Professional Documents

Culture Documents

Unit 6

Unit 6

Uploaded by

Dippi VermaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 6

Unit 6

Uploaded by

Dippi VermaCopyright:

Available Formats

Chap 6

Financial Instruments and Financial

Services

MISSION VISION CORE VALUES

CHRIST is a nurturing ground for an individual’s Excellence and Service Faith in God | Moral Uprightness

holistic development to make effective contribution to Love of Fellow Beings

the society in a dynamic environment Social Responsibility | Pursuit of Excellence

CHRIST

Deemed to be University

Coverage

● Financial Instrument

● Financial Services

● Fee Based Services

Excellence and Service

CHRIST

Deemed to be University

Classification Basis of Source of Finance

● Time Period

● Source of generation

● Ownership & Control

Excellence and Service

CHRIST

Deemed to be University

Financial Instrument

● Share

● Debentures

● Bonds

● Mutual Funds

● Money Market Instruments

● Derivative Instruments

Excellence and Service

CHRIST

Deemed to be University

What is share

● In simple words, a share indicates a unit of ownership of the particular

company.

● If you are a shareholder of a company, it implies that you as an

investor, hold a percentage of ownership of the issuing company.

● As a shareholder you stand to benefit in the event of the company’s

profits, and also bear the disadvantages of the company’s losses.

Excellence and Service

CHRIST

Deemed to be University

Characteristics of share

Face Value: -Each share has a definite face value, say Rs. 10,

Rs. 25, Rs. 100 or so. The share has a market value which may

be more or less than the face value.

Issue Value: - A Share may be issued at par (exact face Value),

at Premium (more than the face value), or at discount (less than

the face value)

Excellence and Service

CHRIST

Deemed to be University

-Contd-

Paid up Value: -Shares may be fully paid-up or partly paid-up. A

company can forfeit partly paid-up shares, if calls on shares not paid in

time.

Distinctive Number: - Each share has a distinctive number. The shares

are allotted in lots say 10 shares, 50 shares, 100 shares, or so.

Ownership: -The owner of the share is called shareholder or member of

the company. The shareholders are the owners of the company.

Excellence and Service

CHRIST

Deemed to be University

-contd-

Rights: -A share confers certain rights on its holder, such as right to vote

at a meeting, right to inspect books of accounts, right to receive dividend,

etc.

Proof of Title: -The title of a share is evidence by a share certificate,

issued by the company under its common seal.

Transferability: - The shares of a public limited company are freely

transferable. The equity shares of reputed companies can be easily traded

on the stock markets.

Excellence and Service

CHRIST

Deemed to be University

Types of share

● Equity Share

● Preference share

Excellence and Service

CHRIST

Deemed to be University

Equity share

● Equity financing or share capital is the amount raised by a particular

company by issuing shares. A company can increase its share capital

by additional Initial Public Offerings (IPOs).

Excellence and Service

CHRIST

Deemed to be University

Classification of Equity share on the basis of share

Capital

• Authorized Share Capital: Every company, in its Memorandum of

Associations, requires to prescribe the maximum amount of capital

that can be raised by issuing equity shares. The limit, however, can be

increased by paying additional fees and after completion of certain

legal procedures.

• Issued Share Capital: This implies the specified portion of the

company’s capital, which has been offered to investors through

issuance of equity shares. For example, if the nominal value of one

stock is Rs 200 and the company issues 20,000 equity shares, the

issued share capital will be Rs 40 lakh.

Excellence and Service

CHRIST

Deemed to be University

-Contd-

• Subscribed Share Capital: The portion of the issued capital, which

has been subscribed by investors is known as subscribed share capital.

• Paid-Up Capital: The amount of money paid by investors for

holding the company’s stocks is known as paid-up capital. As

investors pay the entire amount at once, subscribed and paid-up

capital refer to the same amount.

Excellence and Service

CHRIST

Deemed to be University

Classification Of Equity Shares On The Basis Of

Definition

• Bonus Shares

• Rights Shares

• Sweat Equity Shares

• Voting And Non-Voting Shares

Excellence and Service

CHRIST

Deemed to be University

Bonus share

Excellence and Service

CHRIST

Deemed to be University

Bonus Shares

● Bonus share definition implies those additional stocks which are

issued to existing shareholders free-of-cost, or as a bonus.

● Bonus shares are additional shares given to the current shareholders

without any additional cost, based upon the number of shares that a

shareholder owns.

● These are company's accumulated earnings which are not given out in

the form of dividends, but are converted into free shares.

Excellence and Service

CHRIST

Deemed to be University

Key Take Away For Bonus Share

• A bonus issue of shares is stock issued by a company in lieu of cash

dividends. Shareholders can sell the shares to meet their liquidity

needs.

• Bonus shares increase a company's share capital but not its net

assets.

Excellence and Service

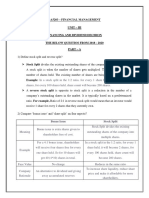

Why Are Bonus Shares Issued.?

Let me try & simplify this for

you…

Let’s say a company makes Rs 1000 as

profit, Now suppose the company

has 100 shares, Then earning per share

is:-

𝑃𝑟𝑜𝑓𝑡𝑖

= Rs. 1000 = Rs. 10.

𝑛𝑜.𝑜𝑓 𝑠ℎ𝑎𝑟𝑒𝑠 100

Suppose there is a surge in the demand

for company’s product causing its profits

to go up from Rs 1,000 to Rs 10,000.

One should observe is that while the profit went up

from Rs 1000 to Rs 10,000 the number of shares

remains the same at 100.Hence, by definition,

earnings per share would be 100. .

Now, as we know that Market Price = EPS x 𝑃𝐸 .If

we

were to assume a P/E of 10, the price per share

would become Rs 1000…

Here :- P = Market vale per share.

E= Earning per share.

At a price of Rs 1000, it would be very difficult

to expect retail participation because any

investor would need a minimum of Rs 1000 to

purchase a single stock.

But that’s quite a large amount. Say, an

investor has only Rs 500 but wants to invest in

this company. What does he do??

Despite having the desire to buy the stock, he

will not be able to participate for want of

money.

It, therefore, becomes essential for the

company to increase the number of shares, so

that the price per share is within the reach of

retail participants.

Let’s say the company declares a 1:4 bonus

which essentially means that for every 1 share

you get an additional 4 shares. So, in effect, you

get a total of 5 shares…

This would increase the total number of shares

from 100 to 500.

The earnings per share would now become EPS =

Total Earnings (or)Rs (10,000 = Rs 20)

No. of Shares 500

And that would bring down the price per

share from an unaffordable Rs 1000 to a more

amenable Rs 200 (EPS x 𝑃/𝐸 = 20 x 10)

So in other words 100 shares x 1000 = Rs

10,000 is reconfigured as 500 shares x 200 = Rs

10,000.

This division of shares thus increases retail

participation and hence liquidity to the stock,

making it easily tradable as more buyers and

sellers are able to participate because of a lower

unit value per share.

And our friend is also in a better position &

can buy at least two shares with his Rs 500 (2

x 200 = 400) & he will be left with Rs 100.

Thus we have seen how and why ‘Bonus Shares’

are issued in the stock market.

What can be used for issue of bonus

shares ?

Balance in the Profit and Loss Account;

General Reserves or other Reserves created

out of the profits;

Realized capital profits and reserves;

Securities Premium Account;

Capital Redemption Reserve Account

LEGAL

REQUIREMENT’S

Bonus shares to existing

share holder’s :-

Specific prior permission from

RBI.

ADVANTAGE

S

Remedy for under capitalization .

Marketability of share increases .

Maintenance of liquidity position of the

company .

Increase in shareholders holdings and

increased investor confidence .

Retained profits can be used for

development and expansion.

Disadvantage’s

More costly to administer.

