Professional Documents

Culture Documents

Profit & Loss Account of Idea Cellular - in Rs. Cr.

Uploaded by

lowell789Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profit & Loss Account of Idea Cellular - in Rs. Cr.

Uploaded by

lowell789Copyright:

Available Formats

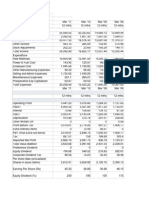

Profit & Loss account of Idea Cellular

------------------- in Rs. Cr. -------------------

Mar '12

Mar '11

Mar '10

12 mths

12 mths

12 mths

Sales Turnover

Excise Duty

Net Sales

Other Income

Stock Adjustments

Total Income

Expenditure

19,275.32

0.00

19,275.32

-4.03

0.00

19,271.29

15,332.80

0.00

15,332.80

109.23

0.00

15,442.03

11,850.24

0.00

11,850.24

383.83

0.00

12,234.07

Raw Materials

Power & Fuel Cost

Employee Cost

Other Manufacturing Expenses

Selling and Admin Expenses

Miscellaneous Expenses

Preoperative Exp Capitalised

Total Expenses

0.00

1,553.25

848.34

9,564.78

2,329.56

121.83

0.00

14,417.76

Mar '12

0.02

1,392.66

719.38

7,412.44

2,082.93

107.92

0.00

11,715.35

Mar '11

0.02

942.27

561.17

5,187.63

1,823.48

91.58

0.00

8,606.15

Mar '10

Operating Profit

12 mths

4,857.56

12 mths

3,617.45

12 mths

3,244.09

PBDIT

Interest

PBDT

Depreciation

Other Written Off

Profit Before Tax

Extra-ordinary items

PBT (Post Extra-ord Items)

Tax

Reported Net Profit

4,853.53

1,488.39

3,365.14

2,019.46

543.32

802.36

39.88

842.24

265.72

576.54

3,726.68

894.82

2,831.86

1,723.00

250.02

858.84

47.46

906.30

61.72

844.60

3,627.92

982.44

2,645.48

1,366.61

184.59

1,094.28

91.61

1,185.89

115.08

1,053.66

Total Value Addition

Preference Dividend

Equity Dividend

Corporate Dividend Tax

Per share data (annualised)

14,417.75

0.00

0.00

0.00

11,715.32

0.00

0.00

0.00

8,606.12

0.00

0.00

0.00

Shares in issue (lakhs)

Earning Per Share (Rs)

33,088.45

1.74

33,032.72

2.56

32,998.38

3.19

0.00

38.99

0.00

37.18

0.00

34.59

Income

Equity Dividend (%)

Book Value (Rs)

Balance Sheet of Idea Cellular

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

12 mths

12 mths

12 mths

3,308.85

3,303.27

3,299.84

Sources Of Funds

Total Share Capital

Equity Share Capital

Share Application Money

Preference Share Capital

Reserves

Revaluation Reserves

Networth

3,308.85

34.95

0.00

9,590.75

0.00

12,934.55

3,303.27

47.81

0.00

8,979.62

0.00

12,330.70

3,299.84

44.45

0.00

8,112.95

0.00

11,457.24

Secured Loans

Unsecured Loans

Total Debt

Total Liabilities

7,794.14

2,344.03

10,138.17

23,072.72

Mar '12

7,760.04

2,797.42

10,557.46

22,888.16

Mar '11

5,988.61

537.81

6,526.42

17,983.66

Mar '10

12 mths

12 mths

12 mths

33,211.43

9,468.17

23,743.26

28,938.75

9,807.13

19,131.62

22,834.40

7,907.34

14,927.06

656.62

1,636.81

3,594.05

2,572.81

462.58

2,755.13

Inventories

Sundry Debtors

Cash and Bank Balance

Total Current Assets

Loans and Advances

Fixed Deposits

Total CA, Loans & Advances

Deffered Credit

Current Liabilities

Provisions

Total CL & Provisions

Net Current Assets

52.94

807.55

39.58

900.07

4,895.45

94.61

5,890.13

0.00

8,708.81

145.29

8,854.10

-2,963.97

52.22

461.45

47.47

561.14

2,941.45

404.07

3,906.66

0.00

6,187.79

129.17

6,316.96

-2,410.30

46.70

430.12

129.13

605.95

3,533.15

151.31

4,290.41

0.00

4,313.76

137.76

4,451.52

-161.11

Miscellaneous Expenses

Total Assets

0.00

23,072.72

0.00

22,888.18

0.00

17,983.66

3,340.02

38.99

3,409.89

37.18

1,960.75

34.59

Application Of Funds

Gross Block

Less: Accum. Depreciation

Net Block

Capital Work in Progress

Investments

Contingent Liabilities

Book Value (Rs)

Cash conversion cycle

=Inventory conversion

period

4.14

-270.172

+

+

Receivables conversion

period

61.1674948

Payables conversion

period

- 335.48

Inventory Conversion Ratio = (sales x 0.5) / cost of sales.

