Professional Documents

Culture Documents

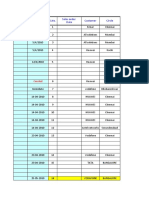

Savings Account: Are Typically Listed On The Right-Hand Side of A Bank's Balance Sheet

Uploaded by

Vairag JainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Savings Account: Are Typically Listed On The Right-Hand Side of A Bank's Balance Sheet

Uploaded by

Vairag JainCopyright:

Available Formats

Bank Liability Product: - What a bank owes, including most notably customer deposits.

Bank liabilities are typically listed on the right-hand side of a bank's balance sheet. Commercial banks offer a variety

of "liability products" to consumers. These products are known as "liability products" because they represent liabilities of the bank. Consumers generally know them as "deposit" products. Typically, liability products include checking and savings accounts, money market accounts and certificates of deposit (CDs). Bank liability products are useful to consumers since they provide a safe place to keep their funds and give them the opportunity to earn interest on cash that they may not immediately need. Liability products also give consumers access to cash via checks and ATMs, and except for most checking accounts, they allow consumers to earn interest on their deposits. Savings account Savings account has been designed to help people save for their future financial requirements. Under this account, bank gives free ATM cum debit card. The account can also be accessed through internet banking facility. The rate of interest is product based under this account. On the other hand, savings plus account gives the facility of savings account along with term deposit account. Any surplus funds in the account exceeding the threshold limit, for a minimum amount of Rs.10,000 and in multiple of Rs.1000 in any one instance, are transferred as term deposit and earns interest as applicable to term deposits. Current account Non interest-bearing bank account which write checks against the funds in the account allows the accountholder to

Individuals, public and private limited companies, partnership firms, and trusts Overdraft facility is a short-term credit instrument to secure the liquidity you need for your operational business @1.5% p.a Term deposit Earn higher income on surplus funds Bank offers flexibility in period from 7 days to 10 years can be opened with a nominal amount of Rs. 1000/ Against your fixed deposit you can take loan/overdraft during your urgent financial requirement.

You might also like

- Infinite Banking Secrets for Tax-Free Retirement: A Beginner's Guide: How to invest in Real Estate with Infinite BankingFrom EverandInfinite Banking Secrets for Tax-Free Retirement: A Beginner's Guide: How to invest in Real Estate with Infinite BankingNo ratings yet

- Banking Law NotesDocument6 pagesBanking Law NotesAfiqah IsmailNo ratings yet

- Banking AathishDocument19 pagesBanking AathishLinga AlexNo ratings yet

- Module 1Document15 pagesModule 1Prajakta GokhaleNo ratings yet

- What Is A BankDocument5 pagesWhat Is A BankmanojdunnhumbyNo ratings yet

- 5 Deposit ProductsDocument19 pages5 Deposit ProductsLAMOUCHI RIMNo ratings yet

- Liability Products: Personal Banking Segment of SBIDocument4 pagesLiability Products: Personal Banking Segment of SBIapu20090% (2)

- Management of Commercial BankDocument7 pagesManagement of Commercial BankSamridhi RakhejaNo ratings yet

- Role of Commercial Bank-1Document9 pagesRole of Commercial Bank-1TanzeemNo ratings yet

- Banks: Banking ServicesDocument7 pagesBanks: Banking ServicesTaran ChadhaNo ratings yet

- Indian Retail BankingDocument17 pagesIndian Retail BankingNeelam KarpeNo ratings yet

- Banking Products Assignment FINAL 2Document19 pagesBanking Products Assignment FINAL 2satyabhagatNo ratings yet

- Desarrollo Guia 10Document16 pagesDesarrollo Guia 10Ibeth DahanaNo ratings yet

- Retail Banking Products and ServicesDocument17 pagesRetail Banking Products and ServicesAneesha AkhilNo ratings yet

- Chapter 5 EditedDocument10 pagesChapter 5 EditedSeid KassawNo ratings yet

- Bank DepositDocument8 pagesBank DepositHarmin ViraNo ratings yet

- Banking Is Described As The Business of Taking and Securing Money Held by Other People and CompaniesDocument8 pagesBanking Is Described As The Business of Taking and Securing Money Held by Other People and CompaniesTasnim ZaraNo ratings yet

- Types of Bank AccountsDocument8 pagesTypes of Bank Accountschaitanya100% (1)

- Financial Services SectorDocument12 pagesFinancial Services SectorDominic RomeroNo ratings yet

- Retail Banking in Allahabad BankDocument45 pagesRetail Banking in Allahabad Bankaru161112No ratings yet

- Banks: Deposits AccountsDocument11 pagesBanks: Deposits AccountsMukesh AroraNo ratings yet

- English 10Document11 pagesEnglish 10Hellen LaraNo ratings yet

- Marketing Mix OldDocument15 pagesMarketing Mix OldAisha rashidNo ratings yet

- Basics of BankingDocument8 pagesBasics of Bankingnishant vermaNo ratings yet

- Payment N Settlem, EntDocument17 pagesPayment N Settlem, EntNandini JaganNo ratings yet

