Professional Documents

Culture Documents

Finance Department

Uploaded by

Akriti Srivastava0 ratings0% found this document useful (0 votes)

4 views16 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views16 pagesFinance Department

Uploaded by

Akriti SrivastavaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 16

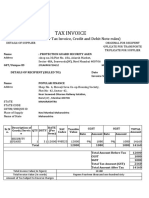

INVOICE BILL

Mandatory requirement in an Invoice

• Name , Address and GSTIN of the Seller

• Name , Address and GSTIN of the Buyer

• HSN code or SAC code

• Invoice number (should be serially numbered)

• Date of invoice

• Description of the goods/service

• Quantity of goods

• Taxable value of supply

• GST Rate (CGST,SGST,IGST,UTGST)

• Total value of supply of Goods/Services

• Place of supply/delivery address and name of the destination

• Whether GST is payable on a reverse charge basis

• Signature of the supplier or his authorized representative

Service Tax Billing

• Sec 31(2)-Service tax assessee issue • G.A.R-7:- Challan which is used for

a bill or invoice within 14 days from the payment of service tax

the date on which taxable service manually. The challan is available in

was completed. specific authorized banks.

Penalties- (Sec: 76,77,78) Agreement:-

• Fail to furnish the ST-3 Return • Bank Guarantee

within the due dates 25Oct & • Liquidated damages and so on.

25April of every year.

• Penalty for non-payment or delayed

Exempted:-

• Turnover is less than 10lakh in the

previous fiscal.

• Commercia training & Coaching

services.

Goods Tax Billing

• Sec 31(1)

• 4Q:- Company, Firm

• A registered person supplying

• 8Q:- Non-company, Individual

taxable goods shall issue a tax

invoice.

• The invoice shall be issued before

or at the time of removal of goods

for supply to the recipient.

• Where the supply does not involve

the movement of goods, the

invoice shall be issued when goods

made available to the recipient.

Process for selecting of vendor

• Search for a vendor.

• Write a request for proposal and request for quotation.

• Select a vendor who is best and giving good quality of goods in

reasonable price.

• Mail the legal terms and condition which fulfills the company clause.

• Then creating a contract negotiation strategy.

• Then mail for the purchase order(PO).

• When goods coming in the company first there will be a inspection of

goods. When everything is ok then it will go for further process.

• The company issues an invoice to the supplier. After that, the company

pays for the goods.

Taxation

Indirect tax

• TDS/TCS

• GST , Service tax

TDS

Tax deducted at source is income tax reduced from the money paid at

the time of making specified payments such as rent, commission,

professional fees, salary interest etc.

TCS

Tax collected at source is the tax collected by the seller from the buyer

on sale so that it can be deposited with the tax authorities. Section 206C

of the Income-tax act governs the goods on which the seller has to

collect tax from the buyers.

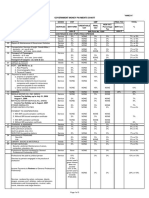

TDS Rates

GST

• GST is known as the Goods and Services Tax. It is an indirect tax which has

replaced many indirect taxes in India such as the excise duty, VAT, services tax,

etc. The Goods and Service Tax Act was passed in the Parliament on 29th March

2017 and came into effect on 1st July 2017.

Reverse charge mechanism Process

GST Rates

GSTR-1

• Form GSTR-1 is a return statement in GSTR-1 Due Date

which a regular dealer needs to • Monthly GSTR-1 :- 11th of Subsequent

capture all the outward supplies made

during the month or a quarter. GSTR- month.

1 is a return in which details of sales • Quarterly GSTR-1:- Last of the date of

and other outward supplies needs to be

captured.

the month following

the end of the

quarter.

GSTR-3B

• GSTR-3B is a self-declared summary Due date:-

GST return filed every month This GSTR form is a monthly return form.

(quarterly ). Taxpayers need to report The due date for submission every month

the summary figures of sales, ITC is the 20th of the succeeding month.

claimed, and net tax payable in GSTR-

3B. For example, the due date to file GSTR-3B

for September, 2019 is 20th October, 2019

• A separate GSTR-3B must be filed for

every GSTIN

• The GST liability must be paid on or

before the date of filing GSTR-3B,

earlier of its due date

• The GSTR-3B once filed cannot be

revised

• Even in case of a zero liability, GSTR-

3B must be compulsory filed.

P2P:-Procure-to-pay

• It covers the entire process of acquiring goods and services from

suppliers and paying for them.

Steps in P2P Process

1.Create Approval Note

2.Requirement identification and purchase requisition.

3.Authorizing the purchase requisition.

