Professional Documents

Culture Documents

W09 - T5 - Mining 1

W09 - T5 - Mining 1

Uploaded by

Thanh NgânOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

W09 - T5 - Mining 1

W09 - T5 - Mining 1

Uploaded by

Thanh NgânCopyright:

Available Formats

BEIJING CAMBRIDGE CASABLANCA CHICAGO DELHI DUBAI HONG KONG JOHANNESBURG

LONDON LOS ANGELES MADRID MOSCOW MUMBAI MUNICH NEW YORK PARIS RIYADH

SAN FRANCISCO SÃO PAULO SEOUL SHANGHAI SINGAPORE TOKYO TORONTO ZURICH

Há Tĩnh

Investment Opportunities for the Province

26 April 2011

40

Copyright © 2011 by Monitor Company Group, L.P.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means — electronic, mechanical, photocopying,

recording, or otherwise — without the permission of Monitor Company Group, L.P.

This document provides an outline of a presentation and is incomplete without the accompanying oral commentary and discussion.

COMPANY CONFIDENTIAL

Agenda

Mining

– Waste Management Plant

– Mining College

Metals

General Manufacturing – Metal Products

General Manufacturing – Textiles

General Manufacturing – Wood Products

Agriculture

BPO – ITO

CAS-COD-Prez-Date-CTL Copyright © 2011 Monitor Company Group, L.P. — Confidential 2

Mining

Waste Management Plant

Market Opportunity

The demand for iron ore and steel in Asia is expected to increase as a result of industrialization and increasing investment in infrastructure

This demand will be met by limited supply of iron ore globally

Vietnam can leverage the growing demand through its vast iron ore reserves, measuring up to 1,200 Mn tons in 2008

Large-scale mining operations will create an opportunity for developing effective waste management systems

Ha Tinh could develop advanced waste management systems, and later transfer the knowledge to neighboring provinces and countries

Factor Conditions and Enabling Infrastructure

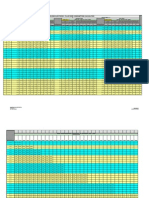

Ha Tinh’s Industrial Growth & Employment

Mining has displayed high industrial growth rate in Ha Tinh. The growth rate of the sector will further

increase once Thach Khe mine, one of the largest iron ore deposits in Asia, becomes operational Mining

Growth in employment in the mining sector in Ha Tinh (12.9% during 2009–2010) will enable easy access

CAGR (Real GDP

to labor. Also, availability of cheap labor (at ~60% of the national labor cost average in 2008) will

2001–2009)

substantially reduce the operational cost of the plant

Growing partnerships between local firms and experienced firms (e.g., Cavico Mining) could drive

innovation in waste management projects

Ha Tinh has access to roads and railway lines for transport of waste

# of Employees (Persons)

Indicative Incentives

The government is providing financial support for Thach Khe and assistance in securing investors

Thach Khe Iron Ore JSC is increasingly focusing on solid waste dump construction at Thach Khe for environmental protection

Railways and roads between Vung Ang and Thach Khe iron mine are being planned and constructed

Target Investment

Investment Capacity: Investment of up to USD 5 Mn for a plant with capacity for treating 120 tons of waste per day

Potential Locations: Vung Ang Economic Zone

Key Risks Mitigating Factors

Weak government support in infrastructure Construction of Vung Ang Thermal Power plants and hydro power plants

Lack of low cost transportation from iron ore mine Government and donor loans for development of infrastructure

Frequent power cuts disrupt mining operations

Source: General Statistics Office of Vietnam; Ha Tinh Statistical Books; Mining Weekly Website; U.S. Geological Survey; Vietnam News Agency; Monitor Analysis

CAS-COD-Prez-Date-CTL Copyright © 2011 Monitor Company Group, L.P. — Confidential 3

