Professional Documents

Culture Documents

B S Extrema

B S Extrema

Uploaded by

Gallo Solaris0 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

B-S-extrema

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesB S Extrema

B S Extrema

Uploaded by

Gallo SolarisCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

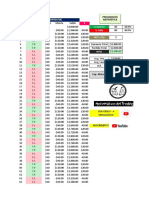

Time increment

Stock Price increment

K-Strike increment

$0

$2

Days to Expiry:

Current Stock Price:

Strike Price:

V=

25.00%

Rf =

4.00%

120

$40.00

$25.00

120

120

120

120

120

120

120

120

$40

$40

$40

$40

$40

$40

$40

$40

$27

$29

$31

$33

$35

$37

$39

$41

Black-Scholes BS

"Winning" Stock Price

$15.33

$40.33

$13.36

$40.36

$11.39

$40.39

$9.46

$40.46

$7.61

$40.61

$5.88

$40.88

$4.35

$41.35

$3.08

$42.08

$2.07

$43.07

Counter =

3%

3%

3%

4%

5%

7%

11%

17%

25%

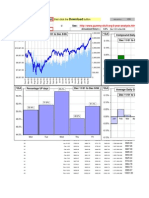

Black-Scholes BS

Strike = $25Strike

to $49

= $25 to $49

Stock = $40

Days = 120

"Winning" Stock Price

Stock = $40

Days = 120

$50.00

$40.00

$30.00

$20.00

$10.00

Counter

$0.00

1

Risk-free Rate

T=

S=

K=

Required Annual Return to WIN

$60.00

Volatility

10

11

12

13

Your stock is selling for $40.00

You sell a Covered Call Option.

Pick the Strike Price

and Days to Expiry

so that a buyer is unlikely to WIN !

(I.e. Stock Price reaches BS + K)

With the parameters above:

Days to Expiry: 120 to 120,

Current Stock Price: $40 to $40,

Strike Price: $25 to $49.

'Winning' Stock Price: $40 to $49.

most unlikely Gain = 89%

Counter = 13

Days = 120

Stock Price = $40.00

Strike Price = $49.00

Required Annual Return to WIN

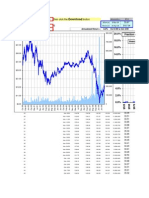

1 2

120

120

120

120

$40

$40

$40

$40

$43

$45

$47

$49

$1.33

$44.33

$0.82

$45.82

$0.48

$47.48

$0.27

$49.27

10

11

12

13

37%

51%

68%

89%

Required Annual Return to WIN

2 3 4 5 6 7 8 9 10 11 12 13

You might also like

- Supply Worksheet AnswersDocument27 pagesSupply Worksheet AnswersConnie Jehng100% (2)

- Cerebrosoft CaseDocument16 pagesCerebrosoft CaseDEEP725No ratings yet

- BDs PDFDocument16 pagesBDs PDFSandro RicardoNo ratings yet

- BCA 20 Activity1 - Creating TablesDocument4 pagesBCA 20 Activity1 - Creating TablesVenz LacreNo ratings yet

- Faith Hill High School: Textbook Stock List (2010-2011)Document17 pagesFaith Hill High School: Textbook Stock List (2010-2011)Luca DJNo ratings yet

- New Frontiers CaseDocument10 pagesNew Frontiers CaseMansi DhamijaNo ratings yet

- Weeklygamedeal - Price ListDocument1 pageWeeklygamedeal - Price Listsony156282No ratings yet

- Delta PaintDocument8 pagesDelta PaintJannah LuissaNo ratings yet

- Siemens Electric Motor WorksDocument4 pagesSiemens Electric Motor WorksSangtani PareshNo ratings yet

- Siemens Electric Motor WorksDocument4 pagesSiemens Electric Motor WorksSangtani PareshNo ratings yet

- PrivateplacementinsidersDocument9 pagesPrivateplacementinsidersglory2theone8552No ratings yet

- Butcher SuppliesDocument28 pagesButcher SuppliesballonbubbleNo ratings yet

- Inventory SolutionDocument7 pagesInventory SolutionAnkur AryaNo ratings yet

- HB1114Document14 pagesHB1114OKCFOXNo ratings yet

- JC Stats Archive (Public) - 01-2012 To 05-2012Document16 pagesJC Stats Archive (Public) - 01-2012 To 05-2012DonnaAntonucciNo ratings yet

