Professional Documents

Culture Documents

Mckinsey Survey On Corporate Governance

Uploaded by

rhood10%(1)0% found this document useful (1 vote)

978 views5 pagesMckinsey Survey on Corporate Governance

Original Title

Mckinsey Survey on Corporate Governance

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMckinsey Survey on Corporate Governance

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

978 views5 pagesMckinsey Survey On Corporate Governance

Uploaded by

rhood1Mckinsey Survey on Corporate Governance

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

Sample size of 188 companies from six emerging markets Results reveal that there is a positive correlation between

the two. Corporate Governance increase market valuation in three following ways:

Increasing Financial Performance Increasing Investor confidence Transparency in dealings

Accountability: Transparent Ownership, Board Size, Board Accountability Disclosure & Transparency of the Board Shareholder equality

Companies with good corporate governance practices have high price to book values. It also revealed that investors are willing to pay a premium of as much as 28% for shares of such companies. Corporate Governance is concerned with holding balance between economic and social goals.

You might also like

- McKinsey Survey, Committees On Corporate GovernanceDocument104 pagesMcKinsey Survey, Committees On Corporate Governanceajmal0% (1)

- Financial Management in Psu'sDocument14 pagesFinancial Management in Psu'sAkshaya Mali100% (1)

- Wisdom Based Management PDFDocument10 pagesWisdom Based Management PDFRishab Jain 20272030% (1)

- Mba 4th Sem Syllabus....Document5 pagesMba 4th Sem Syllabus....MOHAMMED SHEBEER A50% (2)

- Role of Organizational Systems in Strategic EvaluationDocument1 pageRole of Organizational Systems in Strategic EvaluationNAIMNo ratings yet

- Types & Fomation of ValuesDocument17 pagesTypes & Fomation of ValuesRishab Jain 2027203No ratings yet

- Case Study On Strategic ManagementDocument17 pagesCase Study On Strategic Managementshitish_924020247No ratings yet

- BBA VI Semester: Business and SocietyDocument15 pagesBBA VI Semester: Business and SocietyChhaya sharmaNo ratings yet

- PoM Case StudiesDocument3 pagesPoM Case StudiesAkash NathwaniNo ratings yet

- 25 Landmarks in Corporate GovernanceDocument25 pages25 Landmarks in Corporate Governancem_dattaias100% (5)

- 5-Gec ModelDocument10 pages5-Gec Modelsirisha INo ratings yet

- Indian Manager's Attitudes Towards Business EthicsDocument10 pagesIndian Manager's Attitudes Towards Business EthicsGaurav Srivastava100% (2)

- Bcom III BECSR Notes UNIT-1 PDFDocument37 pagesBcom III BECSR Notes UNIT-1 PDFRaghav BajajNo ratings yet

- Top Brass RemunerationDocument4 pagesTop Brass RemunerationJaspreetKaurNo ratings yet

- Unit - 5 (Special Areas of Audit)Document3 pagesUnit - 5 (Special Areas of Audit)Meghaa KabraNo ratings yet

- Corporate Governance RatingDocument10 pagesCorporate Governance RatingMayur Devani75% (4)

- Corporate Governance With Special Reference To Aditya Birla GroupDocument8 pagesCorporate Governance With Special Reference To Aditya Birla Grouprohit sharmaNo ratings yet

- Naresh Chandra CommiteeDocument23 pagesNaresh Chandra CommiteeAnu Vanu88% (8)

- Clause 49 Listing AgreementDocument10 pagesClause 49 Listing AgreementAarti MaanNo ratings yet

- CSR Unit3&4Document51 pagesCSR Unit3&4NidhiThakkar60% (5)

- CORPORATE GOVERNANCE ppt-1Document26 pagesCORPORATE GOVERNANCE ppt-1lakshmiNo ratings yet

- Impact of Foreign Institutional Investment (FII) On Indian Stock MarketDocument7 pagesImpact of Foreign Institutional Investment (FII) On Indian Stock MarketDr. Sangeeta SahniNo ratings yet

- Literature Review For Financial Performance Mba ProjectDocument3 pagesLiterature Review For Financial Performance Mba ProjectIjas Aslam75% (12)

- Was National Semiconductor morally responsible for falsified military partsDocument11 pagesWas National Semiconductor morally responsible for falsified military partssomenathkunduNo ratings yet

- Corporate Sector's Duty Towards Social Responsibility in IndiaDocument5 pagesCorporate Sector's Duty Towards Social Responsibility in IndiaAJAY KUMARNo ratings yet

- Project Report: New Trends in CSR and Its Advantage Towards SocietyDocument31 pagesProject Report: New Trends in CSR and Its Advantage Towards SocietyHarsh Vijay0% (1)

