Professional Documents

Culture Documents

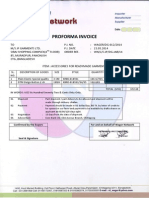

Particulars No. of BOX No. of Cartons PCS./KG. PER Carton Total QTY PCS./KG. Rate Per 1000 PCS./KG. Assessable Value Excise Duty Total Value

Uploaded by

swap1519890 ratings0% found this document useful (0 votes)

8 views1 pageThis invoice summarizes the transportation of goods from 7 Hills to PADI Chennai. It includes details of the transporter, excisable goods as super LH sheets, customer and consignee names and addresses, quantities transported consisting of 1 box and 1 carton with a total of 120 kg, applicable rates and taxes, and a grand total of Rs. 2,172.02. It was issued on September 19, 2012 at 2:08 AM and signed by an authorized representative of D & H India Limited.

Original Description:

Original Title

Swap TaxInv

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis invoice summarizes the transportation of goods from 7 Hills to PADI Chennai. It includes details of the transporter, excisable goods as super LH sheets, customer and consignee names and addresses, quantities transported consisting of 1 box and 1 carton with a total of 120 kg, applicable rates and taxes, and a grand total of Rs. 2,172.02. It was issued on September 19, 2012 at 2:08 AM and signed by an authorized representative of D & H India Limited.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageParticulars No. of BOX No. of Cartons PCS./KG. PER Carton Total QTY PCS./KG. Rate Per 1000 PCS./KG. Assessable Value Excise Duty Total Value

Uploaded by

swap151989This invoice summarizes the transportation of goods from 7 Hills to PADI Chennai. It includes details of the transporter, excisable goods as super LH sheets, customer and consignee names and addresses, quantities transported consisting of 1 box and 1 carton with a total of 120 kg, applicable rates and taxes, and a grand total of Rs. 2,172.02. It was issued on September 19, 2012 at 2:08 AM and signed by an authorized representative of D & H India Limited.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

INVOICE NO : CHALLAN NO :

DATE : 18-Sep-2012 DATE :

PARTY ORDER No : PARTY ORDER DATE : DATE & TIME REMOVAL :

7 HILLS - 654 18-Sep-2012

19-Sep-12 2:08:05AM

Name of The Transporter

Name of Excisable Goods

Customer Name

7 HILLS

Consignee Name L. R. NO. : Vehicle No. : Address

Chapter No

Tarrif Sub Heading Address :

Freight : Terms of Payment

Rate of Duty BED @ G. Ex. Regd No. P. L. A. No. : RANGE DIVISION PAN No. : : :

PADI CHENNAI NO.732M.T.H.ROAD PAID CHENNAI-600 050 India

Documents Sent Through CST NO. : S. T. NO. : E. C. C. NO.:

PARTICULARS NO. OF BOX NO. OF CARTONS

20251014 DT. 28.7.64

CST NO. : S. T. NO. : E. C. C. NO. :

PCS./KG. PER CARTON TOTAL QTY PCS./KG. RATE PER 1000 PCS./KG. ASSESSABLE VALUE EXCISE DUTY TOTAL VALUE

E. C. C. No. :

L. R. / Name :

SUPER LH 6.30 X 450 SUPER LH 3.00 X 350

1 1

4 4

30 30

120.00 120.00

370.80 648.00

370.80 648.00

Total

CESS DUTY @2% O Excies Duty (In Words) : H & S CESS @1% LOCAL FREIGHT & CART. Cess Duty (In Words) : TOTAL TAX -.2% AGAINST FORM C H & S.Cess Duty (In Words) : ROUNDING OFF

GRAND TOTAL

Total Value (in words) :

Rs. Two Thousand One Hundred Seventy-Two And Paise Two Only

2,172.02

Date & Time of Issue :

19-Sep-12

2:08:05AM

TIN No. : TERMS & CONDITIONS :

For D & H INDIA LIMITED

Authorised Signatory

You might also like

- Stores FormsDocument55 pagesStores FormsJitendraNo ratings yet

- Purchase Order 754087Document1 pagePurchase Order 754087Elmer HarrisNo ratings yet

