Professional Documents

Culture Documents

The Illusion of Thin-Tails Under Aggregation - SSRN-Id1987562

Uploaded by

adeka1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Illusion of Thin-Tails Under Aggregation - SSRN-Id1987562

Uploaded by

adeka1Copyright:

Available Formats

The Illusion of Thin-Tails Under Aggregation

Nassim N. Taleb, NYU-Poly George A. Martin, Associate Director, CISDM, University of Massachusetts January 2012

Abstract: It is assumed that while portfolio theory fails with daily returns, that it would work with yearly returns, an standard argument recently repeated in Treynor (2011). This paper debunks the confusion that daily returns, when nonGaussian but with finite variance can aggregate to thin tails. Alas, portfolio theory fails in both the short and the long run. The central limit theorem operates too slowly for economic data for us to use it and take portfolio theory with any degree of seriousness. The point is illustrated with a Monte Carlo simulation.

We disagree with the statements in Treynor (2011) on logical, epistemological, empirical, and mathematical grounds. Let us summarize Treynors key argument: he accepts that equity market returns on a daily basis are fat-tailed, in agreement with the first author. But he then argues that such returns, by aggregation, become thin tailed in other words, when we look at yearly, not daily, data. To the question do annual returns behave as Taleb would predict [sic] correlated, with dispersion that shifts too rapidly to have a finite variance?, he offers a stark nooffering as evidence the past 195 years of annual equity market returns which seem to disconfirm such theory. In sum, what he offers is N=195 years of annual returns as a test of his theory of aggregation (which is, no doubt, afflicted by the survivorship bias associated with a continuous financial market that has existed while many have failed but we can ignore the point for now). Alas, we believe that the data that he produces is not just entirely compatible with presence of fat tails under aggregation, but what one should expect, as small sample effects may mask the tail effects, regardless of whether or not the data has infinite or finite variance. In particular, Treynor (and others) incorrectly rely on the central limit theorem, which states that the distribution of the sum of scaled random variables independently drawn from a finite-variance distribution will converge to a Gaussian distribution. However, the central limit theorem is only valid asymptotically, and in finite samples, the center of the distribution converges towards a Gaussian distribution before the tails. This is a repeat of

the mistake made by officer (1972), debunked in Taleb (2009a) which showed how Kurtosis fails to decline under aggregation, once one is aware of the small sample effect. Let us define a power-law as, for extreme values, the ratios of exceedance probabilities are scale invariant. So take X a random variable, we have a power-law if for x large enough, P[X>x] ~ O[x]. For aggregation of random variables drawn from distributions with power law tails (and finite variance) of, say, a power law exponent of 3, the width of the Gaussian component is proportional to N1/2(ln N)1/2 (Bouchaud and Potters, 2003; Sornette, 2004). The growth in width can be thought of deriving from two components that inherent growth of the standard deviation of the sum from addition of independent random variableswhich constitutes the body of the distribution--and then a factor of (ln N)1/2 that represents any taming of the tails. Further, using extreme value theory, the maximum of a random variable is not affected much by aggregation as the aggregation effect is very slow, even in the presence of finite variance (Mandelbrot and Taleb, 2010). Clearly we have had for sometime since Mandelbrot (1963) sufficient evidence that daily returns in finance and commodities markets are power-law distributed, or, to say the least, insufficient evidence to reject it; this fact has been particularly rejuvenated by research conducted by the Econophysics groups. Almost all empirical results describe returns even when they have finite variance, as power-law

Copyright 2011 by N. N. Taleb.

Electronic copy available at: http://ssrn.com/abstract=1987562

distributed (Sornette, Gabaix et al.,2003, Stanley et al.,2000). Further, Weron (2001) showed that infinite variance processes can masquerade as having an >2, again, from small sample effects. In part because of the influence of research on non-Gaussian stable distributions, it seemed crucial that fat tails were paired with the focus on values of <2, where the variance is infinite. But Taleb (2009b) showed that the requirement for power-law effects such as fat tails is not the same requirement of finite or infinite variance: power-laws are power-laws, and their mere acceptance invalidates the results of Markowitz (1959) portfolio theory. Simply, power laws have infinite moments higher than , meaning that even if variance is the highest moment needed for the Markowitz derivations, this is merely an asymptotic property that breaks down anywhere before infinity. The results of Markowitz cannot accommodate power laws, finite or infinite variance (though derivatives pricing is not affected at all by such argument). The empirical tests in the literature point to a cubic power-law, with an around 2.7. Let us look at the properties of aggregated (log) returns and determine whether the return properties in Treynor (2011) may be consistent with fat tails at the weekly level or the annual level. Let x be daily log returns, and take x randomly generated following the distribution with tail exponent = 2.7

