Professional Documents

Culture Documents

Hindalco

Uploaded by

Kush AggarwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hindalco

Uploaded by

Kush AggarwalCopyright:

Available Formats

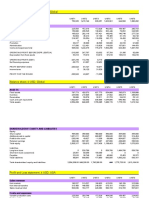

Hindalco(Aluminium Industry)

Sales

Other income

Mar ' 11

Mar ' 10

Mar ' 09

Mar ' 08

Mar ' 07

23,859

19,536

18,220

19,201

18,313

317

260

637

493

370

-395

-755

521

-133

-443

15,531

13,226

10,426

12,047

11,078

Power and fuel

2,221

1,938

2,232

1,911

1,849

Employee expenses

1,040

878

668

621

520

Research and

development

expenses

Expenses capitalised

1,753

1,300

1,338

1,353

1,294

687

667

645

588

638

Total cost

20,839

17,254

15,829

16,388

14,936

Variable cost

15,136

12,470

10,947

11,915

10,636

Semi variable cost

63%

5,703

4,783

4,882

4,473

4,300

Stock adjustment

Raw material

Excise

Admin and selling

expenses

Other expenses

Provisions made

Depreciation

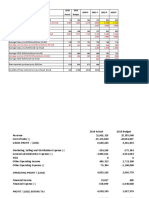

Y=723+0.21xSales

Intercept

723

Slope

0.21

Fixed cost

723

723

723

723

723

4940

4045

3772

3976

3792

Predicted Y(Predicted semivariable

5663 cost)

4768

4496

4699

4515

386

-226

-215

Variable cost

Standard error

39

15

Total Fixed cost

Total Variable cost

723

20116

84%

Contribution

3,743

16%

BEP

Margin of safety

4610

19,249

Sales are the independent Variable

Semi variable cost =Y

MOS %

418%

are the independent Variable

mi variable cost =Y

You might also like

- Straight Through Processing for Financial Services: The Complete GuideFrom EverandStraight Through Processing for Financial Services: The Complete GuideNo ratings yet

- TSLADocument23 pagesTSLAtlarocca1No ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Profit & Loss Account of Idea Cellular - in Rs. Cr.Document3 pagesProfit & Loss Account of Idea Cellular - in Rs. Cr.lowell789No ratings yet

- Yearly Results of Hero MotocorpDocument2 pagesYearly Results of Hero MotocorpNeha SamantNo ratings yet

- TRIAL BALANCE 2022 pt2Document1 pageTRIAL BALANCE 2022 pt2mafumbojackson683No ratings yet

- Sample Assumption For Strategic Management PaperDocument2 pagesSample Assumption For Strategic Management PaperDaniela AubreyNo ratings yet

- Tesla Inc ModelDocument57 pagesTesla Inc ModelRachel GreeneNo ratings yet

- Produksi AndesitDocument6 pagesProduksi AndesitRizki AmaliaNo ratings yet

- GSK Financial FiguresDocument35 pagesGSK Financial FiguresKalenga CyrilleNo ratings yet

- Results Round 1,2-2Document68 pagesResults Round 1,2-2Parth MalikNo ratings yet

- Book 1Document2 pagesBook 1ggi2022.1928No ratings yet

- Attok Petroroleum AnalysisDocument44 pagesAttok Petroroleum Analysisfareed608No ratings yet

- 5 EstadosDocument15 pages5 EstadosHenryRuizNo ratings yet

- Mar ' 14 Mar ' 13 Mar ' 12 Mar ' 11Document2 pagesMar ' 14 Mar ' 13 Mar ' 12 Mar ' 11sauravv7No ratings yet

- EPCL Financial Model CY22Document87 pagesEPCL Financial Model CY22Umer FarooqNo ratings yet

- Tesla Company AnalysisDocument83 pagesTesla Company AnalysisStevenTsaiNo ratings yet

- Tesla Inc Unsolved Model 330PMDocument61 pagesTesla Inc Unsolved Model 330PMAYUSH SHARMANo ratings yet

- TeslaDocument5 pagesTeslaRajib ChatterjeeNo ratings yet

- Group 2 RSRMDocument13 pagesGroup 2 RSRMAbid Hasan RomanNo ratings yet

- Profit and Loss Account: Budget 2007-2008: (Rs. in Lakhs)Document8 pagesProfit and Loss Account: Budget 2007-2008: (Rs. in Lakhs)grimm312No ratings yet

- Round 2Document68 pagesRound 2fereNo ratings yet

- Jet Airways (India) LTD Industry:Transport - AirlinesDocument4 pagesJet Airways (India) LTD Industry:Transport - AirlinesNitish BawejaNo ratings yet

- Crgo VS AmdtDocument2 pagesCrgo VS AmdtPradeep KonapoorNo ratings yet

- ACT3301 19202 Assgmt Excel FS RealMax@1Apr20Document8 pagesACT3301 19202 Assgmt Excel FS RealMax@1Apr20Trick1 HahaNo ratings yet

- Anx 1 Unaudited Financial Results For Quarter 30th September 2023Document12 pagesAnx 1 Unaudited Financial Results For Quarter 30th September 2023ranjana.verma6No ratings yet