- Vision RX Lab Canada Inc.,: InvoiceDocument1 pageVision RX Lab Canada Inc.,: InvoicearmaniNo ratings yet

- Government of Andhra Pradesh C.T.Department: Form of Way Bill Form X or Form 600Document3 pagesGovernment of Andhra Pradesh C.T.Department: Form of Way Bill Form X or Form 600abdulkhaderjeelani1450% (2)

- Icpo TDLDocument2 pagesIcpo TDLMustolih MusNo ratings yet

- InvoiceDocument2 pagesInvoiceThejaswini ChalapathiNo ratings yet

- Documents For ExportDocument26 pagesDocuments For Exportnatrajang100% (1)

- Purchase Order NoDocument1 pagePurchase Order NoSourav MaitraNo ratings yet

- Bill of Lading: See Attached PageDocument5 pagesBill of Lading: See Attached PageRohitava SahaNo ratings yet

- Print ReportDocument1 pagePrint ReportRohitava SahaNo ratings yet

- Invoice FormatDocument1 pageInvoice FormatMohitaGupta0% (1)

- Blank Bill of Lading (BOL) FormDocument1 pageBlank Bill of Lading (BOL) FormdonsterthemonsterNo ratings yet

- Invoice 4875062232Document1 pageInvoice 4875062232Gaurav SharmaNo ratings yet

- Invoice: 5, Perira Street TuticorinDocument3 pagesInvoice: 5, Perira Street TuticorinParani RajNo ratings yet

- Government of Andhra Pradesh C.T.Department: Form of Way Bill Form X or Form 600Document3 pagesGovernment of Andhra Pradesh C.T.Department: Form of Way Bill Form X or Form 600Arjun B Menon100% (1)

- 8fa FormatDocument2 pages8fa FormatvarunNo ratings yet

- Sravya InvoiceDocument1 pageSravya InvoicenatassidogNo ratings yet

- At 60 Days After Shipment Date Rotterdam, The NetherlandsDocument3 pagesAt 60 Days After Shipment Date Rotterdam, The NetherlandsNinson KMNo ratings yet

- Form Logistics - BlankDocument7 pagesForm Logistics - BlankGendon LgazNo ratings yet

- Dolphin Polymers - InvoiceDocument2 pagesDolphin Polymers - InvoiceBhaskar Teja AtluriNo ratings yet

- Provincial Enterprises02ddDocument1 pageProvincial Enterprises02ddSanjay PatelNo ratings yet

- Ship From: Grand TotalDocument2 pagesShip From: Grand TotalDian Ayu PuspitasariNo ratings yet

- 8/8/09 Sears BatteryDocument1 page8/8/09 Sears BatteryVan Der KokNo ratings yet

- 001 - 2011-12, Excisedt.02.04.2011Document1 page001 - 2011-12, Excisedt.02.04.2011Hasan Babu KothaNo ratings yet

- Purchase Order: Beside-Praful Eng., Nr. Shreenathji Haveli, Laxminagar Main Road, Rajkot-360004Document4 pagesPurchase Order: Beside-Praful Eng., Nr. Shreenathji Haveli, Laxminagar Main Road, Rajkot-360004vishal kalariyaNo ratings yet

- Mit Company Inc.: Purchase Request SlipDocument5 pagesMit Company Inc.: Purchase Request SlipIke Mag-away GaamilNo ratings yet

- Carborundum Universal Limited: Order AcknowledgementDocument1 pageCarborundum Universal Limited: Order AcknowledgementVinu RajNo ratings yet

- Prpform For Ptwde A11re5Document3 pagesPrpform For Ptwde A11re5Irfan GhanchiNo ratings yet

- Invoice: Place of Receipt by Pre Carrier Vessel /flight No. Port of LordingDocument2 pagesInvoice: Place of Receipt by Pre Carrier Vessel /flight No. Port of LordingRaj SharmaNo ratings yet

- JaipurDocument1 pageJaipurMeena ChouhanNo ratings yet

- Waybill Details FORMAT 2015Document6 pagesWaybill Details FORMAT 2015Vaibhav SrivastavaNo ratings yet

