Professional Documents

Culture Documents

Chapter 3 Regional Economic Integration

Uploaded by

francis albaracin0 ratings0% found this document useful (0 votes)

2 views45 pagesRegional economic integration

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRegional economic integration

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views45 pagesChapter 3 Regional Economic Integration

Uploaded by

francis albaracinRegional economic integration

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 45

MODULE 3: Regional Economic Integration

Regional Integration includes a multitude

of economic and / or political steps that

maybe taken by member states of a union

to increase their global competitiveness –

not only preferential trade access.

Learning Objectives:

After studying this chapter, you should be able to:

1. Define regional economic integration and identify its

levels.

2. Discuss the benefits and drawbacks of regional economic

integration.

3. Describe regional integration in Europe and its pattern of

enlargement.

4. Discuss the regional integration in the Americas and

analyze its future prospects.

5. Characterize regional integration in Asia and how it differs

from integration elsewhere.

6. Describe integration in the Middle East and Africa, and

explain the slow progress.

Nestlé's Global Recipe

Vevey, Switzerland – Although

based in small Switzerland,

Nestlé’s (www.nestle.com)

sells its products in nearly every

Country on the planet. Nestlé is

the world’s largest food company.

It operates across cultural borders

24 hours a day and earns just 2

percent of its sales at home.

Nestlé is known for its ability

to turn humdrum products like http://www.harborbarandgrill.com/the-benefits-of-a-professional-service/

bottled water and pet food into well-known global

brands. The company also takes regional products to the

global market when opportunity arises. For example,

Nestlé first launched a cereal bar for diabetics in Asia

under the brand name Nutren Balance and then

introduced it to other markets worldwide.

Nestlé must navigate cultural and political

traditions in other countries because food is an integral

part of the social fabric everywhere. Today the company

makes every effort to be sensitive to the traditional ways

in which babies are fed. For example, Nestlé learned

from its past mistakes and now does it all it can to ensure

the mothers in developing nations to use pure water to

mix its baby milk formulas. As Nestlé expands more

aggressively into emerging markets, it must be alert to

changes in ( pls. continue reading in the next slide)

consumer attitudes due to greater cross-cultural contact

that results from regional integration.

The laws of regional trading bloc also affect the

business activities of Nestlé. When Nestlé and Coca-Cola

announced a joint venture to develop coffee and tea

drinks, they first had to show the European Union (EU)

Commission that they would not stifle competition

across the region. Firms operating within the EU also

have to abide by the EU environmental protection laws.

Nestlé works with government to minimize the

packaging waste that results from the use of its products

by developing and managing waste-recovery programs.

As you read this chapter, think of all the ways business

activities are being affected when groups of nations

band together in regional trading blocks.

Regional trade agreements are changing the

landscape of the global marketplace. Companies like

Nestlé of Switzerland are finding these agreements

lower trade barriers and open new markets for goods

and services. Markets otherwise off-limits because

tariffs made imported products too expensive can

become quiet attractive once tariffs are lifted. Not only

those domestic companies to seek new markets

abroad, but they also let competitors from other

nations enter the domestic market. Such mobility

increases competition in every market that takes part

in an agreement.

Trade agreements can allow companies to alter

their strategies, sometimes radically. For example,

nations in the Americas want to create a free trade

area that runs from the northern tip of Alaska to the

Southern tip of South America. Companies that do

business throughout the region could save millions of

dollars annually from the removal of import tariffs

under an eventual agreement. Multinationals could

save money by supplying the entire regions from just

a few regional factories, rather than the factory in

each nation.

What is Regional Economic Integration?

The process whereby countries in geographic

region cooperate to reduce or eliminate trade barriers to

the international flow of products, people, or capital is

called Regional Economic Integration (Regionalism). A

group of nations in a geographic region undergoing

economic integration is called a regional trading bloc.

The goal of nations undergoing economic

integration is not only to increase cross-border trade and

investment but also to raise the living standards for

their people. Moreover, regional integration sometimes

has additional goals, such as protection of intellectual

property rights or the environment, or eventual political

union.

Free Trade Area

Economic integration whereby countries seek to

remove all barriers to trade among themselves, but each

country determine its own barriers against non-members

is called a free trade area. A free trade area is the lowest

level of economic integration that is possible between

two or more countries. Countries belonging to the free

trade area strive to remove all tariffs and nontariff

barriers such as quotas and subsidies, on international

trade in goods and services.

