Professional Documents

Culture Documents

By:Vaibhav Malhotra: Chapter One Financial Management: An Overview

By:Vaibhav Malhotra: Chapter One Financial Management: An Overview

Uploaded by

sweet19girlOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

By:Vaibhav Malhotra: Chapter One Financial Management: An Overview

By:Vaibhav Malhotra: Chapter One Financial Management: An Overview

Uploaded by

sweet19girlCopyright:

Available Formats

BY :VAIBHAV MALHOTRA EMAIL:vaibhav4u38@rediffmail.

com

CH APTER ON E FIN AN CIAL M AN AGEM EN T : AN OVERVI EW

Ques t io n : What do yo u me an b y financi al manag e me nt ? Ans we r : M e aning o f Financ ial M anag e me nt : The pri mary task of a C harte re d Ac c ount ant is to de al w i th funds, 'Man age me nt of F unds' is an i mportant aspe c t of fi nanc i al mana ge me nt i n a busi ne ss unde rtak i n g or any othe r i nsti tuti on l i ke hospi tal , art soc i e ty, and so on. The te rm 'F i nanc i al Manage me nt ' has be e n de fi ne d di ffe re ntl y by di ffe re nt authors. Ac c ordi ng to Sol omon " Fi nanc i al Manage me nt i s c onc e rne d w i th the e ffi ci e nt use of an i mportant e c onomi c re sourc e , name l y c api tal funds. " Phi l l i ppatus has gi ve n a more e l aborate de fi ni ti on of the te rm, as , "F i nanc i al Mana ge me nt, is c onc e rne d wi th the mana ge ri al de c i si ons that re sul ts i n the ac qui si ti on and fi nanc i ng of short and l ong te rm c re di ts for the fi rm. " Thus, i t de al s w i th the si tuati ons that re qui re se l e c ti on of spe c i fi c probl e m of si ze and grow th of an e nte rpri se . The anal ysi s of the se de c i si ons i s base d on the expe c te d i nfl ow s and outfl ow s of funds and the i r effe c t on mana ge ri al obj e c ti ve s. The most ac ce ptabl e de fi ni ti on of fi nanc i al manage me nt is that gi ve n by S. C .K uc hhal as, "F i nanc i al manage me nt de al s w i th proc ure me nt of funds and thei r e ffe c ti ve uti l i sati on i n the busi ne ss. " Thus, the re are 2 basi c aspe c ts of fi nanc i al manage me nt : 1 ) p ro cure me nt o f f unds : As funds c an be obtai ne d from di ffe re nt sourc e s thus, the i r proc ure me nt i s al w ays c onsi de re d as a c ompl e x probl e m by busi ne ss c onc e rns. The se funds proc ure d from di ffe re nt sourc e s have di ffe re nt c harac te ri sti c s i n te rms of ri sk, c ost and c ontrol that a manage r must c onsi de r w hi l e proc uri n g funds. The funds shoul d be proc ure d at mi ni mum c ost, at a bal anc e d ri sk and c ontrol fac tors. F unds rai se d by i ssue of e qui ty share s are the be st from ri sk poi nt of vi ew for the c ompan y, as i t has no re payme nt l i abi l i ty exc e pt on wi ndi ng up of the c ompan y, but from c ost poi nt of vi ew , i t is most e xpe nsi ve , as di vi de nd e xpe c tati ons of share hol de rs are hi ghe r than pre vai l i ng i nte re st rate s and di vi de nds are appropri ati o n of profi ts and not al l owe d as e xpe nse unde r the i nc ome tax ac t. The issue of ne w e qui ty share s may di l ute the c ontrol of the exi sti ng share hol de rs. De be nture s are c omparati ve l y c he ape r si nc e the i nte re st is pai d out of profi ts be fore tax. B ut, the y e ntai l a hi gh de gree of ri sk si nc e the y have to be re pai d as pe r the te rms of agre e me nt; al so, the

i nte re st payme nt has to be made w he the r or not the c ompan y mak e s profi ts . F unds c an al so be proc ure d from bank s and fi nanc i al i nsti tuti ons, the y provi de funds subj e c t to ce rtai n re stri c ti ve c ove nants. The se c ove nants re stri c t fre e dom of the borrow e r to rai se l oans from othe r sourc e s. The re form proc e ss i s al so movi ng i n di re c ti on of a c l ose r moni tori ng of 'e nd use ' of re sourc e s mobi l i se d throu gh c api tal mark e ts. Suc h re stri c ti ons are e sse nti al for the safe ty of funds provi de d by i nsti tuti ons and i nve stors. The re are othe r fi nanc i al i nstrume nts use d for rai si ng fi nanc e e . g. c omme rc i al pape r, dee p di sc ount bonds, e tc. The fi nanc e manage r has to bal anc e the avai l abi l i ty of funds and the re stri c ti ve provi si ons tie d wi th suc h funds re sul ti ng i n l ac k of fl e xi bi l i ty. I n the gl obal i se d c ompe ti ti ve sc e nari o, i t is not e nough to de pe nd on avai l abl e w ays of fi nanc e but re sourc e mobi l i sati on i s to be unde rtak e n throu gh i nnovati ve w ays or fi nanc i al prod uc ts that may me e t the nee ds of i nve stors. Mul ti pl e opti on c onve rti bl e bonds c an be si ghte d as an exampl e , funds c an be rai se d i ndi ge nousl y as al so from abroa d. Fore i gn Di re c t Inve stme nt (F DI ) and F orei gn I nsti tuti onal I nve stors (FI I ) are tw o maj or sourc e s of fi nanc e from abroa d al ong wi th Ame ri c an De posi tory Re c e i pts (ADR's) and Gl obal De posi tory Re c e i pts (GDR's). The me c hani sm of proc uri n g funds i s to be modi fi e d i n the l i ght of re qui re me nts of fore i gn i nve stors. Proc ure me nt of fund s i nte r al i a i nc l ude s : - I de nti fi c ati on of sourc e s of fi nanc e - De te rmi nati on of fi nanc e mi x - Rai si ng of funds - Di vi si on of profi ts be twe e n di vi de nds and re te nti on of profi ts i. e. i nte rnal fund ge ne rati on. 2 ) e ff e ct ive us e o f s uch f unds : The fi nanc e mana ge r i s al so re sponsi bl e for e ffe c ti ve uti l i sati on of funds. He must poi nt out si tuati ons w he re funds are k e pt i dl e or are use d i mprope rl y. Al l funds are proc ure d at a ce rtai n c ost and afte r e ntai l i ng a ce rtai n amount of ri sk . If the funds are not uti li se d i n the manne r so that the y ge ne rate an i nc ome hi ghe r than c ost of proc ure me nt, the re is no me ani ng i n runni n g the busi ne ss. I t i s an i mporta nt c onsi de rati on i n di vi de nd de c i si ons al so, thus, i t i s c ruc i al to e mpl oy funds prope rl y and profi tabl y. The funds are to be e mpl oye d i n the manne r so that the c ompany c an produc e at i ts opti mum le vel w i thout e ndange ri ng i ts fi nanc i al sol ve nc y. Thus, fi nanc i al i mpl i c ati ons of e ac h de c i si on to i nve st i n fi xe d asse ts are to be prope rl y anal yse d. F or thi s, the fi nanc e manage r must posse ss sound k now l e dge of te c hni que s of c api tal bud ge ti ng and must k ee p i n vi e w the ne e d of ade quate w ork i ng c api tal and e nsure that w hil e fi rms e nj oy an opti mum l e ve l of w orki ng c api tal the y do not ke e p too muc h funds bl oc ke d i n i nve ntori e s, book de bts, c ash, e tc. F ixe d asse ts are to fi nanc e d from me di um or l ong te rm funds, and not short te rm funds, as fi xe d asse ts c annot be sol d i n short te rm i. e. w i thi n a ye ar, al so a l arge amount of fund s w oul d be bl oc k e d i n stoc k i n hand as the c ompany c annot i mme di ate l y se l l i ts fi ni she d goods.

Ques t io n : Exp lain t he s co p e of financi al manag e me nt ? Ans we r : Scop e of f inancial manag e me nt : A sound fi nanc i al manage me nt is e sse nti al i n al l type of fi nanc i al organi sati ons - w he the r profi t orie nte d or not, w he re funds are i nvol ve d and al so i n a c e ntral l y pl anne d e c onomy as al so i n a c api tal i st se t-up. Fi rms, as pe r the c omme rc i al hi story, have not li qui da te d be c ause the i r te c hnol ogy w as obsol e te or the i r prod uc ts had no or l ow de mand or due to any othe r fac tor, but due to l ac k of fi nanc i al mana ge me nt. Eve n i n boom pe ri od, w he n a c ompa ny mak e s hi gh profi ts , the re i s dange r of li qui da ti on, due to bad fi nanc i al mana ge me nt. The mai n c ause of l i qui dati on of suc h c ompani e s i s ove rtradi n g or ove r-expan di ng wi thout an ade quate fi nanc i al base . F i nanc i al manage me nt opti mi se s the output from the gi ve n i nput of funds and atte mpts to use the funds i n a most produc ti ve manne r. I n a c ountry li ke I ndi a, w he re re sourc e s are sc arc e and de mand on funds are many, the ne e d for prope r fi nanc i al mana ge me nt i s e normous. I f prope r te c hni que s are use d most of the e nte rpri se s c an re duc e the i r c api tal e mpl oye d and i mprove re turn on i nve stme nt. Thus, as me n and mac hi ne are prope rl y manage d, fi nanc e s are al so to be w el l manage d. I n new l y starte d c ompani e s, i t i s i mportant to have sound fi nanc i al manage me nt, as i t e nsure s the i r survi val , ofte n suc h c ompa ni e s i gnore s fi nanc i al manage me nt at the i r ow n pe ri l . Eve n a si mpl e ac t, l ik e de posi ti ng the c he que s on the day of the i r re c e i pt i s not pe rforme d. Suc h organi sa ti ons pay he avy i nte re st c harge s on borrow e d funds, but are tardy i n re al i si ng the i r ow n de btors. Thi s is due to the fac t the y l ac k re al i sati on of the c onc e pt of ti me val ue of mone y, i t i s not appre c i ate d that e ac h val ue of rupe e has to be made use of and that i t has a di re c t c ost of uti l i sati on. It must be re al i se d that k ee pi ng rupe e i dle e ve n for a day, re sul ts i nto l osse s. A non- profi t organi sa ti on may not be k ee n to mak e profi t, tradi ti onal l y, but i t doe s ne e d to c ut dow n i ts c ost and use the funds at i ts di sposal to the i r opti mu m c apac i ty. A sound se nse of fi nanc i al manage me nt has to be c ul ti vate d among our bure auc rats, admi ni stra tors, e ngi ne e rs, e duc ati oni sts and publ i c at l arge . Unl e ss thi s i s done , c ol ossal w astage of the c api tal re sourc e s c annot be arre ste d.

