Professional Documents

Culture Documents

Yearly Results of Hero Motocorp

Uploaded by

Neha SamantCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yearly Results of Hero Motocorp

Uploaded by

Neha SamantCopyright:

Available Formats

Yearly Results of Hero Motocorp

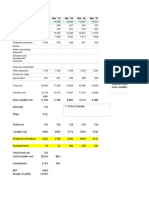

Net Sales/Income from operations

Other Operating Income

Total Income From Operations

------------------- in Rs. Cr. -------------------

Mar '13

Mar '12

Mar '11

Mar '10

Mar '09

23,582.74

23,368.05

19,245.03

15,860.51

12,356.88

185.37

210.98

156.12

--

--

23,768.11

23,579.03

19,401.15

--

--

17,364.86

17,365.41

14,135.17

10,730.41

8,760.22

--

--

--

--

--

32.80

-83.84

-24.06

5.95

-18.21

EXPENDITURE

Consumption of Raw Materials

Purchase of Traded Goods

Increase/Decrease in Stocks

Power & Fuel

Employees Cost

Depreciation

--

--

--

--

--

820.92

735.52

618.95

560.32

448.65

1,141.75

1,097.34

402.38

191.47

180.66

Excise Duty

--

--

--

--

--

Admin. And Selling Expenses

--

--

--

--

--

R & D Expenses

--

--

--

--

--

Provisions And Contingencies

--

--

--

--

--

Exp. Capitalised

--

--

--

--

--

Other Expenses

2,265.05

1,943.16

2,054.10

1,796.88

1,416.70

P/L Before Other Inc. , Int., Excpt. Items & Tax

2,142.73

2,521.44

2,214.61

--

--

398.38

364.57

268.14

235.63

180.92

2,541.11

2,886.01

2,482.75

--

--

11.91

21.30

-1.85

-20.62

-31.68

2,529.20

2,864.71

2,484.60

2,831.73

1,781.46

--

--

--

--

--

2,529.20

2,864.71

2,484.60

--

--

411.04

486.58

476.86

599.90

499.70

Other Income

P/L Before Int., Excpt. Items & Tax

Interest

P/L Before Exceptional Items & Tax

Exceptional Items

P/L Before Tax

Tax

P/L After Tax from Ordinary Activities

2,118.16

2,378.13

2,007.74

--

--

Prior Year Adjustments

--

--

--

--

--

Extra Ordinary Items

--

--

-79.84

--

--

2,118.16

2,378.13

1,927.90

2,231.83

1,281.76

Net Profit/(Loss) For the Period

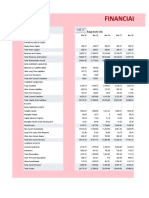

Equity Share Capital

39.94

39.94

39.94

39.94

39.94

4,966.30

42.50

2,916.12

3,425.08

3,760.81

--

--

--

--

1,000.00

Basic EPS

106.07

119.09

100.53

--

--

Diluted EPS

106.07

119.09

100.53

--

--

Basic EPS

106.07

119.09

96.54

--

--

Diluted EPS

106.07

119.09

96.54

--

--

Reserves Excluding Revaluation Reserves

Equity Dividend Rate (%)

EPS Before Extra Ordinary

EPS After Extra Ordinary

Public Share Holding

No Of Shares (Crores)

9.54

9.54

9.05

8.99

8.99

47.79

47.79

47.79

45.04

45.04

- Number of shares (Crores)

--

0.32

4.42

--

--

- Per. of shares (as a % of the total sh. of prom. and promoter group)

--

3.07

42.44

--

--

- Per. of shares (as a % of the total Share Cap. of the company)

--

1.61

22.16

--

--

10.43

10.11

6.00

--

--

100.00

96.93

57.56

--

--

Share Holding (%)

Promoters and Promoter Group Shareholding

a) Pledged/Encumbered

b) Non-encumbered

- Number of shares (Crores)

- Per. of shares (as a % of the total sh. of prom. and promoter group)

- Per. of shares (as a % of the total Share Cap. of the company)

52.21

50.60

30.05

--

You might also like

- Blue Chip CompaniesDocument7 pagesBlue Chip CompaniesgopanollavenkatNo ratings yet

- CSDCVDVDVDFVDocument12 pagesCSDCVDVDVDFVlakshita1234No ratings yet

- Print FinancialsDocument2 pagesPrint Financialssourav.upadhyay0304No ratings yet