However, each country is able to maintain

whatever policy it sees fit against non-member countries.

These policies can differ widely from one country to

another. Countries belonging to a free trade area also

typically establish a process by which trade disputes can

be resolved.

Free Trade Area

This is the most basic form of economic

cooperation. Member countries remove all barriers

to trade between themselves but are free to

independently determine trade policies with

nonmember nations. An example is the North

American Free Trade Agreement (NAFTA).

Customs Union

Economic integration whereby countries

remove all the barriers to trade among themselves,

but erect a common trade policy against non-

members, is called customs union. Thus the main the

difference between free trade area and a customs

union is that the members of a customs union agree

to treat trade with all non-member nations in a

similar a manner.

Countries belonging to a customs union might

also negotiate as a single entity with other

supranational organizations, such as the World Trade

Organization.

Customs Union

This type provides for economic cooperation

as in a free-trade zone. Barriers to trade are removed

between member countries. The primary difference

from the free trade area is that members agree to

treat trade with nonmember countries in a similar

manner.

Common Market

Economic integration whereby countries remove all

barriers to trade and the movement of labour and capital

among themselves, but erect a common trade policy

against non-members, is called a common market. Thus,

a common market integrates the elements of free trade

areas and adds the free movement of important factors

of production – people and cross-border investment.

This level of integration is very difficult to attain

because it requires members to cooperate to at least

some extent on economic and labour policies.

Furthermore, the benefits to individual countries can be

uneven because skilled labour may move to countries

where wages are higher, and investment capital may flow

to areas where return are greater.

Common Market

` This type allows for the creation of

economically integrated markets between member

countries. Trade barriers are removed, as are any

restrictions on the movement of labor and capital

between member countries. Like customs unions,

there is a common trade policy for trade with

nonmember nations.

The primary advantage to workers is that they

no longer need a visa or work permit to work in

another member country of a common market. An

example is the Common Market for Eastern and

Southern Africa (COMESA).

Economic Union

Economic Integration whereby countries

remove barriers to trade and the movement of

labour and capital among members, erect a common

trade policy against non-members, and coordinate

their economic policies is called an economic union.

An economic union goes beyond the demands

of a common market by requiring member nations

to harmonize their tax, monetary, and fiscal policies

and to create a common currency. Economic Unions

require the member countries concede a certain

amount of their national autonomy or (sovereignty)

to the supranational union which they are part of.

Economic Union

This type is created when countries enter into

an economic agreement to remove barriers to trade

and adopt common economic policies. An example is

the European Union (EU).

Political Union

Economic and political integration whereby

countries coordinate aspects of their economic and

political systems is called a political union. A political

union requires member nations to accept a common

stance of economic and political matters regarding

non-member nations. However, nations are allowed

a degree of freedom in setting its political and

economic policies within their territories.

Individually, Canada and the United States

provide early examples of political unions. In both

nations, smaller states and provinces combine to

form larger entities. A group of nations currently

taking steps in this direction is the European Union.

Pros of creating Regional Agreements

• Trade creation

The increase in the level of trade between nations

that results from regional economic integration is called

trade creation.

These agreements create more opportunities for

countries to trade with one another by removing the

barriers to trade and investment. Due to a reduction or

removal of tariffs, cooperation results in cheaper prices for

consumers in the bloc countries. Studies indicate that

regional economic integration significantly contributes to

the relatively high growth rates in the less-developed

countries.

Pros of creating Regional Agreements

• Employment opportunities By removing restrictions on

labor movement, economic integration can help expand

job opportunities.

• Consensus and cooperation Member nations may find it

easier to agree with smaller numbers of countries.

Regional understanding and similarities may also

facilitate closer political cooperation.

Cons involved in creating Regional

Agreements

• Trade diversion The flip side to trade creation is trade

diversion. It is the diversion of trade away from nations

not belonging to a trading bloc and member nations.

Member countries may trade more with each other

than with nonmember nations.

This may mean increased trade with a less

efficient or more expensive producer because it is in a

member country. In this sense, weaker companies can

be protected inadvertently with the bloc agreement

acting as a trade barrier. In essence, regional

agreements have formed new trade barriers with

countries outside of the trading bloc.

