Professional Documents

Culture Documents

TCODE - S - ALR - 87099918 - Primary Cost Planning - Depreciation PDF

Uploaded by

rajdeeppawarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TCODE - S - ALR - 87099918 - Primary Cost Planning - Depreciation PDF

Uploaded by

rajdeeppawarCopyright:

Available Formats

COST CENTER ACCOUNTING COST CENTER ACCOUNTING END USER TRAINING DOCUMENTS

S_ALR_87099918 - Primary Cost Planning - Depreciation

Functionality While doing cost center planning for the next year, you want to plan the future depreciation for the next year. This is possible through Asset accounting module. You can transfer planned depreciation for a depreciation area for the next year to the controlling module.

Scenario The Program transfers the depreciation, using the appropriate cost element, on the cost center. Any existing panned costs for this cost element are overwritten (meaning that the new costs are not added to the existing costs). Requirements Recalculation of depreciation (AFAR) has been run. Menu Path Accounting Controlling Cost Center Accounting Planning Aids Transfers S_ALR_87099918 Depreciation/Interest FI-AA

S_ALR_87099918

Transaction Code

1.

Double Click on S_ALR_87099918 - Primary Cost Planning: Depreciation/Interest

Page 1 of 5

COST CENTER ACCOUNTING COST CENTER ACCOUNTING END USER TRAINING DOCUMENTS

2.

Update the following fields:

Field Name Company code From period To period Fiscal year Field Description The company code is an organizational unit within financial accounting. From period beginning period of transfer. To period last period of transfer. Period, 12 months as a rule, for which the company is to create its inventory and balance sheet. 9100 1 12 2006 Values

Page 2 of 5

COST CENTER ACCOUNTING COST CENTER ACCOUNTING END USER TRAINING DOCUMENTS

3.

Click

to scroll down and update the following fields:

Field Name Fiscal year From period To period

Field Description Period, 12 months as a rule, for which the company is to create its inventory and balance sheet. From period beginning period of transfer. To period last period of transfer. 2006 1 12

Values

4.

Click More fields Button

Page 3 of 5

COST CENTER ACCOUNTING COST CENTER ACCOUNTING END USER TRAINING DOCUMENTS

5. 6.

Deselect <checkbox> Test run

Deselect <checkbox> Activity Type-dependant planning . Click Execute .

7.

Page 4 of 5

COST CENTER ACCOUNTING COST CENTER ACCOUNTING END USER TRAINING DOCUMENTS

8.

The system displays a list of planned depreciation by cost center.

Page 5 of 5

You might also like

- Plan Reconciliation of Internal ActivitiesDocument7 pagesPlan Reconciliation of Internal ActivitiesZakir ChowdhuryNo ratings yet

- Sap Controlling ConfigurationDocument58 pagesSap Controlling ConfigurationFaychal Ahmed100% (3)

- The Balanced Scorecard: Turn your data into a roadmap to successFrom EverandThe Balanced Scorecard: Turn your data into a roadmap to successRating: 3.5 out of 5 stars3.5/5 (4)

- Manpower Calculator Introduction V1.5Document18 pagesManpower Calculator Introduction V1.5lisahunNo ratings yet

- Execute Plan Cost AssessmentDocument5 pagesExecute Plan Cost AssessmentZakir ChowdhuryNo ratings yet

- Blueprint DocumentDocument17 pagesBlueprint DocumentZirukKhan0% (1)

- Plan Costs on Cost CentersDocument9 pagesPlan Costs on Cost CentersNilesh KumarNo ratings yet

- Controlling: Cost AccountingDocument144 pagesControlling: Cost AccountingBharat WealthNo ratings yet

- Year and Month End ActivityDocument23 pagesYear and Month End ActivityRaheem531985100% (1)

- Chart of AccountsDocument9 pagesChart of AccountsMarius PaunNo ratings yet

- Rel - My SAP CO Material FullDocument284 pagesRel - My SAP CO Material FullJyotiraditya BanerjeeNo ratings yet

- Rel - My SAP CO Material FullDocument284 pagesRel - My SAP CO Material Fullkalicharan1350% (2)

- SAP Month End Closing ProcessDocument30 pagesSAP Month End Closing ProcesssurendraNo ratings yet

- Month End ActivitiesDocument30 pagesMonth End ActivitiesRaju BothraNo ratings yet

- ABST2 Preperation For Year-End Closing - Account ReconcilationDocument10 pagesABST2 Preperation For Year-End Closing - Account ReconcilationVenkata Araveeti0% (1)

