Professional Documents

Culture Documents

High Country

Uploaded by

Henny DeWillisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

High Country

Uploaded by

Henny DeWillisCopyright:

Available Formats

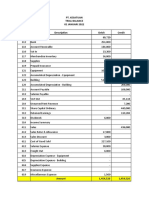

High Country, Inc., produces and sells many recreational products.

The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation:

Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed (total) Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead cost (total)

0 45,000 40,000 $80 $2 $567,000 $18 $10 $2 $675,000

Management is anxious to see how profitable the new camp cot will be and has asked that an income statement be prepared for May. Requirement 1: Assume that the company uses absorption costing. (a) Determine the unit product cost. (Omit the "$" sign in your response.) Unit product cost

(b) Prepare an income statement for May. (Input all amounts as positive values. Omit the "$" sign in your response.)

Requirement 2: Assume that the company uses variable costing. (a) Determine the unit product cost. (Omit the "$" sign in your response.)

Unit product cost

(b) Prepare a contribution format income statement for May. (Input all amounts as positive values. Omit the "$" sign in your response.)

$ Variable expenses: $

Fixed expenses:

Requirement 3: (a) Choose the reason for any difference in the ending inventory balances under the two costing methods.

(b) Choose the impact of the difference in the ending inventory balance and costing methods on reported net operating income.

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- LATIHAN Soal Uas AMDocument5 pagesLATIHAN Soal Uas AMqinthara alfarisiNo ratings yet

- Required:: ExplanationDocument3 pagesRequired:: ExplanationAshari PsiNo ratings yet

- 3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Document2 pages3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Jonathan Altamirano Burgos0% (1)

- Managerial Accounting Practice Problems2 PDFDocument9 pagesManagerial Accounting Practice Problems2 PDFFrank Lovett100% (1)

- 8508 QuestionsDocument3 pages8508 QuestionsHassan MalikNo ratings yet

- Managerial accounting problemsDocument9 pagesManagerial accounting problemsMohitNo ratings yet

- 2 5370806713307890464 PDFDocument5 pages2 5370806713307890464 PDFMekuriawAbebawNo ratings yet

- Variable Costing Discussion ProblemsDocument7 pagesVariable Costing Discussion ProblemsVatchdemonNo ratings yet

- CVP Analysis Questions ExplainedDocument5 pagesCVP Analysis Questions ExplainedArtee GuptaNo ratings yet

- Ch12 VarianceAnalysis QDocument11 pagesCh12 VarianceAnalysis QUmairSadiqNo ratings yet

- Short Answer Questions AssignmentDocument4 pagesShort Answer Questions Assignmentkarupa maharajNo ratings yet

- Cost and Management Accounting -II - Work SheetDocument7 pagesCost and Management Accounting -II - Work SheetBeamlak WegayehuNo ratings yet

- Managerial Accounting - WS4 Connect Homework GradedDocument9 pagesManagerial Accounting - WS4 Connect Homework GradedJason HamiltonNo ratings yet

- Kuis UTS Genap 21-22 ACCDocument3 pagesKuis UTS Genap 21-22 ACCNatasya FlorenciaNo ratings yet

- Amercian FuelDocument8 pagesAmercian FuelAsh KaiNo ratings yet

- Accounting QuestionDocument8 pagesAccounting QuestionMusa D Acid100% (1)

- Study Guide For Mgr. Exam 2Document10 pagesStudy Guide For Mgr. Exam 2Skirmante ZalysNo ratings yet

- QS08 - Class Exercises SolutionDocument5 pagesQS08 - Class Exercises Solutionlyk0texNo ratings yet

- KisikisiDocument7 pagesKisikisijalunasaNo ratings yet

- Practical QuestionsDocument5 pagesPractical QuestionsBui Thi Lan Anh (FGW HCM)No ratings yet

- Practice Question 2,3,5,6Document10 pagesPractice Question 2,3,5,6student.devyankgosainNo ratings yet

- Practice - Chapter 7 - ACCT - 401Document8 pagesPractice - Chapter 7 - ACCT - 401mohammed azizNo ratings yet

- MGRL Practice 2 ModDocument20 pagesMGRL Practice 2 ModAnn Kristine TrinidadNo ratings yet

- Day 06Document8 pagesDay 06Cy PenalosaNo ratings yet

- Quiz 2 - CVPDocument2 pagesQuiz 2 - CVPArpana KhadkaNo ratings yet

- ACC 302second MidtermDocument8 pagesACC 302second MidtermvirgofairiesNo ratings yet

