Professional Documents

Culture Documents

New Dfinition of Priority Sector Advances

Uploaded by

anuragmehta1985Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Dfinition of Priority Sector Advances

Uploaded by

anuragmehta1985Copyright:

Available Formats

, . 5, - 32 , () - 122001. 0124-4126147/148/149/150 .

0124-4126162

Rural Development & Priority Sector Department Head Office: 1st Floor, Plot No - 5, Sector 32 Institutional Area, Gurgaon, Haryana 122001. Telephone No 0124 4126147/148/149/150 Fax no. 0124 - 4126162

Circular No. HO/RD & PS/47/2012-13/554

Date : 03.11.2012

All the Branches/Offices

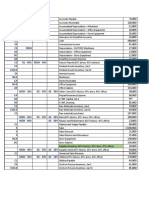

PRIORITY SECTOR LENDING TARGETS AND CLASSIFICATION The master circular on Priority Sector Lending Target and Classification issued by RBI vide their circular no. RBI/2012-13/138 RPCD. CO. Plan. BC 13/04.09.01/2012-13 dated July 20, 2012 was circulated vide our circular no. HO: RD &PS:29:2012-13:324 21.07.2012. The RBI vide their letter RPCD. CO. Plan. BC 37/04.09.01/2012-13 dated October 17, 2012, has made the following additions and amendments in the aforesaid master circular dated 20.07.2012:Agriculture: Loans to corporates, partnership firms and co-operatives of farmers directly engaged in Agriculture and Allied Activities, viz., dairy, fishery, animal husbandry, poultry, bee-keeping and sericulture (up to cocoon stage) up to an aggregate limit of `2 crore per borrower shall be classified under DIRECT Agriculture. If the aggregate loan limit per borrower is more than `2 crore to such entrepreneurs, the entire loan should be treated as INDIRECT finance to agriculture. Micro & Small Enterprises (Service Sector): Bank loans upto an aggregate loan limit of `2 crore per borrower/unit to Micro and Small Enterprises (MSE) engaged in providing or rendering of services will be eligible for classification as direct finance to MSE Sector under priority sector, provided they satisfy the investment criteria for equipment as defined under MSMED Act, 2006. Housing Loan: The ceiling to any governmental agency for construction of dwelling units or for slum clearance and rehabilitation of slum dwellers has been raised from of `5 lakh to `10 lakh.

The ceiling total cost of house has been raised from `5 lakh to `10 lakh per dwelling unit for the loans sanctioned for housing projects exclusively for the purpose of construction of houses only to economically weaker sections and low income groups. Bank loans to Housing Finance Companies (HFCs), approved by NHB for their refinance, for on-lending for the purpose of purchase/construction/reconstruction of individual dwelling units or for slum clearance and rehabilitation of slum dwellers, subject to an aggregate loan limit of `10 lakh per borrower, provided the all inclusive interest rate charged to the ultimate borrower is not exceeding lowest lending rate of the lending bank for housing loans plus two percent per annum shall be covered under priority sector. The eligibility under priority sector loans to HFCs is restricted to five percent of the individual banks total priority sector lending, on an ongoing basis. A copy of additions/amendments is enclosed as Annexure-A (RBI circular dated 17.10.2012). All field functionaries including officers of Regional Offices are advised to go through these additions/amendments and comply with all instructions/guidelines contained therein in letter and spirit. Please note that the additions and amendments will be operational with effect from July 20, 2012.

(P S Hooda) General Manager (RD & PS)

You might also like

- Project Report SCDL FinalDocument63 pagesProject Report SCDL FinalDev Choudhary75% (4)

- A Report On Organizational BEHAVIOUR of HDFC BankDocument112 pagesA Report On Organizational BEHAVIOUR of HDFC Bankanuragmehta198573% (22)

- Form 2A - Application For Provisional RegistrationDocument6 pagesForm 2A - Application For Provisional Registrationchadchankar chadchankarswamiNo ratings yet

- Term Loan Review FormatDocument14 pagesTerm Loan Review Formatanuragmehta1985100% (2)

- ExtremeHurst For Bloomberg GuideDocument23 pagesExtremeHurst For Bloomberg GuideAlex BernalNo ratings yet

- Case 1 Presentation China Yunan Vs Yunus ModelDocument14 pagesCase 1 Presentation China Yunan Vs Yunus ModelRaja Fahd Sultan0% (1)

