Professional Documents

Culture Documents

Ipsas 23 - Revenue From Non Exchange Transaction 2

Uploaded by

nemz25930 ratings0% found this document useful (0 votes)

5 views36 pagesThis document summarizes the key aspects of IPSAS 23 on revenue from non-exchange transactions. It defines non-exchange revenue and the types of transactions that fall under this, including taxes, transfers, grants, debt forgiveness, fines, bequests, gifts and donations. It outlines the criteria for recognizing these revenues, such as when an asset is controlled, and how to initially measure the asset. Specific guidance is provided on recognizing and measuring revenue from taxes, transfers, debt forgiveness, fines, bequests, gifts and donations.

Original Description:

Original Title

5. Ipsas 23 - Revenue From Non Exchange Transaction 2

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the key aspects of IPSAS 23 on revenue from non-exchange transactions. It defines non-exchange revenue and the types of transactions that fall under this, including taxes, transfers, grants, debt forgiveness, fines, bequests, gifts and donations. It outlines the criteria for recognizing these revenues, such as when an asset is controlled, and how to initially measure the asset. Specific guidance is provided on recognizing and measuring revenue from taxes, transfers, debt forgiveness, fines, bequests, gifts and donations.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views36 pagesIpsas 23 - Revenue From Non Exchange Transaction 2

Uploaded by

nemz2593This document summarizes the key aspects of IPSAS 23 on revenue from non-exchange transactions. It defines non-exchange revenue and the types of transactions that fall under this, including taxes, transfers, grants, debt forgiveness, fines, bequests, gifts and donations. It outlines the criteria for recognizing these revenues, such as when an asset is controlled, and how to initially measure the asset. Specific guidance is provided on recognizing and measuring revenue from taxes, transfers, debt forgiveness, fines, bequests, gifts and donations.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 36

IPSAS 23: REVENUE

FROM NON EXCHANGE

TRANSACTIONS

Objective

• The objective of this Standard is to prescribe requirements

for the financial reporting of revenue arising from non-

exchange transactions.

• This Standard deals with issues that need to be considered in

recognizing and measuring revenue from non-exchange

transactions, including the identification of contributions

from owners.

Scope

• An entity that prepares and presents financial statements under the

accrual basis of accounting shall apply this Standard in accounting for

revenue from non-exchange transactions.

• Revenues received by public sector entities arise from both exchange

and non-exchange transactions

• The majority of public sector entities revenue is derived from non-

exchange transactions, such as taxes and transfers (whether cash or

non-cash), including grants, debt forgiveness, fines, bequests, gifts,

donations, goods and services in-kind.

Key terms

• Revenue comprises gross inflows of economic benefits or service potential

received and receivable by the reporting entity, which represents an increase

in net assets/equity, other than increases relating to contributions from

owners.

• Conditions on transferred assets are stipulations that specify that the future

economic benefits or service potential embodied in the asset is required to be

consumed by the recipient as specified, otherwise, must be returned to the

transferor.

• Restrictions on transferred assets are stipulations that limit or direct the

purposes for which a transferred asset may be used, but do not specify that

future economic benefits or service potential is required to be returned to the

transferor if not deployed as specified.

Cont.

• Subsidized price is a price that is not approximately equal to the fair

value of the goods sold, that transaction falls within the definition of a

non-exchange transaction

Cont.

• Fines are economic benefits or service potential received or receivable

by public sector entities, as determined by a court or other law

enforcement body, as a consequence of the breach of laws or

regulations.

• Taxes are economic benefits or service potential compulsorily paid or

payable to public sector entities, in accordance with laws and/or

regulations, established to provide revenue to the government.

• The taxable event is the event that the government, legislature, or

other authority has determined will be subject to taxation

Recognition

• Initial measurement of assets

• An inflow of resources from a non-exchange transaction that meets the

definition of an asset is recognized as an asset when, and only when:

It is probable that the future economic benefits or service potential

associated with the asset will flow to the entity; and

The fair value of the asset can be measured reliably.