EPS, MPS, declines

Rate of dividend in future may reduce

It may encourage speculation in shares

Increases in capitalization which cannot be

justified until and unless there is

proportionate increase in earning capacity of

the company

CHRIST

Deemed to be University

Right Shares

● Right shares meaning is that a company can provide new shares to its

existing shareholders - at a particular price and within a specific time-

period - before being offered for trading in stock markets.

Excellence and Service

CHRIST

Deemed to be University

• Key points regarding right shares

● 5. A special resolution should be passed

● 1. Right shares are always issued to current regarding right issue of shares .

shareholders in proportion to theirs existing

shareholding . ● 6. There must be provision in Article of

Association regarding right issue of shares .

● 2. They are issued at discounted price

( lower than market price). ● 7. This prior right of existing shareholders

is also known as ‘ Pre-emptive right. ‘

● 3. Companies Act , 2013 ( sec. 62 ) mention

that a company can make right issue either

after the two years of registration or after

the one year of first issue of shares ,

whichever is earlier .

● 4. Only those companies ( public or

private ) which are listed on stock exchange

can make right issue Of shares .

Excellence and Service

CHRIST

Deemed to be University

Process

Excellence and Service

CHRIST

Deemed to be University

Advantages of Right Issue share

1. It ensures that the control of the company is preserved in the hands of the existing

shareholders.

2. The expenses to be incurred, otherwise if shares are offered to the public, are avoided

3. There is more certainty of the shares being sold to the existing shareholders.

4. It betters the image of the company and stimulates enthusiastic response from

shareholders and the investment market.

5. It ensures that the directors do not misuse the opportunity of issuing new shares to

their relatives and friends at lower prices on the one hand and on the other get more

controlling rights in the company.

Excellence and Service

CHRIST

Deemed to be University

Sweat Shares

● Sweat Equity Share is defined under Section 2(88) of the Companies

Act, 2013. The sweat equity shares mean shares issued by a company

to its directors or employees for non-cash consideration or at a

discount for making rights available in the nature of intellectual

property rights or providing know-hows or any providing any value

additions in any form. Rule 8 of Companies (Share Capital and

Debentures) Rules, 2014 regulates the procedure of issue of sweat

equity shares.

Excellence and Service

CHRIST

Deemed to be University

Employee Stock Option Plan

● Employee Stock Option is defined under Section 2(37) of the

Companies Act, 2013. The employees stock option means the option

provided to the directors, employees or officers of the company or its

holding or subsidiary company, which gives the right or benefit to

subscribe or purchase the shares of the company at a predetermined

price on a future date. It is issued by a company when it wants to raise

its subscribed capital. Rule 12 of Companies (Share Capital and

Debentures) Rules, 2014 regulates the procedure of the issue of

ESOP.

Excellence and Service

CHRIST

Deemed to be University

ESOP Vs Sweat Equity

● ESOP VS Sweat.docx

Excellence and Service

CHRIST

Deemed to be University

Voting And Non-Voting Shares

● Although the majority of shares carry voting rights, the company can

make an exception and issue differential or zero voting rights to

shareholders.

Excellence and Service

CHRIST

Deemed to be University

Classification Of Equity Shares On The Basis Of

Returns

• Dividend Shares: A company can choose to pay dividends in the

form of issuing new shares, on a pro-rata basis.

• Growth Shares: These types of shares are associated with companies

that have extraordinary growth rates. While such companies might not

provide dividends, the value of their stocks increase rapidly, thereby

providing capital gains to investors.

• Value Shares: These types of shares are traded in stock markets at

prices lower than their intrinsic value. Investors can expect the prices

to appreciate over a period of time, thus providing them with a better

share price.

Excellence and Service

CHRIST

Deemed to be University

Preference Shares

● These are among the next types of shares issued by a company.

Preferentiprofitsal shareholders receive preference in receiving of a

company as compared to ordinary shareholders. Also, in the event of

liquidation of a particular company, the preferential shareholders are

paid off before ordinary shareholders.

Excellence and Service

CHRIST

Deemed to be University

Types of Preference Shares

● Cumulative And Non-Cumulative Preference Shares

● Participating/Non-Participating Preference Share

● Redeemable/Irredeemable Preference Shares

● Convertible/Non Convertibles Preference Shares

Excellence and Service

CHRIST

Deemed to be University

Cumulative And Non-Cumulative Preference Shares

● In the case of cumulative preference shares, if a particular company

doesn’t declare an annual dividend, the benefit is carried forward to

the next financial year. Non-cumulative preference shares don't

provide for receiving outstanding dividends benefits.

Excellence and Service

CHRIST

Deemed to be University

Participating/Non-Participating Preference Share

● Participating preference shares allow shareholders to receive surplus

profits, after payment of dividends by the company. This is over and

above the receipt of dividends. Non-participating preference shares

carry no such benefits, apart from the regular receipt of dividends.

Excellence and Service

CHRIST

Deemed to be University

Redeemable/Irredeemable Preference Share

● A company can repurchase or claim redeemable preference share at a

fixed price and time. These types of shares are sans any maturity date.

Irredeemable preference shares, on the other hand, have no such

conditions.

Excellence and Service

CHRIST

Deemed to be University

Convertible/Non-Convertible Preference Shares

• Convertible preference shares can be converted into equity shares,

after meeting the requisite stipulations by the company’s Article of

Association (AoA), while non-convertible preference shares carry no

such benefits.

Excellence and Service

BENEFITS

Helpful in raising long-term capital for a company.

Have first claim on profits and proceeds from the sale of the

company’s asset at the time of bankruptcy.

Have fixed rate of dividend for fixed number of years.

Guaranteed Rate of Return.

DRAWBACKS

Not traded in market like ordinary shares.

Not available to retail investors.

Not advantageous to investors form the point of view of

control & management as preference share do not carry

voting rights.

Cost of raising preference share capital is higher.

WHO CAN BUY PREFRENCE SHARES?

Financial Institution.

Lending firms.

Other investors through brokerage firm.

HOW TO SELL THESE SHARES?

Through private placement via broker at a negotiated price.

Price one receives depend upon financial state of the

company.

One may have to sell at discount which is negotiated price

not the market price.

CHRIST

Deemed to be University

Debts

Excellence and Service

CHRIST

Deemed to be University

Debentures

● When borrowed capital is divided into equal parts, then, each part is called as a

debenture. Debenture represents debt. For such debts, company pays interest at

regular intervals. It represents borrowed capital and a debenture holder is the creditor

of the company.

●

Debenture holder provides loan to the company and he has nothing to do with the

management of the company.

Excellence and Service

CHRIST

Deemed to be University

Types of Debentures

● Registered and Bearer Debentures

● Secured and Unsecured Debentures

● Redeemable And Irredeemable Debentures

● Convertible /Non Convertible Debentures

Excellence and Service

CHRIST

Deemed to be University

Registered and Bearer Debentures

● This classification of debentures is made on the basis of transferability of debentures.

● Registered debentures are those in respect of which the names, addresses, and

particulars of the holdings of debenture holders are entered in a register kept by the

company. The transfer of ownership of such debentures is possible through a regular

instrument of transfer which is duly signed by the transferee and the transferor.

However, the transfers are freely allowed through the execution of a regular Transfer

Deed. Only formal approval of the Board is necessary. Interest on such debentures is

paid through interest warrants.

● Bearer debentures are transferable by mere delivery. They are freely negotiable

instruments. The company keeps no records of the debenture- holders in the case of

bearer debentures. Such debentures are similar to Share Warrants; the interest on

them is paid by means of attached coupons which encashed by the holder are as and

when cash falls due. On maturity, the principal sum of Bearer Debenture is paid back

to the holder.

Excellence and Service

CHRIST

Deemed to be University

Secured and Unsecured Debentures

● This classification is made on the basis of security offered to debenture-holders.

● Secured debentures are those which are secured by some safe charge on the property

of the company. The charge or, mortgage may be “Fixed”, or, “Floating”, and thus,

there may be “Fixed Mortgage Debentures”, or, “Floating Mortgage Debentures”

depending upon the nature of charge under the category of Secured Debentures.

