Professional Documents

Culture Documents

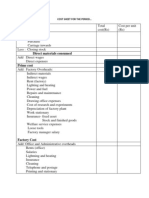

Income Statement: Less Sales Returns and Allowances

Uploaded by

Anyone Anywhere0 ratings0% found this document useful (0 votes)

6 views1 pageThis income statement shows the company's revenue, costs, expenses, and profits over a period ending on a specific date. It details net sales, cost of goods sold, gross profit, operating expenses including selling and general/administrative costs, net income before and after taxes, and any extraordinary gains or losses. The statement provides a breakdown of financial information over both the current month and year to date to analyze the company's performance.

Original Description:

Original Title

INC ST

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis income statement shows the company's revenue, costs, expenses, and profits over a period ending on a specific date. It details net sales, cost of goods sold, gross profit, operating expenses including selling and general/administrative costs, net income before and after taxes, and any extraordinary gains or losses. The statement provides a breakdown of financial information over both the current month and year to date to analyze the company's performance.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageIncome Statement: Less Sales Returns and Allowances

Uploaded by

Anyone AnywhereThis income statement shows the company's revenue, costs, expenses, and profits over a period ending on a specific date. It details net sales, cost of goods sold, gross profit, operating expenses including selling and general/administrative costs, net income before and after taxes, and any extraordinary gains or losses. The statement provides a breakdown of financial information over both the current month and year to date to analyze the company's performance.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

Income Statement

Revenue Gross sales

(all numbers in $000)

[Company Name] % of Sales Amount

[Period ending date] Year to Date % of Sales

Current Month Amount

Less sales returns and allowances

Net sales Cost of Sales Beginning inventory Current Month Amount % of Sales Amount Year to Date % of Sales

Plus goods purchased/manufactured

Total goods available

Less ending inventory

Total cost of goods sold Gross profit (loss) Operating Expenses

Selling

Current Month Amount % of Sales Amount

Year to Date % of Sales

Salaries and wages Commissions Advertising Depreciation Total selling expenses

General/Administrative

Salaries and wages Employee benefits Payroll taxes Insurance Rent Utilities Depreciation and amortization Office supplies Travel and entertainment Postage Equipment maintenance and rental Interest Furniture and equipment Total General/Administrative expenses Total operating expenses Net income before taxes Taxes on income Net income after taxes Extraordinary gain or loss Income tax on extraordinary gain Net Income (Loss)

You might also like

- Income Statement1Document1 pageIncome Statement1James HohoasiNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Income StatementDocument2 pagesIncome Statementrroy725No ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- In Come Statement TemplateDocument2 pagesIn Come Statement TemplaterrmmvbNo ratings yet

- Income StatementDocument1 pageIncome Statementapi-251439918No ratings yet

- Two-Year Comparative Income Statement 1Document1 pageTwo-Year Comparative Income Statement 1Thalia Sanders100% (1)

- Pro Forma Income StatementDocument6 pagesPro Forma Income StatementinfosurenNo ratings yet

- Accounting For Merchandising BusinessDocument17 pagesAccounting For Merchandising BusinessFeroz AhmadNo ratings yet

- Income Statement 1Document2 pagesIncome Statement 1api-276044694No ratings yet

- Annual Projected Profit and Loss: January February March April May JuneDocument4 pagesAnnual Projected Profit and Loss: January February March April May JuneTheresia NgaswagaNo ratings yet

- AnnualProjectedProfit Loss-ServicesDocument4 pagesAnnualProjectedProfit Loss-ServicesNizwa KhalifaNo ratings yet

- Annual Projected Profit and Loss: January February March April May JuneDocument4 pagesAnnual Projected Profit and Loss: January February March April May JuneTheresia NgaswagaNo ratings yet

- Business Budget: Income Less ExpensesDocument6 pagesBusiness Budget: Income Less ExpensesedinosNo ratings yet

- K P I T Cummins Infosystems Limited: Financials (Standalone)Document8 pagesK P I T Cummins Infosystems Limited: Financials (Standalone)Surabhi RajNo ratings yet

- Income Statement TemplateDocument1 pageIncome Statement TemplateJocoser NguyenNo ratings yet

- Task 5 - 2020571670 - Ayush - KandariDocument8 pagesTask 5 - 2020571670 - Ayush - Kandariayush kandariNo ratings yet

- Schedule of Expected Cash Collections: Master BudgetingDocument14 pagesSchedule of Expected Cash Collections: Master BudgetingAniruddha RantuNo ratings yet

- Sample Income Statement For School ReunionDocument3 pagesSample Income Statement For School ReunionCrystalFaithNo ratings yet

- SBV Financial StatementsDocument17 pagesSBV Financial Statementsbhundofcbm0% (1)