Taxes

Taxes are defined as economic benefits compulsorily paid or payable

to public sector entities, in accordance with laws or regulation,

established to provide revenue to the government, excluding fines or

other penalties imposed for breaches of laws or regulation.

Taxes satisfy the definition of “non-exchange transaction” because the

taxpayer transfers resources to the government, without receiving

approximately equal value directly in exchange.

While the taxpayer may benefit from a range of social policies

established by the government, these are not provided directly in

exchange as consideration for the payment of taxes.

The Taxable Event-Recognition of taxes

An asset in respect of taxes is recognized together with an equivalent

amount of revenue when the taxable event occurs

I. Income tax is the earning of assessable income during the taxation period by

the taxpayer.

II. Value added tax is the undertaking of taxable activity during the taxation

period by the taxpayer.

III.Goods and services tax is the purchase or sale of taxable goods and services

during the taxation period.

IV.Customs duty is the movement of dutiable goods or services across the

customs boundary.

V. Property tax is the passing of the date on which the tax is levied, or the

period for which the tax is levied, if the tax is levied on a periodic basis.

Transfers/Grants

• A common attribute of Transfers is that they transfer resources from

one entity to another without providing approximately equal value

in exchange, and are not taxes.

• Receiving entity should recognize an asset in respect of transfers

when the transferred resources met the definition of an asset and

satisfy the criteria for recognition as an asset.

• Transfers of resources that satisfy the definition of contributions

from owners will not give rise to revenue.

• Transferred assets be measured at their fair value.

Transfers

• An entity shall recognize an asset in respect of transfers when the

transferred resources meet the definition of an asset and satisfy the

criteria for recognition as an asset.

• Transfers include:-

• Grants, debt forgiveness, fines, bequests, gifts, donations, and goods

and services in-kind.

• All these items have the common attribute that they transfer resources

from one entity to another without providing approximately equal

value in exchange, and are not taxes

Debt Forgiveness

• Lenders will sometimes waive their right to collect a debt owed by a

public sector entity by canceling the debt.

• Entities recognize revenue in respect of debt forgiveness when the

former debt no longer meets the definition of a liability or satisfies the

criteria for recognition as a liability, provided that the debt forgiveness

does not satisfy the definition of a contribution from owners.

• Revenue arising from debt forgiveness is measured at the carrying

amount of the debt forgiven

Fines

• Fines are economic benefits or service potential received or receivable

by a public sector entity, from an individual or other entity, as

determined by a court or other law enforcement body, as a

consequence of the individual or other entity breaching the

requirements of laws or regulations.

• Fines are recognized as revenue when the receivable meets the

definition of an asset and satisfies the criteria for recognition as an

asset

Bequests

• A bequest is a transfer made according to the provisions of a deceased person’s

will.

• The past event giving rise to the control of resources embodying future economic

benefits or service potential for a bequest occurs when the entity has an

enforceable claim for example on the death of the testator or the granting of

probate, depending on the laws of the jurisdiction.

• Bequests that satisfy the definition of an asset are recognized as assets and

revenue when it is probable that the future economic benefits or service potential

will flow to the entity, and the fair value of the assets can be measured reliably.

• The fair value of bequeathed assets is determined in the same manner as for gifts

and donations and are measured at the fair value of the resources received or

receivable.

Gifts and Donations

Gifts and donations are voluntary transfers of assets including cash or

other monetary assets, goods in-kind, and services in-kind that one

entity makes to another, normally free from stipulations.

For gifts and donations of cash or other monetary assets and goods in-

kind, the past event giving rise to the control of resources embodying

future economic benefits or service potential is normally the receipt of

the gift or donation.

Cont.

• Gifts and donations are recognized as assets and revenue when it is

probable that the future economic benefits or service potential will

flow to the entity and the fair value of the assets can be measured

reliably.

• Goods in-kind are recognized as assets when the goods are received,

or there is a binding arrangement to receive the goods.

If goods in-kind are received without conditions attached, revenue is

recognized immediately.

If conditions are attached, a liability is recognized, which is reduced

and revenue recognized as the conditions are satisfied

Cont.

On initial recognition, gifts and donations including goods in-kind are

measured at their fair value as at the date of acquisition, which may be

ascertained by reference to an active market, or by appraisal.

An appraisal of the value of an asset is normally undertaken by a

member of the valuation profession who holds a recognized and

relevant professional qualification.

Pledges

• Pledges are unenforceable undertakings to transfer assets to the

recipient entity.

• Pledges do not meet the definition of an asset, because the recipient

entity is unable to control the access of the transferor to the future

economic benefits or service potential embodied in the item pledged.

• Entities do not recognize pledged items as assets or revenue. If the

pledged item is subsequently transferred to the recipient entity, it is

recognized as a gift or donation.

Advance Receipts of Transfers

• Where an entity receives resources before a transfer arrangement

becomes binding the resources are recognized as an asset when they

meet the definition of an asset and satisfy the criteria for recognition

as an asset.

• The entity will also recognize an advance receipt liability if the

transfer arrangement is not yet binding.

• When that event occurs and all other conditions under the agreement

are fulfilled, the liability is discharged and revenue is recognized

Concessionary Loans

Concessionary loans are loans received by an entity at below market

terms.

The portion of the loan that is repayable, along with any interest

payments, is an exchange transaction and is accounted for in accordance

with IPSAS 29.

An entity considers whether any difference between the transaction

price (loan proceeds) and the fair value of the loan on initial recognition

is non-exchange revenue that should be accounted for in accordance

with this Standard.

STIPULATIONS

• Stipulations are laws, regulations, or binding arrangements with

external parties imposing terms on the use of transferred assets by the

recipient

• Stipulations comprise either

• Conditions; or

• Restrictions

• Stipulations are enforceable through legal or administrative processes

Types of stipulations

Conditions on transferred assets:

• Stipulations that specify that the future economic benefits or

service potential embodied in the asset is required to be

consumed by the recipient as specified or must be returned to the

transferor

Restrictions on transferred assets:

• Stipulations that limit or direct the purposes for which a

transferred asset may be used, but does not specify that future

economic benefits or service potential is required to be returned

to the transferor if not deployed as specified

Stipulations – Conditions

Conditions on transferred assets:

• Conditions require that the entity either:

• Consumes the future economic benefits / service

potential as specified, or Return future economic

benefits / service potential to transferor if conditions are

breached

• Entity therefore incurs a present obligation, as stipulated or

else to return to the transferor future economic benefits or

service potential.

• Liability is recognised at gross amount

Stipulations - Restrictions

• Restrictions on transferred assets:

• No requirement to return the future economic benefits /

service potential if the asset is not deployed as specified

• Therefore no present obligation

• Breaches of restrictions may result in penalties – not the

result of acquiring the asset, but of breaching the

restriction

• Revenue is recognized at a gross amount.

Disclosures

An entity shall disclose the following:

(a) The amount of revenue from non-exchange transactions recognized

during the period by major classes showing separately:

(i) Taxes, showing separately major classes of taxes; and

(ii) Transfers, showing separately major classes of transfer revenue.

(b) The amount of receivables recognized in respect of non-exchange

revenue;

Disclosures

c) The amount of liabilities recognized in respect of transferred assets

subject to conditions;

d) The amount of assets recognized that are subject to restrictions and

the nature of those restrictions;

e) The existence and amounts of any advance receipts in respect of

non-exchange transactions; and

f) The amount of any liabilities forgiven

Disclosures

An entity shall disclose in the notes:

(a) The accounting policies adopted for the recognition of revenue from

non-exchange transactions;

(b) For major classes of revenue from non-exchange transactions, the

basis on which the fair value of inflowing resources was measured;

(c) For major classes of taxation revenue that the entity cannot measure

reliably during the period in which the taxable event occurs, information

about the nature of the tax; and

(d) The nature and type of major classes of bequests, gifts, and

donations, showing separately major classes of goods in-kind received.

Example 1

On 1st July 2021, Local Government A received TZS 12 billion from

donors of a Malaria Project. Transfer agreement specified that 80% of

the transfer should be used in buying motor vehicles in Malaria Project,

and 20% to be used in other Malaria Project administrative activities,

but does not specify that the fund to be returned if not used as specified.