Mining

Mining College

Market Opportunity

Mining is a fast-growing sector in Vietnam. Given that the country has vast exploited and unexploited mineral reserves, Ha Tinh can gain first mover advantage

by developing a trained workforce to exploit these resources

Productivity of Ha Tinh in mining and quarrying is as low as 4% of the national average. The productivity, and hence the industrial output of mining, can be

improved significantly by a trained workforce

If successful, Ha Tinh will be able to transfer highly developed skills, vast amounts of labor, and capital equipment to nearby mines

Factor Conditions and Enabling Infrastructure

Exploitation of the Thach Khe mine, which is expected to begin in 2014, will require a large and trained Iron Ore Exploitation of Thach Khe,

labor pool 2011–2057 (Mn tons/year)

10

Increasing rate of employment in mining sector in Ha Tinh (employment grew at a 12.9% rate during 2009–

2010) demonstrates the interest of the population in mining as a profession 8

With 97.2% adult literacy rate and nearly half of the working population under 35 years of age, Ha Tinh has 6

access to the required student pool 4

Increasing internet access in Ha Tinh can facilitate e-learning and distance education

2

Access to roads and railway lines and can attract students from neighboring provinces

0

2010 2020 2030 2040 2050 2060

Indicative Incentives

The government is providing financial support for Thach Khe and assistance in securing investors

Railways between Vung Ang–Tha Khek (Laos) and Vung Ang–Thach Khe iron mine are under planning

Target Investment

Investment Capacity: Mining college that can train 1,000 students per year

Potential Locations: Vung Ang Economic Zone

Key Risks Mitigating Factors

Weak training and research infrastructure Government and donor loans for development of infrastructure

Limited availability of qualified labor in supporting industries On-going development plans, such as mineral exploration, would create

The population prefers to study in colleges outside the province jobs

Source: General Statistics Office of Vietnam; Ha Tinh Statistical Books; Mining Weekly Website; U.S. Geological Survey; Vietnam News Agency; Monitor Analysis

CAS-COD-Prez-Date-CTL Copyright © 2011 Monitor Company Group, L.P. — Confidential 4

Agenda

Mining

Metals

– Refractory Material Production

– Maintenance Services and Engineering

– Steel Service Providers

General Manufacturing – Metal Products

General Manufacturing – Textiles

General Manufacturing – Wood Products

Agriculture

BPO

CAS-COD-Prez-Date-CTL Copyright © 2011 Monitor Company Group, L.P. — Confidential 5

Metals

Refractory Material Production

Market Opportunity

The demand for refractory material in Asia/Pacific grew at a 9.8% rate during 2004–20091

In Ha Tinh, four steel mill complexes are being developed that can produce 22 Mn tons of steel per year. The demand for refractory material will further

increase in the province once these complexes are operational

Factor Conditions and Enabling Infrastructure

Access to international trade routes for convenient import of raw materials such as aluminium, silicon, and Refractory Material Demand

magnesium Worldwide, 2004–20091 (Tons) CAGR

– Proximity to international shipping lines through Vung Ang–Son Duong port 25,000

20,000 + 9.8%

– Access to raw materials in Laos and Thailand via Cau Treo border gate

15,000

Employment rate is expected to increase in the metal cluster in Ha Tinh. Also, availability of cheap labor (at 10,000

~60% of the national labor cost average in 2008) will substantially reduce the operational cost of the plant - 1.8%

5,000

Access to roads and railway lines for transport of refractory material to neighboring provinces - 5.2%

0 - 5.9%

– Connected to Hanoi, Da Nang and HCMC through highway 1A and Ho Chi Minh highway 2004 2009

– Existing and planned national, regional and local railway lines

North America

Indicative Incentives

Initiatives to decrease national trade deficit will drive in-house production of refractory material, which is currently imported

Tax benefits for investments are available for Vung Ang EZ, including 4 year income tax exemption and 50% tax reduction for the following 9 years

Target Investment

Investment Capacity: USD 20 Mn investment in a refractory material plant with estimated annual capacity of 10,000–20,000 tons

