Professional Documents

Culture Documents

B.C. Government Pre '09 Election HST Discussion #7 Pgs 43-80

Uploaded by

The Vancouver Sun0 ratings0% found this document useful (0 votes)

1K views38 pagesFreedom of information request documents relating to Campbell government HST discussions.

Original Title

B.C. government pre '09 election HST discussion #7 pgs 43-80

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFreedom of information request documents relating to Campbell government HST discussions.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views38 pagesB.C. Government Pre '09 Election HST Discussion #7 Pgs 43-80

Uploaded by

The Vancouver SunFreedom of information request documents relating to Campbell government HST discussions.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 38

Cole, Elizabeth FIN:EX

Flanagan, Paul FIN:EX

‘Wednesday, March 26, 2009 8:01 AML

Kondall-Craden, Rena PAB:EX; Armstrong, Glen E FIN:EX; Cole, Elizabeth FIN:SK

Patterson, Sheirl PAB:EX; Keast, Gordon PAB EX :

Re: Globe and mai ont to hermorize?

Possibly. We have prepared a note for the minister on this.

Original Message

From: Kendall-Craden, Rena PAB:EX

To: Armstrong, Glen E FIN:EX;.Flanagen, Paul FIN:EX 5

Cci Patterson, Sherri PAB:EX; Keast, Gondon PAB:

Sent: Wed Mar 25 07:56:39 2069

Subject: Fi’ Globe and mail: ont to harmonize?

Hello and good norning.

Is there @ possibility we will get questions on harmonizing tax in BC? RKC

Mcsuinty risks consumer backlash with move to harmonize sales tax Globe and Mail Wednesday,

March 25, 2009 Page Ao2 By Karen Howlett TORONTO BLENDING THE TAX

$46,576

The blended consumption tax runs the risk of infuriating burdened consumers, as a study shows

the harmonized system would add $46,576 to the purchase of a new home in Toronto.

The Ortario government wil announce in tomorrow's budget that it will sign a tentative

accord with Ottawa to harmonize the province's 8 per cent provincial sales tax with the 5 per

cent federal goods and services tax, sources familiar with the document seid.

The accord, a first step in what 1s expected to be a lengthy process to reform the province's

sales tax, was wellconed by business, but could anger consumers, who would end up paying @

single, blended consumption tax of 13 per cent

Consumers fear that taxes would increase on basic goods such as heating oil, dlapers and

children's clothing, all of which are currently exenpt from Ontarlo sales tax. Under

harmonization, @ new value-added tax would apply to all products covered by the goods and

Services tax, and consuners would see one charge on a sales receipt.

A hermondzed systen would add $46,576 *e the purchase of a new hone in Toronto, according to

one study.

But “the biggest political risk for the government 1s at the bottom of the economic spectrum:

Poor Families and those Joining the swelling ranks of the unenployed who can least. afford to

pay an extra 80 cents in tex on a $9.99 pair of baby shoes.

The proposed tax changes are part of an extraordinary move by Premier Dalton McGuinty to

address the province's stunning reversal of fortune.

treanso officially became a poor cousin of Confederation this year, receiving paynents under

the national equalization program for the first time, and it 1s not at all cleer uhether

Canada’s ost populous province will ever reclain its status as the country's econemle

Powerhouse.

Normorization would help’ the ailing province weather the recassion by making businesses nore

competitive, because they could receive a refund for taxes paid on goods and services and

other purchases to run thein operations. Wr. McGuinty would not confirm yesterday that the

reform is part of the budget, but he acknowledged the risks.

id don't think we've been put in government to choose what's easy," he told reporters.

He said in Jenuary that he was considering harmonizing the two taxes. Yesterday, however, he

said. the initiative could dle unless: the Harper government agroes to drop the GST from

household goods that are not charged provincial sales taxes. Federal Finance Minister Jin

1

Flaherty has been urging Me. McGuinty.to harmonize: the two taxes for more than a year. The

Premier noted that when three of the Atlantic provinces harmonized their sales taxes with the

6st back in 1997, at the urging of forner finance minister Paul Martin, thoy received

conpensation from the federal government because their tax revenues declined.

“It's not. the kind of thing you would want to pursue unless at the sane time you were going

to find a way to protect families," vir. McGuinty said.

The backlash has already begun.

‘The Building Industry and Land Developnent Association’ released a study earlier this month,

showing that harmonization would cost hone buyers $2.4-billdon more a year. Tax increeses on

new hone sales would range from $12,00@ to more than $46,000.

“I fear the worst,” Stephen Dupuis, president of the association, said in an interview

yesterday. “We're the most expensive thing people buy, so the impact is just huge."

Opposition menbers also weighed in on harnonization yesterday, revealing that the government

will face opposition from both sides of the political spectrum. x

“On the surface, we're very, very nervous about bringing in harmonization at the very tine

when this province is really belng faced with challenging tines," said Bcb Runciman, interim

leader of, the Progressive Conservatives,

New Democrat Leader Andrea Horwath criticized harmonization. as a “regressive” schéne. "This

4s nothing out a sales tex grab that will nickel-and-dine families that are elready feeling

the squeeze,” she said.

Fann Poschnann, vice-president of research at the C.D. Howe Institute, said ‘the governnent

could introduce measures for consumers, including rebates for low-income families, to

compensate thon for paying taxes on products now exenpt from provincial tax.

Cole, Elizabeth FIN:EX

Cole, Elizabeth FIN:EX

Wednesday, March 25, 2009 9:44 AM

‘Armetrong, Glen E FIN:EX; Kendal-Craden, Rena PAB:EX

( Andrew, Marc FIN:EX

RE; Globe end mat: cnt to harmonize?

yes, this is the final draft.

Original Message:

From: armstrong, Glen € FIN:EX

Sent: Wednesday, March 25, 2669 8:37 AM

To: Kendall-Craden, Rena PAB:EX

Cci Cole, Elizabeth FIN:EX; Flanagan, Paul FIN:EX; Andrew, Marc FIN:EX

Subject: RE: Globe and mail: ont to harmonize?

Theminister has anew BN from lest week. oi 900° 0

es =

BN attached (I believe it is the final draft - Beth can confirm whan she gets in)

Original Message-

From: Kendall-Craden, Rena PAB:EX

Sent: Wednesday, March 25, 2009 8:19 AN

To: Armstrong, Glen E FIN:EX; Flanagan, Paul FIN:EX

Cc: Keast, Gordon PAB:EX

Subject: RE: Globe and mail: ont to harmonize?

Hey thene: is this up to date? RKC

-original Message

From: Anastrong, Glen E FIN:EX

Sent: Wednesday, March 25, 2009 8:¢0 AN

To: Kendall-Craden, Rena PAB:EX; Flanagan, Paul FIN:EX

Subject: Re: Globe and mail: ont to hormonize?

Ninistes has © oN. I've given CT, GW,and mare a heads” up

Cheers

Original message

From: Kendall-Craden, Rena PAB:EX

To: Armstrong, Glen E FIN:EX; Flanagan, Paul FIN:EX

(ci Patterson, Sherri PAB:EX; Keast, Gordon PAB:EX

Sent: Wed Mar 25 07:56:39 2009

Subject: FW: Globe and medl: ont to harnonize?

Hello. and good morning.

Is there a possibLlity we will get questions on harmonizing tax in BC? RKC

McGuinty risks consumer backlash with move to harmonize sales tax Globe and Nail Wednesday,

March 25, 2609 Page AQ1 By Karen Howlett TORONTO BLENDING THE TAX

$46,676

1

‘The blended consumption tax runs the risk of infuriating burdened consumers, as a study shows

the harmonized system would add $46,676 to the purchase of a new home in Toronto,

The Ontario government will anrounce in tonorron's budget that it will sign a tentative

accord with Ottawa to harmonize the province's 8 per cent provincial sales tax with the $ per

cent federal goods and services tax, sources famlllar with the document said.

The accord, a first step in what is expected’to be a lengthy process to reform the province's

sales tax, was welconed by business, but could anger consumers, who would end up paying 3

single, blended consumption tex of 13 per cent.

Consumers fear that taxes would increase on basic goods such as heating ofl, diapers and

children's clothing, @ll of which are currently exenpt from Ontario sales tax. Under

harmonization, a new value-added tax would apply to all products covered by the goods and

services tax, and consumers would see one charge on 2 sales receipt.

& harmonized system would add $46,676 to the purchase of a new home in Toronto, according to

one study.

Sut the biggest political risk for the government is at the bottom of the economic spectrun:

poor families and those joining the swelling ranks of the unenployed who can least afford to

pay an extra 88 cents in tax ona $9.99 pain of baby shoos. .

The proposed tax changes are part of an extraordinary move by Premfer Dalton McGuinty to

address the province's stunning reversal of fortune.

Ontario officially becane a poor cousin. of Confederation this ycar, receiving poynents under

the national equalization program for the first tine, and it is not at all clear whether

Canada's most populous province will ever reclaim its status as the country's economic

Powerhouse,

Harmonization would help the ailing province weather the recession by making businesses more

competitive, because they could receive a refund for taxes paid on goods and services and

other purchases to run their operations. Mr. fcGuinty would not confirm yesterday that the

reforn is part of the budget, but he acknowledged the risks.

"r don’t think we've been put in goverment to choose what's easy," he told reporters.

