Professional Documents

Culture Documents

Income Statement

Uploaded by

api-2514399180 ratings0% found this document useful (0 votes)

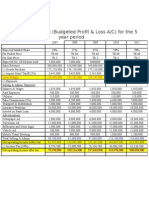

55 views1 pageYour Company Inc.'s income statement for the period ending June 30, 2009 showed a net loss of $8,792. Net sales were $300,000 but cost of goods sold was $3,260,000, resulting in a gross loss of $2,960,000. Total operating expenses including selling, general and administrative costs amounted to $5,810,000. With a net loss before taxes of $8,770,000 and taxes of $22,000, the net loss after taxes was $8,792,000.

Original Description:

Original Title

income statement

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentYour Company Inc.'s income statement for the period ending June 30, 2009 showed a net loss of $8,792. Net sales were $300,000 but cost of goods sold was $3,260,000, resulting in a gross loss of $2,960,000. Total operating expenses including selling, general and administrative costs amounted to $5,810,000. With a net loss before taxes of $8,770,000 and taxes of $22,000, the net loss after taxes was $8,792,000.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

55 views1 pageIncome Statement

Uploaded by

api-251439918Your Company Inc.'s income statement for the period ending June 30, 2009 showed a net loss of $8,792. Net sales were $300,000 but cost of goods sold was $3,260,000, resulting in a gross loss of $2,960,000. Total operating expenses including selling, general and administrative costs amounted to $5,810,000. With a net loss before taxes of $8,770,000 and taxes of $22,000, the net loss after taxes was $8,792,000.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

Income Statement

Your Company, Inc.

For Period Ending June 30, 2009

(all numbers in $000)

Current Month

Amount

% of Sales

REVENUE

Gross Sales

Less sales returns and allowances

Net Sales

COST OF SALES

Beginning inventory

Plus goods purchased / manufactured

Total Goods Available

Less ending inventory

Total Cost of Goods Sold

Gross Profit (Loss)

OPERATING EXPENSES

Selling

Salaries and wages

Commissions

Advertising

Depreciation

Other

Total Selling Expenses

General/Administrative

Salaries and wages

Employee benefits

Payroll taxes

Insurance

Rent

Utilities

Depreciation & amortization

Office supplies

Travel & entertainment

Postage

Equipment maintenance & rental

Interest

Furniture & equipment

Total General/Administrative Expenses

Total Operating Expenses

Net Income Before Taxes

Taxes on income

Net Income After Taxes

Extraordinary gain or loss

Income tax on extraordinary gain

NET INCOME (LOSS)

$500

200

$300

Year to Date

Amount

% of Sales

100%

$2,500

500

$2,000

$3,500

120

$3,620

360

$3,260

($2,960)

1167%

40%

1207%

120%

1087%

-987%

$25,000

900

$25,900

360

$25,540

($23,540)

$84

1,350

560

475

46

$2,515

28%

450%

187%

158%

15%

838%

$12

357

589

568

0

0

243

435

456

0

235

0

400

$3,295

$5,810

($8,770)

22

($8,792)

$0

0

($8,792)

4%

119%

196%

189%

0%

0%

81%

145%

152%

0%

78%

0%

133%

1098%

1937%

-2923%

7%

-2931%

0%

0%

-2931%

$130

80

60

120

30

$420

$130

31

23

1

23

30

16

8

4

11

49

31

10

$367

$787

($24,327)

135

($24,462)

$0

0

($24,462)

100%

1250%

45%

1295%

18%

1277%

-1177%

7%

4%

3%

6%

2%

21%

7%

2%

1%

0%

1%

2%

1%

0%

0%

1%

2%

2%

1%

18%

39%

-1216%

7%

-1223%

0%

0%

-1223%

You might also like

- Income Statement: Less Sales Returns and AllowancesDocument1 pageIncome Statement: Less Sales Returns and AllowancesAnyone AnywhereNo ratings yet

- Income Statement1Document1 pageIncome Statement1James HohoasiNo ratings yet

- In Come Statement TemplateDocument2 pagesIn Come Statement TemplaterrmmvbNo ratings yet