As at 30th June 2022 the Ministry used 40% of the transfer in the

administrative activities not related to Malaria Project, and 50% of the

transfer was used for buying 30 motor vehicles to be used in Malaria

Project.

You are an accountant of Local Government A Indicates treatment of the

transfer received

Example 1-Treatment

• Local government A recognizes the fund received as an

asset in the statement of financial position.

• As there is no condition attached to the fund received ,

therefore Local Government A recognize revenue in the

statement of financial performance.

• Dr. Cash 12 Billion

• Cr. Revenue 12 Billion

Example 2

On 30th July 2021, Local Government A received a transfer of TZS 4.5 billion from the

Treasury. The analysis shows that the transfer was for construction of hospital Building (TZS

4 billion) and management travelling and per-diems (TZS 500 million). Transfer agreement

specifies that, Local Government A will be required to prepare a report indicating how the

received fund has been utilized during the year and the transfer agreement specify further that

the transferred amount be spent as specified during the year otherwise be returned to the

Treasury. As of 30th June 2022, all funds for management travelling and per-diems were spent

as specified, only 75% of the funds allocated for construction of hospital building was utilized.

The Accountant General asked the Chief Accountant of the Ministry of Health to consider the

stipulations in the grant agreement and exchequer agreement when recording funds from donors

and the Treasury.

Required:

Write a Memo to the Chief Accountant of the Ministry of Health indicating the following: -

i. The difference between conditions and restrictions.

ii. Treatment of the above transactions in the books of accounts for the year ended 30th June

2022

(i) The difference between condition and restrictions

Conditions:

• Stipulations that specify that the future economic benefits or

service potential embodied in the asset is required to be consumed

by the recipient as specified or must be returned to the transferor

Restrictions:

• Stipulations that limit or direct the purposes for which a transferred

asset may be used, but does not specify that future economic

benefits or service potential is required to be returned to the

transferor if not deployed as specified

Example 2-Treatment

• Therefore a liability is also recognized in respect of the condition attached to the

grant.

Initial recognition

• DR.Cash 4.5 B

• Cr. Deferred Revenue 4.5 B

Subsequent recognition

• As the Local Government A satisfies the condition, that is, as it makes

authorized expenditures, it reduces the liability and recognizes revenue in the

statement of financial performance of the reporting period in which the liability is

discharged.

• Dr. Deferred Revenue 3.5 B

• Cr.Revenue 3.5 B

Example 3

The national government (transferor) transfers 200 hectares of land in

a major city to a university (reporting entity) for the establishment of

a university campus. The transfer agreement specifies that the land is

to be used for a campus, but does not specify that the land is to be

returned if not used for a campus.

Required:

You are an accountant of university, show the necessary journal entry.

Example 4

Entity A in public sector received 5 motor vehicles from

development partner B . The received motor vehicles were not

attached with any condition. Entity A assessed the fair value of the

received motor vehicle to be TZS200,000,000 each. It further

determined that the useful life of the received motor vehicles to be 5

years.

Required:

As an accountant show the accounting treatment of the 5 motor

vehicles.

Example 5

A public school (reporting entity) purchases land with a fair value of TZS

10,000,000 for TZS 5,000,000 from a local government. A reporting entity

concludes that the non-exchange transaction comprises two components, an

exchange component and a non-exchange component.

Required:

Show an accounting treatment

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- CCC Agnpo Lesson5 2021 2022Document4 pagesCCC Agnpo Lesson5 2021 2022Jr PedidaNo ratings yet

- 4 - CHAPTER - Revenue & Other ReceiptsDocument61 pages4 - CHAPTER - Revenue & Other ReceiptsJoebet Debuyan100% (2)

- Chapter 4 Revenue and Other ReceiptsDocument46 pagesChapter 4 Revenue and Other Receiptsroselynm18100% (1)

- Acctg For Revenue and Other ReceiptsDocument6 pagesAcctg For Revenue and Other ReceiptsLeonard CanamoNo ratings yet

- Government AccountingDocument22 pagesGovernment Accountingkris4aleya4domingo4sNo ratings yet