Cons involved in creating Regional

Agreements

• Employment shifts and reductions Countries may move

production to cheaper labor markets in member countries.

Similarly, workers may move to gain access to better jobs

and wages. Sudden shifts in employment can tax the

resources of member countries.

• Loss of national sovereignty With each new round of

discussions and agreements within a regional bloc, nations

may find that they have to give up more of their political

and economic rights. In the opening case study, you learned

how the economic crisis in Greece is threatening not only

the EU in general but also the rights of Greece and other

member nations to determine their own domestic

economic policies.

The Regional Trading Groups

NAFTA

The North American Free Trade Agreement

(NAFTA) came into being during a period when free

trade and trading blocs were popular and positively

perceived. In 1988, the United States and Canada

signed the Canada–United States Free Trade

Agreement. Shortly after it was approved and

implemented, the United States started to negotiate a

similar agreement with Mexico.

When Canada asked to be party to any

negotiations to preserve its rights under the most-

favored-nation clause (MFN), the negotiations began

for NAFTA, which was finally signed in 1992 and

implemented in 1994.

Effects of NAFTA

Since The North American Free Trade Agreement

(NAFTA) came into effect , trade among three nations has

increased markedly, with the greatest gains occurring in

Mexico and the United States. Today the United States

exports more to Mexico that it does to Britain, France,

Germany and Italy combined. In fact, Mexico is the third

largest source of U.S. imports (behind China and Canada)

and second largest market for U.S. exports (behind Canada)

The agreement’s effect on employment and wages is

not easy to determine. In addition to claims of job losses,

opponents that NAFTA has damaged the environment

particularly along the United States-Mexico border.

Expansion of NAFTA

Expansion of NAFTA. Continued ambivalence

among union leaders and environmental watchdog

regarding the long-term effects of NAFTA is delaying its

expansion. The pace at which NAFTA expands will depend

to a large extent on whether the U.S. Congress grants

successive U.S. Presidents trade promotion (“fast track”)

authority.

But there us little doubt that integration will expand

some day in the Americas. In fact, it is even possible that

the North American economies will adopt a single

currency. As trade among Canada, Mexico, and the United

States strengthens, a single currency (most likely the U.S.

Dollar) would benefit companies in these countries with

reduced exposure to changes in exchange rates.

South America: MERCOSUR

The Common Market of the South, Mercado

Común del Sur or MERCOSUR, was originally

established in 1988 as a regional trade agreement

between Brazil and Argentina and then was

expanded in 1991 to include Uruguay and Paraguay.

Over the past decade, Bolivia, Chile, Colombia,

Ecuador, and Peru have become associate members,

and Venezuela is in the process for full membership.

CARICOM and Andean Community

The Caribbean Community and Common Market

(CARICOM), or simply the Caribbean Community, was formed in

1973 by countries in the Caribbean with the intent of creating a

single market with the free flow of goods, services, labor, and

investment. The Andean Community (called the Andean Pact

until 1996) is a free trade agreement signed in 1969 between

Bolivia, Chile, Colombia, Ecuador, and Peru. Eventually Chile

dropped out, while Venezuela joined for about twenty years and

left in 2006.

This trading bloc had limited impact for the first two

decades of its existence but has experienced a renewal of

interest after MERCOSUR’s implementation. In 2007,

MERCOSUR members became associate members of the

Andean Community, and more cooperative interaction between

the trading groups is expected

CAFTA-DR

The Dominican Republic–Central America–United

States Free Trade Agreement (CAFTA-DR) is a free trade

agreement signed into existence in 2005. Originally, the

agreement (then called the Central America Free Trade

Agreement, or CAFTA) encompassed discussions

between the US and the Central American countries of

Costa Rica, El Salvador, Guatemala, Honduras, and

Nicaragua. A year before the official signing, the

Dominican Republic joined the negotiations, and the

agreement was renamed CAFTA-DR.

Europe: EU

The European Union (EU) is the most

integrated form of economic cooperation. As you

learned in the opening case study, the EU originally

began in 1950 to end the frequent wars between

neighboring countries in the Europe.

The six founding nations were France, West

Germany, Italy, and the Benelux countries (Belgium,

Luxembourg, and the Netherlands), all of which

signed a treaty to run their coal and steel industries

under a common management. The focus was on

the development of the coal and steel industries

for peaceful purposes.

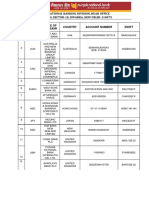

The EU Structure/Institutions

Institution of the European Union

European Parliament

The European Parliament consist of 736 members elected by

popular vote within each member nation every five years. As

such, they are expected to voice their particular views on EU

matters. The European Parliament fulfils its role of adopting

EU law by debating and amending legislation proposed by the

European Commission. It exercises political supervision over

all EU institutions – giving it the power to supervise

commissioner appointments and to censure the commission.

It also has veto power over some laws (including the annual

budget of the EU). There is a call for increased

democratization within the EU, and some believe this could

be achieved by strengthening the powers of the parliament.

The Parliament conducts its activities in Belgium (in the city of

Brussels), France (in the city Strasbourg), and Luxembourg.

Institution of the European Union

Council of the European Union

The council is the legislative body of the EU. When it

meets, it brings together representatives of members states at

the ministerial level. The makeup of the council changes

depending on the topic under discussion. For example, when

the topic is agriculture, the council is composed of the

ministers of agriculture from each other nation. No proposed

legislation becomes EU law unless the council votes into law.

Although passage into law of sensitive issues such as

immigration and taxation still requires a unanimous vote, some

legislation today requires only a simple majority to win

approval. The council also concludes, on behalf of the UE

international agreements with other nations or international

organizations. The council is headquartered in Brussels,

Belgium.

Institution of the European Union

European Commission

The commission is the executive body of EU. It

comprises commissioners appointed by each member country

– larger nations get two more commissioners, smaller

countries get one. Member nations appoint the president and

commissioners after being approved by the European

Parliament. It has the right to draft legislation, is responsible

for managing and implementing policy, and monitors member

nation’s implementation of, and compliance with, EU law.

Each commissioner is assigned in a specific policy area,

such as competitive policy or agricultural policy. Although

commissioners are appointed by their national governments,

they are expected to behave in the best interest of the EU as a

whole, not in the interest of their own country. The European

Commission is headquartered in Brussels, Belgium.

Institution of the European Union

Court of Justice

The Court of Justice is the court of appeals of the EU and is

composed 27 judges (one from each member nation) and

eight advocates general who hold renewable six year terms.

One type of case that the Court of Justice hears is one which

member nation is accused of not meeting treating obligations.

Another type is one which the commission or council

is charged with failing to live up to its responsibilities under

the terms of the treaty. Like the commissioners, justices are

required to act in the interest of the EU as a whole, not in the

interest of their own countries. The Court of Justice is located

in Luxembourg.

Institution of the European Union

Court of Auditors

The Court of Auditors comprises 27 members (one

from each member nation) appointed for renewable six-year

terms. The court is assigned the duty of auditing the EU

accounts and implementing its budget. It also aims to improve

financial management in the EU and report to member

nation’s citizens on the use of public funds. As such, it issues

annual reports and statements on implementation of the EU

budget. The court employs roughly 800 auditors and staff to

assist it in carrying out its functions. The Court of Auditors is

based on Luxembourg.

Management Implications of the Euro

The move to a single currency influences the

activities of companies within the European Union.

First, the euro removes financial obstacles created by

the use of multiple currencies. It completely

eliminates exchange-rate risk for business deals

between member nations using the euro.

Second, the euro makes prices between

markets more transparent, making it difficult to

charge different prices in adjoining markets.

Enlargement of the European Union

One of the most historic events across Europe in

recent memory was EU enlargement from 15 to 27

members. Croatia, Turkey and the former Yugoslav Republic

of Macedonia remain candidates for EU membership and

are to becomes members after they meet certain demands

laid down by the EU. These so-called Copenhagen Criteria

require each country to demonstrate that it:

- Has stable institution

- Has a functioning market economy

- Is able to assume the obligations of membership

- Has the ability to adopt the rule and regulations of the

community

Asia: ASEAN

The Association of Southeast Asian Nations

(ASEAN) was created in 1967 by five founding-member

countries: Malaysia, Thailand, Indonesia, Singapore, and

the Philippines. Since inception, Myanmar (Burma),

Vietnam, Cambodia, Laos, and Brunei have joined the

association.