- Multiplier Approach To Share ValuationDocument2 pagesMultiplier Approach To Share ValuationI am IndianNo ratings yet

- Part I. Sem. I Business Ethics and Corporate Social Responsibility PDFDocument9 pagesPart I. Sem. I Business Ethics and Corporate Social Responsibility PDFIqra farooqNo ratings yet

- How Strategic Financial Planning is Impacted by Macro and Micro Environmental FactorsDocument4 pagesHow Strategic Financial Planning is Impacted by Macro and Micro Environmental FactorsDivyaDesai100% (1)

- Developing Global ManagersDocument51 pagesDeveloping Global ManagersmysohagNo ratings yet

- Factors Influencing Business EthicsDocument16 pagesFactors Influencing Business EthicsAparna Devi67% (3)

- Internal Corporate Governance MechanismDocument23 pagesInternal Corporate Governance MechanismSyed AhmadNo ratings yet

- Need & Scope of Corporate Governance in IndiaDocument8 pagesNeed & Scope of Corporate Governance in IndiaVaishnavi VenkatesanNo ratings yet

- CACG Guidelines for Corporate GovernanceDocument7 pagesCACG Guidelines for Corporate Governancemittal_parmar5224No ratings yet

- M Com Strategic Management Project TopicsDocument4 pagesM Com Strategic Management Project TopicsAdelle Moldovan50% (4)

- ETOPDocument8 pagesETOPHaytham Janoub HamoudaNo ratings yet

- HRM NotesDocument37 pagesHRM NotesMohima ChakravortyNo ratings yet

- Final PPT Reforms in Financial SystemDocument25 pagesFinal PPT Reforms in Financial SystemUSDavidNo ratings yet

- Strategy and Corporate EvolutionDocument16 pagesStrategy and Corporate EvolutionSandeep Ghatuary100% (8)

- ETHICS GOVERNANCE GUIDE BUSINESSDocument4 pagesETHICS GOVERNANCE GUIDE BUSINESSw_sampathNo ratings yet

- Question and AnswersDocument25 pagesQuestion and AnswersAlfred godsonNo ratings yet

- Ethical Issues in HRMDocument19 pagesEthical Issues in HRMSamarendra Nallavelli100% (1)

- Ethics Assignment Business-Ethics-in-bangladeshDocument15 pagesEthics Assignment Business-Ethics-in-bangladeshMd. Ashraf Hossain SarkerNo ratings yet

- BBA-N-107 Unit-1 Q1. What Do You Understand by Ethics? Give Its Scope and Importance? Ans. The WordDocument20 pagesBBA-N-107 Unit-1 Q1. What Do You Understand by Ethics? Give Its Scope and Importance? Ans. The WordPs Bharti100% (1)

- N Murthy Report On Corporate GovernanceDocument8 pagesN Murthy Report On Corporate GovernanceShrishtiNarayaniNo ratings yet

- Corporate Governance:CG Mechanism, CG System, Good CG, Land Mark in The Emergence of CG: CG Committees, World Bank On CG, OECD PrincipleDocument22 pagesCorporate Governance:CG Mechanism, CG System, Good CG, Land Mark in The Emergence of CG: CG Committees, World Bank On CG, OECD PrincipleRashmi Ranjan Panigrahi100% (3)

- Ek Ruka Hua FaislaDocument30 pagesEk Ruka Hua FaislaVidita Navadiya100% (1)

- Corporate Governance (Final)Document26 pagesCorporate Governance (Final)Kunal K PanchalNo ratings yet

- Corporate Governance in India: An EvaluationDocument10 pagesCorporate Governance in India: An EvaluationAshish ChopraNo ratings yet

- Factors Affecting IHRMDocument2 pagesFactors Affecting IHRMSamish ChoudharyNo ratings yet

- Tata Consultancy Services LimitedDocument4 pagesTata Consultancy Services LimitedPRITEENo ratings yet

- Mkt-Lab Assignment Book ReviewDocument11 pagesMkt-Lab Assignment Book ReviewRishabh Khichi100% (2)

- G G C G: Uide To OOD Orporate OvernanceDocument14 pagesG G C G: Uide To OOD Orporate OvernanceE W100% (1)

- Delivering Service Through Intermediaries and Electronic ChannelsDocument10 pagesDelivering Service Through Intermediaries and Electronic ChannelsDr Rushen Singh100% (2)

- Peachtree Plumbing Valuation ReportDocument40 pagesPeachtree Plumbing Valuation ReportBobYu100% (1)

- Merchant Banking InsightsDocument78 pagesMerchant Banking InsightsorangeponyNo ratings yet

