Professional Documents

Culture Documents

CHALLAN 280 For 2013-14

Uploaded by

mohanktvmOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CHALLAN 280 For 2013-14

Uploaded by

mohanktvmCopyright:

Available Formats

Single Copy (to be sent to the ZAO)

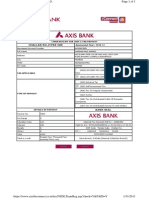

Tax Applicable (Tick One) CHALLAN NO./ITNS 280 (0020) INCOME-TAX ON COMPANIES (CORPORATION TAX) (0021) INCOME TAX (OTHER THAN COMPANIES) Assessment Year

Permanent Account Number Full Name Complete Address with City & State Phone No. PIN Type of Payment (Tick One) Advance Tax (100) Self Assessment Tax (300) Tax on Regular Assessment (400) DETAILS OF PAYMENTS Income Tax on pension Surcharge Education Cess Interest Penalty Others Total Total (in words) Crores

Surtax (102) Tax on Distributed Profits of Domestic Companies (106) Tax on Distributed Income to Unit Holders (107) FOR USE IN RECEIVING BANK Debit to A/c / Cheque credited on DD/MM DD MM 0

~ ~ ~ ~ ~ ~ ~

0

Dated SPACE FOR BANK SEAL

Rupees Nil

Lacs Thousands Hundreds Tens Units

CHEQUE DRAWN No. Paid in Drawn on (Name of the Bank and State Bank of Travancore, Main Branch, Statue, Branch) Thiruvananthapuram

Date :

Signature of person making payment Taxpayers' Counterfoil (To be filled up by tax payer)

PAN NUMBER Received from (Name) CHEQUE DRAWN No. Rs. (in words) Crores 0

0

0

0

For $

SPACE FOR BANK SEAL

0 Rupees Nil

Lacs 0 Thousands 0 Hundreds 0

Tens 0

Units 0

Drawn on (Name of the Bank and Branch) on account of Type of Payment Assessment Year

State Bank of Travancore, Main Branch, Statue, Thiruvananthapuram Income tax other than companies /Advance Tax (100)

CHEQUE DRAWN No. 0

0 $ 0

You might also like

- TDS TDSChallan280Document1 pageTDS TDSChallan280sikander1990No ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment Yearanaga1982No ratings yet

- Challan 280Document1 pageChallan 280Mohit MehtaNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Saravana KumarNo ratings yet

- RSD3Document1 pageRSD3Thaneshwar MishraNo ratings yet

- Challan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDocument2 pagesChallan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDharmeshNo ratings yet

- Challan No. ITNS 281 : Assessment YearDocument1 pageChallan No. ITNS 281 : Assessment YearTpm UmasankarNo ratings yet

- Pay Income Tax OnlineDocument1 pagePay Income Tax OnlineKamalNo ratings yet

- 27180Document1 page27180nupursingh604No ratings yet

- Challan 280Document1 pageChallan 280purepuneetNo ratings yet

- Challan NO./ ITNS 280Document2 pagesChallan NO./ ITNS 280amritaasraaNo ratings yet

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- ChallanDocument1 pageChallanRAVINDERNo ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- Challan NO./ ITNS 280: A D G P M 4 8 2 8 BDocument1 pageChallan NO./ ITNS 280: A D G P M 4 8 2 8 BKarur KumarNo ratings yet

- Challan No Itns 280 PDFDocument2 pagesChallan No Itns 280 PDFArvind Rathod50% (4)

- ImportantDocument1 pageImportantWilliam SureshNo ratings yet

- TAX PAYMENT CHALLANDocument2 pagesTAX PAYMENT CHALLANravibhartia1978No ratings yet

- VP Goyalt Tds ChallanDocument1 pageVP Goyalt Tds Challanverma619No ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- Zentds KDK SoftwareDocument1 pageZentds KDK Softwarear8ku9sh0aNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaNo ratings yet

- Draft Challan IchhaDocument1 pageDraft Challan IchhaSneha SharmaNo ratings yet

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Document1 pageAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Anita SahgalDocument3 pagesAnita SahgalNaveen AsthanaNo ratings yet

- Sureshbhai (Challan)Document1 pageSureshbhai (Challan)Ketan DhameliyaNo ratings yet

- Challan F.Y 2012-13Document1 pageChallan F.Y 2012-13amit22505No ratings yet

- Challan No. ITNS 280Document2 pagesChallan No. ITNS 280RAHUL AGARWALNo ratings yet

- Zero Zero Three Zero Two Zero: DD MM YyDocument1 pageZero Zero Three Zero Two Zero: DD MM YyShubham Pandey WatsonNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- TDS TCS Tax ChallanDocument1 pageTDS TCS Tax Challanjagdish412301No ratings yet