● Unsecured, or, Naked Debentures are those that, are secured by any charge on the

assets of the company. The holders of such debentures are like ordinary creditors of

the company. The general solvency of the company is the only security available to

unsecured or, naked debentures.

Excellence and Service

CHRIST

Deemed to be University

Redeemable And Irredeemable Debentures

● This classification is made on the basis of terms of repayment.

● Redeemable Debentures are for fixed period and they provide for payment of the

principal sum on specified date, or, on demand, or, notice.

● Irredeemable Debentures are not issued for a fixed period. The issuing company

does not fix any date by which the principal would be paid back. The holders of such

debentures cannot demand payment from the company so long as it is a going

concern. Such debentures are perpetual in nature as they are payable after a long

time, or, on winding up of the company.

Excellence and Service

CHRIST

Deemed to be University

Convertible And Non- Convertible Debentures

● This classification is made on the convertibility of the debentures.

● Convertible Debentures are those which are convertible into Equity Shares on maturity

as per the terms of issue. Convertible Debentures are those which are convertible into

equity shares on maturity as per the terms of issue. Convertible debentures are now

popular in our India and many companies issue convertible debentures which are

automatically converted into shares after a fixed period, or, date (usually, after three

years). The rate of exchange of debentures into shares is also decided at the time of

issue of debentures. Interest is paid on such debentures till conversion. Such debentures

are popular with the investing class.

●Non- Convertible Debentures are not convertible into Equity Shares after some period,

or, on maturity. Prior approval of the shareholders is necessary for the issue of convertible

debentures. It also requires sanction of the central government. The conversion of

debentures into shares particularly of profitable companies is always advantageous to

debenture

● holders as well as to the company.

Excellence and Service

CHRIST

Deemed to be University

Demerits of Debenture

● Interest Obligatory

● High Liability

● Charged against asset

● Not good weak firms

Excellence and Service

CHRIST

Deemed to be University

Merits of Debentures

● Issuing in Cheap

● No dilution

● Best for depression period

Excellence and Service

CHRIST

Deemed to be University

Brain at work (Asyc Class Assignment-Research

Based)

● Why Debenture is considered good for depression period?

Excellence and Service

CHRIST

Deemed to be University

Bonds

Excellence and Service

CHRIST

Deemed to be University

Meaning

● Bonds refer to high-security debt instruments that enable an entity to

raise funds and fulfil capital requirements. It is a category of debt that

borrowers avail from individual investors for a specified tenure.

Excellence and Service

CHRIST

Deemed to be University

Features of Bonds

● Face Value

● Interest or Coupon rate on bond

● Maturity

● Tradable

Excellence and Service

CHRIST

Deemed to be University

Advantage

• Stability – Bonds are long-term investment tools that accrue assured

returns in comparison to other investment options. They provide a

low-risk avenue to investors apprehensive of the volatility of returns

from equity. Even though dividend incomes from equities are

traditionally higher than coupon returns, bonds are comparatively

inelastic as compared to cyclical market fluctuations.

Excellence and Service

CHRIST

Deemed to be University

-Contd-

• Indentures – Bonds grant a legal guarantee that binds borrowers to

return the principal amount to the creditors in due time. They serve as

financial contracts which contain details such as the par value, coupon

rates, tenure, and credit ratings. Companies that attract massive

investments in their bonds are highly unlikely to default on interest

payments due to their reputation in the securities market. Besides,

bondholders precede shareholders in receiving debt repayment in the

event of an entity’s bankruptcy.

Excellence and Service

CHRIST

Deemed to be University

Callable Bonds

● A callable bond, also known as a redeemable bond, is a bond that

the issuer may redeem before it reaches the stated maturity date. A

callable bond allows the issuing company to pay off their debt early.

A business may choose to call their bond if market interest rates

move lower, which will allow them to re-borrow at a more beneficial

rate. Callable bonds thus compensate investors for that potentiality

as they typically offer a more attractive interest rate or coupon rate

due to their callable nature.

Excellence and Service

CHRIST

Deemed to be University

-Contd-

• Portfolio diversification – Investors massively rely on investment in

fixed-income debt instruments such as bonds to diversify their

investment portfolio as they offer superior risk-adjusted returns on

investment. Consequently, portfolio diversification reduces the

possibility of short-term losses due to increased allocation of

investment funds to fixed-income resources instead of solely

depending on equities.

Excellence and Service

CHRIST

Deemed to be University

Limitation

• Inflation’s influence – Bonds are susceptible to inflation risks when

the prevailing rate of inflation exceeds the coupon rate offered by

issuers. Debt instruments which accrue fixed interests face risks of

devaluation too due to the impact of inflation on the principal value

invested.

Excellence and Service

CHRIST

Deemed to be University

-Contd-

• Limited liquidity- Bonds, although tradable, are mostly long-term

investments with withdrawal restrictions on the investment amount.

Shares precede bonds in terms of liquidity, as in bonds are liable to

several fees and penalties if creditors decide to withdraw their debt

amount.

Excellence and Service

CHRIST

Deemed to be University

-Contd-

• Lower returns – Issuers offer coupon rates on bonds which are

usually lower than returns on stocks. Investors receive a consistent

amount as interest over the tenure in a low-risk investment

environment. However, returns are much lower than on other debt

instruments.

Excellence and Service

CHRIST

Deemed to be University

Deep Discount Bond/ Zero Coupon Bond

● A deep discount bond, also known as an accrual bond, is a debt

security that does not pay interest but instead trades at a deep

discount, rendering a profit at maturity, when the bond is

redeemed for its full face value

Excellence and Service

CHRIST

Deemed to be University

Key Take Away

● Debt Security Instrument that does not pay interest

● Trade at deep discount offering profit at face value.

● Difference between face value and purchase value is return to

investor.

Excellence and Service

Mutual Funds

MISSION VISION CORE VALUES

CHRIST is a nurturing ground for an individual’s Excellence and Service Faith in God | Moral Uprightness

holistic development to make effective contribution to Love of Fellow Beings

the society in a dynamic environment Social Responsibility | Pursuit of Excellence

CHRIST

Deemed to be University

Definition

● A mutual fund is a type of financial vehicle made up of

a pool of money collected from many investors to

invest in securities like stocks, bonds, money market

instruments, and other assets.

● Mutual funds are operated by professional money

managers, who allocate the fund's assets and attempt to

produce capital gains or income for the fund's

investors.

● A mutual fund's portfolio is structured and maintained

to match the investment objectives stated in its

prospectus.

Excellence and Service

CHRIST

Deemed to be University

Operation Flow Chart

Excellence and Service

CHRIST

Deemed to be University

Advantages

● Professional Management

● Diversification

● Convenient Administration

● Return Potential

● Low Cost

● Liquidity

● Transferability

● Flexibility

● Tax Benefit

● Well Regulated

● Capital appreciation.

Excellence and Service

CHRIST

Deemed to be University

Organisation of Mutual Funds

Excellence and Service

CHRIST

Deemed to be University

Ways to Earn return trough Mutual Funds

1. Income is earned from dividends on stocks and interest on bonds

held in the fund's portfolio. A fund pays out nearly all of the

income it receives over the year to fund owners in the form of

a distributions. Funds often give investors a choice either to

receive a check for distributions or to reinvest the earnings and

get more shares.

2. If the fund sells securities that have increased in price, the fund

has a capital gain. Most funds also pass on these gains to

investors in a distribution.

3. If fund holdings increase in price but are not sold by the fund

manager, the fund's shares increase in price. You can then sell

your mutual fund shares for a profit in the market.

Excellence and Service

CHRIST

Deemed to be University

Types of Mutual Fund (based on Structure)

● Open Ended

● Close Ended

● Interval Funds

Excellence and Service

CHRIST

Deemed to be University

Open Ender Fund

● Open ended funds allow investors to

subscribe or redeem units as per the

prevailing Net Asset Value (NAV) on a

continuous basis. Basically, what you get

with open ended funds is liquidity and

flexibility of time.