- PM Rozgar Yojana - GuidelinesDocument5 pagesPM Rozgar Yojana - GuidelinesNisarg ShahNo ratings yet

- SC-ST SchemeDocument4 pagesSC-ST Schemeder3181No ratings yet

- Self-Employment and Entrepreneurship Development Programmes: Integrated Rural Development ProgrammeDocument7 pagesSelf-Employment and Entrepreneurship Development Programmes: Integrated Rural Development ProgrammeVirender KulhariaNo ratings yet

- 13 - 19 October 2012Document16 pages13 - 19 October 2012pratidinNo ratings yet

- DDD DDDD DDDDDocument79 pagesDDD DDDD DDDDSangeetaLakhesarNo ratings yet

- Swarnjayanti Gram Swarozgar Yojana ZaidDocument10 pagesSwarnjayanti Gram Swarozgar Yojana ZaidIqra ShaikhNo ratings yet

- AP Debt WaiverDocument10 pagesAP Debt WaiverChandra ReddyNo ratings yet

- SHG, Dairy HorticultureDocument52 pagesSHG, Dairy HorticulturedsdfNo ratings yet

- Pmegp Application Form 15-16Document2 pagesPmegp Application Form 15-16sanjay_lingotNo ratings yet

- Saibaan Comprehensive PresentationDocument61 pagesSaibaan Comprehensive PresentationTalha SiddiquiNo ratings yet

- 22062013hou MS11Document5 pages22062013hou MS11sherakhoNo ratings yet

- NBP Saibaan Product FeaturesDocument2 pagesNBP Saibaan Product FeaturesSyedah Maira ShahNo ratings yet

- By R.Dinesh Kumar: Submitted To The Department ofDocument77 pagesBy R.Dinesh Kumar: Submitted To The Department ofDrRashmiranjan PanigrahiNo ratings yet

- Housing Finance in BangladeshDocument13 pagesHousing Finance in BangladeshShah Muhammed Bodrul HasanNo ratings yet

- FLAgT Checklist of Requirements PDFDocument1 pageFLAgT Checklist of Requirements PDFKathleen Kaye DialNo ratings yet

- FLAgT Checklist of RequirementsDocument1 pageFLAgT Checklist of Requirementsjez pagdawanNo ratings yet

- FLAgT Checklist of Requirements PDFDocument1 pageFLAgT Checklist of Requirements PDFaldin aparecioNo ratings yet

- Agencies and Institutions Directly and Indirectly Influencing The Economic Aspects of A ProjectDocument2 pagesAgencies and Institutions Directly and Indirectly Influencing The Economic Aspects of A ProjectKaushal ModiNo ratings yet

- Building South Dakota DraftDocument22 pagesBuilding South Dakota DraftdhmontgomeryNo ratings yet

- 14 20septemberDocument16 pages14 20septemberpratidinNo ratings yet

- KSFC Scheme For SC - ST K & E-pages-DeletedDocument3 pagesKSFC Scheme For SC - ST K & E-pages-DeletedVishwanath PatilNo ratings yet

- Reserve Bank of India: This Department Is ISO 9001-2000 CertifiedDocument2 pagesReserve Bank of India: This Department Is ISO 9001-2000 CertifiedAmit KumarNo ratings yet

- PLH Customised OfferDocument4 pagesPLH Customised OfferSanjeev KrishnanNo ratings yet

- 08 Oct 2021Document25 pages08 Oct 2021Ajit MauryaNo ratings yet

- Note PmegpDocument5 pagesNote PmegpvedNo ratings yet

- Interest RateDocument21 pagesInterest RateSagara AbeykoonNo ratings yet

- Loan FlyerDocument2 pagesLoan FlyerSameera VithanageNo ratings yet

- Government of Jharkhand: (Rural Development Department)Document21 pagesGovernment of Jharkhand: (Rural Development Department)Vijayant VJNo ratings yet

- 6-12 August 2011Document16 pages6-12 August 2011pratidinNo ratings yet

- Micro PPT PSLDocument23 pagesMicro PPT PSLSONALI HIREKHANNo ratings yet

- MR Rajendra Bhagwan Modak: Insurance AdvisorDocument6 pagesMR Rajendra Bhagwan Modak: Insurance Advisordvs_5352_291349669No ratings yet

