Professional Documents

Culture Documents

Chapter 3 Edited

Uploaded by

Eda Lim0 ratings0% found this document useful (0 votes)

3 views27 pagesCopyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views27 pagesChapter 3 Edited

Uploaded by

Eda LimCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 27

3

Objectives and Scope of

Financial Statement Audit

Learning Outcomes

After studying this chapter, you should be able to:

Discuss audit objectives and conduct audit

procedures

Explain the auditing work with the underlying

principles governing it

Describe the auditor’s and the management’s

responsibilities

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 3

Introduction

An audit is an independent check of a company's

financial statements that is carried out by a third

party who has nothing to do with the business.

An audit provides assurance that management has

presented a ‘true and fair’ view of a company’s

financial performance and position.

It underpins the trust and obligation of stewardship

between those who manage the company.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 4

Audit Objectives and Basic

Principles Governing an Audit

Basic Principles Governing an Audit

An auditor should comply with the MIA By-Laws (On

Professional Ethics, Conduct and Practice) and the Code

of Ethics for Professional Accountants issued by the

IFAC as the general principles in conducting audit work.

Ethical principles governing the auditor’s professional

responsibilities are:

(a) Integrity: To be straightforward and honest in all

professional and business relationships.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 5

Audit Objectives and Basic

Principles Governing an Audit

(b) Objectivity: To not allow bias, conflict of interest

or undue influence of others to override

professional or business judgements.

(c) Professional competence and due care: To

maintain professional knowledge and skill at the

level required.

(d) Confidentiality: To respect the confidentiality of

information acquired.

(e) Professional behaviour: To comply with relevant

laws and regulations.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 6

Auditor’s Responsibility for

Detecting Fraud

The auditors do not only focus on preventing and

detecting fraud and errors, but also assess the truth

and fairness of the firms’ financial statements.

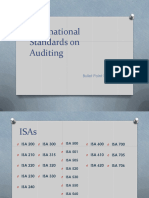

ISA 240 is to establish basic principles and

essential procedures, and to provide guidance on

the auditor’s responsibility to consider fraud in an

audit of financial statements.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 7

Auditor’s Responsibility for

Detecting Fraud (cont.)

The standard distinguishes fraud from error and

describes the two types of fraud that are relevant to

the auditor, that is, misstatements resulting from

misappropriation of assets and misstatements

resulting from fraudulent financial reporting.

It describes the respective responsibilities of those

charged with governance and the management of

the entity for the prevention and detection of fraud.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 8

Auditor’s Responsibility for

Detecting Fraud (cont.)

It also describes the inherent limitations of an audit

in the context of fraud and sets out the

responsibilities of the auditor for detecting material

misstatements due to fraud.

In addition, it requires the auditor to maintain an

attitude of professional scepticism, recognizing the

possibility that a material misstatement due to fraud

could exist.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 9

Auditor’s Responsibility for

Detecting Fraud (cont.)

ISA 240 requires the auditor to:

(a) Perform procedures to obtain information that is

used to identify the risks of material misstatement

due to fraud;

(b) Identify and assess the risks of material

misstatement due to fraud at the financial statement

level and the assertion level; and for those

assessed risks that could result in a material

misstatement due to fraud.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 10

Auditor’s Responsibility for

Detecting Fraud (cont.)

(c) Determine overall responses to address the risks of

material misstatement due to fraud at the financial

statement level and consider the assignment and

supervision of personnel.

(d) Design and perform audit procedures to respond to

the risk of management override of controls.

(e) Determine responses to address the assessed

risks of material misstatement due to fraud.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 11

Auditor’s Responsibility for

Detecting Fraud (cont.)

(f) Consider whether an identified misstatement may

be indicative of fraud.

(g) Obtain written representations from management

relating to fraud.

(h) Communicate with management and those

charged with governance.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 12

Auditor’s Responsibility for

Detecting Fraud (cont.)

The term ‘error’ refers to an unintentional

misstatement in financial statements, including the

omission of an amount or a disclosure, such as the

following:

(a) A mistake in gathering or processing data from

which financial statements are prepared.

(b) An incorrect accounting estimate arising from

oversight or misinterpretation of facts.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 13

Auditor’s Responsibility for

Detecting Fraud (cont.)

(c) A mistake in the application of accounting

principles relating to measurement, recognition,

classification, presentation or disclosure.

