Professional Documents

Culture Documents

Bleaching and Dyeing of Cotton Knitted Fabric: Ntroduction

Uploaded by

PRATEEKMAHAJAN02Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bleaching and Dyeing of Cotton Knitted Fabric: Ntroduction

Uploaded by

PRATEEKMAHAJAN02Copyright:

Available Formats

3

Bleaching and Dyeing of Cotton Knitted Fabric

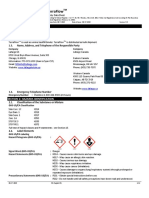

PRODUCT CODE QUALITY AND STANDARDS MONTH AND YEAR OF PREPARATION PREPARED BY : 248100009 : As per IS 689:1956, IS 763:1957, IS 786:1957, IS 687:1966, IS 3417:1966 : May, 2003 : Small Industries Service Institute Industrial AreaB, Ludhiana-141003

INTRODUCTION

Bleaching of textile grey fabrics is generally carried out to impart whiteness to textile fabrics by removing natural colouring matter. The process of dyeing is carried out to improve the marketability of textile products and also to suit the customer needs by adding colour. These two processes are generally carried out in open tank, kier machines, jet dyeing machines, jiggers, soft flow dyeing machines etc. For hosiery goods, it is carried out with winch machines, since it imparts very less tension during operation. Viable processing units can be set up as most of the fabric manufacturing units do not have their own processing units. In this report, details are provided for setting up the unit for bleaching and dyeing of cotton knitted fabrics.

number of units engaged in manufacturing of knitted cloth and most of these units are not having their own captive processing units. Bleaching and dyeing of knitted fabric produced by these units are normally carried out from outside on paying requisite processing charges. It is, therefore, presumed that setting up of textile processing units is economically viable.

B ASIS AND PRESUMPTIONS

This project is based on single shift basis with 300 working days in a year. Time period for achieving maximum capacity utilisation is considered from 3rd year from the date on which production is started. Rental value of the building is taken at Rs. 2 per sq. ft. Costs of machinery and equipments/materials indicated refer to a particular make and approximately to those prevailing at the time of preparation of this project. Cost of installation and electrification is taken @ 10% of cost of machinery and equipment. Non-refundable deposits,

MARKET POTENTIAL

The demand for hosiery garments is increasing due to its popularity in domestic and export market. There are

16

B LEACHING

AND

DYEING

OF

COTTON KNITTED FABRIC

project report cost, trial production, security deposit with Electricity Board are classified under pre-operative expenses. Depreciation has been considered at 10% on plant and machinery, 15% on office furniture, fixtures, vehicle and 20% on testing equipments. Interest rate on capital loan has been taken @ 14% per annum.

Production Capacity (per annum)

Quantity (Kg.) 1. Bleaching Charges 2. Dyeing Charges Total 1,50,000 1,50,000 3,00,000 Value (Rs.) 27,00,000 34,50,000 61,50,000

Motive Power 20 HP is required to run the unit and proposed to be obtained from State Electricity Board. Pollution Control As this process involves treatment of chemicals, entrepreneurs are required to obtain NOC from State Pollution Control Board. Energy Conservation Energy can be conserved by proper house-keeping i.e. unnecessary running of boilers, heaters and fans are to be monitored in order to reduce the excess energy consumption.

IMPLEMENTATION SCHEDULE

The implementation period required for executing this project right from selection of site to starting the trial run production will be 6 months.

TECHNICAL ASPECTS

Process of Manufacture The knitted fabric to be bleached is thoroughly wet in a soap solution of 2% and piled in kier boiling pan containing 1.5% caustic soda, 2% soda ash and 1% lisapol etc. and allowed to boil for 6-8 hours. The cloth is washed well and taken to SS winches for bleaching using 2% bleaching powder and then washed thoroughly. This bleached cloth is scoured using hydrochloric acid of 1.5% concentration. After sometime, cloth is washed thoroughly to neutralise the traces of acid. In case of only bleaching the cloth is treated with optical whitening agent, thereafter, it is hydro-extracted, dried and calendered as final operations. In case of dyeing, about 15-20% salts, 2% brightol C paste, 2-4% dyes as per shade are mixed and fabric is treated with the solution in winches. The cloth is allowed to run for several times in order to maintain uniform shade, thereafter, washed, hydro-extracted, dried and calendered.