- Chapter 4Document8 pagesChapter 4ShantalNo ratings yet

- Chapter 4Document46 pagesChapter 4Clove Wall100% (1)

- Revenue and Other Receipts: Revenue From Exchange TransactionsDocument6 pagesRevenue and Other Receipts: Revenue From Exchange TransactionsMaria Cecilia ReyesNo ratings yet

- Accounting For Revenue and Other Receipts: Instructor: Rey C. Ramonal, CPADocument13 pagesAccounting For Revenue and Other Receipts: Instructor: Rey C. Ramonal, CPACarlo manejaNo ratings yet

- Revenue and Other Receipts - ScriptDocument30 pagesRevenue and Other Receipts - ScriptChristine Leal-Estender100% (2)

- Ipsas - 9 - Revenue From Exchange TransactionDocument24 pagesIpsas - 9 - Revenue From Exchange TransactionduncanNo ratings yet

- A.) Prea5 Module 3.1Document18 pagesA.) Prea5 Module 3.1Hana SukoshiNo ratings yet

- Chapter 5 Accounting For Revenue and Other ReceiptsDocument49 pagesChapter 5 Accounting For Revenue and Other ReceiptsKapoy-eeh LazanNo ratings yet

- Chapter 5Document40 pagesChapter 5Celine ClaudioNo ratings yet

- Revenues and Other ReceiptsDocument45 pagesRevenues and Other ReceiptsFrank James100% (1)

- CCC Agnpo Lesson4 2021 2022Document4 pagesCCC Agnpo Lesson4 2021 2022Jr PedidaNo ratings yet

- Government+Accounting 5 Revenue+and+Other+ReceiptsDocument21 pagesGovernment+Accounting 5 Revenue+and+Other+ReceiptsMaxene Joi PigtainNo ratings yet

- Reviewer Pfrs 15 Revenue From Contracts With CustomersDocument4 pagesReviewer Pfrs 15 Revenue From Contracts With CustomersMaria TheresaNo ratings yet

- Module 4. Revenues and Other ReceiptsDocument10 pagesModule 4. Revenues and Other ReceiptsAbegail CadacioNo ratings yet

- Reviewer PFRS 15 Revenue From Contracts With CustomersDocument4 pagesReviewer PFRS 15 Revenue From Contracts With CustomersJezela CastilloNo ratings yet

- Chapter 6 - Accounting For Revenue and Other ReceiptsDocument7 pagesChapter 6 - Accounting For Revenue and Other ReceiptsAdan EveNo ratings yet

- Chapter 3 Accounting For Revenue Other ReceiptsDocument15 pagesChapter 3 Accounting For Revenue Other ReceiptsSuzanne SenadreNo ratings yet

- PAS 39 Financial Instruments Recognition and MeasurementsDocument51 pagesPAS 39 Financial Instruments Recognition and MeasurementsSherry Mae Malabago93% (14)

- Accgov Revenues Receiptsmidterm Wk3Document32 pagesAccgov Revenues Receiptsmidterm Wk3Christine Joyce MagoteNo ratings yet

- Topic Four: Full Accrual Financial Reporting Under Ipsas: Ibrahim YDocument22 pagesTopic Four: Full Accrual Financial Reporting Under Ipsas: Ibrahim YProf. SchleidenNo ratings yet

- Intermediate Accounting ReviewerDocument5 pagesIntermediate Accounting ReviewerBroniNo ratings yet

- Chapter 4 Revenues and Other ReceiptsDocument10 pagesChapter 4 Revenues and Other ReceiptsKyree VladeNo ratings yet

- Probiotec Annual Report 2021 6Document8 pagesProbiotec Annual Report 2021 6楊敬宇No ratings yet

- PH Gam - Revenues and Other ReceiptsDocument7 pagesPH Gam - Revenues and Other ReceiptsNabelah OdalNo ratings yet

- DYBSAAgn313 - Accounting For Government & Non-Profit Organizations (SEMI-FINAL MODULE)Document14 pagesDYBSAAgn313 - Accounting For Government & Non-Profit Organizations (SEMI-FINAL MODULE)Jonnafe Almendralejo IntanoNo ratings yet