- Equity ValuationDocument2,424 pagesEquity ValuationMuteeb Raina0% (1)

- Book 1Document6 pagesBook 1gogaNo ratings yet

- Kunci Jawaban Black and WhiteDocument18 pagesKunci Jawaban Black and WhitefebrythiodorNo ratings yet

- Year-End Tax Plan1Document1 pageYear-End Tax Plan1Dana A Daspit ConteNo ratings yet

- Descriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsDocument15 pagesDescriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsVALLIAPPAN.PNo ratings yet

- Jawaban Cash FlowDocument1 pageJawaban Cash FlowChoiru IbadilhaqNo ratings yet

- FS - Auto Workshop FeasibilityDocument45 pagesFS - Auto Workshop Feasibilitywaqas_baloch_10% (1)

- Commencing: Insert Date HereDocument67 pagesCommencing: Insert Date HereMichael AthertonNo ratings yet

- Result Sheet TASK 2Document4 pagesResult Sheet TASK 2Nishant KolheNo ratings yet

- Auto Dealer KPIsDocument18 pagesAuto Dealer KPIsnkrishnan1984No ratings yet

- Cash Flow FormatDocument2 pagesCash Flow Formatrajesh shekarNo ratings yet

- Cost Sheet FormatDocument5 pagesCost Sheet Formatvicky3230No ratings yet

- Cost Sheet FormatDocument5 pagesCost Sheet Formatvicky3230No ratings yet

- Cost Sheet FormatDocument5 pagesCost Sheet FormatMadan GoreNo ratings yet

- Cost Sheet ProformaDocument4 pagesCost Sheet ProformaMorerpNo ratings yet

- P & L Bookmybread Year 1 Year 2Document2 pagesP & L Bookmybread Year 1 Year 2Ramanjit SinghNo ratings yet

- Budgeted Income StatementDocument1 pageBudgeted Income StatementJackie S LaymanNo ratings yet

- Itc - ImibDocument20 pagesItc - ImibYash RoxsNo ratings yet

- Income Statement TemplateDocument4 pagesIncome Statement TemplateAnonymous gFcnQ4goNo ratings yet

- Modül Business Decisions and EconomicsDocument60 pagesModül Business Decisions and Economicsmuhendis_8900No ratings yet

- Profit and Loss Forecast v1.0Document4 pagesProfit and Loss Forecast v1.0Jessica AngelinaNo ratings yet

- Arctic Products Company Balance Sheet at 6/30/2010: Cash Budget WorksheetDocument4 pagesArctic Products Company Balance Sheet at 6/30/2010: Cash Budget WorksheetbgamejNo ratings yet

- Tax PresentationDocument39 pagesTax Presentationtap4awhileNo ratings yet

- Tally Ledger List in Excel Format - TeachooDocument12 pagesTally Ledger List in Excel Format - TeachooGaurav RawatNo ratings yet

- 12-Month Business BudgetDocument10 pages12-Month Business Budgetrohanrajore00No ratings yet

- SBV Financial StatementsDocument18 pagesSBV Financial StatementsAmsalu WalelignNo ratings yet

- Profit & Loss A/C of Apollo Tyres: Income Sales Turnover Net SalesDocument4 pagesProfit & Loss A/C of Apollo Tyres: Income Sales Turnover Net SalesVineet Pratap SinghNo ratings yet

- Detailed Format of Cost SheetDocument3 pagesDetailed Format of Cost SheetRishabh Agrawal100% (5)

- Income Statement ABC Company For The Month Ended: RevenueDocument3 pagesIncome Statement ABC Company For The Month Ended: RevenueKalim Ullah KhanNo ratings yet

- Risk Management - Initial BaselineDocument10 pagesRisk Management - Initial BaselineLeroyAlicandroNo ratings yet

- Glossary FinanceDocument4 pagesGlossary FinanceGerencia ComercialNo ratings yet

- Cost Sheet FormatDocument3 pagesCost Sheet Formatvsbfx1234No ratings yet

- Classification of Trial Balance ItemsDocument4 pagesClassification of Trial Balance Itemsnimit playzNo ratings yet

- Inputs Base Case: Part-1Document4 pagesInputs Base Case: Part-1Ali Tariq ButtNo ratings yet

- Restolax Del Rosario Yukong - VerticalDocument1 pageRestolax Del Rosario Yukong - VerticalKing del RosarioNo ratings yet

- Book 1Document3 pagesBook 1prasadmvkNo ratings yet

- Amounts in USD Million Amounts in DKK Million: Container ActivitiesDocument4 pagesAmounts in USD Million Amounts in DKK Million: Container Activitiesmail2adeelNo ratings yet