Ques t io n : What are t he ob je ct ive s of financi al manag e me nt ? Ans we r : Ob je ct ive s of financi al manag e me nt : Effi c i e nt fi nanc i al mana ge me nt re qui re s exi ste nc e of some obj e c ti ve s or goal s be c ause j udgme nt as to w he the r or not a fi nanc i al de c i si on i s effi c i e nt i s to be made i n li ght of some obj e c ti ve . The tw o mai n obj e c ti ve s of fi nanc i al manage me nt are : 1 ) Pro f it M ax imis at io n :

I t i s tradi ti on al l y be i ng argue d, that the obj e c ti ve of a c ompany is to e arn profi t, he nc e the obj e c ti ve of fi nanc i al manage me n t i s profi t maxi mi sati on. Thus, e ac h al te rnati ve , is to be see n by the fi nanc e mana ge r from the vie w poi nt of profi t maxi mi sati o n. B ut, i t c annot be the onl y obj e c ti ve of a c ompany, i t i s at be st a li mi te d obj e c ti ve el se a num be r of probl e ms w oul d ari se . Some of the m are : a) The te rm profi t i s vague and doe s not cl ari fy w hat e xac tl y i t me ans. I t c onve ys di ffe re nt me ani ng to di ffe re nt pe opl e . b) Profi t maxi mi sati on has to be atte mpte d w i th a re ali sati on of ri sk s i nvol ve d. The re is di re c t rel ati on be twe e n ri sk and profi t; hi ghe r the ri sk , hi ghe r i s the profi t. F or maxi mi si ng profi t, ri sk i s al toge the r i gnore d, i mpl yi ng that fi nanc e manage r ac c e pts hi ghl y ri sk y proposal s al so. Prac ti c al l y, ri sk i s a ve ry i mportan t fac tor to be bal anc e d w i th profi t obj e c ti ve. c ) Profi t maxi mi sati on i s an obj e c ti ve not tak i ng i nto ac c ount the ti me patte rn of re turns. E. g. Proposal X gi ve s re turns hi ghe r than that by proposal Y but, the ti me pe ri od i s say, 10 ye ars and 7 ye ars re spe c ti ve l y. Thus, the ove rall profi t i s onl y c onsi de re d not the ti me pe ri od, nor the fl ow of profi t. d) Profi t maxi mi sati on as an obj e c ti ve i s too narrow , i t fai l s to tak e i nto ac c ount the soc i al c onsi de rati ons and obl i gati ons to vari ous i nte re sts of w orke rs, c onsume rs, soc ie ty, as w el l as e thi c al trade prac ti c e s. I gnori ng the se fac tors, a c ompa ny c annot survi ve for l ong. Profi t maxi mi sati on at the c ost of soc i al and moral obl i gati ons i s a short si ghte d pol i c y. 2 ) We alt h max imis at io n : The c ompani e s havi ng profi t maxi mi sati on as i ts obj e c ti ve , may adopt pol i c i e s yi e l di ng exorbi tant profi ts i n the short run w hi c h are unhe al thy for the grow th, survi val and ove rall i nte re sts of the busi ne ss. A c ompa ny may not unde rtak e pl anne d and pre sc ri be d shut- dow ns of the pl ant for mai nte nanc e , and so on for maxi mi si ng profi ts i n the short run. Thus, the obj e c ti ve of a fi rm shoul d be to maxi mi se i ts val ue or w e al th. Ac c ordi ng to Van Horne , " Val ue of a fi rm i s re pre se nte d by the mark e t pri c e of the c ompany 's c ommon stoc k .. . . .. . the mark e t pri c e of a fi rm's stoc k re pre se nts the foc al j udgme nt of all mark e t parti c i pa nts as to w hat the val ue of the parti c ul ar fi rm i s. I t tak e s i nto ac c ount pre se nt as al so prospe c ti ve future earni ngs pe r share , the ti mi ng and ri sk of the se e arni ng, the di vi de nd pol i c y of the fi rm and many othe r fac tors havi ng a be ari ng on the mark e t pri ce of stoc k . The mark e t pri c e se rve s as a pe rformanc e i nde x or re port c ard of the fi rm's progre ss. I t i ndi c ate s how we ll manage me n t i s doi ng on be hal f of stoc k hol de rs. " Share pri c e s i n the share mark e t, at a gi ve n poi nt of ti me , are the re sul t of a mi xture of many fac tors, as ge ne ral ec onomi c outl ook , parti c ul ar outl ook of the c ompa ni e s unde r c onsi de rati on, te c hni c al fac tors and e ve n mass psyc hol ogy, but, tak e n on a l ong te rm basi s, the y re fl e c t the val ue , w hi c h vari ous parti e s, put on the c ompa ny.

N ormal l y thi s val ue is a func ti on, of : - the l ik e l y rate of earni ngs pe r share of the c ompan y; and - the c api tal i sati on rate . The li k el y rate of e arni ngs pe r share (EPS) de pe nds upon the asse ssme nt as to the profi tabl y a c ompan y i s goi ng to ope rate i n the future or w hat i t i s li k el y to e arn agai nst eac h of i ts ordi nary share s. The c api tal i sati on rate re fl e c ts the li k i ng of the i nve stors of a c ompa ny. If a c ompan y e arns a hi gh rate of earni ngs pe r share throu gh i ts ri sk y ope rati ons or ri sk y fi nanc i n g patte rn, the i nve stors wi l l not l ook upon i ts share w i th favour. To that exte nt, the mark e t val ue of the share s of suc h a c ompan y wi l l be l ow . An e asy w ay to de te rmi ne the c api tal i sati on rate i s to start wi th fi xe d de posi t i nte re st rate of bank s, i nve stor w oul d w ant a hi ghe r re turn i f he i nve sts i n share s, as the ri sk i nc re ase s. How muc h hi ghe r re turn i s expe c te d, de pe nds on the ri sk s i nvol ve d i n the parti c ul ar share w hi c h i n turn de pe nds on c ompa ny pol i c i e s, past re c ords, type of busi ne ss and c onfi de nc e c omman de d by the mana ge me nt. Thus, c api tal i sati on rate i s the c umul ati ve re sul t of the asse ssme nt of the vari ous share hol de rs re gardi n g the ri sk and othe r qual i tati ve fac tors of a c ompany. I f a c ompany i nve sts i ts funds i n ri sk y ve nture s, the i nve stors w il l put i n the i r mone y i f the y ge t hi ghe r re turn as c ompare d to that from a l ow ri sk share . The mark e t val ue of a share i s thus, a func ti on of earni ngs pe r share and c api tal i sati on rate . Si nc e the profi t maxi mi sati on c ri te ri a c annot be appl i e d i n re al w orl d si tuati ons be c ause of i ts te c hni c al l i mi tati on the fi nanc e manage r of a c ompan y has to ensure that hi s de c i si ons are suc h that the mark e t val ue of the share s of the c ompany i s maxi mum i n the l ong run. Thi s i mpl i e s that the fi nanc i al pol i c y has to be suc h that i t opti mi se s the EPS, k ee pi ng i n vie w the ri sk and othe r fac tors. Thus, w e al th maxi mi sati on i s a be tte r obj e c ti ve for a c omme rc i al unde rtak i n g as c ompare d to re turn and ri sk . The re i s a grow i ng e mphasi s on soc i al and othe r obl i gati ons of an e nte rpri se . I t c annot be de ni e d that i n the c ase of unde rtak i ngs, e spe c i all y those i n the publ i c se c tor, the que sti on of w e al th maxi mi sati on i s to be see n i n c onte xt of soc i al and othe r obl i gati ons of the e nte rpri se . I t must be unde rstoo d that fi nanc i al de c i si on mak i ng i s rel ate d to the obj e c ti ve s of the busi ne ss. The fi nanc e manage r has to e nsure that the re i s a posi ti ve i mpac t of e ac h fi nanc i al de ci si on on the furthe ranc e of the busi ne ss obj e c ti ve s. O ne of the mai n obj e c ti ve of an unde rtak i n g may be to " progre ssi ve l y bui l d up the c apabi l i ty to unde rtak e the de si gn and de ve l opme nt of ai rc raft e ngi ne s, he li c opte rs, e tc . " A fi nanc e manage r i n suc h c ase s w i ll al l oc ate funds i n a w ay that thi s obje c ti ve i s ac hi e ve d al thou gh suc h an al l oc ati on may not ne c e ssari l y maxi mi se we al th.

Ques t io n : What are t he funct io ns o f a Finan ce M anag e r ? Ans we r :

Funct io ns o f a Finance M anag e r : The tw i n aspe c ts, proc ure me nt and e ffe c ti ve uti l i sati on of funds are c ruc i al task s face d by a fi nanc e mana ge r. The fi nanc i al mana ge r i s re qui re d to l ook i nto the fi nanc i al i mpl i c ati ons of any de c i si on i n the fi rm. Thus all de c i si ons i nvol ve manage me nt of funds unde r the purvi e w of the fi nanc e manage r. A l arge numbe r of de c i si ons i nvol ve substan ti al or mate ri al c hange s i n val ue of fund s proc ure d or e mpl oye d. The fi nanc e mana ge r, has to manage funds i n suc h a w ay so as to mak e the i r opti mu m uti l i sati on and to e nsure the i r proc ure me nt i n a w ay that the ri sk , c ost and c ontrol are prope rl y bal anc e d unde r a gi ve n si tuati on. He may not, be c onc e rne d wi th the de c i si ons, that do not affe c t the basi c fi nanc i al manage me nt and struc ture . The nature of job of an ac c ounta nt and fi nanc e manage r i s di ffe re nt, an ac c ountant 's j ob i s pri mari l y to re c ord the busi ne ss transac ti o ns, pre pare fi nanc i al state me nts show i ng re sul ts of the organi sa ti on for a gi ve n pe ri od and i ts fi nanc i al c ondi ti on at a gi ve n poi nt of ti me . He i s to re c ord vari ous happe ni ngs i n mone tary te rms to e nsure that asse ts, li abi l i ti e s, i nc ome s and e xpe nse s are prope rl y groupe d, c l assi fi e d and di sc l ose d i n the fi nanc i al state me nts. Ac c ount ant is not c onc e rne d w i th manage me nt of funds that i s a spe c i al i se d task and i n mode rn ti me s a c ompl e x one. The fi nanc e mana ge r or c ontrol l e r has a task e nti rel y di ffe re nt from that of an ac c ount ant, he i s to manage funds. Some of the i mportan t de c i si ons as re gards fi nanc e are as fol l ow s : 1 ) Es t imat ing t he re q uire me nt s of f und s : A busi ne ss re qui re s funds for l ong te rm purp ose s i .e . i nve stme nt i n fi xe d asse ts and so on. A c are ful e sti mate of suc h funds i s re qui re d to be made . An asse ssme nt has to be made re gardi n g re qui re me nts of w ork i ng c api tal i nvol vi ng, esti mati on of amount of funds bl oc ke d i n c urre nt asse ts and that l i ke l y to be ge ne rate d for short pe ri ods throu gh c urre nt li abi l i ti e s. F ore c asti ng the re qui re me nts of funds i s done by use of te c hni que s of bud ge tary c ontrol and l ong range pl anni ng. Esti mate s of re qui re me nts of funds c an be made onl y if al l the physi c al ac ti vi ti e s of the organi sa ti on are fore c aste d. The y c an be transl ate d i nto mone tary te rms. 2 ) De cis io n re g ard ing cap it al s t ruct ure : O nce the re qui re me nts of funds is e sti mate d, a de c i si on re gardi ng vari ous sourc e s from w he re the funds woul d be rai se d is to be tak e n. A prope r mi x of the vari ous sourc e s i s to be w orke d out, e ac h sourc e of funds i nvol ve s di ffe re nt i ssue s for c onsi de rati on. The fi nanc e manage r has to c are ful l y l ook i nto the e xi sti ng c api tal struc ture and se e how the vari ous proposal s of rai si ng funds w il l affe c t i t. He i s to mai ntai n a prope r bal anc e be twe e n l ong and short te rm funds and to e nsure that suffi c ie nt l ong- te rm funds are rai se d i n orde r to fi nanc e fi xe d asse ts and othe r l ong- te rm i nve stme nts and to provi de for pe rmane nt nee ds of w ork i ng c api tal . I n the ove ral l vol ume of l ong- te rm funds, he is to mai ntai n a prope r bal anc e be twe e n ow n and l oan funds and to se e that the ove ral l c api tal i sati on of the c ompa ny i s suc h, that the c ompany is abl e to proc ure funds at mi ni mum c ost and i s abl e to tol e rate shoc k s of l e an pe ri ods. Al l the se de ci si ons are k now n as 'fi nanc i ng de ci si ons'.

