Professional Documents

Culture Documents

Referred To in Paragraphs 9.5.1, 9.5.4 AND 22.4.4 of CPWA Code

Uploaded by

cjmOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Referred To in Paragraphs 9.5.1, 9.5.4 AND 22.4.4 of CPWA Code

Uploaded by

cjmCopyright:

Available Formats

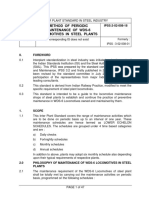

FORM 46 (P.W.A.9) REGISTER OF REVENUE REALISED (Referred to in paragraphs 9.5.1, 9.5.4 AND 22.4.4 of CPWA Code) Major Head.

Particulars * Water Rates 1 Rs. Amount brought forward from last month... Deduct Refunds Rs. * Owners Rates 2 Rs. * Water supply of Towns 3 Rs. * Sales of Water 4 Rs. * Plantations 5 Rs. * * Other Water canal Power produce 6 Rs. 7 Rs. * Navigation 8 Rs. * Licence Fees 9 Rs.

@ Name of system.

Recoveries of Expenditure Tools Establ* Other & ishment Fines Plants recovRecoveRecoeries ries veries 10 11 12 13 Rs. Rs. Rs. Rs. * Miscellaneous

eferce to Item ucher No. No.

Total 15 Rs.

14 Rs.

Transaction of the month.. Total for the month... Total up-todate carried over to the following month...

Net Rs.

This form is also used for maintaining the detailed accounts of (1) Refunds of Revenue and (2) Receipt and Recoveries on Capital Accounts. When a Major Head is divided into parts, a separate Register of Revenue should be kept for each part. Receipts pertaining to (a) Military Engineer Service Works, (b) Indian Air Force Works, (c) Postal Departmental Works, (d) Telecommunication Departmental Works and (e) Archeological Works referred to in paragraph 22.2.6 should be posted in separate registers/folio for each. * These columns are intended for the minor heads (and detailed heads, if any) subordinate to the major head concerned. @ To be used in respect of projects for which capital and revenue accounts are kept.

FORM 46 A SCHEDULE OF (I) REVENUE REALISED (II) REFUNDS OF REVENUE (III) RECEIPTS & RECOVERIES ON CAPITAL ACCOUNT (Referred to in paragraph 22.4.15) Division .. Major Head . Minor Heads (and detailed Heads) Establishment Rs. Name of System .. Recoveries of Expenditure Tools & MiscellOther Plant aneous Rs. Rs. Rs.

Total Rs.

Rs. 1. Amount brought forward from last month 2. Amount pertaining to this month 3. Total to end of the month 4. Deduct refunds 5. Net up-to-date carried over to the following month

Rs.

Rs.

Rs.

Divisional Accountant

You might also like

- PLRSDocument508 pagesPLRSankigarg8719No ratings yet

- Annexure ThermalDocument114 pagesAnnexure ThermaleshanmukharaoNo ratings yet

- Financial Assistance For Industrial and Other Allied SectorDocument4 pagesFinancial Assistance For Industrial and Other Allied SectorHarsha VarunNo ratings yet

- Bit EoDocument6 pagesBit EoRuby Joy G. BugtongNo ratings yet

- CA Audit Report Format-1Document88 pagesCA Audit Report Format-1nuudmNo ratings yet

- 1.3 BSKE 2023 Annexes A B and C Barangay Inventory and Turnover of BPFRD and Money October 30 RA No. 11935 February 27Document6 pages1.3 BSKE 2023 Annexes A B and C Barangay Inventory and Turnover of BPFRD and Money October 30 RA No. 11935 February 27sangitan westNo ratings yet

- Annex-1-13-Blank 5Document23 pagesAnnex-1-13-Blank 5ಜಂಟಿ ನಿರ್ದೇಶಕರು ಜಿಲ್ಲಾ ಕೈಗಾರಿಕಾ ಕೇಂದ್ರ ಶಿವಮೊಗ್ಗNo ratings yet

- RAB, PaymentsDocument7 pagesRAB, Paymentsagrawalbs0% (1)

- MANUAL OF OUTSIDE AUDITDEPARTMENT INSPECTION Economic Services II 20200929120844Document184 pagesMANUAL OF OUTSIDE AUDITDEPARTMENT INSPECTION Economic Services II 20200929120844Reshmi R NairNo ratings yet

