Professional Documents

Culture Documents

International Equity Markets

International Equity Markets

Uploaded by

Nidhi DedhiaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Equity Markets

International Equity Markets

Uploaded by

Nidhi DedhiaCopyright:

Available Formats

Chapter 5

Page 1 of 6

International Equity Markets

Concepts FDI FDI is the acquisition of a controlling interest in a foreign firm or affiliate (branch, subsidiary, etc.). There are a variety of ways that FDI can occur, including building new foreign facilities from scratch ("Greenfield investment"), merging with a foreign firm, taking over a foreign firm, and entering a partnership with a foreign firm (Example; a joint venture). Horizontal FDI involves investing in a firm that is in the same industry. Vertical FDI involves investing in a supplier or customer firm. PI Portfolio investments consist mainly of the holding of transferable securities or guaranteed by the govt. of the capital importing country. Such holdings do not amount to right to control the company. E.g. shares, debenture, bonds etc.

GDR Global Depositary Receipts mean any instrument in the form of a depositary receipt or certificate (by whatever name it is called) created by the Overseas Depositary Bank outside India and issued to non-resident investors against the issue of ordinary shares or Foreign Currency Convertible Bonds of issuing company. They are negotiable certificates that usually represent a companys publicly traded equities and can be denominated in any freely convertible foreign currency. They are listed on a European stock exchange, often Luxembourg or London. Each DR represents a multiple number or fraction of underlying shares or alternatively the shares correspond to a fixed ratio, for example, 1 GDR = 10 Shares. ADR A GDR issued in America is an American Depositary Receipt (ADR). An ADR represents an ownership interest in foreign securities. It is a negotiable instrument issued by an American Depository bank certifying that shares of a non-US issuing company are held by the depositorys custodian bank abroad. Each unit of ADR is called an American Depository Share (ADS). They are an ideal way for foreign companies to raise funds to expand their international capital base and get name and product exposure in the US. ADR could be listed on the New York stock exchange, NASDAQ or could be issued as private placement securities under rule 144a in the US. 1. A1. Explain and discuss the various factors responsible for FDI inflows. Introduction

Foreign investment can take two forms: foreign equity investors can simply buy a stake in an enterprise or take a direct interest in its management. The first, indirect form of investment is called foreign portfolio investment. Foreign direct investment (FDI) involves more than just

Chapter 5

Page 2 of 6

buying a share or a security. It is the amount of financing provided by a foreign owner who is also directly involved in the management of the enterprise. For statistical purposes, the International Monetary Find (IMF) defines foreign investment as (FDI) when the investor holds 10% or more of the equity of an enterprise. Foreign investment has clearly been a major factor in stimulating economic growth and development in recent times. Foreign Direct Investment (FDI) is one of the most important sources of capital. FDI links the host economy with the global markets and fosters economic growth. The main factors are: 1. Market size and growth rate are principal determinants of FDI flows - Every nation has to compete in the international market for scarce resources. MacroEconomic stability and low inflation have been successful in attracting external capital. Maintaining inflation under 5% and recording a growth rate of 7% would make India an attractive place for foreign investments. India is a favorite among Asian countries because of it's sheer size. A hospitable environment for foreign investors - by providing essential guarantees for investors to: Enter and exit Operate on equal terms alongside local operators Repatriate their investments when needed Availability of the required infrastructure - in form of serviceable roads, ports, telecommunications, airports, water and power facilities is a pre-requisite for attracting large volumes foreign investments. Method and ease of entry - There are currently six possible entry routes/ clearing mechanisms for FDI, depending on the sector, extent of foreign equity desired, level of investment and geographical location of the project. This system is perceived to be complex by many foreign investors and analysts. Consequently it appears that the number of entry routes should be reduced to only two, viz. the Automatic Approval (AA) Route of RBI and the FIPB. Scope of operations - The Indian system has both a positive list and a negative list. The positive list comprises of sectors where automatic approval is granted, subject to certain conditions. In the negative list foreign investment is currently not allowed. Political stability - Different governments follow a different policy framework for FDI. One government may follow a liberal approach whereas the other may follow a conservative one. Thus political instability deters FDI from coming to any country. While India has now emerged as the second most-sought-after FDI destination in Asia after China, the actual inflows into India are less than a tenth of those received by China. This should make the government reflect on the shortcomings in the policy framework. Incidentally, successive governments wasted considerable time identifying the desirable sectors where the FDI could be encouraged and those where it must be discouraged. Some coalition partners in the present as well as the previous

2.

3.

4.

5.

6.

Chapter 5

Page 3 of 6 government were totally opposed to inviting FDI because of their misplaced sense of Swadeshi.

7.