Excellence and Service

CHRIST

Deemed to be University

● Under close-ended schemes, there is no repurchase

facility.

● However, the Units are listed in the stock market and

investors can sell and buy Units like any other

securities in the market.

● The scheme has a `specific life (say 10 years or 5

years) and at the end of the period, the mutual fund

sells securities bought under the scheme and disburses

the proceeds to Unit holders.

Excellence and Service

CHRIST

Deemed to be University

Interval Funds

● Interval funds combine the features of

open-ended and close-ended schemes.

They are open for sale or redemption

during pre-determined intervals at NAV

related prices.

Excellence and Service

CHRIST

Deemed to be University

Based on Investment Objective

● Growth Fund

● Income Fund

● Balanced Fund

● Money Market Fund

● Unit Linked Fund

● Tax Saving Scheme

● Special Schemes

Excellence and Service

Financial Service

MISSION VISION CORE VALUES

CHRIST is a nurturing ground for an individual’s Excellence and Service Faith in God | Moral Uprightness

holistic development to make effective contribution to Love of Fellow Beings

the society in a dynamic environment Social Responsibility | Pursuit of Excellence

CHRIST

Deemed to be University

Fund Based Service

● Leasing

● Hire purchase

● Consumer Credit

● Bill Discounting

● Factoring

● Insurance

Excellence and Service

CHRIST

Deemed to be University

Leasing

● A lease is a contract under which one party, the lessor

(owner of the asset), gives another party (the lessee)

the exclusive right to use the asset, usually for a

specified time in return for the payment of rent.

● Leasing is the process by which a firm can obtain the

use of certain fixed assets for which it must make a

series of contractual, periodic, tax-deductible

payments. A lease is a contract that enables a lessee to

secure the use of the tangible property for a specified

period by making payments to the owner.

Excellence and Service

CHRIST

Deemed to be University

Features of Leasing

1. The Contract: There are essentially two parties to a contract of

lease financing, namely the owner and the user.

2. Assets: The assets, property to be leased are the subject matter

lease financing contract.

3. Lease Period: The basic lease period during which the lease is

non-cancelable.

4. Rental Payments: The lessee pays to the lessor for the lease

transaction is the lease rental.

5. Maintain: Provision for the payment of the costs of maintenance

and repair, taxes, insurance, and other expenses appertaining to

the asset leased.

Excellence and Service

CHRIST

Deemed to be University

-Contd-

6. Term of Lease: The term of the lease is the period for

which the agreement of lease remains in operation.

7. Ownership: During the lease period, ownership of the assets is

being kept with the lessor, and its use is allowed to the

lessee.

8. Terminating: At the end of the period, the contract may be

terminated.

9. Renew or Purchase: An option to renew the lease or to

purchase the assets at the end of the basic period.

10. Default: The lessee may be liable for all future payments at

once, receiving title to the asset in exchange.

Excellence and Service

CHRIST

Deemed to be University

Advantages (Point of view of lessee)

● Saving of Capital

● Flexibility and Convenience

● Planning Cash Flows

● Improvement in Liquidity

● Shifting of Risk of Obsolescence

● Maintenance And Specialized Services

● Off-the-Balance-Sheet-Financing

Excellence and Service

CHRIST

Deemed to be University

Advantages (Point of view of lessor)

● High Profit

● Tax Benefit

● Quick Returns

Excellence and Service

CHRIST

Deemed to be University

Disadvantages(lessee)

1. Higher Cost: The lease rental includes a margin for the

lessor as also the cost of risk of obsolescence; it is, thus,

regarded as a form of financing at a higher cost.

2. Risk: Risk of being deprived of the use of assets in case

the leasing company winds up.

3. No Alteration in Asset: Lessee cannot make changes in

assets as per his requirement.

4. Penalties On Termination of Lease: The lessee has to

pay penalties in case he has to terminate the lease

before the expiry lease period.

Excellence and Service

CHRIST

Deemed to be University

Disadvantages(lessor)

1. High Risk of Obsolescence: The Lessor has to bear the

risk of obsolescence as there are rapid technological

changes.

2. Price Level Changes: In the case of inflation, the

prices of an asset rise, but the lease rentals remain

fixed.

3. Long term Investment: Leasing requires the long term

investment in the purchase of an asset and takes a long

time to cover the cost of that asset

Excellence and Service

CHRIST

Deemed to be University

Types of Lease

● Operating Lease

● Financial Lease

Excellence and Service

CHRIST

Deemed to be University

Operating Lease

● An operating lease is a cancellable contractual

agreement whereby the lessee agrees to make

periodic payments to the lessor, often for 5 or

fewer years, to obtain an asset set’s services.

According to the International Accounting

Standards (IAS-17), an operating lease is one

that is not a finance lease.

Excellence and Service

CHRIST

Deemed to be University

Financial Lease

● A financial (or capital) lease is a longer-term lease than

an operating lease that is non-cancelable and obligates

the lessee to make payments for the use of an asset

over a predetermined .period of time.

● According to the International Accounting Standard

(IAS-17), in a financial lease, the lessor transfer to the

lessee substantially all the risks and rewards identical

to the ownerships of the asset whether or not the title is

eventually transferred.

Excellence and Service

CHRIST

Deemed to be University

Distinguish between the Operating and Financial Lease

Topics Operating Lease Financial Lease

An operating lease is short term lease used to A financial lease is the lease used in connection with long-

Definition finance assets & is not fully amortized over the life term assets & amortizes the entire cost of the asset over

of the asset. the life of the lease.

Duration Short term leasing Long term leasing

Cost The lessor pays the maintenance cost. Lessee pays the maintenance cost.

Cancelable lease & It is a changeable lease Non-cancelable lease & It is not a changeable lease

Cancel & Changeable

contract. contract.

Risk lessor bears the risk of the asset. The lessee bears the risk of the asset.

Purchase At the end of the asset is hot purchasable. At the end of the contract, the asset is purchasable.

Renew It is a renewable contract. It is not a renewable contract.

Also called Service lease, short term lease, cancelable lease. A capital lease, long term lease, non-cancelable lease.

Excellence and Service

CHRIST

Deemed to be University

Hire Purchase

● Hire purchase is a method of financing of

the fixed asset to be purchased on future

date. Under this method of financing, the

purchase price is paid in instalments.

Ownership of the asset is transferred after

the payment of the last instalment.

Excellence and Service

CHRIST

Deemed to be University

Features

The hire purchaser becomes the owner of the

asset after paying the last instalment.

Every instalment is treated as hire charge for

using the asset.

Hire purchaser can use the asset right after

making the agreement with the hire vendor.

The hire vendor has the right to repossess the

asset in case of difficulties in obtaining the

payment of instalment.

Rental payments are paid in instalments over the

period of the agreement.

Excellence and Service

CHRIST

Deemed to be University

-Contd-

Each rental payment is considered as a charge for hiring the

asset. This means that, if the hirer defaults on any payment, the

seller has all the rights to take back the assets.

All the required terms and conditions between both the parties

involved are documented in a contract called Hire-Purchase

agreement.

The frequency of the instalments may be annual, half-yearly,

quarterly, monthly, etc. according to the terms of the agreement.

Assets are instantly delivered to the hirer as soon as the

agreement is signed.

Excellence and Service

CHRIST

Deemed to be University

-Contd-

If the hirer uses the option to purchase, the assets are passed to him after the

last installment is paid.

If the hirer does not want to own the asset, he can return the assets any time

and is not required to pay any installment that falls due after the return.

However, once the hirer returns the assets, he cannot claim back any payments

already paid as they are the charges towards the hire and use of the assets.

The hirer cannot pledge, sell or mortgage the assets as he is not the owner of

the assets till the last payment is made.

The hirer, usually, pays a certain amount as an initial deposit / down payment

while signing the agreement.

Generally, the hirer can terminate the hire purchase agreement any time before

the ownership rights pass to him.

Excellence and Service

CHRIST

Deemed to be University

Advantage

Financing of an asset through hire purchase is very easy.