- CLSS EWS Leaflet Oct2019 PDFDocument2 pagesCLSS EWS Leaflet Oct2019 PDFmonakgohelNo ratings yet

- Jaypee Plots Wish Town Ken Sing Ton Park Agra-Call 09958959555Document11 pagesJaypee Plots Wish Town Ken Sing Ton Park Agra-Call 09958959555residential8126No ratings yet

- 1710-Dda 31.05.17Document53 pages1710-Dda 31.05.17sunilNo ratings yet

- Onetary PolicyDocument4 pagesOnetary PolicySundeep ShresthaNo ratings yet

- Scheme Guidelines - As Per New Modified Guidelines OM. Dt. 18th May 2022Document7 pagesScheme Guidelines - As Per New Modified Guidelines OM. Dt. 18th May 2022Prakriti Environment SocietyNo ratings yet

- El Katragadda Sai SandeepDocument9 pagesEl Katragadda Sai Sandeeps saiNo ratings yet

- CompassionateDocument36 pagesCompassionateRaviKiran AvulaNo ratings yet

- Clean OverdraftDocument8 pagesClean OverdraftfatincheguNo ratings yet

- HBA - 25 Lakhs Order PDFDocument4 pagesHBA - 25 Lakhs Order PDFkarik1897No ratings yet

- Study On Npa of Priority Section LendingDocument25 pagesStudy On Npa of Priority Section LendingAnkur SrivastavaNo ratings yet

- Scheduled Castes Special Development Fund (SCSDF) : Volume VII/2 As Presented To The LegislatureDocument19 pagesScheduled Castes Special Development Fund (SCSDF) : Volume VII/2 As Presented To The LegislatureanuragmwwNo ratings yet

- Home LoanDocument78 pagesHome LoanSohel Bangi100% (2)

- Excessive Availability of Credit For Unproductive Purpose, Does Not Affect The Inflationary Pressure in Any MannerDocument12 pagesExcessive Availability of Credit For Unproductive Purpose, Does Not Affect The Inflationary Pressure in Any MannerRakesh KushwahaNo ratings yet

- Advertisement For Walk in interview-NEZ-GuwahatiDocument5 pagesAdvertisement For Walk in interview-NEZ-GuwahatiAmanulla KhanNo ratings yet

- Eligibility:: Please Click Retail Credit Interest RatesDocument8 pagesEligibility:: Please Click Retail Credit Interest RatesPriya S MurthyNo ratings yet

- Rajiv Rinn Yojana (RRY) : October 2013Document9 pagesRajiv Rinn Yojana (RRY) : October 2013Sudheer MacNo ratings yet

- Budget NoteDocument4 pagesBudget NoteSunil SharmaNo ratings yet

- Salient Features (Typhoon Yolanda) Finale With WatermarkDocument28 pagesSalient Features (Typhoon Yolanda) Finale With WatermarkJude SampangNo ratings yet

- Analysis of Housing Finance Schemes of HDFC Bank ICICI Bank PNB SBI BankDocument85 pagesAnalysis of Housing Finance Schemes of HDFC Bank ICICI Bank PNB SBI BanksindhukotaruNo ratings yet

- 200314intellasia Finance VietnamDocument31 pages200314intellasia Finance VietnamNguyen QuyetNo ratings yet

- 1 Application For The Post of Young Professional Finance On Contract Basis at RO-Uttarakhand and Its PIUsDocument6 pages1 Application For The Post of Young Professional Finance On Contract Basis at RO-Uttarakhand and Its PIUsYash AgrawalNo ratings yet

- Directive 17Document10 pagesDirective 17Manish BhandariNo ratings yet

- Final Report Discussion Bus 635Document4 pagesFinal Report Discussion Bus 635Farha ElvyNo ratings yet

- Swarnjayanti Gram Swarojgar Yojna 1999Document29 pagesSwarnjayanti Gram Swarojgar Yojna 1999Muzaffar HussainNo ratings yet

- The Tribune TT 05 March 2013 15Document1 pageThe Tribune TT 05 March 2013 15Jessica JacksonNo ratings yet

- Land to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesFrom EverandLand to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesNo ratings yet

- Viet Nam: Financial Sector Assessment, Strategy, and Road MapFrom EverandViet Nam: Financial Sector Assessment, Strategy, and Road MapNo ratings yet