The term ‘fraud’ refers to an intentional act by one or

more individuals among management, those charged

with governance, employees, or third parties, involving

the use of deception to obtain an unjust or illegal

advantage.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 14

Auditor’s Responsibility for

Detecting Fraud (cont.)

Responsibilities of the Auditor for Detecting

Material Misstatement Due to Fraud

Audit procedures are designed to detect material

misstatements in the financial statements and focus on

the financial aspects of transactions and events.

Examples of fraudulent financial reporting include:

(a) Manipulating, falsifying or altering records or

documents.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 15

Auditor’s Responsibility for

Detecting Fraud (cont.)

(b) Omitting transactions (e.g. not disclosing a legal

suit in the notes to financial statements).

(c) Intentionally misapplying accounting principles (e.g.

treating an operating lease as a finance lease).

(d) Recording fictitious journal entries.

(e) Inappropriately adjusting assumptions and

changing judgements used.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 16

Auditor’s Responsibility for

Detecting Fraud (cont.)

(f) Omitting, advancing or delaying recognition of

events and transactions (e.g. recognizing December

2016 sales in January 2017).

Examples of misappropriation of assets involving the

theft of an entity’s assets and often committed by

employees include:

(a) Embezzling receipts (money not tally to total in the

receipts report).

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 17

Auditor’s Responsibility for

Detecting Fraud (cont.)

(b) Stealing physical or intellectual assets.

(c) Causing the company to pay for goods and

services not received (e.g. committed by accounts

payable clerk).

(d) Using an entity’s assets for personal use.

The auditor is not and cannot be held responsible for

the prevention of fraud and error.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 18

Auditor’s Responsibility for

Detecting Fraud (cont.)

In the planning stage, the auditor should assess the

risk that fraud and error may cause the financial

statements to contain material misstatements.

Circumstances that may indicate the possibility of

financial statements containing misstatements as

stipulated in the MIA By- Laws are as follows:

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 19

Auditor’s Responsibility for

Detecting Fraud (cont.)

(a) Discrepancies in the accounting records.

(b) Conflicting or missing evidence.

(c) Problematic or unusual relationships between the

auditor and management.

Based on the risk assessment, the auditor should

design audit procedures as to have reasonable

expectation of detecting material misstatement arising

from fraud or error.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 20

Management’s Assertions

Management’s assertions are claims made by

members of management regarding certain aspects

of a business.

The auditors test the validity of these assertions by

conducting a number of audit tests. Assertions are

evaluated within three categories:

(a) Transaction-level assertions.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 21

Management’s Assertions

(cont.)

Accuracy: Full amounts of all transactions were

recorded, without error.

Classification: All transactions have been recorded

within the correct accounts in the general ledger.

Completeness: All business events to which the

company was subjected were recorded.

Cut-off: All transactions were recorded within the

correct reporting period.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 22

Management’s Assertions

(cont.)

Occurrence: Recorded business transactions

actually took place.

(b) Account balance assertions.

Completeness: All reported asset, liability, and

equity balances have been fully reported.

Existence: All account balances exist for assets,

liabilities, and equity.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 23

Management’s Assertions

(cont.)

Rights and obligations: The entity has the rights to

the assets it owns and is obligated under its

reported liabilities.

Valuation: All asset, liability, and equity balances

have been recorded at their proper valuations.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 24

Management’s Assertions

(cont.)

(c) Presentation and disclosure assertions.

Accuracy: All information disclosed is in the correct

amounts, and which reflect their proper values.

Completeness: All transactions that should be

disclosed have been disclosed.

Occurrence: Disclosed transactions have indeed

occurred.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 25

Management’s Assertions

(cont.)

Rights and obligations: Disclosed rights and

obligations actually relate to the reporting entity.

Understand ability: Information included in the

financial statements has been appropriately

presented and is clearly understandable.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 26

Conclusion

The objective of an audit is to enable the auditor to

express an opinion as to whether the financial

statements are prepared, in all material respects, in

accordance with an identified financial reporting

framework.

While the auditor’s opinion adds credibility to the

financial statements, it cannot be held responsible

for the prevention of fraud and error.