Hire purchaser becomes the owner of the asset in future.

Hire purchaser gets the benefit of depreciation on asset

hired by him/her.

Hire purchasers also enjoy the tax benefit on the interest

payable by them.

Immediate use of assets without paying the entire

amount.

Expensive assets can be utilized as the payment is

spread over a period of time.

Fixed rental payments make budgeting easier as all the

expenditures are known in advance.

Excellence and Service

CHRIST

Deemed to be University

Disadvantage

Ownership of asset is transferred only after the payment of the last installment.

The magnitude of funds involved in hire purchase are very small and only

small types of assets like office equipment’s, automobiles, etc., are purchased

through it.

The cost of financing through hire purchase is very high.

The addition of any covenants increases the cost.

If the hired asset is no longer needed because of any change in the business

strategy, there may be a resulting penalty.

Total amount paid towards the asset could be much higher than the cost of the

asset due to substantially high-interest rates.

Excellence and Service

CHRIST

Deemed to be University

Term Used for Hire Purchase

Hire Purchaser: He is buyer in hire purchase

agreement.

Hire Vendor: He is seller in a hire purchase agreement.

Cash Price: It is the amount to be paid for outright

purchase in cash.

Down Payment: It is the of initial payment payable by

the hire purchaser at the time of entering into a hire

purchase agreement.

Hire Purchase Price: It is the total amount payable by

the hire purchasers to the hire vendor of goods are

purchased under the hire purchase system.

Excellence and Service

CHRIST

Deemed to be University

Suitability

● Small scale companies and entrepreneurs can

benefit from Hire Purchase. Expensive and

important assets can be hired and later owned.

This ensures that they can start using the asset

from very first day and use the money earned to

later buy the same assets.

Excellence and Service

CHRIST

Deemed to be University

Consumer Credit

● Consumer credit is personal debt taken on to purchase

goods and services. A credit card is one form of

consumer credit.

● Although any type of personal loan could be labeled

consumer credit, the term is more often used to

describe unsecured debt that is taken on to buy

everyday goods and services. However, consumer debt

can also include collateralized consumer loans like

mortgage and car loans.

● Consumer credit is also known as consumer debt.

Excellence and Service

CHRIST

Deemed to be University

Type of Consumer Credit

● Instalment Credit

● Revolving Credit

Excellence and Service

CHRIST

Deemed to be University

Advantages

● Consumer credit allows consumers to get an advance

on income to buy products and services. In an

emergency, such as a car breakdown, that can be a

lifesaver. Because credit cards are relatively safe to

carry, America is increasingly becoming a cashless

society in which people routinely rely on credit for

purchases large and small.

● Revolving consumer credit is a highly lucrative

industry. Banks and financial institutions, department

stores, and many other businesses offer consumer

credit.

Excellence and Service

CHRIST

Deemed to be University

Disadvantages

● The main disadvantage of using

revolving consumer credit is the cost to

consumers who fail to pay off their entire

balances every month and continue to accrue

additional interest charges from month to

month.

Excellence and Service

CHRIST

Deemed to be University

Bill Discounting

● Bill discounting, also known as invoice discounting or invoice

financing, is a financing arrangement where a business sells its

unpaid invoices to a financial institution at a discounted rate.

● The business receives immediate funds, usually a percentage of

the invoice value, while the financial institution assumes the

right to collect the full payment from the debtor.

● Bill discounting allows businesses to address immediate cash

flow needs without waiting for their customers to make the

payment.

Excellence and Service

CHRIST

Deemed to be University

Process of Bill Discounting

● The business delivers goods or services to its customers and generates

an invoice.

● The business approaches a financial institution, such as a bank or a

non-banking financial company (NBFC), for bill discounting.

● The financial institution evaluates the creditworthiness of the business

and the debtor.

● If approved, the financial institution purchases the invoice from the

business at a discount.

● The financial institution provides immediate funds to the business,

usually a percentage of the invoice value.

● The business retains the responsibility of collecting the payment from

the debtor within the specified period.

● Once the debtor pays the invoice, the business repays the financial

institution the discounted amount

Excellence and Service

CHRIST

Deemed to be University

Factoring

● Factoring, on the other hand, involves a broader range of services

beyond financing. It is a financial arrangement where a business sells

its accounts receivable to a third-party known as a factor.

● The factor purchases the receivables at a discounted rate and assumes

responsibility for collecting the payments from the debtors.

● Factoring includes not only financing but also services such as credit

checks, collections, and bookkeeping.

Excellence and Service

CHRIST

Deemed to be University

Factoring

● The business delivers goods or services to its customers and generates

an invoice.

● The business enters into a factoring agreement with a factor.

● The factor assesses the creditworthiness of the business and the

debtors.

● The factor purchases the accounts receivable from the business at a

discount.

● The factor provides immediate funds to the business, usually a

percentage of the accounts receivable value.

● The factor assumes the responsibility of collecting the payments from

the debtors.

● The factor may provide additional services such as credit checks,

collections, and bookkeeping.

● Once the debtors pay the invoices, the factor deducts its fees and

returns the remaining amount to the

Excellence business.

and Service

CHRIST

Deemed to be University

Natu of Transaction Short-term financing against Sale of accounts receivable or

the discounted value of a bill invoices to a third-party

of exchange or promissory (factor) at a discount

note

Parties Involved Involves the drawer of the Involves the seller (client),

bill (seller), the drawee the buyer (debtor), and the

(buyer), and a financing factor (financing company)

institution

Financing Provides immediate cash Provides immediate cash

flow by receiving a flow by selling invoices or

discounted value of the bill accounts receivable to the

from the financing institution factor

Ownership of Receivables The seller retains ownership The factor takes ownership of

of the bill and is responsible the accounts receivable and is

for collecting payment from responsible for collecting

the buyer payment

Excellence and Service

CHRIST

Risk and Responsibility The seller remains The factorDeemed

assumes the risk

to be University

responsible for credit risk, of non-payment and is

collection, and credit responsible for credit

control control and collection

Invoice Verification The financing institution The factor verifies the

generally verifies the authenticity and validity of

authenticity and acceptance the invoices

of the bill

Use of Collateral Collateral may or may not Collateral may or may not

be required, depending on be required, depending on

the creditworthiness of the the creditworthiness of the

drawer and the buyer invoices

Relationship with Buyer The seller maintains a The factor may establish a

direct relationship with the direct relationship with the

buyer, who is obligated to buyer for payment

pay the bill collection

Excellence and Service

CHRIST

Deemed to be University

Insurance

● epresented in a form of policy, Insurance is a contract in which the

individual or an entity gets the financial protection, in other words,

reimbursement from the insurance company for the damage (big or

small) caused to their property.

● The insurer and the insured enter a legal contract for the insurance

called the insurance policy that provides financial security from the

future uncertainties.

Excellence and Service

CHRIST

Deemed to be University

Principle of Insurance

● Utmost Good Faith

● Proximate Cause

● Insurable Interest

● Indemnity

● Subrogation

● Contribution

● Loss Minimization

Excellence and Service

CHRIST

Deemed to be University

Types Of Insurance

There are two broad categories of insurance:

1. Life Insurance

2. General insurance

Excellence and Service

CHRIST

Deemed to be University

Life Insurance

● The insurance policy whereby the policyholder (insured) can ensure

financial freedom for their family members after death. It offers

financial compensation in case of death or disability.

Excellence and Service

CHRIST

Deemed to be University

Classification of Life Insurance

● Term Insurance: Gives life coverage for a specific time

period.

● Whole life insurance: Offer life cover for the whole

life of an individual

● Endowment policy: a portion of premiums go toward

the death benefit, while the remaining is invested by

the insurer.

● Money back Policy: a certain percentage of the sum

assured is paid to the insured in intervals throughout

the term as survival benefit.

Excellence and Service

CHRIST

Deemed to be University

-Contd-

● Pension Plans: Also called retirement plans are a

fusion of insurance and investment. A portion from the

premiums is directed towards retirement corpus, which

is paid as a lump-sum or monthly payment after the

retirement of the insured.