FINANCIAL ASPECTS

A. Fixed Capital

(i) Land and Building Covered area Uncovered area Rent/month @ Rs. 2/sq.ft. (ii) Machinery and Equipments Sl. Description No. 1. SS Winch m/c of 6-4 86 200kg. No. 1 Rate (Rs.) 1,05,000 1,00,000 70,000 Amount (Rs.) 1,05,000 3,00,000 1,40,000 5,000 sq. ft. 1,000 sq. ft. Rs. 12,000

2. SS Winch m/c 6-4 3 66 size 150kg. 3. MS Kier wall thick 1/4' bottom 8 2

B LEACHING

AND

DYEING

OF

COTTON KNITTED FABRIC

17

Sl. Description No.

No.

Rate (Rs.) 70,000 70,000

Amount (Rs.) 70,000 1,40,000 2,30,000 32,000 1,20,000 75,000 50,000 45,000

(ii) Production Staff Sl. Designation No. 7. Dyeing Master 8. Skilled Workers 10. Lab. Attendant 11. Boiler Attendant 12. Electrician Nos. 1 5 1 1 1 Rate (Rs.) 6,000 4,000 2,500 3,000 2,500 2,500 Total S. Total Amount (Rs.) 6,000 20,000 10,000 3,000 2,500 2,500 44,000 68,500 13,700 G. Total (iii) Raw Material (per month) 82,200

4. Steam callendering 1 m/c roller sizes 51/21 5. Hydro-extractor 40-45 kg capacity 2

6. 4 cylinder drier with 1 2,30,000 motor and gear box 7. Wooden conveyor with ball bearing 8. Baby boiler 9. Water softening plant (cap. 6kl/hr) 11. Steam, water pipeline and other accessories 4 8,000

9. Semi-skilled Workers 4

1 1,20,000 1 75,000 50,000 45,000

10. Effuent treatment plant 1 LS

Perquisites@ 20%

12. Deep tube well with 1 1,25,000 submersible pump 13. Mini transport vehicle (3 Wheeler) 14. Fire extinguisher 5 kg capacity 1 2 75,000 8,000 50,000

1,25,000 75,000 16,000 50,000

Sl. Description No. 1. Caustic Soda 2. Soda ash 3. Sodium silicate 4. Lisopal 5. Bleaching Powder 6. Hydrochloric acid 7. Glabours salt 8. Common salt 9. Optical whitening agent 10. Hydrogen peroxide 11. Sulphuric acid 12. Acetic acid

Unit Kgs. Kgs. Kgs.

Qty. 5 750 250

Rate/ Amount unit(Rs.) (Rs.) 18 14 5 90 13 6 8 2 85 5 6 40 80 9,000 24,500 3,750 22,500 13,000 14,400 2,000 700 6,375 1,175 4,500 10,000 20,000 80,000 2,12,500 (Rs.) 10,000 3,000 20,000 2,000

Kgs. 1,750

15. Testing equipments LS

16. Computer colour 1 18,00,000 18,00,000 matching equipment (optional) Total (iii) Other Fixed Assets (a) Erection and installation (b) Office furniture (c) Pre-operative expenses Total Total Fixed Capital 33,73,000 (Rs.) 98,500 40,000 25,000 1,63,500 35,36,500

Kgs. 1,000 Kgs. 2,400 Kgs. Kgs. Lit. Lit. Lit. Lit. 250 350 75 355 750 250 250

B. Working Capital

(i) Staff and Labour Wages Sl. Designation No. 1. Manager 2. Accountant 3. Computer Operator 4. Clerk/Typist 5. Peon 6. Watchman Nos. 1 1 1 1 1 1 Total Rate (Rs.) 8,500 4,500 3,500 3,000 2,500 2,500 Amount (Rs.) 8,500 4,500 3,500 3,000 2,500 2,500 24,500