- Income StatementDocument2 pagesIncome Statementrroy725No ratings yet

- Pro Forma Income StatementDocument6 pagesPro Forma Income StatementinfosurenNo ratings yet

- Arp 4Document1 pageArp 4Ega N WidjajaNo ratings yet

- E4-6a Multiple Step Income StatementDocument2 pagesE4-6a Multiple Step Income Statementgilli1trNo ratings yet

- Appendix 2 PR6-10ADocument4 pagesAppendix 2 PR6-10APuput HapsariNo ratings yet

- Colgate Palmolive Edos. Financieros 2009 A 2011Document11 pagesColgate Palmolive Edos. Financieros 2009 A 2011manzanita_2412No ratings yet

- Income Statement ABC Company For The Month Ended: RevenueDocument3 pagesIncome Statement ABC Company For The Month Ended: RevenueKalim Ullah KhanNo ratings yet

- Statements of Comprehensive IncomeDocument3 pagesStatements of Comprehensive IncomeKSpamshNo ratings yet

- Data Bodie Industrial SupplyDocument5 pagesData Bodie Industrial SupplyTecsloNo ratings yet

- SUADocument5 pagesSUABusi LutaNo ratings yet

- Arctic Products Company Balance Sheet at 6/30/2010: Cash Budget WorksheetDocument4 pagesArctic Products Company Balance Sheet at 6/30/2010: Cash Budget WorksheetbgamejNo ratings yet

- Income: Total Gross SalesDocument4 pagesIncome: Total Gross Salesapi-327527846No ratings yet

- Pro Forma Profit and LossDocument2 pagesPro Forma Profit and LossIrem AàmarNo ratings yet

- Exercise 18.7Document3 pagesExercise 18.7Tiffany ChiamNo ratings yet

- Profit&Loss May 2010Document2 pagesProfit&Loss May 2010Andre KjNo ratings yet

- Income StatementDocument19 pagesIncome StatementiPakistan67% (3)

- Statement of Income 2017-2021Document5 pagesStatement of Income 2017-2021Lailani KatoNo ratings yet

- Income Statement 1Document2 pagesIncome Statement 1api-276044694No ratings yet

- Income Statement1Document19 pagesIncome Statement1arabindapradhan92650No ratings yet

- Test 2 HomeworkDocument12 pagesTest 2 HomeworkMiguel CortezNo ratings yet

- Income Statement MonthlyDocument5 pagesIncome Statement MonthlybassampharmaNo ratings yet

- Print This Shit in The MorningDocument3 pagesPrint This Shit in The MorningDave SmithNo ratings yet

- Task 5 - 2020571670 - Ayush - KandariDocument8 pagesTask 5 - 2020571670 - Ayush - Kandariayush kandariNo ratings yet

- Financial For Feasibility StudyDocument15 pagesFinancial For Feasibility StudyAbigail GeronimoNo ratings yet

- P & L Bookmybread Year 1 Year 2Document2 pagesP & L Bookmybread Year 1 Year 2Ramanjit SinghNo ratings yet

- Study Unit 15 - Solution Q 1, 2 3Document5 pagesStudy Unit 15 - Solution Q 1, 2 3dumisaniNo ratings yet

- Budget With Variance AnalysisDocument1 pageBudget With Variance AnalysisyonnimNo ratings yet

- Business Budget: Income Less ExpensesDocument6 pagesBusiness Budget: Income Less ExpensesedinosNo ratings yet

- SMC Financial StatementDocument4 pagesSMC Financial StatementHoneylette Labang YballeNo ratings yet

- Budgeted Income StatementDocument1 pageBudgeted Income StatementJackie S LaymanNo ratings yet

- Intermediate Accounting - Chapter 4 Spreadsheet Answer - KiesoDocument55 pagesIntermediate Accounting - Chapter 4 Spreadsheet Answer - KiesodNo ratings yet

- AnnualProjectedProfit Loss-ServicesDocument4 pagesAnnualProjectedProfit Loss-ServicesNizwa KhalifaNo ratings yet