- Tata Steel: Dion Global Solutions LimitedDocument2 pagesTata Steel: Dion Global Solutions LimitedMukesh ManwaniNo ratings yet

- Yearly Results of Bharti AirtelDocument1 pageYearly Results of Bharti AirteljatinkakkarNo ratings yet

- Dabur India Ltd.Document1 pageDabur India Ltd.Pushpa ShettiyarNo ratings yet

- Mar '12 Mar '11 Mar '10 Mar '09 Mar '08Document4 pagesMar '12 Mar '11 Mar '10 Mar '09 Mar '08Jack DowsonNo ratings yet

- Bharti Airtel LTDDocument7 pagesBharti Airtel LTDNanvinder SinghNo ratings yet

- Profit & Loss Account of Idea Cellular - in Rs. Cr.Document3 pagesProfit & Loss Account of Idea Cellular - in Rs. Cr.lowell789No ratings yet

- Balance Sheet of Tata SteelDocument9 pagesBalance Sheet of Tata SteelsahumonikaNo ratings yet

- Maruti Suzuki India LTD 03Document5 pagesMaruti Suzuki India LTD 03sidhantbehl17No ratings yet

- Seminar on Accounting Theory and PracticeDocument13 pagesSeminar on Accounting Theory and PracticeDEEPALI ANANDNo ratings yet

- Asian Paints: Previous YearsDocument8 pagesAsian Paints: Previous YearsKarthik RaviNo ratings yet

- Jhanvi Shah 2012 CF PresentationDocument12 pagesJhanvi Shah 2012 CF PresentationJhanvi ShahNo ratings yet

- Idea Cellular: Previous YearsDocument4 pagesIdea Cellular: Previous YearsParvez AnsariNo ratings yet

- Tata Motors Consolidated Profit & LossDocument2 pagesTata Motors Consolidated Profit & Lossprathamesh tawareNo ratings yet

- Hero Motocorp Profit & LossDocument2 pagesHero Motocorp Profit & LossPhuntru PhiNo ratings yet

- Balance Sheet of Hero Motocorp - in Rs. Cr.Document16 pagesBalance Sheet of Hero Motocorp - in Rs. Cr.Khushboo VishwakarmaNo ratings yet

- HindalcoDocument3 pagesHindalcoKush AggarwalNo ratings yet

- Weighted ComaniesDocument58 pagesWeighted ComaniesrotiNo ratings yet

- Consolidated Balance Sheet of Reliance Industries: - in Rs. Cr.Document58 pagesConsolidated Balance Sheet of Reliance Industries: - in Rs. Cr.rotiNo ratings yet

- Wipro P&L AccDocument12 pagesWipro P&L AccSwati PahujaNo ratings yet

- GVK Power & Infrastructure: Fuel and Leverage ConcernsDocument6 pagesGVK Power & Infrastructure: Fuel and Leverage ConcernsOmkar BibikarNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsAakash AakashNo ratings yet

- Mahind Ra and Mahind Ra Consolid Ated Profit & Loss Account - in Rs. Cr.Document37 pagesMahind Ra and Mahind Ra Consolid Ated Profit & Loss Account - in Rs. Cr.Ashwini MahaleNo ratings yet

- Profit &loss Acc of LibertyDocument2 pagesProfit &loss Acc of LibertyasqwdferNo ratings yet

- Maruti Suzuki India LTDDocument17 pagesMaruti Suzuki India LTDAmma AppaNo ratings yet

- Financial HighlightsDocument1 pageFinancial HighlightsAhmed SiddNo ratings yet

- Balance Sheet of Adani Power: - in Rs. Cr.Document7 pagesBalance Sheet of Adani Power: - in Rs. Cr.bpn89No ratings yet

- Quarterly Results in BriefDocument7 pagesQuarterly Results in BriefNaveenSharmaNo ratings yet

- Reliance Industries: Previous YearsDocument6 pagesReliance Industries: Previous YearsSweta ChakravartyNo ratings yet

- HPCL Audited Results31Mar2013Document1 pageHPCL Audited Results31Mar2013Pranav DesaiNo ratings yet

- Income Statement of Mahaweli Reach HotelDocument7 pagesIncome Statement of Mahaweli Reach Hotelदेवीना गिरीNo ratings yet

- Final Project Report - Excel SheetDocument24 pagesFinal Project Report - Excel SheetrajeshNo ratings yet