- ControllingDocument85 pagesControllingGarlapati Santosh KumarNo ratings yet

- Controlling Module in SAPDocument284 pagesControlling Module in SAPS VenkatakrishnanNo ratings yet

- Controlling in DetailDocument284 pagesControlling in DetailAnonymous nDTiiq6UNo ratings yet

- CO001 NAW To Be - Cost Element AccountingDocument9 pagesCO001 NAW To Be - Cost Element AccountingsivasivasapNo ratings yet

- SAP Controlling and COST Center Accounting (CO-CCA)Document17 pagesSAP Controlling and COST Center Accounting (CO-CCA)Ancuţa CatrinoiuNo ratings yet

- D365 Budgeting CookbookDocument123 pagesD365 Budgeting Cookbookshashankpadhye100% (1)

- MR11 GRIR Clearing Account MaintenanceDocument9 pagesMR11 GRIR Clearing Account MaintenanceJayanth MaydipalleNo ratings yet

- Asset Year End ClosingDocument13 pagesAsset Year End ClosingPrasad PunupuNo ratings yet

- SAP Controlling and CO-CCA OverviewDocument17 pagesSAP Controlling and CO-CCA OverviewAmina Quadri100% (2)

- Configure TPM Accruals in SAP CRMDocument16 pagesConfigure TPM Accruals in SAP CRMArnab MahatoNo ratings yet

- SAP FICO Financial AccountingDocument4 pagesSAP FICO Financial AccountingNeelesh KumarNo ratings yet

- S - ALR - 87099918 Cost Planning - DepreciationDocument4 pagesS - ALR - 87099918 Cost Planning - DepreciationZakir Chowdhury100% (1)

- TCODE - S - ALR - 87099918 - Cost - Planning - DepreciationDocument5 pagesTCODE - S - ALR - 87099918 - Cost - Planning - DepreciationrajdeeppawarNo ratings yet

- Primary Cost Planning on Cost CentersDocument8 pagesPrimary Cost Planning on Cost CentersbiggyjengNo ratings yet

- Execute Plan Cost SplittingDocument9 pagesExecute Plan Cost SplittingMurli Manohar ShuklaNo ratings yet

- 2KES PCA Balance Carry ForwardDocument12 pages2KES PCA Balance Carry Forwardmarcos16v67% (3)

- Arbaminch University: Colege of Business and EconomicsDocument13 pagesArbaminch University: Colege of Business and EconomicsHope KnockNo ratings yet

- Provisions for Doubtful Receivables in SAPDocument3 pagesProvisions for Doubtful Receivables in SAPRegis NemezioNo ratings yet

- Dynamics AX 2012 Year-End ChecklistDocument7 pagesDynamics AX 2012 Year-End ChecklistHasna Hassan AnnacotNo ratings yet

- Sap FiDocument4 pagesSap FiNicky AugustineNo ratings yet

- TCODE - 2KES PCA Balance Carry ForwardDocument8 pagesTCODE - 2KES PCA Balance Carry ForwardrajdeeppawarNo ratings yet

- Purchase Order Accruals-3Document5 pagesPurchase Order Accruals-3bhogaraju ravi sankarNo ratings yet

- Cost Management P1Document3 pagesCost Management P1Muzamil LoneNo ratings yet

- AJRW Asset Fiscal Year ChangeDocument10 pagesAJRW Asset Fiscal Year ChangeVenkata AraveetiNo ratings yet

- Execute Plan Cost Splitting.Document8 pagesExecute Plan Cost Splitting.Zakir ChowdhuryNo ratings yet

- Designing Billing ExtensionsDocument24 pagesDesigning Billing ExtensionsYugwan MittalNo ratings yet

- Financial Compliance Model - User GuideDocument5 pagesFinancial Compliance Model - User GuideSitakanta AcharyaNo ratings yet

- KSBT Activity Prices of Cost CentersDocument10 pagesKSBT Activity Prices of Cost CentersZakir ChowdhuryNo ratings yet

- Asset Accounting Interview QuestionsDocument18 pagesAsset Accounting Interview QuestionsBandita RoutNo ratings yet

- Cost Center Accounting Cost Center AccountingDocument6 pagesCost Center Accounting Cost Center AccountingLili Garibay0% (1)

- Advanced General Ledger Reporting and Optional ChartfieldsDocument11 pagesAdvanced General Ledger Reporting and Optional ChartfieldsVijaya GaliNo ratings yet

- BSBFIM601 Manage FinancesDocument7 pagesBSBFIM601 Manage FinancesLiu ElaineNo ratings yet

- Better Budgeting With Microsoft Dynamics AX 2012Document11 pagesBetter Budgeting With Microsoft Dynamics AX 2012atifhassansiddiquiNo ratings yet