Access to resources and low production costs - the availability of natural, capital, technological and human resources are an important consideration when attracting FDI inflows. Also, the costs at which these resources can be obtained are a deciding factor. Cultural-cum-geographic proximity the similarities in culture and geographic nearness to the foreign investors own land makes the destination country easier for the investor to enter, since he is surer of certain factors, or rather, more comfortable getting into a land which is as similar as home. Access to export markets the markets that one can service from the destination country, i.e. it's strategic location gives the country a one-up against competing nations in attracting foreign investments. Not only the location, but also its trade relations with the neighboring nations is an important factor. Explain and discuss the objectives of FDI and PI. Need for foreign capital

8.

9.

2. A2.

The following arguments are advanced in favour of foreign capital: 1. Sustaining a high level of investment - Since the underdeveloped countries want to industrialized themselves within a short period of time, it becomes necessary to raise the level of investment substantially. This requires, in turn, a high level of savings. However, because of general poverty of masses, the savings are often very low. Hence emerges a resource gap between investment and savings. This gap has to be filled through foreign capital. Technological gap - The under developed countries have very low level of technology as compared to the advanced countries. However they possess strong urge for industrialization to develop their economies and to wriggle out of the low level equilibrium trap in which they are caught. This raises the necessity for importing technology from advanced countries. Such technology usually comes with foreign capital when it assumes the form of private foreign investment or foreign collaboration. In the Indian case technical assistance received from abroad has helped in filling the technological gap through the following three ways: (a) Provision for expert services (b) Training of Indian personnel (c) Education research and training institution in the country Exploitation of natural resources - A number of underdeveloped countries possess huge mineral resources, which await exploitation. These countries themselves do not possess the required technical skill and expertise to accomplish this task. As a consequence, they have to depend upon foreign capital to undertake the exploitation of their mineral wealth.

2.

3.

Chapter 5 4.

Page 4 of 6 Undertaking the initial risk - Many under developed countries suffer from acute private entrepreneurs. This creates obstacles in the programs of industrialization. An argument advanced in favour of the foreign capital is that it undertakes the risk of investment in host countries and thus provides the much-needed impetus to the process of industrialization. Once the programme of industrialization gets started with the initiative of foreign capital, domestic industrial activity starts picking up as more and more of the host country enter the industrial field. Development of basic economic infrastructure - It has been observed that the domestic capital of the under developed countries is often too inadequate to build up the economic infra structure of its own. Thus these countries require the assistance of foreign capital to undertake this task. In the latter half of the 20th century, especially during the last 3-4 decades, international financial institutions and many governments of advanced countries have made substantial capital available to the under developed countries to develop their system of transport and communications, generation and distribution of electricity, development of irrigation facilities, etc. Improvement in balance of payments position - In the initial phase of the economic development, the under developed countries need much larger imports (in the form of machinery, capital goods, industrial raw materials, spares and components), then they can possibly export. As a result, the balance of payments generally turns adverse. This creates a gap between the earnings and foreign exchange. Foreign capital presents short run solution to the problem.

5.

6.

This shows that the economic development of an underdeveloped country should obviously receive a boost as a result of foreign capital. Accordingly, if foreign capital is obtained on easy terms and without any strings, it should be welcomed. However, as noted by John P. Lewis, despite denials, the fact is that all foreign aid carries strings and every foreign aid relationship involves bargaining, however genteel, between aiding and receiving parties. 3. A3. Discuss the different instruments available with a corporate body in India to raise equity capital abroad. Introduction Equity capital can flow to a developing country in the following ways: 1. Developed country investors can directly purchase shares in the stock market of a developing country. 2. Companies from developing countries, can issue shares or depository receipts in stock markets of developed countries Out of both these options, the second one is concerned with an Indian corporates ability to raise equity from foreign markets. Types of Equity Instruments Equity instruments can be classified into the following categories based on the different characteristics with which they are floated in the market:

Chapter 5

Page 5 of 6

Equity shares Equity shares represent ownership capital, as equity shareholders collectively own the company. Preference shares Preference shares refer to a form of shares, which lie in between pure equity and debt. These are shares, which do not carry voting rights. Warrants Warrant is a certificate giving the holder the right to purchase securities at a stipulated price within a specified time limit or perpetually. Sometimes a warrant is offered with securities as an inducement to buy. The warrant acts as a sweetener because the holder of the warrant has the right but not the obligation of investing in the equity at the indicated rate The above three are instruments that are used in domestic markets. The GDRs and ADRs are instruments used in foreign markets to raise equity. We will now go ahead with the explanations of GDRs and ADRs and how they can be used to raise finance for an Indian corporate from international markets. Note (Before going on to the mechanism about how ADRs and GDRs wrok, we need to know a few concepts. These concepts do not form a part of the answer. They are only given here for better understanding of the mechanism.)

