Professional Documents

Culture Documents

Intimation of Demand Note

Uploaded by

DeepakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intimation of Demand Note

Uploaded by

DeepakCopyright:

Available Formats

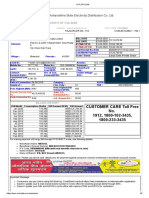

Print Date : 02.05.

2023 TPDDL PAN:AABCN6808R

Intimation of Demand Note TPDDL GST No.: 07AABCN6808R1ZV

Notification No.:2033306845/

District/Zone:SHALIMAR BAGH/Zone Bhalswa

Notification Type:New Connection

Priority:Permanent Connection Generation Date:01.05.2023

Contract Account No.:60031071917 Due Date:03.05.2023

Connection Details

Name:Mr. SHIV MANGAL SHARMA Sanctioned Load(KW): 1.00

Relationship:S/O Mr. DADAN SHARMA Contract Demand(KVA):0.00

Communication Address: Meter Type:Single Phase Meter

HOUSE NO 800 KH.NO. 32 2ND FLOOR EXTN Billing Class / Rate Category: EDOM / E-DOMESTIC

STREET NO 7 BLK-C JANTA VIHAR VILLAGE

MUKANDPUR LANDMARK FRIDAY MARKET ROAD

110042

Phone No.:7835945013 Pay Using UPI

Supply Address:

HOUSE NO 800 KH. NO. 32 2ND FLOOR EXTN STREET NO. 7 B

LK-C JANTA VIHAR VILLAGE MUKANDPUR CITY DELHI 110042

LANDMARK FRIDAY MARKET ROAD

Charges Details

S.No. Description Amount CGST CGST Amount SGST SGST Amount Total

Rate Rate

1 Security Deposit 600.00 600.00

2 SLD Charges 3000.00 9% 270.00 9% 270.00 3540.00

Total Payable Amount: 4140.00

Notes

- Be a Digital and Green Customer, make online payment using Net-Banking/Credit Card*/Debit Card*, under option "Pay Demand Note"

on our website www.tatapower-ddl.com/ Mobile App (TPDDL Connect).For Credit/Debit card payments above Rs.5000/-, Customer need

to pay the commission charges to the bank.

- Demand note payment through Cash (upto Rs.20,000 including sum of current and previous security deposit)/Credit Card/Debit

Card/DD/PO in favour of TPDDL payable at Delhi at Cash collection time as per below mail ( 9 AM to 4 PM Monday to Saturday). Please

mention Notification No. 002033306845 ,CA No. 60031071917 and your Contact No. behind the DD/PO, for correct adjustment of amount

- Energisation of the connection will be subject to augmentation of capacity and/or extension of the electricity network and / or

availability of space by Government of NCT / Developer, if required.

- For any further query/clarification, you may contact at 19124 (24x7 hrs) or visit our Consumer Care Center (9:30 AM to 5:30 PM)

from Monday to Friday and 9:30 AM to 1:00 PM on Saturday

- Security Deposit, if included in above Demand Note, is refundable (subject to clearance of final bill at time of connection

termination/surrender)

Additional Notes

A. Please ensure that: a) The details like name /address/load etc. are as per your application, b) The internal wiring is complete and there is a safe place for meter above 2 feet from

the ground, c) For single phase connection : MCB is installed in case of sanctioned load below 2 KW & ELCB for sanctioned load equal to or more than 2 KW, d) For 3 phase

Connection: 4 pole MCCB and ELCB or RCCB is installed, earthing is done and equal load is distributed on all phases, e) Building Height is less than 15 Meters as per approved

Land Owning Agency plans. B. As per DERC regulation 2017, Developer/ applicant taking supply at Low Tension level for any premises or for re-constructed premises, requiring LT

Service connections has to provide the space for installation of distribution transformers as per the required load whose: (i) total cumulative demand of all floors in the plot/ building

for LT service connection exceeds 100 kW/108 kVA; or (ii) total cumulative built up area of the premises in the plot/building exceeds 1000 sqm; or (iii) plot of size above 500 sqm or

above. C. This is not a tax invoice but only an intimation of estimation or actual charges as per DERC guidelines. Tax invoice shall be issued as per provision of GST Act, 2017.

Eligible customer can avail the input tax credit as per the provision of GST Act, 2017 and GST Rules. Therefore, Tata Power - DDL cannot be held responsible for any demand/

penalty/ interest that may be raised by the GST department on the consumer for wrong availing of input tax credit as per the provision and rules of GST Act, 2017. With reference to

section 34 of CGST Act, TATA Power-DDL shall issue credit note adjusting GST only in case of specified circumstances upto 31st August of the next financial year, after considering

the time involved in processing the cases. May please note that beyond the said timelines, TATA Power-DDL shall not be in a position to raise credit note or refund GST Amount D.