13. Dye fixing agent Kgs.

14. Dyes of different shades Lump-sum Total (iv) Utilities Electricity bill Water charges Fuel Coal/furnace oil Fuel for vehicle Total

35,000

18

B LEACHING

AND

DYEING

OF

COTTON KNITTED FABRIC

(Rs.) 12,000 1,000 8,208 1,000 2,000 1,000 1,000 (3) Net Profit (per year) (4) Net profit ratio (Net profit/Turnover (per year) (5) Rate of return on investment (Net profit/Total capital investment) (6) Break-even Point Fixed Cost Depreciation Rent Interest on capital investment 40% of wages of staff and labour 40% of other expenses Insurance Total B.E.P. FC 100 = FC+profit 1587202 100 = 1587202+1081058 1587202 100 = 2668260 = 59.48% (Rs.) 1,53,450 1,44,000 6,44,592 3,94,560 2,26,600 24,000 15,87,202 10,81,058 17.57% 23.47%

(v) Other Contingent Expenses (a) Rent (b) Postage/stationery (c) Repair and maintenance (d) Transport/travelling charges (e) Insurance (f) Telephone bills (g) Miscellaneous Total

26,208

(vi) Total Recurring Expenses (per month) 3,55,908 (vii) Total Working Capital for 3 months10,67,725

C. Total Capital Investment

(i) Machinery and equipment (ii) Working capital for 3 months Total Rs. 35,36,500 Rs. 10,67,725 Rs. 46,04,225

MACHINERY UTILIZATION

Capacity utilisation is considered as 75% of installed capacity.

FINANCIAL ANALYSIS

(1) Cost of Production (per year) Recurring expenses Depreciation on machinery @ 10% Depreciation on office furniture @ 15% (Rs.) 42,70,90 1,26,200 6,000

Addresses of Machinery and Equipment Suppliers 1. M/s. Gangan Mech. Works 28-B, Industrial Area, Ludhiana-141003. 2. M/s. Ludhiana Dyeing Machinery Works 3064, St. No. 3, Ganesh Nagar, Ludhiana-141003. 3. M/s. Paradise Engg. Corpn. 302, Industrial Area-A, Ludhiana-141003. 4. M/s. Dynamic Engg. Corpn. Dionic Chambers, 50, Rani Jhansi Road, New Delhi-110055

Depreciation on testing equipments @20% 10,000 Depreciation on vehicle @ 15% Interest on total investment @ 14% Total (2) Turnover (per year) Processing Charges Bleaching Charges Dyeing charges Qty. Rate K g s . /Kg. 1,50,000 1,50,000 Total Amount (Rs.) 11,250 64,4592 50,68,942

18 27,00,000 23 34,50,000 61,50,000

B LEACHING

AND

DYEING

OF

COTTON KNITTED FABRIC

19

5. M/s. Data Colour 3061/4, Lucky Lanes, Andheri East, Mumbai. Raw Material Suppliers 1. M/s. Rangila Dyes Co. Chauri Sarak, Ludhiana. 2. M/s. Crescent Dye Industries

Chauri Sarak, Ludhiana. 3. M/s. Sarjeevan Dyes Mfr. Co. Industrial Area-A, Ludhiana-141003. 4. M/s. ICI (India) Ltd. P. B. No. 107, Himaltane House, New Delhi-110001.