- Bases de CostosDocument13 pagesBases de CostosNohemi LopezNo ratings yet

- 3 Controlling-StudentDocument16 pages3 Controlling-StudentRahul ShelarNo ratings yet

- CONTROLLING AREA - OKKP SettingsDocument7 pagesCONTROLLING AREA - OKKP SettingsMohammed Nawaz ShariffNo ratings yet

- Create Cost Center.Document6 pagesCreate Cost Center.Zakir ChowdhuryNo ratings yet

- Cost Accounting Project: Submitted By: Palka Jamwal Year Section A Roll No.-784Document12 pagesCost Accounting Project: Submitted By: Palka Jamwal Year Section A Roll No.-784Ekta AnejaNo ratings yet

- Nge 01Document12 pagesNge 01Kashif Malik100% (1)

- MANAGEMENT CONTROL SYSTEMS-Report Stell Plant & HPCLDocument17 pagesMANAGEMENT CONTROL SYSTEMS-Report Stell Plant & HPCLPrasad GantiNo ratings yet

- Controlling Area and Cost Center Setup in SAPDocument7 pagesControlling Area and Cost Center Setup in SAPsree_v123No ratings yet

- Simple finance overview of managerial accountingDocument13 pagesSimple finance overview of managerial accountingAb SalehNo ratings yet

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocument4 pagesNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNo ratings yet

- SCS 2007 04Document40 pagesSCS 2007 04rajdeeppawarNo ratings yet

- SCS 2007 02Document29 pagesSCS 2007 02rajdeeppawarNo ratings yet

- SCS 2011 01Document43 pagesSCS 2011 01rajdeeppawar100% (1)

- SCS 2006 02Document40 pagesSCS 2006 02rajdeeppawarNo ratings yet

- Paper 6Document3 pagesPaper 6Suppy PNo ratings yet

- SCS 2007 11Document46 pagesSCS 2007 11rajdeeppawarNo ratings yet

- SCS 2006 02Document40 pagesSCS 2006 02rajdeeppawarNo ratings yet

- SCS 2007 03Document36 pagesSCS 2007 03Suppy PNo ratings yet

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocument3 pagesNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNo ratings yet

- Paper 5Document4 pagesPaper 5rajdeeppawarNo ratings yet

- Paper 8Document3 pagesPaper 8rajdeeppawarNo ratings yet

- Paper 7Document4 pagesPaper 7Suppy PNo ratings yet

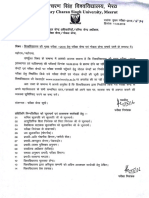

- Exam Form Issue CircularDocument1 pageExam Form Issue CircularrajdeeppawarNo ratings yet

- Differences between US GAAP, Indian GAAP & IFRSDocument7 pagesDifferences between US GAAP, Indian GAAP & IFRSrajdeeppawarNo ratings yet

- Trade Unions Act 1926Document15 pagesTrade Unions Act 1926JenniferMujNo ratings yet

- Paper 2Document12 pagesPaper 2rajdeeppawarNo ratings yet

- Tds 195Document46 pagesTds 195rajdeeppawarNo ratings yet

- Calculating taxable income from bank account detailsDocument5 pagesCalculating taxable income from bank account detailsrajdeeppawarNo ratings yet

- Statutory Due Date For F y 15 16Document1 pageStatutory Due Date For F y 15 16rajdeeppawarNo ratings yet

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocument3 pagesNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNo ratings yet

- Calculating taxable income from bank account detailsDocument5 pagesCalculating taxable income from bank account detailsrajdeeppawarNo ratings yet

- Changes in Remittance Procedures For Payments To NonDocument5 pagesChanges in Remittance Procedures For Payments To NonrajdeeppawarNo ratings yet

- GrammerDocument10 pagesGrammerrajdeeppawarNo ratings yet

- Dtaa UsaDocument35 pagesDtaa UsarajdeeppawarNo ratings yet

- Cost Accounting Standard DisclosuresDocument10 pagesCost Accounting Standard DisclosuresrajdeeppawarNo ratings yet

- Exam Centre Node CentreDocument17 pagesExam Centre Node CentrerajdeeppawarNo ratings yet

- Cost Accounting Standard DisclosuresDocument10 pagesCost Accounting Standard DisclosuresrajdeeppawarNo ratings yet

- MIRO Credit MemoDocument5 pagesMIRO Credit Memochapx032No ratings yet

- Story On DT Case Law Nov.13: Amit JainDocument3 pagesStory On DT Case Law Nov.13: Amit JainrajdeeppawarNo ratings yet