We said in January that he was considering -harmonizing the tuo taxes. Yesterday, however, he

said the initiative could die unless the Harper government agrees to drop the GST from

household goods that are not charged provincial seles taxes. Federal Finance Minister Jim

Flaherty has been urging Mr. McGuinty to harmonize the two taxes for more than a year. The

Premier noted that when three of the Atlantic provinces harmonized their sales taxes with the

6sT back in 1997, at the urging of former finance minister Paul Nartin, they receivee

compensation fron the federal governnent because their tex revenues declined.

‘it's not the kind of thing you would want to pursue unless st the same time you were going

to Find a way to protect families," Mr. McGuinty said.

‘The backlash has already begun.

The Building Industry and Lend Development Association released a study earlier this aonth,

showing that harmonization would cost home buyers $2.4-billion more a year. Tax increases on

new home sales would range fron $12,@00 to nore than $46,000.

"I fear the worst," Stephen Dupuis, president of the association, said in an interview

yesterday. "We're the most expensive thing people buy, so the impact 1s Just huge.”

Cpposition nembers eso weighed in on harmonization yestorday, revealing that the government

wil] face opposition from both sides of the political spectrum.

“on the surface, we're very, very nervous about bringing in harmonization et the very time

luhen ‘this province is really being faced with challenging times," said Bob Runciman, interim

leader of the Progressive Conservatives.

New Denocret Leader Andrea Horwath criticized harmonization as a "regressive" schene. "This

As nothing but a seles tax grab thet will nickel-and-dine families that are already feeling

the squeeze,” she said.

Finn Poschnann, vice-president of research at the C.D. Howe Institute, said the government

Could intreduce neasures for consumers, including rebates for low-incone families, to

compensate them for paying taxes on products now exenpt from provincial tex.

Colo, Elizebath FIN:EX

Fricay, March 27, 2008 12:49 PM

‘Andrew, Mare FIN:EX

Chambers, An B FIN‘EX

Subject: FW: Apparently Ontario hes confirmed and provided same detail

Attachments; 184734 Hatmenzaton BN doc: Appendix doc; «4.

‘Not Response =

HiMare,

live attached the harmonization BN (plus 3 appendices) 20d. maapenane _

|e Resconsie— Se)

From: Armstiong, Geen & FIN:EX

‘Sent: Friday, March 27, 2008 12: : |

To Cole, Elizabeth FIN:EX

Cet Andrew, Marc FIN:EX

Subject: FW: Apparently Ontario has confirmed and provided some deteils

Beth, please ema the harmonization no aN, sassonsne ‘to mare.

Thanks

Sent: Friday, March 27, 2009 10:50 AM

Tot Armstrong, Glan E FIN:

‘Subject: RE: Apparently Cntario has confirmed and provided some details

Glen - do you have an electronic version of this BN handy?

From: Armstrong, Glen E FIN:EX

Sent: Thursday, March 26, 2009 3:12.4M

To: Andrew, Marc FIN:EX

‘Subject: Fw: Apparently Ontario has corfirmed and provided some details

Importance: High

From: Cole, Elizabeth FIN:EX

To: Armstrong, Glen E FIN:EX

Sent: Wed Mar 25 19:13:27 2009

Subject: Apparently Ontario has confirmed and provided some details

http://www. thes! obeandmail.comv/servlet/story/RTGAM.20090325,wPOLonibudget0325/BNStary/palities/hom

2

Ontario will exempt some | goods from harmonized tax

KAREN HOWLETT and BRIAN LAGHI

From Thursday's Globe and Mail

March 25, 2009 at 10:00 PM EDT

TORONTO — The Oniario government has moved to douse a firestorm of criticism over its plans to reform the

provincial sales tax by exempting a umber of basic goods, including children's clothing, diapers and new

homes costing Jess thar: $400,000. The government also proposes to help consumers adjust to the new regime

by providing one-time compensation of $1,000 —in three eqiial payments over 12 months ~ to families with

mua incomes of less than $160,000. Goverment sources eonfirmed last night that today's budget will

{include plans to harmonize the 8-per-cent provincial sales tax with the 5-per-cont federal goods and se-vices

fx, The sources also confirmed thatthe government is taking the sting out of harmonization for consumers by

exempting fiom the new blended sales tax many household goods that are not currently subject to provincial

sales taxes,

However, not everyone is kappy. Newly built homes that cost moze then $400,000 will be hit with higher taxes

Gas much as $46,676 in Toronto, according to one study ~ while the federal government has agreed to drop the

GST for those under that threshold, Closing costs on all homes, including realtor fees, legal services and home.

inspections, will climb beceuse they are not currently subject to provincial sales taxes, The Toronto Real Estate

Board estimates that will add $2,037 to the purchase of 2 $360,000 home,

TREB spokesman Von Palmer called it 2 “double whammy” for Toronto, which introduced a lend transfer tex

last year.

fWe're shocked at this. We'e sill reeling from the land transfer ini,” he said, I think the last thing the home

tarket needs right now is increased taxes on homes,

[remfer Dalton MeGuinty's government hes been under siege over its plans 10 introduce tax reforms as part ofa

‘roader initiative to help the province's ailing economy. Constituents have flooded theix MPPs’ constitiency

tices with telephone calls, expressing fears that taxes would increase on basic goods that are camrently exempt

From Ontario sales tex. And opposition members have seized on harmonization asa new opportunity to label

Mr. MeGuinty a tax-raising promise breaker,

Ta fact, any doubt thet the provincial budget will be delivered ia an atmosphece of crisis and intense sorting

sins dispelled yesterday, when Finance Minister Dwight Duncen trod on tradition, e did not buy u new ait of

shoes for presenting the bndget, nor did he hold the usual pre-budget photo-op.

Mis MeGuinty has sic his government would not pursue harmonization unless the Harper government agreed

io drop the goods and services tax from household goods or provide compensation inthe form of rebates for

low-income households, .

ete going to have a budge that protets families and strengthens the economy,” he told reporters yesterday

moming.

With the help ofthe feceral government, it appears that Mz, MeGuinty will be able to make good on that

Hledge, ‘The federal government has agreed to exempt basic goods from the GST. The deal will alo deliver

saultibiilion dollars in compensation to Ontario, said sources familiar with the tentative accord ‘signed by the

‘v0 governments,

‘The compensation will be similar to what three of the Aflantic provinces received when they harmonized their

{exes in 1997. The former Liberal government paid Nevifoundiand and Labredor, Nova Seetia and New

Brunswick $961-millior.

A source also told The Globe and Mail that the government would put the blended tax in place before the 2011

provincial election. Businesses have been pushing for harmonization because it will make them more

competitive by reducing their costs. They could receive a refund for taxes paid on goods and services to run

their operations.

The federal government also plans to bring a bill to Parliament for approval, which could well be tricky for the

federal Liberals, Voting for the blended tax might jeopardize federal Liberal popularity in the province, where

it hopes to make large gains in the next clection. By the same token, Voting agaitis! the proposal could create

{tension between the federal and provincial wings. Liberal Leader Michael Ignatieff has foiged substantial ties

with members of Mr. MoGuinty's government.

‘The payoff for the federal government comes in the backing it gives Finance Minister Jim Flaherty as he

Presses other provinces to adopt a blended tax, something the government has beer secking since its election in

2006: British Columbia, Saskatchewan, Manitoba and Prince Edward Island have all resisted harmonization

Alberta bas no provincial sales taxes.

Mr. Flaherty was tight-lipped about the harmonization idea yesterday. ‘The minister, who has been criticized for

saying the province was not a good place to invest, was asked if he now thinks the opposite

“if you would like to ask me that question after they publish their budget,” he said, “Td love to answer it.”

Mr. Pelmer of the TREB said the sales tax harmonization will disproportionately affect Toronto, where new

detached homes seldom sell for under $400,000. It was unclear how the tex would be applied — if, for instance,

oa the sale of a new $500,000 home, the harmonized tax would apply to the full price, or only the $100,000 that

exceeds the threshold,

fit applies to the full price, Mr. Palmer said one could expect a surge in listings for $399,999 to avoid the new

tax.

“How will that distort the mackeiplace? People will realize that's the threshold,” he seid,

Mr. Palmer cited a study estimating the harmonized tax will rise $3 13-million for the province in taxes on the

closing costs of home sales alone.

Armstrong, Glen E FIN:EX

From: ‘Andrew, Mare FIN:EX

Friday, March 20, 2009 3:61 PM

Armstrong, Glen E FIN:EX

Colo, Eizabeth FIN:EX

Re: Revenue contact,

‘Thanks for this,

From: Armstrong, Glen E FIN:EX

To: Andrew, Marc FIN:EX

Ce: Cole, Elizabeth FIN:EX

Sont: Fri Mar 20 15:01:01 2009

‘Subject: FW: Revenue contract

Mote: Bath ust pointed outa signtcant typo in my ema

ise

Sony eboutthat.