3 ) Inve s t me nt de cis io n : F unds proc ure d from di ffe re nt sourc e s have to be i nve ste d i n vari ous ki nds of asse ts. L ong te rm funds are use d i n a proj e c t for fi xe d and al so c urre nt asse ts. The i nve stme nt of funds i n a proj e c t i s to be made afte r c are ful asse ssme nt of vari ous proj e c ts throu gh c api tal budge ti n g. A part of l ong te rm funds is al so to be k e pt for fi nanc i n g w ork i ng c api tal re qui re me nts. Asse t manage me nt pol i c i e s are to be l ai d dow n re gardi ng vari ous i te ms of c urre nt asse ts, i nve ntory pol i c y i s to be de te rmi ne d by the prod uc ti on and fi nanc e manage r, w hi le k ee pi ng i n mi nd the re qui re me nt of produc ti o n and future pri c e e sti mate s of raw mate ri al s and avai l abi l i ty of fund s. 4 ) Divid e nd de cis io n : The fi nanc e manage r i s c onc e rne d wi th the de c i si on to pay or de c l are di vi de nd. He i s to assi st the top manage me nt i n de c i di ng as to w hat amount of di vi de nd shoul d be pai d to the share hol de rs and w hat amoun t be re tai ne d by the c ompany, i t i nvol ve s a l arge numbe r of c onsi de rati ons. Ec onomi c al l y spe ak i ng, the amoun t to be re tai ne d or be pai d to the share hol de rs shoul d de pe nd on w he the r the c ompan y or share hol de rs c an mak e a more profi tabl e use of re sourc e s, al so c onsi de rati ons li k e tre nd of e arni ngs, the tre nd of share mark e t pri c e s, re qui re me nt of funds for future grow th, c ash fl ow si tuati on, tax posi ti on of share hol de rs, and so on to be ke pt i n mi nd. The pri nc i pal func ti on of a fi nanc e mana ge r re l ate s to de c i si ons re gardi ng proc ure me nt, i nve stme nt and di vi de nds. 5 ) Sup p ly of f und s to all p art s o f t he o rg anis at io n o r cas h manag e me nt : The fi nanc e manage r has to e nsure that al l se c ti ons i .e . branc he s, fac tori e s, uni ts or de partme nts of the organi sa ti on are suppl i e d w i th ade quate funds. Se c ti ons havi ng exc e ss funds c ontri bute to the c e ntral pool for use i n othe r se c ti ons that nee ds funds. An ade quate suppl y of c ash at al l poi nts of ti me i s absol ute l y esse nti al for the smooth fl ow of busi ne ss ope rati ons. Eve n i f one of the many branc he s i s short of funds, the w hole busi ne ss may be i n dange r, thus, c ash manage me nt and c ash di sburse me nt pol i c i e s are i mportan t wi th a vi ew to suppl yi n g ade quate funds at all ti me s and poi nts i n an organi sa ti on. I t shoul d e nsure that the re is no exc e ssi ve c ash. 6 ) Evalu at ing f inancial pe rfo rmance : Manage me n t c ontrol syste ms are usual l y base d on fi nanc i al anal ysi s, e . g. ROI (re turn on i nve stme nt) syste m of di vi si onal c ontrol . A fi nanc e manage r has to c onstantl y re vie w the fi nanc i al pe rformanc e of vari ous uni ts of the organi sa ti on. Anal ysi s of the fi nanc i al pe rforma nc e he l ps the mana ge me nt for asse ssi ng how the funds are uti l i se d i n vari ous di vi si ons and w hat c an be done to i mprove i t. 7 ) Financ ial neg o t iat io ns : Fi nanc e mana ge r's maj or ti me i s uti l i se d i n c arryi ng out ne goti ati ons w i th fi nanc i al i nsti tuti on s, bank s and publ i c de posi tors. He has to furni sh a l ot of i nformati on to the se i nsti tuti ons and pe rsons i n orde r to e nsure that rai si ng of funds is w i thi n the statute s. Ne goti ati ons for outsi de fi nanc i ng ofte n re qui re s spe c i al i se d sk i l l s. 8 ) Ke e p ing in t o uch wit h st o ck e x chang e q uo t at io ns and b e havio r of share p rice s : I t i nvol ve s anal ysi s of maj or tre nds i n the

stoc k mark e t and j udgi ng the i r i mpac t on share pri c e s of the c ompany 's share s.

Ques t io n : What are t he vario us me t hod s and to o ls us e d f o r f inancial manag e me nt ? Ans we r : Fi nanc e mana ge r use s vari ous tool s to di sc harge hi s func ti ons as re gards fi nanc i al manage me nt. I n the are a of fi nanc i ng the re are vari ous me thods to proc ure funds from l ong as al so short te rm sourc e s. The fi nanc e manage r has to de c i de an opti mum c api tal struc ture that c an c ontri b ute to the maxi mi sati on of share hol de r's w e al th. Fi nanc i al le ve rage or tradi ng on e qui ty i s an i mportant me thod by w hi c h a fi nanc e manage r may i nc re ase the re turn to c ommon share hol de rs. F or eval uati on of c api tal proposal s, the fi nanc e manage r use s c api tal budge ti ng te c hni que s as payb ac k , i nte rnal rate of re turn, ne t pre se nt val ue , profi tabi l i ty i nde x, ave rage rate of re turn. I n the are a of c urre nt asse ts manage me nt, he use s me thods to c he c k e ffi c ie nt uti l i sati on of c urre nt re sourc e s at the e nte rpri se 's di sposal . An e nte rpri se c an i nc re ase i ts profi tabi l i ty w i thout affe c ti ng i ts li qui di ty by an effi c i e nt manage me nt of w orki ng c api tal . F or i nstanc e , i n the are a of w ork i ng c api tal manage me n t, c ash manage me nt may be c e ntral i se d or de -c e ntral i se d; ce ntral i se d me thod i s c onsi de re d a be tte r tool of mana gi ng the e nte rpri se 's l i qui d re sourc e s. I n the are a of di vi de nd de c i si ons, a fi rm i s fac e d wi th the probl e m of de cl arati on or postpo ni ng de c l arati on of di vi de nd, a probl e m of i nte rnal fi nanc i n g. F or eval uati on of an e nte rpri se 's pe rformanc e , the re are vari ous me thods, as rati o anal ysi s. Thi s te c hni que i s use d by al l c onc e rne d pe rsons. Di ffe re nt rati os se rvi ng di ffe re nt obj e c ti ve s. An i nve stor use s vari ous rati os to e val uate the profi tabi l i ty of i nve stme nt i n a parti c ul ar c ompa ny. The y e nabl e the i nve stor, to j udge the profi tabi l i ty, sol ve nc y, li qui di ty and grow th aspe c ts of the fi rm. A shortte rm c re di tor i s more i nte re ste d i n the l i qui di ty aspe c t of the fi rm, and i t i s possi bl e by a study of l i qui di ty rati os - c urre nt rati o, qui c k rati os, e tc . The mai n c onc e rn of a fi nanc e manage r i s to provi de ade quate funds from be st possi bl e sourc e , at the ri ght ti me and at mi ni mum c ost and to e nsure that the funds so ac qui re d are put to be st possi bl e use. F unds fl ow and c ash fl ow state me nts and proj e c te d fi nanc i al state me nts he l p a l ot i n thi s re gard.

Ques t io n : Dis cuss t he ro le o f a f inance manag e r ? Ans we r : In the mode rn e nte rpri se, a fi nanc e mana ge r oc c upi e s a ke y posi ti on, he bei ng one of the dynami c me mbe r of c orporate manage ri al te am. Hi s role , i s be c omi ng more and more pe rvasi ve and si gni fi c ant i n sol vi ng c ompl e x manage ri al probl e ms. Tradi ti onal l y, the rol e of a fi nanc e manage r w as c onfi ne d to rai si ng funds from a numbe r of

sourc e s, but due to re ce nt de vel opme nts i n the soc i o-e c onomi c and pol i ti c al sc e nari o throu gho ut the w orl d, he i s pl ac e d i n a c e ntral posi ti on i n the organi sati o n. He i s re sponsi bl e for shapi ng the fortune s of the e nte rpri se and is i nvol ve d i n the most vi tal de c i si on of al l oc ati on of c api tal li k e me rge rs, ac qui si ti ons, e tc . A fi nanc e manage r, as othe r me mbe rs of the c orporate te am c annot be ave rse to the fast de ve l opme nts, around hi m and has to tak e note of the c hange s i n orde r to tak e rel e vant ste ps i n vie w of the dynami c c hange s i n c i rc umstanc e s. E. g. i ntroduc ti o n of Euro - as a si ngl e c urre nc y of Europe i s an i nte rnati onal le ve l c hange , havi ng i mpac t on the c orporate fi nanc i al pl ans and pol i c i e s w orl d- w i de. Dome sti c de vel opme nts as eme rge nc e of fi nanc i al se rvi ce s se c tors and SEB I as a w atc h dog for i nve stor prote c ti on and re gul ati ng body of c api tal mark e ts i s c ontri buti n g to the i mportanc e of the fi nanc e mana ge r's j ob. B ank s and fi nanc i al i nsti tuti ons we re the maj or sourc e s of fi nanc e , mono pol y w as the state of affai rs of I ndi an busi ne ss, share hol de rs sati sfac ti on w as not the promote r 's c onc e rn as most of the c ompani e s, we re c l ose l y he l d. Due to the ope ni ng of e c onomy, c ompe ti ti on i nc re ase d, se l le r's mark e t i s bei ng c onve rte d i nto buye r's mark e t. De ve l opme nt of i nte rne t has brought new c hal l e nge s be fore the mana ge rs. I ndi an c onc e rns no longe r have to c ompe te onl y nati onal l y, i t i s fac i ng i nte rnati onal c ompe ti ti on. Thus a ne w e ra is ushe re d duri ng the re c e nt ye ars, i n fi nanc i al mana ge me nt, spe c i all y, w i th the de ve l opme nt of fi nanc i al tool s, te c hni que s, i nstrume nt s and produc ts. Al so due to i nc re asi ng e mphasi s on publ i c se c tor unde rtak i n gs to be sel f- supporti n g and the i r de pe nde nc e on c api tal mark e t for fund re qui re me nts and the i nc re asi ng si gni fi c anc e of l i be ral i sati on, gl obal i sati on and de re gul ati on.