Relevant Concepts

Domestic Custodian Bank It means, a banking company, which acts as a custodian bank for the ordinary shares or Foreign Currency Convertible Bonds, which are issued by it against depository receipts or certificates. Issuing Company It means, any Indian company permitted to issue Foreign Currency Convertible Bonds, or ordinary shares of that company against depository receipts. Overseas Depository Bank It means, a bank authorized by the Issuing Company to issue depository receipts against issue of Foreign Currency Convertible Bonds or ordinary shares of the Issuing Company.

Chapter 5

Page 6 of 6

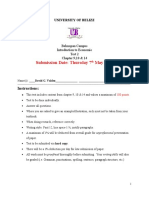

Mechanism- how it works In the recent years, a number of European and Japanese companies have got themselves listed on foreign stock exchanges such as New York and London. Shares of many firms are traded indirectly in the form of depository receipts. In this mechanism, a depository, usually a large international bank, who receives dividends, reports etc. and issues claims against these shares, holds the shares issued by a firm. The claims are called depository receipts with each receipt being a claim on specified number of shares. The depository receipts are denominated in a convertible currency, usually the US$. The depository receipts may be listed and traded on major stock exchanges or may trade in the OTC market. The issuer firm pays dividend in its home currency, which is converted into Dollars by the depository and distributed to the holders of the depository receipts. This way, the issuing firm avoids listing fees and onerous disclosure and reporting requirements, which would be obligatory if it were to be directly listed on the foreign stock exchange. This mechanism originated in the US and is called the American Depository Receipt. The recent years have seen the emergence of European Depository Receipts (EDRs) and Global Depository Receipts, which can be used to tap multiple markets with a single instrument. Indian Corporate

Delivery of ordinary shares or bonds Appoint

Domestic Custodian Bank

Co-ordinate activities

Lead Manager

Co-ordinate activities

Instruction to issue depository receipts or certificates

Overseas Depository Bank

Listing

Purchase of Depository receipts

Foreign Stock Exchange

Investor Base

Payment of Interest / Dividend

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Eat Right For Your Blood TypeDocument5 pagesEat Right For Your Blood Typekingcobra00792% (59)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Animal HusbandryDocument15 pagesAnimal Husbandrymanojpatel5163% (8)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Value InterviewsDocument31 pagesValue InterviewsAmit Rana100% (1)

- Currency WarDocument62 pagesCurrency Warmanojpatel51No ratings yet

- Notes On Capital MarketDocument11 pagesNotes On Capital MarketRDGandhi100% (5)

- Financial Management Solution Manual by Cabrerapdf PDFDocument3 pagesFinancial Management Solution Manual by Cabrerapdf PDFJuda Mae Gieg33% (3)

- Micro Quiz 5Document7 pagesMicro Quiz 5Mosh100% (1)

- Indian Ethos For ManagementDocument7 pagesIndian Ethos For Managementmanojpatel5192% (13)

- Project TerminationDocument16 pagesProject TerminationazsrxNo ratings yet

- EUTHANASIADocument18 pagesEUTHANASIAmanojpatel51100% (2)

- Clause 15: Termination, Payment and Release)Document43 pagesClause 15: Termination, Payment and Release)Sayed WafiullahNo ratings yet

- Life Time CalenderDocument1 pageLife Time Calendermanojpatel51No ratings yet

- Personal Budget PlannerDocument7 pagesPersonal Budget Plannernahen7779No ratings yet

- SR No. 1 2 3 4 5Document246 pagesSR No. 1 2 3 4 5api-25887436100% (2)

- Income Tax Calculator: DisclaimerDocument8 pagesIncome Tax Calculator: Disclaimerapi-3762419No ratings yet

- ALL Purpose Worksheet Conversions)Document28 pagesALL Purpose Worksheet Conversions)sooridushanNo ratings yet

- Excel Formula1Document9 pagesExcel Formula1sathaksNo ratings yet

- Age Character CalculationnhmDocument2 pagesAge Character Calculationnhmapi-3698237No ratings yet

- Chinese Chart: Confirmation Chart (For Already Born Children) Plan Your Children (As On Today)Document3 pagesChinese Chart: Confirmation Chart (For Already Born Children) Plan Your Children (As On Today)manojpatel51No ratings yet

- Vegetarian Recipes CollectionDocument333 pagesVegetarian Recipes Collectionr4b81tNo ratings yet

- What Did Your Mobile Number SayDocument1 pageWhat Did Your Mobile Number Saymanojpatel51No ratings yet

- SSF From LinnyDocument80 pagesSSF From Linnymanojpatel51No ratings yet

- New People ManagementDocument7 pagesNew People Managementmanojpatel51No ratings yet

- Chapter 2 PersonalityDocument18 pagesChapter 2 Personalitymanojpatel51100% (1)

- Leadership Rahul BajajDocument20 pagesLeadership Rahul Bajajchiraglakhani0% (1)