Potential Locations: Vung Ang Economic Zone

Key Risks Mitigating Factors

Limited availability of raw materials Newer mining avenues are being explored, e.g., MITRACO is exploring

Unreliable electricity supply titanium and manganese in Thach Ha district

Coal-fired and hydro power plants are being developed

Source: General Statistics Office of Vietnam; Ha Tinh Statistical Books; VN Steel Website; Business Economics, Palgrave Macmillan; 1’ World Refractories to 2014’,

Feedonia Group; Monitor Analysis

CAS-COD-Prez-Date-CTL Copyright © 2011 Monitor Company Group, L.P. — Confidential 6

Metals

Maintenance Services and Engineering

Market Opportunity

GDP contribution of the metal cluster is expected to increase at a fast pace for the next 20 years

This growth will be substantiated by the development of four large steel mill complexes in Ha Tinh and increasing investments in the sector

– Investments from Ha Tinh Iron Steel JSC, Formosa, TATA and VN Steel

Growth in the metals cluster will lead to increased opportunities in maintenance services and engineering

Ha Tinh can utilize the investments to develop its maintenance services and engineering industry, and aid the growth momentum of the metals cluster

Factor Conditions and Enabling Infrastructure

Illustrative Maintenance Services

Large mineral reserves in Ha Tinh can provide the raw material for the production of required

1 Laser Survey and Alignment

machinery

Low labor cost in Ha Tinh, about 60% of the national average in 2008, can attract maintenance 2 Fabrication and Welding

services business from neighboring countries and provinces Oil and Gas Maintenance

3

Access to roads and railway lines can facilitate the travel of service staff

4 Repair and Overhaul

– Connected to Hanoi, Da Nang and HCMC through highway 1A and Ho Chi Minh highway

– Existing and planned national, regional and local railway lines 5 Fuel Injector Maintenance

6 Connecting Rod Maintenance

7 Turbocharger Maintenance

Indicative Incentives

Tax benefits for investments are available for Vung Ang EZ, including 4 year income tax exemption and 50% tax reduction for the following 9 years

Target Investment

Investment Capacity: USD 10 Mn investment

Potential Locations: Vung Ang Economic Zone

Key Risks Mitigating Factors

Limited supply of technical specialists in engineering and science Employment rate is expected to grow in the metals cluster

Unreliable electricity supply Coal-fired and hydro power plants are being developed

Source: General Statistics Office of Vietnam; Ha Tinh Statistical Books; Global Equipment Services Corporation website; Metal Machines Engineering Services website;

HotFrog UK Business Directory; Monitor Analysis

CAS-COD-Prez-Date-CTL Copyright © 2011 Monitor Company Group, L.P. — Confidential 7

Metals

Steel Service Providers

Market Opportunity

Steel demand in Vietnam has grown at a 17% rate during 2000–2010; it’s predicted that steel demand will further increase with industrialization

Vietnam has historically imported steel to meet this high demand; trade deficit of total steel products was 5,877 Mn tons in 2009

Ha Tinh can aid the development of steel service providers, and enable Vietnam to move towards greater import substitution

– Steel service providers will provide steel plates, sheets, slabs, pipes, etc. to industries such as ship building, automobiles and heavy machinery

Factor Conditions and Enabling Infrastructure

Four steel mill complexes are being developed in Ha Tinh that can produce 22 Mn tons of steel per year. Trade Deficit of Vietnam Total Steel

Once operational, these complexes can provide large quantities of raw material to steel service providers Products, 2005–2009 (Mn tons)

Low labor cost in Ha Tinh, about 60% of the national average in 2008, will facilitate low operational cost 7,000

Proximity to international shipping lines will allow Ha Tinh to trade processed steel easily with East and 6,000

South Asia, especially China, Japan, Korea, and India, who will be major trade partners for steel 5,000 Imports

– Trade through Vung Ang and Son Duong ports, and Cau Treo border gate 4,000 Trade 5,877 Mn