- The Trader Hacker's Ultimate PlaybookDocument64 pagesThe Trader Hacker's Ultimate Playbookpta123100% (1)

- STUDENT IDENTIFICATION NO MULTIMEDIA UNIVERSITYDocument4 pagesSTUDENT IDENTIFICATION NO MULTIMEDIA UNIVERSITYRehairah MunirahNo ratings yet

- Citatah ReportDocument14 pagesCitatah ReportYuannita SariNo ratings yet

- Calpine's Risks Expanding to 25,000MW or 70,000MWDocument2 pagesCalpine's Risks Expanding to 25,000MW or 70,000MWNayana Singh0% (1)

- Strategic Business Analysis (Midterms) : Course Learning OutcomesDocument36 pagesStrategic Business Analysis (Midterms) : Course Learning OutcomesJemimah SerquinaNo ratings yet

- PB1MAT Pert.1-4Document48 pagesPB1MAT Pert.1-4christoperedwinNo ratings yet

- Joint arrangement profit calculation and settlementDocument3 pagesJoint arrangement profit calculation and settlementMaurice AgbayaniNo ratings yet

- Options Strategies For A Range Bound ViewDocument11 pagesOptions Strategies For A Range Bound ViewAshutosh ChauhanNo ratings yet

- Zephyr Financial Publishers PVT LTDDocument17 pagesZephyr Financial Publishers PVT LTDKeigan ChatterjeeNo ratings yet

- Ind As 113Document7 pagesInd As 113qwertyNo ratings yet

- LONG TERM CONSTRUCTION ACCOUNTINGDocument3 pagesLONG TERM CONSTRUCTION ACCOUNTINGLee SuarezNo ratings yet

- Vallourec reports Q3 2020 results and financial restructuringDocument16 pagesVallourec reports Q3 2020 results and financial restructuringShambavaNo ratings yet

- Review of Financial Accounting Theory and PracticeDocument2 pagesReview of Financial Accounting Theory and PracticeMary Jullianne Caile SalcedoNo ratings yet

- Test Bank For Advanced Accounting 13th Edition 13th EditionDocument36 pagesTest Bank For Advanced Accounting 13th Edition 13th Editionmabelalva91g6100% (25)

- BEC 3 Outline - 2015 Becker CPA ReviewDocument4 pagesBEC 3 Outline - 2015 Becker CPA ReviewGabrielNo ratings yet

- Business Profile - THE STRENGTH ENGINEERING PTE. LTD.Document6 pagesBusiness Profile - THE STRENGTH ENGINEERING PTE. LTD.Tinlin KhaingNo ratings yet

- Indigo AviationDocument64 pagesIndigo AviationKumar SinghNo ratings yet

- Consolidations and Joint Ventures SlidesDocument66 pagesConsolidations and Joint Ventures SlidesjalalNo ratings yet

- CACIB - Research FAST FX Fair Value ModelDocument5 pagesCACIB - Research FAST FX Fair Value ModelforexNo ratings yet

- RhAG GB 2012 eDocument169 pagesRhAG GB 2012 ejoker63000No ratings yet

- PSEi TO HEAD HIGHER IN 2019 SAY EXPERTSDocument9 pagesPSEi TO HEAD HIGHER IN 2019 SAY EXPERTSWa37354No ratings yet

- Len Company acquires 80% of Lyn Company stock and consolidates financialsDocument14 pagesLen Company acquires 80% of Lyn Company stock and consolidates financialsMerliza JusayanNo ratings yet

- Accounts Finalization of PL and Bs StepsDocument5 pagesAccounts Finalization of PL and Bs Stepsvb_krishnaNo ratings yet

- Kasus FlinderDocument4 pagesKasus FlinderSarah Fauzia100% (2)

- Tutorial 2 Manufacturing Account 2 AnswerDocument15 pagesTutorial 2 Manufacturing Account 2 AnswerNG JIA LUNGNo ratings yet

- Bu8201 Tutorial 7 Presentation - FinalDocument32 pagesBu8201 Tutorial 7 Presentation - FinalArvin LiangdyNo ratings yet

- CMSL Analysis Sheet Dec 23 (NEW SYLLABUS) - 1Document10 pagesCMSL Analysis Sheet Dec 23 (NEW SYLLABUS) - 1rashmimandhyan12201No ratings yet

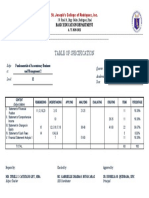

- Table of Specification: Basic Education DepartmentDocument1 pageTable of Specification: Basic Education DepartmentCza VerwinNo ratings yet

- Statement of Changes in EquityDocument65 pagesStatement of Changes in EquityJhie Anne MayoNo ratings yet