor must perform relevant procedures to

gather relevant information to be used as audit

evidence.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 12

Sufficient and Appropriate Audit

Evidence (cont.)

Reliability

Reliability means the evidence must be

trustworthy.

The reliability of information is influenced by its

source and nature, and how it is obtained.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 13

Sufficient and Appropriate Audit

Evidence (cont.)

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 14

Types of Audit Procedures

Audit procedures are the methodologies or

techniques to obtain and evaluate audit evidence.

– various audit procedures

– often applied in combination

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 15

Types of Audit Procedures

(cont.)

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 16

Types of Audit Procedures

(cont.)

Inspection

Examining records or documents, or

Inspection

inspecting or counting physical assets

Analytical Procedures

ur l

Ob

ed ica

Evaluations or comparisons of financial

es

01

se

oc yt

information through analysis of

Pr nal

rv

plausible relationships among financial

Observation

at

A

io

and non-financial data

07 02

n

The auditor looking at a process or

procedure being performed by others

Re

Reperformance

pe

06 03 Enquiry

rfo

Enqu

iry

rm

The auditor’s independent execution of Enquiry may range from a formal

an

procedures or controls that were written enquiry to an informal oral

ce

originally performed as part of the

entity’s internal control. 05 04 enquiry

o n

Re ati

cal f irm

cu n

lat

io Co

n

Recalculation Confirmation

Checking the mathematical accuracy A form of audit evidence obtained by

of figures in documents or records auditors directly from an independent

or third party outside the client.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 17

Types of Audit Procedures

(cont.)

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 18

Classification of Audit

Procedures

Risk assessment procedures

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 19

Classification of Audit

Procedures (cont.)

Further audit procedures

Tests of controls:

The audit procedures designed to evaluate the operating

effectiveness of controls in preventing, or detecting and

correcting, material misstatements at the assertion level

01

Substantive procedures

02 The audit procedures designed to detect

material misstatements at the assertion level.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 20

Classification of Audit

Procedures (cont.)

Tests of Controls

Inspection of relevant Observation of the

documentation; entity’s operations;

Reperformance of

Inquiries of appropriate

the application of the

personnel,

control

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 21

Classification of Audit

Procedures (cont.)

Substantive Procedures

test of details of transactions

test of details of account

balances

test of details of

1 2 3

presentation & disclosures

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 22

The Relationship between

Assertions, Audit Procedures

and Types of Evidence

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 23

The Relationship between

Assertions, Audit Procedures

and Types of Evidence (cont.)

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 24

Conclusion

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 25

You might also like

- Information Systems Auditing: The IS Audit Reporting ProcessFrom EverandInformation Systems Auditing: The IS Audit Reporting ProcessRating: 4.5 out of 5 stars4.5/5 (3)

- Chapter 1 EditedDocument10 pagesChapter 1 EditedSUZILAWATI UYOBNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Chapter 1 EditedDocument10 pagesChapter 1 EditedYu Wen LaiNo ratings yet

- Audit Evidence PDFDocument47 pagesAudit Evidence PDFEsa SulyNo ratings yet

- Chapter 4 EditedDocument27 pagesChapter 4 EditedEda LimNo ratings yet

- Chapter 2 EditedDocument27 pagesChapter 2 EditedEda LimNo ratings yet

- Chapter 15 EditedDocument33 pagesChapter 15 Editedjalilah jamaludinNo ratings yet

- 14 AuditingDocument10 pages14 AuditingLuQmanulhafiz RamliNo ratings yet

- Chapter 5 Edited-NewDocument61 pagesChapter 5 Edited-NewSUZILAWATI UYOBNo ratings yet

- Chapter 7 PDFDocument33 pagesChapter 7 PDFJay SunNo ratings yet

- Module 7 - Substantive Test and Documentation (Autosaved)Document32 pagesModule 7 - Substantive Test and Documentation (Autosaved)The Brain Dump PHNo ratings yet

- Nature of Auditing: Suggested ReadingsDocument9 pagesNature of Auditing: Suggested ReadingsMai LinhNo ratings yet

- Audit Process 151107140430 Lva1 App6891 PDFDocument165 pagesAudit Process 151107140430 Lva1 App6891 PDFHalsey Shih TzuNo ratings yet

- Chapter 1 - Nature of Auditing - StudentDocument36 pagesChapter 1 - Nature of Auditing - StudentHuyền My NguyễnNo ratings yet

- Chapter 7 Audit Procedures & Techniques (NSA 520)Document24 pagesChapter 7 Audit Procedures & Techniques (NSA 520)Moksha HunterNo ratings yet

- 審計Chapter01Document69 pages審計Chapter01api-382006375% (4)

- PSA 500 RedraftedDocument11 pagesPSA 500 RedraftedMario LabangNo ratings yet

- Aud339 IntroductionDocument42 pagesAud339 IntroductionJihan SalihNo ratings yet

- Arens Aud16 Inppt07Document40 pagesArens Aud16 Inppt07euncieNo ratings yet

- Chapter I - CisDocument16 pagesChapter I - CisArielle CabritoNo ratings yet

- Auditing and Investigation Lecture 3 Audit Strategy and Audit EvidenceDocument21 pagesAuditing and Investigation Lecture 3 Audit Strategy and Audit EvidenceEdmund TandohNo ratings yet