Access to roads and railways will enable transport of products within Ha Tinh and to nearby provinces 3,000 Deficit tons

– Connected to Hanoi, Da Nang and HCMC through highway 1A and Ho Chi Minh highway 2,000 Exports

1,000

– Existing and planned national, regional and local railway lines

0

2005 2006 2007 2008 2009

Indicative Incentives

Initiatives to decrease national trade deficit will drive in-house production of steel

Tax benefits for investments are available for Vung Ang EZ, including 4 year income tax exemption and 50% tax reduction for the following 9 years

Target Investment

Investment Capacity: USD 50 Mn investment in a steel factory with estimated annual capacity of 5 Mn tons

Potential Locations: Vung Ang Economic Zone

Key Risks and Mitigating Factors Mitigating Factors

Unclear supply of non-ore raw materials (e.g., coke, oxygen) Newer mining avenues are being explored, e.g., MITRACO is exploring

No supporting industries (machine maintenance or manufacturing) titanium and manganese in Thach Ha district

Investments from Ha Tinh Iron Steel JSC, Formosa, TATA and VN Steel

could aid the development of supporting industries

Source: General Statistics Office of Vietnam; Ha Tinh Statistical Books; Interview with Thach Khe JSC (2011); Interview with Vung Ang Economic Zone Management

Board (2011); Formosa Investment Certificate; Monitor Analysis

CAS-COD-Prez-Date-CTL Copyright © 2011 Monitor Company Group, L.P. — Confidential 8

You might also like

- 3 - 300cubits Case StudyDocument30 pages3 - 300cubits Case StudyrebaalNo ratings yet

- Fls Mat1100Document4 pagesFls Mat1100Jamal Mohamed100% (1)

- Electrode CalculationDocument2 pagesElectrode Calculationtejasp8388100% (1)

- Building Technology 2Document27 pagesBuilding Technology 2DaNica Tomboc Javier100% (1)

- Journal of International Economics: Ralph de Haas, Steven PoelhekkeDocument16 pagesJournal of International Economics: Ralph de Haas, Steven PoelhekkeYohana SariNo ratings yet

- Bi Weekly Vietnam News Highlights 01 03 23 12 03 23 1687156722Document5 pagesBi Weekly Vietnam News Highlights 01 03 23 12 03 23 1687156722hang truongNo ratings yet

- Vietnam Logistics ReportDocument20 pagesVietnam Logistics ReportAmelia LeeNo ratings yet

- Industrials & Transportation Sector: Mobile World Investment Corp (HSX: MWG) Title of PresentationDocument35 pagesIndustrials & Transportation Sector: Mobile World Investment Corp (HSX: MWG) Title of PresentationTung NgoNo ratings yet

- Tran Minh Tam: Lecturer ClassDocument26 pagesTran Minh Tam: Lecturer ClassNgọc MyNo ratings yet

- Vietnam Steel Industry OUTLOOK 2021: OverweightDocument15 pagesVietnam Steel Industry OUTLOOK 2021: OverweightSinh NguyenNo ratings yet

- PTTCDN d01 Hoa Phat Phan Tich Tai Chinh Doanh Nghiep Cong Ty Hoa PhatDocument27 pagesPTTCDN d01 Hoa Phat Phan Tich Tai Chinh Doanh Nghiep Cong Ty Hoa PhatVânAnh NguyễnNo ratings yet

- Business Opportunities in IndiaDocument7 pagesBusiness Opportunities in Indiaahelios79No ratings yet

- SSRN Id1904763Document48 pagesSSRN Id1904763minhbeoccbNo ratings yet

- P - P - P - P - P - P - P - P - P - P - P - P - P - P - P - P - P - P - PDocument3 pagesP - P - P - P - P - P - P - P - P - P - P - P - P - P - P - P - P - P - PAnkur SharmaNo ratings yet