4.Shorting the vendors

5.Taking quotation from vendors.

7.Purchase order.

6.Vendor selection 8.Purchase order approval.

Technical negotiation

Financial negotiation:-LD clause 9.Shipment notice.

Payment term (60 days credit)

10.Receiving the goods/goods

receipt.

11.Recording invoice.

12.Verifying the price, quantity,

payment terms.

13.Making payment to the

supplier.

Sales and Distribution Module

• Sales and Distribution (SD) is an important module of which consisting of business

processes required in selling, shipping, billing of a product , etc.

• 1)Price and Taxation, 2) Availability Check, 3) Billing & Invoice, 4) Material

Determination, 5) Credit Management are some important features of SD.

• Data, Sales, Shipping of Material, Billing-Related, Sales support, Transportation of

products, are some important components of SD.

• Master data, helps you to track each and every transaction within the data.

• SD sales help you to handle the minute details of every sale that is taking place.

• Billing module keeps the track of all the billing data in a proper way.

• SD shipping module helps you record entire process from being shipped to delivered or

return back.

• SD transportation module helps you to track all the transportation-related data.

• SD sales support module record and report data between the sales team and

customers.

• SD foreign trade helps you to manage data, which is related to foreign trade.

SD Codes

Fly ash

• Create customer:-XD01 • RFID:- Radio frequency identification

• Create sales order:-VA01 • More than 100 ton

• Change sales order:-VA02 • Price of 1 ton=225+GST

• Create billing document:-VF01 • Customer code:-FBL51

• Change billing document:-VF02 • Clear customer transaction:-F-32

• Display billing document:-VF03 • Debit(invoice) & Credit:-FV-70

• Cancel billing document:-VF11 Cygnet GSP

E-invoice bill (within 7 days) • Govt. portal

More than 5 crore • Simplifies GST compliances:- GST Return

Code:-ZFIASP015 Filing, E-way bill & E-invoice generation.

• Agreement (all the process will be

done in advance except service) Fly Ash Report-SD sales report

Treasury

Payment process

• Vendor invoice Entry

• Invoice verification

• Invoice Approval

• Payment Run

• Bank Communication

• Payment Execution

• Bank Reconciliation

• Accounting Entries

• Reporting and Analytics

• Archiving

You might also like

- Returns in Goods and Services Tax: A Brief OverviewDocument38 pagesReturns in Goods and Services Tax: A Brief OverviewSushant SaxenaNo ratings yet

- GST Accounts & RecordsDocument12 pagesGST Accounts & RecordsSneha AgarwalNo ratings yet

- GST DocumentationDocument32 pagesGST DocumentationTeju PawarNo ratings yet

- Returns in Goods and Services Tax: A Brief OverviewDocument105 pagesReturns in Goods and Services Tax: A Brief Overviewshivam beniwalNo ratings yet

- Session 5 and 6 - Accounting For RevenueDocument47 pagesSession 5 and 6 - Accounting For RevenueKashish Manish JariwalaNo ratings yet

- GST Day 7Document26 pagesGST Day 7Rahul SinghNo ratings yet

- Introduction To India Statutory RequirementsDocument4 pagesIntroduction To India Statutory Requirementsmksingh_24No ratings yet

- Tax Invoice, Credit and Debit Notes (Section 31-34 of CGST Act)Document16 pagesTax Invoice, Credit and Debit Notes (Section 31-34 of CGST Act)Nikhil PahariaNo ratings yet

- Unit 4 GSTDocument13 pagesUnit 4 GSTViral OkNo ratings yet

- GST - Hospitality IndustryDocument68 pagesGST - Hospitality IndustrySOPHIA POLYTECHNIC LIBRARYNo ratings yet

- Overview of Goods and Services Tax (GST) in Malaysia and Risk ManagementDocument47 pagesOverview of Goods and Services Tax (GST) in Malaysia and Risk ManagementDanish LeongNo ratings yet

- As 9Document27 pagesAs 9AATHARSH RADHAKRISHNANNo ratings yet

- Fake Invoice SSDocument24 pagesFake Invoice SSSUBHASH SHARMANo ratings yet

- Acconts Payable PDFDocument17 pagesAcconts Payable PDFN Tarun ManjunathNo ratings yet

- GST - ReturnsDocument30 pagesGST - ReturnsAniket Rastogi100% (2)

- Revenue RecognitionDocument64 pagesRevenue RecognitionSAHILNo ratings yet

- Returns and Refund Under GSTDocument7 pagesReturns and Refund Under GSTkoushiki mishraNo ratings yet