Yz = y j , z

{ }

(

195 j =1

We calculate the kurtosis of the distribution of annual returns for a given run z

K (z) = 1 195 y yz 195 j =1 j , z

) )

1 195 2 195 y j , z y z j =1

Finally, we end with the vector of length M

{K (z )}zM=1

Now by standard result, the expectation of K(z) is infinite. But small (by which we mean finite) samples may yield a different result, which may obscure the unboundness of the kurtosis for this distribution. We therefore conduct a sampling exercise. We generated close to 4 billion, 3.82 107 daily runs of x, for a total M of 78 103. The median kurtosis observed is 3.36. For a purely Gaussian process the median kurtosis observed for a sample of 200 is 2.95; the probability of observing a kurtosis of 3.36 for a sample size of 200 is approximately .88. Thus, even with infinite higher moments, we may find that observed moments may be consistent with the moments from thin tailed distributions.

we take the sum to get y, the annual return,

y j , z = xi , z

i =1

252

and

Figure 1 The small Monte Carlo run illustrating the distribution of Kurtosis, here M=100.

2 Copyright 2012 by N. N. Taleb

Electronic copy available at: http://ssrn.com/abstract=1987562

The harder conclusion is that portfolio theory (and other results flowing from it) are alas unusable in the real world, whether for daily, monthly, annual, or centennial returns .

***

Figure 2, Distribution M=78,000 from 3.8 billion simulations of daily returns x

Data: 3.8 107 Median: 3.35 Mean:4.8231 Quantile (.98): 19.94 Max: 189.84 What is one of many the lesson from this exercise? Moment-based empirical reasoning is an unreliable basis for determining the distributional properties of the underlying return generating process. If our concern is risk, then we should focused on tail-regarding measures of risk, rather than take misplaced comfort in moment-based measures. We note further, that for an N of 52, we have a width that is 1.3 times the aggregate standard deviation, thus indicating even for finite variance distributions, under power-laws the rate at which tails become Gaussian is very slow relative to sample sizes. Even taking 195x52 weeks of data, or more than 10,000 observations, the Gaussian component of the distribution is only 2.0 times the aggregate standard deviation. Assuming aggregation of daily data, we have the Gaussian component of the distribution through 2.16 times the aggregate standard deviation. Conclusion Treynor (2011) argues from historical data and an imprecise interpretation of the central limit theorem that equity market return data is, when aggregated, sufficiently well behaved to employ volatility-based risk measures derived from price returns. However, we argue that the line of reasoning he pursues namely misplaced reliance on the central limit theorem and the evidence he presents (195 annual returns for equity markets), do not in any way contradict the presence of fat-tailedness in financial market returns, even when aggregated to be considered annually. Moreover, we argue that momentbased measures of risk are insufficient for, particularly for passive/static exposures to, financial market assets. 3 Copyright 2012 by N. N. Taleb

Boucheaud, J.-P. and M. Potters, 2003, Theory of Financial Risks and Derivatives Pricing, From Statistical Physics to Risk Management, 2 nd Ed., Cambridge University Press. Gabaix,X., P. Gopikrishnan, V.Plerou & H.E. Stanley, 2003, A theory of power-law distributions in financial market fluctuations, Nature, 423, 267-270. Markowitz, Harry, Portfolio Selection: Efficient Diversification of Investments, Wiley (1959). Mandelbrot, B. 1963, The variation of cer- tain speculative prices. The Journal of Business, 36(4):394419. Mandelbrot, B. and Taleb, N. N. (2010) Random Jump, not Random Walk", in The Known, the Unknown, and the Unknowable, Frank Diebold, Neil Doherty, and Richard Herring,eds., Princeton University Press Officer, R. R., 1972, The Distribution of Stock Returns. Journal of the American Statistical Association 340(67): 807812. Sornette, D., 2004, 2 nd Ed., Critical Phenomena in Natural Sciences, Chaos, Fractals, Selforganization and Disorder: Concepts and Tools, (Heidelberg: Springer) Stanley, H.E. L.A.N. Amaral, P. Gopikrishnan, and V. Plerou, 2000, Scale invariance and universality of economic fluc- tuations, Physica A, 283,31-41 Taleb, N. N. (2009a). "Errors, robustness, and the fourth quadrant." International Journal of Forecasting 25(4): 744-759. Taleb, N. N. (2009b), Finiteness of variance is irrelevant in the practice of quantitative finance. Complexity, 14: 6676 Treynor, Jack L. (2011), What Can Taleb Learn From Markowitz, Journal Of Investment

Management, Vol. 9, No. 4, (2011), pp. 59

Weron, R., 2001,Levy-stable distributions revisited: tail index > 2 does not exclude the Levy-stable regime. International Journal of Modern Physics C (2001) 12(2), 209-223.