- Study On Economic Partnership Projects in Developing Countries in FY2016Document174 pagesStudy On Economic Partnership Projects in Developing Countries in FY2016jackson michaelNo ratings yet

- Steel - February 2017 IREPDocument54 pagesSteel - February 2017 IREPChinmayiNo ratings yet

- Class 10 Prelims 2023 CourseDocument11 pagesClass 10 Prelims 2023 CourseLacayNo ratings yet

- Solving Africa's Infrastructure ParadoxDocument8 pagesSolving Africa's Infrastructure ParadoxmarcelvandenbroekNo ratings yet

- 10.1007@s11053-019-09568-4 (Ir 3) PDFDocument21 pages10.1007@s11053-019-09568-4 (Ir 3) PDFnaziha MJNo ratings yet

- Experience QuestionnaireDocument22 pagesExperience Questionnaireamirhayat15No ratings yet

- COMM1180 Group AssignmentDocument12 pagesCOMM1180 Group AssignmentQ VanichaNo ratings yet

- Challenges To Infrastructure Development in North East RegionDocument4 pagesChallenges To Infrastructure Development in North East RegionHemavathi HemaNo ratings yet

- H1 Taipei Capital Markets Radar ColliersDocument8 pagesH1 Taipei Capital Markets Radar Colliersnhungoc3028No ratings yet

- Pakistan Leading Telecom& IT News Magazine Flare June+JulyDocument86 pagesPakistan Leading Telecom& IT News Magazine Flare June+Julyfarooq_flareNo ratings yet

- Full Paper WCSET 2016 NXHuyDocument5 pagesFull Paper WCSET 2016 NXHuytgdd123abcNo ratings yet

- PWC TH Infrastructure Market Update and OutlookDocument29 pagesPWC TH Infrastructure Market Update and OutlookNurin AdlinNo ratings yet

- IB Research Report - Group 6Document14 pagesIB Research Report - Group 6Anchita KhaitanNo ratings yet

- Gati Shakti Master PlanDocument15 pagesGati Shakti Master PlanAgni BanerjeeNo ratings yet

- Vietnam Logistics Industry PDFDocument39 pagesVietnam Logistics Industry PDFPhạmThanhThủy100% (1)

- Leadin Unit 7Document21 pagesLeadin Unit 7QUÂN PHAN NGUYỄN ANHNo ratings yet

- Amv 1Document36 pagesAmv 1Kennedy RashidNo ratings yet

- Tracking The Trends 2023: The Indispensable Role of Mining and MetalsDocument71 pagesTracking The Trends 2023: The Indispensable Role of Mining and MetalsMarcos José Canales CornejoNo ratings yet

- Real Estate 1Document6 pagesReal Estate 1Yessin Ben SalemNo ratings yet

- Myanmar EconomyEng V 1.3 20092018Document8 pagesMyanmar EconomyEng V 1.3 20092018Than HanNo ratings yet

- Fluor Expansion: Southeast Asia: Gloria Barbian, Samantha Dawber, Brendan Gerrity, Shannon Knotts, Tiemae RoquerreDocument9 pagesFluor Expansion: Southeast Asia: Gloria Barbian, Samantha Dawber, Brendan Gerrity, Shannon Knotts, Tiemae RoquerreRoss CallahanNo ratings yet

- Term Project MGT 4478: Managing in A Global Environment Troy UniversityDocument22 pagesTerm Project MGT 4478: Managing in A Global Environment Troy UniversityĐức Minh ChuNo ratings yet

- 2.smart City PuneDocument46 pages2.smart City PuneKale100% (2)

- This Study Resource Was: Logistics and Supply Chain management-BADocument9 pagesThis Study Resource Was: Logistics and Supply Chain management-BARizeNo ratings yet

- Selamawit Moges Harawe GraniteDocument19 pagesSelamawit Moges Harawe GraniteAbduselam AhmedNo ratings yet

- Market Entry StrategyDocument13 pagesMarket Entry StrategygauravpdalviNo ratings yet