● Child Plans: Provides financial aid for children of the

policyholders throughout their lives.

● ULIPS – Unit Linked Insurance Plans: same as

endowment plans, a part of premiums go toward the

death benefit while the remaining goes toward mutual

fund investments.

Excellence and Service

CHRIST

Deemed to be University

General Insurance

● Everything apart from life can be insured under

general insurance. It offers financial compensation on

any loss other than death.

● General insurance covers the loss or damages caused

to all the assets and liabilities.

● The insurance company promises to pay the assured

sum to cover the loss related to the vehicle, medical

treatments, fire, theft, or even financial problems

during travel.

Excellence and Service

CHRIST

Deemed to be University

Types of General Insurance

● Health Insurance: Covers the cost of medical care.

● Fire Insurance: give coverage for the damages caused

to goods or property due to fire.

● Travel Insurance: compensates the financial liabilities

arising out of non-medical or medical emergencies

during travel within the country or abroad

● Motor Insurance: offers financial protection to motor

vehicles from damages due to accidents, fire, theft, or

natural calamities.

● Home Insurance: compensates the damage caused to

home due to man-made disasters, natural calamities, or

other threats Excellence and Service

Fee Based Services

MISSION VISION CORE VALUES

CHRIST is a nurturing ground for an individual’s Excellence and Service Faith in God | Moral Uprightness

holistic development to make effective contribution to Love of Fellow Beings

the society in a dynamic environment Social Responsibility | Pursuit of Excellence

CHRIST

Deemed to be University

Fee Based Financial Service

● Merchant Banking,

● Issue Management,

● Credit rating,

● Debt Restructuring

● Depository Services

● Stock Broking

Excellence and Service

CHRIST

Deemed to be University

Merchant Bank

●A merchant bank is a financial institution that conducts

underwriting, loan services, financial advising, and

fundraising services for large corporations and high-net-

worth individuals *HNWI).

●Merchant banks specialize in providing services for

private corporations.

Excellence and Service

CHRIST

Deemed to be University

-Contd-

● Unlike retail or commercial banks, merchant banks do not typically

provide financial services to the general public.

● Unlike investment banks, they focus on private companies not public

companies.

● Examples of large merchant banks include JPMorgan Chase,

Goldman Sachs, and Citigroup.

Excellence and Service

CHRIST

Deemed to be University

Functions

●Corporate counseling

● Project Counseling

●Capital Structuring

●Portfolio Management

●Issue Management

●Credit Syndication

●Working capital

●Venture Capital

●Lease Finance

●ØFixed Deposits

Excellence and Service

CHRIST

Deemed to be University

Other Functions

● Treasury Management- Management of short

term fund requirements by client companies.

● •Stock broking- helping the investors through a

network of service units

● •Servicing of issues- servicing the shareholders

and debenture holders in distributing

● dividends, debenture interest.

● •Small Scale industry counseling- counseling

SSI units on marketing and finance

Excellence and Service

CHRIST

Deemed to be University

-Contd-

● Equity research and investment counseling –merchant

banker plays an important role in providing equity

research and investment counseling because the

investor is not in a position to take appropriate

investment decision.

● •Assistance to NRI investors - the NRI investors are

brought to the notice of the various investment

opportunities in the country.

● •Foreign Collaboration: Foreign collaboration

arrangements are made by the Merchant bankers.

Excellence and Service

CHRIST

Deemed to be University

Issue Management

● Issue Management: Management of issues refers to effective

marketing of corporate securities viz., equity shares, preference

shares and debentures or bonds by offering them to public.

● Merchant banks act as intermediary whose main job is to

transfer capital from those who own it to those who need it.

● The issue function may be broadly divided in to pre issue and

post issue management.

● a. Issue through prospectus, offer for sale and private

placement.

● b. Marketing and underwriting

● c. pricing of issues

Excellence and Service

CHRIST

Deemed to be University

-Contd-

● The function of capital issues management in India is carried out by

merchant bankers.

● The funds are raised by companies to finance new projects, expansion

/ modernization/ diversification.

● Issue are through

i)Public Issue

ii)Right Issue

iii)Private Placement

Excellence and Service

CHRIST

Deemed to be University

Issue Management Activities

● Pre Issue Activities

● Post Issue Activities

Excellence and Service

CHRIST

Deemed to be University

Pre Issue Activities

● Issue of share

● Marketing , Coordinating and Underwriting of Issue

● Pricing of Issue

Excellence and Service

CHRIST

Deemed to be University

Post Issue Activities

● Collection of Issue form and amount

● Scrutinizing Application

● Deciding Allotment

● Mailing share certificate refund or allotment otders.

Excellence and Service

CHRIST

Deemed to be University

Example-LIC IPO –Merchant Bankers

● SBI Capital

● Goldman Sachs

● JP Morgan

● Citigroup

● JM Financial

● Bank of America

● ICICI Securities

● Kotak Mahindra Capital

● Nomura

● Axis Capital

Excellence and Service

CHRIST

Deemed to be University

Credit Rating

● Definition: Credit rating is an analysis of the

credit risks associated with a financial

instrument or a financial entity. It is a rating

given to a particular entity based on the

credentials and the extent to which the financial

statements of the entity are sound, in terms of

borrowing and lending that has been done in the

past.

Excellence and Service

CHRIST

Deemed to be University

CHARACTERISTICS OF CREDIT RATING

● 1. Assessment of issuer's capacity to repay. It assesses issuer's

capacity to meet its financial obligations i.e., its capacity to pay

interest and repay the principal amount borrowed.

● 2. Based on data. A credit rating agency assesses financial

strength of the borrower on the financial data.

● 3. Expressed in symbols. Ratings are expressed in symbols e.g.

AAA, BBB which can be understood by a layman too.

● 4. Done by expert. Credit rating is done by expert of reputed,

accredited institutions.

● 5. Guidance about investment-not recommendation. Credit

rating is only a guidance to investors and not recommendation

to invest in any particular instrument.

Excellence and Service

CHRIST

Deemed to be University

Function

●It provides unbiased opinion to investors

●Provide quality and dependable information.

●Provide information in easy to understand

language

●Provide information free of cost or at nominal

cost.

●Helps investors in taking investment decisions.

●Disciplines corporate borrowers

●Formation of public policy on investment

Excellence and Service

CHRIST

Deemed to be University

Benefits of Credit Rating

● A. Benefits to investors.

● B. Benefits to the rated company.

● C. Benefits to intermediaries.

● D. Benefits to the business world

Excellence and Service

CHRIST

Deemed to be University

Benefits to Investors

● Assessment of Risk

● Information at low Cost

● Advantage of continuous monitoring

● Provides the investors a choice of

Investment.

● Ratings by credit rating agencies is dependable

Excellence and Service

CHRIST

Deemed to be University

Benefits to Company

● Ease in borrowings

● Borrowing at cheaper rates.

● Facilitates growth.

● Recognition of lesser known companies

● Adds to the goodwill of the rated company

● Imposes financial discipline on borrowers

Excellence and Service

CHRIST

Deemed to be University

Benefits to Business world

● Increase in investor population.

● Guidance to foreign investors.

Excellence and Service

CHRIST

Deemed to be University

BENEFITS TO INTERMEDIARIES

● Merchant bankers' and brokers' job made

easy.

Excellence and Service

CHRIST

Deemed to be University

Credit rating Agencies

• Credit Rating Information Services of India Limited (CRISIL)

• Investment Information and Credit Rating Agency of India

Limited (ICRA)

• Credit Analysis & Research (CARE)

• Onida Individual Credit Rating Agency of India (ONICRA)

• Fitch India.

• Brickwork Ratings (BWR)

Excellence and Service

CHRIST

Deemed to be University

Debt Restructuring

● Debt restructuring is a process used by

companies, individuals, and even countries to

avoid the risk of defaulting on their existing

debts, such as by negotiating lower interest

rates. Debt restructuring provides a less

expensive alternative to bankruptcy when a

debtor is in financial turmoil, and it can work

to the benefit of both borrower and lender.