‘Mare: we recently sent up a Briefing Note package to the Minister on harmonization for information. Doug Foster has

den doing some work onthe cortract Revenue ffermerly SBR) has with EDS to hele collect debts owed tothe province,

including tax debts. s 43 51 [sy

Glen Armstiong

AADM

Strategie and Corporate Foley Division

Ministry of Finance

(280) 387-9014

Fax: 387-8051

‘gen.anmsirong@gov.be ca

Frome densene, cen EAs

Sent Fay Horch 20, 2009 2:39

Tor "Andrey, MarcrINEX

Subject FW: Revue contact

Marc: we recently sent up a Briefing Note package to the Minister on harmonization for information, Doug Fosterhas

been doing some werk on the contract Revenue fformerv SBR) has with EDS io help collect debts owed fc the province,

inclucina tax debts. s.1

‘saa.sur _ - —

Sheers

Glen Armstrong

ADM

Strategic and Corporate Policy Division

Ministry of Finance

(250) 387-9011

Fac: 387-061

.aimstrons ca

Front _frmaveng Gen FNox

‘Sent Fay, March 2, 2003 224

er Cae, Haabet FRE

Ge Fanagan, Pau FINES

Subjects FV: Raven conact

‘suasa Se :

Glen Armstrong

A/ADM

Strategic and Corporate Policy Division

Ministry of Finance

(250) 387-0014

Fax: 367-061

atmstrong@aov.be.ca

ester, Bau FIRB

“Thredey, Mirch 19, 2009835 a4

Amstongy ln € FINE

Subject RE! Revere cantast

Se - |

From: rack Gen ANE

Sent werescay March 18, 20092

To: rower, 2009 FINE

Subject: Reverue contact

Dou.wehave 2 BN with the minister on harmonization ¢ 9s 47

13,517 __['d ike an upcaie from you on what you know 80 we Ga

Important piece,

‘end Up some supplementary Info, Its an —

Thanks

Glen Armstiong ‘

ADM

‘Strategie and Corporate Policy Division

Ministry of Finance

(280) 387-9011

Fax: 287-8061

strona @gov.be.ca

Cole, Elizabeth FIN:EX

From: Armstrong, Glen E FIN:EX

Sent: Thureday, March 26, 2009 £:01 AM

Flanagan, Paul FIN‘EX; Cole, Elizabeth FIN:EX

Goss, Jordan T FIN:EX

FW: Ontaro Budget

See my email below. Louise called me backs 16.

‘516 = - - : 2

She will arrange a call with us for tomorrow if we want or need clarification, Pm in MFEX all morning tomorrow so ifwe

think we need a meeting we can decide this afternoon.

Cheers

From: Armstrong, Glen E FINIEX

Sent: Thursday, March 26, 2009 8:43 AM

To: ‘Louise.Levonian@fin.gc.ca’

‘Subject: Ontario Budget

louise: (sia a

Isai

Thanks

Armstrong, Glen EFIN:EX.

Louise. Levorien@tin.gc.ca

‘Thureday, March 28, 2000 6:10 PM

Aumstong, Glen & FIN:EX

RE: Cnilatio Budget

Louise Levonian

‘APselstent Deputy Minister | Scus-rafniseo aol par etc

Tax Policy Branch | Direction de ia politique de rimpot

Department of Finance Canada | Ministére des Finances Canada

Ottawa, Canada K1A 065

Lguleo Levonian@th.go.cg

‘Telephone | Telephone 613-992-1680 / Facsimile | Tolécopleur 613-996-0660 / Teletypewriter | Tél6knprimeur 613-995-

1465

Government of Genada | Gouvernement du Canada

Weel Bizirestorimcs pe teams Canadil

len.Armstrong@gpv.be.ca]

From: Armstrong, Glen E FIN:EX [mal

Sent: tarch 25, 2009 7:10 PM

To: Levonian, Loutse

Subject: RE: Ontario Budget

Thanks Loulse.le43.g4¢———

S386 _

Mary thanks -

From: Loulse.Levonian@fin g¢.ca [maio:Loulse.Levonlan@fin.ge.ca)

Sent: ‘Thursday, March 26, 2609 3:17 PM

To: ndbums@gov..pe.ca; heather wnod@gou.mb.ca; kmegregor@finarce gov sk.ca; Armstrong, Gen £ FIN‘EX

ai Stephen. Watson@gov.mb.ca; esrinvas@tinance.gor ska; Flanagan, Paul FIN:EX; Nancy Horsman@tin.gc.ca;

Bran. Erneweln@fn.gc-a; Lise Potvingfn.gc.ca; Kel Noray@n.gc.ca; Francine. NoRa@in.gc.ca;

Bilchardler@nh.gc.ca; Peter Turner@fngo.ce

‘Subject: Ontario Budget

‘As you may be aware, the Onterlo Budgo! tabled today includes an announcement ofthe provinces nent to ollminate its

rela sales tax end Jon armademized harmonized sales tex framework. For your information, | am allaching a copy of

the Merrorandum of Agreement between Canada and Oniatio in this regard. 1am avallable fo discuss.

-< <>

Louiee Lovonlan

‘AlAssistant Depuly Minister | Sous-ministre adjoint par Interim

‘Tax Policy Branch | Direction de la poltique de impot

Department of Finance Canada | Ministére des Finances Canada

Cttave, Canada K1A 066

Louise Levenlen@iinacica

Telephone | Téléphone $13-892-1630 / Facsimile | Télécopieur 613-996-0680 / Teletypewriter | Télélmprimeur 619-095-

Government of Caneda | Gouvernement du Cenada

Memorandum of Agreement

Concerning a Canada-Ontario

Comprehensive Integrated Tax

Co-ordination Agreement

Confidential

March 2009

Memorandum of Agreement Concerning a Canada-Ontario

Comprehensive Integrated Tax Co-ordination Agreement

BETWEEN:

‘The Government of Canada (referred to as ‘Canada’, as represented by the Minister of

Finance of Canada;

AND:

‘The Government of Ontario, (referred to ae “Ontari

Finance of Ontario;

Preamble

This Memorandum of Agreement ("MOA") refiects the strong commitment by Canada

‘and Ontario to work collaboratively to bull @ stronger economic foundation.

4s represented by the Minister of

Pursuant to this MOA, both parties commit to using their best efforts to negotiate a new

Canada-Ontario Comprehensive integrated Tax Co-ordination Agreement (hereafter

referred to as the "Canada-Ontario CITCA", together with any necessary releted

agreemenis, whereby the Canada Revenue Agency ("CRA") and the Canada Border

Services Agency (‘CESA") will administer an Ontario Value-Added Tax (OVAT?)

‘This MOA forms the framework for concluding the Ganada-Ontario CITCA, .

Canada-Onterio Comprehensive Intecrat ion Agreement

Canada and Ontarlo agres to make thelr best efforts to fulfll the undertekings set out in

this MOA In order that all policy and aciministrative cetalls are finalized, Including any

necessary legislative processes and tho signing of appropriate agreements, before

‘March 31, 2010, except where otherwise specified in this MOA.

Canada undertakes to seek the approval of the Governer-in Council to enter into an

‘agreement under Pert Ill.1 of the Federal-Provincial Fiscal Arrengemenis Act consistent

with the terms of this MOA. The partios understand that this MOA does not constitute an

‘agreement pursuant to subsection 8.3(1) of the Faderal-Provinsial Fiscal Anangemenis

ct.

Onterio undertakes to seek authority to enter into the Canada-Ontario CITCA,

Canada and Ontario will use their best etforts to conclude the Canade-Ontario CITCA

within efx months of having signed this MOA,

Implementation Date

‘Subject to both Parties having signed the Canada-Ontario CITCA, and subject to

legislative eporoval, the Parties will work towerd the impostton of the proposed OVAT by

the CRA/CBSA on July 1, 2010. Subject to these approvals, the CRA/CESA will have

the necessary systems in place to effectively implement the OVAT on July 1, 2010,

Confidential - Canada-Ontarto Memorandum of Agreement

Federal Transitional Assistance to Ontario

To help offset the transition costs essoclated with the implementation of the OVAT and

‘the winding down of the retail sales tax administration in Ortario and because moving to

an OVAT would support economic groath and job creation, Canada will make two

transfer payments ‘ctaling $4,300 milion to Ontario. The schedule of transfer payments

wil be as follows: $3,CO0 milion upon the date of imposition of the OVAT and $1,300

raion one year following the date of imposition of the OVAT provided the tax continues

to be in place one year after the date cf imposition of the OVAT.

Onterio agrees to remain a party to the Canada-Ontario CITCA for a period of at least

five years following Imposition,

Ontario Value-Added Tax

‘An 8% OVAT would be implemented under the federal Excise Tax Act. Ontario will

Propose legislation to give effect to the Canada-Ontarlo CITCA and any other provinclally

administered measures appropriate to the transition to the OVAT.