- Name Jawad AliDocument17 pagesName Jawad AliWaqas AhmedNo ratings yet

- XI BS Ch04 Creative PPT With ObjectivesDocument158 pagesXI BS Ch04 Creative PPT With ObjectivesHiya MakhijaNo ratings yet

- The Role of Commercial BanksDocument29 pagesThe Role of Commercial BanksGeorge Cristinel RotaruNo ratings yet

- Bank AccountDocument4 pagesBank AccountDheemahi 13No ratings yet

- Name Waqas AhmedDocument19 pagesName Waqas AhmedWaqas AhmedNo ratings yet

- FMM Acct For Business Ch2Document9 pagesFMM Acct For Business Ch2swati_chindarkar17No ratings yet

- BAnking Terms and InterviewsDocument25 pagesBAnking Terms and InterviewsassadbilalNo ratings yet

- Retail Banking of Allahabad BankDocument50 pagesRetail Banking of Allahabad Bankaru161112No ratings yet

- MODULE 3 - BankingDocument5 pagesMODULE 3 - BankingKeiko KēkoNo ratings yet

- Commercial BankDocument2 pagesCommercial BankFardin Ahmed MugdhoNo ratings yet

- Banking AwarenessDocument18 pagesBanking AwarenessKritika T100% (1)

- Banking ProductsDocument11 pagesBanking ProductsRadhi BalanNo ratings yet

- Sheethal.S Bcom AccaDocument23 pagesSheethal.S Bcom AccaSheethal SrinevasNo ratings yet

- Commercial BankingDocument12 pagesCommercial BankingwubeNo ratings yet

- What Is A Bank AccountDocument6 pagesWhat Is A Bank AccountJan Sheer ShahNo ratings yet

- Banking and Financial Institutions Module5Document14 pagesBanking and Financial Institutions Module5bad genius100% (1)

- 8A&B Fin LitDocument22 pages8A&B Fin LitRamandeep KaurNo ratings yet

- 2-Notes On Banking Products & Services-Part 1Document16 pages2-Notes On Banking Products & Services-Part 1Kirti GiyamalaniNo ratings yet

- Banking Organizer & Note TakingDocument8 pagesBanking Organizer & Note TakingRashid DannettNo ratings yet

- What Is A Commercial BankDocument12 pagesWhat Is A Commercial BankDEEPUNo ratings yet

- Retail BankingDocument9 pagesRetail BankingBebin RoseNo ratings yet

- Retail BankingDocument14 pagesRetail BankingAkansha DasNo ratings yet

- Retail Lending and Retail DepositsDocument20 pagesRetail Lending and Retail DepositsRavi SinghNo ratings yet

- Types of Bank Accounts in IndiaDocument3 pagesTypes of Bank Accounts in IndiaVasudev GovindanNo ratings yet

- Retail Banking A ST 8bklzgDocument9 pagesRetail Banking A ST 8bklzgNageshwar SinghNo ratings yet

- CH 4 Business ServicesDocument13 pagesCH 4 Business ServicesBaklol Babu JiNo ratings yet

- State Bank of India Punjab National Bank Icici Bank Lakh CroresDocument18 pagesState Bank of India Punjab National Bank Icici Bank Lakh CroresPooja PatnaikNo ratings yet

- Asgment BankingDocument7 pagesAsgment Bankingkiena1991No ratings yet

- Bank Reserves and Bank DepositsDocument2 pagesBank Reserves and Bank DepositsH-Sam PatoliNo ratings yet

- Deposit FunctionsDocument8 pagesDeposit FunctionsangelicamadscNo ratings yet

- Financial ServicesDocument3 pagesFinancial ServicesakhilalakshmiNo ratings yet

- Introduction To The IndustryDocument85 pagesIntroduction To The Industryutkarsh jaiswalNo ratings yet

- Banking Interview QuestionDocument6 pagesBanking Interview Questionberihun admassuNo ratings yet

- Arnav KumarDocument4 pagesArnav KumarSimran JaiswalNo ratings yet

- Bank AssetsDocument19 pagesBank AssetsVairag JainNo ratings yet

- InsuranceDocument7 pagesInsuranceVairag JainNo ratings yet

- Gold Coins: Presented By: Group EDocument21 pagesGold Coins: Presented By: Group EVairag JainNo ratings yet

- Access ControlDocument53 pagesAccess ControlVairag JainNo ratings yet

- Important General Insurance Policies Mba1st 2028Document8 pagesImportant General Insurance Policies Mba1st 2028Vairag JainNo ratings yet

- InsuranceDocument20 pagesInsuranceVairag JainNo ratings yet

- Corporate Sms For MPN B 1170Document4 pagesCorporate Sms For MPN B 1170Vairag JainNo ratings yet

- Perception of Top Level Knowledge Workers On Productivity Improvement Through Tools and TechniquesDocument18 pagesPerception of Top Level Knowledge Workers On Productivity Improvement Through Tools and TechniquesVairag JainNo ratings yet