Excellence and Service

CHRIST

Deemed to be University

Depository Services

● Depository is an institution or organisation, which holds securities

(e.g. s

hares, debentures , bonds, etc) in electronic form, in which trading is

done.

Depositories provide following services :

(i) Maintain records of shareholding in electronic form.

(ii) Enables deposit and withdrawal of securities and from the depository

through the process of dematerlisation and rematerialisation.

(iii) It effects the transfer of securities traded in the depository mode on a

stock exchange.

Excellence and Service

CHRIST

Deemed to be University

Types of central depositories in India

● In India, there are two central depositories, namely.

● NSDL (National Security Depository Limited)

● CSDL (Central Depository Services Limited)

Excellence and Service

CHRIST

Deemed to be University

NSDL

● NSDL is India’s primary & biggest depository founded on 8 August

1996, which is developed mainly to manage securities held in the

Indian economy in a Demat form. Every day the NSDL introduces an

average of 3602 accounts.

● Industrial Development Bank of India (IDBI), Unit Trust of India

(UTI), and National Stock Exchange ( NSE) are promoting NSDL.

Excellence and Service

CHRIST

Deemed to be University

Benefit

● Given the significant financial stakes in NSDL exchanges,

safeguarding measures are imperative.

● The depository system implements various security protocols for

stakeholders.

● SEBI ensures only reputable entities participate.

● Transactions are meticulously recorded in NSDL's central and

partners' databases.

● Depository participants furnish investors with regular account

statements for oversight.

● NSDL conducts routine inspections of participants and Registrar &

Transfer agents..

Excellence and Service

CHRIST

Deemed to be University

CDSL

● The Central Depository Services Limited, or CDSL, is an Indian

central securities depository. To provide depository services to the

Indian securities market, it was founded in 1999.

● Dematerialization of securities—converting physical securities into

electronic form—and dematerialization—converting electronic

securities back into physical form—are services that CDSL provides.

Excellence and Service

CHRIST

Deemed to be University

Difference Between NSDL &CDSL

Particulars NSDL CSDL

Stock Exchange NSE BSE

Establishment Date 1996 1998

Market Share More Comparatively less

Depository Participant More Comparatively less

DEMAT Account Number The NSDL code is a 14- The CDSL DEMAT account

Format character numeric code that number is a numeric code of 16

begins with IN digits.

Excellence and Service

CHRIST

Deemed to be University

Depository Participants

● A depository participant in India refers to a stockbroker or agent

registered with a depository. They should fulfill the minimum net

worth criteria as instructed by the Securities and Exchange Board of

India (SEBI) and the respective depositories. They act as an

intermediary between the depository and investors.

Excellence and Service

CHRIST

Deemed to be University

Excellence and Service

CHRIST

Deemed to be University

Role

● Digitised Convenience: In the past, trading involved significant

paperwork. With depository participants, all these processes are

digitized, making asset management and trading convenient.

● Enhanced Security: Electronic execution of processes by depository

participants enhances security, eliminating concerns about physical

asset loss or theft.

● Speedy Transactions: The transparent and efficient operations of

depository participants expedite the buying, storing, and trading of

assets, compared to traditional methods.

● Efficient Management of Bulk: With online operations, depository

participants efficiently manage transactions with a multitude of

investors, ensuring smooth processes.

Excellence and Service

CHRIST

Deemed to be University

Stock Broking

● Is a service provided by individual or a firm stockbroker is a

financial professional who executes orders in the market on behalf

of clients. A stockbroker may also be known as a registered

representative (RR) or an investment advisor.

Excellence and Service

You might also like

- Geometallurgy PDFDocument5 pagesGeometallurgy PDFEdythMarcaNo ratings yet

- Corporate Accounting Unit 1: Introduction: Mission Vision Core ValuesDocument52 pagesCorporate Accounting Unit 1: Introduction: Mission Vision Core ValuesMudra JainNo ratings yet

- Sources of FinanceDocument9 pagesSources of FinanceDinesh kumar JenaNo ratings yet

- Long Term Source FinalDocument43 pagesLong Term Source Finalsuparshva99iimNo ratings yet

- Financing Decision: Dr. Md. Rezaul KabirDocument129 pagesFinancing Decision: Dr. Md. Rezaul KabirUrbana Raquib Rodosee100% (1)

- Chapter 6 - Long Term Sources of FinanceDocument28 pagesChapter 6 - Long Term Sources of FinanceCiara CrewNo ratings yet

- CFMP - Bloomberg Course: Your GuideDocument47 pagesCFMP - Bloomberg Course: Your GuideWilliam BoschNo ratings yet

- Share Capital and Basic Legal Documents of A CompanyDocument62 pagesShare Capital and Basic Legal Documents of A CompanyMuneebNo ratings yet

- Long Term Sources of FinanceDocument21 pagesLong Term Sources of Financevivek patelNo ratings yet

- Chapter-1 Introduction PDFDocument78 pagesChapter-1 Introduction PDFRaunak YadavNo ratings yet

- Far410 Chapter 3 Equity EditedDocument32 pagesFar410 Chapter 3 Equity EditedWAN AMIRUL MUHAIMIN WAN ZUKAMALNo ratings yet

- Chapter 2 Capital StructureDocument8 pagesChapter 2 Capital StructureAmily SarNo ratings yet

- Sources of FinanceDocument28 pagesSources of FinanceShalini Jain0% (1)

- School of Business and Management Financial Management (FM) - Module - 3 Dividend DecisionDocument26 pagesSchool of Business and Management Financial Management (FM) - Module - 3 Dividend DecisionAyesha RachhNo ratings yet

- Equity of CorporationsDocument51 pagesEquity of Corporationskrys_elleNo ratings yet

- Primary - Market & IPO Version 2Document9 pagesPrimary - Market & IPO Version 2Deekshith KumarNo ratings yet

- Forms of BusinessDocument9 pagesForms of BusinessOtep JulNo ratings yet

- Warrants & ConvertiblesDocument21 pagesWarrants & ConvertiblesSonika SoniNo ratings yet

- Finance Decisions: Unit IvDocument70 pagesFinance Decisions: Unit IvFara HameedNo ratings yet

- Capital Structure - MAINDocument69 pagesCapital Structure - MAINSHASHANK TOMER 21211781No ratings yet

- Unlocking The Potential of Stock Splits and Dividends Understanding Types Practical Applications 20231004072028naqcDocument11 pagesUnlocking The Potential of Stock Splits and Dividends Understanding Types Practical Applications 20231004072028naqcAani RashNo ratings yet

- Corporate Structure and AdministrationDocument10 pagesCorporate Structure and AdministrationDr.Sree Lakshmi KNo ratings yet

- Segmentation Targeting Brand Positioning SwatDocument17 pagesSegmentation Targeting Brand Positioning SwatGüldané DurukanNo ratings yet

- Dividend PolicyDocument52 pagesDividend PolicyANISH KUMARNo ratings yet

- Corporate Finance Till Test 1Document39 pagesCorporate Finance Till Test 1YogeeshNo ratings yet

- EF5158 Unit 4.2 - Private Company ValuationDocument42 pagesEF5158 Unit 4.2 - Private Company Valuationblessingisichei99No ratings yet

- Research and Investment Club Fms Delhi: Online Induction Learning - Batch 2021Document7 pagesResearch and Investment Club Fms Delhi: Online Induction Learning - Batch 2021Shitanshu YadavNo ratings yet

- Slides Lect1Document33 pagesSlides Lect1Gaurav AgarwalNo ratings yet

- Unit-V HEDGE FUNDS AND REAL ASSETSDocument59 pagesUnit-V HEDGE FUNDS AND REAL ASSETSMithun SanjayNo ratings yet

- Original 1490004736 LO Chapter 1 Corporate Action and Its PurposeDocument17 pagesOriginal 1490004736 LO Chapter 1 Corporate Action and Its PurposepetrishiaNo ratings yet