- Invoicing Under GSTDocument53 pagesInvoicing Under GSTkomal tanwaniNo ratings yet

- GM Andean Accounts Payable Workshop v1 April09Document18 pagesGM Andean Accounts Payable Workshop v1 April09Subbireddy ChintapalliNo ratings yet

- GST NAV 2016 Setup For IndiaDocument93 pagesGST NAV 2016 Setup For IndiaKenneth LunaNo ratings yet

- Unit 4Document16 pagesUnit 4Abhishek Kumar GuptaNo ratings yet

- Unit 2:Gst Procedures Topic: Tax InvoiceDocument29 pagesUnit 2:Gst Procedures Topic: Tax InvoiceManada SachdevaNo ratings yet

- Invoicing Under GSTDocument5 pagesInvoicing Under GSTpuru1292No ratings yet

- F3FFA Chapter 5 Day Book PDFDocument40 pagesF3FFA Chapter 5 Day Book PDFMd Enayetur RahmanNo ratings yet

- SAP Business Process FIDocument107 pagesSAP Business Process FIsaithiru780% (1)

- AR - Work FlowDocument14 pagesAR - Work FlowVinayNo ratings yet

- RevenueDocument51 pagesRevenueprasanthg_mba6239No ratings yet

- Ind-AS 115-Revenue From Contract With Customers: C.A. Hemant WaniDocument42 pagesInd-AS 115-Revenue From Contract With Customers: C.A. Hemant WaniBijay ShresthaNo ratings yet

- Time and Value of Supply: Indirect TaxationDocument9 pagesTime and Value of Supply: Indirect TaxationTejasNo ratings yet

- AS Engelsk - 2022Document120 pagesAS Engelsk - 2022Dragutin VujovicNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- GSTR1 GuidelinesDocument40 pagesGSTR1 GuidelinesJeetu PorwalNo ratings yet

- Merchandising BusinessDocument64 pagesMerchandising BusinessKim Pacer100% (1)

- Tax Procedure Migration-TAXINJ To TAXINNDocument5 pagesTax Procedure Migration-TAXINJ To TAXINNprabhulNo ratings yet

- Deeper: India Statutory Requirements and SAP FunctionalitiesDocument44 pagesDeeper: India Statutory Requirements and SAP FunctionalitiesSharad SinghNo ratings yet

- 28 21 Excise All ProceduresDocument111 pages28 21 Excise All Procedurescanar1281No ratings yet

- Revenue ProcessDocument17 pagesRevenue ProcessDaniel TadejaNo ratings yet

- Financial Reporting and Analysis: Session 10Document38 pagesFinancial Reporting and Analysis: Session 10Avinash KumarNo ratings yet

- Department of Business Administration, DDU Gorakhpur University, Gorakhpur-273009Document7 pagesDepartment of Business Administration, DDU Gorakhpur University, Gorakhpur-273009Amit SharmaNo ratings yet

- GST GuidelinesDocument61 pagesGST GuidelinesSandip JadavNo ratings yet

- GST - Documents & Records-May 18Document29 pagesGST - Documents & Records-May 18Sanjay DwivediNo ratings yet

- Revenue CycleDocument24 pagesRevenue CycleAzizul Hakim100% (1)

- AFARevenue RecognitionDocument34 pagesAFARevenue RecognitionRameen ShehzadNo ratings yet

- As 9Document35 pagesAs 9Thanos The titanNo ratings yet

- Overview of GST Session II and III Final - RTCDocument25 pagesOverview of GST Session II and III Final - RTCSuresh Kumar YathirajuNo ratings yet

- GSTR 1 - Presentation by GSTN - 30 August 2017Document42 pagesGSTR 1 - Presentation by GSTN - 30 August 2017NitishNo ratings yet

- Topic 4 - Lecture Slides - Part IDocument25 pagesTopic 4 - Lecture Slides - Part INeha LalNo ratings yet

- Factoring and IngDocument20 pagesFactoring and Ingapi-3865133No ratings yet

- Seminar 12 Explanation of The New Income Standard (First) & Seminar 13 Explanation of The New Income Standard (Second)Document142 pagesSeminar 12 Explanation of The New Income Standard (First) & Seminar 13 Explanation of The New Income Standard (Second)Poun GerrNo ratings yet

- PaymentsDocument22 pagesPaymentsFifi AdiNo ratings yet

- SOP Accounts Payable v3Document16 pagesSOP Accounts Payable v3CA Sanjay SapkalNo ratings yet

- Week 4 - Lecture#1 Expenditures Processes and Controls-PurchasesDocument30 pagesWeek 4 - Lecture#1 Expenditures Processes and Controls-PurchasesrikanshaNo ratings yet