- Francisco BLK 4Document2 pagesFrancisco BLK 4api-297893003No ratings yet

- Francisco BLK 4Document2 pagesFrancisco BLK 4api-297359575No ratings yet

- E3 - Math and Statistical Functions - MALINAODocument6 pagesE3 - Math and Statistical Functions - MALINAOAYAME MALINAO BSA19No ratings yet

- Ather Shafiq Greater Assignment 6.6Document6 pagesAther Shafiq Greater Assignment 6.6Ather ShafiqNo ratings yet

- 04 Charts & Conditional FormatingDocument17 pages04 Charts & Conditional FormatingAvinaba GuhaNo ratings yet

- Home Work 1 Corporate FinanceDocument8 pagesHome Work 1 Corporate FinanceAlia ShabbirNo ratings yet

- Plan FinancieroDocument127 pagesPlan FinancieroDaniel Lagos RamirezNo ratings yet

- Gestion Monetaria Lineal VS GeometricaDocument11 pagesGestion Monetaria Lineal VS GeometricaStiven Medina HeaGerNo ratings yet

- GESTION MONETARIA LINEAL VS GEOMETRICA Mat. Del TradingDocument11 pagesGESTION MONETARIA LINEAL VS GEOMETRICA Mat. Del TradingMartinNo ratings yet

- SPREADSHEETDocument2 pagesSPREADSHEETashaaagrNo ratings yet

- Widget Practice2Document2 pagesWidget Practice2api-275650798No ratings yet

- Precios Zona Game PRODocument9 pagesPrecios Zona Game PROvladimiroNo ratings yet

- Forecastt For PortofilioDocument6 pagesForecastt For Portofilioapi-300301391No ratings yet

- (IFA 11) - Rendy Filiang - 1402210324Document6 pages(IFA 11) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- From/To Chicago Milwaukee Minneapolis Gary Fort Wayne Detroit Rockford Madison Demand 300 100 150Document9 pagesFrom/To Chicago Milwaukee Minneapolis Gary Fort Wayne Detroit Rockford Madison Demand 300 100 150S M AkashNo ratings yet

- Whiteb InventoryDocument4 pagesWhiteb Inventoryapi-265031632No ratings yet

- Sales SpreadsheetDocument2 pagesSales Spreadsheetapi-2570889980% (1)

- Ramirez InventoryDocument5 pagesRamirez Inventoryapi-306760066No ratings yet

- North $509,283 $553,887 109% South $483,519 $511,115 106% East $640,603 $606,603 95% West $320,312 $382,753 119%Document17 pagesNorth $509,283 $553,887 109% South $483,519 $511,115 106% East $640,603 $606,603 95% West $320,312 $382,753 119%Hussain AminNo ratings yet

- Perkalian 35-46Document2 pagesPerkalian 35-46Siti napi'ahNo ratings yet

- Ch14 Evans BA1eDocument65 pagesCh14 Evans BA1eyarli7777No ratings yet

- Hoshigami - Running Blue Earth (NTSC-U) .InfDocument115 pagesHoshigami - Running Blue Earth (NTSC-U) .InfShsjsjsj HsusususNo ratings yet

- Rechnen Mit 2stelligen ZahlenDocument8 pagesRechnen Mit 2stelligen ZahlenDemelzaNo ratings yet

- First 6 Months: No. of Units Sold/day No. of Units Type of Products Total Cost Cost Per UnitDocument6 pagesFirst 6 Months: No. of Units Sold/day No. of Units Type of Products Total Cost Cost Per Unitkcampbell651No ratings yet

- Activity3 Asigna Cuenta de MargenDocument2 pagesActivity3 Asigna Cuenta de MargenSantiago Angeles LozanoNo ratings yet

- B S PlotDocument2 pagesB S PlotGallo SolarisNo ratings yet

- Book Biz The Wicker Men 1Document7 pagesBook Biz The Wicker Men 1api-300534620No ratings yet

- Sales Price Per Unit: $12Document2 pagesSales Price Per Unit: $12Nojoke1No ratings yet

- Block6-Morajeyden-Kylies Pet ShopDocument2 pagesBlock6-Morajeyden-Kylies Pet Shopapi-296057789No ratings yet

