Professional Documents

Culture Documents

Harish Chand: Magic Yield Presentation

Uploaded by

Harish ChandOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Harish Chand: Magic Yield Presentation

Uploaded by

Harish ChandCopyright:

Available Formats

Harish Chand

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

Magic Yield Presentation

Date : 11/11/2010

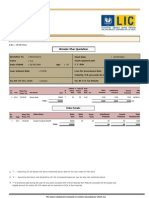

Wonder-Plan Quotation

Quotation No :123 Chart Date :09/10/2010

Name :MUKESH Age : 24

Mat./S.B. proceeds Re-invt. Rate : 0.00% Chart required upto :09/10/2086

Section 80 CCE Investment Limit : Rs. 100000 Section 80 CCE Tax Rebate :33.99%

Sr. Plan/Tm/ Bonus Step Net Mat. Total

No Year Prem. Tm Plan Name Sum Mode DAB GA Rate Premium Year Premium Pd.

1 2010 178/20/6 Jeevan Tarang 500000 Qly 0 48 0 14119 2030 14119

500000 56476 p.a. 14119

Modewise Premium Summary

Mode of Payment

Premium

Sr No Year Plan Term Term Yearly Half Yearly Quaterly Monthly SSS

1 2010 178 20 6 55323 27949 14119 4946 4706

55323 27949 14119 4946 4706

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

Harish Chand

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

Magic Yield Presentation

Insurance Facts

Quotation No : 123 Chart Date : 09/10/2010

Name : MUKESH Age : 24

Section 80 CCE Investment Limit :Rs. 100000 Section 80 CCE Tax Rebate :33.99%

Risk Cover Annual New Loan Total Loan Returns Comp. Value

Year Age Normal Accident Premium Available Available From L.I.C. Of Returns

2010 24 524000 524000 56476 0 0 0 0

2011 25 548000 548000 56476 0 0 0 0

2012 26 572000 572000 56476 58250 58250 0 0

2013 27 596000 596000 56476 37500 95750 0 0

2014 28 620000 620000 56476 36500 132250 0 0

2015 29 644000 644000 56476 41500 173750 0 0

2016 30 668000 668000 0 20750 194500 0 0

2017 31 692000 692000 0 23000 217500 0 0

2018 32 716000 716000 0 25500 243000 0 0

2019 33 740000 740000 0 28250 271250 0 0

2020 34 764000 764000 0 31250 302500 0 0

2021 35 788000 788000 0 29250 331750 0 0

2022 36 812000 812000 0 32750 364500 0 0

2023 37 836000 836000 0 37000 401500 0 0

2024 38 860000 860000 0 42000 443500 0 0

2025 39 884000 884000 0 47750 491250 0 0

2026 40 908000 908000 0 58500 549750 0 0

2027 41 932000 932000 0 65500 615250 0 0

2028 42 956000 956000 0 73000 688250 0 0

2029 43 980000 980000 0 116000 804250 0 0

2030 44 500000 500000 0 80750 405000 480000 480000

2031 45 500000 500000 0 27500 405000 27500 27500

2032 46 500000 500000 0 27500 405000 27500 27500

2033 47 500000 500000 0 27500 405000 27500 27500

2034 48 500000 500000 0 27500 405000 27500 27500

2035 49 500000 500000 0 27500 405000 27500 27500

2036 50 500000 500000 0 27500 405000 27500 27500

2037 51 500000 500000 0 27500 405000 27500 27500

2038 52 500000 500000 0 27500 405000 27500 27500

2039 53 500000 500000 0 27500 405000 27500 27500

2040 54 500000 500000 0 27500 405000 27500 27500

2041 55 500000 500000 0 27500 405000 27500 27500

2042 56 500000 500000 0 27500 405000 27500 27500

2043 57 500000 500000 0 27500 405000 27500 27500

2044 58 500000 500000 0 27500 405000 27500 27500

2045 59 500000 500000 0 27500 405000 27500 27500

2046 60 500000 500000 0 27500 405000 27500 27500