- Mid Assignment - ACT 202Document4 pagesMid Assignment - ACT 202ramisa tasrimNo ratings yet

- Exercise-1 (A) : Joint and by Product Costing (Sales Value at Split Off Method)Document15 pagesExercise-1 (A) : Joint and by Product Costing (Sales Value at Split Off Method)Sky SoronoiNo ratings yet

- CH 6 Noreen Sample Exam Questions F2012 Acct206 2 MTDocument20 pagesCH 6 Noreen Sample Exam Questions F2012 Acct206 2 MTKimberly Claire AtienzaNo ratings yet

- Review ExercisesDocument5 pagesReview ExercisesThy Tran HongNo ratings yet

- AF2110 Mid Term Questoin OnlyDocument2 pagesAF2110 Mid Term Questoin OnlyannaNo ratings yet

- Master Budgeting & Costing TechniquesDocument2 pagesMaster Budgeting & Costing TechniquesAsti EristiasaNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisAnne BacolodNo ratings yet

- Week 7 HWMDocument8 pagesWeek 7 HWMJarongchai Keng HaemaprasertsukNo ratings yet

- PracticeDocument6 pagesPracticeNgan Tran Ngoc ThuyNo ratings yet

- Exam 1 - VI SolutionsDocument9 pagesExam 1 - VI Solutionssyeda hifzaNo ratings yet

- Break Even and CVPDocument2 pagesBreak Even and CVPIshmael OneyaNo ratings yet

- ABC QuestionsDocument14 pagesABC QuestionsLara Lewis Achilles0% (1)

- Ca CH4Document12 pagesCa CH4Charlotte ChanNo ratings yet

- Kompilasi Tugas Mandiri Bagian 2Document4 pagesKompilasi Tugas Mandiri Bagian 2Januar Ashari0% (1)

- Managerial Accounting Exam ReviewDocument9 pagesManagerial Accounting Exam ReviewZyraNo ratings yet

- BREAK EVEN ANALYSISDocument7 pagesBREAK EVEN ANALYSISZubair JuttNo ratings yet

- A. Calculate The Break-Even Dollar Sales For The MonthDocument25 pagesA. Calculate The Break-Even Dollar Sales For The MonthMohitNo ratings yet

- CVP Analysis and Absorption vs Variable CostingDocument3 pagesCVP Analysis and Absorption vs Variable CostingBenjamin0% (1)

- Garrison 14e Practice Exam - Chapter 8Document3 pagesGarrison 14e Practice Exam - Chapter 8Titas Khan100% (1)

- Accounting Questions Week 3Document2 pagesAccounting Questions Week 3milleranNo ratings yet

- Difference between variable and absorption costing methodsDocument13 pagesDifference between variable and absorption costing methodsAika May GarbeNo ratings yet

- ACT 202 AssignmentDocument3 pagesACT 202 AssignmentFahim AnjumNo ratings yet

- Task 2: Cost-Volume-Profit Question 1: Vin Diesel Owns The Fredonia Barber Shop. He Employs Four Barbers and Pays EachDocument2 pagesTask 2: Cost-Volume-Profit Question 1: Vin Diesel Owns The Fredonia Barber Shop. He Employs Four Barbers and Pays EachNgọc Trâm TrầnNo ratings yet

- SCM: Cost Volume Profit AnalysisDocument2 pagesSCM: Cost Volume Profit Analysiscyrellecelestino1998No ratings yet

- Bài Tập Tự LuậnDocument5 pagesBài Tập Tự Luậnhn0743644No ratings yet

- Long Test 2 Set BDocument2 pagesLong Test 2 Set BMonica ReyesNo ratings yet

- Absorption vs Variable Costing CalculationsDocument6 pagesAbsorption vs Variable Costing CalculationsVexana NecromancerNo ratings yet

- Chapters 6-12 Managerial Accounting ProblemsDocument7 pagesChapters 6-12 Managerial Accounting ProblemsVivek BhattNo ratings yet

- HI5017 Tutorial Question Assignment T2 2020Document10 pagesHI5017 Tutorial Question Assignment T2 2020shikha khanejaNo ratings yet

- Cost Behavior and CVPDocument4 pagesCost Behavior and CVPChiodos OliverNo ratings yet

- Intellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementFrom EverandIntellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementNo ratings yet

- MGT101 QUIZ 3 MODULES 11-14Document6 pagesMGT101 QUIZ 3 MODULES 11-14Nauman Marwat100% (1)