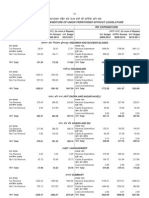

Ques t io n : Draw a t yp ical o rg anis at io n chart hig hlig ht ing t he f inance f unct io n o f a co mp any ? Ans we r : The fi nanc e func ti on i s the same i n al l e nte rpri se s, de tai l s may di ffe r, but maj or fe ature s are uni ve rsal i n nature . The fi nanc e func ti on oc c upi e s a si gni fi c ant posi ti on i n an organi sati o n and i s not the re sponsi bi l i ty of a sole e xe c uti ve . The i mportant aspe c ts of fi nanc e mana ge r are to c arri e d on by top manage me nt i .e . managi n g di re c tor, c hai rman, board of di re c tors. The board of di re c tors tak e s de ci si ons i nvol vi ng fi nanc i al c onsi de rati ons, the fi nanc i al c ontrol l e r i s basi c al l y me ant for assi sti ng the top manage me nt and has an i mportan t role of c ontri bu ti ng to good de c i si on mak i ng on i ssue s i nvol vi ng all func ti onal are as of busi ne ss. He i s to bri ng out fi nanc i al i mpl i c ati ons of al l de c i si ons and mak e the m unde rstoo d. He may be c all e d as the fi nanc i al c ontrol l e r, vi ce -pre si de nt (fi nanc e ), c hie f ac c ount ant, tre asure r, or by any othe r de si gnati on, but has the pri mary re sponsi bi l i ty of pe rformi ng fi nanc e func ti ons. He i s to di sc harge the re sponsi bi l i ty k ee pi ng i n vie w the ove ral l outl ook of the organi sati o n. BOARD OF DIRECTORS PRESI DEN T

V. P. (Produc ti o n)

V. P. (Fi nanc e )

V. P. (Sal e s)

Tre asure r C re di t Mgmt. C ash Mgmt. B ank i ng re l ati on s Portfol i o Mgmt. C orporate Ge ne ral & C ost Ac c ounti n g

C ontrol l e r Taxe s I nte rna l Audi t B udge ti n g

Org anis at io n chart of f inance f unct io n The C hi e f fi nanc e exe c uti ve w ork s di re c tl y unde r the Pre si de nt or Managi ng Di re c tor of the c ompany. B e si de s routi ne w ork , he ke e ps the B oard i nforme d about all phase s of busi ne ss ac ti vi ty, i ncl usi ve of e c onomi c , soc i al and pol i ti c al de ve l opme nts affe c ti ng the busi ne ss be havi our and from ti me to ti me furni she s i nformati on about the fi nanc i al status of the c ompany. Hi s func ti ons are : (i ) Tre asury func ti ons and (i i ) C ontrol func ti ons. Re lat io ns hip Be t we e n f inancial manag e me nt and o t he r are as of manag e me nt : The re is c l ose re l ati onshi p be tw ee n the are as of fi nanc i al and othe r manage me nt li ke produc ti on, sal e s, mark e ti ng, pe rsonne l , e tc . Al l ac ti vi ti e s di re c tl y or i ndi re c tl y i nvol ve ac qui si ti on and use of funds. De te rmi nati on of produc ti on, proc ure me nt and mark e ti ng strate gi e s are the i mportant pre rogati ve s of the re spe c ti ve de partme nt he ads, but for i mpl e me nti ng, the i r de ci si ons funds are re qui re d. L i ke , re pl ac e me nt of fi xe d asse ts for i mprovi ng produc ti o n c apac i ty re qui re s funds. Si mi l arl y, the purc hase and sale s promoti o n pol i c i e s are l ai d dow n by the purc hase and mark e ti ng di vi si ons re spe c ti vel y, but agai n proc ure me nt of raw mate ri al s, adve rti si ng and othe r sal e s promoti on re qui re funds. Same i s for, re c rui tme nt and promoti o n of staff by the pe rsonne l de partme nt w oul d re qui re funds for payme nt of sal arie s, w age s and othe r be ne fi ts. I t may, many ti me s, be di ffi c ul t to de marc ate w he re one func ti on e nds and othe r starts. Al thou gh, fi nanc e func ti on has a si gni fi c ant i mpac t on the othe r func ti ons, i t ne e d not l i mi t or obstruc t the ge ne ral func ti ons of the busi ne ss. A fi rm fac i ng fi nanc i al di ffi c ul ti e s, may gi ve w ei ghta ge to fi nanc i al c onsi de rati ons and de vi se i ts ow n produc ti o n and mark e ti ng strate gi e s to sui t the si tuati on. W hi l e a fi rm havi ng surpl us fi nanc e , w oul d have c omparati ve l y l ow e r ri gi di ty as re gards the fi nanc i al c onsi de rati ons vi s- a-vi s othe r func ti ons of the mana ge me nt. Pe rvas ive N at ure o f Finance Funct io n : F i nanc e i s the l i fe bl ood of of an organi sati on, i t i s the c ommon thre ad bi ndi ng al l organi sati on al func ti ons. Thi s i nte rfac e c an be e xpl ai ne d as bel ow : * Pro d uct io n - Finance : Produc ti on func ti on re qui re s a l arge i nve stme nt. Produc ti ve use of re sourc e s e nsure s a c ost advant age for

the fi rm. O pti mum i nve stme nt i n i nve ntori e s i mprove s profi t margi ns. Many parame te rs of produc ti o n have an i mpac t on c ost and c an possi bl y be c ontrol l e d throug h i nte rnal mana ge me nt, thus e nhanc i ng profi ts . I mportant prod uc ti on de c i si ons l i ke mak e or buy c an be tak e n onl y afte r the fi nanc i al i mpl i c ati ons are c onsi de re d. * M ark e t ing - Finance : Vari ous aspe c ts of mark e ti ng manage me nt have fi nanc i al i mpl i c ati ons, de c i si ons to hol d i nve ntori e s on l arge sc al e to provi de off the she l f se rvi c e to c ustome rs i nc re ase s i nve ntory hol di ng c ost and at the same ti me may i nc re ase sal e s, si mi l ar w i th e xte nsi on of c re di t fac i l i ty to c ustome rs. Mark e ti ng strate gi e s to i nc re ase sale i n most c ase s, have addi ti onal c osts that are to be w ei ghte d c are ful l y agai nst i nc re me ntal re ve nue be fore tak i ng de c i si on. * Pe rs o nne l - Finance : I n the gl obal i se d c ompe ti ti ve sce nari o, busi ne ss organi sati on s are movi ng to a fl atte r organi sati on al struc ture . I nve stme nts i n human re sourc e de ve l opme nts are al so i nc re asi ng. Re struc turi ng of re mune rati on struc ture , vol untary re ti re me nt sc he me s, sw e at e qui ty, e tc. have be c ome maj or fi nanc i al de c i si ons i n the human re sourc e manage me nt.

Ques t io n : Dis cuss so me of t he ins t ance s ind icat ing t he chang ing s ce nario o f f inancial manag e me nt in Ind ia ? Ans we r : Mode rn fi nanc i al manage me nt has c ome a l ong w ay from tradi ti onal c orporate fi nanc e , the fi nanc e mana ge r is w ork i ng i n a c hal l e ngi ng e nvi ronme nt that i s c hangi ng c onti nuousl y. Due to the ope ni ng of the e c onomi e s, gl obal re sourc e s are bei ng tappe d, the opport uni ti e s avai l abl e to fi nanc e mana ge rs vi rtual l y have no l i mi ts, he must al so unde rsta nd the ri sk s e ntai l i ng al l hi s de c i si ons. Fi nanc i al mana ge me nt i s passi ng throug h an e ra of e xpe ri me ntati on and e xc i te me nt i s a part of fi nanc e ac ti vi tie s now a days. A few i nstanc e s are as be l ow : i ) I nte re st rate s have be e n free d from re gul ati on, tre asury ope rati ons thus, have to be more sophi sti c ate d due to fl uc tuati ng i nte re st rate s. Mi ni mum c ost of c api tal ne c e ssi tate s anti c i pati ng i nte re st rate move me nts. i i ) The rupe e had be c ome ful l y c onve rti bl e on c urre nt ac c ount. i i i ) O pti mum de bt e qui ty mi x i s possi bl e . Fi rms have to tak e advan tage of the fi nanc i al le ve rage to i nc re ase the share hol de r's w e al th, how e ve r, usi ng fi nanc i al le ve rage ne ce ssari l y mak e s busi ne ss vul ne rabl e to fi nanc i al ri sk. F i ndi ng a c orre c t trade off be tw ee n ri sk and i mprove d re turn to share hol de rs is a c hal l e ngi ng task for a fi nanc e manage r. i v) W i th free pri c i ng of i ssue s, the opti mu m pri c e de te rmi nati on of ne w i ssue s i s a daunti n g task as ove rpri c i ng re sul ts i n unde r subsc ri pti o n

and l oss of i nve stor c onfi de nc e , w hi le unde r pri c i ng le ads to unw arran te d i nc re ase i n numbe r of share s the re by re duc i ng the EPS. v) Mai ntai ni n g share pri c e s i s c ruc i al . I n the li be ral i se d sce nari o the c api tal mark e ts i s the i mportant ave nue of fund s for busi ne ss. Di vi de nd and bonus pol i ci e s frame d by fi nanc e manage rs have a di re c t be ari ng on the share pri ce s. vi ) Ensuri ng manage me nt c ontrol i s vi tal e spe c i all y i n l i ght of forei gn parti c i pati o n i n e qui ty, bac k e d by huge re sourc e s mak i ng the fi rm an e asy tak e ove r targe t. Exi sti ng manage me nts mi ght l ose c ontrol i n the e ve ntual i ty of bei ng unabl e to tak e up share e nti tl e me nts, fi nanc i al strate gi e s, are vi tal to pre ve nt thi s. I n a re sourc e s c onstrai n t si tuati on, the i mportanc e of fi nanc i al manage me nt i s hi ghl i ghte d as fi nanc i al strate gi e s are re qui re d to ge t the c ompa ny throug h the c onstrai nts posi ti on. The re asons for i t, may be l ac k of de mand, sc arc i ty of raw mate ri al s, l abour c onstrai nt s, etc . If the probl e m i s not prope rl y de al t w i th at i ni ti al stage s, i t c oul d le ad ul ti mate l y to bank ru ptc y and si c k ne ss. The fi nanc i al manage r's role i n suc h si tuati ons, w oul d be fi rst to asce rtai n, w he the r unde r the ci rc umsta nc e s, the organi sati o n i s vi abl e or not. If the vi abi l i ty of the organi sa ti on, i tse l f i s i n doubt, the n the al te rnati ve of c l osi ng dow n ope rati ons must be e xpl ore d. B ut, i n maj or c ase s the probl e m c an be sol ve d w i th prope r strate gi e s.