As per income tax rules, TDS is deducted for interest earned on Security deposit of amount exceeding Rs.5000/- in a financial year. You are requested to update the PAN in our

records by visiting nearest customer care center along with copy of PAN. In case of non-availability of PAN, TDS will be deducted @20% under Section 206(AA) of Income Tax Act.

Note:* For more details please visit bill payment section on our website www.tatapower-ddl.com

(This is system generated letter & does not require any signature)

Page 1 of 1

CENCARE Building, Opposite C2 Block, Lawrence Road, Keshavpuram, Delhi-110035

24x7 Toll Free No: 19124, Mobile App: Tata Power-DDL Connect, Website: www.tatapower-ddl.com, Email: customercare@tatapower-ddl.com

Tata Power-DDL CIN No: U40109DL2001PLC111526, PAN No: AABCN6808R, GST No: 07AABCN6808R1ZV, TIN: 07880254419

You might also like

- Intimation of Demand NoteDocument1 pageIntimation of Demand NoteArshNo ratings yet

- TPDDL Demand Note DetailsDocument1 pageTPDDL Demand Note DetailsRishabh jainNo ratings yet

- Intimation of Demand NoteDocument1 pageIntimation of Demand Notemk2729712No ratings yet

- G 1Document1 pageG 1Masum KhanNo ratings yet

- JPL Service Order SummaryDocument16 pagesJPL Service Order Summaryask1968No ratings yet

- BillDocument2 pagesBilltalibNo ratings yet

- Maharashtra State Electricity Distribution Co. LTD.: Bill of Supply For The Month ofDocument2 pagesMaharashtra State Electricity Distribution Co. LTD.: Bill of Supply For The Month ofAyush TandonNo ratings yet

- Student Aesthetics - Upper Lower SplitDocument2 pagesStudent Aesthetics - Upper Lower SplitSayantan SarkarNo ratings yet

- Rural Broadband PVT LTDDocument2 pagesRural Broadband PVT LTDOmPrakashKumarNo ratings yet

- Kalyan Jewellers Thanjavur Invoice Dec-2020Document1 pageKalyan Jewellers Thanjavur Invoice Dec-2020get getrNo ratings yet

- QuatationDocument1 pageQuatationmeghalayatripmar23No ratings yet

- Total Amount PayableDocument2 pagesTotal Amount Payablekeshav GuptaNo ratings yet

- I - LT E-Bill - Nov 2017Document2 pagesI - LT E-Bill - Nov 2017Sushil KhedekarNo ratings yet

- PPWC Static MeterDocument3 pagesPPWC Static Meterpant.vk8514No ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS)Document3 pagesYour Reliance Bill: Summary of Current Charges Amount (RS)anooprchNo ratings yet

- Manipur LBDocument1 pageManipur LBSatkar GarmentNo ratings yet

- HT - LTIP E-Bill AprilDocument4 pagesHT - LTIP E-Bill Aprilsudarshan.sanap7080No ratings yet

- Bill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDDocument2 pagesBill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDAyush TandonNo ratings yet

- HT - LTIP E-BillDocument4 pagesHT - LTIP E-BillRatnakar GuravNo ratings yet

- E-Bill KhurdDocument3 pagesE-Bill KhurdTejas kalaskarNo ratings yet

- Inv 12484-MarchDocument1 pageInv 12484-Marchintegral.shanNo ratings yet

- Skylink Nov2022Document3 pagesSkylink Nov2022Dharmaraj ManojNo ratings yet

- Tax Invoice DetailsDocument4 pagesTax Invoice DetailsPrashanshu100% (1)

- BiptDocument1 pageBiptAshishNo ratings yet

- ELECTRICITYDocument2 pagesELECTRICITYKAMAL SONINo ratings yet

- 2nd FloorDocument2 pages2nd Floorkeshav GuptaNo ratings yet

- Bill 4Document2 pagesBill 4GeetanjaliNo ratings yet

- Bill For Current Month (7) - 1Document1 pageBill For Current Month (7) - 1Ankit GuptaNo ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/02/2019Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/02/2019pravv vvvNo ratings yet

- Domestic_All_GADocument1 pageDomestic_All_GAknpranchi111No ratings yet

- Oct-13Document2 pagesOct-13Vivek MauryaNo ratings yet

- 1HT - LTIP E-BillDocument2 pages1HT - LTIP E-BillAtul DeshmukhNo ratings yet

- Coochbehar Telecom District: Arvind Kumar Dept - Qtrs.Attached To Dto Building Po&Dt-Coochbehar COB WB 736101 P O StampDocument3 pagesCoochbehar Telecom District: Arvind Kumar Dept - Qtrs.Attached To Dto Building Po&Dt-Coochbehar COB WB 736101 P O StampverarvindNo ratings yet

- Gagan BishtDocument1 pageGagan BishtAshishNo ratings yet

- LT E-Bill PDFDocument2 pagesLT E-Bill PDFsyed parvez100% (1)

- Nashik 1Document3 pagesNashik 1JayshreeNo ratings yet

- Bill HomeDocument2 pagesBill HomeMahesh DeshmukhNo ratings yet

- LT E-Bill PDFDocument2 pagesLT E-Bill PDFAnkita SharmaNo ratings yet

- LT E-Bill PDFDocument2 pagesLT E-Bill PDFAnkita SharmaNo ratings yet

- ISHRAT JAHAN BILLDocument2 pagesISHRAT JAHAN BILLanisalways2020No ratings yet

- Electricity BillDocument1 pageElectricity BillSushila SinghNo ratings yet

- Terp Asia Construction Corp.: Statement of AccountDocument4 pagesTerp Asia Construction Corp.: Statement of AccountMark Israel DirectoNo ratings yet

- Tax invoice for silt curtains and anchoring systemsDocument5 pagesTax invoice for silt curtains and anchoring systemsDumindu Chandana PunchihewaNo ratings yet

- Summary of Charges For This Bill Period: Amit GuptaDocument3 pagesSummary of Charges For This Bill Period: Amit GuptaRiya AggarwalNo ratings yet

- Maharashtra State Electricity Distribution Co. Ltd. Bill of Supply For The Month of Apr 2022Document4 pagesMaharashtra State Electricity Distribution Co. Ltd. Bill of Supply For The Month of Apr 2022MAHA LAXMINo ratings yet

- 1.teleindia Networks Private Limited-I-WO-1019Document1 page1.teleindia Networks Private Limited-I-WO-1019AnuNo ratings yet

- Inv-Ka-B1-36680539-102017859871-14th February-2021 To 13TH September 2021Document2 pagesInv-Ka-B1-36680539-102017859871-14th February-2021 To 13TH September 2021CLS AKNo ratings yet

- Invoice 1285669629 I0133P2208135080Document1 pageInvoice 1285669629 I0133P2208135080CA Ramajayam JayachandranNo ratings yet

- Shankar6771 / 88 Bill Number Account ID/NoDocument1 pageShankar6771 / 88 Bill Number Account ID/NoShankar CNo ratings yet

- Oct BillDocument3 pagesOct Billhimanshu.jainNo ratings yet

- Inv Ka B1 32251227 102017859871 June 2020Document2 pagesInv Ka B1 32251227 102017859871 June 2020CLS AKNo ratings yet

- NOC FormatDocument3 pagesNOC FormatDee JayNo ratings yet

- Tax invoice receipt FUP25Mbps package renewalDocument1 pageTax invoice receipt FUP25Mbps package renewalDipam HalderNo ratings yet

- Proforma invoice for UPS equipment installationDocument2 pagesProforma invoice for UPS equipment installationVishal JoshiNo ratings yet

- Vaghela Delhi New Ele BillDocument2 pagesVaghela Delhi New Ele Billjadavbhimraj7810No ratings yet

- Siddu PDFDocument2 pagesSiddu PDFNikhil MohaneNo ratings yet

- LT E-Bill - pdf2.PDF Feb To MarchDocument2 pagesLT E-Bill - pdf2.PDF Feb To Marchrajesh chavanNo ratings yet

- On the Road to Achieving Full Electrification in Sri LankaFrom EverandOn the Road to Achieving Full Electrification in Sri LankaNo ratings yet

- Electric Motorcycle Charging Infrastructure Road Map for IndonesiaFrom EverandElectric Motorcycle Charging Infrastructure Road Map for IndonesiaNo ratings yet

- SmartGrid vs MicroGrid; Energy Storage Technology: Energy, #2From EverandSmartGrid vs MicroGrid; Energy Storage Technology: Energy, #2No ratings yet

- Fuw5fomwrucbh1ojdlxe Signature Poli 201005073934 PDFDocument24 pagesFuw5fomwrucbh1ojdlxe Signature Poli 201005073934 PDFDeepakNo ratings yet

- Tamilnadu SOR 2022 2023 APPROVED Watermark 2Document177 pagesTamilnadu SOR 2022 2023 APPROVED Watermark 2Golden KingNo ratings yet

- Estimation & CostingDocument31 pagesEstimation & CostingKrztofer PrnzNo ratings yet

- Rohini 85418870988Document11 pagesRohini 85418870988DeepakNo ratings yet

- Https Edustud - Nic.in Result Frmpubliclevelresult - Aspx Id 6785Document1 pageHttps Edustud - Nic.in Result Frmpubliclevelresult - Aspx Id 6785DeepakNo ratings yet

- EnglishDocument10 pagesEnglishDeepakNo ratings yet

- Course Outline for Advanced SurveyingDocument9 pagesCourse Outline for Advanced SurveyingDeepakNo ratings yet