You might also like

- Bleaching and Dyeing of Cotton Knitted Fabric Project ReportDocument9 pagesBleaching and Dyeing of Cotton Knitted Fabric Project ReportRajesh Kumar PandeyNo ratings yet

- Cotton Yarn Dyeing Project ReportDocument6 pagesCotton Yarn Dyeing Project ReportkreeshnuNo ratings yet

- Cotton Knitted Undergarments (Briefs, Panties, Vests) : 1. Procurement of Knitted FabricDocument6 pagesCotton Knitted Undergarments (Briefs, Panties, Vests) : 1. Procurement of Knitted FabricPaka ManojNo ratings yet

- Project of Rexin BagDocument11 pagesProject of Rexin BagShayan Pitruja100% (1)

- Uniform ManufacturingDocument6 pagesUniform ManufacturingcollinsongoriNo ratings yet

- Printing Ink Project ProfileDocument8 pagesPrinting Ink Project Profilepraveen4ppkNo ratings yet

- A Project Profile On Saddlery & Harness: Dcdi-Agra@dcmsme - Gov.inDocument8 pagesA Project Profile On Saddlery & Harness: Dcdi-Agra@dcmsme - Gov.inroufzargarNo ratings yet

- Manufacture of Shirt (Top) and Skirts: Ntroduction Arket OtentialDocument5 pagesManufacture of Shirt (Top) and Skirts: Ntroduction Arket OtentialAnurag PalNo ratings yet

- Plaster of ParisDocument5 pagesPlaster of ParisAniket Salvi100% (1)

- Project Report - Garment - Textile Screen PrintingDocument4 pagesProject Report - Garment - Textile Screen PrintingM D Ramprasad ReddyNo ratings yet

- Project Profile On Computerized Machine (Job Work) : Such Specification For This ProductDocument8 pagesProject Profile On Computerized Machine (Job Work) : Such Specification For This ProductParijat RaiNo ratings yet

- Lycra & Air Covered YarnDocument6 pagesLycra & Air Covered YarnDanish NawazNo ratings yet

- Shamp PapadDocument5 pagesShamp PapadRaj GiriNo ratings yet

- Men's Readymade GarmentsDocument5 pagesMen's Readymade Garmentsmorshed.mahamudNo ratings yet

- Project Profile On Gent's ShirtsDocument12 pagesProject Profile On Gent's ShirtsNidhin ChandranNo ratings yet

- Shuttle CockDocument5 pagesShuttle Cockpradip_kumarNo ratings yet

- Project Feasibility Studies ch8Document5 pagesProject Feasibility Studies ch8Pradeep KrishnanNo ratings yet

- Plaster of Par IsDocument6 pagesPlaster of Par IsHenock TsegayeNo ratings yet

- Gentsshirtsandtrousers PDFDocument12 pagesGentsshirtsandtrousers PDFwwwaqarNo ratings yet

- Ready Made GarmentsDocument8 pagesReady Made Garmentsarmk_0073141No ratings yet

- Gents T-Shirts: NtroductionDocument8 pagesGents T-Shirts: Ntroductionharish_kavetiNo ratings yet

- PVCDocument10 pagesPVCVarun RanguNo ratings yet

- Design Handbook MAchine DesignDocument5 pagesDesign Handbook MAchine DesignsouravNo ratings yet

- Ice Cream Churner: Released By: The Development Commissioner (SSI), Ministry of SSI, New DelhiDocument9 pagesIce Cream Churner: Released By: The Development Commissioner (SSI), Ministry of SSI, New DelhiBunty RathoreNo ratings yet

- Disposable SyringeDocument5 pagesDisposable SyringePrabhu KoppalNo ratings yet

- Gent Shirt and Trouser UnitsDocument10 pagesGent Shirt and Trouser Unitsmurali muraliNo ratings yet

- Portfolio BagDocument5 pagesPortfolio Bagpradip_kumarNo ratings yet

- Chloninated Heavy-Normal ParafynDocument5 pagesChloninated Heavy-Normal ParafynRamesh KapoorNo ratings yet

- CH 22Document5 pagesCH 22ProfNDAcharyaNo ratings yet

- Manufacturing of NailsDocument15 pagesManufacturing of Nailsshreeshail_mp6009100% (4)

- MSME Project ReportDocument8 pagesMSME Project Reportchaudhary1604No ratings yet

- Hand Gloves Project EportDocument4 pagesHand Gloves Project Eportktgururaj0% (1)

- Project Feasibility Studies ch7Document5 pagesProject Feasibility Studies ch7Pradeep KrishnanNo ratings yet