- ISA Bullet Points For D11Document24 pagesISA Bullet Points For D11Muzamil RaoNo ratings yet

- Objective 7-8 Prepare Organized Audit DocumentationDocument9 pagesObjective 7-8 Prepare Organized Audit Documentationrusaketiupangin XunLuNo ratings yet

- Materi Webinar SA 500 Bukti Audit - Audit Berbasis ISA Studi Kasus Di Indonesia, Australia, Dan SingapuraDocument37 pagesMateri Webinar SA 500 Bukti Audit - Audit Berbasis ISA Studi Kasus Di Indonesia, Australia, Dan SingapuraIkhsan Uiandra Putra SitorusNo ratings yet

- Niosh Sho 13-AuditingDocument45 pagesNiosh Sho 13-AuditingAlif Adha KamalNo ratings yet

- 12 Further Audit Procedures - Substantive TestingDocument6 pages12 Further Audit Procedures - Substantive Testingrandomlungs121223No ratings yet

- Chapter 15 EditedDocument32 pagesChapter 15 EditedHEMALA A/P VEERASINGAM MoeNo ratings yet

- Audit Evidence: ©2003 Prentice Hall Business Publishing, Auditing and Assurance Services 9/e, Arens/Elder/Beasley 7 - 1Document27 pagesAudit Evidence: ©2003 Prentice Hall Business Publishing, Auditing and Assurance Services 9/e, Arens/Elder/Beasley 7 - 1Nabeel MunawarNo ratings yet

- Topic 4 PDFDocument15 pagesTopic 4 PDFIT manNo ratings yet

- Arens Aud16 Inppt07 KKDocument8 pagesArens Aud16 Inppt07 KKUlfa AdirantiNo ratings yet

- 3 Audit EvidenceDocument44 pages3 Audit Evidencewalsonsanaani3rdNo ratings yet

- Yanbu University College: Acct 413 - Auditing & Assurance ServicesDocument37 pagesYanbu University College: Acct 413 - Auditing & Assurance ServicesNora AlghanemNo ratings yet

- Audit Process PDFDocument165 pagesAudit Process PDFRheneir MoraNo ratings yet

- AUDIT Bible Ac2104Document123 pagesAUDIT Bible Ac2104Streak CalmNo ratings yet

- Principles of Auditing Lecture 5Document4 pagesPrinciples of Auditing Lecture 5Isaac PortelliNo ratings yet

- Overview AuditDocument58 pagesOverview AuditRikky Adiwijaya100% (1)

- Chapter 4-Audit EvidenceDocument142 pagesChapter 4-Audit Evidenceabhichavan7722No ratings yet

- Chapter 7Document16 pagesChapter 7hendrixNo ratings yet

- CH 19 GRP AuditDocument39 pagesCH 19 GRP AuditrtttdNo ratings yet

- ACCT413 - Module 3-Sem 211Document77 pagesACCT413 - Module 3-Sem 211Nora AlghanemNo ratings yet

- ACCT413 - Module 3-Sem 211Document77 pagesACCT413 - Module 3-Sem 211Nora AlghanemNo ratings yet

- Microteaching Fix Stie IrmaDocument7 pagesMicroteaching Fix Stie IrmaWA ODE IRMA SARINo ratings yet

- HS 031 Internal AuditDocument16 pagesHS 031 Internal AuditgrantNo ratings yet

- AUD339 (NOTES CP1) - IntroductionDocument21 pagesAUD339 (NOTES CP1) - IntroductionpinocchiooNo ratings yet

- Examinable DocumentsDocument3 pagesExaminable DocumentsKim SoonNo ratings yet

- Audit ProgrammeDocument21 pagesAudit ProgrammeKetan JainNo ratings yet

- Auditing 2Document4 pagesAuditing 2tooru oikawaNo ratings yet

- Unit I Audit OverviewDocument21 pagesUnit I Audit OverviewMark GerwinNo ratings yet

- Chapter 9 EditedDocument27 pagesChapter 9 EditedYu Wen LaiNo ratings yet

- CA. Saju Sreedhar.K, FCADocument22 pagesCA. Saju Sreedhar.K, FCASimon QuinnyNo ratings yet

- The Assurance Services MarketDocument42 pagesThe Assurance Services MarketAn Phan Thị HoàiNo ratings yet

- Art. 1 Pia InglésDocument5 pagesArt. 1 Pia InglésOdalys RivasNo ratings yet

- Arens - Chapter07 Audit Working PaperDocument17 pagesArens - Chapter07 Audit Working Paperpadma adrianaNo ratings yet

- Chapter 3 EditedDocument27 pagesChapter 3 EditedEda LimNo ratings yet

- F8-16 Analytical ProceduresDocument18 pagesF8-16 Analytical ProceduresReever RiverNo ratings yet

- At 02Document5 pagesAt 02Mitch PacienteNo ratings yet

- Auditing AssuranceDocument16 pagesAuditing AssurancesolomonNo ratings yet

- Other Assurance and Non-Assurance EngagementsDocument28 pagesOther Assurance and Non-Assurance EngagementsmerantidownloaderNo ratings yet

- Revision of ISA's and Audit ReportDocument30 pagesRevision of ISA's and Audit ReportZakariya ZuberiNo ratings yet