‘The OVAT would have the same tax base as the Goods and Services Tax (GST), subject

to the exceptions described below,

incial Tax Policy Fiextbit

‘The Canade-Ontario CITCA will confirm Ontario's flexibtity, subject to reascnable notice

Provisions, to:

~ Increase or decrease the OVAT rate afler two years from the date of

OVAT implementation;

~ designate a imited number of OVAT point-of-eale rebates, not

exceeding 5%, in aggregate, of the estimated GST base for Onterio

subject to data avalabilily and definitions used in the Canadian System

of National Accounts or other mutually agreed upon data source

definitions and methedologies. For greater certainty, point-of-sal

rebates that Canada agrees to administer for Ontario will inciude |

children’s clothing, feminine hygiene products and books; |

~ temporarily deny for & period of up to five years a portion, up to 100%, of

allowable business input tax crecits (*ITCs") based on a select list of

tems to be determined ‘by Ontario (not to apply beyond the items subject

to the current ITCs denials under the Quebec Sales Tex). Following this

Period, full ITCs will be phased-in, in: ‘equal annual proportions, over a

Period of up to three years, Ontario would advance the timeline fer the

Phase-in of full TCs should fiscal circumstances allow; and

~ et OVAT rebate rates and thresholds for Municipalities, Universities,

Schools, Cofleges and Hospitels (MUSH), Chavilles, qualifying NPOs

‘and New Housing, subject to matching other federal GST administrative

and structural parameters,

Canada agrees to Introduce legislation to enable the tax policy flexibility noted herein,

Confidential ~ Canada-Ontario Memorendum of Agreement

Common Tax Base

Except as provided In this MOA under the heading Provincial Tax Policy Flexibilty,

Ontario will enter into the Canada-Ontarlo CITCA and will be bound by tax base changes

made by Canada with respect to the GST. However, where Canada proposes a tax base

change that would result in a reduction of more than one percent of OVAT revenues (net

of provincial rebates provided for under this OA, and ITCs), Conada may Implement the

change only if the Minister of Finance of Ontario provides written agreement to the

change prior fo implementation, If Caneda implements the tax base change without

consultig Ontario, or proceeds without Ontario's written agreement, Canada agrees to

fully compensate Ontario for the revenue reduction for every year that the change

Femains in place and the Canada-Onterio CITCA remains in force.

Canada and Onterio wil! develop reasonable notice provisions in the Canada-Ontatio

crTca.

Collection and Administration

‘The OVAT, Including all eligible rebates and temporarily restricted ITCs provided for in

this MOA under the heading Provinclal Tax Policy Flexibilty, will bo collected and

‘administered, at mutually agreed upon service and compliance levels, by the CRA/CBSA

at no charge to Ontario, ‘In adcition, Cenads wil be solely responsible for all CRAICBSA

stertup and ongcing costs, including their development and systems costs.

For greater clarity, these costs wil not reduce or be offset against the $4,300 milion in

total transfer payments provided for in this MOA under the heading Federal Transitional

Assistance to Ontario.

ayment of Revenues Collected

Canada and Onterio agree thet revenues payable to Ontario will be based on the

Tevenue allocation framework as set out under the Cenade-Oniario CITCA, subject to the

following:

Canada agrees to pay Onterio its revenue entitlements on a dally basis. For

greater clarity, the allocation for a tax enttiement year will bo paid to Ontario

inestmated dally amounts determined using the revenue allocation

framework beginning July 1, 2010, The payments will be based on the

estimate for the tax entitiement year, and will include adjustments to these

‘amounts relating to scheduled revisions end reconciliations as provided for

Under the revenue allocation framework.

‘The revenue allocation framework to be included in the Canada-Onterio CITCA will be

based on the framework in the CITCA between Canada and the HST provinces.

Exchange of Infor

‘There wil be full co-operation between Canada and Ontario with respect to the exchange

cf Information releting to the OVAT. The specific tetms on information exchange and

‘mutual assistance will be provided for in agreements to be enlered Into between Canada

and Ontatio (@.9., the CRA and Ontario ard the CBSA and Ontario). Such agreements

will engure the timely provision of available OVAT specific data and other OVAT related

Confidential ~ Canade-Ontarlo Memorandum of Agreemant 3

information to Ontario, as may be disclosed pursuant to the appropriate laws and

regulations.

Canada and Ontarto wid work to establish mechanism(s)/agreement(s) to provide for the

management of Issues related to cllent services, compliance and enforcement of the

OVAT by the CRA/CESA.

Best efforts will be made to conclude these agreements in a timeframe that is consistent

‘with, and no later than, the target date for the conclusion of the Canada-Ontario CITCA.

noted earlie

Human Resources

Canada end Onterio acknowledge that they each must consider relevant legislation end

policies, and have collective agreement obligations with thelr respective bargaining

agents. Within this context, the Parties agree to negotiate the best possible

arrangements, to be contained within a Human Resources Agreement, for employment at

CRACBSA vilthin Ontario, of Ontario Public Service employees effected by this MOA,

a Inistreti VAT in Ontari

Given the significant presence of CRA/CBSA activity and operations in Ortario, and the

previous clause pertaining to Human Resources, Canada will maximize the amount of

activities and operations carried on in Ontario for OVAT.

Where it can be demonstrated, with respect to specific OVAT activites and operations,

that the effective administration of OVAT would be jeopardized if the activities and

operations are performed in Ontatio, Canada will use best efforts to maximize

employment oppertunties in Ontario for a corresponding number of Ontario employees

affected by ths initiative, within departments or agencles of the federal government,

Audit

The Ontario Minister of Finance may designate a person to examine such books and

records, excluding information which is protected by law, as may be relevant in orderto

Permit such person to report in respect of the payments made to Ontario under the

Canada-Oniario CITCA, |

Appointment of Pane! |

Canada anc Ontario agree to jeintly appoint a Panel or individuel, within 6 months

following the implementation of the OVAT, to review and make recommendations on

Possible improvements to the:

— administrative and policy information avaliable on the OVAT;

~ revenue allocation framework, such as replacement by a system that

‘would provide the distribution of revenue to Ontario, and Harmonized

Sales Tax provinces, based on actuel sales of goods and services in

‘such provinces; and

~ governance and organizational structures of the various committees

Under the Canada-Cntarlo CITCA.

Confidential — Canada-Ontario Memorandum of Agreement

The Panel or Individual will report back to the parties within one year of being

appointed.

Canada and Onterio agree te consider revising the Canada-Onterio CiTCA es

‘appropriate to reflect the recommendations of the Panel or Individual, Canada will

consult with the existing Harmonized Sales Tax provinces.

Ontario Retail Sales Tax

Ontario wil be responsible for winding down its retail sales tax to the extent thet itis to

be replaced by the OVAT.

GRA/CBSA and Ontario will have the option of agreeing on the CRA/CBSA providing

cliont services, collections, audit, rulings, objections and appeal activites In respect of

the retail sales tax on an incremental, fee for service basis aver the transition period,

tion diction Not Waived

Neither Canada nor Ontario shall be deemed to have surrendered or abandoned any of

Its powers, rights, privileges or authorities under the Censtitution Acts, 1867-1982, and

‘any amendments thereto, or otherwise, or to have impaired any such powers, rights,

privileges, or authorities

Confidential

Pending a public announcement by Ontario that It Is Introducing an OVAT, Canada

commis to taking all stops to embargo the existence of this MOA and to rot disclose in

‘any way feceral-provincial discussions relating to the development, negotiation end

‘execution of this MOA or to an OVAT. The Parties agree not to disolose this MOA.

Unless mutually agreed to in writing of required by law,

THIS MEMORANDUM OF AGREEMENT ENTERED INTO ON:

Veuk 4 . 2008 Mervr_to , 2009

RIO

The Honourable James M, Flaherty ‘The Honourable Dwight Duncan

Minister of Financa Minister of Finance

Cenada-Onterio Memorandum of Agreement 6

Cole, E

ee

Goss, Jordan T FINEX

From:

Sent: Friday, March 27, 2000 9:09 AM

To: ‘Armstiong, Glen E FIN:EX; FIN SGP Tax Policy Branch

Subject: RE: globeandmail.com News Update

' created a folder in the Harmonization folder called Ontario Harm information. | saved the

MOU there and a document with the relevant comments from the globe and mail-article. As

more comes out from the Ontario move, we can add it here so that everyone can find it easily

ifneeded.

Jordan Goss

Manager, Consumption Tex

Tax Policy Branch

Ministry of Finance

Ph. (250) 387-7324

Fax (250} 368-7624 pee ths

From: Armstrong, Glen & FIN:EX

Sent: Friday, March 27, 2009 8:15 AM

‘To: FIN SCP Tax Policy Branch

‘Subject: FW: globeandmail.com Nev's Update

‘See comments ~ we stould start tracking them as they will help us remember al sues that may need to be addressed,

even If Just on the communication front, in the event we ever nead them

thanks

From: Glen Armstrong s

Sent Friday, March 27, 2009 6:10AM

To: Armstrong, Glen E FIN:EX

Subject: Fwd: globeandmail.com News Update

Begin forwarded message:

From: "globeandmail.com"

Date: March 27, 2009 4:41:21 AM PDT (CA)

To: —

Subject: globeandmail.com News Update

Reply-To: "globeandmail.com "

© BP atovoendmaticom

news update

Home | National | World | Business | Sports | Opinions Arte | Technology | Travel| Health} Auto

1

ESA EL a ET

.

ropsvonmg

Ontarlo’s tax gamble a action to protect your

Wh 3 racordl defic projected and a move to sales tax harmonization, Ontaros budget ton to pote

signals a complete overhaul ofthe province's economic polley. Will MeGulnty' big risk pay Computer

off? 26/03/09 12:09 AM enti ckar uceat?

(ves

Suicide attackin Pakistan kills 48 7 ONO.

Officials say tow cozen people either killed or Injured 6:24 AM

{vare?)