FUNDAMENTALS OF AUDITING All Rights Reserved

© Oxford Fajar Sdn. Bhd. (008974-T), 2017 1– 27

You might also like

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Chapter 2 EditedDocument27 pagesChapter 2 EditedEda LimNo ratings yet

- Chapter 15 EditedDocument32 pagesChapter 15 EditedHEMALA A/P VEERASINGAM MoeNo ratings yet

- Chapter 5 Edited-NewDocument61 pagesChapter 5 Edited-NewSUZILAWATI UYOBNo ratings yet

- Chapter 15 EditedDocument33 pagesChapter 15 Editedjalilah jamaludinNo ratings yet

- Chapter 9 EditedDocument27 pagesChapter 9 EditedYu Wen LaiNo ratings yet

- Chapter 1 EditedDocument10 pagesChapter 1 EditedYu Wen LaiNo ratings yet

- Chapter 1 EditedDocument10 pagesChapter 1 EditedSUZILAWATI UYOBNo ratings yet

- CH 19 GRP AuditDocument39 pagesCH 19 GRP AuditrtttdNo ratings yet

- Chapter 1 - Introduction To AccountingDocument23 pagesChapter 1 - Introduction To AccountingJoan Lau50% (2)

- 03 FS Audit OverviewDocument4 pages03 FS Audit Overviewrandomlungs121223No ratings yet

- Topic 4 PDFDocument15 pagesTopic 4 PDFIT manNo ratings yet

- Topic 3 PDFDocument40 pagesTopic 3 PDFIT manNo ratings yet

- CH 1 Introduction To AccountingDocument53 pagesCH 1 Introduction To AccountingUmmu ZubairNo ratings yet

- Audit Engagement Letter SummaryDocument6 pagesAudit Engagement Letter Summaryfatima shakeelNo ratings yet

- Chapter 4 EditedDocument27 pagesChapter 4 EditedEda LimNo ratings yet

- Management Representation Letter State AgenciesDocument6 pagesManagement Representation Letter State AgenciesDecky SulistyoNo ratings yet

- Audited Financial Statements - ATRAM AsiaPlus Equity FundDocument29 pagesAudited Financial Statements - ATRAM AsiaPlus Equity FundKnivesNo ratings yet

- Audit Engagement LetterDocument3 pagesAudit Engagement LetterMakeup Viral StudiosNo ratings yet

- Audit & Assurance Model AnswersDocument12 pagesAudit & Assurance Model AnswersS M Wadud TuhinNo ratings yet

- Audit Must Do List!! (Nov - 2021) - 211128 - 234249Document59 pagesAudit Must Do List!! (Nov - 2021) - 211128 - 234249Anjali agrawNo ratings yet

- ISA Bullet Points For D11Document24 pagesISA Bullet Points For D11Muzamil RaoNo ratings yet

- Financial MGTDocument29 pagesFinancial MGTsyakirahNo ratings yet

- AT-04 (Financial Statements Audit Overview)Document5 pagesAT-04 (Financial Statements Audit Overview)Soremn PotatoheadNo ratings yet

- Auditing Chapter 1Document7 pagesAuditing Chapter 1Sigei LeonardNo ratings yet

- Audit Suggested Ans CA Inter Nov 20Document14 pagesAudit Suggested Ans CA Inter Nov 20Priyansh KhatriNo ratings yet

- CH 5 Audit Evidence 2015Document101 pagesCH 5 Audit Evidence 2015simaNo ratings yet

- Semester 1 - PAPER IDocument7 pagesSemester 1 - PAPER IShilongo OliviaNo ratings yet

- Basic ConceptsDocument5 pagesBasic Conceptshaziquehussain8959No ratings yet

- AUTC - PPM - WI 3 Financial ManagementDocument9 pagesAUTC - PPM - WI 3 Financial ManagementPeterNo ratings yet

- Summary of Audit & Assurance Application Level - Self Test With Immediate AnswerDocument72 pagesSummary of Audit & Assurance Application Level - Self Test With Immediate AnswerIQBAL MAHMUDNo ratings yet

- Financial Management 5Document2 pagesFinancial Management 5yeowyangNo ratings yet

- Audit-of-Historical-Financial-Statement (1)Document8 pagesAudit-of-Historical-Financial-Statement (1)badelacuadraNo ratings yet

- Lecture 08 Ch04Document12 pagesLecture 08 Ch04nanaNo ratings yet

- Topic 4 - Revenue N ExpsDocument29 pagesTopic 4 - Revenue N ExpsPrince RyanNo ratings yet

- Chapter 2 Forensic Auditing and Fraud InvestigationDocument92 pagesChapter 2 Forensic Auditing and Fraud Investigationabel habtamuNo ratings yet