- Pi Article - Mining in Kenya PDFDocument8 pagesPi Article - Mining in Kenya PDFPlatinum IntegrationsNo ratings yet

- Nimra Rizwan MM-014: "Opportunities in The Development of Cpec"Document6 pagesNimra Rizwan MM-014: "Opportunities in The Development of Cpec"Nimra RizwanNo ratings yet

- 10 1108 - Jed 10 2022 0199Document21 pages10 1108 - Jed 10 2022 0199Sunil KhoslaNo ratings yet

- China-Pakistan Economic Corridor: CPEC Vision & MissionDocument6 pagesChina-Pakistan Economic Corridor: CPEC Vision & MissionAbdul WaliNo ratings yet

- The Sun Rises in The EastDocument32 pagesThe Sun Rises in The EastKritika VermaNo ratings yet

- Investment Opprtunity in MiningDocument10 pagesInvestment Opprtunity in MiningssprasadNo ratings yet

- Indian Port Sector: Key Trends and Credit Challenges: Summary OpinionDocument8 pagesIndian Port Sector: Key Trends and Credit Challenges: Summary Opinionnagarjuna28No ratings yet

- SWOT Analysis On Construction IndustriesDocument21 pagesSWOT Analysis On Construction IndustriesImran Ali Raza CommandoNo ratings yet

- Construction Industry: Prepared by Nguyen Thien Luat - Credit Department - Chailease International Leasing Co., LTDDocument29 pagesConstruction Industry: Prepared by Nguyen Thien Luat - Credit Department - Chailease International Leasing Co., LTDNGỌC100% (1)

- Materials Industry - Economic and Environmental Issues - An Overview Khalid KhanDocument6 pagesMaterials Industry - Economic and Environmental Issues - An Overview Khalid KhanAmmad SheikhNo ratings yet

- Assignment #2 Strategic Managment FinalDocument14 pagesAssignment #2 Strategic Managment FinalAbeer Saeed100% (1)

- Vaibhav: Erm Project Hyderabad Metro RailDocument25 pagesVaibhav: Erm Project Hyderabad Metro RailNikhil SachdevaNo ratings yet

- Hong Et Al 2011Document8 pagesHong Et Al 2011Gabriel F RuedaNo ratings yet

- Secret Instructions For Zijan Mining 2Document3 pagesSecret Instructions For Zijan Mining 2echozhangNo ratings yet

- Adhithie ReportDocument41 pagesAdhithie Report21E4114 Nithyashree INo ratings yet

- Mining Sector: Make in IndiaDocument8 pagesMining Sector: Make in IndiaBapu123No ratings yet

- Project FinancingDocument32 pagesProject FinancingShardulWaikarNo ratings yet

- 2004 Challenges Construction Industry ProceedingsDocument18 pages2004 Challenges Construction Industry Proceedingsaksjain25No ratings yet

- BOTDocument41 pagesBOTLouise Dela CruzNo ratings yet

- Challenges Before Construction Industry in India: Arghadeep Laskar and C. V. R. MurtyDocument18 pagesChallenges Before Construction Industry in India: Arghadeep Laskar and C. V. R. Murtyvince deguzmaNo ratings yet

- AbstractDocument44 pagesAbstractarked kediaNo ratings yet

- A Comparative Infrastructure Development Assessment of the Kingdom of Thailand and the Republic of KoreaFrom EverandA Comparative Infrastructure Development Assessment of the Kingdom of Thailand and the Republic of KoreaRating: 5 out of 5 stars5/5 (1)

- Hardness Test of WeldsDocument4 pagesHardness Test of Weldsjose_sebastian_2No ratings yet

- Aluminum BronzeDocument37 pagesAluminum Bronzepipedown456100% (1)

- Austentite Steel Thermal StabilizationDocument17 pagesAustentite Steel Thermal StabilizationArangamar KumaranNo ratings yet