- Referred To in Paragraph 7.2.29 of CPWA CodeDocument1 pageReferred To in Paragraph 7.2.29 of CPWA Coderfvz6sNo ratings yet

- 5a05336ac28f7HBA Rules 2017Document271 pages5a05336ac28f7HBA Rules 2017NagaraJu MalleyboinaNo ratings yet

- Groundwater 4Document6 pagesGroundwater 4bahadoor22i5583No ratings yet

- Accounting Line DataDocument6 pagesAccounting Line Dataditoendutojkt75No ratings yet

- 1.3 BSKE 2023 Annexes A B and C Barangay Inventory and Turnover of BPFRD and Money October 30 RA No. 11935 February 27Document6 pages1.3 BSKE 2023 Annexes A B and C Barangay Inventory and Turnover of BPFRD and Money October 30 RA No. 11935 February 27ataydeandrea2324No ratings yet

- Cost Accounting (781) Sample Question Paper Class XII 2018-19Document5 pagesCost Accounting (781) Sample Question Paper Class XII 2018-19Saif HasanNo ratings yet

- RLC - SEC 17-A - December 31 2022Document323 pagesRLC - SEC 17-A - December 31 2022Julius Mark Carinhay TolitolNo ratings yet

- 1.3 BSKE 2023 - Annexes A, B and C - Barangay Inventory and Turnover of BPFRD and Money - October 30-RA No. 11935 - February 27Document6 pages1.3 BSKE 2023 - Annexes A, B and C - Barangay Inventory and Turnover of BPFRD and Money - October 30-RA No. 11935 - February 27DILG San Fabian90% (10)

- ICAO - Airport Services Manual (DOC9137) Part 9 Airport MaintDocument55 pagesICAO - Airport Services Manual (DOC9137) Part 9 Airport MaintJitesh Nichani100% (3)

- Civil Minor Volume II - Uploaded On - 18-11-2020, Edit 2022-03-04Document80 pagesCivil Minor Volume II - Uploaded On - 18-11-2020, Edit 2022-03-04Amila KarunarathneNo ratings yet

- Entrepreneurs Memorandum FOR Setting Up Micro, Small or Medium EnterpriseDocument23 pagesEntrepreneurs Memorandum FOR Setting Up Micro, Small or Medium EnterpriseChirec LegalNo ratings yet

- Method of Periodic Maintenance of Wds-6 Locomotives in Steel PlantsDocument47 pagesMethod of Periodic Maintenance of Wds-6 Locomotives in Steel PlantsPraveen Kumar RoutNo ratings yet

- Rera Eng CertificateDocument3 pagesRera Eng Certificatemr.xinbombayNo ratings yet

- TariffDocument10 pagesTariffDeepshikhaDixitNo ratings yet

- 1.3 BSKE 2023 - Annexes A B and C Barangay Inventory and Turnover of BPFRD and Money - October 30 RA No. 11935 - February 27Document6 pages1.3 BSKE 2023 - Annexes A B and C Barangay Inventory and Turnover of BPFRD and Money - October 30 RA No. 11935 - February 27jerald100% (1)

- 1.3 BSKE 2023 - Annexes A B and C Barangay Inventory and Turnover of BPFRD and Money - October 30 RA No. 11935 - February 27Document5 pages1.3 BSKE 2023 - Annexes A B and C Barangay Inventory and Turnover of BPFRD and Money - October 30 RA No. 11935 - February 27BARANGAY LABNIGNo ratings yet

- Form No. SRF (I) 01 (Indian Supplier) Annexure-Ii Organisational Informa TionDocument1 pageForm No. SRF (I) 01 (Indian Supplier) Annexure-Ii Organisational Informa TionkumarNo ratings yet

- List of Accounts Submitted To Audit (P.W.A. Code Paragraphs 523 and 527)Document2 pagesList of Accounts Submitted To Audit (P.W.A. Code Paragraphs 523 and 527)Muhammad Ishaq ZahidNo ratings yet

- List of Accounts Submitted To Audit (P.W.A. Code Paragraphs 523 and 527)Document2 pagesList of Accounts Submitted To Audit (P.W.A. Code Paragraphs 523 and 527)Muhammad Ishaq ZahidNo ratings yet