- Topic I - Demand For Auditing and Assurance ServicesDocument7 pagesTopic I - Demand For Auditing and Assurance ServicesaragonkaycyNo ratings yet

- AFM Unit IDocument75 pagesAFM Unit Ifhq54148No ratings yet

- CH 1 Question Bank INTER & IPCCDocument24 pagesCH 1 Question Bank INTER & IPCCjamboNo ratings yet

- Chapter Three - Auditing IDocument12 pagesChapter Three - Auditing ITesfaye DiribaNo ratings yet

- Ernst Young: Audit Engagement LetterDocument10 pagesErnst Young: Audit Engagement LetterSyed Shafqat Shah0% (1)

- Accept Affects The Sample Size Required. The Lower The Risk The Auditor Is Willing To Accept, The Greater The Sample Size Will Need To BeDocument11 pagesAccept Affects The Sample Size Required. The Lower The Risk The Auditor Is Willing To Accept, The Greater The Sample Size Will Need To BeGao YungNo ratings yet

- Chapter 4Document7 pagesChapter 4syrexdestroyerNo ratings yet

- © The Institute of Chartered Accountants of India: (2 X 7 14 Marks)Document14 pages© The Institute of Chartered Accountants of India: (2 X 7 14 Marks)Kirthiga dhinakaranNo ratings yet

- Appendix-1.2 - Engagement-Letter-ISPSC (Sta. Maria Campus)Document4 pagesAppendix-1.2 - Engagement-Letter-ISPSC (Sta. Maria Campus)Jasmine Kay ReyesNo ratings yet

- Financial Reporting and Audit Evidence: by Mwamba Ally Jingu: Fcpa PHDDocument20 pagesFinancial Reporting and Audit Evidence: by Mwamba Ally Jingu: Fcpa PHDAdil KhamisNo ratings yet

- Arens Auditing16e SM 10Document30 pagesArens Auditing16e SM 10김현중100% (1)

- Topic 1 - Conceptual FrameworkDocument40 pagesTopic 1 - Conceptual FrameworkPrince RyanNo ratings yet

- Appendix 1.2 - Engagement Letter UNPDocument4 pagesAppendix 1.2 - Engagement Letter UNPJasmine Kay ReyesNo ratings yet

- Republic of The Philippines Commission On AuditDocument4 pagesRepublic of The Philippines Commission On AuditTahani Awar GurarNo ratings yet

- Sas 110Document23 pagesSas 110Jhayanti Nithyananda KalyaniNo ratings yet

- Disclaimer: © The Institute of Chartered Accountants of IndiaDocument17 pagesDisclaimer: © The Institute of Chartered Accountants of IndiaRakesh SoniNo ratings yet

- Audit Practice and Assurance Services - A1.4 PDFDocument94 pagesAudit Practice and Assurance Services - A1.4 PDFFRANCOIS NKUNDIMANANo ratings yet

- Audit Risk ComponentsDocument5 pagesAudit Risk ComponentsCyra EllaineNo ratings yet

- Auditing Standards and Client AcceptanceDocument27 pagesAuditing Standards and Client AcceptanceSarim Ahmad100% (1)

- Audit1 QADocument8 pagesAudit1 QAAmjath JamalNo ratings yet

- The Conceptual Framework For Financial ReportingDocument15 pagesThe Conceptual Framework For Financial ReportingatikahNo ratings yet

- Introduction To Financial Statement AuditDocument28 pagesIntroduction To Financial Statement AuditJnn CycNo ratings yet

- PSAE 3400 (Previously PSA 810)Document15 pagesPSAE 3400 (Previously PSA 810)Gon FreecsNo ratings yet

- Tutorial Chapter 6Document3 pagesTutorial Chapter 6Eda LimNo ratings yet

- Case Study (Weakness)Document8 pagesCase Study (Weakness)Eda LimNo ratings yet

- Chapter 4 EditedDocument27 pagesChapter 4 EditedEda LimNo ratings yet

- Chapter 1 EditedDocument10 pagesChapter 1 EditedYu Wen LaiNo ratings yet

- Lean-burn gas generator sets technical specificationsDocument2 pagesLean-burn gas generator sets technical specificationsHector IuspaNo ratings yet

- Generac Generac CAT MTU Cummins KohlerDocument3 pagesGenerac Generac CAT MTU Cummins KohlerJuly E. Maldonado M.No ratings yet

