Professional Documents

Culture Documents

Bank Funding Costs

Uploaded by

peter_martin9335Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Funding Costs

Uploaded by

peter_martin9335Copyright:

Available Formats

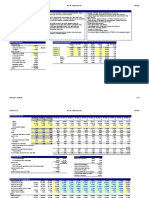

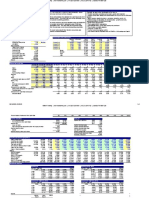

Bank funding costs, 2009 and 2010.

The banks in evidence to the Senate Committee on competition in banking have presented lots of

complicated graphs and figures for certain types of deposits and other funding compared with the cash

rate, the bank bill swap rate, the mortgage rate and so on. What they did not do was actually present their

own costs as they present them in their annual reports. The table below does precisely that and shows

that for each of the top four banks interest expenses have fallen both in absolute terms and as a

proportion of both liabilities and assets. These figures take us to the end of September for all but for the

CBA which finish at the end of June 2010.

ANZ

total assets liabilities interest interest expense interest

expenses as share of expenses as

liabilities share of assets

$million $million $million

2009 476 987 444 558 16 398 3.7% 3.4%

2010 531 739 497 584 15 739 3.2% 3.0%

CBA

total assets liabilities interest interest expense interest

expenses as share of expenses as

liabilities share of assets

$million $million $million

2009 620 372 588 930 21 218 3.6% 3.4%

2010 646 330 610 760 20 293 3.3% 3.1%

NAB

total assets liabilities interest interest expense interest

expenses as share of expenses as

liabilities share of assets

$million $million $million

2009 654 120 616 285 19 034 3.1% 2.9%

2010 685 652 646 998 17 568 2.7% 2.6%

WBC

total assets liabilities interest interest expense interest

expenses as share of expenses as

liabilities share of assets

$million $million $million

2009 589 587 553 016 22 309 4.0% 3.8%

2010 618 277 578 159 21 506 3.7% 3.5%

Source: ANZ, CBA, NAB and WBC Annual Reports 2010.

You might also like

- Discounted Cash Flow Valuation ModelDocument3 pagesDiscounted Cash Flow Valuation ModeljanuarNo ratings yet

- Indicatori Sistem BrazilDocument9 pagesIndicatori Sistem BrazilNatalia BesliuNo ratings yet

- 4211 XLS EngDocument22 pages4211 XLS Engvictor vasquezNo ratings yet

- Banco Santander Chile 2Q18 Earnings Report: July 26, 2018Document27 pagesBanco Santander Chile 2Q18 Earnings Report: July 26, 2018manuel querolNo ratings yet

- CitiRepaying TARPDocument20 pagesCitiRepaying TARPychartsNo ratings yet

- Soumya Lokhande 1353 - Manmouth CaseDocument13 pagesSoumya Lokhande 1353 - Manmouth CasednesudhudhNo ratings yet

- I. Economic Environment (1) I: Nigeria WT/TPR/S/247Document12 pagesI. Economic Environment (1) I: Nigeria WT/TPR/S/247gghNo ratings yet

- Masonite Corp DCF Analysis FinalDocument5 pagesMasonite Corp DCF Analysis FinaladiNo ratings yet

- Bank of Kigali Announces AuditedDocument10 pagesBank of Kigali Announces AuditedinjishivideoNo ratings yet

- Japan Statistical 2010Document2 pagesJapan Statistical 2010Gabriel KanekoNo ratings yet

- BNM - Analisis Financiero Estructural Nov 2000 - Oct 2001Document2 pagesBNM - Analisis Financiero Estructural Nov 2000 - Oct 2001gonzaloromaniNo ratings yet

- Industry Statistics Fact Sheet: June 2019Document2 pagesIndustry Statistics Fact Sheet: June 2019hero111983No ratings yet

- Union Bank - MP: Result TableDocument4 pagesUnion Bank - MP: Result TableManjunath ManjuNo ratings yet

- Free Cash Flow and DCF PresentationDocument3 pagesFree Cash Flow and DCF PresentationJames MitchellNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- Inc.Document136 pagesInc.Jose AntonioNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Free Cash Flow To Firm DCF Valuation Model Base DataDocument3 pagesFree Cash Flow To Firm DCF Valuation Model Base DataTran Anh VanNo ratings yet

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- Q2 2020 Earnings Presentation American Tower CorporationDocument25 pagesQ2 2020 Earnings Presentation American Tower CorporationKenya ToledoNo ratings yet