Ques t io n : What is t he re le vance of t ime value o f mo ne y in f inancial d e cis io n mak ing ? Ans we r : A fi nanc e manage r i s re qui re d to mak e de c i si ons on i nve stme nt, fi nanc i n g and di vi de nd i n vie w of the c ompany' s obj e c ti ve s. The de c i si ons as purc ha se of asse ts or proc ure me nt of funds i. e. the i nve stme nt/ fi nanc i n g de c i si ons affe c t the c ash fl ow i n di ffe re nt ti me pe ri ods. C ash outfl ow s w oul d be at one poi nt of ti me and i nfl ow at some othe r poi nt of ti me , he nc e, the y are not c ompara bl e due to the c hange i n rupe e val ue of mone y. The y c an be made c ompar abl e by i ntroduc i ng the i nte re st fac tor. I n the the ory of fi nanc e , the i nte re st fac tor i s one of the c ruc i al and e xc l usi ve c onc e pt, k now n as the ti me val ue of mone y. Ti me val ue of mone y me ans that w orth of a rupe e re c ei ve d today i s di ffe re nt from the same re c ei ve d i n future . The pre fe re nc e for mone y now as c ompare d to future i s k now n as ti me pre fe re nc e of mone y. The c onc e pt i s appl i c abl e to both i ndi vi dual s and busi ne ss house s. Re as o ns o f t ime p ref e re nce of mo ne y : 1 ) Ris k : The re is unc e rtai nty abou t the re c e i pt of mone y i n future . 2 ) Pre f e re nce f o r p re s e nt co ns ump t io n :

Most of the pe rsons and c ompa ni e s have a pre fe re nce for pre se nt c onsum pti on may be due to urge nc y of ne e d. 3 ) Inve s t me nt op po rt unit ie s : Most of the pe rsons and c ompa ni e s have pre fe re nce for pre se nt mone y be c ause of avai l abi l i ti e s of opport uni ti e s of i nve stme nt for e arni ng addi ti on al c ash fl ow s. Imp o rt ance of t ime value o f mo ne y : The c onc e pt of ti me val ue of mone y hel ps i n arri vi ng at the c omparabl e val ue of the di ffe re nt rupe e amount ari si ng at di ffe re nt poi nts of ti me i nto e qui vale nt val ue s of a parti c ul ar poi nt of ti me , pre se nt or future . The c ash fl ow s ari si ng at di ffe re nt poi nts of ti me c an be made c ompara bl e by usi ng any one of the fol l ow i ng : - by c ompoun di ng the pre se nt mone y to a future date i. e . by fi ndi ng out the val ue of pre se nt mone y. - by di sc ounti ng the future mone y to pre se nt date i. e . by fi ndi ng out the pre se nt val ue (PV) of future mone y. 1 ) Te chniq ue s o f co mpo und ing : i) Fut ure value ( FV) o f a s ing le cas h f lo w : The future val ue of a si ngl e c ash fl ow i s de fi ne d as :

FV = PV (1 + r)n

W he re, F V = future val ue PV = Pre se nt val ue r = rate of i nte re st pe r annum n = numbe r of ye ars for w hi c h c ompou ndi n g i s done . I f, any vari abl e i .e . PV, r, n varie s, the n F V al so vari e s. I t i s ve ry te di ous to c al c ul ate the val ue of (1 + r)n so di ffe re nt c ombi nati on s are publ i she d i n the form of tabl e s. The se may be re fe rre d for c ompu tati on, othe rw i se one shoul d use the k now l e dge of l ogari thms.

ii) Fut ure value of an annuit y : An annui ty i s a se ri e s of pe ri odi c c ash fl ow s, payme nts or re ce i pts, of e qual amou nt. The pre mi um payme nt s of a li fe i nsuranc e pol i c y, for i nstanc e are an annui ty. I n ge ne ral te rms the future val ue of an annui ty i s gi ve n as :

FVAn = A * ([(1 + r)n - 1]/r)

Where,

FVAn =

Future value of an annuity which has duration of n years.

A = Constant periodic flow r = Interest rate per period n = Duration of the annuity

Thus, future value of an annuity is dependent on 3 variables, they being, the annual amount, rate of interest and the time period, if any of these variable changes it will change the future value of the annuity. A published table is available for various combination of the rate of interest 'r' and the time period 'n'.

2 ) Te chniq ue s o f d is co unt ing : i) Pre s e nt value of a s ing le cas h flo w : The pre se nt val ue of a si ngl e c ash fl ow i s gi ve n as :

PV = FVn ( Where, FVn = F u t u r e

1 )n 1 + r

value n years hence

r = rate of interest per annum n = number of years for which discounting is done. From above, it is clear that present value of a future money depends upon 3 variables i.e. FV, the rate of interest and time period. The published tables for various combinations of

)n

1 + r are available.

ii) Pre s e nt value of an annuit y : Some ti me s i nste ad of a si ngl e c ash fl ow , c ash fl ow s of same amount i s re ce i ve d for a numbe r of ye ars. The pre se nt val ue of an annui ty may be e xpre sse d as be l ow :

PVAn = A/(1 + r)1 + A/(1 + r)2 + ................ + A/(1 + r)n-1 + A/(1 + r)n = A [1/(1 + r)1 + 1/(1 + r)2 + ................ + 1/(1 + r)n-1 + 1/(1 + r) ]

n

= A [ (1 + r)n - 1] r(1 + r)n Where, PVAn = Present value of annuity which has duration of n years

A = Constant periodic flow r = Discount rate.

CH APTER ON E FIN AN CIAL M AN AGEM EN T : AN OVERVI EW

Ques t io n : What do yo u me an b y financi al manag e me nt ? Ans we r : M e aning o f Financ ial M anag e me nt : The pri mary task of a C harte re d Ac c ount ant is to de al w i th funds, 'Man age me nt of F unds' is an i mportant aspe c t of fi nanc i al mana ge me nt i n a busi ne ss unde rtak i n g or any othe r i nsti tuti on l i ke hospi tal , art soc i e ty, and so on. The te rm 'F i nanc i al Manage me nt ' has be e n de fi ne d di ffe re ntl y by di ffe re nt authors. Ac c ordi ng to Sol omon " Fi nanc i al Manage me nt i s c onc e rne d w i th the e ffi ci e nt use of an i mportant e c onomi c re sourc e , name l y c api tal funds. " Phi l l i ppatus has gi ve n a more e l aborate de fi ni ti on of the te rm, as , "F i nanc i al Mana ge me nt, is c onc e rne d wi th the mana ge ri al de c i si ons that re sul ts i n the ac qui si ti on and fi nanc i ng of short and l ong te rm c re di ts for the fi rm. " Thus, i t de al s w i th the si tuati ons that re qui re se l e c ti on of spe c i fi c probl e m of si ze and grow th of an e nte rpri se . The anal ysi s of the se de c i si ons i s base d on the expe c te d i nfl ow s and outfl ow s of funds and the i r effe c t on mana ge ri al obj e c ti ve s. The most ac ce ptabl e de fi ni ti on of fi nanc i al manage me nt is that gi ve n by S. C .K uc hhal as, "F i nanc i al manage me nt de al s w i th proc ure me nt of funds and thei r e ffe c ti ve uti l i sati on i n the busi ne ss. " Thus, the re are 2 basi c aspe c ts of fi nanc i al manage me nt : 1 ) p ro cure me nt o f f unds : As funds c an be obtai ne d from di ffe re nt sourc e s thus, the i r proc ure me nt i s al w ays c onsi de re d as a c ompl e x probl e m by busi ne ss c onc e rns. The se funds proc ure d from di ffe re nt sourc e s have di ffe re nt c harac te ri sti c s i n te rms of ri sk, c ost and c ontrol that a manage r must c onsi de r w hi l e proc uri n g funds. The funds shoul d be proc ure d at mi ni mum c ost, at a bal anc e d ri sk and c ontrol fac tors. F unds rai se d by i ssue of e qui ty share s are the be st from ri sk poi nt of vi ew for the c ompan y, as i t has no re payme nt l i abi l i ty exc e pt on wi ndi ng up of the c ompan y, but from c ost poi nt of vi ew , i t is most e xpe nsi ve , as di vi de nd e xpe c tati ons of share hol de rs are hi ghe r than pre vai l i ng i nte re st rate s and di vi de nds are appropri ati o n of profi ts and not al l owe d as e xpe nse unde r the i nc ome tax ac t. The issue of ne w e qui ty share s may di l ute the c ontrol of the exi sti ng share hol de rs. De be nture s are c omparati ve l y c he ape r si nc e the i nte re st is pai d out of profi ts be fore tax. B ut, the y e ntai l a hi gh de gree of ri sk si nc e the y have to be re pai d as pe r the te rms of agre e me nt; al so, the i nte re st payme nt has to be made w he the r or not the c ompan y mak e s profi ts . F unds c an al so be proc ure d from bank s and fi nanc i al i nsti tuti ons, the y provi de funds subj e c t to ce rtai n re stri c ti ve c ove nants. The se c ove nants re stri c t fre e dom of the borrow e r to rai se l oans from othe r sourc e s. The re form proc e ss i s al so movi ng i n di re c ti on of a c l ose r moni tori ng of 'e nd use ' of re sourc e s mobi l i se d throu gh c api tal mark e ts. Suc h re stri c ti ons are e sse nti al for the safe ty of funds provi de d by i nsti tuti ons and i nve stors. The re are othe r fi nanc i al i nstrume nts use d for rai si ng fi nanc e e . g. c omme rc i al pape r, dee p di sc ount bonds, e tc. The fi nanc e manage r has to bal anc e the avai l abi l i ty of funds and the re stri c ti ve provi si ons tie d wi th suc h funds re sul ti ng i n l ac k of fl e xi bi l i ty.

I n the gl obal i se d c ompe ti ti ve sc e nari o, i t is not e nough to de pe nd on avai l abl e w ays of fi nanc e but re sourc e mobi l i sati on i s to be unde rtak e n throu gh i nnovati ve w ays or fi nanc i al prod uc ts that may me e t the nee ds of i nve stors. Mul ti pl e opti on c onve rti bl e bonds c an be si ghte d as an exampl e , funds c an be rai se d i ndi ge nousl y as al so from abroa d. Fore i gn Di re c t Inve stme nt (F DI ) and F orei gn I nsti tuti onal I nve stors (FI I ) are tw o maj or sourc e s of fi nanc e from abroa d al ong wi th Ame ri c an De posi tory Re c e i pts (ADR's) and Gl obal De posi tory Re c e i pts (GDR's). The me c hani sm of proc uri n g funds i s to be modi fi e d i n the l i ght of re qui re me nts of fore i gn i nve stors. Proc ure me nt of fund s i nte r al i a i nc l ude s : - I de nti fi c ati on of sourc e s of fi nanc e - De te rmi nati on of fi nanc e mi x - Rai si ng of funds - Di vi si on of profi ts be twe e n di vi de nds and re te nti on of profi ts i. e. i nte rnal fund ge ne rati on. 2 ) e ff e ct ive us e o f s uch f unds : The fi nanc e mana ge r i s al so re sponsi bl e for e ffe c ti ve uti l i sati on of funds. He must poi nt out si tuati ons w he re funds are k e pt i dl e or are use d i mprope rl y. Al l funds are proc ure d at a ce rtai n c ost and afte r e ntai l i ng a ce rtai n amount of ri sk . If the funds are not uti li se d i n the manne r so that the y ge ne rate an i nc ome hi ghe r than c ost of proc ure me nt, the re is no me ani ng i n runni n g the busi ne ss. I t i s an i mporta nt c onsi de rati on i n di vi de nd de c i si ons al so, thus, i t i s c ruc i al to e mpl oy funds prope rl y and profi tabl y. The funds are to be e mpl oye d i n the manne r so that the c ompany c an produc e at i ts opti mum le vel w i thout e ndange ri ng i ts fi nanc i al sol ve nc y. Thus, fi nanc i al i mpl i c ati ons of e ac h de c i si on to i nve st i n fi xe d asse ts are to be prope rl y anal yse d. F or thi s, the fi nanc e manage r must posse ss sound k now l e dge of te c hni que s of c api tal bud ge ti ng and must k ee p i n vi e w the ne e d of ade quate w ork i ng c api tal and e nsure that w hil e fi rms e nj oy an opti mum l e ve l of w orki ng c api tal the y do not ke e p too muc h funds bl oc ke d i n i nve ntori e s, book de bts, c ash, e tc. F ixe d asse ts are to fi nanc e d from me di um or l ong te rm funds, and not short te rm funds, as fi xe d asse ts c annot be sol d i n short te rm i. e. w i thi n a ye ar, al so a l arge amount of fund s w oul d be bl oc k e d i n stoc k i n hand as the c ompany c annot i mme di ate l y se l l i ts fi ni she d goods.