- Entrepreneurship RamkyDocument85 pagesEntrepreneurship Ramkyapi-3823681100% (4)

- The Foreign Exchange MarketDocument16 pagesThe Foreign Exchange Marketmanojpatel5167% (3)

- IMTPDocument132 pagesIMTPmanojpatel51100% (1)

- Chapter 4 LeadershipDocument29 pagesChapter 4 Leadershipmanojpatel51100% (2)

- Chapter 1 Indian EthosDocument9 pagesChapter 1 Indian Ethosmanojpatel510% (1)

- The Foreign Exchange MarketDocument30 pagesThe Foreign Exchange Marketmanojpatel51No ratings yet

- The International Development Association, IDA,: HistoryDocument7 pagesThe International Development Association, IDA,: Historymanojpatel51No ratings yet

- Exposure and Risk in International FinanceDocument24 pagesExposure and Risk in International Financemanojpatel51100% (6)

- International Financial MarketsDocument13 pagesInternational Financial Marketsmanojpatel5150% (4)

- Long Term Debt: Leverage Ratios Are Used in Determining The Amount of Debt Loan The Business Has Taken On The Assets orDocument3 pagesLong Term Debt: Leverage Ratios Are Used in Determining The Amount of Debt Loan The Business Has Taken On The Assets ordaranee srichanaNo ratings yet

- Date Received (1 Submission)Document12 pagesDate Received (1 Submission)Dương Trung Nguyên (FGW DN)No ratings yet

- Management Science - ExerciseDocument5 pagesManagement Science - ExerciseMelanie RuizNo ratings yet

- Part Iii Mar 2022 InsightDocument98 pagesPart Iii Mar 2022 InsightKorede DavidNo ratings yet

- Integrated Marketing Communications Imc Tools Used by Coca Cola PDFDocument18 pagesIntegrated Marketing Communications Imc Tools Used by Coca Cola PDFShokhsanam Abdukhamidova KhamidNo ratings yet

- PaytmDocument20 pagesPaytmNaveenAnil33% (3)

- Quality Manual: Title: Document Number: QCC1479 Revision: 63 Page 1 of 46Document46 pagesQuality Manual: Title: Document Number: QCC1479 Revision: 63 Page 1 of 46Asad Bin Ala QatariNo ratings yet

- A Model of Customer LoyaltyDocument2 pagesA Model of Customer LoyaltyAshwani Kumar SahuNo ratings yet

- Distinguishing Between Termination of Employment Contract by Notice and Summary Dismissal.Document8 pagesDistinguishing Between Termination of Employment Contract by Notice and Summary Dismissal.Levis M AtukwatseNo ratings yet

- Define Debit Note and Credit NoteDocument5 pagesDefine Debit Note and Credit NotevenkataramanaNo ratings yet

- Financial Reporting Assignment 1Document3 pagesFinancial Reporting Assignment 1Shu HuiNo ratings yet

- In To The Concept - VariancesDocument43 pagesIn To The Concept - VariancesRavi JoshiNo ratings yet

- Appendix 1 - Woodhouse Recruitment Case StudyDocument8 pagesAppendix 1 - Woodhouse Recruitment Case StudyCindy HuangNo ratings yet

- Export Business Process AnalysisDocument28 pagesExport Business Process AnalysisTrang Nguyen Thi QuynhNo ratings yet

- Jawaban GSLC 1Document2 pagesJawaban GSLC 1Soniea DianiNo ratings yet

- BrodoDocument3 pagesBrodoRizky EkaNo ratings yet

- Introduction To Economic Test CHPT 9,10 &14.docx NEWDocument8 pagesIntroduction To Economic Test CHPT 9,10 &14.docx NEWAmir ContrerasNo ratings yet

- U 5 TaxDocument23 pagesU 5 TaxfsafwfNo ratings yet

- 2021 ASQ Strategic PlanDocument11 pages2021 ASQ Strategic PlanRachel JosephNo ratings yet

- Perfect Competative Market Scenario-: BATA SHOE COMPANY (Bangladesh) LTDDocument11 pagesPerfect Competative Market Scenario-: BATA SHOE COMPANY (Bangladesh) LTDAsif Sadat 1815274060No ratings yet

- Harley DavidsonDocument4 pagesHarley DavidsonEmily JohnstonNo ratings yet

- Chapter 3 - Specific Factors and Income DistributionDocument9 pagesChapter 3 - Specific Factors and Income DistributionResha DayaoNo ratings yet

- COBECON - Module4.1 - SupplyDocument17 pagesCOBECON - Module4.1 - SupplyKen 77No ratings yet

- Harry Firmansyah - A1c018064 - Buku BesarDocument41 pagesHarry Firmansyah - A1c018064 - Buku BesarHarry Black ParadiseNo ratings yet