2047 61 500000 500000 0 27500 405000 27500 27500

2048 62 500000 500000 0 27500 405000 27500 27500

2049 63 500000 500000 0 27500 405000 27500 27500

2050 64 500000 500000 0 27500 405000 27500 27500

2051 65 500000 500000 0 27500 405000 27500 27500

2052 66 500000 500000 0 27500 405000 27500 27500

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

2053 67 500000 500000 0 27500 405000 27500 27500

2054 68 500000 500000 0 27500 405000 27500 27500

2055 69 500000 500000 0 27500 405000 27500 27500

2056 70 500000 500000 0 27500 405000 27500 27500

2057 71 500000 500000 0 27500 405000 27500 27500

2058 72 500000 500000 0 27500 405000 27500 27500

2059 73 500000 500000 0 27500 405000 27500 27500

2060 74 500000 500000 0 27500 405000 27500 27500

2061 75 500000 500000 0 27500 405000 27500 27500

2062 76 500000 500000 0 27500 405000 27500 27500

2063 77 500000 500000 0 27500 405000 27500 27500

2064 78 500000 500000 0 27500 405000 27500 27500

2065 79 500000 500000 0 27500 405000 27500 27500

2066 80 500000 500000 0 27500 405000 27500 27500

2067 81 500000 500000 0 27500 405000 27500 27500

2068 82 500000 500000 0 27500 405000 27500 27500

2069 83 500000 500000 0 27500 405000 27500 27500

2070 84 500000 500000 0 27500 405000 27500 27500

2071 85 500000 500000 0 27500 405000 27500 27500

2072 86 500000 500000 0 27500 405000 27500 27500

2073 87 500000 500000 0 27500 405000 27500 27500

2074 88 500000 500000 0 27500 405000 27500 27500

2075 89 500000 500000 0 27500 405000 27500 27500

2076 90 500000 500000 0 27500 405000 27500 27500

2077 91 500000 500000 0 27500 405000 27500 27500

2078 92 500000 500000 0 27500 405000 27500 27500

2079 93 500000 500000 0 27500 405000 27500 27500

2080 94 500000 500000 0 27500 405000 27500 27500

2081 95 500000 500000 0 27500 405000 27500 27500

2082 96 500000 500000 0 27500 405000 27500 27500

2083 97 500000 500000 0 27500 405000 27500 27500

2084 98 500000 500000 0 27500 405000 27500 27500

2085 99 500000 500000 0 27500 405000 27500 27500

2086 100 500000 500000 0 405000 405000 527500 527500

338856 2520000 2520000

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

Harish Chand

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

Magic Yield Presentation

Quotation No : 123 Name : MUKESH

This proposal outlines 2 aspects; viz. Security on your Life and Long Term Savings. The premium that you

will be paying will actually be used for providing insurance risk cover and some returns during or at the end

of the insurance period.

Based on the term insurance rates available for your age, it is possible to estimate the cost of risk cover from the

total premium that you will be paying to LIC. Accordingly the balance premium amount can be considered

as your investment towards savings. The total value of returns from LIC at the end of the proposed

period should be viewed as a result of your savings.

The chart below gives a year by year breakup of the premium that you will be paying to LIC. The Total Premium

column indicates your actual yearwise cash out-go. The Notional Breakup columns show the components of

this out-go in terms of cost of insurance and portion considered for savings.