- Form 26Document7 pagesForm 26pviveknaiduNo ratings yet

- CSR Proposal For ConstructionDocument16 pagesCSR Proposal For Constructionkppandeykaran078No ratings yet

- Commission On Audit: 2t/rp:uhlir NFDocument4 pagesCommission On Audit: 2t/rp:uhlir NFKatherine PacenoNo ratings yet

- 1.4 BSKE 2023 - Annexes D, E and F - SANGGUNIANG KABATAAN Inventory and Turnover of SK PFRDs and Money - October 30-RA No. 11935 - February 27Document4 pages1.4 BSKE 2023 - Annexes D, E and F - SANGGUNIANG KABATAAN Inventory and Turnover of SK PFRDs and Money - October 30-RA No. 11935 - February 27cjunuelNo ratings yet

- Atswa Public Sector AccountingDocument458 pagesAtswa Public Sector Accountinghabth100% (1)

- Volume 3 Section 2 Process Requirements-FINAL 10062010Document63 pagesVolume 3 Section 2 Process Requirements-FINAL 10062010Pavle DimitrijevicNo ratings yet

- Cash FlowDocument8 pagesCash FlowSUPERHERO WORLDNo ratings yet

- dm7 01 02 Old FormatDocument668 pagesdm7 01 02 Old FormatlilycastNo ratings yet

- Manual On The New Government Accounting System For Local Government UnitsDocument12 pagesManual On The New Government Accounting System For Local Government UnitsCarlota Nicolas VillaromanNo ratings yet

- Sullabus of Works OrdersDocument10 pagesSullabus of Works OrdersMOHD USMANNo ratings yet

- 1.4 BSKE 2023 Annexes D E and F SANGGUNIANG KABATAAN Inventory and Turnover of SK PFRDs and Money October 30 RA No. 11935 February 27Document7 pages1.4 BSKE 2023 Annexes D E and F SANGGUNIANG KABATAAN Inventory and Turnover of SK PFRDs and Money October 30 RA No. 11935 February 27juan heartNo ratings yet

- Nih 2655 FormDocument2 pagesNih 2655 FormVrusabh ShahNo ratings yet

- 1 FinancialDocument6 pages1 FinancialMorshedDenarAlamMannaNo ratings yet

- Designbuild RFP PDFDocument50 pagesDesignbuild RFP PDFNadeemplannerNo ratings yet

- UFGS 01 33 00 Submittal ProceduresDocument36 pagesUFGS 01 33 00 Submittal Proceduresrhunter2010No ratings yet

- Cfi - Fy2004 - F990Document37 pagesCfi - Fy2004 - F990Didi RemezNo ratings yet

- Mil P 24534Document150 pagesMil P 24534jandroweenNo ratings yet

- Mso A&E Volume 1 - 2014 - AgaecgDocument203 pagesMso A&E Volume 1 - 2014 - AgaecgDev ChhotuNo ratings yet

- Fiscal Management ER 415-1-16Document66 pagesFiscal Management ER 415-1-16joe_pulaskiNo ratings yet

- Birla Cement Corporation-Chittorgarh 23.04.2016 Audit 2015-16 IndexDocument2 pagesBirla Cement Corporation-Chittorgarh 23.04.2016 Audit 2015-16 IndexPravesh PangeniNo ratings yet

- MOU Part 7 E-July18Document193 pagesMOU Part 7 E-July18susmit.walavalkarNo ratings yet

- High-Speed Craft 2020: Rules For Building and ClassingDocument6 pagesHigh-Speed Craft 2020: Rules For Building and ClassingTihomir MarkovicNo ratings yet

- Rr410803 Chemical Engineering Plant Design and EconomicsDocument8 pagesRr410803 Chemical Engineering Plant Design and EconomicsSrinivasa Rao GNo ratings yet

- Commission On Audit: 2t/rp:uhlir NFDocument4 pagesCommission On Audit: 2t/rp:uhlir NFJuan Luis LusongNo ratings yet

- Bskeit 3Document6 pagesBskeit 3Kent Charles M. NotarioNo ratings yet

- KSP RBT Rac CD Cal Irr 0002Document51 pagesKSP RBT Rac CD Cal Irr 0002alaa sadikNo ratings yet