Ques t io n : Exp lain t he s co p e of financi al manag e me nt ? Ans we r : Scop e of f inancial manag e me nt : A sound fi nanc i al manage me nt is e sse nti al i n al l type of fi nanc i al organi sati ons - w he the r profi t orie nte d or not, w he re funds are i nvol ve d and al so i n a c e ntral l y pl anne d e c onomy as al so i n a c api tal i st se t-up. Fi rms, as pe r the c omme rc i al hi story, have not li qui da te d be c ause the i r te c hnol ogy w as obsol e te or the i r prod uc ts had no or l ow de mand or due to any othe r fac tor, but due to l ac k of fi nanc i al mana ge me nt. Eve n i n boom pe ri od, w he n a c ompa ny mak e s hi gh

profi ts , the re i s dange r of li qui da ti on, due to bad fi nanc i al mana ge me nt. The mai n c ause of l i qui dati on of suc h c ompani e s i s ove rtradi n g or ove r-expan di ng wi thout an ade quate fi nanc i al base . F i nanc i al manage me nt opti mi se s the output from the gi ve n i nput of funds and atte mpts to use the funds i n a most produc ti ve manne r. I n a c ountry li ke I ndi a, w he re re sourc e s are sc arc e and de mand on funds are many, the ne e d for prope r fi nanc i al mana ge me nt i s e normous. I f prope r te c hni que s are use d most of the e nte rpri se s c an re duc e the i r c api tal e mpl oye d and i mprove re turn on i nve stme nt. Thus, as me n and mac hi ne are prope rl y manage d, fi nanc e s are al so to be w el l manage d. I n new l y starte d c ompani e s, i t i s i mportant to have sound fi nanc i al manage me nt, as i t e nsure s the i r survi val , ofte n suc h c ompa ni e s i gnore s fi nanc i al manage me nt at the i r ow n pe ri l . Eve n a si mpl e ac t, l ik e de posi ti ng the c he que s on the day of the i r re c e i pt i s not pe rforme d. Suc h organi sa ti ons pay he avy i nte re st c harge s on borrow e d funds, but are tardy i n re al i si ng the i r ow n de btors. Thi s is due to the fac t the y l ac k re al i sati on of the c onc e pt of ti me val ue of mone y, i t i s not appre c i ate d that e ac h val ue of rupe e has to be made use of and that i t has a di re c t c ost of uti l i sati on. It must be re al i se d that k ee pi ng rupe e i dle e ve n for a day, re sul ts i nto l osse s. A non- profi t organi sa ti on may not be k ee n to mak e profi t, tradi ti onal l y, but i t doe s ne e d to c ut dow n i ts c ost and use the funds at i ts di sposal to the i r opti mu m c apac i ty. A sound se nse of fi nanc i al manage me nt has to be c ul ti vate d among our bure auc rats, admi ni stra tors, e ngi ne e rs, e duc ati oni sts and publ i c at l arge . Unl e ss thi s i s done , c ol ossal w astage of the c api tal re sourc e s c annot be arre ste d.

Ques t io n : What are t he ob je ct ive s of financi al manag e me nt ? Ans we r : Ob je ct ive s of financi al manag e me nt : Effi c i e nt fi nanc i al mana ge me nt re qui re s exi ste nc e of some obj e c ti ve s or goal s be c ause j udgme nt as to w he the r or not a fi nanc i al de c i si on i s effi c i e nt i s to be made i n li ght of some obj e c ti ve . The tw o mai n obj e c ti ve s of fi nanc i al manage me nt are : 1 ) Pro f it M ax imis at io n : I t i s tradi ti on al l y be i ng argue d, that the obj e c ti ve of a c ompany is to e arn profi t, he nc e the obj e c ti ve of fi nanc i al manage me n t i s profi t maxi mi sati on. Thus, e ac h al te rnati ve , is to be see n by the fi nanc e mana ge r from the vie w poi nt of profi t maxi mi sati o n. B ut, i t c annot be the onl y obj e c ti ve of a c ompany, i t i s at be st a li mi te d obj e c ti ve el se a num be r of probl e ms w oul d ari se . Some of the m are : a) The te rm profi t i s vague and doe s not cl ari fy w hat e xac tl y i t me ans. I t c onve ys di ffe re nt me ani ng to di ffe re nt pe opl e . b) Profi t maxi mi sati on has to be atte mpte d w i th a re ali sati on of ri sk s i nvol ve d. The re is di re c t rel ati on be twe e n ri sk and profi t; hi ghe r the ri sk , hi ghe r i s the profi t. F or maxi mi si ng profi t, ri sk i s al toge the r

i gnore d, i mpl yi ng that fi nanc e manage r ac c e pts hi ghl y ri sk y proposal s al so. Prac ti c al l y, ri sk i s a ve ry i mportan t fac tor to be bal anc e d w i th profi t obj e c ti ve. c ) Profi t maxi mi sati on i s an obj e c ti ve not tak i ng i nto ac c ount the ti me patte rn of re turns. E. g. Proposal X gi ve s re turns hi ghe r than that by proposal Y but, the ti me pe ri od i s say, 10 ye ars and 7 ye ars re spe c ti ve l y. Thus, the ove rall profi t i s onl y c onsi de re d not the ti me pe ri od, nor the fl ow of profi t. d) Profi t maxi mi sati on as an obj e c ti ve i s too narrow , i t fai l s to tak e i nto ac c ount the soc i al c onsi de rati ons and obl i gati ons to vari ous i nte re sts of w orke rs, c onsume rs, soc ie ty, as w el l as e thi c al trade prac ti c e s. I gnori ng the se fac tors, a c ompa ny c annot survi ve for l ong. Profi t maxi mi sati on at the c ost of soc i al and moral obl i gati ons i s a short si ghte d pol i c y. 2 ) We alt h max imis at io n : The c ompani e s havi ng profi t maxi mi sati on as i ts obj e c ti ve , may adopt pol i c i e s yi e l di ng exorbi tant profi ts i n the short run w hi c h are unhe al thy for the grow th, survi val and ove rall i nte re sts of the busi ne ss. A c ompa ny may not unde rtak e pl anne d and pre sc ri be d shut- dow ns of the pl ant for mai nte nanc e , and so on for maxi mi si ng profi ts i n the short run. Thus, the obj e c ti ve of a fi rm shoul d be to maxi mi se i ts val ue or w e al th. Ac c ordi ng to Van Horne , " Val ue of a fi rm i s re pre se nte d by the mark e t pri c e of the c ompany 's c ommon stoc k .. . . .. . the mark e t pri c e of a fi rm's stoc k re pre se nts the foc al j udgme nt of all mark e t parti c i pa nts as to w hat the val ue of the parti c ul ar fi rm i s. I t tak e s i nto ac c ount pre se nt as al so prospe c ti ve future earni ngs pe r share , the ti mi ng and ri sk of the se e arni ng, the di vi de nd pol i c y of the fi rm and many othe r fac tors havi ng a be ari ng on the mark e t pri ce of stoc k . The mark e t pri c e se rve s as a pe rformanc e i nde x or re port c ard of the fi rm's progre ss. I t i ndi c ate s how we ll manage me n t i s doi ng on be hal f of stoc k hol de rs. " Share pri c e s i n the share mark e t, at a gi ve n poi nt of ti me , are the re sul t of a mi xture of many fac tors, as ge ne ral ec onomi c outl ook , parti c ul ar outl ook of the c ompa ni e s unde r c onsi de rati on, te c hni c al fac tors and e ve n mass psyc hol ogy, but, tak e n on a l ong te rm basi s, the y re fl e c t the val ue , w hi c h vari ous parti e s, put on the c ompa ny. N ormal l y thi s val ue is a func ti on, of : - the l ik e l y rate of earni ngs pe r share of the c ompan y; and - the c api tal i sati on rate . The li k el y rate of e arni ngs pe r share (EPS) de pe nds upon the asse ssme nt as to the profi tabl y a c ompan y i s goi ng to ope rate i n the future or w hat i t i s li k el y to e arn agai nst eac h of i ts ordi nary share s. The c api tal i sati on rate re fl e c ts the li k i ng of the i nve stors of a c ompa ny. If a c ompan y e arns a hi gh rate of earni ngs pe r share throu gh i ts ri sk y ope rati ons or ri sk y fi nanc i n g patte rn, the i nve stors wi l l not l ook upon i ts share w i th favour. To that exte nt, the mark e t val ue of the share s of suc h a c ompan y wi l l be l ow . An e asy w ay to de te rmi ne the

c api tal i sati on rate i s to start wi th fi xe d de posi t i nte re st rate of bank s, i nve stor w oul d w ant a hi ghe r re turn i f he i nve sts i n share s, as the ri sk i nc re ase s. How muc h hi ghe r re turn i s expe c te d, de pe nds on the ri sk s i nvol ve d i n the parti c ul ar share w hi c h i n turn de pe nds on c ompa ny pol i c i e s, past re c ords, type of busi ne ss and c onfi de nc e c omman de d by the mana ge me nt. Thus, c api tal i sati on rate i s the c umul ati ve re sul t of the asse ssme nt of the vari ous share hol de rs re gardi n g the ri sk and othe r qual i tati ve fac tors of a c ompany. I f a c ompany i nve sts i ts funds i n ri sk y ve nture s, the i nve stors w il l put i n the i r mone y i f the y ge t hi ghe r re turn as c ompare d to that from a l ow ri sk share . The mark e t val ue of a share i s thus, a func ti on of earni ngs pe r share and c api tal i sati on rate . Si nc e the profi t maxi mi sati on c ri te ri a c annot be appl i e d i n re al w orl d si tuati ons be c ause of i ts te c hni c al l i mi tati on the fi nanc e manage r of a c ompan y has to ensure that hi s de c i si ons are suc h that the mark e t val ue of the share s of the c ompany i s maxi mum i n the l ong run. Thi s i mpl i e s that the fi nanc i al pol i c y has to be suc h that i t opti mi se s the EPS, k ee pi ng i n vie w the ri sk and othe r fac tors. Thus, w e al th maxi mi sati on i s a be tte r obj e c ti ve for a c omme rc i al unde rtak i n g as c ompare d to re turn and ri sk . The re i s a grow i ng e mphasi s on soc i al and othe r obl i gati ons of an e nte rpri se . I t c annot be de ni e d that i n the c ase of unde rtak i ngs, e spe c i all y those i n the publ i c se c tor, the que sti on of w e al th maxi mi sati on i s to be see n i n c onte xt of soc i al and othe r obl i gati ons of the e nte rpri se . I t must be unde rstoo d that fi nanc i al de c i si on mak i ng i s rel ate d to the obj e c ti ve s of the busi ne ss. The fi nanc e manage r has to e nsure that the re i s a posi ti ve i mpac t of e ac h fi nanc i al de ci si on on the furthe ranc e of the busi ne ss obj e c ti ve s. O ne of the mai n obj e c ti ve of an unde rtak i n g may be to " progre ssi ve l y bui l d up the c apabi l i ty to unde rtak e the de si gn and de ve l opme nt of ai rc raft e ngi ne s, he li c opte rs, e tc . " A fi nanc e manage r i n suc h c ase s w i ll al l oc ate funds i n a w ay that thi s obje c ti ve i s ac hi e ve d al thou gh suc h an al l oc ati on may not ne c e ssari l y maxi mi se we al th.