Premisr’s to 4 cal faeranee ae

Fraud tel Involving forme: ministerial ages suggests Patrick Xheele ted to-both BC Rai! ntGFattivesPusdies!»

and its buyer In 2004 26/03/09 10:31 PM Seay boon

it

‘The Globe reviews Mensters vs. Allens and this week's other new movies £2:04 AN cROssWwoRD

PUZZLES

+ ‘Canadiana

Srossword

. : + Universal

eh + Crvntic Puzzle

Olly Hicks tells Hayley Mick that he needs two things to cope with the mind-boggling

solktude of circling Antarctica ~ © 16,000-song iPod and Don Qubvote 5:13 AM suboku puzztes

What's selling? who's buyin?

Toronto's chilled real estate market is showing promising signs of a thaw 26/03/09 6:18 © Sudoku

Pt Slassie

+ Sudoku Mega

Related: ua

‘Toronto dene deals #

Home Turf

The online column

dedicated to covering the GTA's

teal estate market,

(START READING,

THE GLOBE AND MAIL*

REPORT ON BUSINESS

REPORT ON BUSINESS

of financial oversi

Government gets behinc G20 push to beef up regulatory measures; may consider idea of

committee to co-ordinate agencies 3:30 AM

t

U.S, Treesurer proposes sweeping reforms that toughen regulations for big market

players 26/03/C9 40:13 PM

Manulife CEO to cet $12.5-million in 2009

Departing Dominic O'Aessandro to receive compensation package for extracrdinery

erformance;' Insurer rejects say-on-pay vote 25/03/09 4:30 PM

Alberta engineers pin fob hopes on European firms

For the thousands who have been iaid eff, foreign companies that are hiring locelly are

proving thelr best chance 4:07 AM

Issipot's ‘on hol

“Thay bulletin Tupelo, but Toyota may net come 3:30 AM.

Let us prey

Wall Street's recklessness has toppled the most exalted occupation in the land, Get ready,

CEOs, for @ new job description 26/03/08 7:19 AM

NATIONAL

Arrcraft had en abrupt Impact of at least twice the G-force felt by top fighter Jet pllots, 2

devastating blow that tore doors and windows 26/03/09 12:00 AM

s r bl

Aboriginal leader named in lawsult says aggressive legal actlon wor't step land

protested :20 AM

Paramedic ralses questions ahout Dziekanski's care

Polish immigrant was dead when worker arrived more than 10 minutes after tasering by

ReMP, Inqulry told 4:37 AM

But police say they will be offered space in shelters or given help to go wherever they.

want anc only arrested if they refuse ta move 2:22 AM

an ith hel St vi ht ned Int

Quebec police make bixer-related arrests 4:24 AN |

CANADIAN POLITICS

Utlce espectfully not singing in

‘Awkward split on the home front for federal Finance Minister JIm Flaherty 4:28 AM

nev's chief of stoft 7

ther witnesses to Incluce a former defence minister and the widow of & flamboyant,

hard-tiving premier 4:21 AM

© spending will exact he: m |

Current stimulus measures will come back to haunt world economy for years to come,

‘TD's Drummond tells MPs 26/03/08 1:01 PI |

Blaming weak oll prices end ‘unilateral action of the Harper government’ province

forecasts $750-milion deficit 26/03/09 1:51 PM

a rt lyzed MP's ca:

Stephen Fetcher has been fighting Manitoba Public Insurance decision to deny more

money for ful-time care 26/03/09 11:31 AM |

WORLD _.

eh 2!

Dozens more missing as wall of water submerges hundreds of homes §:47 AM

IstesllJets destroyed Iranian arms shipments

Strike Would have bean technically complex, observers say 26/03/09 5:24 PM

uesti a's e-forum,

Spurred by advocacy grou, questioners repeatedly ralsed legalizing marljuana26/03/09

8:21 PM

in Lis

Canada's Miltery Police Complaints Commission rejects Karper government's attempts to

ut off inquiry 26/03/09 4:26 PM

rs investi 2 all

Binyam Mohamed's says an MIS officer was aware he had been tortured 26/03/09 8:54

PM,

LiFe

Keys to Independence

Tetook me years to recover from teaching my daughter te drive. Stomping the Imaginary

brake Is tersitying 12:00 AN

24 hrs of tweets

‘Welcome to Ife on Twitter, where breakfast is breaking news 25/03/09 3:57 AM

Sexed 2.0

Many sexual health educators say only visceral lessons wif speak to youth, but they face

another challenge as some parents ceek epecial accommodation for their children. What to

40? 26/03/09 6:10 AM

Ldtinalty) t

Novene can accuse late-night TV star David Letterman of rushing inte marriace26/03/09

6:03 AM,

‘st ers Cr sl

New economic reallty means Canadian families need to create their own stimulus package,

experts Say 26/03/09 6:00 AM

From arlef comes compassion

When my brother took his life, rather than lose my faith I felt everything more deeply —

sorrew, love and joy 26/03/09 12:00 AM

HEALTH

FAT

Its the cheapest and most effective way to have a hezithy baby 26/03/09 6:32 AM

K

Hundreds of thousands in Ukraine refuse immunizations, a trend being seen worlwide,

and disease could spread beyond Its borders 25/03/09 7:20 AM

How much of the disease can we really cure and conquer? 26/03/09 6:29 AM

‘Real men ought to aat tofu

Nales who eat plenty of soy foods are less ikely to be diagnosed with prostate cancer)

‘eccording to a new study 25/03/09 6:26 AM

SCIENCE

Australie targets toxic cane toads

Festive mass killing takes place this weekend to help cull the population 26/03/09 9:37 AM

of M

Gne expert says it may be time to increase estimates on hovr many of the creatures are

living there 25/03/09 7:43 AM

50new species found

Discoveries in Papua New Guinea include brillant green tree frog with huge black eyes,

Jumping spiders and stripec gecko 25/03/09 2:07 AM

ELNino study challenges alebal warming belief

1918 event far stronger than previously thought, challenging notion climate change Is

making episoces more intense 24/03/09 2:42 AM

TECHNOLOGY

rent you = what a co:

‘With Google Books, The Internet giant Is looking beyond the accepted Web 2.0

Ideology26/03/09 10:00 PM

ovate oy to fil is st

Get ready for your close-up as search engine puts photos of big-city roads and homes on

the Web 25/03/09 9:39 PM

‘18M cutting jobs across Canada, spokesman save

Reports suggest the computing giant also plans to lay off about 4 per cent of Its work

force In the United states, or about 5,000 employees 26/03/09 2:58 PM

‘SPORTS

Captain th

Fionish centre's overtime goal keeps Montréal in eighth, final playoft spot in Eastern

Conference 12:17 AM

‘Shan takes world siiver - '

Canadian takes seconé spot in men's singles at figure skating championships 4:00 AM.

a

in playoff race after nar-ow loss in Phoenty

Edmonton falls bact 5AM

i An

NHL commissioner says team may get new owner, but will not be moving 12:33 AM

niucks for first

St. Lous continues late drive for playoffs by doubling up on Vancouver 1:22 AM

Hames shut out egein

Meson makes 33 saves in NHL-best 10th shutout as Calgary falls to seare for second

straight game 26/03/09 11:14 PM

‘Sanada fersey may now include VANOC logo

Hockey Canada looking at putting the 2010 Icon on the sleeves 26/03/09 7:27 PM

w echl 1

‘Capitals coacn reporting of Russian's 50th goal celebration was blown out of

reportion26/03/09 8:11 PM

ARTS

t at

But saerifices demanded of jewels In public broadcaster's television cron pale In

comparison to those of radio programs 2:25 AM

Nominations are open

Ifyou know someone who should be Immertallzed in concrete, now's your chance to make

it happen 26/03/09 5:20 PM

Filmmaker illuminates city's i

“Two teens in Regent Park are focus of Hot Docs flim that offers a glimpse inside complex

nelghbourtood 440 AM

‘The new wave, tundra-style

Films set in the Arctic must grapple with telling'stories by and about Inuit life while

shooting In harsh conditions 26/03/09 4:58 PM

‘SPONSORED LINKS

+ 18% ROI Canadian REIT

Free eStock shaws you how lo prof tom Canaclan revenue

sroperties.

* Press Release Distribution Service

end your news to op sites, mecla, lors and more. Proof at

Cletributon. SEO.

* Order Your Free PEI Istand Guide Today!

Enjoy beautfu Leathes & gourmet seefood on genie Prince Edward

Istana,

* 1S 2010 Global Outloo! rt

eam wry successful Canadians turn to UB8 forthotrWestth

Mangement needs,

+ Don't Lose Another 35% in Mutual Funds!

Make 63%imonih trading ETFe, 10min. @ night Proven system, get

report!

About this E-Niail

‘You received these headlines because you are subscribed to the daily News Update newsletter from

Globeancmall.com.

‘Sian_up for more free newsletters from globeandmail.com

Remove me from this newsletter

Copyright © 2009 CTVglobemedia Publishing Inc.

