Professional Documents

Culture Documents

Department of Labor: Fines07table

Uploaded by

USA_DepartmentOfLabor0 ratings0% found this document useful (0 votes)

16 views1 pageOriginal Title

Department of Labor: fines07table

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 pageDepartment of Labor: Fines07table

Uploaded by

USA_DepartmentOfLaborCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

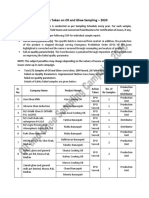

Appendix table

Workers' Compensation Division penalty statistics

FY 2004 FY 2005 FY 2006 FY 2007

Assessed Collected Assessed Collected Assessed Collected Assessed Collected

Total Dollar Total Dollar Total Dollar Total Dollar Total Dollar Total Dollar Dollar Dollar

Penalty type Total # Total #

# amount # amount # amount # amount # amount # amount amount amount

Late filing of 1st

report (M.S. 531 $218,875 446 $182,588 665 $282,375 494 $200,556 674 $288,125 460 $193,542 502 $216,500 510 $215,996

176.231)

Late 1st payment $488,138 $492,735 $426,572 $444,260

(M.S. 176.221 & 1,290 1,251 $425,228 1,238 1,090 $387,846 1,104 1,080 $367,475 1,012 941 $345,778

176.225) $167,060 $168,816 $150,207 $148,540

Late denial (M.S.

392 $236,250 325 $177,575 427 $269,000 320 $167,986 461 $277,000 397 $203,668 342 $199,000 279 $145,141

176.221)

Prohibited

practices (M.S. 74 $294,000 59 $166,075 46 $147,000 22 $59,860 62 $228,000 48 $113,086 86 $366,000 75 $253,211

176.194)

Rehabilitation

provider

1 $450 1 $450 2 $3,400 2 $3,200 4 $2,350 5 $2,550 5 $3,150 4 $2,700

discipline (M.S.

176.102)

Managed care

organization

1 $2,000 1 $2,000 0 $0 0 $0 0 $0 0 $0 0 $0 0 $0

discipline (M.S.

176.1351)

Health care

provider

2 $900 2 $900 0 $0 0 $0 0 $0 0 $0 0 $0 0 $0

discipline (M.S.

176.103)

Failure to insure $2,329,931 $2,340,418 $2,989,498 $1,796,805

205 291 $561,050 131 217 $393,113 153 159 $492,075 144 157 $472,168

(M.S. 176.181) $992,421 $1,135,357 $2,519,905 $1,447,706

Late filing of

special fund

assessment (M.S. 130 $230,636 149 $231,652 83 $229,423 95 $223,507 82 $257,441 73 $209,591 119 $160,387 103 $117,593

176.129 &

176.130)

Other penalties

(M.S. 176.221, $55,666 $61,086 $157,266 $193,362

176.225, 176.138, 163 138 $42,300 148 107 $40,319 292 187 $76,159 353 328 $146,522

176.231, 176.238,

& 176.84) $39,254 $44,721 $71,350 $37,248

Totals 2,789 $2,725,649 2,663 $1,789,818 2,740 $2,833,913 2,347 $1,476,387 2,832 $4,378,216 2,409 $1,658,146 2,563 $3,216,152 2,397 $1,699,109

The differences between the penalties assessed and collected is a result of: rescinded and settled penalties, timing delays and data for penalties paid to employees not being collected by the department.

The assessed penalty amounts for late first payment and other penalties show the amount payable to the department first and the amount payable to the employee second.

The assessed penalty amounts for failure to insure penalties show the estimated amount first and the reduced amount second.

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Challenger 350 Recommended Operating Procedures and TechniquesDocument104 pagesChallenger 350 Recommended Operating Procedures and Techniquessebatsea100% (1)

- Cemco T80Document140 pagesCemco T80Eduardo Ariel Bernal100% (3)

- Under Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Document14 pagesUnder Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Iqbal YusufNo ratings yet

- CARBOWAX™ Polyethylene Glycol (PEG) 1000Document2 pagesCARBOWAX™ Polyethylene Glycol (PEG) 1000Anonymous vJPniV7No ratings yet

- Legg Calve Perthes Disease: SynonymsDocument35 pagesLegg Calve Perthes Disease: SynonymsAsad ChaudharyNo ratings yet