- Comparison and Evaluation of Anti-Windup PI Controllers: Xin-Lan Li, Jong-Gyu Park, and Hwi-Beom ShinDocument6 pagesComparison and Evaluation of Anti-Windup PI Controllers: Xin-Lan Li, Jong-Gyu Park, and Hwi-Beom ShinsaeedNo ratings yet

- Advances in Littorinid BiologyDocument193 pagesAdvances in Littorinid Biologyasaad lahmarNo ratings yet

- Fibre OpticDocument16 pagesFibre OpticJoanna BaileyNo ratings yet

- 2.5 PsedoCodeErrorsDocument35 pages2.5 PsedoCodeErrorsAli RazaNo ratings yet

- Automating The Procure To Pay ProcessDocument47 pagesAutomating The Procure To Pay Processfloatingbrain88% (8)

- Lecture Notes Natural LawDocument52 pagesLecture Notes Natural LawVina EstherNo ratings yet

- CHAPTER 9 Microsoft Excel 2016 Back ExerciseDocument3 pagesCHAPTER 9 Microsoft Excel 2016 Back ExerciseGargi SinghNo ratings yet

- Intolrableboss IIMB DisplayDocument2 pagesIntolrableboss IIMB DisplayMansi ParmarNo ratings yet

- Travelstar 25GS, 18GT, & 12GN: Quick Installation GuideDocument2 pagesTravelstar 25GS, 18GT, & 12GN: Quick Installation Guidebim2009No ratings yet

- 19bcd7246 Assignment2 L27+L28+L31+L32Document7 pages19bcd7246 Assignment2 L27+L28+L31+L32Sriharshitha DeepalaNo ratings yet

- A Knowledge Management Approach To Organizational Competitive Advantage Evidence From The Food SectorDocument13 pagesA Knowledge Management Approach To Organizational Competitive Advantage Evidence From The Food SectorJack WenNo ratings yet

- Technical Service Information: Ford/Lincoln/Mercury 6F50NDocument18 pagesTechnical Service Information: Ford/Lincoln/Mercury 6F50NPlanta Damiana2No ratings yet

- Tia PortalDocument46 pagesTia PortalAndré GomesNo ratings yet

- Analysis of Wood Bending PropertiesDocument11 pagesAnalysis of Wood Bending Propertiesprasanna020391100% (1)

- Yearly Lesson Plan LK Form 5Document26 pagesYearly Lesson Plan LK Form 5Nur'ain Abd RahimNo ratings yet

- DLL Els Quarter 1 Week 5Document4 pagesDLL Els Quarter 1 Week 5alyssa.ballonNo ratings yet

- Human Rights Law IntroductionDocument8 pagesHuman Rights Law IntroductionXander ZingapanNo ratings yet

- Challenges of Deep Excavation for KVMRT StationsDocument85 pagesChallenges of Deep Excavation for KVMRT StationsAlwin AntonyNo ratings yet

- 8.4.3 Alien Genetics LabDocument2 pages8.4.3 Alien Genetics LabCharles KnightNo ratings yet

- MSC - Nastran 2014 Linear Static Analysis User's Guide PDFDocument762 pagesMSC - Nastran 2014 Linear Static Analysis User's Guide PDFFeiNo ratings yet

- BI and Analytics Design Workshop TemplateDocument20 pagesBI and Analytics Design Workshop TemplateMiftahul HudaNo ratings yet

- UNIT-I Problems (PSE EEE)Document6 pagesUNIT-I Problems (PSE EEE)Aditya JhaNo ratings yet

- Standards and Their ClassificationsDocument3 pagesStandards and Their ClassificationsJoecelle AbleginaNo ratings yet

- Domestic Water-Supply - TheoryDocument19 pagesDomestic Water-Supply - Theoryyarzar17No ratings yet

- Scope of WorkDocument4 pagesScope of WorkMathivanan AnbazhaganNo ratings yet

- LP Fuel Gas SystemDocument6 pagesLP Fuel Gas SystemAnonymous QSfDsVxjZNo ratings yet

- ST 30 PDFDocument2 pagesST 30 PDFafiffathin_akramNo ratings yet

- UKPSC JE Civil 2024 Exam (Technical) - ScheduleDocument4 pagesUKPSC JE Civil 2024 Exam (Technical) - ScheduleIES-GATEWizNo ratings yet