- Profile Core Banking SolutionDocument6 pagesProfile Core Banking SolutionVairag JainNo ratings yet

- Struts For J2EE Developers-ObjectSource Training MaterialDocument104 pagesStruts For J2EE Developers-ObjectSource Training Materialdearmohseen100% (1)

- AppletDocument16 pagesAppletVairag JainNo ratings yet

- Journal Pre-Proof: Digital Communications and NetworksDocument20 pagesJournal Pre-Proof: Digital Communications and NetworksOussema OUERFELLINo ratings yet

- Letter of Credit - PCFC Loan - Process FlowDocument4 pagesLetter of Credit - PCFC Loan - Process FlowhiihellloNo ratings yet

- Test Bank For Delivering Health Care in America 6th Ed Test BankDocument8 pagesTest Bank For Delivering Health Care in America 6th Ed Test Banktestbankloo0% (1)

- LIC Office AddressDocument5 pagesLIC Office Addressmpcd07No ratings yet

- IMT - Supply Chain MGMT - Session 11&12Document49 pagesIMT - Supply Chain MGMT - Session 11&12Himanish BhandariNo ratings yet

- Exim May 2023 10Document2 pagesExim May 2023 10jalpa daveNo ratings yet

- Initial Entry Adjusting Entry: Cash Unearned Consulting Revenue Unearned Consulting Rev Consulting RevenueDocument8 pagesInitial Entry Adjusting Entry: Cash Unearned Consulting Revenue Unearned Consulting Rev Consulting Revenuemohitgaba19No ratings yet

- Dansuk Industrial Co LTD (Bill of LadingDocument1 pageDansuk Industrial Co LTD (Bill of LadingJowin SamNo ratings yet

- ToR Consultant - Community Processes - Comprehensive Primary Health Care, NHSRC (Special Focus On Comprehensive Primary Health Care)Document6 pagesToR Consultant - Community Processes - Comprehensive Primary Health Care, NHSRC (Special Focus On Comprehensive Primary Health Care)DPMU MathuraNo ratings yet

- Acct Statement XX6669 23062023Document66 pagesAcct Statement XX6669 23062023Suraj KoratkarNo ratings yet

- ScootyDocument1 pageScootygauravashNo ratings yet

- Icici Bank Analysis by Muzammil HussainDocument44 pagesIcici Bank Analysis by Muzammil HussainHussainNo ratings yet

- PDF de Poche Vocabulaire Anglais AssurancesDocument6 pagesPDF de Poche Vocabulaire Anglais AssurancesMatcheha aimé HervéNo ratings yet

- Dir DepDocument1 pageDir Depfazlah8106No ratings yet

- Summer Training Project On HDC Bank Varanasi SHISH MBA SAMS IBM VaranasiDocument85 pagesSummer Training Project On HDC Bank Varanasi SHISH MBA SAMS IBM VaranasiShish ChoudharyNo ratings yet

- High Tech Banking Epayment Systems & Electronic BankingDocument12 pagesHigh Tech Banking Epayment Systems & Electronic BankingNidhi Nikhil GoyalNo ratings yet

- ACCA Qualification Joint Examination Scheme Fee Information 2020Document4 pagesACCA Qualification Joint Examination Scheme Fee Information 2020TrevorNo ratings yet

- S.No. Customer Circle Reason For Delay Due Date Sales Order DateDocument366 pagesS.No. Customer Circle Reason For Delay Due Date Sales Order DatePriya SawantNo ratings yet

- SABB Signature Visa CC User Guide - Jan. 23Document29 pagesSABB Signature Visa CC User Guide - Jan. 23amirNo ratings yet

- MATCVS Application Form (New)Document3 pagesMATCVS Application Form (New)dr bolaNo ratings yet

- Diagnostic Test in Tourism Promotion ServicesDocument3 pagesDiagnostic Test in Tourism Promotion ServicesMarielena CruzatNo ratings yet

- Welcome To Our Presentation: Wireless CommunicationDocument20 pagesWelcome To Our Presentation: Wireless CommunicationMD. FARHAN AFSARNo ratings yet

- Unit IiDocument35 pagesUnit IiMohammed WaqarNo ratings yet

- 916 3460 1 PBDocument12 pages916 3460 1 PBWiwin NovaNo ratings yet

- Unit 2 Audit of Cash and Cash EquivalentsDocument26 pagesUnit 2 Audit of Cash and Cash Equivalentsjethro carlobosNo ratings yet

- BBA Major ProjectDocument40 pagesBBA Major ProjectDeepak Bhatia100% (5)

- Security in NFC Readers PublicDocument36 pagesSecurity in NFC Readers PublicThuy VuNo ratings yet

- 88937409Document1 page88937409fariborzNo ratings yet

- Abm TermsDocument2 pagesAbm TermsAxeliaNo ratings yet

- Welcome To CIMB Clicks MalaysiaDocument2 pagesWelcome To CIMB Clicks MalaysiaabgutihNo ratings yet