- Boutique Hotel Financial ModelDocument15 pagesBoutique Hotel Financial ModelNgọcThủy0% (1)

- A Cook's Journey To Japan - Fish Tales and Rice Paddies 100 Homestyle Recipes From Japanese KitchensDocument306 pagesA Cook's Journey To Japan - Fish Tales and Rice Paddies 100 Homestyle Recipes From Japanese KitchensEthan F.100% (1)

- Operator'S Manual Controller R-30iBDocument25 pagesOperator'S Manual Controller R-30iBZied RaouakNo ratings yet

- Druthers Forming Answer KeyDocument3 pagesDruthers Forming Answer KeyDesventes AdrienNo ratings yet

- NP EX19 9a JinruiDong 2Document9 pagesNP EX19 9a JinruiDong 2Ike DongNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- Toy World - Working FileDocument30 pagesToy World - Working Filepiyush aroraNo ratings yet

- Waste Heat Recovery UnitDocument15 pagesWaste Heat Recovery UnitEDUARDONo ratings yet

- Toy World, Inc. Case SolutionDocument23 pagesToy World, Inc. Case SolutionArjun Jayaprakash Thirukonda80% (5)

- Reverse Osmosis Desalination: Our Global Expertise To Address Water ScarcityDocument16 pagesReverse Osmosis Desalination: Our Global Expertise To Address Water Scarcitynice guyNo ratings yet

- Nfpa 502 Critical Velocity Vs Fffs EffectsDocument5 pagesNfpa 502 Critical Velocity Vs Fffs Effectsamir shokrNo ratings yet

- Jan. Feb. Mar. Apr.: Sensitivity: LNT Construction Internal UseDocument3 pagesJan. Feb. Mar. Apr.: Sensitivity: LNT Construction Internal UseAkshay WahalNo ratings yet

- Republican Party Finances, 2007-2010Document1 pageRepublican Party Finances, 2007-2010coalitiontorebuildthepartyNo ratings yet

- CF ExcelDocument2 pagesCF ExcelAnam AbrarNo ratings yet

- DisclosureDocument2 pagesDisclosurenuseNo ratings yet

- Loans ListingDocument58 pagesLoans ListingsockeymmNo ratings yet

- Copycooperative Financial Ratio Calculator 2011Document10 pagesCopycooperative Financial Ratio Calculator 2011pradhan13No ratings yet

- County Steel Inc.Document20 pagesCounty Steel Inc.ingrid619No ratings yet

- CF ExcelDocument4 pagesCF ExcelAnam AbrarNo ratings yet

- Tax LiabilityDocument133 pagesTax LiabilitySebastian Cruz RivasNo ratings yet

- American Cheminal Corp SpreadsheetDocument16 pagesAmerican Cheminal Corp SpreadsheetRahul PandeyNo ratings yet

- Ocean Carriers FinalDocument3 pagesOcean Carriers FinalGiorgi MeskhishviliNo ratings yet

- Ryan D. Seelke Ocean Carriers Case: Forcasted Operating Cash Flow For New Capesize Vessel (25 Year Life) Discount Rate 9%Document3 pagesRyan D. Seelke Ocean Carriers Case: Forcasted Operating Cash Flow For New Capesize Vessel (25 Year Life) Discount Rate 9%Giorgi MeskhishviliNo ratings yet

- Netflix Financial StatementsDocument2 pagesNetflix Financial StatementsGoutham RaoNo ratings yet

- Project 6Document10 pagesProject 6api-489150270No ratings yet

- 15 Year Mortgage - Mortgage Calculator 2Document9 pages15 Year Mortgage - Mortgage Calculator 2api-351849605No ratings yet

- End of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)Document1 pageEnd of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)amanuel mindaNo ratings yet

- QR Shopper: To Perform A Financial Analysis For A Startup Tech Company in Rochester, New YorkDocument3 pagesQR Shopper: To Perform A Financial Analysis For A Startup Tech Company in Rochester, New YorkRajat SinghNo ratings yet

- Profit Tracker v3.1Document18 pagesProfit Tracker v3.1alishaNo ratings yet

- Chapter 14Document49 pagesChapter 14Semh ZavalaNo ratings yet

- DSCC Vs SRCC, Jan Filing PeriodsDocument1 pageDSCC Vs SRCC, Jan Filing PeriodsElizabeth BenjaminNo ratings yet