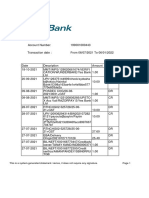

- Axis Bank cyber receipt for CBDT e-tax paymentDocument1 pageAxis Bank cyber receipt for CBDT e-tax paymentbha_goNo ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- Arvind Kumar SoniDocument1 pageArvind Kumar SoniAngad MundraNo ratings yet

- Challan Advance TaxDocument1 pageChallan Advance Taxamit22505No ratings yet

- CBDT E-Payment Request FormDocument1 pageCBDT E-Payment Request FormAlicia Barnes67% (21)

- e-Payment Request FormDocument1 pagee-Payment Request FormSiva ReddyNo ratings yet

- E-Payment Request Form: Payment Details Payment InstructionsDocument1 pageE-Payment Request Form: Payment Details Payment InstructionsSiva ReddyNo ratings yet

- Axis TDS Challan Form PDFDocument1 pageAxis TDS Challan Form PDFSiva ReddyNo ratings yet

- Axis TDS Challan Form PDFDocument1 pageAxis TDS Challan Form PDFSiva ReddyNo ratings yet

- Excel 04Document3 pagesExcel 04Pawan UdyogNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Income Tax Proforma PakistanDocument16 pagesIncome Tax Proforma PakistanInayat UllahNo ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNo ratings yet

- Challan AxisDocument3 pagesChallan AxisSumit Darak50% (2)

- SA Tax Challan KharnareDocument1 pageSA Tax Challan KharnareCorman LimitedNo ratings yet

- Challan 280Document6 pagesChallan 280Narendra PrajapatiNo ratings yet

- For Payment From July 2005 OnwardsDocument1 pageFor Payment From July 2005 Onwardsvijay123*75% (4)

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDocument1 pageAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNo ratings yet

- Dheera SamireDocument1 pageDheera SamiremohanktvmNo ratings yet

- Ribhu Gita Summary by Sri Ramana MaharishiDocument4 pagesRibhu Gita Summary by Sri Ramana MaharishimohanktvmNo ratings yet

- Essence of Ribhu Gita As Told by Bhagavan RamanaDocument2 pagesEssence of Ribhu Gita As Told by Bhagavan RamanamohanktvmNo ratings yet

- Rules Amendment 3 GO (P) 2 2010 Law 25 02 2010Document6 pagesRules Amendment 3 GO (P) 2 2010 Law 25 02 2010mohanktvmNo ratings yet

- Sri Ramachandra KripaluDocument1 pageSri Ramachandra KripalumohanktvmNo ratings yet

- Reduction Certificate ApplicationDocument2 pagesReduction Certificate ApplicationmohanktvmNo ratings yet

- Dheera SamireDocument1 pageDheera SamiremohanktvmNo ratings yet

- Achyutam Keshvam LyricsDocument1 pageAchyutam Keshvam LyricsmohanktvmNo ratings yet

- Possession CertificateDocument2 pagesPossession CertificatemohanktvmNo ratings yet

- Ganga Maa AartiDocument2 pagesGanga Maa AartimohanktvmNo ratings yet

- Application For Extract of BTRDocument1 pageApplication For Extract of BTRmohanktvm0% (1)

- Area ConversionDocument2 pagesArea ConversionmohanktvmNo ratings yet

- Rent Receipt Under Section 1 (13-A) of Income Tax ActDocument1 pageRent Receipt Under Section 1 (13-A) of Income Tax ActmohanktvmNo ratings yet

- Kromrules 08 As On 30 06 2011Document11 pagesKromrules 08 As On 30 06 2011mohanktvmNo ratings yet

- Application For Location CertificateDocument2 pagesApplication For Location CertificatemohanktvmNo ratings yet

- Details: Area of Triangle With Sides1,2 & 3 (In M2) Area in CentsDocument1 pageDetails: Area of Triangle With Sides1,2 & 3 (In M2) Area in CentsmohanktvmNo ratings yet

- Voters Id Adding FormDocument6 pagesVoters Id Adding FormNandakumar UmapathyNo ratings yet

- Railway ReservationDocument1 pageRailway ReservationmohanktvmNo ratings yet

- FORM Under Rule 3 RTIDocument1 pageFORM Under Rule 3 RTImohanktvmNo ratings yet

- Form 6 MalayalamDocument2 pagesForm 6 MalayalammohanktvmNo ratings yet

- Form 8 ADocument2 pagesForm 8 AmohanktvmNo ratings yet

- Rent Agreement CommonDocument5 pagesRent Agreement CommonmohanktvmNo ratings yet