(19,275.32* 0.5)/ 2,329.56

9637.66/2329.56

4.14

Receivable collection Period = Receivables/Sales/365 = # Days

807.55/19,275.32/365=4

0.06539421=4

=4/0.06539421

=61.1674948

Payables Deferral Period = Payables/Cost of Goods Sold/365 = # Days

= 10,138.17/2,329.56/365=4

0.0119232=4

=4/0.0119232

335.48

You might also like

- Blue Chip CompaniesDocument7 pagesBlue Chip CompaniesgopanollavenkatNo ratings yet

- Profit & Loss Account of Tata Steel: - in Rs. Cr.Document4 pagesProfit & Loss Account of Tata Steel: - in Rs. Cr.ruchitacharaniaNo ratings yet

- Ultratech Cement Profit & Loss AccountDocument4 pagesUltratech Cement Profit & Loss Accountyogi1162891No ratings yet

- Mahindra and Mahindra Profit & Loss AccountDocument13 pagesMahindra and Mahindra Profit & Loss AccountwenemeneNo ratings yet

- Dabur India Ltd.Document1 pageDabur India Ltd.Pushpa ShettiyarNo ratings yet

- Profit & Loss AccountDocument2 pagesProfit & Loss AccountPoojaMBNo ratings yet

- Tata Steel: Dion Global Solutions LimitedDocument2 pagesTata Steel: Dion Global Solutions LimitedMukesh ManwaniNo ratings yet

- Idea Cellular: Previous YearsDocument4 pagesIdea Cellular: Previous YearsParvez AnsariNo ratings yet

- M16 FA Deepal SolankiDocument20 pagesM16 FA Deepal SolankiUlpesh SolankiNo ratings yet

- Wipro Consolidated Profit & Loss Account - in Rs. Cr.Document2 pagesWipro Consolidated Profit & Loss Account - in Rs. Cr.Anuj GandhiNo ratings yet

- Nations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118Document19 pagesNations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118haffaNo ratings yet

- Idea ConsolidatedDocument26 pagesIdea ConsolidatedSheetal AhluwaliaNo ratings yet

- Yearly Results of Hero MotocorpDocument2 pagesYearly Results of Hero MotocorpNeha SamantNo ratings yet

- Tata Consultancy Services Standalone Profit & Loss Account - in Rs. Cr.Document2 pagesTata Consultancy Services Standalone Profit & Loss Account - in Rs. Cr.lalitkumar kalaskarNo ratings yet

- Financial Status of The CompanyDocument5 pagesFinancial Status of The Companyankit_shri19No ratings yet

- UltraTech Cement Ltd Profit & Loss Analysis 2013-2004Document3 pagesUltraTech Cement Ltd Profit & Loss Analysis 2013-2004SharmashDNo ratings yet

- Profit LossDocument9 pagesProfit LossAnshika AgarwalNo ratings yet

- FM Term PaperDocument20 pagesFM Term Paperjagpal singhNo ratings yet

- Mahind Ra and Mahind Ra Consolid Ated Profit & Loss Account - in Rs. Cr.Document37 pagesMahind Ra and Mahind Ra Consolid Ated Profit & Loss Account - in Rs. Cr.Ashwini MahaleNo ratings yet

- Profit and Loss and Balance Sheet of Idbi BankDocument11 pagesProfit and Loss and Balance Sheet of Idbi BankHarjeet KaurNo ratings yet

- Horizontal AnalysisDocument4 pagesHorizontal AnalysisAnkit RaiNo ratings yet

- BHEL Balance Sheet and Profit & Loss SummaryDocument22 pagesBHEL Balance Sheet and Profit & Loss SummaryRam Krishna KrishNo ratings yet

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012No ratings yet

- Balance Sheet of Reliance IndustriesDocument10 pagesBalance Sheet of Reliance IndustriesSatyajeet ChauhanNo ratings yet

- Afs SteelDocument21 pagesAfs SteelAnkit AgarwalNo ratings yet

- P&L Consolidated - Blue Dart ExpressDocument4 pagesP&L Consolidated - Blue Dart ExpressNitish BawejaNo ratings yet

- HindalcoDocument3 pagesHindalcoKush AggarwalNo ratings yet

- Financial Analysis and Ratio Comparison of Company for FY 2012 and FY 2011Document12 pagesFinancial Analysis and Ratio Comparison of Company for FY 2012 and FY 2011Shadab AshfaqNo ratings yet

- Comman Size Analysis of Income StatementDocument11 pagesComman Size Analysis of Income Statement4 7No ratings yet

- Tata Motors Financial Report 2002-2006Document1 pageTata Motors Financial Report 2002-2006Hemanga PathakNo ratings yet

- Business Analyis Report - ChaturthiDocument2 pagesBusiness Analyis Report - ChaturthiRavi Pratap Singh TomarNo ratings yet