ASEAN’s primary focus is on economic, social,

cultural, and technical cooperation as well as promoting

regional peace and stability. Although less emphasized

today, one of the primary early missions of ASEAN was

to prevent the domination of Southeast Asia by external

powers—specifically China, Japan, India, and the United

States.

The Ins and Outs of ASEAN

Businesses unfamiliar with operating in ASEAN

countries should exercise caution in their dealings.

Some inescapable facts about ASEAN that warrant

consideration are the following:

Diverse Culture and Politics

The Philippines is a representative democracy, Brunei

is an oil-rich sultanate, and Vietnam is a state-

controlled communist country. Business policies and

protocol must be adapted to each country.

The Ins and Outs of ASEAN

Economic Competition

Many ASEAN nations are feeling the effects of China’s

power to attract investment from multinationals

worldwide. Whereas ASEAN members used to attract

around 30 percent of foreign direct investment into Asia’s

developing economies, it now attracts about half that

amount.

Corruption and Shadow Markets

Bribery and shadow (unofficial) markets are common

in many ASEAN countries including Indonesia,

Myanmar, the Philippines, and Vietnam. Corruption

studies typically place these countries at or very near

the bottom of nations surveyed.

The Ins and Outs of ASEAN

Political Change and Turmoil

Several nations in the region recently elected new leaders.

Indonesia in particular has gone through presidents at a fast

clip recently. Companies must remain alert to shifting

political winds and laws regarding trade and investment.

Border Disputes

Parts of Thailand’s borders with Cambodia and Laos are

tested frequently. Hostilities break out sporadically between

Thailand and Myanmar over border alignment and ethnic

rebels operating along border.

Lack of Common Tariffs and Standards

Doing business in ASEAN nations can be costly. Harmonized

tariffs, quality and safety standards, customs regulations,

and investment rules would cut transaction cost significantly.

You might also like

- Regional Economic GroupingsDocument37 pagesRegional Economic GroupingsNikhil Jain85% (20)

- Concept of Economic IntegrationDocument31 pagesConcept of Economic IntegrationNilin Shetty71% (7)

- (Superpartituras - Com.br) Dios Ha Sido Bueno PDFDocument1 page(Superpartituras - Com.br) Dios Ha Sido Bueno PDFJalil De Armas MindiolaNo ratings yet

- Development Economics - Segment 1Document31 pagesDevelopment Economics - Segment 1Lenoff Cornelius Arce100% (2)

- Chapter 3 Regional Economic IntegrationDocument5 pagesChapter 3 Regional Economic IntegrationMaximusNo ratings yet

- FI S P00 07000134 JPN Execute The Withholding Tax ReportDocument13 pagesFI S P00 07000134 JPN Execute The Withholding Tax ReportnguyencaohuyNo ratings yet

- HSC Complete Economics NotesDocument48 pagesHSC Complete Economics NotesAndrew RongNo ratings yet

- Regional Economic IntegrationDocument32 pagesRegional Economic Integrationਹਰਸ਼ ਵਰਧਨNo ratings yet

- Amity Law School: Economics ProjectDocument16 pagesAmity Law School: Economics Projectprithvi yadavNo ratings yet

- Regional Integrations IBMDocument64 pagesRegional Integrations IBMdileepsuNo ratings yet

- Regional Economic IntegrationDocument15 pagesRegional Economic IntegrationKaechelle Marie MorilloNo ratings yet

- IB FinalDocument6 pagesIB FinalMeaadNo ratings yet

- Globalization and Regional Grouping: Amity Law SchoolDocument10 pagesGlobalization and Regional Grouping: Amity Law SchoolAarti MaanNo ratings yet

- Regional Economic Groupings of The Oic CountriesDocument48 pagesRegional Economic Groupings of The Oic CountriesngayaNo ratings yet

- Group 1 TRADE BLOCSDocument4 pagesGroup 1 TRADE BLOCSGalindo, Justine Mae M.No ratings yet

- Political EcoDocument4 pagesPolitical Ecoenamulbari56No ratings yet

- Final Copy of Econghghomic ItegrationDocument20 pagesFinal Copy of Econghghomic ItegrationSneha BandarkarNo ratings yet

- Controles de Lectura p.49Document5 pagesControles de Lectura p.49Karen SNo ratings yet