- Annual Projected Profit and Loss: January February March April May JuneDocument4 pagesAnnual Projected Profit and Loss: January February March April May JuneTheresia NgaswagaNo ratings yet

- Annual Projected Profit and Loss: January February March April May JuneDocument4 pagesAnnual Projected Profit and Loss: January February March April May JuneTheresia NgaswagaNo ratings yet

- Profit and Loss Forecast v1.0Document4 pagesProfit and Loss Forecast v1.0Jessica AngelinaNo ratings yet

- CF Roll No. 12046Document24 pagesCF Roll No. 12046Shilpa GiriNo ratings yet

- Bodie Industrial SupplyDocument14 pagesBodie Industrial SupplyHectorZaratePomajulca100% (2)

- SBV Financial StatementsDocument17 pagesSBV Financial Statementsbhundofcbm0% (1)

- Specific Compensation PaymentsDocument1 pageSpecific Compensation PaymentsMatt HarveyNo ratings yet

- Wyeth ValuationDocument54 pagesWyeth ValuationSaurav GoyalNo ratings yet

- Year Ended March 31, 2010 IT Services and Products Consumer Care andDocument6 pagesYear Ended March 31, 2010 IT Services and Products Consumer Care andPrateek SharmaNo ratings yet

- Toyota & Honda Financial Ratios ComparisonDocument11 pagesToyota & Honda Financial Ratios Comparisonuaintdown2100% (1)

- 2010 Ibm StatementsDocument6 pages2010 Ibm StatementsElsa MersiniNo ratings yet

- Rec 402 Memo 1-3Document8 pagesRec 402 Memo 1-3api-335331910No ratings yet

- ValuationDocument4 pagesValuationapi-300103541No ratings yet

- 12-Month Income StatementDocument1 page12-Month Income StatementFran PoNo ratings yet

- Income StatementDocument1 pageIncome StatementLinhberry Chunnie's GFNo ratings yet

- 12 Month Income StatementDocument1 page12 Month Income StatementmitkamojsovskaNo ratings yet

- Common SizeDocument1 pageCommon SizeAnshul GargNo ratings yet

- NPV Template P&GDocument15 pagesNPV Template P&GSanket ChatterjeeNo ratings yet

- Sample Fillable P&LDocument6 pagesSample Fillable P&LVestaNo ratings yet

- Profit & Loss A/C of Apollo Tyres: Income Sales Turnover Net SalesDocument4 pagesProfit & Loss A/C of Apollo Tyres: Income Sales Turnover Net SalesVineet Pratap SinghNo ratings yet

- Financial Statement (Budgeted Profit & Loss A/C) For The 5 Year PeriodDocument1 pageFinancial Statement (Budgeted Profit & Loss A/C) For The 5 Year PeriodShakhawat Hossen MunnaNo ratings yet

- Office Supplies, Stationery & Gift Store Revenues World Summary: Market Values & Financials by CountryFrom EverandOffice Supplies, Stationery & Gift Store Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- General Merchandise (Nondurable Goods) Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral Merchandise (Nondurable Goods) Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Travel Agency Revenues World Summary: Market Values & Financials by CountryFrom EverandTravel Agency Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Le Grand Morsure ResumeDocument1 pageLe Grand Morsure Resumeapi-251439918No ratings yet

- Future GrowthDocument1 pageFuture Growthapi-251439918No ratings yet

- Invoice Le Grand Morsure Multimedia in InvoiceDocument1 pageInvoice Le Grand Morsure Multimedia in Invoiceapi-251439918No ratings yet

- Service Price List Le Grand Morsure Services Price ListDocument1 pageService Price List Le Grand Morsure Services Price Listapi-251439918No ratings yet

- Intellectual Property AgreementDocument3 pagesIntellectual Property Agreementapi-251439918No ratings yet

- BudgetDocument11 pagesBudgetapi-251439918No ratings yet

- Schedule PlanDocument2 pagesSchedule Planapi-251439918No ratings yet