Electronic copy available at: http://ssrn.com/abstract=1987562

4 Copyright 2012 by N. N. Taleb

You might also like

- Power-Laws in Economy and Finance: Some Ideas From Physics: Jean-Philippe BouchaudDocument16 pagesPower-Laws in Economy and Finance: Some Ideas From Physics: Jean-Philippe BouchaudJohann Alexandria HughNo ratings yet

- Forecasting Government Bond Yields with Nelson-Siegel ModelDocument28 pagesForecasting Government Bond Yields with Nelson-Siegel Modelstan32lem32No ratings yet

- Diebold 2Document30 pagesDiebold 2fedegrassoNo ratings yet

- Prospect Theory: An Alternative To Rational Theories of Deterrence (Davis)Document8 pagesProspect Theory: An Alternative To Rational Theories of Deterrence (Davis)Ian DavisNo ratings yet

- SSRN Id593584Document28 pagesSSRN Id593584Loulou DePanamNo ratings yet

- Nassim Taleb Journal Article - Report On The Effectiveness and Possible Side Effects of The OFR (2009)Document21 pagesNassim Taleb Journal Article - Report On The Effectiveness and Possible Side Effects of The OFR (2009)casefortrilsNo ratings yet

- Aether Analytics Strategy DeckDocument21 pagesAether Analytics Strategy DeckAlex BernalNo ratings yet

- Nassim Nicholas Taleb, Donnie Darko, and The Meaning of HistoryDocument11 pagesNassim Nicholas Taleb, Donnie Darko, and The Meaning of HistoryJeremiadusNo ratings yet

- FARMER, J. Doyne. Economy As Complex SystemDocument15 pagesFARMER, J. Doyne. Economy As Complex SystemAlvaro PuertasNo ratings yet

- Espen Gaarder Haug: Space-Time FinanceDocument14 pagesEspen Gaarder Haug: Space-Time Financedeenutz93No ratings yet

- The "Dogs of The Dow" MythDocument16 pagesThe "Dogs of The Dow" Mythompomp13No ratings yet

- Paper On Mcap To GDPDocument20 pagesPaper On Mcap To GDPgreyistariNo ratings yet

- CH 22Document68 pagesCH 22Aireen TanioNo ratings yet

- Why Might Share Price Follow A Random Walk by Senior SophisterDocument13 pagesWhy Might Share Price Follow A Random Walk by Senior SophisterHu ShanxiongNo ratings yet

- Kelly (Multi Asset)Document15 pagesKelly (Multi Asset)datsnoNo ratings yet

- SHILLER, Robert J. (1984) Stock Prices and Social DynamicsDocument54 pagesSHILLER, Robert J. (1984) Stock Prices and Social DynamicsDouglas de Medeiros FrancoNo ratings yet

- Fama-Macbeth Two Stage Factor Premium EstimationDocument5 pagesFama-Macbeth Two Stage Factor Premium Estimationkty21joy100% (1)

- Statistical Arbitrage 6Document7 pagesStatistical Arbitrage 6TraderCat SolarisNo ratings yet

- Introduction To Fast Fourier Transform inDocument31 pagesIntroduction To Fast Fourier Transform inALNo ratings yet

- 10 SAMT Journal Spring 2016 PDFDocument46 pages10 SAMT Journal Spring 2016 PDFpatthai100% (1)

- The Missing Risk Premium: Why Low Volatility Investing WorksDocument118 pagesThe Missing Risk Premium: Why Low Volatility Investing WorksMinh NguyenNo ratings yet

- Taleb ProbabilityDocument11 pagesTaleb ProbabilityjbhoerrNo ratings yet

- Fat Tails Statistical ConsequencesDocument364 pagesFat Tails Statistical ConsequencesJuan Carlos Florez100% (2)