Contact Us | Privacy Policy

Armstrong. Glen E FIN:EX

Friday, March 27, 2008 12:53 PM

Flanagan, Paul FINEX

FW: harmorization

Was undeliverablwe last time

cheers

From: Armstrong, Glen FI

Sent: Fiiday, March 27, 000 16 a

To: Flanagan, Peul FIN:

Subject horrenzatan

We will have to update the BN for the Minister based on the MOU. We should think about any questions / clarifications

we need from the feds re: new rules so we can provide an update next week,

Istysee

Cheers

Cole, Elizabeth FIN:EX

From: Cole, Elizabeth FIN-EX

Sent: Monday, Mazch 30, 2009 6:18 PM

Te Aumsirong, Glen E FIN:EX

Subject: Cayo Adticle

Fy, this is the article

Case for harmonized sales tax in B.C. more compelling than ever

Vancouver Sun

Monday, March 30,2009

Page DOS

By Don Cayo

The case for B.C. to harmonize its sales tax with the OST has long been slong. Now itis even more

compelling, :

‘The trigger is Ontario's sickbed conversion to sensible tax policy.

Premier Delton McGuinty and his cabinet have, judging from the budget they tabled last week, looked at their

ailing economy and recognized the need for strong medicine, They responded with both a reduction of

corporate income tax — ftom 14 per cent to 10 per cent fo be phased in over the next four years and a

decision to harmonize Ontario's provincial sales tax with the federal GST.

Its Ontari6, not B.C., that is playing catch-up on business tax sates. It stands at 11 per cent here, and it's on its

vway down ‘0 10 per cent by 2011, after a series of reductions from the 16.5-per-cent rate in effect when the

current government took office.

But on the PSI/GST front, the shoe is now tightly laced on the other foot.

C.D, Howe Institute president Bill Rohson spoke for a lot of analysts when he called Ontario's harmonization

plan overdue, badly needed, and timely. He sees it bolstering investment in Ontario in both the Jong and the

short term,

The exnet same analysis applies now, and always hes, to B.C, But there's an additional reason for our

govemment to act -- to maintain our provinee's position vis-avis Ontario.

When three of the Atlantic provinces harmonized their sales taxes with the GST more than a decade ago, it

bolstered business investment there by, according to some estimates, as much as 17 per cent. Yet it's

ucstionable how much of that investment could or would have come to B.C. if they hada't offered a better tax

cavironment than ours ~ the Atlantic provinces have a lot of other cost disadvantages, including remoteness

from markets and generally high taxes,

But Ontario? Its a direct competitor for a lot of investment British Columbians would like to see come here.

‘And with its established manufacturing economy hurting so badly, is an aggressive competitor, We ean ill-

afford to Ieave unchallenged this new major tex advantage it's creating for itself

‘The obvious appeal of « harmonized tax is the administration and compliance costs it will save, There'd be just

one tax for businesses to collect, and one for government auditors to police.

But a couple of fundamental differences mean much more than mere administrative savings. One of these

contributes to its undeniable unpopularity with consumers, although I think this has more to do with politics

and dislike of Brian Mulroney than with analysis. But the other means thet, when it comes to fostering growth

and prosperity, it's a far better tax than the PST.

‘The unpopular difference is that GST is more broadly based, applying to both goods and services, with few

‘exemptions, The “ax efficiency" difference is that GST taxes things of value only once, while PST ean tax the

same component of a product over and over and over again,

‘Thus the PST can compound several times over by the time a consumer mekes a purchase, Every business peys

ii on every input that goes into their product, and it must often be paid again and again at intermediate stages.

With OST, any tax paid on inputs is refimded, and only the final product is subject to tax.

Critics will be quick to point out that « harmonized tax will shift some tax burden from buisiness to consumers,

‘They're right. About a third of the tax currently raised by PST is paid on business inputs, and thet would be

saved under a harmonized tax.

But increase in total taxes paid dirccfly by consumers will be balanced, at least in pat, by savings on the cost of

goods made from inputs that are taxed and re-taxed by the PST.

And government can easily protect lower and middle-income consumers ftom any such tax increase, Ottawa

already has a system of GST rebates that can be bolstered if the tax rate rises under harmonization. Also,

Ontario is pledging to rebato to consumers virtuelly all of the $4.3 billion it will get from the federal

government to assist with harmonization cost.

That's a very lerge spoonful of sugar to help the medicine go down. And federal Finance Minister Jim Flaherty

is s0 keen to get more provinees on board with harmonization that i's a safe bet B.C. could negotiate at east 2s

sweet a deal,

Cole, Elizabeth FIN:EX

From: ‘Armstrong, Glen E FIN:EX

Sent: ‘Thursday, April 2, 2009 10:19 AM

To: Foy, Anne FIN:EX

Ce: FIN'SCP Tax Policy Branch

Subject: RE: What our taxes need is harmonization (The Vancouver Sun, (2 Apr 2609, Page A15}

thanks

From! Foy, Anne FIN:EX

Sent: Thursday, Apri 2, 2009 10:18 AM

To: Armstrong, Glen E FIN:EX

‘Subject: RE: What our taxes need is harmonization (The Vancouver Sun, 02 Apr 2009, Page A1S)

These are the only quotes! have seen ~both from March 30"

Minister Hansen says he's not sold ox the idea of merging the PST and GST — CHNL~ 8:00 AM~ March 30,

2009 1

Announcer: Itseems that our province will let Ontario be the guinea pig when it comes to merging the federal

and provincial sales taxes. A wait and sce approach from B.C.'s Finance Minister.

Reporter: Ontario will begin collecting provincial sales tax along with GST in the form of e new harmonized

tax next year. B.C. Finance Minister Colin Hansen says he's still not sold on the idea.

Colin Hansen: An HST would have the advantage of being a far more simple program to administe?, The

‘Administrative side would be muci less costly on small businesses in particular but the other side of itis thet it

‘would give us less flexibility as a province in terms of what a sales tex would or would not apply to,

Reporter: Quebec and most Atlantic provinces already use an HST.

rt enttnentinm Tees

top

‘Minister Hanscn says lots of iniput is needed on the idea of merging the OST and PST — CHNL—7:00 AM ~ |

March 30,2009 |

Announcer: Should two become,one? A wait and see approach from British Columbis’s Finance Minister

regarding the whole idea of merging the federal and provincial sales taxes,

Reporter: B.C, Finance Minister Colin Hansen says his government has considered merging the provinciel sales

tex with the GST but isn’t ready to move.

Colin Hansen: You know we're certainly going ‘o follow with interest what Ontario is doing bnt I think as we

1

will see from the debate in Ontario it’s clearly a controversial move and one that we would certainly want to

gets lots of input on,

Reporter: Ontario announced last week it would join Quebec and most Maritime provinees in collecting one

provincial and federal combined sales tax. Hansen says the HST would be easier to administer but would-also

take away B.C, control over what goods and services the tax would be applied on.

‘Anne Foy

Tax Policy Analyst

Ministry of Finano=

From: Armstrong, Glen E FIN:EX

Sent: Thursday, April 2, 2009 10:13 AM

Tot FIN SCP Tax Policy Branch

‘Subjects FW: What our taxes need is hermonization (The Vancouver Sun, 02 Apr 2009, Page A15)

Kesselman on harmonization in BC.

IN? If so please share with me,

Has anyone seen any quotes from our Minister or the Premier on harmoniz

Thanks

lenarmstrong@shaw.ca [mallto:glenarmstreng @shaw.ca]

hurscay, April 2, 2009 6:37 AM

To: Armstrong, Glen E FIN:EX

‘Subject: What our taxes need is harmonization (The Vancouver Sun, 02 Apr 2009, Page A1S),

ics

2

The Vancouver Sun

02 Apr 2009

It's no longer a matter of if,” but simply “ when.” Last week, Ontario,

have a separate sales tax, and the largest of those provinces,

tox with the GST effective....read more...

one of the few remaining provinces to

announced it will be merging ils provincial sales

This email wes sent to you by a Times Colonist Di

inital ser. This earvice contains copyrighted materia, rade marks ard other

>roprctary information, Receipt ofthis email should not be iterpreted as gran: oF ay licences express or implied, tothe intellectual

Property of CanWest MediaWorks Publications Ine

‘This email was sent to you by Newspape:Direct, Inc (200-1311 Vanier Place,

Richmond, BC, Caneda V6V 211, phone 1 604 278

4604) on behalf of Timies Colonist Digital

(© 2003-2008 Times Colonist Digital. All rights reserved, Tertn of Use | Privacy Statement

Armstrong, Glen E FIN:EX

From: Armstrong, Glen E FIN-EX

Sent: Monday, April 6, 2009 10:29 AM

To: Flanagan, Paul FIN‘EX

Ce: Goss, Jorcan T FIN:EX; Cole, Elizabeth FIN:EX

Subject: harmonization

r es - =

|

8 = — =

Can you pull something together for discussion after my holiday?

Thanks

Flanagan, Paul FIN:EX =

From: Cole, Elizabeth FIN:EX

: ‘Wednesday, Apri 8, 2009 1:72 PM

Armstrong, Glen E FIN-EX

Flanagan, Paul FIN:EX

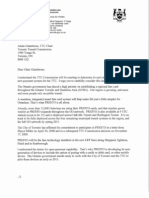

Harmonization ADM Response Letter

Subje

(ve attached a draft of the response. The public quote from the Minister was

Colin Hansen: You know we're certainly going to follow with intecest what Ontario is doing but I think as we will see

from the debate in Ontario it's clearly @ controversial move and one that we would certainly want to gets lots of input on,

Cole, Elizaboth FIN:EX

—SSS——_s-=e—*""—_- << SS

From: Cole, Elizabeth FIN:EX

Sent: Wednesclay, Apri 15, 2009 12:47 PM

To: ‘Armationg, Glen E FIN:EX

Subject: Kesselman Harmonization Article

What our taxes need is harmonization

B.C, should follow Ontario's lead and merge its sales tax with the federal GST -- only do it

hotter

By Jon Kesselman, Special to the Sun April 2, 2009

exemptions for various goods and services that exist under its

B.C. should not retain spe

sales tax.