- Company Net Sales Gross Profit Amara Raja Gabriel India ZF Steering Bharat Gear JMT AutoDocument52 pagesCompany Net Sales Gross Profit Amara Raja Gabriel India ZF Steering Bharat Gear JMT AutoShailesh DwivediNo ratings yet

- PR-444-EGH-Unaudited-Financial-Statements-for-the-third-quarter-ending-September-30-2020.Document8 pagesPR-444-EGH-Unaudited-Financial-Statements-for-the-third-quarter-ending-September-30-2020.kwekuahenakwahNo ratings yet

- IntroductionDocument2 pagesIntroductionMerline AnthonyNo ratings yet

- ANNEXDocument4 pagesANNEXA Wahid KemalNo ratings yet

- $tsla: RevenueDocument15 pages$tsla: RevenuePrabhdeep DadyalNo ratings yet

- Financial Status of The CompanyDocument5 pagesFinancial Status of The Companyankit_shri19No ratings yet

- ACC Consolidated Balance Sheet and Profit & Loss Analysis 2010-2006Document14 pagesACC Consolidated Balance Sheet and Profit & Loss Analysis 2010-2006Vaishnavi KrushakthiNo ratings yet

- Tata Motors Financial Report 2002-2006Document1 pageTata Motors Financial Report 2002-2006Hemanga PathakNo ratings yet

- Balance Sheet of Amara Raja BatteriesDocument11 pagesBalance Sheet of Amara Raja Batteriesashishgrover80No ratings yet

- UltraTech Cement Ltd Profit & Loss Analysis 2013-2004Document3 pagesUltraTech Cement Ltd Profit & Loss Analysis 2013-2004SharmashDNo ratings yet

- Maruti Suzuki India LTDDocument8 pagesMaruti Suzuki India LTDRushikesh PawarNo ratings yet

- Jamna Auto Industries Limited Unaudited ResultsDocument4 pagesJamna Auto Industries Limited Unaudited ResultspoloNo ratings yet

- Financial Analysis of HulDocument1 pageFinancial Analysis of HulaparnaaiyengarNo ratings yet

- MahindraDocument5 pagesMahindraworkf17hoursformeNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print Financials0096 Sree Harsha VardhanNo ratings yet

- Ecobank Ghana PLC: Un-Audited Financial Statements For The Nine-Month Period Ended 30 September 2021Document8 pagesEcobank Ghana PLC: Un-Audited Financial Statements For The Nine-Month Period Ended 30 September 2021Fuaad DodooNo ratings yet

- CR AssignmentDocument16 pagesCR AssignmentWaleed KhalidNo ratings yet

- VineetAg FADocument10 pagesVineetAg FAVineet AgarwalNo ratings yet

- Calculations of OGDCL by Safdar, Safi Ullah, Muhamad AminDocument39 pagesCalculations of OGDCL by Safdar, Safi Ullah, Muhamad AminSaeed Ahmed (Father Name:Jamal Ud Din)No ratings yet

- Chennab LIMITED: Profit and Loss AccountDocument10 pagesChennab LIMITED: Profit and Loss AccountHafizUmarArshadNo ratings yet

- Horizontal AnalysisDocument4 pagesHorizontal AnalysisAnkit RaiNo ratings yet

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012No ratings yet

- Financial Statement 2010-11Document64 pagesFinancial Statement 2010-11Fazal4822No ratings yet

- Operations Research Group Report: Dea AnalysisDocument21 pagesOperations Research Group Report: Dea AnalysisVaibh SinghNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Brake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryFrom EverandBrake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Status Indian Auto IndustryDocument28 pagesStatus Indian Auto IndustryNeha SamantNo ratings yet

- Overview of Indian Consumer Durables MarketDocument8 pagesOverview of Indian Consumer Durables MarketNeha SamantNo ratings yet

- Challenges and Opportunities of FMCD in Rural MarketingDocument1 pageChallenges and Opportunities of FMCD in Rural MarketingNeha SamantNo ratings yet

- Global Bicycles Market To Reach Value ofDocument1 pageGlobal Bicycles Market To Reach Value ofNeha SamantNo ratings yet

- Challenges and Opportunities of FMCD in Rural MarketingDocument1 pageChallenges and Opportunities of FMCD in Rural MarketingNeha SamantNo ratings yet

- JB Advocacy Mar07Document30 pagesJB Advocacy Mar07Neha SamantNo ratings yet

- Cycle IndustryDocument10 pagesCycle IndustryNeha SamantNo ratings yet