- Regional Market Groups and ImplicationsDocument4 pagesRegional Market Groups and ImplicationsKrizza Caryl GallardoNo ratings yet

- Case 3 Economic IntegrationDocument4 pagesCase 3 Economic IntegrationLina Marcela AlzateNo ratings yet

- Regional Integration: Punjabi University Patiala School of Management StudiesDocument9 pagesRegional Integration: Punjabi University Patiala School of Management StudiesjashanNo ratings yet

- ST ND RD THDocument6 pagesST ND RD THKimberly Ann SurdellaNo ratings yet

- Chap 4 Regional IntegrationDocument37 pagesChap 4 Regional IntegrationJoshua DubdubanNo ratings yet

- Arab Academy For Science Technology & Maritime Transport-MBADocument6 pagesArab Academy For Science Technology & Maritime Transport-MBAWessam AhmedNo ratings yet

- Regional 2Document11 pagesRegional 2likib18022No ratings yet

- Meaning: Economic Integration Is The Unification of Economic Policies Between Different States ThroughDocument6 pagesMeaning: Economic Integration Is The Unification of Economic Policies Between Different States ThroughswatiNo ratings yet

- Null 2Document10 pagesNull 2pridegwatidzo2No ratings yet

- Regional Economic Integration: You Are Welcome To The Last Section of Unit 4. The Formation andDocument7 pagesRegional Economic Integration: You Are Welcome To The Last Section of Unit 4. The Formation andBabamu Kalmoni JaatoNo ratings yet

- MPIB7103 Assignment 1 (201805)Document12 pagesMPIB7103 Assignment 1 (201805)Masri Abdul LasiNo ratings yet

- Chapter 12 - TRADE BLOCKSDocument8 pagesChapter 12 - TRADE BLOCKSAriel A. YusonNo ratings yet

- Quiz Finals 4cDocument2 pagesQuiz Finals 4cAngelica Vera L. GuevaraNo ratings yet

- International BusinessDocument3 pagesInternational BusinessNithin MNo ratings yet

- Lecture 1Document5 pagesLecture 1TOLENTINO, Joferose AluyenNo ratings yet

- Economic Integratio1Document23 pagesEconomic Integratio1Bhushan KharatNo ratings yet

- Trading BlocksDocument45 pagesTrading BlocksVikrant LadNo ratings yet

- Global Economic IntegrationDocument26 pagesGlobal Economic IntegrationMunish KaushalNo ratings yet

- Preferential Trade Area: TariffDocument3 pagesPreferential Trade Area: TariffgurneetNo ratings yet

- Global Bus & Env 2Document45 pagesGlobal Bus & Env 2iqrahbanuNo ratings yet

- Advantages of Export-Led GrowthDocument10 pagesAdvantages of Export-Led Growthaman mittalNo ratings yet

- CH - 09 (Regional Economic Integration)Document33 pagesCH - 09 (Regional Economic Integration)AhanafNo ratings yet

- Economic Integration LevelDocument2 pagesEconomic Integration LevelKhan AliNo ratings yet

- GBS Presentation-SmrithiDocument21 pagesGBS Presentation-SmrithiSHRAVANTHI.K 20BCO043No ratings yet

- 01 - Global and Regional Economic Cooperation and Integration and The United Nations Impact On TradeDocument40 pages01 - Global and Regional Economic Cooperation and Integration and The United Nations Impact On TradeAmaranthine Angel HarpNo ratings yet

- Regional Economic GroupingsDocument13 pagesRegional Economic GroupingsTrevor Promise DekeNo ratings yet

- Final On Economic IntDocument10 pagesFinal On Economic IntVandanaNo ratings yet

- Purposes of Regional Trade BlocksDocument7 pagesPurposes of Regional Trade BlocksSukumar ThamilmaniNo ratings yet

- IntroDocument5 pagesIntroKalis WaranNo ratings yet

- Hukuba 2nd IBF AssignmentDocument7 pagesHukuba 2nd IBF AssignmentBobasa S AhmedNo ratings yet

- Stages of Economic IntegrationDocument2 pagesStages of Economic IntegrationLanphuong BuiNo ratings yet

- 1.regeional Economic Integration: The ProsDocument8 pages1.regeional Economic Integration: The ProsDeva JoyNo ratings yet