- Value Creation & Key Drivers of ValueDocument2 pagesValue Creation & Key Drivers of ValueYusra KhalidNo ratings yet

- Valuation of Company - Part 1: Mahesh Savanth Chartered AccountantDocument16 pagesValuation of Company - Part 1: Mahesh Savanth Chartered AccountantvikasajainNo ratings yet

- DiptanshuDocument50 pagesDiptanshukratika maheshwariNo ratings yet

- Chapter 2 - Part 4 - Shares & Loan CapitalDocument24 pagesChapter 2 - Part 4 - Shares & Loan Capital2022885126No ratings yet

- Dividend Decisions: Amity School of BusinessDocument33 pagesDividend Decisions: Amity School of BusinessGurshaan SarlaNo ratings yet

- Equity Securities MarketDocument23 pagesEquity Securities MarketILOVE MATURED FANSNo ratings yet

- Capital StructureDocument10 pagesCapital StructureNishan DuwalNo ratings yet

- Introduction To Stocks and InvestingDocument142 pagesIntroduction To Stocks and InvestingSunil.MNo ratings yet

- Share CapitalDocument6 pagesShare CapitalAashi DharwalNo ratings yet

- Topic 3 - Capital StructureDocument17 pagesTopic 3 - Capital StructureSandeepa KaurNo ratings yet

- Et ZC414 13Document20 pagesEt ZC414 13rajpd28No ratings yet

- FM Unit 3Document20 pagesFM Unit 3chandru R (RE)No ratings yet

- Mod 5 Dividend Decisions Handout SNDocument7 pagesMod 5 Dividend Decisions Handout SNAkhilNo ratings yet

- Financial ManagementDocument22 pagesFinancial Managementutkrsh raghavNo ratings yet

- Developing The Business and Business ModelsDocument27 pagesDeveloping The Business and Business ModelsHananin NasirNo ratings yet

- Designing Capital StructureDocument13 pagesDesigning Capital StructuresiddharthdileepkamatNo ratings yet

- Chapter 15 FinmanDocument13 pagesChapter 15 FinmanEricaNo ratings yet

- RM Assignment-3: Q1. Dividend Policy Can Be Used To Maximize The Wealth of The Shareholder. Explain. AnswerDocument4 pagesRM Assignment-3: Q1. Dividend Policy Can Be Used To Maximize The Wealth of The Shareholder. Explain. AnswerSiddhant gudwaniNo ratings yet

- NsimDocument200 pagesNsimkimakar100% (1)

- Unit 2 FMDocument53 pagesUnit 2 FMdhall.tushar2004No ratings yet

- Financed by LectureDocument5 pagesFinanced by LectureEng Abdikarim WalhadNo ratings yet

- WACCcostDocument53 pagesWACCcostttongoona3No ratings yet

- Session - 2Document19 pagesSession - 2Manan AgarwalNo ratings yet

- Finance Management 4Document26 pagesFinance Management 4charithNo ratings yet

- Corporate ActionsDocument6 pagesCorporate Actionsranaahtsham571No ratings yet

- Equity Financing: Sresth Verma Bba 6A 05290201718Document12 pagesEquity Financing: Sresth Verma Bba 6A 05290201718Sresth VermaNo ratings yet

- Far410 Chapter 4 Equity 2014Document32 pagesFar410 Chapter 4 Equity 2014mr.nazir.shahidanNo ratings yet

- Company Law - SharesDocument25 pagesCompany Law - SharesShweta BhartiNo ratings yet

- Financial Accounting - Information For Decisions - Session 8 - Chapter 10 PPT Eh5CoID6zuDocument38 pagesFinancial Accounting - Information For Decisions - Session 8 - Chapter 10 PPT Eh5CoID6zumukul3087_305865623No ratings yet

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- Essay 1 Professional AspirationsDocument1 pageEssay 1 Professional AspirationsFarhad KabirNo ratings yet

- Project Management Project Final ReportDocument51 pagesProject Management Project Final Reportyara alaskarNo ratings yet

- Chapter 11 Internal ControlDocument5 pagesChapter 11 Internal ControlCazia Mei JoverNo ratings yet

- Finance Word LibDocument45 pagesFinance Word LibTor 2No ratings yet

- SteepDocument5 pagesSteepMark neil a. GalutNo ratings yet

- IIMA - AMP - For - Professionals - in - Aviation - and - Aeronautics - BatchDocument5 pagesIIMA - AMP - For - Professionals - in - Aviation - and - Aeronautics - BatchRaguraam ChandrasekharanNo ratings yet

- DaimlerDocument110 pagesDaimlercainath100% (1)

- Foundations of Organizational Structure PDFDocument13 pagesFoundations of Organizational Structure PDFElizaNo ratings yet

- Treasury Director in Detroit MI Resume John PriceDocument2 pagesTreasury Director in Detroit MI Resume John Pricejohnprice1No ratings yet

- JollibeeDocument3 pagesJollibeeCHARLES DANIEL VELASCONo ratings yet

- A T I R B, 2015: Ftermath OF HE Ndustrial Elations ILLDocument11 pagesA T I R B, 2015: Ftermath OF HE Ndustrial Elations ILLsubhashni kumariNo ratings yet

- GLC Transformation (Slide Presentation)Document29 pagesGLC Transformation (Slide Presentation)Farah LodinNo ratings yet

- "Samsung Electronics": SESSION-2016-2019Document56 pages"Samsung Electronics": SESSION-2016-2019Ambuj RaghuvanshiNo ratings yet

- Entrepreneurship Development Class 12 NotesDocument27 pagesEntrepreneurship Development Class 12 NotesHsnNo ratings yet

- Business Area: Tcode: Ox03: Whether A Single Business Area Can Be Used by Two or More Company Codes?Document41 pagesBusiness Area: Tcode: Ox03: Whether A Single Business Area Can Be Used by Two or More Company Codes?fharooksNo ratings yet

- Cisco Competitive Advantages CheatsheetDocument2 pagesCisco Competitive Advantages CheatsheetAwins OumerNo ratings yet

- GRADE XII-Accountancy-HOLIDAY HOMEWORK-2022-23Document3 pagesGRADE XII-Accountancy-HOLIDAY HOMEWORK-2022-23Aman SinghNo ratings yet

- Family Business Governance HandbookDocument60 pagesFamily Business Governance HandbookselleriverketNo ratings yet

- BAIN BRIEF Strategic Planning That Produces Real StrategyDocument8 pagesBAIN BRIEF Strategic Planning That Produces Real StrategyHoanabc123No ratings yet

- Make or Buy ApproachDocument4 pagesMake or Buy Approachporseena100% (1)

- Arc085 P3 ExamDocument7 pagesArc085 P3 Examcristian abram bautistaNo ratings yet

- Pe 3Document38 pagesPe 3Marie Anne C. PolicarpioNo ratings yet

- DRP Manual-21.09.22Document28 pagesDRP Manual-21.09.22SandeepNo ratings yet

- Risk Assessment TemplateDocument1 pageRisk Assessment TemplateCharielle Esthelin BacuganNo ratings yet

- Dunnhumby - The Complete Journey User GuideDocument11 pagesDunnhumby - The Complete Journey User GuidePreetha RajanNo ratings yet

- The Ideal Pitch: (10 SLIDES)Document2 pagesThe Ideal Pitch: (10 SLIDES)Aziz AdelNo ratings yet

- Research Presentation 001Document9 pagesResearch Presentation 001SharmiLa RajandranNo ratings yet

- Gayatri ResumeDocument1 pageGayatri ResumegayatrinadithokaNo ratings yet

- Effects of Service Quality and Customer Satisfaction On Repurchase Intention in Restaurants On University of Cape Coast CampusDocument11 pagesEffects of Service Quality and Customer Satisfaction On Repurchase Intention in Restaurants On University of Cape Coast CampusPaula JimenezNo ratings yet