- Stock Dads Compound Interest CalculatorDocument4 pagesStock Dads Compound Interest CalculatorMNo ratings yet

- Pagos Diarios EstacionesDocument4 pagesPagos Diarios EstacionesAlan Ramos RosasNo ratings yet

- Taller Practica ContableDocument24 pagesTaller Practica ContableLuiz Cortez ArangoNo ratings yet

- BolsaDocument4 pagesBolsaHugo Romo DiazNo ratings yet

- AmortizationDocument8 pagesAmortizationMohammad IbrahimNo ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Loan Amortization ScheduleDocument30 pagesLoan Amortization ScheduleMarc QuinamotNo ratings yet

- ToyWorld Soln 1Document12 pagesToyWorld Soln 1Spark HsiaoNo ratings yet

- 15 YearstudentloanDocument8 pages15 Yearstudentloanapi-351687679No ratings yet

- Año 10% 0 - 1000 1 400 2 200 3 300 4 500 VPN $87.12 Tir 14%Document4 pagesAño 10% 0 - 1000 1 400 2 200 3 300 4 500 VPN $87.12 Tir 14%Javier Espinosa GomezNo ratings yet

- 15 YearmortgageDocument8 pages15 Yearmortgageapi-351687679No ratings yet

- Department Name Department Code Average of Salary Department NameDocument8 pagesDepartment Name Department Code Average of Salary Department NameDefi Rizki MaulianiNo ratings yet

- Time Value - Excel Function Approach - CH 3&4Document6 pagesTime Value - Excel Function Approach - CH 3&4TakouhiNo ratings yet

- Circuit Breaker Fact Sheet Feb 2019Document7 pagesCircuit Breaker Fact Sheet Feb 2019Alexandria GrantNo ratings yet

- 14-NURFC Financial Analysis 8.07Document3 pages14-NURFC Financial Analysis 8.07COASTNo ratings yet

- Team 5-Arizona Highways ExcelDocument15 pagesTeam 5-Arizona Highways Exceljack stauberNo ratings yet

- Financial Analysis of National Underground Railroad Freedom Center, IncDocument6 pagesFinancial Analysis of National Underground Railroad Freedom Center, IncCOASTNo ratings yet

- Negative Principle Values Are Due To The Extra Payment Forcing The Loan To End 5 Years EarlyDocument12 pagesNegative Principle Values Are Due To The Extra Payment Forcing The Loan To End 5 Years Earlyapi-351687679No ratings yet

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- Playtime SupplementalDocument1 pagePlaytime SupplementalDenis BeaulieuNo ratings yet

- Financial ModelDocument6 pagesFinancial ModelGarvit JainNo ratings yet

- Ejemplo Tabla de Amortización Finanaciamiento Actividad 2Document2 pagesEjemplo Tabla de Amortización Finanaciamiento Actividad 2Alizz CoRaNo ratings yet

- Honduras Fund Request 2021Document98 pagesHonduras Fund Request 2021katy.colindresNo ratings yet

- 2019 April FinancialsDocument2 pages2019 April FinancialsLivermoreParentsNo ratings yet

- Sup Manuf Company Final DraftDocument18 pagesSup Manuf Company Final DraftRama NaveedNo ratings yet

- Tabla de AmortizacionDocument2 pagesTabla de AmortizacionJulio OrdazNo ratings yet

- Session 7 - Financial Statements and RatiosDocument23 pagesSession 7 - Financial Statements and Ratiosalanablues1No ratings yet

- Marketing ExcelDocument4 pagesMarketing ExcelMaria Camila Sierra RamosNo ratings yet

- MBS Pass Thro + Loan AmortisationDocument33 pagesMBS Pass Thro + Loan AmortisationHarshit DwivediNo ratings yet

- Student Workbook Flash Amended Final PDFDocument21 pagesStudent Workbook Flash Amended Final PDFGaryNo ratings yet

- Department of Labor: Generalprovision 6 28 07Document6 pagesDepartment of Labor: Generalprovision 6 28 07USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Aces CPDocument36 pagesDepartment of Labor: Aces CPUSA_DepartmentOfLabor100% (2)