- Project Profile ON Powder Coating: Dcdi-Ahmbad@dcmsme - Gov.inDocument9 pagesProject Profile ON Powder Coating: Dcdi-Ahmbad@dcmsme - Gov.inAravind JNo ratings yet

- CH 21Document5 pagesCH 21Kader Kunju RizwanNo ratings yet

- Business Plan Hair DyeDocument12 pagesBusiness Plan Hair Dyercool_rahul0039341No ratings yet

- Shaving CreamDocument13 pagesShaving CreamDarpan Ashokrao SalunkheNo ratings yet

- Project Report-Readymade Garment SMADocument11 pagesProject Report-Readymade Garment SMAAnsari ShahnazNo ratings yet

- Full PVC FootwearDocument5 pagesFull PVC Footwearpradip_kumarNo ratings yet

- Feasibility StudyDocument7 pagesFeasibility StudySwati SharmaNo ratings yet

- Quality Control and Standards: Sl. Activity No. Period Starting Period CompletionDocument5 pagesQuality Control and Standards: Sl. Activity No. Period Starting Period Completionanand_shrivastavNo ratings yet

- Eva SoleDocument19 pagesEva SoleMakim ThakurNo ratings yet

- Project Profile - Magnetic ButtonsDocument7 pagesProject Profile - Magnetic ButtonsSai PrashanthNo ratings yet

- Acid Slurry (ALKYL Benzene Sulphonate) : Ntroduction Arket OtentialDocument5 pagesAcid Slurry (ALKYL Benzene Sulphonate) : Ntroduction Arket OtentialRajul GargNo ratings yet

- T Shirt Printing ProjectDocument11 pagesT Shirt Printing Projectrangasamibanumathi1950No ratings yet

- Project Profile On HDPE Pipes PDFDocument9 pagesProject Profile On HDPE Pipes PDFnoeNo ratings yet

- Project Report On Integrated Coir Processing UnitDocument9 pagesProject Report On Integrated Coir Processing UnitKrishna PrasadNo ratings yet

- RUBBER RICE POLISHER SmeDocument9 pagesRUBBER RICE POLISHER SmeRajatMerchantNo ratings yet

- Offset Printing Press (Job Work) : NtroductionDocument4 pagesOffset Printing Press (Job Work) : NtroductionMMjagpreetNo ratings yet

- Eco Friendly Shoe Uppre Leather 2011Document12 pagesEco Friendly Shoe Uppre Leather 2011Namrit ZatakiyaNo ratings yet

- CH 21Document5 pagesCH 21ProfNDAcharyaNo ratings yet

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesFrom EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo ratings yet

- Sustainable Innovations in Textile Chemical ProcessesFrom EverandSustainable Innovations in Textile Chemical ProcessesNo ratings yet

- Waste to Energy in the Age of the Circular Economy: Compendium of Case Studies and Emerging TechnologiesFrom EverandWaste to Energy in the Age of the Circular Economy: Compendium of Case Studies and Emerging TechnologiesRating: 5 out of 5 stars5/5 (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryFrom EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryNo ratings yet

- Engineering Applications: A Project Resource BookFrom EverandEngineering Applications: A Project Resource BookRating: 2.5 out of 5 stars2.5/5 (1)

- Flat Panel Display ManufacturingFrom EverandFlat Panel Display ManufacturingJun SoukNo ratings yet

- Environmental Footprints of Recycled PolyesterFrom EverandEnvironmental Footprints of Recycled PolyesterNo ratings yet

- DRI Charging in EAFDocument3 pagesDRI Charging in EAFMuhammad NbNo ratings yet

- Upper Face BotoxDocument32 pagesUpper Face Botoxyaseer arafat67% (3)

- Dust Management PPT 030813 VISHVA KIRANDocument42 pagesDust Management PPT 030813 VISHVA KIRANVishva KiranNo ratings yet