- Dave Pressler No 4th Dimension Commentary5-1Document2 pagesDave Pressler No 4th Dimension Commentary5-1epicurean_tNo ratings yet

- The Boom of 2021Document4 pagesThe Boom of 2021Jeff McGinnNo ratings yet

- Utility of $Document37 pagesUtility of $Max SaubermanNo ratings yet

- Net Net USDocument70 pagesNet Net USFloris OliemansNo ratings yet

- Creditrisk Plus PDFDocument72 pagesCreditrisk Plus PDFNayeline CastilloNo ratings yet

- 1964 - What Should Economist Do - BuchananDocument12 pages1964 - What Should Economist Do - BuchananJuan Manuel Báez CanoNo ratings yet

- Syllabus of Behavior FinanceDocument5 pagesSyllabus of Behavior FinanceCandraNo ratings yet

- Financial Econometrics Rachev S.T PDFDocument146 pagesFinancial Econometrics Rachev S.T PDFRodrigo Chang100% (1)

- Adaptive Markets - Andrew LoDocument22 pagesAdaptive Markets - Andrew LoQuickie Sanders100% (4)

- Accelerating Dual Momentum Is Better Than Classic Dual MomentumDocument26 pagesAccelerating Dual Momentum Is Better Than Classic Dual MomentumAyhanNo ratings yet

- Lucas - Econometric Policy Evaluation, A CritiqueDocument28 pagesLucas - Econometric Policy Evaluation, A CritiqueFederico Perez CusseNo ratings yet

- The Swiss Army Knife of Options AnalyticsDocument4 pagesThe Swiss Army Knife of Options AnalyticsdanNo ratings yet

- Precautionary Principle PapersDocument36 pagesPrecautionary Principle Papersrozo_asterNo ratings yet

- Learning From The Behavior of Others - Conformity, Fads, and Informational CascadesDocument4 pagesLearning From The Behavior of Others - Conformity, Fads, and Informational CascadesAlex LiNo ratings yet

- Log NormalDocument12 pagesLog NormalAlexir86No ratings yet

- Are Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?Document45 pagesAre Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?mayur8898357200No ratings yet

- SSRN Id4336419Document26 pagesSSRN Id4336419brineshrimpNo ratings yet

- Quantum Supremacy Using A Programmable Superconducting ProcessorDocument12 pagesQuantum Supremacy Using A Programmable Superconducting ProcessorMLNo ratings yet

- StocksDocument68 pagesStockscrownstudiopr100% (1)

- Unesco - Eolss Sample Chapter: On The Economics of Non-Renewable ResourcesDocument27 pagesUnesco - Eolss Sample Chapter: On The Economics of Non-Renewable ResourcesKartik MaulekhiNo ratings yet

- Determining The Discount For Lack of Marketability With Put Option Pricing Models in View of The Section 2704 Proposed RegulationsDocument20 pagesDetermining The Discount For Lack of Marketability With Put Option Pricing Models in View of The Section 2704 Proposed RegulationsAlexV100% (1)

- RapportDocument39 pagesRapportMichael PetersNo ratings yet

- Forecasting Nike's Sales Using Facebook DataDocument10 pagesForecasting Nike's Sales Using Facebook Datascher1234No ratings yet

- Fama 1981Document22 pagesFama 1981Marcelo BalzanaNo ratings yet

- Kelly CriterionDocument14 pagesKelly Criterionmustafa-ahmedNo ratings yet

- Flaw of AveragesDocument1 pageFlaw of AveragesMohamed Salah-EldinNo ratings yet

- Whaley+Wilmott TheBestHedgingStrategyDocument5 pagesWhaley+Wilmott TheBestHedgingStrategydlr1949No ratings yet

- BOOK-Soner-Stochastic Optimal Control in FinanceDocument67 pagesBOOK-Soner-Stochastic Optimal Control in FinancefincalNo ratings yet

- The Best of Wilmott 1: Incorporating the Quantitative Finance ReviewFrom EverandThe Best of Wilmott 1: Incorporating the Quantitative Finance ReviewNo ratings yet

- Strategic and Tactical Asset Allocation: An Integrated ApproachFrom EverandStrategic and Tactical Asset Allocation: An Integrated ApproachNo ratings yet

- Microscopic Simulation of Financial Markets: From Investor Behavior to Market PhenomenaFrom EverandMicroscopic Simulation of Financial Markets: From Investor Behavior to Market PhenomenaNo ratings yet