- US Fixed Income Securities Statistics SIFMADocument31 pagesUS Fixed Income Securities Statistics SIFMAÂn TrầnNo ratings yet

- EconomicReview 2006 2007-Vol 3 EngDocument168 pagesEconomicReview 2006 2007-Vol 3 Engrichie81No ratings yet

- KMX Write Up RedditDocument4 pagesKMX Write Up Redditapi-404463664No ratings yet

- Quantamental Research - ITC LTDDocument1 pageQuantamental Research - ITC LTDsadaf hashmiNo ratings yet

- Table: 2.10.2 Asset Quality RatioDocument5 pagesTable: 2.10.2 Asset Quality RatiosahhhhhhhNo ratings yet

- CBO's August 2010 Baseline: Medicare: by Fiscal YearDocument10 pagesCBO's August 2010 Baseline: Medicare: by Fiscal Yearapi-27836025No ratings yet

- Wells Fargo - First-Quarter-2020-EarningsDocument40 pagesWells Fargo - First-Quarter-2020-EarningsAlexNo ratings yet

- Summary Tables CountryDocument4 pagesSummary Tables CountryDanyel TanasaNo ratings yet

- Group BDocument10 pagesGroup BHitin KumarNo ratings yet

- Nepi Results Presentation h1 2013Document60 pagesNepi Results Presentation h1 2013ANDRAS Mihaly AlmasanNo ratings yet

- Corporate Break-Up CalculationDocument5 pagesCorporate Break-Up CalculationNachiketaNo ratings yet

- Ikhtisar Data Keuangan enDocument8 pagesIkhtisar Data Keuangan enFarisNo ratings yet

- Country Economic Forecasts - VietnamDocument7 pagesCountry Economic Forecasts - Vietnamthanhphong17vnNo ratings yet

- Creative Enterprise Holdings Limited SEHK 3992 FinancialsDocument32 pagesCreative Enterprise Holdings Limited SEHK 3992 FinancialsxunstandupNo ratings yet

- The 2023 Long-Term Budget OutlookDocument64 pagesThe 2023 Long-Term Budget Outlookcores406No ratings yet

- Fma17 Bericht enDocument192 pagesFma17 Bericht enjamesNo ratings yet

- Ringkasan Finansial Per September 2017Document3 pagesRingkasan Finansial Per September 2017Dwi UdayanaNo ratings yet

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- Banco Santander Chile 3Q18 Earnings Report: October 31, 2018Document32 pagesBanco Santander Chile 3Q18 Earnings Report: October 31, 2018manuel querolNo ratings yet

- LtboDocument64 pagesLtboCongressman Zach NunnNo ratings yet

- China Economy - GDP, Inflation, CPI and Interest RateDocument11 pagesChina Economy - GDP, Inflation, CPI and Interest Rateaderajew shumetNo ratings yet

- Table 1. Macroeconomic Indicators: MoroccoDocument5 pagesTable 1. Macroeconomic Indicators: MoroccoazfatrafNo ratings yet

- PrepzFy - LBO - VemptyDocument3 pagesPrepzFy - LBO - VemptykouakouNo ratings yet

- 6.1 Stress Test - Sparkassen: RC NotesDocument21 pages6.1 Stress Test - Sparkassen: RC NoteserteNo ratings yet

- NG Debt Press Release June 2023 1Document2 pagesNG Debt Press Release June 2023 1Ma. Theresa BerdanNo ratings yet

- Company Name: Financial ModelDocument13 pagesCompany Name: Financial ModelGabriel AntonNo ratings yet

- Private Equity Model Template For InvestorsDocument12 pagesPrivate Equity Model Template For InvestorsousmaneNo ratings yet

- Complete Private Equity ModelDocument16 pagesComplete Private Equity ModelMichel MaryanovichNo ratings yet

- Kovai Medical Center and Hospital Limited BSE 523323 FinancialsDocument39 pagesKovai Medical Center and Hospital Limited BSE 523323 Financialsakumar4uNo ratings yet

- DCF ModellDocument7 pagesDCF ModellVishal BhanushaliNo ratings yet

- A Study On Loan ManagementDocument19 pagesA Study On Loan ManagementSantosh ChhetriNo ratings yet

- Viet PDFDocument1 pageViet PDFHimanshu YadavNo ratings yet

- 2020-08-11 q2 Report Rbi PDFDocument142 pages2020-08-11 q2 Report Rbi PDFDaler SaidovNo ratings yet