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

Annual Sec. 80 CCE Total Notional Breakup

Year Premium Savings Premium For Risk For Savings

2010 56476 19196 37280 2555 34725

2011 56476 19196 37280 2555 34725

2012 56476 19196 37280 2555 34725

2013 56476 19196 37280 2555 34725

2014 56476 19196 37280 2555 34725

2015 56476 19196 37280 2555 34725

2016 0 0 0 0 0

2017 0 0 0 0 0

2018 0 0 0 0 0

2019 0 0 0 0 0

2020 0 0 0 0 0

2021 0 0 0 0 0

2022 0 0 0 0 0

2023 0 0 0 0 0

2024 0 0 0 0 0

2025 0 0 0 0 0

2026 0 0 0 0 0

2027 0 0 0 0 0

2028 0 0 0 0 0

2029 0 0 0 0 0

2030 0 0 0 0 0

2031 0 0 0 0 0

2032 0 0 0 0 0

2033 0 0 0 0 0

2034 0 0 0 0 0

2035 0 0 0 0 0

2036 0 0 0 0 0

2037 0 0 0 0 0

2038 0 0 0 0 0

2039 0 0 0 0 0

2040 0 0 0 0 0

2041 0 0 0 0 0

2042 0 0 0 0 0

2043 0 0 0 0 0

2044 0 0 0 0 0

2045 0 0 0 0 0

2046 0 0 0 0 0

2047 0 0 0 0 0

2048 0 0 0 0 0

2049 0 0 0 0 0

2050 0 0 0 0 0

2051 0 0 0 0 0

2052 0 0 0 0 0

2053 0 0 0 0 0

2054 0 0 0 0 0

2055 0 0 0 0 0

2056 0 0 0 0 0

2057 0 0 0 0 0

2058 0 0 0 0 0

2059 0 0 0 0 0

2060 0 0 0 0 0

2061 0 0 0 0 0

2062 0 0 0 0 0

2063 0 0 0 0 0

2064 0 0 0 0 0

2065 0 0 0 0 0

2066 0 0 0 0 0

2067 0 0 0 0 0

2068 0 0 0 0 0

2069 0 0 0 0 0

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

2070 0 0 0 0 0

2071 0 0 0 0 0

2072 0 0 0 0 0

2073 0 0 0 0 0

2074 0 0 0 0 0

2075 0 0 0 0 0

2076 0 0 0 0 0

2077 0 0 0 0 0

2078 0 0 0 0 0

2079 0 0 0 0 0

2080 0 0 0 0 0

2081 0 0 0 0 0

2082 0 0 0 0 0

2083 0 0 0 0 0

2084 0 0 0 0 0

2085 0 0 0 0 0

2086 0 0 0 0 0

338856 223680 15330 208350

Total amount invested for savings in 76 years Rs. 208350

Total amount in hand in 2086 Rs. 2520000

Yield on investments (calculated on the basis of IRR method) 8.1 %

Key Assumptions :

1. Assuming LIC will declare the mentioned bonus rates for the year ended 31-Mar-2010

2. Sec.80 CCE Investment Limit considered available upto Rs.100000/- every year and Sec.80 CCE Tax

Rebate rate considered @ 33.99 %

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

You might also like

- Blake and Scott FS AnalysisDocument38 pagesBlake and Scott FS AnalysisFaker PlaymakerNo ratings yet

- Mr. Sanjay: Insurance Proposal ForDocument6 pagesMr. Sanjay: Insurance Proposal Forrajkamal eshwarNo ratings yet

- Sujatha: Exclusively Prepared For: Ven DOC: 1/3/2019 - Age: 48 Plan Criteria Input Data Premium & Rider DetailsDocument6 pagesSujatha: Exclusively Prepared For: Ven DOC: 1/3/2019 - Age: 48 Plan Criteria Input Data Premium & Rider DetailsKilli ValavanNo ratings yet

- Jeevan Saral Plan Presentation: Harish ChandDocument3 pagesJeevan Saral Plan Presentation: Harish ChandHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Single Plan For PensionDocument2 pagesSingle Plan For PensionHarish ChandNo ratings yet

- Manoj Jeevan SaralDocument3 pagesManoj Jeevan SaralRohit Kumar DasNo ratings yet

- New Jeevan Nidhi Plan Presentation: LIC DIRECT-Quick, Simple and EasyDocument2 pagesNew Jeevan Nidhi Plan Presentation: LIC DIRECT-Quick, Simple and EasyKSNo ratings yet

- Money Back 165Document3 pagesMoney Back 165Harish ChandNo ratings yet

- Mr. Rakesh Chaturvedi: Insurance Proposal ForDocument5 pagesMr. Rakesh Chaturvedi: Insurance Proposal ForHarish ChandNo ratings yet

- Jeevan Saral Plan Presentation: R. SubramaniDocument3 pagesJeevan Saral Plan Presentation: R. SubramaniSiva GNo ratings yet

- Jeevan NidhiDocument2 pagesJeevan NidhiAkhil RajNo ratings yet

- Report - Mr. - Abraham Kuruvila - 936 - 16 - 10 - Age - 44 - SA - 2300000Document4 pagesReport - Mr. - Abraham Kuruvila - 936 - 16 - 10 - Age - 44 - SA - 2300000anoopapNo ratings yet