- Government Accounting'Document22 pagesGovernment Accounting'Jayvee FelipeNo ratings yet

- Revenues and Other ReceiptsDocument28 pagesRevenues and Other ReceiptsJV100% (1)

- Unit 3 Revenue AccountingDocument20 pagesUnit 3 Revenue Accountingjatin4verma-2No ratings yet

- Section 11Document30 pagesSection 11Abata BageyuNo ratings yet

- Revenue and Other Receipts Sec. 1. Scope. This Chapter Provides The Standards, Policies, Guidelines, andDocument5 pagesRevenue and Other Receipts Sec. 1. Scope. This Chapter Provides The Standards, Policies, Guidelines, andimsana minatozakiNo ratings yet

- TaxationDocument12 pagesTaxationUwuNo ratings yet

- Govacc 6Document2 pagesGovacc 6bless villahermosaNo ratings yet

- Lesson 5 - Statement of Financial Position (Part 1)Document10 pagesLesson 5 - Statement of Financial Position (Part 1)yana jungNo ratings yet

- Chapter 4 - Reveneus and Other ReceiptsDocument57 pagesChapter 4 - Reveneus and Other ReceiptsBENITEZ, DIANNE ASHLEY G.100% (1)

- The Government Accounting ProcessDocument21 pagesThe Government Accounting ProcesskripsNo ratings yet

- Government Accounting Chapter 6Document33 pagesGovernment Accounting Chapter 6Charlagne LacreNo ratings yet

- Government Accounting ReviewerDocument8 pagesGovernment Accounting ReviewerJoana loize CapistranoNo ratings yet

- Accounts Receivable System For TPITDocument6 pagesAccounts Receivable System For TPITFokso FutekoNo ratings yet

- Chapter 4 Revenues and Other Receipts PDFDocument5 pagesChapter 4 Revenues and Other Receipts PDFSteffany Roque100% (1)

- 4 Revenue 30 QuestionsDocument5 pages4 Revenue 30 QuestionsEzer Cruz BarrantesNo ratings yet

- Chapter Elements of FSDocument15 pagesChapter Elements of FSangellachavezlabalan.cpalawyerNo ratings yet

- Chap 5-Revenue Other ReceiptsDocument30 pagesChap 5-Revenue Other ReceiptsSarina Amor Paderan Cabacaba100% (1)

- Debit Note & Credit NoteDocument9 pagesDebit Note & Credit NoteconciliataxesNo ratings yet

- IFRS 2 ShareDocument5 pagesIFRS 2 ShareSaadiq HuseenNo ratings yet

- 2 - Share-Based PaymentDocument31 pages2 - Share-Based Paymentjecille magalongNo ratings yet

- SWIFT Notes To Financial StatementsDocument11 pagesSWIFT Notes To Financial StatementsArvin TejonesNo ratings yet

- Financial Instrument v.03Document49 pagesFinancial Instrument v.03ashaheen2704No ratings yet

- Assessment - Revenue and Other ReceiptsDocument3 pagesAssessment - Revenue and Other ReceiptsKhryzell Guill Villanueva LagurinNo ratings yet

- Elements of Accounting 1Document13 pagesElements of Accounting 1REOL RAMNo ratings yet

- 1693016198provisions, Contingencies, and Events After The Reporting PeriodDocument28 pages1693016198provisions, Contingencies, and Events After The Reporting PeriodChamil SureshNo ratings yet

- Measurement BasesDocument21 pagesMeasurement BasessurfistasafonsoeliseuNo ratings yet

- Share-Based Payments: Learning CompetenciesDocument18 pagesShare-Based Payments: Learning CompetenciesRaezel Carla Santos FontanillaNo ratings yet

- MODULE - ACC 211 - UNIT1 - ULObDocument8 pagesMODULE - ACC 211 - UNIT1 - ULObhellah salasainNo ratings yet

- 362 End Term FRA SecDDocument5 pages362 End Term FRA SecDkhushali goharNo ratings yet