- LR 0008 BesDocument3 pagesLR 0008 Besdeepuanshu123asNo ratings yet

- 20140527090800Document2 pages20140527090800Minhaz UddinNo ratings yet

- Tax Invoice: Customer Details Vehicle DetailsDocument1 pageTax Invoice: Customer Details Vehicle DetailsSanjay PatelNo ratings yet

- Willow OfferDocument2 pagesWillow OfferSarkarArdhenduRiponNo ratings yet

- ResultDocument3 pagesResultRT Sport SNo ratings yet

- Savo 1Document1 pageSavo 1ankitkg88No ratings yet

- MS 54 Egystone Green Marble and Ab Black Performa Invoice 19 November 2013Document2 pagesMS 54 Egystone Green Marble and Ab Black Performa Invoice 19 November 2013Hager EhabNo ratings yet

- Freshtex Orient Craft LTD: Request For Payment of Expenses / ImprestDocument6 pagesFreshtex Orient Craft LTD: Request For Payment of Expenses / ImprestsameershedgeNo ratings yet

- Ma No GlobeDocument3 pagesMa No GlobeawadnajilpNo ratings yet

- ChallanDocument1 pageChallanGopal KrishanNo ratings yet

- Government of Andhra Pradesh C.T.Department: Form of Way Bill Form X or Form 600Document3 pagesGovernment of Andhra Pradesh C.T.Department: Form of Way Bill Form X or Form 600ChakrNo ratings yet

- Pi PDFDocument1 pagePi PDFJoshua ThorntonNo ratings yet

- Proforma InvoiceDocument1 pageProforma InvoiceRussell KhanNo ratings yet

- DAR 14 Auguest 2014 KPK Steel FurnaceDocument12 pagesDAR 14 Auguest 2014 KPK Steel FurnaceShahzaib KhanNo ratings yet

- Deepak & CompanyDocument1 pageDeepak & CompanynormanwillowNo ratings yet

- Customer Consignee: Allied Enterprises Phase-Iii, Ida Cherlapally HyderabadDocument2 pagesCustomer Consignee: Allied Enterprises Phase-Iii, Ida Cherlapally HyderabadDhanish KumarNo ratings yet

- Vehicle No Account Id Transaction Date Accounting DateDocument21 pagesVehicle No Account Id Transaction Date Accounting DatesukujeNo ratings yet

- Fuel Bills 2 Q3Document2 pagesFuel Bills 2 Q3DevendraNo ratings yet

- ExportDocument1 pageExportManish SrivastavaNo ratings yet

- DC Police Commanders Son Indicted For Armed RobberyDocument5 pagesDC Police Commanders Son Indicted For Armed RobberyDCReformNo ratings yet

- TAS/035/2016-17 /PREMIER EXIM DT:14.07.2016: Buyer (If Other Than Consignee)Document2 pagesTAS/035/2016-17 /PREMIER EXIM DT:14.07.2016: Buyer (If Other Than Consignee)Ninson KMNo ratings yet

- W.O. No.355-2459-67 Al Harfi (B)Document2 pagesW.O. No.355-2459-67 Al Harfi (B)Mubarek MuhsinNo ratings yet

- Retail Invoice: S.NO. Item Description QTY Rate Amount 1 1 479.0 479.0Document1 pageRetail Invoice: S.NO. Item Description QTY Rate Amount 1 1 479.0 479.0rcNo ratings yet

- Bill of LadingDocument1 pageBill of LadingYHNo ratings yet

- Information About Verified Gross Mass of ContainerDocument6 pagesInformation About Verified Gross Mass of ContainerChandra SekaranNo ratings yet

- Purchase OrderDocument1 pagePurchase OrderpmjoshirNo ratings yet

- Carlisle Trading and Manufacturing India Private Limited Weekly Expense ReportDocument6 pagesCarlisle Trading and Manufacturing India Private Limited Weekly Expense ReportAnonymous qRbPsLpuNNo ratings yet

- El negocio espacial: competir y liderar con análisis de ubicaciónFrom EverandEl negocio espacial: competir y liderar con análisis de ubicaciónNo ratings yet