- Weighted ComaniesDocument58 pagesWeighted ComaniesrotiNo ratings yet

- Consolidated Balance Sheet of Reliance Industries: - in Rs. Cr.Document58 pagesConsolidated Balance Sheet of Reliance Industries: - in Rs. Cr.rotiNo ratings yet

- Guj AlkaliDocument8 pagesGuj AlkalirotiNo ratings yet

- Balance Sheet of Gujarat Alkalies and ChemicalsDocument8 pagesBalance Sheet of Gujarat Alkalies and ChemicalsrotiNo ratings yet

- Gujarat Alkalies and Chemicals Balance Sheet AnalysisDocument8 pagesGujarat Alkalies and Chemicals Balance Sheet AnalysisrotiNo ratings yet

- Havells Balance Sheet (4 Years)Document15 pagesHavells Balance Sheet (4 Years)Tamoghna MaitraNo ratings yet

- Balan Ce Sheet of Tata Steel: - in Rs. Cr.Document18 pagesBalan Ce Sheet of Tata Steel: - in Rs. Cr.Mukesh PandeyNo ratings yet

- SML Isuzu Financial Statement Analysis Reveals Sales and Profit GrowthDocument15 pagesSML Isuzu Financial Statement Analysis Reveals Sales and Profit GrowthDeepalNo ratings yet

- Balance Sheet of Amara Raja BatteriesDocument11 pagesBalance Sheet of Amara Raja Batteriesashishgrover80No ratings yet

- Introduction L&T FinalDocument31 pagesIntroduction L&T Finaltushar kumarNo ratings yet

- BMW Group reports net profit of €5.3 billionDocument8 pagesBMW Group reports net profit of €5.3 billionaudit202No ratings yet

- HCL Technologies: Balance Sheet - in Rs. Cr.Document20 pagesHCL Technologies: Balance Sheet - in Rs. Cr.Kuldeep SinghNo ratings yet

- IntroductionDocument2 pagesIntroductionMerline AnthonyNo ratings yet

- Seminar on Accounting Theory and PracticeDocument13 pagesSeminar on Accounting Theory and PracticeDEEPALI ANANDNo ratings yet

- Ratios of HDFC BankDocument50 pagesRatios of HDFC BankrupaliNo ratings yet

- Pradeep ProfitDocument9 pagesPradeep ProfitPradeep TiwariNo ratings yet

- Management Accounting Profit & Loss AnalysisDocument17 pagesManagement Accounting Profit & Loss AnalysisVaibhav ShahNo ratings yet

- Ashok Leyland LTD Industry:Automobiles - Lcvs/HcvsDocument3 pagesAshok Leyland LTD Industry:Automobiles - Lcvs/HcvsNitish BawejaNo ratings yet

- Ashok LeylandDocument13 pagesAshok LeylandNeha GuptaNo ratings yet

- Page 32 - P&L AnnexureDocument1 pagePage 32 - P&L AnnexureKelly GandhiNo ratings yet

- Tata Consultancy Services LTD: Profit and Loss AccountDocument4 pagesTata Consultancy Services LTD: Profit and Loss AccountHiren SutariyaNo ratings yet

- Profit & Loss: Velka Engineering LTDDocument10 pagesProfit & Loss: Velka Engineering LTDparthsavaniNo ratings yet

- Onsolidated Balance Sheet of Jet Airways - in Rs. Cr.Document11 pagesOnsolidated Balance Sheet of Jet Airways - in Rs. Cr.Anuj SharmaNo ratings yet

- Tesla 2018 Production ForecastDocument61 pagesTesla 2018 Production ForecastAYUSH SHARMANo ratings yet

- CR AssignmentDocument16 pagesCR AssignmentWaleed KhalidNo ratings yet

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqNo ratings yet

- Test and Exam Qs Topic 2 QuestionsDocument15 pagesTest and Exam Qs Topic 2 QuestionsAsadvirkNo ratings yet

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Indirect Tax 2Document35 pagesIndirect Tax 2lowell789No ratings yet

- Indirect Tax1Document42 pagesIndirect Tax1lowell789No ratings yet

- TTPDocument2 pagesTTPlowell789No ratings yet

- Indian Textile Industry: Higher Standards............ Making A Difference For YouDocument18 pagesIndian Textile Industry: Higher Standards............ Making A Difference For YouRaj KumarNo ratings yet

- Off-Loading and Priority ManagementDocument22 pagesOff-Loading and Priority Managementlowell789No ratings yet

- Athishi CaseDocument4 pagesAthishi Caselowell789No ratings yet

- Project On Customer Satisfaction Towards Mobile Service ProvidersDocument992 pagesProject On Customer Satisfaction Towards Mobile Service Providerslowell789No ratings yet

- SwitchDocument10 pagesSwitchlowell789No ratings yet