It's no longer a matter of "i," but simply "when." Last week, Ontario, one of the few remaining

provinces to have a separate sales tax, and the largest of those provinces, announced it will be

merging its provincial sales tax with the GST effective mid-2010.

The only question is when British Columbia will follow suit with a harmonized sales tax.

Harmonizing provincial sales taxes with the federal GST is importent for several reasons.

First, it sharply reduces businesses’ compliance burdens of having to deal simultaneously with two

separate salos tax systems; Onterio businesses are projected to save $500 million annually from

harmonization, a savings that will fow through to consumers. :

Second, by extending the provincial sales tax to the wider range of goods and services covered by

the GST, distortions in consumer choices are reduced. Consumers also find it simpler to have a

single, combined tax rate to apply to their purchases and to have the same items taxable both

federally and provincialy,

Third, and most importantly, harmonization eliminates the ourden of the provincial sales tax on

businesses, since they would obtain input tex credits for their payment of provincial tax just as they

do now for their payment of GST on purchases. In B.C., this relief would be about 40 per cent of the

total $5 billion sales tax collected annually.

Eliminating the provincial sales tax burden on business would make B.C. products more competitive

both within Canada and to export markets. It would algo provide a major impetus for increased

investment, with associated Job creation. Sales tax harmonization has been estimated to provide as

much incentive for investment in B.C, as would the complete abolition of provincial corporate income |

tax.

B.C. will be under increasing pressure to follow Ontario in harmonizing sales tax, since our

businesses will be competing with those in Ontario and five other provinces that do not bear

provincial sales tax burdens.

But should B.C: simply follow the Ontario model for harmonization, or should our province pursue a

different, better path?

In four key areas, B.C. can and should'do considerably better than Ontario in how it fashions a sales

tax harmonization agreement with the federal government.

First, B.C. should not retain special exemptions for various goods and services that exist under its

sales tax. In contrast, Ontario will maintain existing tax exemptions for books, children’s clothing and

foolwear, children’s car seats, diapers and feminine hygiene products by'a so-called point-of-sale

exemption system, Those products will bear only the five-per-cent federal GST but not the eight-per-

cent Ontario portion of tax.

B.C. similarly exempts most of the same products as Ontario as well as others, Far better to make

those items taxadle both federally and provincially under a harmonized tax, and to offset any

additional burden on low- and moderate-income households through enriched tax credits. This

approach avoids both adverse distributional impacts and complexities in the operation of the tax for

business and government.

Second, B.C, should implement harmonization with tax-inclusive pricing. As with a few goods or

services currently (such as gasoline and taxi fares), all posted prices would include the harmonized

‘tax. This approach would simplify matters for purchasers and also reduce adverse reactions from the

extension of provincial sales tax to out-of-home meels, which was not an issue for Ontario because It

already taxes restaurant and other meals over $4.

Third, B.C. should seek a modification of the current GST treatment of new housing, which applies to

sales with @ partial tax credit for lower-valued units. Given the high cost of the land component in

urban B.C., the harmorized tax should be based on the structural value and exclude the land value.

Otherwise, a $900,000 new home would face the full 12-per-cent harmonized B.C: tax rate, for a tax

bill of $108,000 that would raise the total above $1 million.

Finally, B.C. should avoid Ontario's siow-moving provision of input tax credits for larger businesses

(with annual sales over $10 million) and financial institutions.

They will be denied input tax credits for the first five years after harmonization starts and not obtain

{ull credits for another three years. The largest economic benefit of harmonization was precisely the

elimination of tax burdens on business, and Ontario is stifling this process for years.

Aprincipal reason that B.C. can move much faster than Ontario in giving full input tax credits to all

businesses is the diffeting fiscal settings. Ontario's recent budget announced a phased cut in its

general corporate income tax rate from the current 14 per cent to 11 per cent in mid-2012. B.C.'s

general corporate rate is already 11 per cent, so B.C, has additional fiscal leeway to move

expeditiously and reap the full benefits of harmonization. |

Ontario has shown that sales tax harmonization is fiscally, technically and politically feasible, B.C.

should quickly follow suit and pursue an even better course. |

von Kesselman is the Canada Research Chair in Public Finance with the graduate public policy

program at Simon Fraser University,

Cole, Elizabeth FIN:EX

ae

From: Gole, Elizabeth FIN:EX

Sont: Tuesday, April 28, 2009 7:64 PM

To: Flanagan, Paul FIN:EX

Subject Discussion |

abeth FIN:EX

—~—"—["—'""“——

Cole, Elizabeth FIN:EX

‘Thursday, Apri 30, 2000 4:69 PM

Flanagan, Paul FIN:EX

Question

Gole, Elizaboth FIN:EX

From: ‘Armstrong, Glen E FIN:EX

Sent: Wednesday, May 6, 2008 &:11, AM

To: Cele, Elizabeth FINE

Subject: GST harmonization

cheers

Armstrong, Glen E FIN:EX

From: Louise. Lovenian@fin.gc.ca

Monday, Mey 11, 2008 10:13 AM

‘Armstrong, Glen & FIN:EX

Lise.Potvin@fn.gc.ca

RE: HST Question

s13.846 ——

Louise Levor

Assistant Deputy Minister | Sous-minisire adjcint

‘Tex Policy Branch | Direction de la politique de Fimpdt

Department of Finance Canada | Minisiére des Finances Canada

Ottawa, Canada KIA 0G5

Louise. Levonlan@itingec,ca

‘Telephono | Téléphone 613-992-1630 / Facsimile | Télécopieur 613-996-0680 / Telelypewr'ter | Téleimprimeur 613-995-

1496

Government of Canada | Gouvernement du Canada

BMD epyrentor nance minttre dos Fnancon Canadii

From: Armstrong, Glen € FIN:EX [mailto:Glen.Armstrong@gov.be.ca]

Sent: May 13, 2009 12:45 PM

To: Levonian, Louise |

Subject: HST Question

Ont may change rate after 2 years, Am | correct in assuming a province could now start at a rate other than

8%? That is, that the legislation will be amended by July 4, 2010 to let a prov harmonize at a rate other than

8%?

Thanks

You might also like

- Gann LettersDocument5 pagesGann LettersKirtan Balkrishna Raut80% (5)

- RCAF Fingal Base - Apr 1943Document20 pagesRCAF Fingal Base - Apr 1943CAP History Library0% (1)

- Xuberence 2010 XIMBDocument12 pagesXuberence 2010 XIMBvikasmax50No ratings yet

- The Geomancie of Maister Christopher Cattan GentlemanDocument139 pagesThe Geomancie of Maister Christopher Cattan Gentlemanzoobabbooz100% (9)

- Vol 01 Issue 01Document8 pagesVol 01 Issue 01Parking TomNo ratings yet

- Pollock File 1Document106 pagesPollock File 1The GazetteNo ratings yet

- Doc08 MuniDocument16 pagesDoc08 MuniEduardo Gutierrez SilvaNo ratings yet

- Transnationalization, The State, and The People (Malaysian Case - Part I)Document110 pagesTransnationalization, The State, and The People (Malaysian Case - Part I)UP Third World Studies Center100% (1)

- Qtmhnix (U#A: A Sel Ci, WPQDocument16 pagesQtmhnix (U#A: A Sel Ci, WPQBren-RNo ratings yet

- Oppression - When Will It End?Document34 pagesOppression - When Will It End?tonyalba81No ratings yet

- Confederate CatechismDocument12 pagesConfederate Catechismrpmackey3334No ratings yet

- Arbitration Under The Alternative Dispute Resolution Act of 2004Document7 pagesArbitration Under The Alternative Dispute Resolution Act of 2004Jane Garcia-ComilangNo ratings yet

- District of Columbia Organic Act of 1871Document12 pagesDistrict of Columbia Organic Act of 1871Ven Geancia100% (7)

- Whittier Anti-Oil Group: Documents Show Drilling Not Allowed in HillsDocument116 pagesWhittier Anti-Oil Group: Documents Show Drilling Not Allowed in HillsSGVNewsNo ratings yet

- 19910315a WSJ ArticleDocument2 pages19910315a WSJ ArticleSamples Ames PLLCNo ratings yet

- Mayans 132Document9 pagesMayans 132OnenessNo ratings yet

- Margarita Britten ProbateDocument23 pagesMargarita Britten Probatekupa7No ratings yet

- Prom Grand President.: Rochester N. Y., DecemberDocument36 pagesProm Grand President.: Rochester N. Y., DecemberAnonymous GPiFpUpZ9gNo ratings yet

- Jttll1: Federal Negarit GazetaDocument4 pagesJttll1: Federal Negarit GazetaSENAIT ABEBENo ratings yet

- Air Force News Jul-Dec 1939Document303 pagesAir Force News Jul-Dec 1939CAP History Library100% (1)

