0% found this document useful (0 votes)

89 views41 pagesProject Management: Financial Selection Techniques

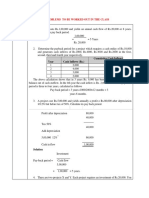

The document discusses various project selection methods based on financial criteria including NPV, IRR, payback period, ROI, etc. It provides examples and calculations of these methods. The key aspects covered are the definitions of various financial methods, calculations using examples, and limitations of some methods.

Uploaded by

siranjivikumar.m1Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

89 views41 pagesProject Management: Financial Selection Techniques

The document discusses various project selection methods based on financial criteria including NPV, IRR, payback period, ROI, etc. It provides examples and calculations of these methods. The key aspects covered are the definitions of various financial methods, calculations using examples, and limitations of some methods.

Uploaded by

siranjivikumar.m1Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd