Professional Documents

Culture Documents

Pradeep Perera - Energy Efficiency Financing in China Challenges, Way Forward and ADB Experience

Uploaded by

Asia Clean Energy ForumOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pradeep Perera - Energy Efficiency Financing in China Challenges, Way Forward and ADB Experience

Uploaded by

Asia Clean Energy ForumCopyright:

Available Formats

ENERGY EFFICIENCY FINANCING IN CHINA : CHALLENGES, WAY FORWARD AND ADB EXPERIENCE

Pradeep Perera Principal Energy Specialist East Asia Energy Department

Chinas Energy Sector in Global Context

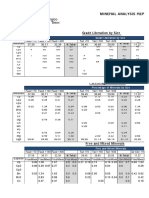

World Primary Energy Consumption in 2009 ( MTOE)

China is the largest energy

consumer in the world with 19% share in global energy consumption. Chinese Energy Consumption is increasing at an annual rate of 8%. Coal contributes to over 65% of primary energy demand.

USA

Japan

OECD Europe Other OECD China India Brazil Russia Other Non OECD

China is a net energy importer and 10% of its primary energy supply ( mainly oil but increasingly coal and gas is imported.

Energy Efficiency in China

Chinas energy intensity measured in energy consumption per unit output is more than double the world average and OECD average.

However, Chinas energy intensity has reduced by 60% since 1990 and is less than India, Russia and Middle East

There has been a rapid decrease since 1990 to 2000, slight increase from 2000 2005 and again decline since 2005.

Importance of Energy Efficiency to Emission Reduction

China need to provide 30 % of global emission reductions required for 450 ppm case. End user efficiency improvement, fuel switching and supply side efficiency improvement are expected to provide 57% of these emission reductions.

Chinas Energy Consumption Mix

Industrial Energy Consumption

158 71 727 315 139 35 112 165 276

Housing

Commercial Buildings

Transport

Iron & Steel

Chemical

Aluminum

Cement

Other Indusry

Industrial Sector contributes to 57% of final energy consumption in China. Iron& Steel ( 22%), Petro chemical (11%) , cement ( 9%) dominate the energy consumption.

Chinas Strategy for Energy Efficiency Improvement 2006 - 2010

Set a National target of 20% improvement in energy intensity compared to 2005. Focused on Industrial Sector & 1000

Largest energy consuming enterprises. Provinces were given energy intensity targets and responsibility for implementing national energy conservation program. Provinces were held accountable for achieving the targets. Progress was tracked annually.

Organizational Structure for Supervicing energy savings in China

Chinas 1000 Key Enterprise Program

Covered the 1,000 largest energy consuming enterprises. ( More than 180,000 tce per year) The Provincial government expanded the coverage by lowering the threshold . Enterprises are required to enter into legally binding contracts with the government for implementing energy saving measures.

Undertaking Energy Audits and identifying energy saving opportunities Establishing enter price wide EMS systems with dedicated staff. Government monitoring of enterprise specific energy saving measures. Undertaking energy saving investments by replacing inefficient equipment and processors Quantitative targets for energy consumption was set based on industry wide benchmarks

Energy Efficiency Improvement Measures Cont.

Fiscal Incentive Program for energy efficiency

investments @ RMB 200 ( $ 29) RMB 250 ( $ 36) per tce of energy saved.

This amount o 10% - 20% of investment cost.

Limited to investments resulting in 10,000 tce. Provinces came up with supplementary

schemes to cover smaller investments.

Central government allocated over 100 billion

RMB ( $ 15 billion) and Provincial governments $ RMB 50 billion ( $ 7.5 billion) for these schemes.

Energy Efficiency Improvement Measures Cont.

Elimination of backward industrial capacity.

Focused on thermal power, iron & steel, cement, aluminum and coke industries Replacing small with large Additional electricity surcharges for backward plants. Subsidies to mitigate transition cost and incentives for early elimination Revoking production permits & credit squeezing

Industrial Technologies are classified as

encouraged, permitted, restricted and eliminated.

Energy Efficiency Assessment of new capacity

Developing Energy Service Industry

Third party service providers

o Energy audits, consulting & technology dissemination

o Energy efficiency project design and appraisal o Energy efficiency project investment & management

under EPC contracts. ( ESCO model)

o Undertaking monitoring & verification of energy savings

Chinas ESCO industry is the largest in the world

with over $ 4.5 billion EPC contracts resulting in energy savings of over 10 million tce in 2010.

Over 75% ESCO investments are in industrial

sector and over 60% of the contracts ESCO was responsible for mobilizing the investments.

Results achieved 2006 2010

Chinas energy intensity has improved by 19.1% compared to 2005. The total energy savings achieved as a result of EE investments was 340 million tce. ( i.e. 5 3 % of energy savings required for 19.1% improvement in energy intensity).

More than 47% of energy intensity improvements are due to structural changes in the economy.

Total investment mobilized was RMB 844 billion ( $ 130 billion).

Central government : RMB 102 billion( US $ 16 billion)

Local government : RMB 48 billion ( US $ 7.5 billion).

Host Enterprises : RMB 169 billion ( US $ 27 billion) Commercial Banks : RMB 488 billion ( US $ 77.5 billion) ESCO Industry : RMB 20.5 billion ( US $ 3.25 billion)

International Funding : RMB 18 billion( US $ 3 billion)

Results Achieved 2006 - 2010

Sustainable institutional framework was

established for achieving further energy savings.

Most of the Energy Savings 56% were achieved in Industrial Sector. Targets were achieved mainly using administrative mechanisms with strong top- down approach. Energy saving performance contracts provides a platform for government to closely monitor the energy consumption in main energy consumers.

Industry

Buildings

Transport

There is less reliance on market forces such as energy pricing and carbon pricing

Challenges of Financing Energy Efficiency during 2006 -2010

Most of the bank financing was for capacity expansion

projects .

Small Scale Retrofit Projects and ESCO projects find

difficult to access bank financing.

Banks as well as enterprises consider transaction costs

are too high for EE retrofit projects.

Banks demand collateral and enter prices are reluctant

to provide collateral for EE retrofit projects.

Low standalone collateral value of EE retrofit assets.

Difficulty in ring fencing the cash flows associated with

EE retrofit projects.

Preference of Chinese banks to finance large projects

and thresholds on minimum project size.

Poor credit ratings of SMEs and ESCOs.

Targets for Energy Efficiency Improvement in 12th FYP 2011- 2015

China has set a target of 16% of improvement of

energy intensity and 17% improvement of carbon intensity over 2010.

The measures initiated in the previous program will

be implemented with increased coverage.

Supervision and Monitoring mechanisms to verify energy savings will be strengthened.

Development and promotion of new EE technologies.

Further Developing energy performance contracting.

Instituting corporate energy management systems in key enterprises.

Provincial Energy Intensity Improvement Targets under 12 FYP

Strategy for Energy Efficiency Improvement in 12th FYP

ADBs Contribution to Energy Efficiency Improvement in China

ADBs energy efficiency investments focused on the three provinces having the largest energy consumption in China. ( Shangdong, Hebei and Guangdong) . ADBs ability to provide low cost funds with long grace and repayment period enabled the establishment of revolving fund to provide sustainable financing.

ADBs first energy Efficiency Project in Guangdong, approved in 2008.

ADB has supported 19 SME projects. Mobilized RMB 1.3 billion ( $ 200 million).

Achieved energy savings of 275,000 tce.

The second round of subprojects utilizing the revolving fund is about to commenced. Capacity building on energy saving monitoring and industrial policy formulation for energy conservation.