- Nuru Ethiopia Final Audit Report 2019Document22 pagesNuru Ethiopia Final Audit Report 2019Elias Abubeker AhmedNo ratings yet

- ACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019Document11 pagesACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019nothingNo ratings yet

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- Format SoplDocument2 pagesFormat Soplhumairayazid12No ratings yet

- 1Z0-960 Exam QuestionsDocument7 pages1Z0-960 Exam QuestionsBill Hopes100% (1)

- Straumann enDocument26 pagesStraumann enyeochunhongNo ratings yet

- 8.31.21 Boa STMNTDocument6 pages8.31.21 Boa STMNTAnthony VinsonNo ratings yet

- CE Period CloseDocument11 pagesCE Period CloseMd MuzaffarNo ratings yet

- Certificate of Insurance - 27175516Document2 pagesCertificate of Insurance - 27175516Andra-Mihaela DutuNo ratings yet

- Sanction Letter INST5187568192559754 914871556872853Document10 pagesSanction Letter INST5187568192559754 914871556872853ManiNo ratings yet

- Additional Case - Urban Chic DesignersDocument2 pagesAdditional Case - Urban Chic DesignersNaman MantriNo ratings yet

- Broker:: Hero Insurance Broking India Pvt. LTDDocument1 pageBroker:: Hero Insurance Broking India Pvt. LTDAakash MotorsNo ratings yet

- The Mortgage Forgiveness Debt Relief Act and Debt CancellationDocument3 pagesThe Mortgage Forgiveness Debt Relief Act and Debt CancellationPeter Smothers100% (1)

- A Summer Training Report On HDFC LifeDocument30 pagesA Summer Training Report On HDFC LifeOwais LatiefNo ratings yet

- Seller Closing Statement - When Buyer Gets FinancingDocument2 pagesSeller Closing Statement - When Buyer Gets FinancingJo Jemison EnglandNo ratings yet

- 2023-10-28 Sub Prime Mortgage Crisis V0.02amDocument13 pages2023-10-28 Sub Prime Mortgage Crisis V0.02amb23036No ratings yet

- PA2 X ESP HW9 G1 Revanza TrivianDocument9 pagesPA2 X ESP HW9 G1 Revanza TrivianRevan KonglomeratNo ratings yet

- AmortizationDocument8 pagesAmortizationprofessionNo ratings yet

- WWW Simandhareducation Com Blogs Mba Vs Cpa What Is Wiser To ChooseDocument5 pagesWWW Simandhareducation Com Blogs Mba Vs Cpa What Is Wiser To Choosesrinu patroNo ratings yet

- Assignment - Funds and Other InvestmentsDocument2 pagesAssignment - Funds and Other InvestmentsJane DizonNo ratings yet

- Elements of Typical LBO Operation: The First StageDocument8 pagesElements of Typical LBO Operation: The First StageEmila DeyNo ratings yet

- HDFC Life Super Savings Plan (SPL) IllustrationDocument2 pagesHDFC Life Super Savings Plan (SPL) IllustrationBrandon WarrenNo ratings yet

- Annual Report 2018-2019 PDFDocument380 pagesAnnual Report 2018-2019 PDFBALA GNo ratings yet

- Suncoast Bank StatementDocument3 pagesSuncoast Bank StatementolaNo ratings yet

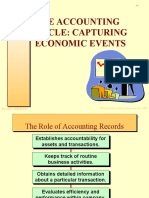

- The Accounting Cycle: Capturing Economic Events: Mcgraw-Hill/IrwinDocument51 pagesThe Accounting Cycle: Capturing Economic Events: Mcgraw-Hill/Irwinazee inmixNo ratings yet

- RBI Lender of Last ResortDocument18 pagesRBI Lender of Last ResortHemantVermaNo ratings yet

- Bonds: Formulas & ExamplesDocument12 pagesBonds: Formulas & ExamplesAayush sunejaNo ratings yet

- Treasury ManagementDocument10 pagesTreasury ManagementHarshit GoyalNo ratings yet

- Inclass Exercise Chapter 17Document4 pagesInclass Exercise Chapter 17임재영No ratings yet