- Department of Labor: YouthworkerDocument1 pageDepartment of Labor: YouthworkerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Yr English GuideDocument1 pageDepartment of Labor: Yr English GuideUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: YouthRulesBrochureDocument12 pagesDepartment of Labor: YouthRulesBrochureUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: 20040422 YouthrulesDocument1 pageDepartment of Labor: 20040422 YouthrulesUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Niosh Recs To Dol 050302Document198 pagesDepartment of Labor: Niosh Recs To Dol 050302USA_DepartmentOfLaborNo ratings yet

- Department of Labor: ln61003Document2 pagesDepartment of Labor: ln61003USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Niosh Letter FinalDocument3 pagesDepartment of Labor: Niosh Letter FinalUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 11x17 3Document1 pageDepartment of Labor: JYMP 11x17 3USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Final ReportDocument37 pagesDepartment of Labor: Final ReportUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Yr English GuideDocument1 pageDepartment of Labor: Yr English GuideUSA_DepartmentOfLaborNo ratings yet

- Pyq of KTGDocument8 pagesPyq of KTG18A Kashish PatelNo ratings yet

- Packed Bed Reactor Slides (B)Document32 pagesPacked Bed Reactor Slides (B)Meireza Ajeng PratiwiNo ratings yet

- Microsoft Security Intelligence Report Volume 21 EnglishDocument180 pagesMicrosoft Security Intelligence Report Volume 21 EnglishAlejandro CadarsoNo ratings yet

- Me3391-Engineering Thermodynamics-805217166-Important Question For Engineering ThermodynamicsDocument10 pagesMe3391-Engineering Thermodynamics-805217166-Important Question For Engineering ThermodynamicsRamakrishnan NNo ratings yet

- Form 28 Attendence RegisterDocument1 pageForm 28 Attendence RegisterSanjeet SinghNo ratings yet

- Chomp Excersie 3Document5 pagesChomp Excersie 3Omahri24No ratings yet

- MAOH600 Ropu 48 Presentation Script and ReferencesDocument10 pagesMAOH600 Ropu 48 Presentation Script and ReferencesFano AsiataNo ratings yet

- As Level Chemistry Practical Paper 3 - GCE GuideDocument1 pageAs Level Chemistry Practical Paper 3 - GCE GuideJamal AldaliNo ratings yet

- Handout Module6Document69 pagesHandout Module6Oana MirceaNo ratings yet

- Free Higher Education Application Form 1st Semester, SY 2021-2022Document1 pageFree Higher Education Application Form 1st Semester, SY 2021-2022Wheng NaragNo ratings yet

- Chapter FourDocument9 pagesChapter FourSayp dNo ratings yet

- Astm d2729Document2 pagesAstm d2729Shan AdriasNo ratings yet

- BCA2006 BCA GuideDocument507 pagesBCA2006 BCA GuidePatrick LiaoNo ratings yet

- English PoemDocument4 pagesEnglish Poemapi-276985258No ratings yet

- (Engine International Air Pollution Prevention) : EIAPP CertificateDocument2 pages(Engine International Air Pollution Prevention) : EIAPP CertificateTan DatNo ratings yet

- A Review On Bioactive Compounds of Beet Beta Vulgaris L Subsp Vulgaris With Special Emphasis On Their Beneficial Effects On Gut Microbiota and Gastrointestinal HealthDocument13 pagesA Review On Bioactive Compounds of Beet Beta Vulgaris L Subsp Vulgaris With Special Emphasis On Their Beneficial Effects On Gut Microbiota and Gastrointestinal HealthWinda KhosasiNo ratings yet

- Action Taken On Oil and Ghee Sampling - 2020Document2 pagesAction Taken On Oil and Ghee Sampling - 2020Khalil BhattiNo ratings yet

- Full Test Bank For Health Economics and Policy 7Th Edition Henderson PDF Docx Full Chapter ChapterDocument34 pagesFull Test Bank For Health Economics and Policy 7Th Edition Henderson PDF Docx Full Chapter Chapterpeeepochaq15d100% (9)

- 2015 12 17 - Parenting in America - FINALDocument105 pages2015 12 17 - Parenting in America - FINALKeaneNo ratings yet

- Adult Module 1 - Five Healthy Habits Handout (English) PDFDocument2 pagesAdult Module 1 - Five Healthy Habits Handout (English) PDFKennedy FadriquelanNo ratings yet

- Emerging Re-Emerging Infectious Disease 2022Document57 pagesEmerging Re-Emerging Infectious Disease 2022marioNo ratings yet