- Financial Statement Analysis UnsolvedDocument3 pagesFinancial Statement Analysis Unsolvedavani singhNo ratings yet

- Trading Summary by Industry Classification - Sep 2023Document2 pagesTrading Summary by Industry Classification - Sep 2023Ayu ArdianaNo ratings yet

- Horizontal AnalysisDocument4 pagesHorizontal AnalysisAnkit RaiNo ratings yet

- Universe 18Document70 pagesUniverse 18fereNo ratings yet

- Ashok LeylandDocument27 pagesAshok LeylandBerkshire Hathway coldNo ratings yet

- Ultratech Cement LTD Industry:Cement - Major - North IndiaDocument3 pagesUltratech Cement LTD Industry:Cement - Major - North IndiaSharmashDNo ratings yet

- Quice Foods Industries LTDDocument4 pagesQuice Foods Industries LTDOsama RiazNo ratings yet

- Statement of Income and ExpenditureDocument4 pagesStatement of Income and Expendituredeevik thiranNo ratings yet

- Financial HighlightsDocument1 pageFinancial HighlightsAhmed SiddNo ratings yet

- Maruti Suzuki India LTD 03Document5 pagesMaruti Suzuki India LTD 03sidhantbehl17No ratings yet

- 8.+opex BeforeDocument45 pages8.+opex BeforeThe SturdyTubersNo ratings yet

- .+Energy+and+Other+gross+profit AfterDocument41 pages.+Energy+and+Other+gross+profit AfterAkash ChauhanNo ratings yet

- 2.+average+of+price+models BeforeDocument23 pages2.+average+of+price+models BeforeMuskan AroraNo ratings yet

- 6.+Energy+and+Other+revenue BeforeDocument37 pages6.+Energy+and+Other+revenue BeforeThe SturdyTubersNo ratings yet

- 6.+Energy+and+Other+Revenue AfterDocument37 pages6.+Energy+and+Other+Revenue AftervictoriaNo ratings yet

- Solution Manual For Essentials of MIS 12th Edition by Laudon ISBN 0134238249 9780134238241Document36 pagesSolution Manual For Essentials of MIS 12th Edition by Laudon ISBN 0134238249 9780134238241jefferyscottixqyarfkbm100% (20)

- FS For ACC 226 Competency AssessmentDocument2 pagesFS For ACC 226 Competency Assessmentriclyde cahucomNo ratings yet

- Pragathi Infra - Financial StatementDocument3 pagesPragathi Infra - Financial StatementAnurag ShuklaNo ratings yet

- Income Statement: (RS.) : Net Sales: 2009 2008 Less: Sales Tax 42,387,502 33,148,455Document6 pagesIncome Statement: (RS.) : Net Sales: 2009 2008 Less: Sales Tax 42,387,502 33,148,455Hamza AsadNo ratings yet

- Blue Chip CompaniesDocument7 pagesBlue Chip CompaniesgopanollavenkatNo ratings yet

- Monthly Average Services Production - Ton (Sillicon A1+A2) : 2020 P 2021 P 2022 P 2023 P 2018 Actual 2019 BudgetDocument12 pagesMonthly Average Services Production - Ton (Sillicon A1+A2) : 2020 P 2021 P 2022 P 2023 P 2018 Actual 2019 Budgetlidia_396516605No ratings yet

- Financial+Statement+Analysis SolvedDocument5 pagesFinancial+Statement+Analysis SolvedMary JoyNo ratings yet

- Session 33-34 Meralco Student Spreadsheet - 1556507703Document31 pagesSession 33-34 Meralco Student Spreadsheet - 1556507703Alexander Jason LumantaoNo ratings yet

- National Foods by Saqib LiaqatDocument14 pagesNational Foods by Saqib LiaqatAhmad SafiNo ratings yet

- Analysis of Financial Statements: Bs-Ba 6Document13 pagesAnalysis of Financial Statements: Bs-Ba 6Saqib LiaqatNo ratings yet

- W18826 XLS EngDocument11 pagesW18826 XLS EngNini HuanachinNo ratings yet

- LSM - Assignment 1 - Hindalco+JindalDocument28 pagesLSM - Assignment 1 - Hindalco+JindalRishab KatariaNo ratings yet

- ASP - PNL2022 - MAY 2023-RevisedDocument47 pagesASP - PNL2022 - MAY 2023-RevisedIan Jasper NamocNo ratings yet

- Income Statements For Group and SegmentsDocument6 pagesIncome Statements For Group and SegmentsedNo ratings yet

- Excel - 13132110014 - Draft Paper Individu - FNT 4A-1Document53 pagesExcel - 13132110014 - Draft Paper Individu - FNT 4A-1Ferian PhungkyNo ratings yet

- VineetAg FADocument10 pagesVineetAg FAVineet AgarwalNo ratings yet

- Maruti Suzuki India LTDDocument17 pagesMaruti Suzuki India LTDAmma AppaNo ratings yet

- WAPO 2019 Final Draft XXXDocument229 pagesWAPO 2019 Final Draft XXXRenatus shijaNo ratings yet

- Activity ExcelDocument1 pageActivity ExcelJoshua GuinauliNo ratings yet