- AssignmentDocument6 pagesAssignmentSaransh PatniNo ratings yet

- PartyDocument7 pagesPartyapi-314946336No ratings yet

- IEC618503Document992 pagesIEC618503Huấn PhanNo ratings yet

- Materi 4 - Variable Costing - Segmented ReportingDocument12 pagesMateri 4 - Variable Costing - Segmented ReportingTrakhita Trona TsezanaNo ratings yet

- Keyword Profit ReportDocument1 pageKeyword Profit ReportCristian CorodescuNo ratings yet

- Gametime Daily Lines Fri Sep 27: ML Total Run LineDocument12 pagesGametime Daily Lines Fri Sep 27: ML Total Run Lineapi-170226922No ratings yet

- Sales:: Reg Sales + Service Charge & Local Tax 300.00 300.00Document5 pagesSales:: Reg Sales + Service Charge & Local Tax 300.00 300.00LilyNo ratings yet

- Allison Manufacturing Sales Budget For The First QuarterDocument3 pagesAllison Manufacturing Sales Budget For The First QuarterQiqi BaihaqiNo ratings yet

- Basic Excel TestDocument3 pagesBasic Excel TestMadeleine StoweNo ratings yet

- Crystals Budget Plan Complete 1Document2 pagesCrystals Budget Plan Complete 1api-452864038No ratings yet

- MerchandiseDocument4 pagesMerchandiseapi-298523603No ratings yet

- Nur Haliza Daeng Besse - Inventory Dan Aktiva TetapDocument28 pagesNur Haliza Daeng Besse - Inventory Dan Aktiva TetapNurhaliza DaengNo ratings yet

- Cosgrove InventoryDocument4 pagesCosgrove Inventoryapi-297055499No ratings yet

- CVP ANALYSIS (Solutions)Document24 pagesCVP ANALYSIS (Solutions)Mohammad UmairNo ratings yet

- Sugerido Coleccion Alma MiaDocument1 pageSugerido Coleccion Alma MiaValentina RojasNo ratings yet

- Carrick Monthly Snes Super nintendo Price Guide and Video Game List March 2014From EverandCarrick Monthly Snes Super nintendo Price Guide and Video Game List March 2014No ratings yet

- R-QuantLib Integration Spanderen 2013 SlidesDocument20 pagesR-QuantLib Integration Spanderen 2013 SlidesGallo SolarisNo ratings yet

- 4 Stock RegressionsDocument16 pages4 Stock RegressionsGallo SolarisNo ratings yet

- OneTick and R - Handling High and Low Frequency Data - Belianina - 2013 - SlidesDocument8 pagesOneTick and R - Handling High and Low Frequency Data - Belianina - 2013 - SlidesGallo SolarisNo ratings yet

- 3 Stock Correlations2Document162 pages3 Stock Correlations2Gallo SolarisNo ratings yet

- Using Quantstrat To Evaluate Intraday Trading Strategies - Humme and Peterson - 2013 - SlidesDocument78 pagesUsing Quantstrat To Evaluate Intraday Trading Strategies - Humme and Peterson - 2013 - SlidesGallo Solaris100% (1)

- Ito PredictDocument79 pagesIto PredictGallo SolarisNo ratings yet

- 5 Year AnalysisDocument100 pages5 Year AnalysisGallo SolarisNo ratings yet

- Download: Fill in The Then Click The ButtonDocument101 pagesDownload: Fill in The Then Click The ButtonGallo SolarisNo ratings yet

- Download: Fill in The Then Click The Button DDocument101 pagesDownload: Fill in The Then Click The Button DGallo SolarisNo ratings yet

- Distribution LaplaceDocument199 pagesDistribution LaplaceGallo SolarisNo ratings yet

- Asset Volatility2Document126 pagesAsset Volatility2Gallo SolarisNo ratings yet

- D Stock Symbol: MSFT MSFT MSFTDocument76 pagesD Stock Symbol: MSFT MSFT MSFTGallo SolarisNo ratings yet

- Download: Fill in The Then Click The Button DDocument23 pagesDownload: Fill in The Then Click The Button DGallo SolarisNo ratings yet

- Download: Fill in The Then Click The Button DDocument18 pagesDownload: Fill in The Then Click The Button DGallo SolarisNo ratings yet

- Download: Fill in The Then Click The Button MDocument13 pagesDownload: Fill in The Then Click The Button MGallo SolarisNo ratings yet