- The Gentleman and Citizen's Almanack 1815Document695 pagesThe Gentleman and Citizen's Almanack 1815Geordie WinkleNo ratings yet

- Philippine Democracy Agenda Vol. 2 - State Civil Society Relations in Policy MakingDocument307 pagesPhilippine Democracy Agenda Vol. 2 - State Civil Society Relations in Policy MakingUP Third World Studies CenterNo ratings yet

- 2005 March 1 Safe VisitDocument2 pages2005 March 1 Safe VisitAnother AnonymomsNo ratings yet

- PEU151Document4 pagesPEU151coffeepathNo ratings yet

- Watchdog February 1984Document28 pagesWatchdog February 1984Lynda BoydNo ratings yet

- Transnationalization, The State, and The People (Malaysian Case - Part II)Document200 pagesTransnationalization, The State, and The People (Malaysian Case - Part II)UP Third World Studies CenterNo ratings yet

- L1-Anti-Corruption Proclamation PDFDocument17 pagesL1-Anti-Corruption Proclamation PDFTWWNo ratings yet

- 1941 Watchtower Convention Condemns Olin R. MoyleDocument3 pages1941 Watchtower Convention Condemns Olin R. MoylesirjsslutNo ratings yet

- A - An History of MetalsDocument204 pagesA - An History of MetalsJimmy-NeonNo ratings yet

- Project Blue BookDocument45 pagesProject Blue BookFred Black100% (2)

- Loyal Legion TributeDocument1 pageLoyal Legion TributesuzenataleNo ratings yet

- Watchtower: 1909-1916 Brooklyn Eagle News ClippingsDocument29 pagesWatchtower: 1909-1916 Brooklyn Eagle News ClippingssirjsslutNo ratings yet

- Watchdog November 1977Document6 pagesWatchdog November 1977Lynda BoydNo ratings yet

- Self Builder & Homemaker - April & May 2010Document44 pagesSelf Builder & Homemaker - April & May 2010dvskiwiNo ratings yet

- Engineering Vol 56 1893-07-14Document37 pagesEngineering Vol 56 1893-07-14ian_newNo ratings yet

- Genealogy GlossaryDocument81 pagesGenealogy GlossaryGeordie Winkle50% (2)

- Capitalism and the Industrial Revolution: How New Technologies Drove Economic GrowthDocument15 pagesCapitalism and the Industrial Revolution: How New Technologies Drove Economic GrowthIce AgeNo ratings yet

- Cakes and Bakes 3th Ed.Document97 pagesCakes and Bakes 3th Ed.hadrian75No ratings yet

- 765th Transportation Railway Shop BattalionDocument32 pages765th Transportation Railway Shop BattalionNancyNo ratings yet

- Flames of War - Mid-War MonstersDocument52 pagesFlames of War - Mid-War MonstersLe Di Chang100% (7)

- Works of Geber by Robert J Holmyrad PDFDocument160 pagesWorks of Geber by Robert J Holmyrad PDFRafa Cosmopolita100% (1)

- News Direct From The State Capitol Or. Frank Crane'S Weekly Lecture C. M. Reserve Summer GampsDocument4 pagesNews Direct From The State Capitol Or. Frank Crane'S Weekly Lecture C. M. Reserve Summer GampsmarylcookpubliclibraNo ratings yet

- Country Property Small Investors by Freeman H. Bloodgood First Real Estate Commissioner of CaliforniaDocument6 pagesCountry Property Small Investors by Freeman H. Bloodgood First Real Estate Commissioner of Californiareal-estate-historyNo ratings yet

- Chronicles 06Document32 pagesChronicles 06Yibrael100% (1)

- 2007 July 15 To Judge Johnson - Safe VisitDocument2 pages2007 July 15 To Judge Johnson - Safe VisitAnother AnonymomsNo ratings yet

- Lawsuit by Steven A. Cohen's Ex-WifeDocument25 pagesLawsuit by Steven A. Cohen's Ex-WifeDealBook100% (1)

- Verve Magazine Issue 1 - 2010-11Document36 pagesVerve Magazine Issue 1 - 2010-11VerveMagazineNo ratings yet

- The Dailynews ST John SNL 19560414Document20 pagesThe Dailynews ST John SNL 19560414encipherNo ratings yet

- All Pages of Interest From Our Town and Early HistoryDocument30 pagesAll Pages of Interest From Our Town and Early HistoryJohn Durst100% (1)

- Colorado Group 5 - 02/01/49Document2 pagesColorado Group 5 - 02/01/49CAP History LibraryNo ratings yet

- Ranciere - Short Voyages To The Land of The PeopleDocument72 pagesRanciere - Short Voyages To The Land of The PeoplepenzinNo ratings yet

- The Texan and Dutch Gas: Kicking off the European Energy RevolutionFrom EverandThe Texan and Dutch Gas: Kicking off the European Energy RevolutionNo ratings yet

- The Gold Coin: A Story of New York City's Lower East Side and Its ImmigrantsFrom EverandThe Gold Coin: A Story of New York City's Lower East Side and Its ImmigrantsNo ratings yet

- Science, Churchill and Me: The Autobiography of Hermann BondiFrom EverandScience, Churchill and Me: The Autobiography of Hermann BondiNo ratings yet

- Babine Inspection Report 04/02Document6 pagesBabine Inspection Report 04/02TheGlobeandMailNo ratings yet

- Babine Inspection Report 01/21Document10 pagesBabine Inspection Report 01/21TheGlobeandMailNo ratings yet

- Speaker's Ruling On Bev Oda's StatementsDocument7 pagesSpeaker's Ruling On Bev Oda's StatementsTheGlobeandMailNo ratings yet

- The London Stock Exchange and TMX Group Merger AgreementDocument213 pagesThe London Stock Exchange and TMX Group Merger AgreementTheGlobeandMailNo ratings yet

- Postmedia - Preliminary ProsepectusDocument279 pagesPostmedia - Preliminary ProsepectusTheGlobeandMailNo ratings yet

- Alcohol and WorkoutsDocument1 pageAlcohol and WorkoutsTheGlobeandMailNo ratings yet

- Postmedia - Preliminary ProsepectusDocument279 pagesPostmedia - Preliminary ProsepectusTheGlobeandMailNo ratings yet

- g8 Legacy Fund - Baysville Bandshell and Public WashroomsDocument7 pagesg8 Legacy Fund - Baysville Bandshell and Public WashroomsTheGlobeandMailNo ratings yet

- A National Strategy For High-Growth EntrepreneurshipDocument20 pagesA National Strategy For High-Growth EntrepreneurshipTheGlobeandMailNo ratings yet

- Rob Ford's Telecommunications ExpensesDocument23 pagesRob Ford's Telecommunications ExpensesTheGlobeandMailNo ratings yet

- Final Q4 2010 VC Data Deck - EnglishDocument33 pagesFinal Q4 2010 VC Data Deck - EnglishTheGlobeandMailNo ratings yet

- BRISON-Privilege-production of Document FINA-Final-EnDocument3 pagesBRISON-Privilege-production of Document FINA-Final-EnGlenn JohnsonNo ratings yet

- Tron LegacyDocument1 pageTron LegacyTheGlobeandMailNo ratings yet

- The Paper TrailDocument8 pagesThe Paper TrailTheGlobeandMailNo ratings yet

- CFIB SurveyresultsDocument2 pagesCFIB SurveyresultsTheGlobeandMailNo ratings yet

- Keeping An Eye On Prescription Drugs, Keeping Canadians SafeDocument5 pagesKeeping An Eye On Prescription Drugs, Keeping Canadians SafeTheGlobeandMailNo ratings yet

- CMAJ Tobacco EditorialDocument2 pagesCMAJ Tobacco EditorialTheGlobeandMailNo ratings yet

- The Wall - Anatomy of A Rock ExtravaganzaDocument1 pageThe Wall - Anatomy of A Rock ExtravaganzaTheGlobeandMailNo ratings yet

- Read The Article 'Mounties Stop Murdoch's Sun TV News From Shining' From The GuardianDocument1 pageRead The Article 'Mounties Stop Murdoch's Sun TV News From Shining' From The GuardianTheGlobeandMailNo ratings yet

- Performance Persistence in EntrepreneurshipDocument44 pagesPerformance Persistence in EntrepreneurshipTheGlobeandMailNo ratings yet

- BDC Survey ResultsDocument42 pagesBDC Survey ResultsTheGlobeandMailNo ratings yet

- Canada's Top Entrepreneurial CitiesDocument7 pagesCanada's Top Entrepreneurial CitiesTheGlobeandMailNo ratings yet

- CFIB Business Barometer, Sept., 2010Document4 pagesCFIB Business Barometer, Sept., 2010TheGlobeandMailNo ratings yet

- Ontario Superior Court of Justice Sentencing of Fahim AhmadDocument37 pagesOntario Superior Court of Justice Sentencing of Fahim AhmadTheGlobeandMailNo ratings yet

- Special Report: TD EconomicsDocument6 pagesSpecial Report: TD EconomicsTheGlobeandMailNo ratings yet

- Read The Ontario Transportation Minister's Letter To The TTCDocument2 pagesRead The Ontario Transportation Minister's Letter To The TTCTheGlobeandMailNo ratings yet