- Jlakshya 1Document8 pagesJlakshya 1Annapurna VadaliNo ratings yet

- Future GainDocument9 pagesFuture GainSantosh DasNo ratings yet

- Kum. Akshaya. L.: Insurance Proposal ForDocument7 pagesKum. Akshaya. L.: Insurance Proposal ForAkshaya LakshminarasimhanNo ratings yet

- Anikit Pradhan - 11Document4 pagesAnikit Pradhan - 11Anurag pradhanNo ratings yet

- HDFC BankDocument12 pagesHDFC BankAman ShahNo ratings yet

- Chidrenplan - 2-2-2024 5.17.47Document5 pagesChidrenplan - 2-2-2024 5.17.47KanVish kvNo ratings yet

- Life Insurance Company The Whole Life Policy-Single PremiumDocument13 pagesLife Insurance Company The Whole Life Policy-Single PremiumNazneenNo ratings yet

- Jeevan Anand: S. Sudheer BabuDocument4 pagesJeevan Anand: S. Sudheer BabuSiva Krishna NeppaliNo ratings yet

- Insurance and Savings Quotation For Shri Vijay Kumar JonnalagaddaDocument1 pageInsurance and Savings Quotation For Shri Vijay Kumar JonnalagaddaninthsevenNo ratings yet

- Child Gain 21 IllustrationDocument2 pagesChild Gain 21 IllustrationHarish ChandNo ratings yet

- Sales-Brochure 108Document4 pagesSales-Brochure 108nirmal kumarNo ratings yet

- Jlakshya - 10-12-2020 4.53.21 PDFDocument8 pagesJlakshya - 10-12-2020 4.53.21 PDFAnuNo ratings yet

- LIC - Retire and EnjoyDocument4 pagesLIC - Retire and EnjoyThiagarajan VasuNo ratings yet

- Mr. Kumar Gaurav: Insurance Proposal ForDocument6 pagesMr. Kumar Gaurav: Insurance Proposal ForHarish ChandNo ratings yet

- Personal FinanceDocument4 pagesPersonal FinanceparambhaiofficialNo ratings yet

- Mixing - 5-8-2023 0.16.45Document7 pagesMixing - 5-8-2023 0.16.45MISHRA ENTERPRISENo ratings yet

- 933-Jeevan Lakshya: Prepared byDocument9 pages933-Jeevan Lakshya: Prepared byGURSIMRAN SINGHNo ratings yet

- JeevanAnand - 22-4-2023 7.46.22Document8 pagesJeevanAnand - 22-4-2023 7.46.22mdfkjadsjkNo ratings yet

- Jlakshya - 2-8-2023 9.7.27Document9 pagesJlakshya - 2-8-2023 9.7.27Navin kumarNo ratings yet

- Cus - Mixing - 6-12-2023 8.54.44Document7 pagesCus - Mixing - 6-12-2023 8.54.44naveend9741No ratings yet

- Sales Forecast & Cost of Sales - NaometDocument3 pagesSales Forecast & Cost of Sales - NaometErnest Mohau SomolekaeNo ratings yet

- Komal JeevanDocument1 pageKomal JeevanRohit KashyapNo ratings yet

- MR - ABHINAY - JeevanUmang - 1-12-2023 2.8.5Document8 pagesMR - ABHINAY - JeevanUmang - 1-12-2023 2.8.5Abhinay singhaniyaNo ratings yet

- Report Master. V 874 Age 2 SA 1000000Document4 pagesReport Master. V 874 Age 2 SA 1000000basavarajbalagod8No ratings yet

- Mudaladwani 10 LakhDocument6 pagesMudaladwani 10 LakhManju MysoreNo ratings yet

- Avdhoot InvestmentDocument2 pagesAvdhoot Investmentsaroj09No ratings yet

- Sharekhan Capital Gain Summary Report Beta (FY2020-2021)Document2 pagesSharekhan Capital Gain Summary Report Beta (FY2020-2021)NACHIKETH89No ratings yet

- Singleendment - 7-11-2023 9.12.43Document5 pagesSingleendment - 7-11-2023 9.12.43samsunggranddousromNo ratings yet

- Happy Family Floater Policvy-2015 Premium Sheet - 290920Document1 pageHappy Family Floater Policvy-2015 Premium Sheet - 290920BalaNo ratings yet