- Hcp cq tImÀ«v ^okv Ìm1⁄4vDocument1 pageHcp cq tImÀ«v ^okv Ìm1⁄4vmohanktvmNo ratings yet

- 100 Types of Fools TamilDocument4 pages100 Types of Fools TamilmohanktvmNo ratings yet

- Pension Thru Banks Kerala GovtDocument2 pagesPension Thru Banks Kerala GovtmohanktvmNo ratings yet

- Form 8 ADocument2 pagesForm 8 AmohanktvmNo ratings yet

- Vulture CapitalistDocument2 pagesVulture Capitalistjosh321No ratings yet

- Berkshire 2022ltrDocument10 pagesBerkshire 2022ltrZerohedge100% (1)

- PerquisitesDocument6 pagesPerquisitesArgha DeySarkarNo ratings yet

- Cyprus Companies LawDocument298 pagesCyprus Companies LawNikhil MahajanNo ratings yet

- APC Ch10solDocument10 pagesAPC Ch10solkeith niduelanNo ratings yet

- Chapter 1 - Solution Manual CabreraDocument2 pagesChapter 1 - Solution Manual CabreraClarize R. Mabiog67% (12)

- Data Analysis of Infosys ShareDocument22 pagesData Analysis of Infosys ShareJoshuaNo ratings yet

- Gurukripa’s Guide to Nov 2014 CA Final SFM ExamDocument12 pagesGurukripa’s Guide to Nov 2014 CA Final SFM ExamShashank SharmaNo ratings yet

- MPBF Other MethodsDocument10 pagesMPBF Other Methodskaren sunilNo ratings yet

- Brac Bank PresentationDocument24 pagesBrac Bank PresentationSumi Islam100% (2)

- Sensitivity AnalysisDocument23 pagesSensitivity AnalysisKamrul Hasan0% (1)

- Corporate Governance in Financing and Banking in BangladeshDocument22 pagesCorporate Governance in Financing and Banking in BangladeshAsrafia Mim 1813026630No ratings yet

- 66107bos53355fold p8Document19 pages66107bos53355fold p8sam kapoorNo ratings yet

- Warren SM - Ch.10 - FinalDocument32 pagesWarren SM - Ch.10 - FinalLan Hương Trần ThịNo ratings yet

- Finacle Friendly A Handbook On CbsDocument289 pagesFinacle Friendly A Handbook On CbsS. Allen78% (23)

- Resume - Bharati Desai Senior Accounting PositionsDocument4 pagesResume - Bharati Desai Senior Accounting PositionsJeremy SmithNo ratings yet

- Internship Report On: Submitted byDocument50 pagesInternship Report On: Submitted bysumaiya sumaNo ratings yet

- B.Com Money and Banking Reading MaterialDocument110 pagesB.Com Money and Banking Reading MaterialBabita DeviNo ratings yet

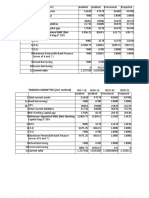

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument5 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any Signaturegaming boyNo ratings yet

- Accounting Cycle & Financial Statements ExplainedDocument3 pagesAccounting Cycle & Financial Statements ExplainedMohiuddin GaalibNo ratings yet

- Customer Inquiry ReportDocument4 pagesCustomer Inquiry ReportHartito HargiastoNo ratings yet

- PLM Business School Credit Management Module on Credit DecisionsDocument29 pagesPLM Business School Credit Management Module on Credit DecisionsHarlene BulaongNo ratings yet

- State of North Carolina: CountyDocument2 pagesState of North Carolina: CountykurtNo ratings yet

- FAR Finals ReviewerDocument5 pagesFAR Finals ReviewerJulie Anne DanteNo ratings yet

- Choosing Between Entrepreneurship and EmploymentDocument9 pagesChoosing Between Entrepreneurship and EmploymentMa Melissa Nacario SanPedroNo ratings yet

- Financial Statement Analysis of Citizen BankDocument44 pagesFinancial Statement Analysis of Citizen BankNijan JyakhwoNo ratings yet

- Beechy 7e Tif Ch09Document20 pagesBeechy 7e Tif Ch09mashta04No ratings yet

- RFM Corp Annual ReportDocument169 pagesRFM Corp Annual ReportGab RielNo ratings yet

- LiabilitiesDocument2 pagesLiabilitiesFrederick AbellaNo ratings yet

- A Proclamation To Provide For The Establishment of Ecx PDFDocument13 pagesA Proclamation To Provide For The Establishment of Ecx PDFTSEDEKENo ratings yet