ADBs Response : Hebei & Shangdong Energy Efficiency Projects

ADB has approved Shangdong and Hebei Energy Efficiency Loans in 2011. Use similar structure to Guangdong but make effective partnerships with middle level commercial banks. Focus on Medium to Large scale enterprises for Industrial process conversion projects. Provides Capacity Building for Energy Manager Training in Shangdong. A GEF Project for remote monitoring of energy savings, third party M&V agency capacity building and energy management system certification in Hebei Province is under preparation. The first round of projects are expected to realize energy savings of around 250,000 tce each in Shangdong and Hebei. ADB intend to structure future energy efficiency projects with enhanced leveraging and risk sharing with commercial banks.

Issues and Challenges for next 5 years.

China intend to Mobilize RMB 1,500 billion ( $ 240

billion) for EE investments during 12th FYP to achieve energy savings of 670 mtce. This involves scale up of Provincial energy efficiency programs and implementation and monitoring capacity will be an issue. Channeling the required financing from the banks to enterprise for EE investments require special efforts and incentives. Need for more market based approaches such as emission trading, sectoral trading of energy efficiency and tradable energy efficiency certificates. Further expanding the capacity of energy service industry. Further expanding the enterprise energy management capacity.

You might also like

- Agung Wicaksono - Improving Access To Electricity GOI National Priority 2012Document8 pagesAgung Wicaksono - Improving Access To Electricity GOI National Priority 2012Asia Clean Energy ForumNo ratings yet

- Ruzaida Daud - Malaysia Renewable Energy in Grid ExpansionDocument15 pagesRuzaida Daud - Malaysia Renewable Energy in Grid ExpansionAsia Clean Energy ForumNo ratings yet

- Thusitha Sugathapala - EE Initiatives in Sri LankaDocument12 pagesThusitha Sugathapala - EE Initiatives in Sri LankaAsia Clean Energy ForumNo ratings yet

- Dadan Kusdiana - Indonesia Renewable Energy Policies and RegulationsDocument14 pagesDadan Kusdiana - Indonesia Renewable Energy Policies and RegulationsAsia Clean Energy ForumNo ratings yet

- Bek Chee Jin - Harmonization of Energy Efficiency Standards For Household Appliances-BekDocument11 pagesBek Chee Jin - Harmonization of Energy Efficiency Standards For Household Appliances-BekAsia Clean Energy ForumNo ratings yet

- Robert Aitken - South Africa Off Grid Programme Policy Framework For Enabling AccessDocument13 pagesRobert Aitken - South Africa Off Grid Programme Policy Framework For Enabling AccessAsia Clean Energy ForumNo ratings yet

- Twarath Subtabutr - Green Islands Renewable Energy Investment On Remote IslandsDocument18 pagesTwarath Subtabutr - Green Islands Renewable Energy Investment On Remote IslandsAsia Clean Energy ForumNo ratings yet

- U.N. Panjiar - Bihar ExperienceDocument16 pagesU.N. Panjiar - Bihar ExperienceAsia Clean Energy ForumNo ratings yet

- Mohammad Roqibul Islam - Efficiency in Products and AppliancesDocument9 pagesMohammad Roqibul Islam - Efficiency in Products and AppliancesAsia Clean Energy ForumNo ratings yet

- Ranjit Perera - Mini Grids in Sri Lanka Regulatory IssuesDocument10 pagesRanjit Perera - Mini Grids in Sri Lanka Regulatory IssuesAsia Clean Energy Forum100% (1)

- Terry Mohn - Mini Grid Systems Standards and RegulationsDocument11 pagesTerry Mohn - Mini Grid Systems Standards and RegulationsAsia Clean Energy ForumNo ratings yet

- Bodha Raj Dhakal - Nepal Energy Savings For Maximizing AccessDocument12 pagesBodha Raj Dhakal - Nepal Energy Savings For Maximizing AccessAsia Clean Energy ForumNo ratings yet

- Alan Kneisz - Using Green Power For Telecom PowerDocument12 pagesAlan Kneisz - Using Green Power For Telecom PowerAsia Clean Energy ForumNo ratings yet

- Victor Jona - Cambodia's Rural Electrification Minigrid Systems, Standard and RegulationDocument28 pagesVictor Jona - Cambodia's Rural Electrification Minigrid Systems, Standard and RegulationAsia Clean Energy ForumNo ratings yet

- Toshihiro Nakamura - Spreading Technology Improving LivesDocument12 pagesToshihiro Nakamura - Spreading Technology Improving LivesAsia Clean Energy ForumNo ratings yet

- Bounsy Dethavong - Introduction of Power Sector in Lao PDRDocument14 pagesBounsy Dethavong - Introduction of Power Sector in Lao PDRAsia Clean Energy ForumNo ratings yet

- Sunil Dhingra - Renewable Energy and The Minigrid, The Indian ExperienceDocument15 pagesSunil Dhingra - Renewable Energy and The Minigrid, The Indian ExperienceAsia Clean Energy Forum100% (1)

- Govind Pokharel - Energy Services Rural ElectricityDocument11 pagesGovind Pokharel - Energy Services Rural ElectricityAsia Clean Energy ForumNo ratings yet

- Nazmul Haque - Solar Energy Program in BangladeshDocument12 pagesNazmul Haque - Solar Energy Program in BangladeshAsia Clean Energy ForumNo ratings yet

- Simon Henschel - Solar Lantern Charging SolutionDocument9 pagesSimon Henschel - Solar Lantern Charging SolutionAsia Clean Energy ForumNo ratings yet

- Sohail Hasnie - Energy Efficiency MattersDocument16 pagesSohail Hasnie - Energy Efficiency MattersAsia Clean Energy ForumNo ratings yet

- Pepukaye Bardouille - Market-Based Approach To Catalyzing Energy Access LightiDocument13 pagesPepukaye Bardouille - Market-Based Approach To Catalyzing Energy Access LightiAsia Clean Energy ForumNo ratings yet

- Harry Verhaar - Enhancing Life With Solar LED LightingDocument9 pagesHarry Verhaar - Enhancing Life With Solar LED LightingAsia Clean Energy ForumNo ratings yet

- Stewart Craine - Sustainable Energy Access For Rural HomesDocument18 pagesStewart Craine - Sustainable Energy Access For Rural HomesAsia Clean Energy ForumNo ratings yet

- Balawant Joshi - Policy and Regulatory Interventions To Support Community Level Off Grid ProjectsDocument11 pagesBalawant Joshi - Policy and Regulatory Interventions To Support Community Level Off Grid ProjectsAsia Clean Energy ForumNo ratings yet

- Twarath Sutabutr - Thailand From Near Universal Access To Sustainable AccessDocument19 pagesTwarath Sutabutr - Thailand From Near Universal Access To Sustainable AccessAsia Clean Energy ForumNo ratings yet

- Wilfred L. Billena - RE SuccessDocument15 pagesWilfred L. Billena - RE SuccessAsia Clean Energy ForumNo ratings yet

- Dennis O'Brien - U.S. Rural ElectrificationDocument10 pagesDennis O'Brien - U.S. Rural ElectrificationAsia Clean Energy ForumNo ratings yet

- Sicheng Wang - Success in Electrification and Transition To Clean EnergyDocument17 pagesSicheng Wang - Success in Electrification and Transition To Clean EnergyAsia Clean Energy ForumNo ratings yet

- Pola Singh - Malaysia Sustainable Electrification For Facilitating AccessDocument16 pagesPola Singh - Malaysia Sustainable Electrification For Facilitating AccessAsia Clean Energy ForumNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 5 Sources of ElectricityDocument2 pages5 Sources of Electricityalimoya1380% (5)

- Arghadeep Chatterjee - DeforestationDocument10 pagesArghadeep Chatterjee - DeforestationArghadeep ChatterjeeNo ratings yet