- Lampiran. Cash FlowDocument2 pagesLampiran. Cash Flowkukuh atmantoNo ratings yet

- Pooja & Pooja Team Profit-and-Loss-StatementDocument5 pagesPooja & Pooja Team Profit-and-Loss-StatementPOOJA SUNKINo ratings yet

- BgjkggJyoti - 2-3-2024 6.40.29Document4 pagesBgjkggJyoti - 2-3-2024 6.40.29KanVish kvNo ratings yet

- Mr. Harish Chand: Presentation Specially Prepared ForDocument4 pagesMr. Harish Chand: Presentation Specially Prepared ForHarish ChandNo ratings yet

- Single PremiumDocument2 pagesSingle PremiumHarish ChandNo ratings yet

- Dhanuka Agritech7 PDFDocument221 pagesDhanuka Agritech7 PDFkailasNo ratings yet

- Assignmen3 (Mahmoud Abd El Aziz)Document5 pagesAssignmen3 (Mahmoud Abd El Aziz)Mahmoud ZizoNo ratings yet

- Eltu ProjectionsDocument15 pagesEltu ProjectionscphycherryNo ratings yet

- KAPIL - Jlabh - 14-3-2023 1.32.3Document6 pagesKAPIL - Jlabh - 14-3-2023 1.32.3Aarti ThdfcNo ratings yet

- Capital BudgetingDocument18 pagesCapital Budgetingteen agerNo ratings yet

- 936-Jeevan Labh: Prepared byDocument6 pages936-Jeevan Labh: Prepared by09789993119No ratings yet

- KAPIL - Jlakshya - 12-3-2023 5.18.55Document8 pagesKAPIL - Jlakshya - 12-3-2023 5.18.55Aarti ThdfcNo ratings yet

- 933-Jeevan Lakshya: Prepared byDocument8 pages933-Jeevan Lakshya: Prepared byVishal GuptaNo ratings yet

- Conditions Governing The Benefits Illustration Shown in The Subsequent PagesDocument4 pagesConditions Governing The Benefits Illustration Shown in The Subsequent PagesAshfaque SayedNo ratings yet

- PolicyprintingDocument5 pagesPolicyprintingRafiq MagdyNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Corporate AgentsDocument1,023 pagesCorporate AgentsVivek Thota0% (1)

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- 16 Year at 41 AgeDocument4 pages16 Year at 41 AgeHarish ChandNo ratings yet

- Rad 28 E72Document1 pageRad 28 E72Harish ChandNo ratings yet

- Agency Presentation - ZTCDocument24 pagesAgency Presentation - ZTCHarish ChandNo ratings yet

- Mr. Harish Chand: Presentation Specially Prepared ForDocument4 pagesMr. Harish Chand: Presentation Specially Prepared ForHarish ChandNo ratings yet

- Anmol Jeevan - 9811896425Document1 pageAnmol Jeevan - 9811896425Harish ChandNo ratings yet

- Harish Chand: Jeevan Anand Plan PresentationDocument4 pagesHarish Chand: Jeevan Anand Plan PresentationHarish ChandNo ratings yet

- Mr. Gupta: Insurance Proposal ForDocument8 pagesMr. Gupta: Insurance Proposal ForHarish ChandNo ratings yet

- All Illustration of LICDocument6 pagesAll Illustration of LICHarish ChandNo ratings yet

- Mrs. Nirali Mehta: Insurance Proposal ForDocument5 pagesMrs. Nirali Mehta: Insurance Proposal ForHarish ChandNo ratings yet

- Mr. Gupta: Harish ChandDocument4 pagesMr. Gupta: Harish ChandHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Jeevan AkshayDocument1 pageJeevan AkshayHarish ChandNo ratings yet

- Rad 211 D0Document1 pageRad 211 D0Harish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Rad 1 FDF9Document2 pagesRad 1 FDF9Harish ChandNo ratings yet

- Rad 20356Document1 pageRad 20356Harish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Premiums Due Statement: Harish ChandDocument1 pagePremiums Due Statement: Harish ChandHarish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- All Illustration of LICDocument6 pagesAll Illustration of LICHarish ChandNo ratings yet