Ques t io n : What are t he funct io ns o f a Finan ce M anag e r ? Ans we r : Funct io ns o f a Finance M anag e r : The tw i n aspe c ts, proc ure me nt and e ffe c ti ve uti l i sati on of funds are c ruc i al task s face d by a fi nanc e mana ge r. The fi nanc i al mana ge r i s re qui re d to l ook i nto the fi nanc i al i mpl i c ati ons of any de c i si on i n the fi rm. Thus all de c i si ons i nvol ve manage me nt of funds unde r the purvi e w of the fi nanc e manage r. A l arge numbe r of de c i si ons i nvol ve substan ti al or mate ri al c hange s i n val ue of fund s proc ure d or e mpl oye d. The fi nanc e mana ge r, has to manage funds i n suc h a w ay so as to mak e the i r opti mu m uti l i sati on and to e nsure the i r proc ure me nt i n a w ay that the ri sk , c ost and c ontrol are prope rl y bal anc e d unde r a gi ve n si tuati on. He may not, be c onc e rne d wi th the de c i si ons, that do not affe c t the basi c fi nanc i al manage me nt and struc ture . The nature of job of an ac c ounta nt and fi nanc e manage r i s di ffe re nt, an ac c ountant 's j ob i s pri mari l y to re c ord the busi ne ss

transac ti o ns, pre pare fi nanc i al state me nts show i ng re sul ts of the organi sa ti on for a gi ve n pe ri od and i ts fi nanc i al c ondi ti on at a gi ve n poi nt of ti me . He i s to re c ord vari ous happe ni ngs i n mone tary te rms to e nsure that asse ts, li abi l i ti e s, i nc ome s and e xpe nse s are prope rl y groupe d, c l assi fi e d and di sc l ose d i n the fi nanc i al state me nts. Ac c ount ant is not c onc e rne d w i th manage me nt of funds that i s a spe c i al i se d task and i n mode rn ti me s a c ompl e x one. The fi nanc e mana ge r or c ontrol l e r has a task e nti rel y di ffe re nt from that of an ac c ount ant, he i s to manage funds. Some of the i mportan t de c i si ons as re gards fi nanc e are as fol l ow s : 1 ) Es t imat ing t he re q uire me nt s of f und s : A busi ne ss re qui re s funds for l ong te rm purp ose s i .e . i nve stme nt i n fi xe d asse ts and so on. A c are ful e sti mate of suc h funds i s re qui re d to be made . An asse ssme nt has to be made re gardi n g re qui re me nts of w ork i ng c api tal i nvol vi ng, esti mati on of amount of funds bl oc ke d i n c urre nt asse ts and that l i ke l y to be ge ne rate d for short pe ri ods throu gh c urre nt li abi l i ti e s. F ore c asti ng the re qui re me nts of funds i s done by use of te c hni que s of bud ge tary c ontrol and l ong range pl anni ng. Esti mate s of re qui re me nts of funds c an be made onl y if al l the physi c al ac ti vi ti e s of the organi sa ti on are fore c aste d. The y c an be transl ate d i nto mone tary te rms. 2 ) De cis io n re g ard ing cap it al s t ruct ure : O nce the re qui re me nts of funds is e sti mate d, a de c i si on re gardi ng vari ous sourc e s from w he re the funds woul d be rai se d is to be tak e n. A prope r mi x of the vari ous sourc e s i s to be w orke d out, e ac h sourc e of funds i nvol ve s di ffe re nt i ssue s for c onsi de rati on. The fi nanc e manage r has to c are ful l y l ook i nto the e xi sti ng c api tal struc ture and se e how the vari ous proposal s of rai si ng funds w il l affe c t i t. He i s to mai ntai n a prope r bal anc e be twe e n l ong and short te rm funds and to e nsure that suffi c ie nt l ong- te rm funds are rai se d i n orde r to fi nanc e fi xe d asse ts and othe r l ong- te rm i nve stme nts and to provi de for pe rmane nt nee ds of w ork i ng c api tal . I n the ove ral l vol ume of l ong- te rm funds, he is to mai ntai n a prope r bal anc e be twe e n ow n and l oan funds and to se e that the ove ral l c api tal i sati on of the c ompa ny i s suc h, that the c ompany is abl e to proc ure funds at mi ni mum c ost and i s abl e to tol e rate shoc k s of l e an pe ri ods. Al l the se de ci si ons are k now n as 'fi nanc i ng de ci si ons'. 3 ) Inve s t me nt de cis io n : F unds proc ure d from di ffe re nt sourc e s have to be i nve ste d i n vari ous ki nds of asse ts. L ong te rm funds are use d i n a proj e c t for fi xe d and al so c urre nt asse ts. The i nve stme nt of funds i n a proj e c t i s to be made afte r c are ful asse ssme nt of vari ous proj e c ts throu gh c api tal budge ti n g. A part of l ong te rm funds is al so to be k e pt for fi nanc i n g w ork i ng c api tal re qui re me nts. Asse t manage me nt pol i c i e s are to be l ai d dow n re gardi ng vari ous i te ms of c urre nt asse ts, i nve ntory pol i c y i s to be de te rmi ne d by the prod uc ti on and fi nanc e manage r, w hi le k ee pi ng i n mi nd the re qui re me nt of produc ti o n and future pri c e e sti mate s of raw mate ri al s and avai l abi l i ty of fund s. 4 ) Divid e nd de cis io n : The fi nanc e manage r i s c onc e rne d wi th the de c i si on to pay or de c l are di vi de nd. He i s to assi st the top manage me nt i n de c i di ng as to w hat amount of di vi de nd shoul d be pai d to the share hol de rs and w hat amoun t be re tai ne d by the c ompany, i t i nvol ve s

a l arge numbe r of c onsi de rati ons. Ec onomi c al l y spe ak i ng, the amoun t to be re tai ne d or be pai d to the share hol de rs shoul d de pe nd on w he the r the c ompan y or share hol de rs c an mak e a more profi tabl e use of re sourc e s, al so c onsi de rati ons li k e tre nd of e arni ngs, the tre nd of share mark e t pri c e s, re qui re me nt of funds for future grow th, c ash fl ow si tuati on, tax posi ti on of share hol de rs, and so on to be ke pt i n mi nd. The pri nc i pal func ti on of a fi nanc e mana ge r re l ate s to de c i si ons re gardi ng proc ure me nt, i nve stme nt and di vi de nds. 5 ) Sup p ly of f und s to all p art s o f t he o rg anis at io n o r cas h manag e me nt : The fi nanc e manage r has to e nsure that al l se c ti ons i .e . branc he s, fac tori e s, uni ts or de partme nts of the organi sa ti on are suppl i e d w i th ade quate funds. Se c ti ons havi ng exc e ss funds c ontri bute to the c e ntral pool for use i n othe r se c ti ons that nee ds funds. An ade quate suppl y of c ash at al l poi nts of ti me i s absol ute l y esse nti al for the smooth fl ow of busi ne ss ope rati ons. Eve n i f one of the many branc he s i s short of funds, the w hole busi ne ss may be i n dange r, thus, c ash manage me nt and c ash di sburse me nt pol i c i e s are i mportan t wi th a vi ew to suppl yi n g ade quate funds at all ti me s and poi nts i n an organi sa ti on. I t shoul d e nsure that the re is no exc e ssi ve c ash. 6 ) Evalu at ing f inancial pe rfo rmance : Manage me n t c ontrol syste ms are usual l y base d on fi nanc i al anal ysi s, e . g. ROI (re turn on i nve stme nt) syste m of di vi si onal c ontrol . A fi nanc e manage r has to c onstantl y re vie w the fi nanc i al pe rformanc e of vari ous uni ts of the organi sa ti on. Anal ysi s of the fi nanc i al pe rforma nc e he l ps the mana ge me nt for asse ssi ng how the funds are uti l i se d i n vari ous di vi si ons and w hat c an be done to i mprove i t. 7 ) Financ ial neg o t iat io ns : Fi nanc e mana ge r's maj or ti me i s uti l i se d i n c arryi ng out ne goti ati ons w i th fi nanc i al i nsti tuti on s, bank s and publ i c de posi tors. He has to furni sh a l ot of i nformati on to the se i nsti tuti ons and pe rsons i n orde r to e nsure that rai si ng of funds is w i thi n the statute s. Ne goti ati ons for outsi de fi nanc i ng ofte n re qui re s spe c i al i se d sk i l l s. 8 ) Ke e p ing in t o uch wit h st o ck e x chang e q uo t at io ns and b e havio r of share p rice s : I t i nvol ve s anal ysi s of maj or tre nds i n the stoc k mark e t and j udgi ng the i r i mpac t on share pri c e s of the c ompany 's share s.