- TCW Chapter 2 STRUCTURE OF GLOBALIZATION The Global EconomyDocument2 pagesTCW Chapter 2 STRUCTURE OF GLOBALIZATION The Global EconomyCathleen Rose GadianeNo ratings yet

- Regional Integration Functions and FormsDocument26 pagesRegional Integration Functions and FormsTafwaza JereNo ratings yet

- 5ITB Economic Integration Among CountriesDocument3 pages5ITB Economic Integration Among Countriesbrigitte.banitogNo ratings yet

- Economic IntegrationDocument9 pagesEconomic IntegrationabhicueeNo ratings yet

- Lesson 2: The Global Economy: Impacts On Job & PricingDocument4 pagesLesson 2: The Global Economy: Impacts On Job & Pricingrosalie toqueroNo ratings yet

- Introduction To Regional Economic Integration and Degrees of Formal Economic IntegrationDocument3 pagesIntroduction To Regional Economic Integration and Degrees of Formal Economic IntegrationIngyin ThawNo ratings yet

- Introduction To Trade BlocsDocument19 pagesIntroduction To Trade BlocsMT RANo ratings yet

- Agreement (FTA), Which Eliminates Tariffs, Import Quotas, and Preferences On Most (If NotDocument3 pagesAgreement (FTA), Which Eliminates Tariffs, Import Quotas, and Preferences On Most (If NotBandi VargaNo ratings yet

- Regional Trading BlocsDocument51 pagesRegional Trading BlocsNirlipta SwainNo ratings yet

- Session No. 5 / Week No. 5Document17 pagesSession No. 5 / Week No. 5Merge MergeNo ratings yet

- Least Restrictive and Loosest Form of Economic Integration Among CountriesDocument4 pagesLeast Restrictive and Loosest Form of Economic Integration Among CountriesAnti CovidNo ratings yet

- Aisyiah Putri Haris - Economic IntegrationDocument6 pagesAisyiah Putri Haris - Economic IntegrationAisyiah Putri HarisNo ratings yet

- 07 Audit-SamplingDocument24 pages07 Audit-Samplingfrancis albaracinNo ratings yet

- Critique No. 1Document1 pageCritique No. 1francis albaracinNo ratings yet

- 09 - Independent Auditors ReportDocument16 pages09 - Independent Auditors Reportfrancis albaracinNo ratings yet

- 08 - Completing The AuditDocument27 pages08 - Completing The Auditfrancis albaracinNo ratings yet

- Acctg 406 DCE CompanyDocument10 pagesAcctg 406 DCE Companyfrancis albaracinNo ratings yet

- Chapter 1 GlobalizationDocument55 pagesChapter 1 Globalizationfrancis albaracinNo ratings yet

- Chapter 2 Evolution of TradeDocument44 pagesChapter 2 Evolution of Tradefrancis albaracinNo ratings yet

- Gmail - USJ-R E-Study LoadDocument1 pageGmail - USJ-R E-Study Loadfrancis albaracinNo ratings yet

- Statement of Changes in EquityDocument4 pagesStatement of Changes in Equityfrancis albaracinNo ratings yet

- Finite-Mixture Structural Equation Models For Response-Based Segmentation and Unobserved HeterogeneityDocument7 pagesFinite-Mixture Structural Equation Models For Response-Based Segmentation and Unobserved Heterogeneityfrancis albaracinNo ratings yet

- ENTREPDocument39 pagesENTREPDanica RafolsNo ratings yet

- 03 FS-AuditDocument39 pages03 FS-Auditfrancis albaracinNo ratings yet

- Mock Final Departmental Exam - Accounting 201 - NCABALUNA 1Document9 pagesMock Final Departmental Exam - Accounting 201 - NCABALUNA 1francis albaracinNo ratings yet

- Chapter 5 CUSTOMERS AND MARKETDocument29 pagesChapter 5 CUSTOMERS AND MARKETfrancis albaracin0% (1)

- Unit 1.2 - Comparative Economic DevelopmentDocument38 pagesUnit 1.2 - Comparative Economic Developmentfrancis albaracinNo ratings yet

- Stockholders' Equity SummaryDocument18 pagesStockholders' Equity SummaryJheza Mae PitogoNo ratings yet