- Rad 1 F405Document3 pagesRad 1 F405Harish ChandNo ratings yet

- Rad 1 F405Document3 pagesRad 1 F405Harish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- Jeevan Saral IllustrationDocument3 pagesJeevan Saral IllustrationHarish ChandNo ratings yet

- Harish Chand: Multi - Plan ChartDocument4 pagesHarish Chand: Multi - Plan ChartHarish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Ga000027 Karimnagar 1052400 65600418 CmkgajlDocument2 pagesGa000027 Karimnagar 1052400 65600418 CmkgajlVasu AmmuluNo ratings yet

- Data ": Overview: Purchasing (Big)Document3 pagesData ": Overview: Purchasing (Big)preeti singhNo ratings yet

- R.A. 9147 Wildlife Resources Conservation and Protection ActDocument17 pagesR.A. 9147 Wildlife Resources Conservation and Protection ActDennis S. SiyhianNo ratings yet

- INTERROGATIVES Depositions For DisclosureDocument6 pagesINTERROGATIVES Depositions For Disclosureolboy92No ratings yet

- Portfolio Management Through Mutual FundsDocument14 pagesPortfolio Management Through Mutual FundsMedha SinghNo ratings yet

- Quiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Document2 pagesQuiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Martin ManuelNo ratings yet

- Liberty Media Corporation Annual Report Proxy Statement BookmarkedDocument232 pagesLiberty Media Corporation Annual Report Proxy Statement BookmarkedWillNo ratings yet

- Cash and Cash Equivalents TheoriesDocument5 pagesCash and Cash Equivalents Theoriesjane dillanNo ratings yet

- Consumer Durable LoansDocument10 pagesConsumer Durable LoansdevrajkinjalNo ratings yet

- Howard Marks Market Health Outlook ChecklistDocument1 pageHoward Marks Market Health Outlook ChecklistGlenn BuschNo ratings yet

- Transfield Vs LHCDocument3 pagesTransfield Vs LHCKarla BeeNo ratings yet

- Guideline For Synopsis, Thesis Submission MDMS Post Graduate CoursesDocument2 pagesGuideline For Synopsis, Thesis Submission MDMS Post Graduate Courses365mohiseenNo ratings yet

- CA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111Document20 pagesCA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111pari maheshwariNo ratings yet

- Canning The Eastern Question PDFDocument285 pagesCanning The Eastern Question PDFhamza.firatNo ratings yet

- Week 4 Solutions To ExercisesDocument5 pagesWeek 4 Solutions To ExercisesBerend van RoozendaalNo ratings yet

- Challenges Facing Entrepreneurs in Thika CountyDocument10 pagesChallenges Facing Entrepreneurs in Thika CountySenelwa AnayaNo ratings yet

- IFRNPO FullReport FinalDocument140 pagesIFRNPO FullReport FinalRatnawatyNo ratings yet

- Document 886483241Document38 pagesDocument 886483241Cirillo Mendes RibeiroNo ratings yet

- Intimation of Demand NoteDocument1 pageIntimation of Demand NoteDeepakNo ratings yet

- NeekiDocument2 pagesNeekiRamNo ratings yet

- Business Line - Chennai - 15 - 08 - 2022Document26 pagesBusiness Line - Chennai - 15 - 08 - 2022BSNo ratings yet

- ICCR DeputationDocument4 pagesICCR DeputationsmNo ratings yet

- Risk and Managerial (Real) Options in Capital BudgetingDocument40 pagesRisk and Managerial (Real) Options in Capital BudgetingRaazia ImranNo ratings yet

- PNB Vs CA - DigestDocument2 pagesPNB Vs CA - DigestGladys Viranda100% (1)

- Chapter 2 Audit of CashDocument11 pagesChapter 2 Audit of Cashadinew abeyNo ratings yet

- Od 226180983725961000Document2 pagesOd 22618098372596100021Keshav C7ANo ratings yet

- Institutional Support For SSIDocument11 pagesInstitutional Support For SSIRideRNo ratings yet

- Zero To IPO: Lessons From The Unlikely Story ofDocument44 pagesZero To IPO: Lessons From The Unlikely Story ofoutlook.krishnaNo ratings yet

- Final Project Report of Summer Internship (VK)Document56 pagesFinal Project Report of Summer Internship (VK)Vikas Kumar PatelNo ratings yet