- Commercial Catalog PIVADocument12 pagesCommercial Catalog PIVAVanja Zoric SundicNo ratings yet

- 6th Sem Group Diploma Front Pkiet BargarhDocument10 pages6th Sem Group Diploma Front Pkiet BargarhPrabir Kumar PatiNo ratings yet

- 06 - Hofmann - Forged Steel Fabricated Girth Gears Brochure - A4Document2 pages06 - Hofmann - Forged Steel Fabricated Girth Gears Brochure - A4Jorge VillalobosNo ratings yet

- Pop A Plug MaterialDocument2 pagesPop A Plug MaterialHijau Auliya Keramat Al-qadiryNo ratings yet

- 4330V Nickel-Molybdenum-Vanadium Through Hardening Steel - Hillfoot Multi MetalsDocument1 page4330V Nickel-Molybdenum-Vanadium Through Hardening Steel - Hillfoot Multi MetalsidontlikeebooksNo ratings yet

- 00 PR SP 00001 - 2 Wet Hydrogen Sulphide (H2S) Service SpecificationDocument12 pages00 PR SP 00001 - 2 Wet Hydrogen Sulphide (H2S) Service SpecificationStevanNikolicNo ratings yet

- Continuous Cooling Transforming DiagramDocument26 pagesContinuous Cooling Transforming DiagramaunginternetNo ratings yet

- Poldi Impact Hardness Tester PoldihammerDocument2 pagesPoldi Impact Hardness Tester PoldihammerPedro SilvaNo ratings yet

- Aircraft Materials and ProcessesDocument15 pagesAircraft Materials and ProcessesRajesh KumarNo ratings yet

- Mechanical Properties of Dual-Phase Steels PDFDocument122 pagesMechanical Properties of Dual-Phase Steels PDF1_Roman_1No ratings yet

- Galvanizing For Corrosion Protection (AGA)Document18 pagesGalvanizing For Corrosion Protection (AGA)Abrianto AkuanNo ratings yet

- Form 9711EDocument52 pagesForm 9711EJavierNo ratings yet

- Calypso Operation and Installation ManualDocument64 pagesCalypso Operation and Installation Manualmilen65No ratings yet

- MACHINES FEATURES CONTROLLER SM5500+ - Rev.0Document64 pagesMACHINES FEATURES CONTROLLER SM5500+ - Rev.0Valerio Carpio ChuraNo ratings yet

- Rules For Ships High Speed, Light Craft and Naval Surface Craft, January 2003Document43 pagesRules For Ships High Speed, Light Craft and Naval Surface Craft, January 2003roostercockburnNo ratings yet

- 5 - VasoflonDocument16 pages5 - Vasoflonstavros_stergNo ratings yet

- E Smartlink MRV M Specs InstructionsDocument84 pagesE Smartlink MRV M Specs InstructionsAnthonyNo ratings yet

- PDSLimitSwitchBoxFC 1Document4 pagesPDSLimitSwitchBoxFC 1Samuel MacêdoNo ratings yet

- Welding Procedure Specification NO. 23-3-1: National Certified Pipe Welding BureauDocument4 pagesWelding Procedure Specification NO. 23-3-1: National Certified Pipe Welding BureautalhaNo ratings yet

- Lincoln GralDocument516 pagesLincoln GralCristian Alejandro Huerta HernandezNo ratings yet

- Budget For 2A23Document12 pagesBudget For 2A23Sridhar ChebroluNo ratings yet

- CH 11Document55 pagesCH 11Anuj shuklaNo ratings yet

- IS 4049-2 (1996) Formed Ends For Tanks and Pressure (Inside Diameter Basis) PDFDocument14 pagesIS 4049-2 (1996) Formed Ends For Tanks and Pressure (Inside Diameter Basis) PDFShivprasadNo ratings yet

- NABL Scope JKTRCDocument27 pagesNABL Scope JKTRCNeelam PatelNo ratings yet