- State of The Economy and Prospects: Website: Http://indiabudget - Nic.inDocument22 pagesState of The Economy and Prospects: Website: Http://indiabudget - Nic.insurajkumarjaiswal9454No ratings yet

- The Presentation MaterialsDocument35 pagesThe Presentation MaterialsZerohedgeNo ratings yet

- Capitec Bank - Valuation Looks Steep But Growth Outlook Is The Differentiating Factor - FinalDocument54 pagesCapitec Bank - Valuation Looks Steep But Growth Outlook Is The Differentiating Factor - FinalMukarangaNo ratings yet

- Philippines Economic OutlookDocument9 pagesPhilippines Economic Outlookrain06021992No ratings yet

- Starhub FY21Document20 pagesStarhub FY21SurachaiNo ratings yet

- The Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaFrom EverandThe Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaNo ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- 2014 Talent Et Al ACT Energy and Water BaselineDocument66 pages2014 Talent Et Al ACT Energy and Water Baselinepeter_martin9335No ratings yet

- GitAA 2015 EconomicsDocument2 pagesGitAA 2015 Economicspeter_martin9335No ratings yet

- Coalition Jobs Pledge November 2012Document2 pagesCoalition Jobs Pledge November 2012peter_martin9335No ratings yet

- Scope BusinessDay Economic Survey Panel July 2017Document1 pageScope BusinessDay Economic Survey Panel July 2017peter_martin9335No ratings yet

- GitAA 2015 EconomicsDocument2 pagesGitAA 2015 Economicspeter_martin9335No ratings yet

- Letter From PanelDocument1 pageLetter From PanelUniversityofMelbourneNo ratings yet

- GitAA 2015 EconomicsDocument2 pagesGitAA 2015 Economicspeter_martin9335No ratings yet

- GitAA 2015 EconomicsDocument2 pagesGitAA 2015 Economicspeter_martin9335No ratings yet

- PBO Costing Progressive SuperannuationDocument6 pagesPBO Costing Progressive Superannuationpeter_martin9335No ratings yet

- Progressive SuperannuationDocument2 pagesProgressive Superannuationpeter_martin9335No ratings yet

- Names of Exec Managers CEO and Chief ExecDocument4 pagesNames of Exec Managers CEO and Chief Execpeter_martin9335No ratings yet

- Complaint To CPA Australia PDFDocument13 pagesComplaint To CPA Australia PDFpeter_martin9335No ratings yet

- Industry Consultation Draft IA Roads Report 14Document28 pagesIndustry Consultation Draft IA Roads Report 14peter_martin9335No ratings yet

- GitAA 2015 EconomicsDocument2 pagesGitAA 2015 Economicspeter_martin9335No ratings yet

- The Effect of Consumer Copayments in Medical Care Jeff RichardsonDocument36 pagesThe Effect of Consumer Copayments in Medical Care Jeff Richardsonpeter_martin9335No ratings yet

- 131210-Acting PM - MR Mike Devereux, GM HoldenDocument2 pages131210-Acting PM - MR Mike Devereux, GM Holdenpeter_martin9335No ratings yet

- Post IncreaseDocument2 pagesPost Increasepeter_martin9335No ratings yet

- AA 2014 Economics2Document2 pagesAA 2014 Economics2peter_martin9335No ratings yet

- Arnold Bloch Leibler Re Proposed Introduction of FOFA Amendments by RegulationDocument4 pagesArnold Bloch Leibler Re Proposed Introduction of FOFA Amendments by Regulationpeter_martin9335No ratings yet

- ACHR Paper On GP CopaymentsDocument14 pagesACHR Paper On GP CopaymentsABC News OnlineNo ratings yet

- Administrative Orders For Restructuring The Australian GovernmentDocument45 pagesAdministrative Orders For Restructuring The Australian GovernmentAlan KerlinNo ratings yet

- Proposed Tax Changes - Treasurer Joe Hockey 6-11-13Document19 pagesProposed Tax Changes - Treasurer Joe Hockey 6-11-13fkeany6189No ratings yet

- Treasuryletter PDFDocument6 pagesTreasuryletter PDFpeter_martin9335No ratings yet

- Prime Minister Tony Abbott's Second MinistryDocument1 pagePrime Minister Tony Abbott's Second MinistryLatika M BourkeNo ratings yet

- Tony Abbott's First MinistryDocument2 pagesTony Abbott's First MinistryLatika M BourkeNo ratings yet

- Commonwealth of Australia: The ConstitutionDocument4 pagesCommonwealth of Australia: The Constitutionpeter_martin9335No ratings yet