- TFM MII PretelParejoMerino, CarlosJesusDocument105 pagesTFM MII PretelParejoMerino, CarlosJesusadeka1No ratings yet

- Short-Term Stock Price Prediction by Analysis of Order Pattern ImagesDocument5 pagesShort-Term Stock Price Prediction by Analysis of Order Pattern Imagesadeka1No ratings yet

- Liquidity 2008Document47 pagesLiquidity 2008adeka1No ratings yet

- Pattern Discovery in The Financial Time Series Based On Local TrendDocument10 pagesPattern Discovery in The Financial Time Series Based On Local Trendadeka1No ratings yet

- SSRN Id1664823Document37 pagesSSRN Id1664823María Lina del BarroNo ratings yet

- Random ForestDocument225 pagesRandom Forestadeka1No ratings yet

- The Value of Queue Position in A Limit Order BookDocument48 pagesThe Value of Queue Position in A Limit Order Bookadeka1100% (1)

- ZakDocument28 pagesZakadeka1No ratings yet

- The Illusions of Dynamic Replication TheoryDocument5 pagesThe Illusions of Dynamic Replication Theoryalfredking77No ratings yet

- ProgrammingGuide v1.0Document89 pagesProgrammingGuide v1.0adeka10% (1)

- The Future Has Thicker Tails Than The Past: Model Error As Branching CounterfactualsDocument11 pagesThe Future Has Thicker Tails Than The Past: Model Error As Branching Counterfactualstetsuotrees100% (1)

- JASF VolumeIII Issue2 (6) Winter2012Document67 pagesJASF VolumeIII Issue2 (6) Winter2012adeka1No ratings yet

- Static simplicity: Hedging barrier and lookback options with standard optionsDocument6 pagesStatic simplicity: Hedging barrier and lookback options with standard optionsKevin ChanNo ratings yet

- FAQ's in Option Pricing Theory ExplainedDocument31 pagesFAQ's in Option Pricing Theory ExplainedmuralimoviesNo ratings yet

- Nassim Taleb Anti-Fragile Portfolio ResearchDocument24 pagesNassim Taleb Anti-Fragile Portfolio Researchplato363No ratings yet

- How To Prevent Other Financial Crises - SSRN-Id2029092Document7 pagesHow To Prevent Other Financial Crises - SSRN-Id2029092adeka1No ratings yet

- Statistical Undecidability is Statistically UndecidableDocument4 pagesStatistical Undecidability is Statistically Undecidableadeka1No ratings yet

- SSRN Id1142785Document12 pagesSSRN Id1142785Kári FinnssonNo ratings yet

- J. P Morgan - FX Techs - London OpenDocument5 pagesJ. P Morgan - FX Techs - London Openadeka1No ratings yet

- Common Errors in The Interpretation of The Ideas of The Black Swan and Associated Papers - SSRN-Id1490769Document7 pagesCommon Errors in The Interpretation of The Ideas of The Black Swan and Associated Papers - SSRN-Id1490769adeka1No ratings yet

- Cochrane J. H. Asset Pricing Solution 2010Document34 pagesCochrane J. H. Asset Pricing Solution 2010ire04100% (3)

- J. P Morgan - FX Techs - London OpenDocument5 pagesJ. P Morgan - FX Techs - London Openadeka1No ratings yet

- Convertible ArbitrageDocument10 pagesConvertible ArbitrageGorakhnathNo ratings yet

- AIMA Canada July Strategy Paper 2 LSEQ FINALDocument11 pagesAIMA Canada July Strategy Paper 2 LSEQ FINALadeka1No ratings yet

- AP AB Calculus FRQ 1991Document2 pagesAP AB Calculus FRQ 1991PB PBNo ratings yet

- Renewable and Non-Renewable Natural Resources ModuleDocument9 pagesRenewable and Non-Renewable Natural Resources ModuleEnzuNo ratings yet

- Resistance of Concrete To Rapid Freezing and Thawing: Standard Test Method ForDocument6 pagesResistance of Concrete To Rapid Freezing and Thawing: Standard Test Method ForRam Kumar Jaiswal100% (3)

- Unit - 4 Work SheetDocument6 pagesUnit - 4 Work SheetNathan GetachewNo ratings yet

- Datacolor ColorTheory Webinar Part1 PDFDocument36 pagesDatacolor ColorTheory Webinar Part1 PDFdamarNo ratings yet