- Notes 1Document12 pagesNotes 1francis albaracinNo ratings yet

- EconDev OrientationDocument9 pagesEconDev Orientationfrancis albaracinNo ratings yet

- Christian MoralityDocument4 pagesChristian Moralityfrancis albaracinNo ratings yet

- Capacity PlanningDocument1 pageCapacity Planningfrancis albaracinNo ratings yet

- Us Foreclosure Lists March 2019Document113 pagesUs Foreclosure Lists March 2019Virginia HolmesNo ratings yet

- 72 00 04 Fault3Document12 pages72 00 04 Fault3fernando heNo ratings yet

- Case StudyDocument3 pagesCase Studysameer prasadNo ratings yet

- Definition of International TradeDocument7 pagesDefinition of International TradeSinta YuliawatiNo ratings yet

- PWC Brexit Monitor TradeDocument11 pagesPWC Brexit Monitor TradeNICU ZAMFIRNo ratings yet

- Ibt Report - Non-Tariff BarriersDocument3 pagesIbt Report - Non-Tariff BarriersChristen HerceNo ratings yet

- (IntroToEconomic) Assignment 1Document3 pages(IntroToEconomic) Assignment 1giska grafinsiNo ratings yet

- Balance of Payments of Pakistan (Presentation)Document19 pagesBalance of Payments of Pakistan (Presentation)Abrar Ahmed Qazi100% (2)

- Foreign Aid & Its Role in Economic DevelopmentDocument12 pagesForeign Aid & Its Role in Economic DevelopmentAbrar Ahmed QaziNo ratings yet

- ForwardRates - January 10 2018Document2 pagesForwardRates - January 10 2018Tiso Blackstar GroupNo ratings yet

- MacroEconomics AssignmentDocument10 pagesMacroEconomics AssignmentRobelyn EnriquezNo ratings yet

- International Finance: Foreign TradeDocument36 pagesInternational Finance: Foreign TradeAmit JainNo ratings yet

- 2022 - Part-I - Handout-Đã G PDocument202 pages2022 - Part-I - Handout-Đã G PNhu HaNo ratings yet

- ISO Tolerances For HolesDocument3 pagesISO Tolerances For HolesMatthew HaleNo ratings yet

- Ssi PNBDocument3 pagesSsi PNBKumar KalyanNo ratings yet

- 3 Chap3 IBFDocument27 pages3 Chap3 IBFLe Hong Phuc (K17 HCM)No ratings yet

- Principles of Business Quiz Form 4 - NameDocument2 pagesPrinciples of Business Quiz Form 4 - NameyuvitaNo ratings yet

- CH 09Document26 pagesCH 09Ar-Rayyan AshNo ratings yet

- Lecture 6 Government Intervention in International Business and Regional Economic IntegrationDocument26 pagesLecture 6 Government Intervention in International Business and Regional Economic IntegrationUmer ZindaniNo ratings yet

- Question #1 of 58: Best A) Tari S. B) Quotas. C) SubsidiesDocument28 pagesQuestion #1 of 58: Best A) Tari S. B) Quotas. C) SubsidiesALL ROUNDNo ratings yet

- Global Economics 13th Edition Robert Carbaugh Test Bank 1Document20 pagesGlobal Economics 13th Edition Robert Carbaugh Test Bank 1peggy100% (46)

- Recent Trends in India's BopDocument6 pagesRecent Trends in India's BopAashi JainNo ratings yet

- Data Extract From World Development IndicatorsDocument14 pagesData Extract From World Development IndicatorsJohanna Milena RuizNo ratings yet

- Notes On The Chinn-Ito Financial Openness Index 2017 UpdateDocument14 pagesNotes On The Chinn-Ito Financial Openness Index 2017 Updaterameeztariq20No ratings yet

- G20Document27 pagesG20tavish koulNo ratings yet

- What To Trade, When.: 0700 GMT 0800 GMTDocument1 pageWhat To Trade, When.: 0700 GMT 0800 GMTHarms GundamNo ratings yet

- Test Bank For International Economics 9th Edition by HustedDocument6 pagesTest Bank For International Economics 9th Edition by HustedJennifer Vega100% (42)

- History of The International Monetary SystemDocument34 pagesHistory of The International Monetary SystemAksa GarseinNo ratings yet