- CC Report PDFDocument16 pagesCC Report PDFPolitical AlertNo ratings yet

- CC Report PDFDocument16 pagesCC Report PDFPolitical AlertNo ratings yet

- Tony Abbott's First MinistryDocument2 pagesTony Abbott's First MinistryLatika M BourkeNo ratings yet

- COSTINGSDocument5 pagesCOSTINGSPolitical Alert100% (1)

- Airworthiness Directive: FAA Aviation SafetyDocument2 pagesAirworthiness Directive: FAA Aviation SafetyCarlos VarrentiNo ratings yet

- Catalogo HydronixDocument68 pagesCatalogo HydronixNANCHO77No ratings yet

- Hot Rolled Coils Plates & SheetsDocument40 pagesHot Rolled Coils Plates & Sheetssreekanth6959646No ratings yet

- British Birds 10 LondDocument376 pagesBritish Birds 10 Londcassy98No ratings yet

- Lightolier Lytecaster Downlights Catalog 1984Document68 pagesLightolier Lytecaster Downlights Catalog 1984Alan MastersNo ratings yet

- SCC5-4000F Single ShaftDocument15 pagesSCC5-4000F Single ShaftudelmarkNo ratings yet

- ENG 102 Essay PromptDocument2 pagesENG 102 Essay Promptarshia winNo ratings yet

- Case StudyDocument2 pagesCase StudyFadhlin Sakina SaadNo ratings yet

- Reservoir Bag Physics J PhilipDocument44 pagesReservoir Bag Physics J PhilipJashim JumliNo ratings yet

- Asme b16.3 (1998) Malleable Iron Threaded FittingsDocument30 pagesAsme b16.3 (1998) Malleable Iron Threaded FittingsMarcos RosenbergNo ratings yet

- Your Bentley Bentayga V8: PresentingDocument9 pagesYour Bentley Bentayga V8: PresentingThomas SeiferthNo ratings yet

- BDRRM Sample Draft EoDocument5 pagesBDRRM Sample Draft EoJezreelJhizelRamosMendozaNo ratings yet

- APRStt Implementation Notes PDFDocument36 pagesAPRStt Implementation Notes PDFCT2IWWNo ratings yet

- PDFDocument3 pagesPDFvaliNo ratings yet

- 5070 s17 QP 22 PDFDocument20 pages5070 s17 QP 22 PDFMustafa WaqarNo ratings yet

- Facultybooklet2011-2012final - 006 (Unlocked by WWW - Freemypdf.com)Document199 pagesFacultybooklet2011-2012final - 006 (Unlocked by WWW - Freemypdf.com)kalam19892209No ratings yet

- Unit 2 Operations of PolynomialsDocument28 pagesUnit 2 Operations of Polynomialsapi-287816312No ratings yet

- License Fee PaidDocument1 pageLicense Fee Paidmy nNo ratings yet

- B2B Marketing: Chapter-8Document23 pagesB2B Marketing: Chapter-8Saurabh JainNo ratings yet

- Enemies Beyond Character Creation SupplementDocument8 pagesEnemies Beyond Character Creation SupplementCain BlachartNo ratings yet

- Heisenberg, "Über Den Anschaulichen Inhalt Der Quantentheoretischen Kinematik Und Mechanik"Document16 pagesHeisenberg, "Über Den Anschaulichen Inhalt Der Quantentheoretischen Kinematik Und Mechanik"Benjamin Crowell0% (1)

- PDF Synopsis PDFDocument9 pagesPDF Synopsis PDFAllan D GrtNo ratings yet

- Johari WindowDocument7 pagesJohari WindowSarthak Priyank VermaNo ratings yet

- 2017-04-27 St. Mary's County TimesDocument32 pages2017-04-27 St. Mary's County TimesSouthern Maryland OnlineNo ratings yet

- Accounting System (Compatibility Mode) PDFDocument10 pagesAccounting System (Compatibility Mode) PDFAftab AlamNo ratings yet

- Manuscript PDFDocument50 pagesManuscript PDFMartina Mae Benig GinoNo ratings yet

- Daftar Harga Toko Jeremy LengkapDocument2 pagesDaftar Harga Toko Jeremy LengkapSiswadi PaluNo ratings yet

- Basler Electric TCCDocument7 pagesBasler Electric TCCGalih Trisna NugrahaNo ratings yet

- When I Was A ChildDocument2 pagesWhen I Was A Childapi-636173534No ratings yet

- Geography NotesDocument2 pagesGeography NotesMinethegroundNo ratings yet