- Energia Solar en EspañaDocument1 pageEnergia Solar en EspañaCatalin LeusteanNo ratings yet

- Design and Drawing of Irrigation StructuresDocument6 pagesDesign and Drawing of Irrigation StructuresRam Krishna Arikatla100% (3)

- Last Minute Revision Guide GeoDocument43 pagesLast Minute Revision Guide Geoabdul saeedNo ratings yet

- EoI Final - CompiledDocument218 pagesEoI Final - CompiledAnonymous I1o0ZTC100% (1)

- ISCC 205 Greenhouse Gas EmissionsDocument43 pagesISCC 205 Greenhouse Gas Emissionskkjayasurya100% (1)

- Mid Term Exam With Solutions PDFDocument15 pagesMid Term Exam With Solutions PDFKristina Ormacido100% (3)

- Watershed ManagementDocument17 pagesWatershed Managementali_loraineNo ratings yet

- AASHTO Soil Classification SystemDocument2 pagesAASHTO Soil Classification SystemfidelgeoNo ratings yet

- 19thdec Sustainable Agriculture and Food Policy White Paper For IndiaDocument4 pages19thdec Sustainable Agriculture and Food Policy White Paper For Indiaapi-124950933No ratings yet

- Flot Lab TA MicroscDocument10 pagesFlot Lab TA MicroscLaura B. AlvarezNo ratings yet

- Notes For Lecture #7Document8 pagesNotes For Lecture #7Debbie DebzNo ratings yet

- 1 PBDocument9 pages1 PBTimeHack GamingNo ratings yet

- Research QuestionnaireDocument7 pagesResearch QuestionnaireROMY DAVE PABICONo ratings yet

- DrainageVijayawadaSPL02080283 83 113Document6 pagesDrainageVijayawadaSPL02080283 83 113Manjul KothariNo ratings yet

- Eir January2018Document2,753 pagesEir January2018Ramesh BabuNo ratings yet

- Management of Natural ResourcesDocument5 pagesManagement of Natural ResourcesAARTI1012100% (1)

- Aquaticecosystemsppt 121008162921 Phpapp01Document18 pagesAquaticecosystemsppt 121008162921 Phpapp01Girlie Faith Morales BrozasNo ratings yet

- Performance Evaluation of Wastewater Stabilization Ponds in Arak-IranDocument6 pagesPerformance Evaluation of Wastewater Stabilization Ponds in Arak-Iranachmadrb1971No ratings yet

- Mark Addison Dissolved Air Flotation-OTCODocument19 pagesMark Addison Dissolved Air Flotation-OTCOAzman Bin KadirNo ratings yet

- Replicating Success in VadodaraDocument7 pagesReplicating Success in Vadodaradhruv vashisthNo ratings yet

- MOW MS2 Samyak TeltumbadeDocument5 pagesMOW MS2 Samyak TeltumbadeSamyak teltumbadeNo ratings yet

- Civl3501 - Soil Mechanics: ConsolidationDocument63 pagesCivl3501 - Soil Mechanics: ConsolidationBazimya DixonNo ratings yet

- The Benefits of Indoor - Vertical FarmingDocument1 pageThe Benefits of Indoor - Vertical FarminganneNo ratings yet

- Assessing Land Use and Land Cover Change in The Wassa West District of Ghana Using Remote SensingDocument11 pagesAssessing Land Use and Land Cover Change in The Wassa West District of Ghana Using Remote SensingHamzaNo ratings yet

- National Renewable BoardDocument11 pagesNational Renewable BoardMark Angelo UyNo ratings yet

- Gehrlicher Solar AgDocument76 pagesGehrlicher Solar Agjeanpierrepuissant2518No ratings yet

- LLRC Kilinochchi DistrictDocument146 pagesLLRC Kilinochchi DistrictMalith MadushanNo ratings yet

- Wasteland ReclamationDocument20 pagesWasteland ReclamationRekha YadavNo ratings yet