- Audit ProceduresDocument42 pagesAudit ProceduresRohan ChavanNo ratings yet

- GST1Document25 pagesGST1DeepikaNo ratings yet

- Vat Presentation: RevisionDocument30 pagesVat Presentation: RevisionKartik VermaNo ratings yet

- Expenditure Cycle:: Report byDocument1 pageExpenditure Cycle:: Report byolganetrixNo ratings yet

- As 9 Revenue RecognitionDocument6 pagesAs 9 Revenue Recognitionhealthylifestyle21tipsNo ratings yet

- Revenue RecognitionDocument5 pagesRevenue Recognitionadela_iunieNo ratings yet

- Sop - Invoice ProcessingDocument3 pagesSop - Invoice Processingapi-29896722871% (17)

- Government Money Payments Chart - BirDocument3 pagesGovernment Money Payments Chart - BirVan Caz89% (9)

- Overview of Business Processes: © 2009 Pearson Education, Inc. Publishing As Prentice HallDocument20 pagesOverview of Business Processes: © 2009 Pearson Education, Inc. Publishing As Prentice HallCharles MK ChanNo ratings yet

- Tripura Natural GasDocument123 pagesTripura Natural GasprocesspipingdesignNo ratings yet

- Inventory Management Module For Perfex CRM - DocumentationDocument54 pagesInventory Management Module For Perfex CRM - DocumentationSlimweb vietnam100% (1)

- LOI For Buyers (Blank)Document3 pagesLOI For Buyers (Blank)Vikram Sathish AsokanNo ratings yet

- Tata Steel Price ListDocument11 pagesTata Steel Price Listmdavies20No ratings yet

- Tax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Document5 pagesTax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Bharat DafalNo ratings yet

- On June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDocument63 pagesOn June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDachell Chiva SantiagoNo ratings yet

- In Voice Id 193945Document1 pageIn Voice Id 193945Amit kumarNo ratings yet

- Ar SetupsDocument35 pagesAr Setupssurinder_singh_69No ratings yet

- Tax Invoice: Customer Invoice Vision Motors Private LimitedDocument2 pagesTax Invoice: Customer Invoice Vision Motors Private LimitedAnish AbrahamNo ratings yet

- Draft Invoice UAE Free Zone Dubai Internet CityDocument7 pagesDraft Invoice UAE Free Zone Dubai Internet CityDdlc CenterNo ratings yet

- InvoiceDocument1 pageInvoiceVikki KumarNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sharp CutsNo ratings yet

- COGM in SAPDocument19 pagesCOGM in SAPSuryanarayana Tata85% (13)

- Pricing Based On Secondary UOMDocument20 pagesPricing Based On Secondary UOMfarhanahmed01No ratings yet

- Isd Process V1Document3 pagesIsd Process V1Anand PrakashNo ratings yet

- Is The Transfer of Invoice Price Variance Not Updating Item CostDocument10 pagesIs The Transfer of Invoice Price Variance Not Updating Item Costmks210No ratings yet

- Tax Invoice/bill of Supply/Cash Memo: Sumit DeyDocument3 pagesTax Invoice/bill of Supply/Cash Memo: Sumit DeyHUSSAINA RAJKOTNo ratings yet

- Wa0000Document1 pageWa0000Sainath ReddyNo ratings yet

- 14 PDFDocument15 pages14 PDFBindiya SalatNo ratings yet

- Loadmaster BE770-spare PartsDocument5 pagesLoadmaster BE770-spare Partsandrei20041No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ajinkya BagadeNo ratings yet

- Value Added Tax in The PhilippinesDocument14 pagesValue Added Tax in The Philippinesagathe laurent100% (1)

- Accounting Voucher 14Document1 pageAccounting Voucher 14Woven FabricNo ratings yet

- 2-Cost Plus Fixed Fee Sample InvoiceDocument4 pages2-Cost Plus Fixed Fee Sample Invoicekoyangi jagiyaNo ratings yet

- 21 Free Tools & Utilities For Translators - Alessandra MartelliDocument64 pages21 Free Tools & Utilities For Translators - Alessandra Martelliqazqazw100% (1)

- LN 10.5 Tfcmgug En-UsDocument128 pagesLN 10.5 Tfcmgug En-UstomactinNo ratings yet

- Vaishnavi EnterpriseDocument49 pagesVaishnavi EnterpriseKetan Chauhan (KC)No ratings yet

- Used Auto BankDocument6 pagesUsed Auto Bankfabio2006No ratings yet