- Sem 1 Topic 6 Seg TGTDocument20 pagesSem 1 Topic 6 Seg TGTanuragmehta1985No ratings yet

- Sem-I-Topic-4-Ind MKTDocument9 pagesSem-I-Topic-4-Ind MKTanuragmehta1985No ratings yet

- Interview GuideDocument28 pagesInterview Guideanuragmehta1985100% (2)

- Management Thought and OBDocument79 pagesManagement Thought and OBanuragmehta1985No ratings yet

- Factors Affecting Investors Preference For Mutual Funds in IndiaDocument52 pagesFactors Affecting Investors Preference For Mutual Funds in Indiaanuragmehta1985100% (15)

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDocument1 pageACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualNo ratings yet

- 2017 ADB Annual ReportDocument104 pages2017 ADB Annual ReportFuaad DodooNo ratings yet

- Income Tax RatesDocument1 pageIncome Tax RatesAcharla NarasimhaNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Nisha Summer Project ReportDocument302 pagesNisha Summer Project ReportSaransh Singh67% (3)

- Lakshmi Agencies: Tax Invoice (Cash)Document2 pagesLakshmi Agencies: Tax Invoice (Cash)srinivas kandregulaNo ratings yet

- Accounting For Business Combination PART 1Document30 pagesAccounting For Business Combination PART 1Niki DimaanoNo ratings yet

- CF Export 29 04 2023Document9 pagesCF Export 29 04 2023Shubham KumarNo ratings yet

- Foreign Investment and Technological Transfer ActDocument19 pagesForeign Investment and Technological Transfer ActRASMITA BHANDARINo ratings yet

- Drag Me To HellDocument4 pagesDrag Me To HellEms SekaiNo ratings yet

- 1&2 PDFDocument24 pages1&2 PDFNoorullah Patwary ZubaerNo ratings yet

- SD Mock TestDocument35 pagesSD Mock TestSAPCertificationNo ratings yet

- Presentation On: Venture Capital & SebiDocument14 pagesPresentation On: Venture Capital & Sebivineeta4604No ratings yet

- History of The Republic of The United States of America VOL 6 - John C Hamilton 1857Document648 pagesHistory of The Republic of The United States of America VOL 6 - John C Hamilton 1857WaterwindNo ratings yet

- Annual Report of IOCL 126Document1 pageAnnual Report of IOCL 126NikunjNo ratings yet

- BNA SWIFT For SecuritiesDocument16 pagesBNA SWIFT For SecuritiesTelmo CabetoNo ratings yet

- The Financial Management Practices of Small and Medium EnterprisesDocument15 pagesThe Financial Management Practices of Small and Medium EnterprisesJa MieNo ratings yet

- The Fundamental Accounting EquationDocument2 pagesThe Fundamental Accounting EquationPreeny Parong ChuaNo ratings yet

- History and Pestel Analysis of Russia Economics EssayDocument10 pagesHistory and Pestel Analysis of Russia Economics EssayAnoushka SharmaNo ratings yet

- Dividend Policy and Financial Performance of Nigerian Pharmaceutical FirmsDocument17 pagesDividend Policy and Financial Performance of Nigerian Pharmaceutical FirmsRitesh ChatterjeeNo ratings yet

- Evercore ISI's Best "Core" IdeasDocument21 pagesEvercore ISI's Best "Core" IdeasJoyce Dick Lam PoonNo ratings yet

- Nama - Nama Perkiraan (Akun) Dan Istilah Dalam Bahasa InggrisDocument4 pagesNama - Nama Perkiraan (Akun) Dan Istilah Dalam Bahasa InggrisAlpha SimanjuntakNo ratings yet

- Pdic 2Document6 pagesPdic 2jeams vidalNo ratings yet

- Sector Grant and Budget Guidelines 2017/18Document152 pagesSector Grant and Budget Guidelines 2017/18NsubugaNo ratings yet

- JAIB Examination Form PDFDocument2 pagesJAIB Examination Form PDFManisha ShahaniNo ratings yet

- Day 9 Tullow Uganda Limited Vs Heritage OilDocument214 pagesDay 9 Tullow Uganda Limited Vs Heritage OilThe New VisionNo ratings yet

- Principle MaterialDocument35 pagesPrinciple MaterialHay JirenyaaNo ratings yet