- Securities and Exchange Board of IndiaDocument6 pagesSecurities and Exchange Board of Indiashailaja_kumaranNo ratings yet

- Draft Letter SAICPL To EE - Compliance Letter of Inception Report & QAPDocument3 pagesDraft Letter SAICPL To EE - Compliance Letter of Inception Report & QAPBilal A BarbhuiyaNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- International Financial Reporting Standards (IFRS) Workbook and Guide: Practical insights, Case studies, Multiple-choice questions, IllustrationsFrom EverandInternational Financial Reporting Standards (IFRS) Workbook and Guide: Practical insights, Case studies, Multiple-choice questions, IllustrationsNo ratings yet

- ReferencesDocument6 pagesReferencescjmNo ratings yet

- Steel TrussDocument36 pagesSteel Trusssubhashguptamaddu67% (3)

- Part 5 PG 66 81 643Document16 pagesPart 5 PG 66 81 643Pandal RajNo ratings yet

- Part-7 PG 98-109Document12 pagesPart-7 PG 98-109cjmNo ratings yet

- Span: 10m: Roof Slope: 1 in 3 Bay: 4.5Document16 pagesSpan: 10m: Roof Slope: 1 in 3 Bay: 4.5cjmNo ratings yet

- Part-9 PG 146-158Document15 pagesPart-9 PG 146-158cjmNo ratings yet

- District Wise Population in India As of 2011 CensusDocument20 pagesDistrict Wise Population in India As of 2011 CensuscjmNo ratings yet

- Part-4 PG 50-65Document16 pagesPart-4 PG 50-65cjmNo ratings yet

- Steel TrussDocument36 pagesSteel Trusssubhashguptamaddu67% (3)

- Design ManualDocument3 pagesDesign ManualcjmNo ratings yet

- S Pan: 25m: Roof Slope: 1 in 3 Bay: 4.5Document16 pagesS Pan: 25m: Roof Slope: 1 in 3 Bay: 4.5cjmNo ratings yet

- Part-2 PG 18-33Document16 pagesPart-2 PG 18-33cjmNo ratings yet

- Part-9 PG 146-158Document15 pagesPart-9 PG 146-158cjmNo ratings yet

- Flat Joint - Steel BattenDocument1 pageFlat Joint - Steel BattencjmNo ratings yet

- Kozybm Edt2004Document165 pagesKozybm Edt2004cjmNo ratings yet

- Pane of Roof - Steel BattenDocument1 pagePane of Roof - Steel BattencjmNo ratings yet

- Eaves Steel BattenDocument1 pageEaves Steel BattencjmNo ratings yet

- Roofs Steel BattenDocument1 pageRoofs Steel BattencjmNo ratings yet

- Building Design TipsDocument13 pagesBuilding Design TipscjmNo ratings yet

- Upper Eaves For Monopitch Roof - Steel BattenDocument1 pageUpper Eaves For Monopitch Roof - Steel BattencjmNo ratings yet

- Verge Steel BattenDocument1 pageVerge Steel BattencjmNo ratings yet

- Tubular Truss Design Using Steel Grades S355 and S420Document35 pagesTubular Truss Design Using Steel Grades S355 and S420Muzamil Rather100% (1)

- Batten Distance - Steel BattenDocument1 pageBatten Distance - Steel BattencjmNo ratings yet

- TATA Structura BrochureDocument20 pagesTATA Structura Brochurecjm100% (2)

- Arms PDFDocument13 pagesArms PDFcjmNo ratings yet

- Fee AdvisoryDocument8 pagesFee Advisoryjohn_lonerNo ratings yet

- PM's 15 Point Programme For Minorities-Minority AffairsDocument7 pagesPM's 15 Point Programme For Minorities-Minority AffairsHussainNo ratings yet

- Analysis and Design of Steel Framed Buildings With and Without Steel Plate Shear WallsDocument9 pagesAnalysis and Design of Steel Framed Buildings With and Without Steel Plate Shear WallscjmNo ratings yet

- Passport AdvisoryDocument4 pagesPassport AdvisorySindhu BrahmaNo ratings yet

- Sbi Internet Banking FormDocument3 pagesSbi Internet Banking Formrajandtu93No ratings yet