- Cot MagnetDocument4 pagesCot MagnetNerissa BaricauaNo ratings yet

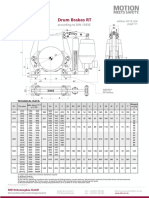

- Drum Brakes RT: According To DIN 15435Document1 pageDrum Brakes RT: According To DIN 15435LukaNo ratings yet

- Small-Signal Stability Analysis of A DFIG-Based Wind Power System Under Different Modes of OperationDocument11 pagesSmall-Signal Stability Analysis of A DFIG-Based Wind Power System Under Different Modes of OperationAhmed WestministerNo ratings yet

- Stress StrainDocument4 pagesStress StrainFreedom Love NabalNo ratings yet

- Lesson 13-The Solar System 1 - Outer Planets 2Document19 pagesLesson 13-The Solar System 1 - Outer Planets 2Kate Ngọc DiệpNo ratings yet

- Unit VDocument460 pagesUnit VNisarga JNo ratings yet

- Investigation of The Possibilities For Seabottom Characterization Using Echosounder DataDocument124 pagesInvestigation of The Possibilities For Seabottom Characterization Using Echosounder DatadaanroNo ratings yet

- Passivity Based ControlDocument10 pagesPassivity Based ControlmeetNo ratings yet

- An Intuitive Guide To Linear Algebra - BetterExplainedDocument25 pagesAn Intuitive Guide To Linear Algebra - BetterExplainedvkk intensiveNo ratings yet

- Lesson Plan Ohms LawDocument4 pagesLesson Plan Ohms Lawjoice samonte100% (1)

- Bis Is 9143 - 1979 (Reaffirmed 2021) - Method For The Determination of Unconfined Compressive Strength of Rock MaterialsDocument8 pagesBis Is 9143 - 1979 (Reaffirmed 2021) - Method For The Determination of Unconfined Compressive Strength of Rock MaterialsArpan NandyNo ratings yet

- Choudhary Coaching Classes and Counselling Centre: A (X R: 1 X 1) B C (X R: X 0) SDocument5 pagesChoudhary Coaching Classes and Counselling Centre: A (X R: 1 X 1) B C (X R: X 0) STrupti JadhaoNo ratings yet

- A Revolutionary Look at Sky CreaturesDocument197 pagesA Revolutionary Look at Sky Creaturesocryptid100% (4)

- European Steel and Alloy Grades: Gx5Crnimo19-11-3 (1.4412)Document2 pagesEuropean Steel and Alloy Grades: Gx5Crnimo19-11-3 (1.4412)farshid KarpasandNo ratings yet

- Dixell XR40CDocument4 pagesDixell XR40Cminhdung76np100% (1)

- Inner Vessel Check Shell Thickness For Internal PressureDocument6 pagesInner Vessel Check Shell Thickness For Internal PressureSAMER OSMANNo ratings yet

- Entanglements in Filament Yarns by Needle Insertion: Standard Test Method ForDocument6 pagesEntanglements in Filament Yarns by Needle Insertion: Standard Test Method ForJuanNo ratings yet

- Dys NotesDocument4 pagesDys NotesANIKET AWASTHI ITNo ratings yet

- Using The Discriminant To Determine Tangency: Last LessonDocument13 pagesUsing The Discriminant To Determine Tangency: Last LessonAbdurauf SawadjaanNo ratings yet

- An Overview: Simulation Hot Water Eor Injection by Old and New SoftwareDocument8 pagesAn Overview: Simulation Hot Water Eor Injection by Old and New SoftwarebafadhalNo ratings yet

- P008 Delgadillo FinalPaper SimultaneousPressureLevelControlDeaeratorDocument12 pagesP008 Delgadillo FinalPaper SimultaneousPressureLevelControlDeaeratorIgnacio RamirezNo ratings yet

- Reaction Paper (Sudoy, Jan Daryll S.)Document2 pagesReaction Paper (Sudoy, Jan Daryll S.)Jan Daryll Saldivar SudoyNo ratings yet

- 17 Differential Equations Ma102Document3 pages17 Differential Equations Ma102Salim ShahulNo ratings yet

- Chapter 5: Technology: Technology Is Not Demonic, But Its Essence Is MysteriousDocument37 pagesChapter 5: Technology: Technology Is Not Demonic, But Its Essence Is MysteriousBrille Adrian FernandoNo ratings yet

- ETY155 Lab10 SuperpositionDocument4 pagesETY155 Lab10 SuperpositionprantiNo ratings yet