- Concrete TechnologyDocument6 pagesConcrete TechnologyDeepakNo ratings yet

- ESTIMATING AND COSTING COURSEDocument9 pagesESTIMATING AND COSTING COURSEDeepakNo ratings yet

- Rateanalysis 191216083643Document43 pagesRateanalysis 191216083643DeepakNo ratings yet

- BUILDING PLANNING COURSEDocument5 pagesBUILDING PLANNING COURSEDeepakNo ratings yet

- AABB Accredited DNA Testing FacilitiesDocument2 pagesAABB Accredited DNA Testing Facilitiesjosueduran75No ratings yet

- Gem EscortingDocument7 pagesGem Escortingsuman sutharNo ratings yet

- Acknowledgement For Project Report SampleDocument23 pagesAcknowledgement For Project Report SampleSiddhesh BhavsarNo ratings yet

- Mitsubishi Motors: Service ManualDocument29 pagesMitsubishi Motors: Service ManualCristobalNo ratings yet

- PMR205 DR Shawn BakerDocument31 pagesPMR205 DR Shawn Bakerspiridon_andrei2011No ratings yet

- Binzel - Katalog MAGDocument64 pagesBinzel - Katalog MAGAdrian KustraNo ratings yet

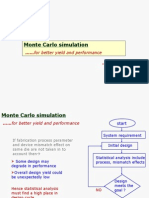

- Cadence Monte Carlo Simulation TutorialDocument51 pagesCadence Monte Carlo Simulation Tutorialkuomatt100% (1)

- Tabcalcs.com general equations sheetDocument2 pagesTabcalcs.com general equations sheetRamadan RashadNo ratings yet

- Metal Enameling: Arts & CommunicationDocument15 pagesMetal Enameling: Arts & CommunicationAnjali DavidNo ratings yet

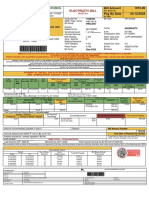

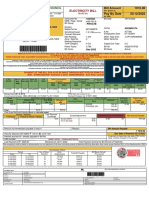

- Meralco Bill 330370940102 04142023Document2 pagesMeralco Bill 330370940102 04142023Jha CruzNo ratings yet

- Brief History About Volley BallDocument1 pageBrief History About Volley BallAmbrad, Merlyn H.No ratings yet

- BAlochistanDocument14 pagesBAlochistanzee100% (1)

- Creme Brulee - Printer Friendly PDFDocument1 pageCreme Brulee - Printer Friendly PDFmtlpcguysNo ratings yet

- Parapsychology QP - WikiDocument371 pagesParapsychology QP - WikiAdamNo ratings yet

- Stereochemistry MSCDocument29 pagesStereochemistry MSCBapu Thorat50% (2)

- Understanding of AVO and Its Use in InterpretationDocument35 pagesUnderstanding of AVO and Its Use in Interpretationbrian_schulte_esp803100% (1)

- Collaboration Processes: Looking Inside the Black BoxDocument13 pagesCollaboration Processes: Looking Inside the Black Boxเข้าใจว่า น่าจะชื่อตุ้นNo ratings yet

- Cell Structure ActivityDocument4 pagesCell Structure ActivitysharksiedNo ratings yet

- IAL Edexcel Pure Math 1 January 2020Document28 pagesIAL Edexcel Pure Math 1 January 2020Mohamed Said Daw100% (4)

- Petford & Atherton., 1996Document31 pagesPetford & Atherton., 1996Ivan Hagler Becerra VasquezNo ratings yet

- 1 Proforma of Allotment LetterDocument32 pages1 Proforma of Allotment LetterGovind SandhaNo ratings yet

- 5988-4082EN Designers GuidDocument82 pages5988-4082EN Designers GuidAndreaNo ratings yet

- Form WorkDocument25 pagesForm Workhina khanNo ratings yet

- Bio Sem2 EssayDocument2 pagesBio Sem2 EssayEileen WongNo ratings yet

- Mass DisasterDocument70 pagesMass DisasterJoseph RadovanNo ratings yet

- Full Report-Disinfectant and SanitizerDocument19 pagesFull Report-Disinfectant and Sanitizermohd addinNo ratings yet

- Managed Pressure Drilling MPD BrochureDocument5 pagesManaged Pressure Drilling MPD Brochureswaala4realNo ratings yet

- Script For TSB GRDDocument9 pagesScript For TSB GRDJuvel OrquinazaNo ratings yet

- Chapter-1: Introduction of The StudyDocument21 pagesChapter-1: Introduction of The StudyViswanathanNo ratings yet

- Life Time Prediction of GRP Piping SystemsDocument15 pagesLife Time Prediction of GRP Piping SystemsRamon FrenchNo ratings yet