- Chainguard 280 TDSDocument2 pagesChainguard 280 TDSTeófilo LimasNo ratings yet

- International Journal of Innovative Pharmaceutical ResearchDocument9 pagesInternational Journal of Innovative Pharmaceutical Researchعبدالعزيز بدرNo ratings yet

- Combustion and FlamesDocument4 pagesCombustion and FlamesSURYA PRAKASHNo ratings yet

- Msds Diapolisher PasteDocument10 pagesMsds Diapolisher PasteIka KusumawatiNo ratings yet

- Atoms Elements and Compounds: Define: Proton Number (Atomic Number) : Nucleon Number (Mass Number) : IsotopeDocument2 pagesAtoms Elements and Compounds: Define: Proton Number (Atomic Number) : Nucleon Number (Mass Number) : IsotopeNuan Ting NgNo ratings yet

- FERT18Document253 pagesFERT18Margarit AnamaryaNo ratings yet

- Brochure Cleaning Professional Vehicle Cleaning Formulation Guide GlobalDocument4 pagesBrochure Cleaning Professional Vehicle Cleaning Formulation Guide Globalpkh2967% (3)

- Metal Oxide SemiconductorDocument2 pagesMetal Oxide Semiconductorcommonsense1010No ratings yet

- Unit 1 Lesson 2: Use of Nail Care Tools and EquipmentDocument56 pagesUnit 1 Lesson 2: Use of Nail Care Tools and EquipmentRheovien Joy BagoodNo ratings yet

- Elsa Manual SabreDocument50 pagesElsa Manual SabrerijalharunNo ratings yet

- Novo GO ALKYD GlossyDocument1 pageNovo GO ALKYD Glossysarah magdyNo ratings yet

- 3G4 Distillation CalculationsDocument22 pages3G4 Distillation Calculationsrkm_rkmNo ratings yet

- Lafarge Terraflow en 190617Document12 pagesLafarge Terraflow en 190617Pat AuffretNo ratings yet

- TR0006 Extinction CoefficientsDocument3 pagesTR0006 Extinction CoefficientsRizmahardian Ashari KurniawanNo ratings yet

- Edible Oil Centrifuges 9997 1711 010Document6 pagesEdible Oil Centrifuges 9997 1711 010JerryChenNo ratings yet

- Eh PHDocument22 pagesEh PHGörkem Efe100% (1)

- Inorganic Chemistry For BiologyDocument163 pagesInorganic Chemistry For BiologyBezabih KeltaNo ratings yet

- Divine Child High School Ghod Dod Road, Surat Sub: Science Class: 8 STD Fa-1 NotesDocument12 pagesDivine Child High School Ghod Dod Road, Surat Sub: Science Class: 8 STD Fa-1 Notesshivam thakurNo ratings yet

- Moles and Empirical FormulaDocument11 pagesMoles and Empirical FormulaZenoxu 7zNo ratings yet

- FAS146en - Electrical Temperature MeasurementDocument164 pagesFAS146en - Electrical Temperature MeasurementShiva Sai BuraNo ratings yet

- Advanced Preliminary and Primary Treatment Study GuideDocument22 pagesAdvanced Preliminary and Primary Treatment Study GuideBuenaventura Jose Huamani TalaveranoNo ratings yet

- 1375 2013Document10 pages1375 2013Hidayah Sofia Hidzir0% (1)

- Worksheet #23 - Standard Enthalpies of FormationsDocument2 pagesWorksheet #23 - Standard Enthalpies of FormationsTanishq MainiNo ratings yet

- Cassava Flour Processing StagesDocument8 pagesCassava Flour Processing StagesAhmed BinNo ratings yet

- Positive Displacement Pump PDFDocument345 pagesPositive Displacement Pump PDFTapas Chaudhuri100% (3)

- Provisional RestorationsDocument10 pagesProvisional Restorationsapi-3775747100% (1)

- Pressure Vessel Plates, Alloy Steel, Chromium-Molybdenum-TungstenDocument3 pagesPressure Vessel Plates, Alloy Steel, Chromium-Molybdenum-TungstenMytzy Godoy TapiaNo ratings yet