Ques t io n : What are t he vario us me t hod s and to o ls us e d f o r f inancial manag e me nt ? Ans we r : Fi nanc e mana ge r use s vari ous tool s to di sc harge hi s func ti ons as re gards fi nanc i al manage me nt. I n the are a of fi nanc i ng the re are vari ous me thods to proc ure funds from l ong as al so short te rm sourc e s. The fi nanc e manage r has to de c i de an opti mum c api tal struc ture that c an c ontri b ute to the maxi mi sati on of share hol de r's w e al th. Fi nanc i al le ve rage or tradi ng on e qui ty i s an i mportant me thod

by w hi c h a fi nanc e manage r may i nc re ase the re turn to c ommon share hol de rs. F or eval uati on of c api tal proposal s, the fi nanc e manage r use s c api tal budge ti ng te c hni que s as payb ac k , i nte rnal rate of re turn, ne t pre se nt val ue , profi tabi l i ty i nde x, ave rage rate of re turn. I n the are a of c urre nt asse ts manage me nt, he use s me thods to c he c k e ffi c ie nt uti l i sati on of c urre nt re sourc e s at the e nte rpri se 's di sposal . An e nte rpri se c an i nc re ase i ts profi tabi l i ty w i thout affe c ti ng i ts li qui di ty by an effi c i e nt manage me nt of w orki ng c api tal . F or i nstanc e , i n the are a of w ork i ng c api tal manage me n t, c ash manage me nt may be c e ntral i se d or de -c e ntral i se d; ce ntral i se d me thod i s c onsi de re d a be tte r tool of mana gi ng the e nte rpri se 's l i qui d re sourc e s. I n the are a of di vi de nd de c i si ons, a fi rm i s fac e d wi th the probl e m of de cl arati on or postpo ni ng de c l arati on of di vi de nd, a probl e m of i nte rnal fi nanc i n g. F or eval uati on of an e nte rpri se 's pe rformanc e , the re are vari ous me thods, as rati o anal ysi s. Thi s te c hni que i s use d by al l c onc e rne d pe rsons. Di ffe re nt rati os se rvi ng di ffe re nt obj e c ti ve s. An i nve stor use s vari ous rati os to e val uate the profi tabi l i ty of i nve stme nt i n a parti c ul ar c ompa ny. The y e nabl e the i nve stor, to j udge the profi tabi l i ty, sol ve nc y, li qui di ty and grow th aspe c ts of the fi rm. A shortte rm c re di tor i s more i nte re ste d i n the l i qui di ty aspe c t of the fi rm, and i t i s possi bl e by a study of l i qui di ty rati os - c urre nt rati o, qui c k rati os, e tc . The mai n c onc e rn of a fi nanc e manage r i s to provi de ade quate funds from be st possi bl e sourc e , at the ri ght ti me and at mi ni mum c ost and to e nsure that the funds so ac qui re d are put to be st possi bl e use. F unds fl ow and c ash fl ow state me nts and proj e c te d fi nanc i al state me nts he l p a l ot i n thi s re gard.

Ques t io n : Dis cuss t he ro le o f a f inance manag e r ? Ans we r : In the mode rn e nte rpri se, a fi nanc e mana ge r oc c upi e s a ke y posi ti on, he bei ng one of the dynami c me mbe r of c orporate manage ri al te am. Hi s role , i s be c omi ng more and more pe rvasi ve and si gni fi c ant i n sol vi ng c ompl e x manage ri al probl e ms. Tradi ti onal l y, the rol e of a fi nanc e manage r w as c onfi ne d to rai si ng funds from a numbe r of sourc e s, but due to re ce nt de vel opme nts i n the soc i o-e c onomi c and pol i ti c al sc e nari o throu gho ut the w orl d, he i s pl ac e d i n a c e ntral posi ti on i n the organi sati o n. He i s re sponsi bl e for shapi ng the fortune s of the e nte rpri se and is i nvol ve d i n the most vi tal de c i si on of al l oc ati on of c api tal li k e me rge rs, ac qui si ti ons, e tc . A fi nanc e manage r, as othe r me mbe rs of the c orporate te am c annot be ave rse to the fast de ve l opme nts, around hi m and has to tak e note of the c hange s i n orde r to tak e rel e vant ste ps i n vie w of the dynami c c hange s i n c i rc umstanc e s. E. g. i ntroduc ti o n of Euro - as a si ngl e c urre nc y of Europe i s an i nte rnati onal le ve l c hange , havi ng i mpac t on the c orporate fi nanc i al pl ans and pol i c i e s w orl d- w i de. Dome sti c de vel opme nts as eme rge nc e of fi nanc i al se rvi ce s se c tors and SEB I as a w atc h dog for i nve stor prote c ti on and re gul ati ng body of c api tal mark e ts i s c ontri buti n g to the i mportanc e of the fi nanc e mana ge r's j ob. B ank s and fi nanc i al i nsti tuti ons we re the maj or sourc e s

of fi nanc e , mono pol y w as the state of affai rs of I ndi an busi ne ss, share hol de rs sati sfac ti on w as not the promote r 's c onc e rn as most of the c ompani e s, we re c l ose l y he l d. Due to the ope ni ng of e c onomy, c ompe ti ti on i nc re ase d, se l le r's mark e t i s bei ng c onve rte d i nto buye r's mark e t. De ve l opme nt of i nte rne t has brought new c hal l e nge s be fore the mana ge rs. I ndi an c onc e rns no longe r have to c ompe te onl y nati onal l y, i t i s fac i ng i nte rnati onal c ompe ti ti on. Thus a ne w e ra is ushe re d duri ng the re c e nt ye ars, i n fi nanc i al mana ge me nt, spe c i all y, w i th the de ve l opme nt of fi nanc i al tool s, te c hni que s, i nstrume nt s and produc ts. Al so due to i nc re asi ng e mphasi s on publ i c se c tor unde rtak i n gs to be sel f- supporti n g and the i r de pe nde nc e on c api tal mark e t for fund re qui re me nts and the i nc re asi ng si gni fi c anc e of l i be ral i sati on, gl obal i sati on and de re gul ati on.

Ques t io n : Draw a t yp ical o rg anis at io n chart hig hlig ht ing t he f inance f unct io n o f a co mp any ? Ans we r : The fi nanc e func ti on i s the same i n al l e nte rpri se s, de tai l s may di ffe r, but maj or fe ature s are uni ve rsal i n nature . The fi nanc e func ti on oc c upi e s a si gni fi c ant posi ti on i n an organi sati o n and i s not the re sponsi bi l i ty of a sole e xe c uti ve . The i mportant aspe c ts of fi nanc e mana ge r are to c arri e d on by top manage me nt i .e . managi n g di re c tor, c hai rman, board of di re c tors. The board of di re c tors tak e s de ci si ons i nvol vi ng fi nanc i al c onsi de rati ons, the fi nanc i al c ontrol l e r i s basi c al l y me ant for assi sti ng the top manage me nt and has an i mportan t role of c ontri bu ti ng to good de c i si on mak i ng on i ssue s i nvol vi ng all func ti onal are as of busi ne ss. He i s to bri ng out fi nanc i al i mpl i c ati ons of al l de c i si ons and mak e the m unde rstoo d. He may be c all e d as the fi nanc i al c ontrol l e r, vi ce -pre si de nt (fi nanc e ), c hie f ac c ount ant, tre asure r, or by any othe r de si gnati on, but has the pri mary re sponsi bi l i ty of pe rformi ng fi nanc e func ti ons. He i s to di sc harge the re sponsi bi l i ty k ee pi ng i n vie w the ove ral l outl ook of the organi sati o n. BOARD OF DIRECTORS PRESI DEN T V. P. (Produc ti o n) V. P. (Fi nanc e ) V. P. (Sal e s)

Tre asure r C re di t Mgmt. C ash Mgmt. B ank i ng re l ati on s Portfol i o Mgmt. C orporate Ge ne ral & C ost Ac c ounti n g

C ontrol l e r Taxe s I nte rna l Audi t B udge ti n g

Org anis at io n chart of f inance f unct io n The C hi e f fi nanc e exe c uti ve w ork s di re c tl y unde r the Pre si de nt or Managi ng Di re c tor of the c ompany. B e si de s routi ne w ork , he ke e ps the B oard i nforme d about all phase s of busi ne ss ac ti vi ty, i ncl usi ve of e c onomi c , soc i al and pol i ti c al de ve l opme nts affe c ti ng the busi ne ss be havi our and from ti me to ti me furni she s i nformati on about the fi nanc i al status of the c ompany. Hi s func ti ons are : (i ) Tre asury func ti ons and (i i ) C ontrol func ti ons. Re lat io ns hip Be t we e n f inancial manag e me nt and o t he r are as of manag e me nt : The re is c l ose re l ati onshi p be tw ee n the are as of fi nanc i al and othe r manage me nt li ke produc ti on, sal e s, mark e ti ng, pe rsonne l , e tc . Al l ac ti vi ti e s di re c tl y or i ndi re c tl y i nvol ve ac qui si ti on and use of funds. De te rmi nati on of produc ti on, proc ure me nt and mark e ti ng strate gi e s are the i mportant pre rogati ve s of the re spe c ti ve de partme nt he ads, but for i mpl e me nti ng, the i r de ci si ons funds are re qui re d. L i ke , re pl ac e me nt of fi xe d asse ts for i mprovi ng produc ti o n c apac i ty re qui re s funds. Si mi l arl y, the purc hase and sale s promoti o n pol i c i e s are l ai d dow n by the purc hase and mark e ti ng di vi si ons re spe c ti vel y, but agai n proc ure me nt of raw mate ri al s, adve rti si ng and othe r sal e s promoti on re qui re funds. Same i s for, re c rui tme nt and promoti o n of staff by the pe rsonne l de partme nt w oul d re qui re funds for payme nt of sal arie s, w age s and othe r be ne fi ts. I t may, many ti me s, be di ffi c ul t to de marc ate w he re one func ti on e nds and othe r starts. Al thou gh, fi nanc e func ti on has a si gni fi c ant i mpac t on the othe r func ti ons, i t ne e d not l i mi t or obstruc t the ge ne ral func ti ons of the busi ne ss. A fi rm fac i ng fi nanc i al di ffi c ul ti e s, may gi ve w ei ghta ge to fi nanc i al c onsi de rati ons and de vi se i ts ow n produc ti o n and mark e ti ng strate gi e s to sui t the si tuati on. W hi l e a fi rm havi ng surpl us fi nanc e , w oul d have c omparati ve l y l ow e r ri gi di ty as re gards the fi nanc i al c onsi de rati ons vi s- a-vi s othe r func ti ons of the mana ge me nt. Pe rvas ive N at ure o f Finance Funct io n : F i nanc e i s the l i fe bl ood of of an organi sati on, i t i s the c ommon thre ad bi ndi ng al l organi sati on al func ti ons. Thi s i nte rfac e c an be e xpl ai ne d as bel ow : * Pro d uct io n - Finance : Produc ti on func ti on re qui re s a l arge i nve stme nt. Produc ti ve use of re sourc e s e nsure s a c ost advant age for the fi rm. O pti mum i nve stme nt i n i nve ntori e s i mprove s profi t margi ns. Many parame te rs of produc ti o n have an i mpac t on c ost and c an possi bl y be c ontrol l e d throug h i nte rnal mana ge me nt, thus e nhanc i ng profi ts . I mportant prod uc ti on de c i si ons l i ke mak e or buy c an be tak e n onl y afte r the fi nanc i al i mpl i c ati ons are c onsi de re d. * M ark e t ing - Finance : Vari ous aspe c ts of mark e ti ng manage me nt have fi nanc i al i mpl i c ati ons, de c i si ons to hol d i nve ntori e s on l arge sc al e to provi de off the she l f se rvi c e to c ustome rs i nc re ase s i nve ntory hol di ng c ost and at the same ti me may i nc re ase sal e s, si mi l ar w i th e xte nsi on of c re di t fac i l i ty to c ustome rs. Mark e ti ng strate gi e s to i nc re ase sale i n most c ase s, have addi ti onal c osts that are to be w ei ghte d c are ful l y agai nst i nc re me ntal re ve nue be fore tak i ng de c i si on.