- 061B Jsa Land Clearing 0+00Document10 pages061B Jsa Land Clearing 0+00sas13No ratings yet

- Busines EthicsDocument8 pagesBusines EthicsjinkyNo ratings yet

- 2023 07 q1-2024 Investor PresentationDocument73 pages2023 07 q1-2024 Investor PresentationtsasidharNo ratings yet

- Aaa Bisnis Profil 1Document22 pagesAaa Bisnis Profil 1Afrian HindrawijayaNo ratings yet

- Digital Marketing ProjectDocument55 pagesDigital Marketing Projectsarah IsharatNo ratings yet

- Rantai Pasok Daging KambingDocument9 pagesRantai Pasok Daging Kambingdian dwi cahyaniNo ratings yet

- Chapter 8 Powerpoint Slides-2Document33 pagesChapter 8 Powerpoint Slides-2Goitsemodimo SennaNo ratings yet

- Name: DEC. 17, 2020 Buscom ScoreDocument4 pagesName: DEC. 17, 2020 Buscom ScoreErica DaprosaNo ratings yet

- Push Carts VapeDocument8 pagesPush Carts Vapemuhammad ibrarNo ratings yet

- Ocobee River Rafting Company profit analysisDocument4 pagesOcobee River Rafting Company profit analysiskristine torresNo ratings yet

- Personal Assistant Hour Notification Form: Month - 20Document1 pagePersonal Assistant Hour Notification Form: Month - 20Shahnaz NawazNo ratings yet

- The Atlas Copco BookDocument16 pagesThe Atlas Copco Bookfurkan cavit önalNo ratings yet

- Laa 2 Donald Gunns 12 Types Codes Conventions of PrintsDocument13 pagesLaa 2 Donald Gunns 12 Types Codes Conventions of Printsapi-544028479No ratings yet

- CRM in ICICIDocument17 pagesCRM in ICICIAkshay keerNo ratings yet

- Ladder of Customer LoyaltyDocument31 pagesLadder of Customer LoyaltyEshita Hajela100% (2)

- 6 Types of Adjusting EntriesDocument13 pages6 Types of Adjusting EntriesMarjorie GabonNo ratings yet

- Management, Leadership, Training & HR (PDFDrive)Document202 pagesManagement, Leadership, Training & HR (PDFDrive)ADITYA RANJANNo ratings yet

- Assessment 3 Choice and Change (Presentation)Document5 pagesAssessment 3 Choice and Change (Presentation)Vladimir Losenkov100% (1)

- Apchemi'S Project Lifecycle Partnership SolutionDocument2 pagesApchemi'S Project Lifecycle Partnership SolutionDharamNo ratings yet

- Kunci Jawaban Uts - Pengantar Akuntansi - s1 AkuntansiDocument18 pagesKunci Jawaban Uts - Pengantar Akuntansi - s1 AkuntansiAll AboutNo ratings yet

- Kelayakan Investasi (Invesment Feasibility) Pembangunan Pasar Tradisional Rukoh Barona Kota Banda AcehDocument7 pagesKelayakan Investasi (Invesment Feasibility) Pembangunan Pasar Tradisional Rukoh Barona Kota Banda AcehBianNo ratings yet

- Dr. A.K. Sengupta: Former Dean, Indian Institute of Foreign TradeDocument12 pagesDr. A.K. Sengupta: Former Dean, Indian Institute of Foreign TradeimadNo ratings yet

- Activity 1 UTSDocument14 pagesActivity 1 UTSdoieNo ratings yet

- Questionnaire Marketing MixDocument12 pagesQuestionnaire Marketing MixPushpa Barua100% (3)

- Department of Collegiate and Technical Education: Government Polytechnic, KarwarDocument41 pagesDepartment of Collegiate and Technical Education: Government Polytechnic, Karwarmisba shaikhNo ratings yet

- Islamic Banking and Finance Review (Vol. 2), 166-Article Text-412-1-10-20191121Document12 pagesIslamic Banking and Finance Review (Vol. 2), 166-Article Text-412-1-10-20191121UMT JournalsNo ratings yet

- KL 39 H 3095 PDFDocument1 pageKL 39 H 3095 PDFSujith Raj SNo ratings yet

- MCQ Monopolistic & Oligopolistic Competition PDFDocument5 pagesMCQ Monopolistic & Oligopolistic Competition PDFAJAY KUMAR SAHUNo ratings yet

- One To One MarketingDocument22 pagesOne To One MarketingSamuel HenriqueNo ratings yet